Professional Documents

Culture Documents

Withholding Tax Table

Withholding Tax Table

Uploaded by

JENNIFER SIALANA0 ratings0% found this document useful (0 votes)

15 views2 pagesThe document provides information on Philippine tax withholding tables and forms. It includes revised withholding tax tables for daily, weekly, semi-monthly and monthly income ranges effective from 2018 to 2022. It also includes an annual tax table for the same period. Finally, it lists various withholding tax forms issued by the Bureau of Internal Revenue including registration forms, payment forms, remittance forms and certificates.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides information on Philippine tax withholding tables and forms. It includes revised withholding tax tables for daily, weekly, semi-monthly and monthly income ranges effective from 2018 to 2022. It also includes an annual tax table for the same period. Finally, it lists various withholding tax forms issued by the Bureau of Internal Revenue including registration forms, payment forms, remittance forms and certificates.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views2 pagesWithholding Tax Table

Withholding Tax Table

Uploaded by

JENNIFER SIALANAThe document provides information on Philippine tax withholding tables and forms. It includes revised withholding tax tables for daily, weekly, semi-monthly and monthly income ranges effective from 2018 to 2022. It also includes an annual tax table for the same period. Finally, it lists various withholding tax forms issued by the Bureau of Internal Revenue including registration forms, payment forms, remittance forms and certificates.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

WITHHOLDING TAX TABLE

REVISED WITHHOLDING TAX TABLE

Effective January 1, 2018 to December 31, 2022

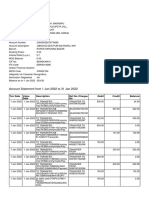

DAILY 1 2 3 4 5 6

Compensation Range P685 and below P685 -P1,095 P1,096 - P2,191 P2,192 - P5,478 P5,479 - P21,917 P21,918 and above

Prescribed Withholding 0.00 +20% over P82.19 +25% over P356.16 +30% over P1,342.47 +32% over P6,602.74 +35% over

0.00

Tax P685 P1,096 P2,192 P5,479 P21,918

WEEKLY 1 2 3 4 5 6

P4,808 and

Compensation Range P4,808 - P7,691 P7,692 - P15,384 P15,385 - P38,461 P38,462 - P153,845 P153,846 and above

below

Prescribed Withholding 0.00 +20% over P576.92 +25% over P2,500.00 +30% over P9,423.08 +32% over P46,346.15 +35% over

0.00

Tax P4,808 p7,692 p15,385 P38,462 P153,846

SEMI-MONTHLY 1 2 3 4 5 6

P10,417 and

Compensation Range P10,417 - P16,666 P16,667 - P33,332 P33,333 - P83,332 P83,333 - P333,332 P333,333 and above

below

Prescribed Withholding 0.00 +20% over P1,250.00 +25% over P5,416.67 +30% over P20,416.67 +32% over P100,416.67 +35% over

0.00

Tax P10,417 P16,667 P33,333 P83,333 P333,333

MONTHLY 1 2 3 4 5 6

P20,833 and

Compensation Range P20,833 - P33,332 P33,333 - P66,666 P66,667 - P166,666 P166,667 - P666,666 P666,667 and above

below

Prescribed Withholding 0.00 +20% over P2,500.00 +25% over P10,833.33 +30% over P40,833.33 +32% over P200,833.33 +35% over

0.00

Tax P20,833 33,333 P66,667 P166,667 P666,667

ANNUAL TAX TABLE

EFFECTIVE DATE JANUARY 1, 2018 to DECEMBER 31, 2022

Not over P250,000 0%

Over P250,000 but not over P400,000 20% of the excess over P250,000

Over P400,000 but not over P800,000 P30,000 + 25% of the excess over P400,000

Over P800,000 but not over P2,000,000 P130,000 + 30% of the excess over P800,000

Over P2,000,000 but not over

P490,000 + 32% of the excess over P2,000,000

P8,000,000

P2,410,000 + 35% of the excess over

Over P8,000,000

P8,000,000

WITHHOLDING TAX FORMS

WITHHOLDING TAX FORMS DESCRIPTION

REGISTRATION FORM

BIR FORM NO. 1901 Application for Registration for Self-Employed and Mixed Income Individuals, Estates and Trusts

BIR FORM NO. 1902 Application for Registration for Individuals Earning Purely Compensation Income and Non-Residnet Citizens/Resident Alien Employee

BIR FORM NO. 1903 Application for Registration for Corporations/Partnerships (Taxable/Non-Taxable), including GAIs and LGUs

BIR FORM NO. 1904 Application for Registration for One-time Taxpayer and Persons Registering under E.O. 98 (Securing a TIN to be able to transact with any government office)

