Professional Documents

Culture Documents

Birla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR Division

Birla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR Division

Uploaded by

SUSHANT RAICopyright:

Available Formats

You might also like

- Santander Consumer Finance Case StudyDocument8 pagesSantander Consumer Finance Case StudyKennedy Gitonga ArithiNo ratings yet

- Keystone Church Bond ProposalDocument77 pagesKeystone Church Bond ProposalwatchkeepNo ratings yet

- Investment Analysis and Portfolio ManagementDocument5 pagesInvestment Analysis and Portfolio ManagementNajam Us SaharNo ratings yet

- Aptitude QuestionsDocument55 pagesAptitude Questionsapi-19418583100% (2)

- Course No. Course Title Instructor-In-ChargeDocument4 pagesCourse No. Course Title Instructor-In-ChargeAryan JainNo ratings yet

- Econ F354 1565 20230816113358Document5 pagesEcon F354 1565 20230816113358AMAN GUPTANo ratings yet

- Birla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR DivisionDocument6 pagesBirla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR DivisionArchak SinghNo ratings yet

- Opfbj23 4Document7 pagesOpfbj23 4Yash SahuNo ratings yet

- Birla Institute of Technology and Science, Pilani: Pilani Campus AUGS/ AGSR DivisionDocument4 pagesBirla Institute of Technology and Science, Pilani: Pilani Campus AUGS/ AGSR DivisionKshitij ShuklaNo ratings yet

- CO Derivative ManagementDocument8 pagesCO Derivative ManagementAbhinav MahajanNo ratings yet

- PAM Outlines 07012021 042154pmDocument7 pagesPAM Outlines 07012021 042154pmzainabNo ratings yet

- ECON - F412 - 1566 - 1 SapmDocument3 pagesECON - F412 - 1566 - 1 SapmAvNo ratings yet

- Econ F354 - Fin F311 - DRMDocument5 pagesEcon F354 - Fin F311 - DRMf20220292No ratings yet

- DerivativesDocument3 pagesDerivativesAditya SukhijaNo ratings yet

- FIN F311 - Derivative and Risk Management (2) - CMSDocument6 pagesFIN F311 - Derivative and Risk Management (2) - CMSSaksham GoyalNo ratings yet

- Econ F315 1923 20240111123625Document5 pagesEcon F315 1923 20240111123625TIRTH ANAND TRIVEDINo ratings yet

- Uum College of Business Universiti Utara MalaysiaDocument7 pagesUum College of Business Universiti Utara MalaysiaSyai GenjNo ratings yet

- Financial Derivatives & Risk ManagementDocument2 pagesFinancial Derivatives & Risk ManagementKanickai DsouzaNo ratings yet

- Course Outline - Investment Management - IIM Ranchi - 2018Document7 pagesCourse Outline - Investment Management - IIM Ranchi - 2018Ankit BhardwajNo ratings yet

- FD Course OutlineDocument8 pagesFD Course OutlineSudip ThakurNo ratings yet

- Synopsis: B N Bahadur Institute of Management SciencesDocument5 pagesSynopsis: B N Bahadur Institute of Management SciencesManojkumar KumarNo ratings yet

- Capital Markets 2020-30Document6 pagesCapital Markets 2020-30Andres Saavedra CameranoNo ratings yet

- Econ F354 (Fin F311)Document5 pagesEcon F354 (Fin F311)satya01031999No ratings yet

- Summer Training Project Report Derivatives in The Stock MarketDocument42 pagesSummer Training Project Report Derivatives in The Stock Marketprashant purohitNo ratings yet

- Course Outline Financial Markets & InstitutionsDocument6 pagesCourse Outline Financial Markets & Institutionskonica chhotwaniNo ratings yet

- Mi Fa ProspectusDocument19 pagesMi Fa ProspectusJas SudanNo ratings yet

- Ifbi (HDBFS)Document2 pagesIfbi (HDBFS)dilipbiswakarmaNo ratings yet

- Fnce102 Chan SH Ay20-21 t1 (Final)Document5 pagesFnce102 Chan SH Ay20-21 t1 (Final)shanice.ellevinaaNo ratings yet

- Finance Elective Syllabus Tri-IV Batch 2021-23Document9 pagesFinance Elective Syllabus Tri-IV Batch 2021-23sanket patilNo ratings yet

- Uniform Course Outline (DBA, CU) FIN601Document3 pagesUniform Course Outline (DBA, CU) FIN601Jubayer AhmedNo ratings yet

- IAPMDocument7 pagesIAPMrossNo ratings yet

- HDFC Ar 17Document3 pagesHDFC Ar 17baz chackoNo ratings yet

- BBA-Investments and Stocks TradingDocument2 pagesBBA-Investments and Stocks TradingMr. Sharath Harady BBA - IADCANo ratings yet

- Derivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorDocument90 pagesDerivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorChandan Srivastava100% (1)

- MMS Financial Markets and Institutions 1Document167 pagesMMS Financial Markets and Institutions 1Sonali MoreNo ratings yet

- Financial EngineeringDocument3 pagesFinancial Engineeringluvnica6348No ratings yet

- DBA 5035 - Financial Derivatives ManagementDocument277 pagesDBA 5035 - Financial Derivatives ManagementShrividhyaNo ratings yet

- FIN301 Outline FinalDocument13 pagesFIN301 Outline FinalArsalan AqeeqNo ratings yet

- Investment Management 2015-16Document6 pagesInvestment Management 2015-16Udayan BhattacharyaNo ratings yet

- Investment Analysis, Portfolio Management & Wealth ManagementDocument5 pagesInvestment Analysis, Portfolio Management & Wealth Managementkonica chhotwaniNo ratings yet

- FinDerviatives CourseOutlineDocument2 pagesFinDerviatives CourseOutlineShivani Patnaik RajetiNo ratings yet

- Post Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesDocument6 pagesPost Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesprachiNo ratings yet

- School of Management Internship Diary: Strategy SpecializationDocument10 pagesSchool of Management Internship Diary: Strategy SpecializationRohit YadavNo ratings yet

- MBA Sem III FMIDocument6 pagesMBA Sem III FMIAnonymous GuyNo ratings yet

- Investment Analysis and Portfolio Management Course ObjectiveDocument5 pagesInvestment Analysis and Portfolio Management Course ObjectiveNishantNo ratings yet

- Module of IBFDocument5 pagesModule of IBFmuqadasgh42No ratings yet

- Portfolio Theory Part1 and 2 DR - ToukabriDocument51 pagesPortfolio Theory Part1 and 2 DR - ToukabriNermine LimemeNo ratings yet

- Investment MGNT SyllabusDocument6 pagesInvestment MGNT Syllabusradhika vermaNo ratings yet

- Af-302 - Financial Markets and InstitutionsDocument2 pagesAf-302 - Financial Markets and InstitutionsFuadNo ratings yet

- FM 05Document3 pagesFM 05roshandd2001No ratings yet

- Asheesh Sir Course OutlineDocument3 pagesAsheesh Sir Course Outlinesanyam20007No ratings yet

- Course Outline - Security and Portfolio ManagementDocument6 pagesCourse Outline - Security and Portfolio ManagementYeshwanth BabuNo ratings yet

- Fincourse 1apr2020Document7 pagesFincourse 1apr2020feliciaNo ratings yet

- IJREAMV05I0452086745Document4 pagesIJREAMV05I0452086745yash wankhadeNo ratings yet

- Course Outline FIN701Document11 pagesCourse Outline FIN701Bimal KrishnaNo ratings yet

- Financial Analytics, Valuation and Risk ManagementDocument16 pagesFinancial Analytics, Valuation and Risk ManagementMayank KhuranaNo ratings yet

- A Study of Mutual Fund at Mahindra Finance"Document59 pagesA Study of Mutual Fund at Mahindra Finance"varsha100% (1)

- International Financial Management: Course Coordinator: V. Raveendra Saradhi Course Credit: 3Document4 pagesInternational Financial Management: Course Coordinator: V. Raveendra Saradhi Course Credit: 3Tanu GuptaNo ratings yet

- Ficha Reina: International Finance: CompetencesDocument2 pagesFicha Reina: International Finance: CompetencesmolapauNo ratings yet

- Sapm SyllbusDocument2 pagesSapm SyllbusAaditya JhaNo ratings yet

- Invt Analysis Course OutlineDocument2 pagesInvt Analysis Course OutlineShivani Patnaik RajetiNo ratings yet

- Course Outline Derivatives (Term-IV) 2017-19 SKDocument5 pagesCourse Outline Derivatives (Term-IV) 2017-19 SKAnkit BhardwajNo ratings yet

- An Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionFrom EverandAn Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionRating: 3 out of 5 stars3/5 (2)

- Gen Math Simple and Compound InterestDocument51 pagesGen Math Simple and Compound InterestMary Grace TolentinoNo ratings yet

- Managerial EconomicsDocument2 pagesManagerial Economicsahmer sayamNo ratings yet

