Professional Documents

Culture Documents

2006 Community Bank Technology Survey Results: Part 1. Respondent Profile

2006 Community Bank Technology Survey Results: Part 1. Respondent Profile

Uploaded by

Kareena BeenessreesinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2006 Community Bank Technology Survey Results: Part 1. Respondent Profile

2006 Community Bank Technology Survey Results: Part 1. Respondent Profile

Uploaded by

Kareena BeenessreesinghCopyright:

Available Formats

Survey Sponsored by:

2006 Community Bank

Technology Survey Results

Part 1. Respondent Profile Asset Size in Millions

$1–10 1%

$11–20 3%

10% Northwest $21–30 6%

$31–50 12%

54% Midwest 9% Northeast

$51–75 13%

$76–100 11%

$101–200 24%

$201–400 17%

$401+ 10%

No Answer 3%

Number of Full-Time

Equivalent Employees

1–10 9%

11–20 19%

21–30 16%

31–40 10%

41–50 8%

51–75 12%

76–100 7%

19% Southeast 101–200 9%

8% Southwest 201+ 5%

No Answer 5%

Survey results can be found at:

www.icba.org • www.bkd.com • www.plantemoran.com

2006 Community Bank Technology Survey Results

Part 1. Respondent Profile (Continued)

Some results have been sorted by bank asset size to Banks to $100 Million Exceeding $100 Million

allow for more accurate comparisons. All Responses in Assets in Assets

1. Does your bank have a chief information officer (CIO), chief technical officer (CTO), or a staff member otherwise dedicated to technology full time?

Yes 43% 20% 63%

No 57% 80% 37%

2. What long-term technology decisions does your bank face?

Internet banking 28% 32% 25%

Imaging-related technologies 53% 53% 54%

Systems security 60% 54% 66%

WAN/LAN/Network concerns 30% 25% 35%

Keeping technology affordable 64% 66% 62%

Core processing issues 22% 19% 25%

Staying up-to-date on upgrades to existing technologies 55% 51% 58%

Internet access, e-mail, or connectivity concerns 25% 23% 27%

In-house vs. outsourced processing decisions 17% 17% 18%

Regulatory compliance solutions 44% 38% 49%

Call center solutions 09% 13% 15%

Data security 55% 52% 58%

Other 03% 12% 15%

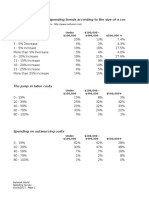

3. What have you budgeted for technology spending in 2006?

Less than $50,000 41% 66% 18%

$50,000 – $100,000 26% 21% 31%

$100,000 – $250,000 17% 19% 25%

$250,000 – $500,000 08% 01% 15%

More than $500,000 05% – 09%

No answer 03% 12% 02%

4. How will your technology spending be focused?

Hardware 54% 52% 55%

Software 64% 60% 67%

Personnel 12% 12% 11%

No answer 2% 3% 2%

5. Is your 2006 technology budget more or less than the 2005 technology budget?

More 54% 51% 58%

Less 13% 17% 10%

Same 31% 31% 30%

No answer 12% 12% 2%

6. Do you foresee your 2007 technology budget to be more or less than your 2006 technology budget?

More 50% 49% 51%

Less 18% 20% 15%

Same 31% 30% 32%

No answer 1% 1% 2%

Banks to $100 Million Exceeding $100 Million

Part 2. Technology All Responses

in Assets in Assets

1. How is your bank’s core account processing performed?

In-house 53% 53% 53%

Outsourced 46% 46% 46%

No answer 1% 1% 1%

2. How is your bank’s check processing done?

In-house 63% 61% 64%

Outsourced 36% 38% 35%

No answer 1% 1% 1%

3. Which of the following vendors does your bank utilize for Core Processing? Which of the following vendors does your bank utilize for your

(Top five in alphabetical order) Imaging Solutions Vendor? (Top five in alphabetical order)

Fidelity Information Services (FIS) Computer Services, Inc. (CSI)

Fiserv/ITI Fidelity Information Services (FIS)

Hartland Financial Solutions Fiserv/ITI

Jack Henry Hartland Financial Solutions

Precision Jack Henry

Which of the following vendors does your bank utilize for Item Processing?