BIR FORM NO. 1905 Application for Information Update

PAYMENT FORM

BIR FORM NO. 0605 Payment form

BIR FORM NO. 0619-E Monthly Remittance Form of Creditable Income Taxes Withheld (Expanded)

BIR FORM NO. 0619-F Monthly Remittance Form of Final Income Taxes Withheld

REMITTANCE FORM

BIR FORM NO. 1600-VT Monthly Remittance Return of Value-Added Tax

BIR FORM No. 1600-PT Monthly Remittance Return of Percentage Tax

BIR FORM NO. 1600WP Remittance Return of Percentage Tax on Winnings and Prizes Withheld by Race Track Operators

BIR FORM NO. 1601-C Monthly Remittance Return of Income Taxes Withheld on Comnpensation

BIR FORM NO. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes withheld (Expanded)

BIR FORM NO. 1601-FQ Quarterly Remittance Return of Final Income Taxes Withheld

BIR FORM NO. 1602-Q Quarterly Remittance Return of Final Taxes Withheld on Interest Paid on Deposits and Deposits Substitutes/Trusts/Etc.

BIR FORM NO. 1603-Q Quarterly Remittance Return of Final Income Taxes Withheld on Fringe benefits Paid to Employees Other Than Rank and File

CERTIFICATES

BIR FORM NO. 2304 Certificate of Income Payment Not Subject to Withholding Tax (Excluding Compensation Income)

BIR FORM NO. 2306 Certificate of Final Tax Withheld at Source

BIR FORM NO. 2307 Certificate of Creditable Tax Withheld at Source

BIR FORM NO. 2316 Certificate of Compensation Payment/Tax Withheld

You might also like

- Horcrux of Geography English Langauge Book 1695783100290Document2 pagesHorcrux of Geography English Langauge Book 1695783100290preetivokar0% (1)

- Washing Machine ReceiptDocument1 pageWashing Machine Receiptdenny devassyNo ratings yet

- PRTC - TAX-Final PB - May 2022Document16 pagesPRTC - TAX-Final PB - May 2022Luna VNo ratings yet

- PRTC TAX-1stPB 0522 220221 091723Document16 pagesPRTC TAX-1stPB 0522 220221 091723MOTC INTERNAL AUDIT SECTIONNo ratings yet

- Taxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Document15 pagesTaxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Harold Dan AcebedoNo ratings yet

- Your Consolidated Statement: Contact UsDocument5 pagesYour Consolidated Statement: Contact Usmohamed elmakhzniNo ratings yet

- SGV and Co Presentation On TRAIN LawDocument48 pagesSGV and Co Presentation On TRAIN LawPortCalls100% (8)

- SS and SSS Chap 01 To 10 (2019)Document263 pagesSS and SSS Chap 01 To 10 (2019)lavpreetpannuNo ratings yet

- Withholding Tax TableDocument2 pagesWithholding Tax TableJENNIFER SIALANANo ratings yet

- Withholding Tax TableDocument2 pagesWithholding Tax TableJENNIFER SIALANANo ratings yet

- Minimum Wage Earners: (Return To Index)Document11 pagesMinimum Wage Earners: (Return To Index)Shaina Jane LibiranNo ratings yet

- Tax Table: Effective Date January 1, 2018 To December 31, 2022Document9 pagesTax Table: Effective Date January 1, 2018 To December 31, 2022Renz VillaramaNo ratings yet

- Tax Table: Effective Date January 1, 2018 To December 31, 2022Document9 pagesTax Table: Effective Date January 1, 2018 To December 31, 2022Renz VillaramaNo ratings yet

- Tax TableDocument9 pagesTax TableRenz VillaramaNo ratings yet

- Tax Table: Effective Date January 1, 2018 To December 31, 2022Document9 pagesTax Table: Effective Date January 1, 2018 To December 31, 2022Renz VillaramaNo ratings yet

- Withholding Tax Table 2019Document1 pageWithholding Tax Table 2019Gelie RaelNo ratings yet

- Pag-Ibig: Monthly Compensation Employee Share Employer ShareDocument6 pagesPag-Ibig: Monthly Compensation Employee Share Employer ShareJun Wilson MawiratNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Document10 pagesRevised Withholding Tax Table Effective January 1, 2018 To December 31, 2022 Daily 1 2 3 4 5 6Raymundo EirahNo ratings yet

- Revised Withholding Tax TableDocument2 pagesRevised Withholding Tax TableNina CastilloNo ratings yet

- Witthholding Tax TableDocument2 pagesWitthholding Tax TableFrenzy PopperNo ratings yet