- MouthfreshenerdprDocument22 pagesMouthfreshenerdprSumit SharmaNo ratings yet

- Module 5Document26 pagesModule 5Ivan LeeNo ratings yet

- Agricultural Credit and Its Impact On Farm Productivity: A Case Study of Kailali DistrictDocument43 pagesAgricultural Credit and Its Impact On Farm Productivity: A Case Study of Kailali Districtajay adhikariNo ratings yet

- Guingona Vs City Fiscal of ManilaDocument4 pagesGuingona Vs City Fiscal of ManilaLouNo ratings yet

- 2015 MarchDocument64 pages2015 Marchehlaban100% (3)

- Determinants of Attitude Towards Credit Card Usage: Jurnal Pengurusan September 2014Document11 pagesDeterminants of Attitude Towards Credit Card Usage: Jurnal Pengurusan September 2014helloNo ratings yet

- Overview of Financial Management and The Financial EnvironmentDocument37 pagesOverview of Financial Management and The Financial EnvironmentZardar Rafid Sayeed 2025078660No ratings yet

- Seminar Presentation Cooperative Bank 11Document32 pagesSeminar Presentation Cooperative Bank 11preetjotw0% (1)

- Land Bank of The Philippines v. NavarroDocument19 pagesLand Bank of The Philippines v. NavarroJashen TangunanNo ratings yet

- Kaahwa Ritah Research Report FinalDocument55 pagesKaahwa Ritah Research Report Finalsolomon kyagabaNo ratings yet

- Bonds Payable ReviewDocument6 pagesBonds Payable ReviewJyasmine Aura V. AgustinNo ratings yet

- PobDocument24 pagesPobgillyhicksNo ratings yet

- The Complete Static Banking Awareness PDF CapsuleDocument101 pagesThe Complete Static Banking Awareness PDF CapsuleS TharakNo ratings yet

- My Courses AMCAT Quantitative Ability Cram Up SI & CI PreviewDocument4 pagesMy Courses AMCAT Quantitative Ability Cram Up SI & CI PreviewInsignia D.No ratings yet

- Complaint 080917Document8 pagesComplaint 080917Kshamaa KshamaaNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsJladySilhoutte100% (3)

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- Far Loans ReceivableDocument3 pagesFar Loans ReceivableAlliah Hope AngNo ratings yet

- 20181112111447443373Document62 pages20181112111447443373HươngNo ratings yet

- Monetary Policy of BangladeshDocument52 pagesMonetary Policy of BangladeshZafour93% (14)

- Banking AwarenessDocument94 pagesBanking Awarenesschandrashekhar prasadNo ratings yet

- Ceguera Technological CollegesDocument2 pagesCeguera Technological CollegesGienelle BermidoNo ratings yet

- A Project Report On Financial Performance Evaluation With Key Ratios at Vasavadatta Cement Kesoram Industries LTD Sedam GulbargaDocument79 pagesA Project Report On Financial Performance Evaluation With Key Ratios at Vasavadatta Cement Kesoram Industries LTD Sedam GulbarganawazNo ratings yet

- Lesson 9Document11 pagesLesson 9Alan ZhouNo ratings yet

- Tutorial Solution Chap 5Document4 pagesTutorial Solution Chap 5Nurul AriffahNo ratings yet

Birla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR Division

Birla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR Division

Uploaded by

SUSHANT RAIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Birla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR Division

Birla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR Division

Uploaded by

SUSHANT RAICopyright:

Available Formats

BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE, Pilani

Pilani Campus

AUGS/ AGSR Division

Course Handout Part II

Date: 20/01/2021

In addition to Part-I (General Handout for all courses appended to the timetable) this portion gives further specific

details regarding the course.

Course No. : ECON F354 / FIN F311

Course Title : Derivatives & Risk Management

Instructor-in-charge : ARUN KUMAR VAISH

1. Scope & Objective:

The objective of this course is to provide students an introductory level familiarity with a particular

type of financial instruments known as DERIVATIVES. To achieve the stated objectives the course

provides a detailed description on the structure (read, design) and utility (read, relevance) of the

most common and popular financial derivatives namely, Options, Futures, and Swaps. The scope of

the course entails acquainting students with the mechanics of trading and settlement of derivative

instruments in the financial markets and their function as insurance products for hedging financial

risk.

No understanding about financial instruments or their derivatives is complete without a thorough

grasp over interest rate concepts and hence the course also includes discussion on topics such as

time value of money, term structure of interest rates and their role in valuation of bonds,

computation of yield and forward interest rates, estimating bond-price volatility, and the role of

bond duration and convexity in mitigating interest rate risks.