(Top five in alphabetical order)

Fidelity Information Services (FIS)

Fiserv/ITI

Hartland Financial Solutions

Jack Henry

NCR

4. Which of the following software applications is your bank currently using or planning to evaluate in the next 12 to 18 months?

Currently Planning to Of No No Currently Planning to Of No No

Imaging Technologies Using Evaluate Interest Answer Internet Technologies Using Evaluate Interest Answer

Automated signature verification 12% 23% 37% 28% E-mail customer service applications 19% 31% 27% 23%

Check imaging applications 72% 19% 2% 7% E-mail statement delivery 24% 47% 15% 14%

Document imaging applications 38% 45% 6% 11% Authentication Technologies

Imaged-check clearing networks 28% 52% 6% 14% Token/Devices 12% 37% 29% 22%

Power encoding (Using optical Smart cards 1% 23% 45% 31%

character recognition) 22% 23% 32% 23% Digital certicficates 21% 25% 29% 25%

Third-party image archive Location ID (IP address confirmation) 11% 34% 28% 27%

storage solutions 21% 18% 37% 24%

Secret image selections 4% 29% 38% 29%

Bar coding 10% 16% 47% 27%

Biometrics 8% 24% 41% 27%

Bank Operations Technologies

Challenge questions 18% 41% 19% 20%

Asset and liability modeling 51% 13% 17% 19%

Behavioral/Transaction analytics 6% 23% 40% 31%

Branch profitability 23% 21% 31% 25%

Other

Customer profitability 20% 34% 22% 24%

“Talking” ATMs 8% 6% 60% 26%

Customer relationship management (CRM) 14% 31% 29% 26%

Triple-DES encryption 71% 7% 9% 13%

Lockbox (remittance) technologies 11% 13% 48% 27%

Online training for staff—Compliance 59% 21% 7% 13%

Integrated (“online”) teller systems 43% 18% 20% 19%

Online training for staff—General skills 52% 23% 9% 16%

Product profitability 9% 30% 32% 29%

Report generator technologies 46% 13% 19% 22%

5. Is your bank’s technology ahead of or behind where you would like it to be?

Far Less On Better Far Ahead No

Behind Than Desired Target Than Expected and Advancing Answer

All Responses 1% 23% 57% 15% 3% 1%

Banks to $100 Million in Assets 2% 26% 53% 15% 3% <1%

Exceeding $100 Million in Assets 1% 21% 60% 15% 2% 2%

Part 3. Internet All Responses Banks to $100 Million

in Assets

Exceeding $100 Million

in Assets

1. On average, have the number of your online banking customers increased, decreased, or stayed the same in the last three years?

Increased 79% 68% 89%

Decreased <1% 1% –

Stayed the same 9% 10% 8%

No answer 12% 21% 3%

5. Which of the following is your bank using

Part 3. Internet (continued) Part 4. Security to learn about computer or physical

vulnerabilities? Check all that apply.

2. Does your bank maintain an Internet 1. Do you have formal written policies to

banking site that allows your customers to Financial Services Information

follow for the following issues?

perform Internet banking transations? Sharing & Analysis Center (FS/ISAC) 22%

Network security 89%

Yes 83% Microsoft or other technology

Acceptable Internet use/security 91%

provider websites 63%

No 16% Technology planning 45%

No answer 1% Intrusion protection websites 35%

IT service provider selection and/or

contract maintenance 54% Security research websites

3. If you offer Internet banking through IT disaster recovery plan 94% (for example, CERT.org) 34%

your bank’s website, please share what IT business continuity plan 83% Federal government websites

functions can be performed: Data security 84% (for example, US-Cert.gov, infragaurd.net) 38%

Pay bills electronically 100% Data security breaches 71% No answer 18%

Update account information 66% No answer 1%

Apply for loans 27%

View check images 83% 2. Does your bank employ the following 6. Do you have wireless networks?

