Professional Documents

Culture Documents

Chapter 10

Chapter 10

Uploaded by

kochanay oya-oyCopyright:

Available Formats

You might also like

- TAX 2 ExercisesDocument22 pagesTAX 2 ExercisesWinter Summer50% (4)

- Quiz 4 VATDocument3 pagesQuiz 4 VATAsiong Salonga100% (2)

- TB ch07Document31 pagesTB ch07ajaysatpadi100% (1)

- Business Plan:: Nzyoki Janet MutanuDocument6 pagesBusiness Plan:: Nzyoki Janet MutanuDAN0% (1)

- Pre-Week Notes On Vat: Prepared by Dr. Jeannie P. LimDocument11 pagesPre-Week Notes On Vat: Prepared by Dr. Jeannie P. LimMark MagnoNo ratings yet

- Value Added TaxDocument5 pagesValue Added TaxRaven Vargas DayritNo ratings yet

- BIBLE STUDY WORKSHOP USING PHOTOTHEOLOGY BY PASTOR IVOR MYERS For Care GroupDocument2 pagesBIBLE STUDY WORKSHOP USING PHOTOTHEOLOGY BY PASTOR IVOR MYERS For Care GroupMeresa W. MartinNo ratings yet

- Writ Against MEPCODocument10 pagesWrit Against MEPCOapi-3745637No ratings yet

- Chapter 9 TaxDocument27 pagesChapter 9 TaxJason MalikNo ratings yet

- Discussion Questions: True True True False True FalseDocument7 pagesDiscussion Questions: True True True False True FalseJustin TempleNo ratings yet

- Tax 2 Valencia Chapter 10 MLTPL Choice 3-4Document3 pagesTax 2 Valencia Chapter 10 MLTPL Choice 3-4NervianeX HaleNo ratings yet

- Quiz 4 Vat Business Tax 1322 - CompressDocument3 pagesQuiz 4 Vat Business Tax 1322 - CompressChris MartinezNo ratings yet

- Chapter 9 Tax 2 (9-5) ND 9-6Document2 pagesChapter 9 Tax 2 (9-5) ND 9-6Elai grace FernandezNo ratings yet

- Chapter 10 Practice Problems ValenciaDocument1 pageChapter 10 Practice Problems ValenciaElai grace FernandezNo ratings yet

- 3rdyr 1stF BusinessTax 2324Document43 pages3rdyr 1stF BusinessTax 2324zaounxosakubNo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxAllen KateNo ratings yet

- Multiple Choice QuestionsDocument14 pagesMultiple Choice QuestionsVince ManahanNo ratings yet

- Additional Vat MSQ PDFDocument14 pagesAdditional Vat MSQ PDFPrincesNo ratings yet

- Prelim Examination. AY 2nd SEM 2023 2024Document5 pagesPrelim Examination. AY 2nd SEM 2023 2024amseservices18No ratings yet

- Input Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocument28 pagesInput Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTAjey MendiolaNo ratings yet

- TQ VatDocument6 pagesTQ VatJaneNo ratings yet

- Bmtax Fa2Document5 pagesBmtax Fa2KHYSHA NICOLE PALTINGNo ratings yet

- BT - Sq1 VatDocument4 pagesBT - Sq1 VatTherese Janine HetutuaNo ratings yet

- Chapter 13 Mixed Business TransactionsDocument10 pagesChapter 13 Mixed Business TransactionsGeraldNo ratings yet

- JPIA Review S3 Installment 2 (Business Tax)Document30 pagesJPIA Review S3 Installment 2 (Business Tax)rylNo ratings yet

- Tax2 FinalsDocument8 pagesTax2 FinalsKevin Elrey Arce100% (2)

- VAT (Theory & Problem)Document10 pagesVAT (Theory & Problem)dimpy dNo ratings yet

- Value Added Tax (VAT) : Transfer and Business TaxDocument58 pagesValue Added Tax (VAT) : Transfer and Business TaxRizzle RabadillaNo ratings yet

- St. Anthony'S College San Jose, AntiqueDocument9 pagesSt. Anthony'S College San Jose, AntiqueClaire Araneta AlcozeroNo ratings yet

- Final Examintation - TaxationDocument5 pagesFinal Examintation - TaxationMPCINo ratings yet

- Value Added Taxation 2021Document18 pagesValue Added Taxation 2021lllllnubhbhgNo ratings yet

- Excess Input and Senior Citizen and PWDDocument9 pagesExcess Input and Senior Citizen and PWDsahitariosoNo ratings yet

- VAT ReviewDocument10 pagesVAT ReviewRachel LeachonNo ratings yet

- Tax Review - Overview Vat and Opt (Quiz)Document4 pagesTax Review - Overview Vat and Opt (Quiz)Lovenia Magpatoc100% (7)

- Value Added Tax PracticeDocument7 pagesValue Added Tax PracticeSelene DimlaNo ratings yet

- VAT DiscussionDocument5 pagesVAT DiscussionArcide Rcd ReynilNo ratings yet

- Bustax Chap9 Theory and ProblemsDocument4 pagesBustax Chap9 Theory and ProblemsPineda, Paula MarieNo ratings yet

- Tax RevDocument4 pagesTax RevCanapi AmerahNo ratings yet

- TAX2UNIT9TO12Document4 pagesTAX2UNIT9TO12Catherine Joy VasayaNo ratings yet

- QuizDocument5 pagesQuizRomaica Ella AmbidaNo ratings yet

- Transfer Annd Business TaxationDocument5 pagesTransfer Annd Business TaxationRoselgin DagalaNo ratings yet