The topics covered in the course will, at an introductory level, enable participants to learn about

common risks prevalent in the financial markets and how to manage its impact on investment

exposure by using derivatives. Discussion on valuation of financial derivatives and a brief

introduction to creating synthetic investment positions by combining derivatives prepares students

for advanced level courses such as Financial Engineering and Financial Risk Analytics and

Management. The course concludes with a survey of selective topics of contemporary interest to risk

management industry such as forecasting volatility, estimating value-at-risk, etc. The topics covered

in the course will also assist students in preparing for competitive professional international

certifications such as Financial Risk Manager (FRM) and Chartered Financial Analyst (CFA).

2. Prerequisites: This is an elementary course on Derivatives and Risk Management and does not

assume any prior knowledge of Financial Markets, Instruments and Derivatives. However,

familiarity of basic economic theory such as law of supply and demand, utility maximization

principle, compounding and discounting of cash flows, etc. are desirable. The course is not

mathematically rigorous and a first-year course on elementary linear algebra, calculus, probability,

and differential equations will be sufficient to grasp the contents of the course. It is expected that

students have technical know-how of MS excel as it will be used to demonstrate required

computations, wherever required, and for carrying out take-home assignments.

Please Do Not Print Unless Necessary

BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE, Pilani

Pilani Campus

AUGS/ AGSR Division

3. Text book:

Hull, John C., and Basu, Sankarshan (2016). Options, Futures, and Other Derivatives, 10th Edition. Pearson

Education Inc.

4. Reference books:

R1. David A. Dubrofsky and Thomos W. Miller, Jr., Deivatives Valuation and Risk Management,

Oxford Unversity Press.

R2. David G. Luenberger, Investment Science, Oxford University Press

Please Do Not Print Unless Necessary

BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE, Pilani

Pilani Campus

AUGS/ AGSR Division

Lecture Learning Objectives Topics to be Covered Learning Outcomes Reading

No. and Reference

Date

0 Orientation: Importance of this course to the

Course introduction and -NA- participants for gaining -NA-

discussion on the hand- knowledge in this field and for

out. fulfilling career aspirations

Brief orientation of the related to this course.

participants and their Familiarity of the course

expectations from the instructor with course participants

course. and their expectations from this

course.

1-4 Time Value of Money Concept of interest, Calculation of Should be able to understand Class

interest, Time Value of Money, application and various methods Notes

Present Value and Future Value of interest,

Familiarity about application of

interest rate in real world.

5-6 Introduction: Exchange-traded markets vs. Fundamental distinction between Ch. 1

Introduction to Financial Over-the-counter markets. underlying instruments and (selective

Markets and financial Introduction to common derivatives of those instruments. topics:

instruments. financial instruments such as Different types of derivatives follow

Role of intermediaries in stocks and bonds, and their role and how they differ from each classroom

modern-day finance. in financial markets. other, e.g. Difference between discussion)

What are derivatives and Basics of derivatives and the Options and Futures. Difference + Class

their relation with concept of the underlying between call option and put notes

traditional financial instrument. option.

instruments? First principles of asset The first principles of asset

Philosophy of asset valuation i.e. Discounted Cash valuation, which will enable

valuation. Flow approach to asset students to learn the universal

Types of traders in valuation. convention followed for asset

financial markets. Distinction between investment, valuation.

hedging, and speculation.

Role of arbitrageurs in financial

markets.

Please Do Not Print Unless Necessary

BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE, Pilani

Pilani Campus

AUGS/ AGSR Division

7-8 Basic Tenet: An introduction to: Understand the inherent Class

Introduction to types of What is risk? How to estimate relation between risk and return notes

risks present in the risk? and importance of risk in asset

financial markets. What is return? How to valuation.

What is return on estimate return on stocks? Common types of risks that

investment and how is it Historical analysis of financial investors encounter in financial

calculated? instruments from their risk- markets.

How derivatives are used return profiles. Develop familiarity with risk-

in managing downside return characteristics of

risk? different financial assets that are

traded in the domestic market.

Basic understanding of using

derivatives for hedging

downside risk.

9-15 Futures and Forwards Specification of a futures Identify futures contract on Ch 2 and 3

contract. stock exchange and read and + Class

Introduction to Futures Trading of futures contract on interpret online quotes on note

How Futures are traded stock exchange. futures.

on stock exchange? Margin requirements and Place trading orders on Futures.

Clearing and settlement marking-to-market futures Importance and implications of

of Futures contract. position. margin requirements for

Risk management Expiration of futures contract initiating a futures contract and

strategies using futures. and rollover. role of maintenance margin in

Anticipation based Basic trading strategies using sustaining the contract.

strategies using futures. futures contract. The concept of Marking-to-

Forwards contract Hedging stock risk using futures Market (MTM) an open position

Valuation of Futures and contract. in futures contract as stock

Forwards. Law of convergence and prices fluctuate real-time.

valuation of futures contract. Identification of variables that

Forwards vs Futures affect intra-and-inter-day prices

Cost of carry and its implication of futures contract.

on futures valuation. Role of interest rates,

Short selling and intra-day transportation costs, storage

trading of futures. costs on prices of futures.