Apply for credit cards 11% technologies to defend against intrusions? Yes 12%

Open deposit accounts 8% Intrusion Detection Service (IDS) 64% No 88%

Aggregate financial information Intrusion Prevention Service (IPS) 48%

from other Internet sites 3%

No answer 25%

Online brokerage 3% 7. What is your bank doing about multifactor

Provide insurance quotes 1% authentication?

3. In the last 12 months, has your bank had Implementing the core banking

4. How much has branch traffic reduced due any of the following? vendor’s solution 66%

to Internet banking? An external systems/ Implementing another

Decreased 25% 55% Network security assessment 69% security feature 14%

Decreased 50% 1% Doing nothing 15%

An internal systems/

Decreased 75% <1% Network security assessment 58% No answer 5%

No answer 44% A phishing and/or spoofing attempt 25%

5. Who is your Internet banking software vendor? No answer 18%

(Top five in alphabetical order)

Certegy 4. Do you perform 24/7 network security

Digital Insight monitoring?

Fiserv/ITI Yes, monitored in-house 25%

FundsXpress Yes, outsourced to a security

Jack Henry monitoring company 47%

No 26%

6. How does your bank connect to the Internet? No answer 2%

Modem 2% Shared T1 9%

DSL 35% Full T1 35%

Cable 10% T3 2%

Satellite 2% Other 5%

The survey was sent to 8,470 community banks; the survey data

is based on responses from 12% of the banks.

7. Are you able to receive Internet e-mail?

Yes — Staff have individual e-mail addresses 59%

Yes — Some staff have e-mail addresses 35% Questions or comments regarding this survey can be directed to

Yes — Shared e-mail address for all staff 3% dewite.north@icba.org, greg.cole@bkd.com, or

No — Cannot receive Internet e-mail <1% donna.smith@plantemoran.com.

No answer 2%

You might also like

- 2.11.2 Project - Performance Task - The Parallax Problem (Project)Document7 pages2.11.2 Project - Performance Task - The Parallax Problem (Project)Tyler West100% (1)

- ZAMPS 2021 - First Half - FINAL-Presentation - 23 June 2021 V2Document70 pagesZAMPS 2021 - First Half - FINAL-Presentation - 23 June 2021 V2Ratidzai Muyambo100% (7)

- IATA TaxDocument1,510 pagesIATA TaxMiguelRevera100% (1)

- Cambridge Residents Survey Results 2020Document39 pagesCambridge Residents Survey Results 2020AmyNo ratings yet

- Mobile Backhaul Evolution: Jennifer M. Pigg April 27, 2010Document35 pagesMobile Backhaul Evolution: Jennifer M. Pigg April 27, 2010a1129mNo ratings yet

- Deloitte IndonesiaDocument15 pagesDeloitte IndonesiaPuneet ChauhanNo ratings yet

- Total Student GrowthDocument4 pagesTotal Student GrowthParam ShahNo ratings yet

- 2023 WIND Ventures VC Survey On Latin America For Startup GrowthDocument13 pages2023 WIND Ventures VC Survey On Latin America For Startup GrowthWIND VenturesNo ratings yet

- UBS RE ResearchDocument89 pagesUBS RE Researchmr1234blogguyNo ratings yet

- CIO Tech Poll: Tech Priorities 2018Document7 pagesCIO Tech Poll: Tech Priorities 2018IDG_WorldNo ratings yet

- Supply Chain Hot TrendsDocument15 pagesSupply Chain Hot TrendsgilusNo ratings yet

- 2020 Salary Survey Report PDFDocument42 pages2020 Salary Survey Report PDFMatthew Burke100% (1)

- 0124 SpendingDocument18 pages0124 SpendingChristopher BrownNo ratings yet

- JobsDB Salary Report 2023Document4 pagesJobsDB Salary Report 2023leotong628No ratings yet

- Monthly Economic ReviewDocument1 pageMonthly Economic ReviewShamim IqbalNo ratings yet

- Top Risk 2024Document4 pagesTop Risk 2024kamallNo ratings yet

- 4Q22 - Analyst Meeting Long FormDocument104 pages4Q22 - Analyst Meeting Long FormLusi rahmawatiNo ratings yet

- Dse Placement Report PDFDocument78 pagesDse Placement Report PDFAbhijithKríshñàNo ratings yet

