Professional Documents

Culture Documents

Pascual vs. Secretary of Public Works

Pascual vs. Secretary of Public Works

Uploaded by

Kyle DionisioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pascual vs. Secretary of Public Works

Pascual vs. Secretary of Public Works

Uploaded by

Kyle DionisioCopyright:

Available Formats

PASCUAL vs.

SECRETARY OF PUBLIC WORKS

110 PHIL 331

GR No. L-10405, December 29, 1960

FACTS:

Wenceslao Pascual (then Provincial Governor of Rizal) instituted this action for declaratory relief

with a prayer for injunction on the ground that RA 920 (an act appropriating funds for public works). This

is because Pascual alleges that one item wrongfully allotted P85,000 for the construction, repair, and

improvement of Pasig feeder road terminals and subdivisions. This is because the roads to be improved

were still the private property of then Senator Zulueta, albeit to be donated on the condition that the roads

in question be used for street purposes only. Zulueta is the owner of several parcels of land in Pasig,

Rizal, known as the Antonio Subdivision, certain portions of which had been reserved for the projected

feeder roads, which were private property when RA 290 was enacted by Congress. Pascual also prays

that the donation be declared void ab initio for being violative of the Constitutional prohibition on members

of Congress from being directly or indirectly interested financially in any contract with the government. He

also alleges that the construction of the roads using public funds would “relieve him [Sen. Zulueta] from

the burden of constructing his subdivision streets or roads at his own expense”. Respondents moved to

dismiss on the ground that petitioner had no capacity to sue (also mentioned in the motion to dismiss is

“movant is not aware of any law which makes illegal the appropriation of public funds for the improvement

of what we, in the meantime, may assume as private property”. The lower court acted in favor of the

respondents, upholding the validity of the appropriation on the ground that petitioner Pascual, not being

directly affected, had no capacity to question the donation made by Sen. Zulueta.

ISSUE: Whether incidental gains by the public is considered a "public purpose" for the purpose of

justifying an expenditure of the government.

HELD:

No, it cannot be considered a “public purpose”. It is a general rule that the legislature is

without power to appropriate public revenue for anything but a public purpose. It is the essential

character of the direct object of the expenditure which must determine its validity as justifying a tax,

and not the magnitude of the interest to be affected nor the degree to which the general advantage

of the community, and thus the public welfare, may be ultimately benefited by their promotion.

Incidental to the public or to the state, which results from the promotion of private interest and the

prosperity of private enterprises or business, does not justify their aid by the use of public money.

The test of the constitutionality of a statute requiring the use of public funds is whether the

statute is designed to promote the public interest, as opposed to the furtherance of the advantage of

individuals, although each advantage to individuals might incidentally serve the public

You might also like

- DIGESTS - Pascual Vs Secretary of Public WorksDocument3 pagesDIGESTS - Pascual Vs Secretary of Public WorksPatricia Bautista100% (3)

- The Legal Writer - Legal Writing Exercises IDocument6 pagesThe Legal Writer - Legal Writing Exercises IManuel RoseroNo ratings yet

- Laras Gifts v. MidtownDocument4 pagesLaras Gifts v. MidtownKyle DionisioNo ratings yet

- CR 00786Document56 pagesCR 00786Kyle DionisioNo ratings yet

- Beyonce Knowles-Carter Et Al v. Eleven LLC Complaint PDFDocument96 pagesBeyonce Knowles-Carter Et Al v. Eleven LLC Complaint PDFMark JaffeNo ratings yet

- Acker James - The Death Penalty An American HistoryDocument18 pagesAcker James - The Death Penalty An American HistoryCarmen GonzalezNo ratings yet

- 7A.41 Delgado v. GQ Realty, G.R. No. 241774, 25 September 2019Document5 pages7A.41 Delgado v. GQ Realty, G.R. No. 241774, 25 September 2019Sheila Faith FajaritoNo ratings yet

- White Light Corporation Vs City of Manila - DigestDocument2 pagesWhite Light Corporation Vs City of Manila - DigestJen DeeNo ratings yet

- Gloria V CADocument8 pagesGloria V CAbeaenriquezNo ratings yet

- Commissioner of Internal Revenue vs. Philippine National BankDocument6 pagesCommissioner of Internal Revenue vs. Philippine National BankCj AndalNo ratings yet