- VAT ReviewDocument8 pagesVAT ReviewabbyNo ratings yet

- Quiz 2 Part 1Document1 pageQuiz 2 Part 1Renz CastroNo ratings yet

- Value Added TaxDocument6 pagesValue Added TaxjamNo ratings yet

- Capital Gains Tax ReviewerDocument14 pagesCapital Gains Tax ReviewerCleah WaskinNo ratings yet

- Business TaxDocument116 pagesBusiness TaxScarlett FernandezNo ratings yet

- VAT Basics - July 2023Document8 pagesVAT Basics - July 2023maharajabby81No ratings yet

- VAT Questions For Professional Stage Knowledge LevelDocument14 pagesVAT Questions For Professional Stage Knowledge LevelFahimaAkterNo ratings yet

- C9 Input VATDocument18 pagesC9 Input VATdraga pinasNo ratings yet

- 1 Understanding VAT For BusinessesDocument6 pages1 Understanding VAT For BusinessesBensonNo ratings yet

- MCQ Pre-Long Exam On Value Added Tax May 19, 2020Document6 pagesMCQ Pre-Long Exam On Value Added Tax May 19, 2020JDR JDRNo ratings yet

- Business TaxDocument9 pagesBusiness TaxWere dooomedNo ratings yet

- What Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14Document8 pagesWhat Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14EstherNalubegaNo ratings yet

- VAT ReviewerDocument3 pagesVAT ReviewerCJ LopezNo ratings yet

- VatDocument22 pagesVatFarhani Sam RacmanNo ratings yet

- Page 1 of 24Document24 pagesPage 1 of 24Peter AhNo ratings yet

- 93-13 - VatDocument19 pages93-13 - VatJuan Miguel UngsodNo ratings yet

- A. C. D. With:: If of Is If If of If IsDocument3 pagesA. C. D. With:: If of Is If If of If IsFerl Diane SiñoNo ratings yet

- VAT Act 2052Document8 pagesVAT Act 2052Nirmal Shrestha100% (1)

- CPAR VAT (Batch 92) - HandoutDocument38 pagesCPAR VAT (Batch 92) - HandoutVan DahuyagNo ratings yet

- Chapter 8Document9 pagesChapter 8nena cabañesNo ratings yet

- HANDOUT-business TaxesDocument29 pagesHANDOUT-business TaxesGianJoshuaDayrit67% (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Department of Accountancy: Short-Term Non-Routine DecisionsDocument6 pagesDepartment of Accountancy: Short-Term Non-Routine Decisionskochanay oya-oyNo ratings yet

- ECA QuizzerDocument3 pagesECA Quizzerkochanay oya-oyNo ratings yet

- RF14 Confirmation of Transfer From Closed SchoolDocument3 pagesRF14 Confirmation of Transfer From Closed Schoolkochanay oya-oyNo ratings yet

- Rf14 Confirmation of Transfer From Closed SchoolDocument3 pagesRf14 Confirmation of Transfer From Closed Schoolkochanay oya-oyNo ratings yet

- How To Work With Gross PricesDocument26 pagesHow To Work With Gross Priceskochanay oya-oyNo ratings yet

- Purchases Journal Date Purchased From PR Debit Credit Purchases Sundry Accounts Payable Account Title PR AmountDocument1 pagePurchases Journal Date Purchased From PR Debit Credit Purchases Sundry Accounts Payable Account Title PR Amountkochanay oya-oyNo ratings yet

- Position Paper On Andres BonifacioDocument5 pagesPosition Paper On Andres Bonifaciokochanay oya-oy67% (3)

- The Tilled Field Is The First of The Joan Miró: SurrealismDocument2 pagesThe Tilled Field Is The First of The Joan Miró: Surrealismkochanay oya-oyNo ratings yet

- Purchases JournalDocument1 pagePurchases Journalkochanay oya-oyNo ratings yet

- Purchases Journal Date Purchased From PR Debit Credit Purchases Sundry Accounts Payable Account Title PR AmountDocument1 pagePurchases Journal Date Purchased From PR Debit Credit Purchases Sundry Accounts Payable Account Title PR Amountkochanay oya-oyNo ratings yet

- Merchandising Financial StatementsDocument7 pagesMerchandising Financial Statementskochanay oya-oy100% (1)

- April 2, 2017 Jrtasing: Posted On byDocument5 pagesApril 2, 2017 Jrtasing: Posted On bykochanay oya-oyNo ratings yet

- Jean Jac RousseauDocument19 pagesJean Jac RousseauFroilan TinduganNo ratings yet

- Relations Between Husband and WifeDocument23 pagesRelations Between Husband and WifeMariam BautistaNo ratings yet

- Private Equity and Venture Capital in SMEs in Developing CountriesDocument34 pagesPrivate Equity and Venture Capital in SMEs in Developing CountriesAgroEmpresario ExportadorNo ratings yet

- Liberalism Upsc Notes 16Document3 pagesLiberalism Upsc Notes 16Sk SharmaNo ratings yet

- Spectranet FebDocument4 pagesSpectranet FebnitinNo ratings yet

- Rental Agreement FinalDocument6 pagesRental Agreement FinalAmarnath WadwaleNo ratings yet

- Circular and Rotational Motion (Rev1)Document52 pagesCircular and Rotational Motion (Rev1)Nilambar DebSharmaNo ratings yet

- 31jan2019 - PDs CompiledDocument108 pages31jan2019 - PDs CompiledharigroupphilippinesNo ratings yet

- Tamatave V QueenDocument4 pagesTamatave V QueennitumNo ratings yet

- Document 4Document4 pagesDocument 4Ana Sofía Cruz AcostaNo ratings yet

- PPT-4-Kenyan History, Culture and IdentityDocument3 pagesPPT-4-Kenyan History, Culture and IdentitySaksham SinghNo ratings yet