- Roa RoeDocument4 pagesRoa RoeEdwin Ernesto Mariano SalazarNo ratings yet

- Dse Placement ReportDocument77 pagesDse Placement ReportPari SinghNo ratings yet

- Vietnamese Youth Culture Interest Japan or Korea enDocument20 pagesVietnamese Youth Culture Interest Japan or Korea enPham Hong TrìnhNo ratings yet

- AdMob Mobile Metrics Mar 10 Publisher SurveyDocument10 pagesAdMob Mobile Metrics Mar 10 Publisher Surveyespanyol01No ratings yet

- 2022 WIND Ventures VC Survey On Latin America For Startup GrowthDocument24 pages2022 WIND Ventures VC Survey On Latin America For Startup GrowthWIND VenturesNo ratings yet

- Charlotte Regional Business Alliance - Return To Office Survey June 2021Document8 pagesCharlotte Regional Business Alliance - Return To Office Survey June 2021Mikaela Thomas100% (1)

- Investor Presentation - Jan 2024Document46 pagesInvestor Presentation - Jan 2024minhnghia070203No ratings yet

- Người tiêu dùng kỹ thuật số và thị trường TMĐT ở Việt Nam 2022 - Shared by WorldLine TechnologyDocument52 pagesNgười tiêu dùng kỹ thuật số và thị trường TMĐT ở Việt Nam 2022 - Shared by WorldLine TechnologyTrịnh HoàngNo ratings yet

- Vietnam Digital Consumers and Ec Market 2022 enDocument52 pagesVietnam Digital Consumers and Ec Market 2022 en42. Nguyễn Thị Khánh LyNo ratings yet

- Consumer Behavior: A Study of Consumer Purchase Behavior of Mobile Phones in India 2019-21Document17 pagesConsumer Behavior: A Study of Consumer Purchase Behavior of Mobile Phones in India 2019-21RAVI JAISWANI Student, Jaipuria IndoreNo ratings yet

- Venture View 2011Document55 pagesVenture View 2011Dan PrimackNo ratings yet

- 2018-3-29 Moldova Poll PresentationDocument66 pages2018-3-29 Moldova Poll PresentationElena PutregaiNo ratings yet

- For Face2Face With Vivek Bajaj & Vineet JainnDocument62 pagesFor Face2Face With Vivek Bajaj & Vineet JainnbaljogiNo ratings yet

- Consumer Behaviour Factor Influencing The Usage of 3G ServiceDocument15 pagesConsumer Behaviour Factor Influencing The Usage of 3G ServiceSandip NandyNo ratings yet

- Digital Consumer Fact Sheet 111008Document6 pagesDigital Consumer Fact Sheet 111008elituaNo ratings yet

- Gridley & Co. Mobile Industry Overview December 2010Document72 pagesGridley & Co. Mobile Industry Overview December 2010Feng HongNo ratings yet

- 2023 Graduate Outlook Survey - Global Report: June 2023Document93 pages2023 Graduate Outlook Survey - Global Report: June 2023Begidu TangaNo ratings yet

- Global Mobile Consumer Trends, 2nd Edition: Mobile Continues Its Global Reach Into All Aspects of Consumers' LivesDocument19 pagesGlobal Mobile Consumer Trends, 2nd Edition: Mobile Continues Its Global Reach Into All Aspects of Consumers' LivesTristan LirioNo ratings yet

- Seven Keys To Privacy White PaperDocument8 pagesSeven Keys To Privacy White Paperzhiqunzeng1No ratings yet

- PhaseII Admissions StatisticsDocument2 pagesPhaseII Admissions StatisticskarimNo ratings yet

- The Indian Media & Entertainment Industry 2019: Trends & Analysis - Past, Present & FutureDocument63 pagesThe Indian Media & Entertainment Industry 2019: Trends & Analysis - Past, Present & FutureSharvari ShankarNo ratings yet

- OA ROI Case StudyDocument10 pagesOA ROI Case Studyscmarti2No ratings yet

- Romanian Leasing MarketDocument10 pagesRomanian Leasing MarketPetre GabrielNo ratings yet