- Pilipino Telephone Corp Vs Radiomarine NetworkDocument11 pagesPilipino Telephone Corp Vs Radiomarine NetworkCatherine MerillenoNo ratings yet

- Fabian v. Desierto G.R. No. 129742, 16 September 1998Document2 pagesFabian v. Desierto G.R. No. 129742, 16 September 1998Du AlbaranNo ratings yet

- People vs. SerzoDocument1 pagePeople vs. SerzoLaila Ismael SalisaNo ratings yet

- Bona V BrionesDocument2 pagesBona V BrionesJessie Albert CatapangNo ratings yet

- Assoc. of Small Landowers in The Phils Inc. V Sec. of Agrarian Reform Case Digest - Constitutional LawDocument1 pageAssoc. of Small Landowers in The Phils Inc. V Sec. of Agrarian Reform Case Digest - Constitutional LawMichael BongalontaNo ratings yet

- Rule 7 Case DigestDocument3 pagesRule 7 Case DigestAnonymous LodBhyKEhGNo ratings yet

- Power of Taxation - 3. Lladoc v. CIRDocument1 pagePower of Taxation - 3. Lladoc v. CIRPaul Joshua Torda SubaNo ratings yet

- Sycip Salazar DigestedDocument1 pageSycip Salazar DigestedFrederick BarcelonNo ratings yet

- Lozano V MartinezDocument1 pageLozano V MartinezDanica Irish RevillaNo ratings yet

- Cuartocruz Vs Active Works G.R. No. 209072, July 24, 2019Document1 pageCuartocruz Vs Active Works G.R. No. 209072, July 24, 2019GLORILYN MONTEJONo ratings yet

- Akbayan Vs Aquino Facts:: The JPEPA Is A Matter of Public ConcernDocument3 pagesAkbayan Vs Aquino Facts:: The JPEPA Is A Matter of Public ConcernCarl IlaganNo ratings yet

- Pstmsdwo v. PNCC (2010)Document4 pagesPstmsdwo v. PNCC (2010)phoenix rogueNo ratings yet

- Paramount Life Vs CastroDocument1 pageParamount Life Vs CastroGillian Caye Geniza BrionesNo ratings yet

- Marcos Vs ComelecDocument2 pagesMarcos Vs ComelecJairus Adrian VilbarNo ratings yet

- Spouses Francisco Ong and Betty Ong v. BPI Family Savings Bank, Inc.Document2 pagesSpouses Francisco Ong and Betty Ong v. BPI Family Savings Bank, Inc.RafaelNo ratings yet

- Guanzon V de Villa DigestDocument2 pagesGuanzon V de Villa Digestalma navarro escuzarNo ratings yet

- Francia Vs Meycauyan, BulacanDocument1 pageFrancia Vs Meycauyan, BulacanDindo Palgan100% (1)

- Romullo vs. Samahang MagkakapitbahayDocument3 pagesRomullo vs. Samahang MagkakapitbahayGeimmo SNo ratings yet

- Central Bank Employees Association vs. BSPDocument27 pagesCentral Bank Employees Association vs. BSPAlelie Joy MalazarteNo ratings yet

- Zaldivar v. SandiganbayanDocument1 pageZaldivar v. SandiganbayanArahbellsNo ratings yet

- 6 - Drugstore Assoc V National Council On Disability AffairsDocument10 pages6 - Drugstore Assoc V National Council On Disability AffairsPat EspinozaNo ratings yet

- Pulgar v. RTC of MaubanDocument1 pagePulgar v. RTC of MaubanKaira CarlosNo ratings yet

- ICHONG v. HERNANDEZ Case DigestDocument2 pagesICHONG v. HERNANDEZ Case DigestKrizzaShayneRamosArqueroNo ratings yet

- 08-Quinto v. COMELEC G.R. No. 189698 December 1, 2009Document16 pages08-Quinto v. COMELEC G.R. No. 189698 December 1, 2009Jopan SJNo ratings yet

- Commercial Law (Partial Digest)Document4 pagesCommercial Law (Partial Digest)Domie AbataNo ratings yet

- La Sallian Educational Innovators Foundation Inc, Vs CIR GR No. 202792 February 27, 2019Document4 pagesLa Sallian Educational Innovators Foundation Inc, Vs CIR GR No. 202792 February 27, 2019Junaid DadayanNo ratings yet