- VB 08 Errors StatmentsDocument4 pagesVB 08 Errors StatmentsMike LouisNo ratings yet

- 1 Mendezona Vs OzamizDocument21 pages1 Mendezona Vs OzamizJerric CristobalNo ratings yet

- Biography (Arabic & English) of A Muhaddith of Our Age DR Abdul Haleem ChishtiDocument14 pagesBiography (Arabic & English) of A Muhaddith of Our Age DR Abdul Haleem ChishtiIslamic_Books_LiteratureNo ratings yet

- Lewis and ClarkDocument23 pagesLewis and ClarkdaltonwsandersNo ratings yet

- List of CasesDocument3 pagesList of Casestin_m_sNo ratings yet

- 4.A.3.3 Ramos v. CA (1999 and 2002)Document4 pages4.A.3.3 Ramos v. CA (1999 and 2002)Soraya Salubo Laut100% (1)

- 10-Compostela2016 Part1-Notes To FSDocument84 pages10-Compostela2016 Part1-Notes To FSsandra bolokNo ratings yet

- Kh. Shafiqur RahmanDocument48 pagesKh. Shafiqur RahmanAnonymous UqGvTrNo ratings yet

- ReconveyanceDocument30 pagesReconveyanceJane CaramountNo ratings yet

- Long Wharf Tour RiderDocument6 pagesLong Wharf Tour RiderOmar MackNo ratings yet

- Pecho vs. PeopleDocument2 pagesPecho vs. PeopleDana Denisse RicaplazaNo ratings yet

- Foakes Beer CaseDocument13 pagesFoakes Beer CaseSebastian SjkNo ratings yet

- GROUPtwoDocument12 pagesGROUPtwoNor Aen CastilloNo ratings yet

- Costing Booster Batch: FOR MAY 2023Document244 pagesCosting Booster Batch: FOR MAY 2023Vishal VermaNo ratings yet

- Dahan, Dexter Ian BagobeDocument2 pagesDahan, Dexter Ian Bagobeglenn goldNo ratings yet

Chapter 10

Chapter 10

Uploaded by

kochanay oya-oyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 10

Chapter 10

Uploaded by

kochanay oya-oyCopyright:

Available Formats

lOMoARcPSD|5631877

Chapter 10

B.S. Accountancy (University of San Agustin)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

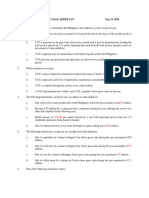

CHAPTER 9 INPUT VAT & 10 VAT STILL DUE + MISCELLANEOUS

REQUIREMENTS

True or False 1

True 1. Only VAT-registered taxpayers can claim input VAT.

True 2. There is no input VAT from purchases made from non-VAT-registered suppliers.

True 3. The total consideration pay by purchasers to VAT taxpayers includes the selling price

and the VAT.

False 4. Registrable persons can claim input VAT.

True 5.Those who cannot claim input VAT can deduct those input VAT as part of their cost or

expenses.

False 6. Input VAT can be claimed as a tax credit or a deduction at the option of the taxpayer.

True 7. The term creditable input VAT means input VAT deductible from output VAT.

False 8. Exempt persons who issue VAT invoices can claim input VAT.

False 9. Input VAT is computed as 12/112 of the selling price of the seller.

True 10. Input VAT may come from importation and domestic purchase.

True 11. The purchase of exempt goods and services has no input VAT/

True 12. If the VAT is not separately billed, it shall be computed as 12/112 of the selling price

in the sales document.

False 13. Input taxes on purchases for personal consumption are creditable against output

VAT.

True 14. Only input VAT for purchase of goods or services in the course of business is

creditable.

True 15. Input VAT needs to be evidenced by a VAT invoice or official receipt to be creditable.

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

True or False 2

False 1. The transitional input VAT is 2% of the vatable beginning inventory.

True 2. The input VAT on importation is creditable upon release of the goods from the

Customs custody.

False 3. The input VAT on domestic purchase of goods is deductible upon payment.

False 4. The input VAT on purchases of services is claimable in the month the services are

rendered not when paid.

True 5. Persons transitioning to the VAT system shall submit an inventory of goods.

True 6. The input VAT on the purchase of real properties may be paid in installment.

False 7.The input VAT on depreciable capital goods or properties must be amortized over a

period of 60 months.

False 8. The input VAT on depreciable capital goods or properties with aggregate acquisition

costs exceeding P1M must be amortized over a period of 60 months.

True 9. The input VAT on non-depreciable vehicles is disallowed as tax credit.

False 10. The presumptive input VAT is 4% of the agricultural and marine purchases.

False 11. Traders of sardines, mackerel, milk, and cooking oil can claim presumptive input VAT.

False 12. The standard input VAT is 5% of sales to the government.

False 13. The standard input Vat is 7% of the purchases sold to the government.

True 14. There is a deductible expense when the actual input VAT exceeds the standard input

VAT on government sales.

True 15. There is a reduction in costs or expenses or an item of gross income when the

standard input VAT exceeds the actual input VAT on government sales.

True 16. The excess of the input VAT over the output VAT is referred to as input VAT carry-

over.

True 17. Input VAT carry-over is included as part of the creditable input VAT of the following

month.

True 18. The input VAT carry-over in a quarter is deductible in the following quarter.

False 19. The input VAT carry-over cannot be credited over a period of 3 years.

True 20. The input VAT carry-over in the second month of a quarter is creditable on the third

month of that quarter.

False 21. The Input VAT carry-over in the second month of a quarter is creditable on the third

month of that quarter.