- COVID-19 Banking - 15 May 2020Document39 pagesCOVID-19 Banking - 15 May 2020Aditia Nur PratamaNo ratings yet

- Introduction & Chart Part 1 & Part 2Document13 pagesIntroduction & Chart Part 1 & Part 2thanhntt21No ratings yet

- Global Passenger Survey 2021 HighlightsDocument19 pagesGlobal Passenger Survey 2021 HighlightsKurtulus OzturkNo ratings yet

- BanglalinkDocument13 pagesBanglalinkশাইখ উদ্দীনNo ratings yet

- Motial Oswal India Excellence (Mid To Mega)Document29 pagesMotial Oswal India Excellence (Mid To Mega)SandyNo ratings yet

- Challenges and Prospects of Reference Services in FederalDocument15 pagesChallenges and Prospects of Reference Services in FederalAjakaye EmmanuelNo ratings yet

- Service CategoryDocument1 pageService CategoryArnab DattaNo ratings yet

- Real Estate Tech TrendsDocument18 pagesReal Estate Tech TrendsSun Meng100% (1)

- Geita Gold Mine MD Safety MeetingDocument50 pagesGeita Gold Mine MD Safety MeetingStephen MadahaNo ratings yet

- IT Services - Analyst Presentation - Sep15Document15 pagesIT Services - Analyst Presentation - Sep15Nimish NamaNo ratings yet

- Domestic Vietnam Brand PopularityDocument19 pagesDomestic Vietnam Brand Popularityraina reavesNo ratings yet

- RAN - PER - ZTE FDD Massive MIMO Pro SolutionDocument36 pagesRAN - PER - ZTE FDD Massive MIMO Pro SolutionNosherwan LatifNo ratings yet

- 4 ReCAAP CBSOM 2022 - Timeliness Accuracy of Reporting Submitted by FPsDocument10 pages4 ReCAAP CBSOM 2022 - Timeliness Accuracy of Reporting Submitted by FPsน.ท.พิฑูรย์ ทองประหยัดNo ratings yet

- Cakupan Bidang KesmasDocument30 pagesCakupan Bidang KesmasKesmas DinkesbiakNo ratings yet

- The Good, The Bad and The Ugly On Tech Valuations, AI, Energy and US PoliticsDocument11 pagesThe Good, The Bad and The Ugly On Tech Valuations, AI, Energy and US Politicsmuratc.cansoyNo ratings yet

- Colgate Financial Statement AnalysisDocument26 pagesColgate Financial Statement AnalysisRafik Shop ukNo ratings yet

- 2023 December Nick Atkeson How To Make Money in A World Where Fin Analyst Are WrongDocument60 pages2023 December Nick Atkeson How To Make Money in A World Where Fin Analyst Are WrongBob ReeceNo ratings yet

- Economie Numerique 4Document168 pagesEconomie Numerique 4Biggest JunjunNo ratings yet

- 2018 CIO Tech Poll: Economic OutlookDocument8 pages2018 CIO Tech Poll: Economic OutlookIDG_World100% (1)

- What Matters in Security Highlighter 22Document19 pagesWhat Matters in Security Highlighter 22Andre MuscatNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Square and Square Root (6th Grade)Document18 pagesSquare and Square Root (6th Grade)Rishabh Vasudev Kapatkar100% (2)

- Report RUSADocument16 pagesReport RUSApawan kumar100% (1)

- Cardiac Pacemakers and Defibrillators 2nd Ed - C. Love (Landes, 2006) WW PDFDocument183 pagesCardiac Pacemakers and Defibrillators 2nd Ed - C. Love (Landes, 2006) WW PDFJozsa Attila100% (1)

- Entrepreneurship Development (BM-302) : Assignment 1Document7 pagesEntrepreneurship Development (BM-302) : Assignment 1AbhishekNo ratings yet

- Dede Aditya Saputra - Chapter IiDocument16 pagesDede Aditya Saputra - Chapter IiSS English AcademyNo ratings yet

- Instruction Manual: MissionDocument93 pagesInstruction Manual: Missionamjad atayaNo ratings yet