- #76 Punzalan v. Municipal Board of ManilaDocument2 pages#76 Punzalan v. Municipal Board of ManilaKristine EnriquezNo ratings yet

- On Separation of Powers and Undue Delegation of Legislative PowerDocument2 pagesOn Separation of Powers and Undue Delegation of Legislative PowerMicaellaNo ratings yet

- ASEAN Integration 2015 and The Imperative For Reforms in The Legal Profession and The Legal Education in The Philippines by Dean Joan S. LargoDocument28 pagesASEAN Integration 2015 and The Imperative For Reforms in The Legal Profession and The Legal Education in The Philippines by Dean Joan S. LargoHornbook Rule100% (1)

- 32 in Re Atty Marcial EdillionDocument1 page32 in Re Atty Marcial EdillionNARAG LAW OFFICENo ratings yet

- Rufino v. Endriga, G.R. No. 139554, July 21, 2006 HI-LITEDocument15 pagesRufino v. Endriga, G.R. No. 139554, July 21, 2006 HI-LITEEmil BautistaNo ratings yet

- Professional Video Inc. v. Technical Education and Skills Development Authority, GR 155504. 26 June 2009, Second Division, Brion (J)Document7 pagesProfessional Video Inc. v. Technical Education and Skills Development Authority, GR 155504. 26 June 2009, Second Division, Brion (J)Midzfar OmarNo ratings yet

- Gamboa vs. Teves 2011Document4 pagesGamboa vs. Teves 2011Emmanuel C. DumayasNo ratings yet

- Republic Vs Sandiganbayan Case DigestDocument1 pageRepublic Vs Sandiganbayan Case DigestBoom EbronNo ratings yet

- Fausto Barredo, Petitioner, vs. Severino Garcia and Timoteo ALMARIO, RespondentsDocument12 pagesFausto Barredo, Petitioner, vs. Severino Garcia and Timoteo ALMARIO, RespondentsGia DimayugaNo ratings yet

- Accessories Specialists vs. AlabanzaDocument2 pagesAccessories Specialists vs. AlabanzaRuss TuazonNo ratings yet

- Counsel's Affidavit of Verification of ResidencyDocument1 pageCounsel's Affidavit of Verification of Residencymiss independentNo ratings yet

- Consti-2 Digest Fonacier V Court of AppealsDocument1 pageConsti-2 Digest Fonacier V Court of AppealsJestherin BalitonNo ratings yet

- Philippine Long Distance Telephone Company, Inc. vs. City of BacolodDocument1 pagePhilippine Long Distance Telephone Company, Inc. vs. City of Bacolodmei atienzaNo ratings yet

- 28 Lladoc v. Commissioner of Internal Revenue PDFDocument2 pages28 Lladoc v. Commissioner of Internal Revenue PDFKJPL_1987No ratings yet

- 58 RP V Gingoyan - Case DigestDocument3 pages58 RP V Gingoyan - Case DigestVanityHugh100% (1)

- Free Telephone Workers V Minister of Labor & EmploymentDocument2 pagesFree Telephone Workers V Minister of Labor & EmploymentTrixie PeraltaNo ratings yet

- Consti - Mmda vs. BelairDocument2 pagesConsti - Mmda vs. BelairIrish GarciaNo ratings yet

- Tolentino vs. Board of Accountancy DigestDocument1 pageTolentino vs. Board of Accountancy DigestTine TineNo ratings yet

- Remedial Review - SCA - Own DigestsDocument26 pagesRemedial Review - SCA - Own DigestsMaddieNo ratings yet

- Sheker vs. Sheker GR No. 157912 December 13, 2007 Case FlowDocument2 pagesSheker vs. Sheker GR No. 157912 December 13, 2007 Case FlowJoshua Erik MadriaNo ratings yet

- Ledesma vs. CA 278 S 656Document1 pageLedesma vs. CA 278 S 656Emman CenaNo ratings yet

- RETIRED SPO4 BIENVENIDO LAUD vs. PEOPLE OF THE PHILIPPINES (CrimPro)Document3 pagesRETIRED SPO4 BIENVENIDO LAUD vs. PEOPLE OF THE PHILIPPINES (CrimPro)Mia Angela100% (1)

- The Law On Secrecy of Bank DepositsDocument17 pagesThe Law On Secrecy of Bank DepositsMakoy BixenmanNo ratings yet