Multiple Choice – Theory:

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

Part 1

1. Which is creditable?

D. Input VAT traceable to vatable sales

2. Which is a likely source of a creditable input VAT?

C. Purchase of goods from aliens who are not engaged in business abroad

3. Partial credit for input VAT is allowed on

A. Government sales

4. Full input VAT credit is allowed on

D. A and B

5. No input VAT credit is allowed on

C. Exempt sales

6. Which of the following input VAT can be claimed as tax refund?

D. Input VAT traceable to export sales

7. The input VAT on purchases of non-VAT-registered taxpayers shall be claimable as

B. Deduction against gross income for income tax purposes

8. Who can claim the VAT on importation as tax credit?

C. An importer of goods for business use

9. The traditional input VAT is whichever is the

B. Higher of 2% of beginning vatable inventory or the actual input VAT thereon.

10. Which is included in the basis of the traditional input VAT?

C. Vatable goods only purchased from VAT or non-VAT suppliers

11. Which is included in the VAT basis of the 2% transitional input VAT?

D. A and C

12. Which of the following properties may be included in the basis of the 2% transitional input

VAT?

C. Land or building classified as inventory held for sale

13. Which of the following input VAT may be amortized?

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

D. Input VAT on the purchase of depreciable property

14. The amortization of input VAT on certain properties is allowed when the aggregate

acquisition costs

A. exceeds P1M.

15. The input VAT on purchases of real properties may be claimed in installment if

A. the VAT seller is subject to VAT on the installment payments.

Multiple Choice – Theory: Part 2

1. The amortization period for depreciable capital goods or properties shall be

B. whichever is shorter between the actual useful life in months or 60 months.

2. Statement 1: The input VAT on non-depreciable vehicles shall be claimed to the month

purchased. Statement 2: The input VAT on construction in progress shall be claimed in the

month billing is paid.

Which is correct?

B. Statement 2

3. The final withheld final VAT is

B. 5% of the sales made to government.

4. Which of the following cannot claim presumptive input VAT?

B. Manufacturer of grease oil

5. The presumptive input VAT is

D. 4% of primary agricultural input.

6. The standard input VAT is equivalent to A. 7% of the sales made to government.

7. The withheld final percentage tax is

B. 3% of the sales made to government.

8. If the standard input VAT exceeds the actual input VAT traceable to

A. an item of gross income subject to income tax.

9. Statement 1: VAT-registered persons do not pay VAT on zero-rated sales.

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

Statement 2: VAT-registered persons always pay VAT on government sales.

Which statement is correct?

C. Both statement

10. Statement 1: The excess of the output VAT over creditable input VAT is paid to the

government. Statement 2: The excess of creditable input VAT over output VAT is claimed as

a tax credit or tax refund.

Which statement is incorrect?

B. Statement 2

11. The excess of creditable input VAT over output VAT is

C. Input VAT carry-over

12. Which of the following Input VAT carry-over is creditable against output VAT of the quarterly

VAT return?

C. Those arising from the prior quarter

13. Which of the following is creditable against the input VAT of the quarterly VAT return?

D. All of these

MC Problem Part 1

1. Andrew, a VAT-taxpayer, imported a golden necklace as a gift to his girlfriend.

- P0

2. A VAT-taxpayer purchase services from a non-VAT-registered person in which he paid a

total of P56,000 on the purchase.

– P0

3. A VAT-Taxpayer imported vatable goods from a non-resident person who is not engaged

in trade or business.