Speculation using futures Fundamental difference

contract. between futures and forwards.

Forwards on non-financial Application of time value of

assets (commodities). money for valuing futures and

Stock index futures. forward contracts.

Risk management using futures

contract.

Please Do Not Print Unless Necessary

BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE, Pilani

Pilani Campus

AUGS/ AGSR Division

16-20 Options: Introduction, Types of options. Distinction between long on Ch 10, 11

Trading, Strategies Options positions and basic options and short on options. (selective

pay-off diagrams. Draw pay-off diagrams of topics:

Introduction to options. Specification of options and different options based follow

Difference between interpretation of options strategies. classroom

options and futures. quotes. Interpretation of price of an discussion)

Options trading Market mechanics of options option as function of intrinsic and 12 +

mechanism, Clearing and trading, clearing, and value and time value. Class

settlement of options. settlement. Impact of moneyness of an notes

Difference between long Factors affecting options prices. option on its value and utility for

and short on options. Stock position protection using hedging the underlying.

Basic options pay-off options. Creating hedging strategies

diagrams. Creating spreads, net debit and using options.

Identify important net credit strategies, Creating speculative strategies

variables that impact anticipation based strategies, using options.

options prices. volatility based strategies.

Options strategies for risk

management and

speculation.

20-25 Option Greeks and Introduction to option Greeks: Basics of option Greeks and their Ch. 11

Valuation. The Greek Delta, Theta, Gamma, Vega, different types. Differentiate (selective

topics), 19,

letters and their Rho. What is moneyness of an between At-the-money, In-the-

13, 15 +

estimation. Moneyness of option and its role in option money, and Out-of-the-money Class

an option and option valuation and creating options. Utilize information on notes

Greeks. Hedging the strategies? Moneyness and options Greeks to formulate

underlying using options delta hedging. One-step hedging strategies. Identify

Greeks. Relations binomial model and a no- mispricing of options using Put-

between option Greeks arbitrage argument. Risk- Call parity. Learn the theory of

and volatility smiles Put- neutral valuation. Two-step risk-neutral valuation and use

call Parity and option binomial trees. Binomial model: Binomial and B-S-M model to

valuation. Binomial model Simulation example. Bounds for price options using data from

of option pricing. Black- option prices. Put-call parity the stock exchange. Learn the

Scholes-Merton (B-S-M) and no-arbitrage condition. impact of dividends on option

option pricing model. Inputs to Black-Scholes-Merton prices.

option pricing model.

Estimation of call and put prices

using B-S-M model.

Please Do Not Print Unless Necessary

BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE, Pilani

Pilani Campus

AUGS/ AGSR Division

26-32 Fixed Income Instruments Features of fixed income Role of interest rates in pricing Ch. 4 + 6 +

and their Derivatives instruments. securities. class notes

Interest rate basics. Bond yield calculation. Relate fluctuations in interest

Interest rates and their Pricing plain-vanilla bond. rates with macroeconomic

role in bond valuation. Yield curve analysis. scenario.

Calculate yield-to- Bond price volatility. Factors affecting bond yields and

maturity and yield-to-call Forward rates of interest. the term structure of interest

on fixed income Strips markets. rates.

instruments. Overview of interest rate Estimating bond duration and

Day count convention and derivatives. convexity.

calculating clean and dirty Hedging using interest rate Bond portfolio management

price of bond. futures. strategies.

Market mechanics of Trading strategies using interest Futures and options on interest

bond trading. rate options. bearing instruments and their

Zero coupon bonds. Currency derivative use in hedging interest rate risk.

Estimating forward instruments. Foreign exchange rate and

interest rates. Determinants of foreign- international risk management.

Duration, modified exchange rate Cross-currency exchange rates

duration and bond price and common currency

volatility,Convexity. derivatives.

Bond portfolio

immunization.

Interest rate futures.

Currency futures.

32-42 Swaps and their Mechanics of swaps. Why firms undertake swaps Ch. 7 +

applications Comparative-advantage contract for exchanging one class notes

Need for swaps in argument. cash-flow with another?

modern day finance. The nature of swap rates. How swap contracts are

Different types of swaps. Determining the LIBOR / swap designed and what purpose they

Swaps and cash flow zero rates. satisfy?

engineering. Valuation of interest rate Role of financial intermediaries

Role of financial swaps. in a swap contract.

institutions in a swap Cross-currency swaps. Distinction between different

contract. Commodity swaps. types of swaps.