- Daily 1 2 3 4 5 6: Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022Document2 pagesDaily 1 2 3 4 5 6: Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022DENR-NCR Legal DivisionNo ratings yet

- Withholding Taxes & Tax TablesDocument9 pagesWithholding Taxes & Tax Tableslloyd limNo ratings yet

- Tax TablesDocument6 pagesTax TablesGeromil HernandezNo ratings yet

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- Annex D RR 11-2018-Revised Witholding Tax TableDocument1 pageAnnex D RR 11-2018-Revised Witholding Tax TableDuko Alcala EnjambreNo ratings yet

- Annex D RR 11-2018Document1 pageAnnex D RR 11-2018Maureen PascualNo ratings yet

- Annex D RR 11-2018 PDFDocument1 pageAnnex D RR 11-2018 PDFKarl Anthony MargateNo ratings yet

- RR 11 2018 - Annex D - Revised Withholding Tax Table - 2018 2022 PDFDocument1 pageRR 11 2018 - Annex D - Revised Withholding Tax Table - 2018 2022 PDFRiña Lizte AlteradoNo ratings yet

- Revised Withholding Tax Table: Daily 1 2 3 4 5 6Document1 pageRevised Withholding Tax Table: Daily 1 2 3 4 5 6Renzo Ross Certeza SarteNo ratings yet

- Taxation - Withholding TaxDocument15 pagesTaxation - Withholding TaxJohn Francis IdananNo ratings yet

- Income Tax On Employed Taxpayer and Mixed Income EarnerDocument20 pagesIncome Tax On Employed Taxpayer and Mixed Income EarnerFritzie Grace C. FraycoNo ratings yet

- WHT TableDocument2 pagesWHT TableJoneric RamosNo ratings yet

- Train LawDocument23 pagesTrain LawDennis BudanoNo ratings yet

- 2023 WT Table Annex E RR 11-2018Document2 pages2023 WT Table Annex E RR 11-2018Cee MoralesNo ratings yet

- Annex E RR 11-2018Document2 pagesAnnex E RR 11-2018Bernardino PacificAceNo ratings yet

- Revised Withholding Tax Table: Daily 1 2 3 4 5 6Document2 pagesRevised Withholding Tax Table: Daily 1 2 3 4 5 6Maureen PascualNo ratings yet

- I - Problem On PayrollDocument39 pagesI - Problem On PayrollHazel Joy UgatesNo ratings yet

- Train Law PhilippinesDocument64 pagesTrain Law PhilippinesThe BeatlessNo ratings yet

- TRAIN LAW - Individual Income TaxationDocument25 pagesTRAIN LAW - Individual Income TaxationJennilyn SantosNo ratings yet

- Train by SGV ColorDocument32 pagesTrain by SGV ColorFlorenz AmbasNo ratings yet

- Tabc - Train - Noel N. Cobangbang, CpaDocument117 pagesTabc - Train - Noel N. Cobangbang, CpaIsaac CursoNo ratings yet

- Importance of Withholding Tax System: Compensation ExpandedDocument14 pagesImportance of Withholding Tax System: Compensation ExpandedJAYAR MENDZ100% (1)

- 2018-Tax Reform For Acceleration and Inclusion2Document14 pages2018-Tax Reform For Acceleration and Inclusion2Sinetch EteyNo ratings yet

- PRTC 1stpb - 05.22 Sol TaxDocument21 pagesPRTC 1stpb - 05.22 Sol TaxCiatto SpotifyNo ratings yet

- PRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressDocument16 pagesPRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressNovemae CollamatNo ratings yet

- OCA Circular No. 35-2024Document4 pagesOCA Circular No. 35-2024tpr1nc3ss6No ratings yet

- Team PRTC 1stPB May 2024 - TAXDocument7 pagesTeam PRTC 1stPB May 2024 - TAXAnne Marie SositoNo ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- Train Law - 17mar2018Document63 pagesTrain Law - 17mar2018Janelle ManzanoNo ratings yet

- Old Tax Law Vs Train Law Tax PH Lessons - CompressDocument7 pagesOld Tax Law Vs Train Law Tax PH Lessons - CompressRonron De ChavezNo ratings yet

- Train Law WordDocument12 pagesTrain Law WordIsaac CursoNo ratings yet

- Tax Updates Vs Tax Code OldDocument7 pagesTax Updates Vs Tax Code OldGianna Chloe S Victoria100% (1)

- Tax Final Exam Practice Material - CompressDocument10 pagesTax Final Exam Practice Material - CompressNovemae CollamatNo ratings yet

- Primer On Train LawDocument8 pagesPrimer On Train LawVeronica ChanNo ratings yet