– P18,000

4. A non-VAT registered person purchased goods invoiced at P112,000

– P0

5. A VAT taxpayer incurred the following during the month: Consultancy fees P 700,000

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

– P162,000

6. A Vat-registered purchaser received the following billing from a VAT-registered seller:

- P23,571

7. A VAT-taxpayer made the following purchases during the year: Purchases of goods,

exclusive of VAT P50,000 – P13,320

8. Mr. Alarcon is a percentage taxpayer. – P0

9. A taxpayer who became subject to VAT on the third quarter of 2020 – P72,000

10. Mr. Dontetsk – P4,286

11. Ms. Kibungan – P30,000

12. A VAT-taxpayer received and paid the following billings for vatable goods purchased:

Purchase from non-VAT taxpayers P 50,000

- P26,786

13. A VAT taxpayer had the following transactions during a first calendar quarter of 2020:

- Purchase of services rendered in January but was paid in February P80,000

14. What is the creditable input VAT in February 2020?

– P9,600

15. What is the creditable input VAT for the 1st quarter of 2020?

– P45,600

16. Mr. and Mrs. Sikorsky

– P0; P20,000

17. A VAT taxpayer had the following input VAT during the year: Input VAT on exempt sales

P204,000 – P324,000

MC Problem Part 2

1. Dino Rado

– P4,600

2. A taxpayer who is transitioning to the VAT system had the following inventories

– P7,600

3. Miss Beauty Fooled

– P26,400

4. The vatable sales of an agricultural supplier exceeded the VAT threshold.

– P1,928.57

5. A realty development company is commencing business. – P224,000

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

6. A VAT registered taxpayer purchased equipment which is expected to last 10 years in

January 2020. – P120,000; P0

7. In January 2020, a VAT taxpayer made the following purchases: Goods, exclusive of

VAT P800,000 – P180,000

8. Popogiron Corporation – P192,000

9. Master Pogi – P0; P0

10. A VAT-registered individual purchased the following from various suppliers in November

2020: - P96,000

11. In the preceding problem, what is the creditable input VAT in the December quarterly

VAT return – P3,200

12. A VAT-registered corporation reports on a fiscal year. – P2,650

13. In the preceding problem, what is the creditable input VAT in July 2020 – P2,650

14. In the preceding problem, what is the creditable input VAT for the quarter ending August

2020? – P79,950

15. A VAT-registered individual purchased the following capital goods – P3,000

16. In the preceding problem, what is the creditable input VAT in August 2020? – P5,750

17. Still on the same problem, September 2020 – P14,500

18. A VAT-taxpayer purchased a commercial lot payable in 10 monthly installments

– P24,000; P48,000

19. Thor Corporation – P2,400

20. In the preceding problem, what is the creditable input VAT for May 2020 – P122,400

21. In the preceding problem, what is the creditable input VAT for the quarter ended June 30,

2020 – P151,200

22. Lupao Corporation – P116,000

23. In the immediately preceding problem, what is the claimable input VAT in the second

calendar – P120,000

24. VPI Corporation – March – P120,000; P102,000

25. In the immediately preceding problem, what is the creditable input VAT in the first quarter

– P366,000

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

MC Problems Part 3

1. Sardinia – P6,000

2. What is the total creditable input VAT of Sardinia – P18,000

3. A wholesale trader of canned sardines – P0

4. Sugarland Corporation – P20,000

5. A sugar refiner processes raw sugar – P0

6. Mr. Mantica – P30,000

7. Nizzin manufacturers – P800

8. Assuming the vatable purchases in the preceding problem were exclusive of VAT

– P34,400

9. Misamis Company – P38,500

10. In the immediately preceding problem, what is to be included in the calculation

– P9,500 loss or expense

11. Abenson Builders – P300,000

12. In the immediately preceding problem, what is the final withholding VAT – P200,000

13. Still on the same problem, what is the standard input VAT – P280,000

14. Still on the same problem, what is the treatment – P20 000 expense

15. Mayon Corporation – P60,000

16. What is the creditable input VAT in April – P360,000

17. What is the input VAT carry-over to be credited in June – P40,000

18. A VAT taxpayer had the following data in a quarter: Input VAT carry-over, prior quarter

– P60,000

19. Him Corporation – P30,000

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

CHAPTER 10 VAT STILL DUE

True or False

FALSE 1. Traders who import wheat shall pay advanced VAT.

FALSE 2. The importation of sugar cane is subject to advanced input VAT.

TRUE 3. A manufacturer of refined sugar shall pay advanced VAT before pulling out the

refined sugar at the point of production.

TRUE 4. Millers who Imports wheat shall pay advanced VAT.

TRUE 5. The owner of naturally grown timber shall pay advanced VAT prior to its transport to

buyers

FALSE 6. Traders of refined sugar and flour shall pay advanced VAT.

TRUE 7. Millers of refined sugar and flour shall pay advanced VAT.

TRUE 8. A non-VAT registered person who transport naturally grown timber sale shall pay

advanced percentage tax In lieu of the VAT.

TRUE 9. Unclaimed advanced VAT may be claimed as tax credit

FALSE 10. Unutilized advanced VAT may be claimed as tax refund.

FALSE 11. Unutilized advanced VAT may only be claimed as tax credit certificate.

TRUE 12. Unutilized input VAT can be refunded upon termination of the business of the

taxpayer.

TRUE 13. A VAT overpayment may be carried over in the succeeding periods.

FALSE 14. Advanced VAT is an input VAT

FALSE 15. The quarterly VAT due of the taxpayer is paid within 20 days following the end of the

quarter,

MULTIPLE CHOICE

I. Which is not subject to payment of advanced Input

VAT? a. Milk

b. Refined sugar

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

C. Flour

d. Timber

2. Which is a correct statement regarding the advanced input VAT?

a. The advanced input VAT is synonymous to the VAT on importation

b. The advanced Input VAT is the final VAT due from the seller.

c. The advanced input vat is a down payment of the vat on the ultimate sale of refined sugar,

flour or

timbe

r.

d. The advanced input vat in lieu of the actual input vat traceable to the sales of refined sugar,

flour or timber

3. Which of the following tax credit can be claimed through a tax credit

certificate c. Input VAT on sales to the government

4. Which of the following is not subject to the requirement to pay advanced

VAT

a. Wheat traders

b. Millers of flour

c. Sugar refineries which process sugar for their own accounts

d. Owners of harvested timber

5. Which of the following can be claimed as VAT refund?

a. Input VAT on export sales

b. Advanced Input VAT

c. Input VAT on sales to the government

d. A and B

6. Which is not a tax credit against net VAT payable?

a. Advanced VAT c. Standard input VAT

b. Monthly VAT payments d. Final withheld VAT

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

7. Which Industry is not subject to VAT?

a. Mining c. Banking

L Construction d. Air transport

8. Which is not a VAT compliance requirement?

a. VAT Invoicing

b. Transactional Recording

c. Filing monthly summary list

d. None of these

9. The summary list is required for

a. Large tax payers c Non-VAT taxpayers

b. Non large taxpayers d. All VAT taxpayers

10. What is the effectivity of the request for cancellation of VAT registration?

a. On the day of the request is approved

b. On the day following the date the request was approved

c. On the month following the month the cancellation was approved

d. On the quarter following the quarter when the cancellation was approved

Multiple choice- Problems PART 1

1. Sabina Flour Milling (SFM) Corporation imports and mills wheat.

B. 288,000

2. Sugar Nanny Corporation (SNC) buys sugar cane from farmers and processes

D. 336,000

3. In the immediately preceding problem, what is the total credit C. 456,000

4. A VAT Taxpayer had the following data on its VAT obligation on the last quarter of the

year: B. 40,000

5. Mr. Esperon, a VAT taxpayer, recorded the following during the month.

A. 84,000

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

6. Ms. Chelsea had the following transactions in June 2019 D. 18,000

7. The following gross receipts and input VAT relate to a non profit and non stock

A. 116,000

8. A seller of goods reported the following in the month:

A. 24,000

9. The net income of AKLAN Trading Company during the quarter is as follows.

C. 30,600

10. ABC Construction Company started work on a 5,6000,000 fixed price construction

contract. C. 213,600

11. A VAT registered seller of goods had the following sales and purchases exclusive of VAT:

D. 26,400

12. Mrs.Baniaga, A fruit and vegetable dealer, had the following sales and purchases.

A. 0

13. A VAT registered traded reported the following during the month

A. 24,000

14. A domestic seller and exporter had the following summary of trading activities in the

quarter:

C. 60,000

MC- Problem Part 2

1.A realty dealer disposed two residential units during the month.