Valuation of swap. Valuation of swap contracts and

Risk management using their role in financial risk

swaps. management.

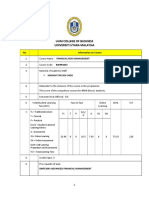

5. Course Plan:

6. Evaluation Scheme:

Component Duration Weightage Date& Time Remarks

(marks)

Mid-Semester 90 Min. 30% (90) Open Book

Compre- Exam 2 hrs. 40% (120) Open Book

Surprise Quizzes 2 Best 20 Min. 30% (90) Open Book

Out Of 3 (One Buffer,

No Makeup)

Please Do Not Print Unless Necessary

BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE, Pilani

Pilani Campus

AUGS/ AGSR Division

7. Learning outcome

Students who complete this course would be able to

1) Understand the various accounting methods for recording the business transactions.

2) Evaluate various financial concepts and preparation of financial statements-balance sheet, income

statement, and cash flow statement.

3) Identify the financial position and performance of the companies.

4) Make better economic decisions while undertaking investments in financial assets.

Make-up policy

The application for make-up tests/exam will not be entertained without specifying any genuine reasons.

Application must be submitted to instructor-in-charge of the course along with documents supporting the

reason for seeking make-up before conducting the respective tests/exams.

Chamber Consultation Hour: 6165 E, Tuesday- from 3:30PM to 4:30 PM;

Notices: Notices concerning the course will be displayed on the Economics and Finance Group Notice Board

only.

Instructor in-charge

Dr. Arun Kumar Vaish

Please Do Not Print Unless Necessary

You might also like

- Santander Consumer Finance Case StudyDocument8 pagesSantander Consumer Finance Case StudyKennedy Gitonga ArithiNo ratings yet

- Keystone Church Bond ProposalDocument77 pagesKeystone Church Bond ProposalwatchkeepNo ratings yet

- Investment Analysis and Portfolio ManagementDocument5 pagesInvestment Analysis and Portfolio ManagementNajam Us SaharNo ratings yet

- Aptitude QuestionsDocument55 pagesAptitude Questionsapi-19418583100% (2)

- Course No. Course Title Instructor-In-ChargeDocument4 pagesCourse No. Course Title Instructor-In-ChargeAryan JainNo ratings yet

- Econ F354 1565 20230816113358Document5 pagesEcon F354 1565 20230816113358AMAN GUPTANo ratings yet

- Birla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR DivisionDocument6 pagesBirla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR DivisionArchak SinghNo ratings yet

- Opfbj23 4Document7 pagesOpfbj23 4Yash SahuNo ratings yet

- Birla Institute of Technology and Science, Pilani: Pilani Campus AUGS/ AGSR DivisionDocument4 pagesBirla Institute of Technology and Science, Pilani: Pilani Campus AUGS/ AGSR DivisionKshitij ShuklaNo ratings yet

- CO Derivative ManagementDocument8 pagesCO Derivative ManagementAbhinav MahajanNo ratings yet

- PAM Outlines 07012021 042154pmDocument7 pagesPAM Outlines 07012021 042154pmzainabNo ratings yet

- ECON - F412 - 1566 - 1 SapmDocument3 pagesECON - F412 - 1566 - 1 SapmAvNo ratings yet

- Econ F354 - Fin F311 - DRMDocument5 pagesEcon F354 - Fin F311 - DRMf20220292No ratings yet

- DerivativesDocument3 pagesDerivativesAditya SukhijaNo ratings yet

- FIN F311 - Derivative and Risk Management (2) - CMSDocument6 pagesFIN F311 - Derivative and Risk Management (2) - CMSSaksham GoyalNo ratings yet

- Econ F315 1923 20240111123625Document5 pagesEcon F315 1923 20240111123625TIRTH ANAND TRIVEDINo ratings yet

- Uum College of Business Universiti Utara MalaysiaDocument7 pagesUum College of Business Universiti Utara MalaysiaSyai GenjNo ratings yet

- Financial Derivatives & Risk ManagementDocument2 pagesFinancial Derivatives & Risk ManagementKanickai DsouzaNo ratings yet

- Course Outline - Investment Management - IIM Ranchi - 2018Document7 pagesCourse Outline - Investment Management - IIM Ranchi - 2018Ankit BhardwajNo ratings yet

- FD Course OutlineDocument8 pagesFD Course OutlineSudip ThakurNo ratings yet

- Synopsis: B N Bahadur Institute of Management SciencesDocument5 pagesSynopsis: B N Bahadur Institute of Management SciencesManojkumar KumarNo ratings yet