- Codal Reference and Related IssuancesDocument17 pagesCodal Reference and Related IssuancesBernardino PacificAceNo ratings yet

- Train Law 2018Document55 pagesTrain Law 2018Mira Mendoza100% (1)

- Income Tax Credits - ReviewerDocument10 pagesIncome Tax Credits - Reviewer버니 모지코No ratings yet

- Provision of Train Law UpdatedDocument91 pagesProvision of Train Law UpdatedAldrich De VeraNo ratings yet

- Iligan City - Seminar On TRAIn Law For Students - 05 03 18Document195 pagesIligan City - Seminar On TRAIn Law For Students - 05 03 18Lorainne AjocNo ratings yet

- 5 6170280447000445052 PDFDocument358 pages5 6170280447000445052 PDFmanoj mohanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- National Budget CycleDocument33 pagesNational Budget CycleJENNIFER SIALANANo ratings yet

- Withholding Tax TableDocument2 pagesWithholding Tax TableJENNIFER SIALANANo ratings yet

- Journal Entry Voucher: National Housing Authority AgencyDocument22 pagesJournal Entry Voucher: National Housing Authority AgencyJENNIFER SIALANANo ratings yet

- Withholding Tax TableDocument2 pagesWithholding Tax TableJENNIFER SIALANANo ratings yet

- Gsis Vs Manila DigestDocument2 pagesGsis Vs Manila DigestPatrick Tan100% (1)

- DT Combined CA INTERDocument203 pagesDT Combined CA INTERkarthick rajNo ratings yet

- Transaction Slip LatestDocument1 pageTransaction Slip LatestIrene Rechelle Rebanal-FajaritoNo ratings yet

- Tax Invoice: Transportation Charges On Sale Output CGST Output SGST Round OffDocument1 pageTax Invoice: Transportation Charges On Sale Output CGST Output SGST Round OffAlfiyaNo ratings yet

- 3.4.accounting For Income TaxesDocument65 pages3.4.accounting For Income TaxesPranjal pandeyNo ratings yet

- Invoice 18Document1 pageInvoice 18kuldeep singhNo ratings yet

- Quiz - Income Tax For CorporationsDocument3 pagesQuiz - Income Tax For Corporationskim mindoroNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAsif IqbalNo ratings yet

- Return Review Letter 2019 11 14 09 07 35 944Document3 pagesReturn Review Letter 2019 11 14 09 07 35 944Waqar Alam KhanNo ratings yet

- 1999 68 ITD 95 Mumbai 03 10 1997Document9 pages1999 68 ITD 95 Mumbai 03 10 1997shubhit shokeenNo ratings yet

- TRAIN Law Lecture Legal Edge 2020 Ver 2 by Atty Bobby LockDocument80 pagesTRAIN Law Lecture Legal Edge 2020 Ver 2 by Atty Bobby LockIah FriaNo ratings yet

- Chapter 4Document25 pagesChapter 4crackheads philippinesNo ratings yet

- MP6 y IIAex ZOex 7 YaDocument6 pagesMP6 y IIAex ZOex 7 YaSrikanth MarrapuNo ratings yet

- Deductions On Gross IncomeDocument34 pagesDeductions On Gross IncomeKathlyn PostreNo ratings yet

- Money VocabularyDocument3 pagesMoney VocabularyPaulaBaqRodNo ratings yet

- Business IncomeDocument8 pagesBusiness IncomeMoon Kim100% (1)

- Local Business TaxDocument2 pagesLocal Business TaxvenickeeNo ratings yet

- CV-Lelin Roul - EcommerceDocument2 pagesCV-Lelin Roul - Ecommercewww.taxontrackNo ratings yet

- Revised Implementing Rules and Regulations (IRR)Document12 pagesRevised Implementing Rules and Regulations (IRR)Cez Yassan100% (1)

- Pre8 Midterm QuizzesDocument3 pagesPre8 Midterm QuizzesJalyn Jalando-onNo ratings yet

- GSTDocument40 pagesGSTsangkhawmaNo ratings yet

- RMC 36-94Document2 pagesRMC 36-94saintkarriNo ratings yet

- Tax Invoice: Blupin Technologies Private LimitedDocument2 pagesTax Invoice: Blupin Technologies Private LimitedRahNo ratings yet

- Bitumen Price List 1-09-2010 & 16-09-2010Document2 pagesBitumen Price List 1-09-2010 & 16-09-2010Vizag RoadsNo ratings yet

- Daily Sales Report Test Gas Station: From 1/1/2003 To 1/1/2003Document1 pageDaily Sales Report Test Gas Station: From 1/1/2003 To 1/1/2003noorul hakeemNo ratings yet