- Matrix Training Safety PT Acset Indonusa TBKDocument6 pagesMatrix Training Safety PT Acset Indonusa TBKonyo sjariefNo ratings yet

- Hepatic Encephalopathy: PRESENTER:Dr - Ch.Priyanka (DNB Junior Resident) Moderator: DR - Thirupathi Reddy (AssociateDocument19 pagesHepatic Encephalopathy: PRESENTER:Dr - Ch.Priyanka (DNB Junior Resident) Moderator: DR - Thirupathi Reddy (AssociatePriyanka ChinthapalliNo ratings yet

- Community College DisadvantagesDocument1 pageCommunity College DisadvantagesRhelbamNo ratings yet

- Just in Time in Indian ContextDocument8 pagesJust in Time in Indian ContextLithin GeorgeNo ratings yet

- Establishing Product Function StructureDocument23 pagesEstablishing Product Function StructureSanapathi Prasad100% (1)

- Submitted JTOIDocument10 pagesSubmitted JTOIFAHIRA RAHMA NATHANIANo ratings yet

- Chemistry Questions and Answers: Waxa Diyariyey: Hassan Honest Tell:0616 76 82 04Document4 pagesChemistry Questions and Answers: Waxa Diyariyey: Hassan Honest Tell:0616 76 82 04Abaas MuuseNo ratings yet

- 1978 Handbook of Birds of India and Pakistan Vol 1 by Ali and Ripley S PDFDocument481 pages1978 Handbook of Birds of India and Pakistan Vol 1 by Ali and Ripley S PDFsreelathapNo ratings yet

- Win Progress Co., LTD.: Technical Service BulletinDocument2 pagesWin Progress Co., LTD.: Technical Service BulletinKo ZayNo ratings yet

- Key Differences Between Sole Proprietorship and Joint Hindu Family Firm - A Comparison ChartDocument6 pagesKey Differences Between Sole Proprietorship and Joint Hindu Family Firm - A Comparison ChartVarun KocharNo ratings yet

- Maria Katticaran/ M.Arch II/ UCLA SuprastudioDocument19 pagesMaria Katticaran/ M.Arch II/ UCLA SuprastudioMaria KatticaranNo ratings yet

- Republic of Liberia Bureau of Maritime AffairsDocument11 pagesRepublic of Liberia Bureau of Maritime AffairsHarun KınalıNo ratings yet

- Paper1 1Document119 pagesPaper1 1Damián VillegasNo ratings yet

- Walt Disney DIS Value Analysis DashboardDocument3 pagesWalt Disney DIS Value Analysis DashboardmacrovalueinvestmentNo ratings yet

- Chicco Cortina CX Stroller ManualDocument22 pagesChicco Cortina CX Stroller ManualRRNo ratings yet

- SH - Module 10 Lesson 8-LayersDocument52 pagesSH - Module 10 Lesson 8-LayersMine Cuevas Dela CruzNo ratings yet

- Resonant Acoustic Nondestructive Testing: Ram-NdtDocument18 pagesResonant Acoustic Nondestructive Testing: Ram-Ndtsalfm08No ratings yet

- At The End of The Lesson The Students Are Expected To:: Dependent and Independent VariablesDocument9 pagesAt The End of The Lesson The Students Are Expected To:: Dependent and Independent VariablesYoo KeniNo ratings yet

- SDS (Safety Data Sheet) For LRV Vehicle Cleaning and OMSF Facilities Expired SheetsDocument4 pagesSDS (Safety Data Sheet) For LRV Vehicle Cleaning and OMSF Facilities Expired SheetsmilandivacNo ratings yet

- Lecture 4: Plasticity: 4.1: Stiffness-Limited DesignDocument4 pagesLecture 4: Plasticity: 4.1: Stiffness-Limited DesignThomas Van KuikNo ratings yet

- No. Nama Penyakit Kode Dan Nama Diagnosa ICD 10Document16 pagesNo. Nama Penyakit Kode Dan Nama Diagnosa ICD 10Sari Eka RahayuNo ratings yet

- Chemistry and Technology of Rubber PDFDocument215 pagesChemistry and Technology of Rubber PDFCharlie CB Portner100% (1)