- Capital Markets 2020-30Document6 pagesCapital Markets 2020-30Andres Saavedra CameranoNo ratings yet

- Econ F354 (Fin F311)Document5 pagesEcon F354 (Fin F311)satya01031999No ratings yet

- Summer Training Project Report Derivatives in The Stock MarketDocument42 pagesSummer Training Project Report Derivatives in The Stock Marketprashant purohitNo ratings yet

- Course Outline Financial Markets & InstitutionsDocument6 pagesCourse Outline Financial Markets & Institutionskonica chhotwaniNo ratings yet

- Mi Fa ProspectusDocument19 pagesMi Fa ProspectusJas SudanNo ratings yet

- Ifbi (HDBFS)Document2 pagesIfbi (HDBFS)dilipbiswakarmaNo ratings yet

- Fnce102 Chan SH Ay20-21 t1 (Final)Document5 pagesFnce102 Chan SH Ay20-21 t1 (Final)shanice.ellevinaaNo ratings yet

- Finance Elective Syllabus Tri-IV Batch 2021-23Document9 pagesFinance Elective Syllabus Tri-IV Batch 2021-23sanket patilNo ratings yet

- Uniform Course Outline (DBA, CU) FIN601Document3 pagesUniform Course Outline (DBA, CU) FIN601Jubayer AhmedNo ratings yet

- IAPMDocument7 pagesIAPMrossNo ratings yet

- HDFC Ar 17Document3 pagesHDFC Ar 17baz chackoNo ratings yet

- BBA-Investments and Stocks TradingDocument2 pagesBBA-Investments and Stocks TradingMr. Sharath Harady BBA - IADCANo ratings yet

- Derivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorDocument90 pagesDerivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorChandan Srivastava100% (1)

- MMS Financial Markets and Institutions 1Document167 pagesMMS Financial Markets and Institutions 1Sonali MoreNo ratings yet

- Financial EngineeringDocument3 pagesFinancial Engineeringluvnica6348No ratings yet

- DBA 5035 - Financial Derivatives ManagementDocument277 pagesDBA 5035 - Financial Derivatives ManagementShrividhyaNo ratings yet

- FIN301 Outline FinalDocument13 pagesFIN301 Outline FinalArsalan AqeeqNo ratings yet

- Investment Management 2015-16Document6 pagesInvestment Management 2015-16Udayan BhattacharyaNo ratings yet

- Investment Analysis, Portfolio Management & Wealth ManagementDocument5 pagesInvestment Analysis, Portfolio Management & Wealth Managementkonica chhotwaniNo ratings yet

- FinDerviatives CourseOutlineDocument2 pagesFinDerviatives CourseOutlineShivani Patnaik RajetiNo ratings yet

- Post Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesDocument6 pagesPost Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesprachiNo ratings yet

- School of Management Internship Diary: Strategy SpecializationDocument10 pagesSchool of Management Internship Diary: Strategy SpecializationRohit YadavNo ratings yet

- MBA Sem III FMIDocument6 pagesMBA Sem III FMIAnonymous GuyNo ratings yet

- Investment Analysis and Portfolio Management Course ObjectiveDocument5 pagesInvestment Analysis and Portfolio Management Course ObjectiveNishantNo ratings yet

- Module of IBFDocument5 pagesModule of IBFmuqadasgh42No ratings yet

- Portfolio Theory Part1 and 2 DR - ToukabriDocument51 pagesPortfolio Theory Part1 and 2 DR - ToukabriNermine LimemeNo ratings yet

- Investment MGNT SyllabusDocument6 pagesInvestment MGNT Syllabusradhika vermaNo ratings yet

- Af-302 - Financial Markets and InstitutionsDocument2 pagesAf-302 - Financial Markets and InstitutionsFuadNo ratings yet

- FM 05Document3 pagesFM 05roshandd2001No ratings yet

- Asheesh Sir Course OutlineDocument3 pagesAsheesh Sir Course Outlinesanyam20007No ratings yet

- Course Outline - Security and Portfolio ManagementDocument6 pagesCourse Outline - Security and Portfolio ManagementYeshwanth BabuNo ratings yet

- Fincourse 1apr2020Document7 pagesFincourse 1apr2020feliciaNo ratings yet

- IJREAMV05I0452086745Document4 pagesIJREAMV05I0452086745yash wankhadeNo ratings yet

- Course Outline FIN701Document11 pagesCourse Outline FIN701Bimal KrishnaNo ratings yet

- Financial Analytics, Valuation and Risk ManagementDocument16 pagesFinancial Analytics, Valuation and Risk ManagementMayank KhuranaNo ratings yet