Unit 141-B 2,500,000

Unit 142-C

Total sales, Exclusive of VAT

Total input Vat During the month 210,000

Compute the VAT payable.

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

C. 297,500

2. A vat registered restaurant had the following transaction during the month:

Receipt from foods served 600,0

00

Receipts from soft drink 200,0

00

Purchase of rice,meat and vegetable 200,0

00

Purchase of vegetable 100,0

00

Purchase of soft drink 120,0

00

80,00

Purchase of food condiments 0

Assuming all amounts are exclusive of VAT, compute the vat Payable

D. 72,000

3. A Vat-registered tax practitioner who uses the cash basis of accounting disclosed the ff

results of operation (exclusive of Vat)

d. 654,000

4. A manufacturing subcontractor generated the ff receipt from various clients.

Compute the VAT payable

D. 0

5. DZQC, a radio broadcasting company with 8M annual receipt, generated a total revenue of

1M out f which of 800,000 was collected.

A. O

6. A Vat- taxpayer had the following data during the month. Regular sale 3M export sale 1.5 M

input vat o reg sale 240k input vat on export sale 100k. compute the VAT payable B. B.

B.100,000

7. An insurer had the ff receipt and input Vat data during the month. Compute the VAT payable.

D. 195,000

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

8. A lessor of commercial spaces had the ff receipts and input VAT data for the month.

Compute for VATPayable

B. 270,000

9. a domestic airliner had the following transaction during the month

B. 192,000

10. A seller of goods had the ff. sale

C. 48,800

Chapter !0- MC Probs Part 3

1. Denzi company bought a building

- B. 64, 000

2. A VAT- registered bus company has the following receipts on January 2020:

What is the VAT Payable for January

- B. 27, 400

3. A domestic sea carrier has the following receipts and attributable input VAT for the month:

What is the VAT payable:

- C 24, 000

4. A VAT registered television company with annual receipts of P8M reported P 1M total

revenue

What is the VAT payable:

-C. 68, 571

5. A bookstore had the following summary of transaction during the month:

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

What is VAT payable?

-C. 78, 120

6. Danes Bakeshop had the following details of operations during the month:

Compute the VAT payable.

-D. 180, 000

7. Sweet Papa Corporation is a VAT- registered sugar refiner.

What is the VAT payable?

-D. 32, 000

8. Baguio General Hospital has the following receipts and input VAT:

Compute the VAT payable.

-B. 360, 000

9. A VAT –registered professional review school has the following receipts during the month:

Compute the VAT payable.

-C. 92, 000

10. Cordon College had the following receipts and input VAT payments:

Compute the VAT payable.

-A. 0

11. Polaris Company, a VAT seller, has the following sales and purchases

Compute the VAT payable.

-A. 71, 000

12. A VAT taxpayer made the following sales:

Compute the VAT payable:

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

lOMoARcPSD|5631877

-C. 56, 500

Downloaded by Kochanay Garret Oya-oy (kochanay2000@gmail.com)

You might also like

- TAX 2 ExercisesDocument22 pagesTAX 2 ExercisesWinter Summer50% (4)

- Quiz 4 VATDocument3 pagesQuiz 4 VATAsiong Salonga100% (2)

- TB ch07Document31 pagesTB ch07ajaysatpadi100% (1)

- Business Plan:: Nzyoki Janet MutanuDocument6 pagesBusiness Plan:: Nzyoki Janet MutanuDAN0% (1)

- Pre-Week Notes On Vat: Prepared by Dr. Jeannie P. LimDocument11 pagesPre-Week Notes On Vat: Prepared by Dr. Jeannie P. LimMark MagnoNo ratings yet

- Value Added TaxDocument5 pagesValue Added TaxRaven Vargas DayritNo ratings yet

- BIBLE STUDY WORKSHOP USING PHOTOTHEOLOGY BY PASTOR IVOR MYERS For Care GroupDocument2 pagesBIBLE STUDY WORKSHOP USING PHOTOTHEOLOGY BY PASTOR IVOR MYERS For Care GroupMeresa W. MartinNo ratings yet

- Writ Against MEPCODocument10 pagesWrit Against MEPCOapi-3745637No ratings yet

- Chapter 9 TaxDocument27 pagesChapter 9 TaxJason MalikNo ratings yet

- Discussion Questions: True True True False True FalseDocument7 pagesDiscussion Questions: True True True False True FalseJustin TempleNo ratings yet

- Tax 2 Valencia Chapter 10 MLTPL Choice 3-4Document3 pagesTax 2 Valencia Chapter 10 MLTPL Choice 3-4NervianeX HaleNo ratings yet

- Quiz 4 Vat Business Tax 1322 - CompressDocument3 pagesQuiz 4 Vat Business Tax 1322 - CompressChris MartinezNo ratings yet

- Chapter 9 Tax 2 (9-5) ND 9-6Document2 pagesChapter 9 Tax 2 (9-5) ND 9-6Elai grace FernandezNo ratings yet