- Padilla V Magdua Case Digest (OBLIGATIONS & CONTRACTS)Document2 pagesPadilla V Magdua Case Digest (OBLIGATIONS & CONTRACTS)Laila Ismael SalisaNo ratings yet

- 061 Padilla Rumbaua V Rumbaua PDFDocument3 pages061 Padilla Rumbaua V Rumbaua PDFJul A.No ratings yet

- Philippine Airlines v. CABDocument2 pagesPhilippine Airlines v. CABMarilou AgustinNo ratings yet

- Republic v. Vda de CastellviDocument2 pagesRepublic v. Vda de CastellviErika Mariz CunananNo ratings yet

- Re Letter of Tony Q ValencianoDocument1 pageRe Letter of Tony Q ValencianoCherry BepitelNo ratings yet

- Pascual v. Public WorksDocument2 pagesPascual v. Public WorksKrischelle AlimaNo ratings yet

- Lutz v. AranetaDocument2 pagesLutz v. AranetaKyle Dionisio100% (1)

- Phil Comm. Satellite Corp. v. AlcuazDocument1 pagePhil Comm. Satellite Corp. v. AlcuazKyle DionisioNo ratings yet

- Pepsi-Cola Co. V City of Butuan 24 SCRA 789Document1 pagePepsi-Cola Co. V City of Butuan 24 SCRA 789Kyle DionisioNo ratings yet

- Sea-Land Service v. CA 357 SCRA 441Document2 pagesSea-Land Service v. CA 357 SCRA 441Kyle DionisioNo ratings yet

- CIR V Botelho Shipping Corp. 20 SCRA 487Document2 pagesCIR V Botelho Shipping Corp. 20 SCRA 487Kyle DionisioNo ratings yet

- Sea-Land Service v. CA 357 SCRA 441Document2 pagesSea-Land Service v. CA 357 SCRA 441Kyle DionisioNo ratings yet

- Philippine Stock Exchange v. Court of Appeals, 281 SCRA 232 (1997)Document13 pagesPhilippine Stock Exchange v. Court of Appeals, 281 SCRA 232 (1997)Kyle DionisioNo ratings yet

- Plaridel Surety & Ins Co v. CIR 21 SCRA 1187Document1 pagePlaridel Surety & Ins Co v. CIR 21 SCRA 1187Kyle DionisioNo ratings yet

- CIR v. The Estate of Benigno P. TodaDocument2 pagesCIR v. The Estate of Benigno P. TodaKyle DionisioNo ratings yet

- Luzon Stevedoring Corp. V CTA 163 SCRA 647Document2 pagesLuzon Stevedoring Corp. V CTA 163 SCRA 647Kyle DionisioNo ratings yet

- Philippine Deposit Insurance CorporationDocument10 pagesPhilippine Deposit Insurance CorporationKyle DionisioNo ratings yet

- Motion For New Trial 1Document2 pagesMotion For New Trial 1Kyle DionisioNo ratings yet

- Chapter 6. Prohibited Transactions (Enzo)Document14 pagesChapter 6. Prohibited Transactions (Enzo)Kyle DionisioNo ratings yet

- Dionisio - Assignment 2Document3 pagesDionisio - Assignment 2Kyle DionisioNo ratings yet

- Recei/Ied: O Ar ODocument56 pagesRecei/Ied: O Ar OKyle DionisioNo ratings yet

- (Book) Abad LaborDocument312 pages(Book) Abad LaborKyle DionisioNo ratings yet

- Cases On Employer-Employee Relationship and JurisdictionDocument3 pagesCases On Employer-Employee Relationship and JurisdictionKyle DionisioNo ratings yet

- Spreading Fake News On Social MediaDocument3 pagesSpreading Fake News On Social MediaKyle DionisioNo ratings yet

- De La Salle University: (CD/DVD Title or Description)Document1 pageDe La Salle University: (CD/DVD Title or Description)Kyle DionisioNo ratings yet

- White Light v. City of ManilaDocument15 pagesWhite Light v. City of ManilaRy AsteteNo ratings yet

- 2020 Loss Nha-Anthony Salazar AdriculaDocument3 pages2020 Loss Nha-Anthony Salazar AdriculaAidalyn MendozaNo ratings yet

- Media Governance, State Subsidies and Impacts On Regional Press and RadioDocument18 pagesMedia Governance, State Subsidies and Impacts On Regional Press and RadioJournalismdavidNo ratings yet