- A Study of Mutual Fund at Mahindra Finance"Document59 pagesA Study of Mutual Fund at Mahindra Finance"varsha100% (1)

- International Financial Management: Course Coordinator: V. Raveendra Saradhi Course Credit: 3Document4 pagesInternational Financial Management: Course Coordinator: V. Raveendra Saradhi Course Credit: 3Tanu GuptaNo ratings yet

- Ficha Reina: International Finance: CompetencesDocument2 pagesFicha Reina: International Finance: CompetencesmolapauNo ratings yet

- Sapm SyllbusDocument2 pagesSapm SyllbusAaditya JhaNo ratings yet

- Invt Analysis Course OutlineDocument2 pagesInvt Analysis Course OutlineShivani Patnaik RajetiNo ratings yet

- Course Outline Derivatives (Term-IV) 2017-19 SKDocument5 pagesCourse Outline Derivatives (Term-IV) 2017-19 SKAnkit BhardwajNo ratings yet

- An Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionFrom EverandAn Introduction to Stocks, Trading Markets and Corporate Behavior: Student EditionRating: 3 out of 5 stars3/5 (2)

- Gen Math Simple and Compound InterestDocument51 pagesGen Math Simple and Compound InterestMary Grace TolentinoNo ratings yet

- Managerial EconomicsDocument2 pagesManagerial Economicsahmer sayamNo ratings yet

- MouthfreshenerdprDocument22 pagesMouthfreshenerdprSumit SharmaNo ratings yet

- Module 5Document26 pagesModule 5Ivan LeeNo ratings yet

- Agricultural Credit and Its Impact On Farm Productivity: A Case Study of Kailali DistrictDocument43 pagesAgricultural Credit and Its Impact On Farm Productivity: A Case Study of Kailali Districtajay adhikariNo ratings yet

- Guingona Vs City Fiscal of ManilaDocument4 pagesGuingona Vs City Fiscal of ManilaLouNo ratings yet

- 2015 MarchDocument64 pages2015 Marchehlaban100% (3)

- Determinants of Attitude Towards Credit Card Usage: Jurnal Pengurusan September 2014Document11 pagesDeterminants of Attitude Towards Credit Card Usage: Jurnal Pengurusan September 2014helloNo ratings yet

- Overview of Financial Management and The Financial EnvironmentDocument37 pagesOverview of Financial Management and The Financial EnvironmentZardar Rafid Sayeed 2025078660No ratings yet

- Seminar Presentation Cooperative Bank 11Document32 pagesSeminar Presentation Cooperative Bank 11preetjotw0% (1)

- Land Bank of The Philippines v. NavarroDocument19 pagesLand Bank of The Philippines v. NavarroJashen TangunanNo ratings yet

- Kaahwa Ritah Research Report FinalDocument55 pagesKaahwa Ritah Research Report Finalsolomon kyagabaNo ratings yet

- Bonds Payable ReviewDocument6 pagesBonds Payable ReviewJyasmine Aura V. AgustinNo ratings yet

- PobDocument24 pagesPobgillyhicksNo ratings yet

- The Complete Static Banking Awareness PDF CapsuleDocument101 pagesThe Complete Static Banking Awareness PDF CapsuleS TharakNo ratings yet

- My Courses AMCAT Quantitative Ability Cram Up SI & CI PreviewDocument4 pagesMy Courses AMCAT Quantitative Ability Cram Up SI & CI PreviewInsignia D.No ratings yet

- Complaint 080917Document8 pagesComplaint 080917Kshamaa KshamaaNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsJladySilhoutte100% (3)

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- Far Loans ReceivableDocument3 pagesFar Loans ReceivableAlliah Hope AngNo ratings yet

- 20181112111447443373Document62 pages20181112111447443373HươngNo ratings yet

- Monetary Policy of BangladeshDocument52 pagesMonetary Policy of BangladeshZafour93% (14)

- Banking AwarenessDocument94 pagesBanking Awarenesschandrashekhar prasadNo ratings yet

- Ceguera Technological CollegesDocument2 pagesCeguera Technological CollegesGienelle BermidoNo ratings yet

- A Project Report On Financial Performance Evaluation With Key Ratios at Vasavadatta Cement Kesoram Industries LTD Sedam GulbargaDocument79 pagesA Project Report On Financial Performance Evaluation With Key Ratios at Vasavadatta Cement Kesoram Industries LTD Sedam GulbarganawazNo ratings yet

- Lesson 9Document11 pagesLesson 9Alan ZhouNo ratings yet

- Tutorial Solution Chap 5Document4 pagesTutorial Solution Chap 5Nurul AriffahNo ratings yet