- Chapter 10 Practice Problems ValenciaDocument1 pageChapter 10 Practice Problems ValenciaElai grace FernandezNo ratings yet

- 3rdyr 1stF BusinessTax 2324Document43 pages3rdyr 1stF BusinessTax 2324zaounxosakubNo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxAllen KateNo ratings yet

- Multiple Choice QuestionsDocument14 pagesMultiple Choice QuestionsVince ManahanNo ratings yet

- Additional Vat MSQ PDFDocument14 pagesAdditional Vat MSQ PDFPrincesNo ratings yet

- Prelim Examination. AY 2nd SEM 2023 2024Document5 pagesPrelim Examination. AY 2nd SEM 2023 2024amseservices18No ratings yet

- Input Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocument28 pagesInput Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTAjey MendiolaNo ratings yet

- TQ VatDocument6 pagesTQ VatJaneNo ratings yet

- Bmtax Fa2Document5 pagesBmtax Fa2KHYSHA NICOLE PALTINGNo ratings yet

- BT - Sq1 VatDocument4 pagesBT - Sq1 VatTherese Janine HetutuaNo ratings yet

- Chapter 13 Mixed Business TransactionsDocument10 pagesChapter 13 Mixed Business TransactionsGeraldNo ratings yet

- JPIA Review S3 Installment 2 (Business Tax)Document30 pagesJPIA Review S3 Installment 2 (Business Tax)rylNo ratings yet

- Tax2 FinalsDocument8 pagesTax2 FinalsKevin Elrey Arce100% (2)

- VAT (Theory & Problem)Document10 pagesVAT (Theory & Problem)dimpy dNo ratings yet

- Value Added Tax (VAT) : Transfer and Business TaxDocument58 pagesValue Added Tax (VAT) : Transfer and Business TaxRizzle RabadillaNo ratings yet

- St. Anthony'S College San Jose, AntiqueDocument9 pagesSt. Anthony'S College San Jose, AntiqueClaire Araneta AlcozeroNo ratings yet

- Final Examintation - TaxationDocument5 pagesFinal Examintation - TaxationMPCINo ratings yet

- Value Added Taxation 2021Document18 pagesValue Added Taxation 2021lllllnubhbhgNo ratings yet

- Excess Input and Senior Citizen and PWDDocument9 pagesExcess Input and Senior Citizen and PWDsahitariosoNo ratings yet

- VAT ReviewDocument10 pagesVAT ReviewRachel LeachonNo ratings yet

- Tax Review - Overview Vat and Opt (Quiz)Document4 pagesTax Review - Overview Vat and Opt (Quiz)Lovenia Magpatoc100% (7)

- Value Added Tax PracticeDocument7 pagesValue Added Tax PracticeSelene DimlaNo ratings yet

- VAT DiscussionDocument5 pagesVAT DiscussionArcide Rcd ReynilNo ratings yet

- Bustax Chap9 Theory and ProblemsDocument4 pagesBustax Chap9 Theory and ProblemsPineda, Paula MarieNo ratings yet

- Tax RevDocument4 pagesTax RevCanapi AmerahNo ratings yet

- TAX2UNIT9TO12Document4 pagesTAX2UNIT9TO12Catherine Joy VasayaNo ratings yet

- QuizDocument5 pagesQuizRomaica Ella AmbidaNo ratings yet

- Transfer Annd Business TaxationDocument5 pagesTransfer Annd Business TaxationRoselgin DagalaNo ratings yet

- VAT ReviewDocument8 pagesVAT ReviewabbyNo ratings yet

- Quiz 2 Part 1Document1 pageQuiz 2 Part 1Renz CastroNo ratings yet

- Value Added TaxDocument6 pagesValue Added TaxjamNo ratings yet

- Capital Gains Tax ReviewerDocument14 pagesCapital Gains Tax ReviewerCleah WaskinNo ratings yet

- Business TaxDocument116 pagesBusiness TaxScarlett FernandezNo ratings yet

- VAT Basics - July 2023Document8 pagesVAT Basics - July 2023maharajabby81No ratings yet

- VAT Questions For Professional Stage Knowledge LevelDocument14 pagesVAT Questions For Professional Stage Knowledge LevelFahimaAkterNo ratings yet

- C9 Input VATDocument18 pagesC9 Input VATdraga pinasNo ratings yet

- 1 Understanding VAT For BusinessesDocument6 pages1 Understanding VAT For BusinessesBensonNo ratings yet

- MCQ Pre-Long Exam On Value Added Tax May 19, 2020Document6 pagesMCQ Pre-Long Exam On Value Added Tax May 19, 2020JDR JDRNo ratings yet

- Business TaxDocument9 pagesBusiness TaxWere dooomedNo ratings yet

- What Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14Document8 pagesWhat Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14EstherNalubegaNo ratings yet

- VAT ReviewerDocument3 pagesVAT ReviewerCJ LopezNo ratings yet

- VatDocument22 pagesVatFarhani Sam RacmanNo ratings yet

- Page 1 of 24Document24 pagesPage 1 of 24Peter AhNo ratings yet

- 93-13 - VatDocument19 pages93-13 - VatJuan Miguel UngsodNo ratings yet

- A. C. D. With:: If of Is If If of If IsDocument3 pagesA. C. D. With:: If of Is If If of If IsFerl Diane SiñoNo ratings yet

- VAT Act 2052Document8 pagesVAT Act 2052Nirmal Shrestha100% (1)

- CPAR VAT (Batch 92) - HandoutDocument38 pagesCPAR VAT (Batch 92) - HandoutVan DahuyagNo ratings yet