- 1896 Nash, StephenPayne AnnekeJansBogardus HerFarm AndHowItBecameThePropertyOfTrinityChurch, NewYorkDocument126 pages1896 Nash, StephenPayne AnnekeJansBogardus HerFarm AndHowItBecameThePropertyOfTrinityChurch, NewYorkJames D. KeelineNo ratings yet

- Documents From Tolx-Ziegler ControversyDocument38 pagesDocuments From Tolx-Ziegler ControversyAnonymous m9ytYrLuNo ratings yet

- MOA-Starter Kit-Polomolok BUBDocument6 pagesMOA-Starter Kit-Polomolok BUBMary Rose LituanasNo ratings yet

- Legal and Ethical Issues in NursingDocument53 pagesLegal and Ethical Issues in Nursingkrishnasree100% (2)

- Donoghue v. StevensonDocument2 pagesDonoghue v. StevensonAmirah AmirahNo ratings yet

- Article 1802 Civil Code CaseDocument1 pageArticle 1802 Civil Code CaseJessielleNo ratings yet

- Property Rights of Women in Modern IndiaDocument26 pagesProperty Rights of Women in Modern IndiaAmitShekhar100% (1)

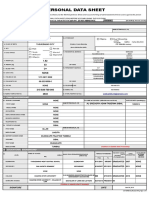

- CS Form No. 212 Revised Personal Data Sheet - NewDocument8 pagesCS Form No. 212 Revised Personal Data Sheet - NewAlex Sibal100% (1)

- Bank of New York, Ocwen and Litton Loan Servicing Get Slammed by NM Supreme and New York CourtsDocument14 pagesBank of New York, Ocwen and Litton Loan Servicing Get Slammed by NM Supreme and New York CourtstawnyoneNo ratings yet

- Module 9 - Completing The AuditDocument19 pagesModule 9 - Completing The AuditThe Brain Dump PHNo ratings yet

- United BF Homeowners Association Inc Aet Al V The City Mayor of ParanaqueDocument2 pagesUnited BF Homeowners Association Inc Aet Al V The City Mayor of ParanaqueVian O.No ratings yet

- Iqssl RulesDocument17 pagesIqssl RulesGimhan Godawatte67% (3)

- LTD Cases 5Document60 pagesLTD Cases 5Jalieca Lumbria GadongNo ratings yet

- In The High Court of Judicature at PatnaDocument2 pagesIn The High Court of Judicature at PatnaSaurav ChoudharyNo ratings yet

- Present: Thiru R. Selvakumar, B.A., M.L., Principal JudgeDocument6 pagesPresent: Thiru R. Selvakumar, B.A., M.L., Principal JudgeSugan GavaskarNo ratings yet

- Richard H. Pildes - Dworkin's Two Conceptions of Rights PDFDocument8 pagesRichard H. Pildes - Dworkin's Two Conceptions of Rights PDFIoan GurgilaNo ratings yet

- Format of Request Letter To Creditors To Confirm MSME Status - Taxguru - inDocument2 pagesFormat of Request Letter To Creditors To Confirm MSME Status - Taxguru - inDeveshChauhanNo ratings yet

- Labour Law Midsem Assignments Sem 6Document9 pagesLabour Law Midsem Assignments Sem 6Mithlesh ChoudharyNo ratings yet

- Occasional Paper 2 ICRCDocument82 pagesOccasional Paper 2 ICRCNino DunduaNo ratings yet

- Brown v. United States, 171 U.S. 631 (1898)Document6 pagesBrown v. United States, 171 U.S. 631 (1898)Scribd Government DocsNo ratings yet

- 7 - Alex Ferrer Vs NLRCDocument6 pages7 - Alex Ferrer Vs NLRCMaan VillarNo ratings yet

- Mandatory Requirement of Implementing Internal Financial Controls For All Companies - Vishnu Daya & Co LLPDocument5 pagesMandatory Requirement of Implementing Internal Financial Controls For All Companies - Vishnu Daya & Co LLPKRISHNA RAO KNo ratings yet

- 19 (1) (A) Freedom of Speech and Expression Ramesh Thappar V Union of IndiaDocument11 pages19 (1) (A) Freedom of Speech and Expression Ramesh Thappar V Union of IndiaNaman MishraNo ratings yet

- Section 80 CPCDocument2 pagesSection 80 CPCravi_bhateja_2100% (1)