- Chapter 8Document9 pagesChapter 8nena cabañesNo ratings yet

- HANDOUT-business TaxesDocument29 pagesHANDOUT-business TaxesGianJoshuaDayrit67% (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Department of Accountancy: Short-Term Non-Routine DecisionsDocument6 pagesDepartment of Accountancy: Short-Term Non-Routine Decisionskochanay oya-oyNo ratings yet

- ECA QuizzerDocument3 pagesECA Quizzerkochanay oya-oyNo ratings yet

- RF14 Confirmation of Transfer From Closed SchoolDocument3 pagesRF14 Confirmation of Transfer From Closed Schoolkochanay oya-oyNo ratings yet

- Rf14 Confirmation of Transfer From Closed SchoolDocument3 pagesRf14 Confirmation of Transfer From Closed Schoolkochanay oya-oyNo ratings yet

- How To Work With Gross PricesDocument26 pagesHow To Work With Gross Priceskochanay oya-oyNo ratings yet

- Purchases Journal Date Purchased From PR Debit Credit Purchases Sundry Accounts Payable Account Title PR AmountDocument1 pagePurchases Journal Date Purchased From PR Debit Credit Purchases Sundry Accounts Payable Account Title PR Amountkochanay oya-oyNo ratings yet

- Position Paper On Andres BonifacioDocument5 pagesPosition Paper On Andres Bonifaciokochanay oya-oy67% (3)

- The Tilled Field Is The First of The Joan Miró: SurrealismDocument2 pagesThe Tilled Field Is The First of The Joan Miró: Surrealismkochanay oya-oyNo ratings yet

- Purchases JournalDocument1 pagePurchases Journalkochanay oya-oyNo ratings yet

- Purchases Journal Date Purchased From PR Debit Credit Purchases Sundry Accounts Payable Account Title PR AmountDocument1 pagePurchases Journal Date Purchased From PR Debit Credit Purchases Sundry Accounts Payable Account Title PR Amountkochanay oya-oyNo ratings yet

- Merchandising Financial StatementsDocument7 pagesMerchandising Financial Statementskochanay oya-oy100% (1)

- April 2, 2017 Jrtasing: Posted On byDocument5 pagesApril 2, 2017 Jrtasing: Posted On bykochanay oya-oyNo ratings yet

- Jean Jac RousseauDocument19 pagesJean Jac RousseauFroilan TinduganNo ratings yet

- Relations Between Husband and WifeDocument23 pagesRelations Between Husband and WifeMariam BautistaNo ratings yet

- Private Equity and Venture Capital in SMEs in Developing CountriesDocument34 pagesPrivate Equity and Venture Capital in SMEs in Developing CountriesAgroEmpresario ExportadorNo ratings yet

- Liberalism Upsc Notes 16Document3 pagesLiberalism Upsc Notes 16Sk SharmaNo ratings yet

- Spectranet FebDocument4 pagesSpectranet FebnitinNo ratings yet

- Rental Agreement FinalDocument6 pagesRental Agreement FinalAmarnath WadwaleNo ratings yet

- Circular and Rotational Motion (Rev1)Document52 pagesCircular and Rotational Motion (Rev1)Nilambar DebSharmaNo ratings yet

- 31jan2019 - PDs CompiledDocument108 pages31jan2019 - PDs CompiledharigroupphilippinesNo ratings yet

- Tamatave V QueenDocument4 pagesTamatave V QueennitumNo ratings yet

- Document 4Document4 pagesDocument 4Ana Sofía Cruz AcostaNo ratings yet

- PPT-4-Kenyan History, Culture and IdentityDocument3 pagesPPT-4-Kenyan History, Culture and IdentitySaksham SinghNo ratings yet

- VB 08 Errors StatmentsDocument4 pagesVB 08 Errors StatmentsMike LouisNo ratings yet

- 1 Mendezona Vs OzamizDocument21 pages1 Mendezona Vs OzamizJerric CristobalNo ratings yet

- Biography (Arabic & English) of A Muhaddith of Our Age DR Abdul Haleem ChishtiDocument14 pagesBiography (Arabic & English) of A Muhaddith of Our Age DR Abdul Haleem ChishtiIslamic_Books_LiteratureNo ratings yet

- Lewis and ClarkDocument23 pagesLewis and ClarkdaltonwsandersNo ratings yet

- List of CasesDocument3 pagesList of Casestin_m_sNo ratings yet

- 4.A.3.3 Ramos v. CA (1999 and 2002)Document4 pages4.A.3.3 Ramos v. CA (1999 and 2002)Soraya Salubo Laut100% (1)

- 10-Compostela2016 Part1-Notes To FSDocument84 pages10-Compostela2016 Part1-Notes To FSsandra bolokNo ratings yet

- Kh. Shafiqur RahmanDocument48 pagesKh. Shafiqur RahmanAnonymous UqGvTrNo ratings yet

- ReconveyanceDocument30 pagesReconveyanceJane CaramountNo ratings yet

- Long Wharf Tour RiderDocument6 pagesLong Wharf Tour RiderOmar MackNo ratings yet

- Pecho vs. PeopleDocument2 pagesPecho vs. PeopleDana Denisse RicaplazaNo ratings yet

- Foakes Beer CaseDocument13 pagesFoakes Beer CaseSebastian SjkNo ratings yet

- GROUPtwoDocument12 pagesGROUPtwoNor Aen CastilloNo ratings yet

- Costing Booster Batch: FOR MAY 2023Document244 pagesCosting Booster Batch: FOR MAY 2023Vishal VermaNo ratings yet

- Dahan, Dexter Ian BagobeDocument2 pagesDahan, Dexter Ian Bagobeglenn goldNo ratings yet