Professional Documents

Culture Documents

US Internal Revenue Service: ffc110

US Internal Revenue Service: ffc110

Uploaded by

IRSOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: ffc110

US Internal Revenue Service: ffc110

Uploaded by

IRSCopyright:

Available Formats

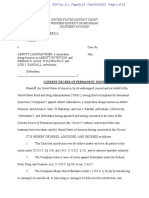

FinCEN Form 110 Designation of Exempt Person

(Formerly form TD F 90-22.53)

Previous editions will not be accepted after January 2006

August 2005 Please type or print. Complete all parts that apply. See instructions.

OMB No.1506-0012

Send your completed form to: IRS Detroit Computing Center, Attn: Designation of Exempt Person, P. O. Box 33112, Detroit, MI 48232-0112

Part I Filing Information

1 Indicate the type of filing by checking a, b, c, or d (check only one)

a Initial designation b Biennial renewal c Exemption amended d Exemption revoked

2 Effective date of the exemption

__________ / __________ / __________

MM DD YYYY

Part II Exempt Person Information

3 Legal name of the exempt person 4 Doing business as (DBA)

5 Address

F

6 City 7 State 8 ZIP Code *9 EIN or SSN

10 Type of exempt person, check box a, b, c, d, e, or f (check only one)

A

a Bank b Government agency/Governmental authority c Listed company

d Listed company subsidiary e Eligible non-listed business f Payroll customer

R

11 If this is a biennial renewal, and the exempt person is an eligible non-listed business or a payroll customer,

a Yes b No

( 10 e or f above) has there been a change in control of the exempt person during the last two calender years?

Part III Filer Information

12 Name of bank

D

13 Address

14 City 15 State 16 ZIP Code 17 EIN

18 Indicate the bank’s primary federal regulator by

checking a, b, c, d, e, or f (check only one) a OCC b FDIC c FRS d OTS e NCUA f IRS

19 If this designation is also being made for one or more affiliated banks, check this box.

See Part V of the instructions for the procedure for listing additional affiliated bank(s) and requirements of the biennial renewal certification.

Part IV Signature

I am authorized to sign this form on behalf of the bank granting the exemption and any listed bank subsidiaries. I declare that the information

provided is true, correct and complete.

20 Signature (If item 1a, c, or d is checked, sign here) 21 Print name

22 Title 23 Date of signature 24 Telephone number - (include area code)

_____ / _____ / _______

MM DD YYYY ( )

Part V Biennial Renewal Certification

Complete this part only if you are filing a biennial renewal (Item 1b checked).

I certify on behalf of the bank that its system of monitoring the transactions in currency of an exempt person for suspicious activity has been

applied as necessary, but at least annually, to this exempt person.

25 Signature (If item 1b is checked, sign here) 26 Print name

27 Title 28 Date of signature 29 Telephone number - (include area code)

_______ / ______ / ________

MM DD YYYY ( )

Catalog Number 47385C Rev. 08/05

FinCEN Form 110 Designation of Exempt Person

General Information 6. Enter identifying numbers starting from left to right. if you checked Item 1b to indicate that you are filing a

The Bank Secrecy Act and its implementing Do not include spaces, dashes, or other punctuation. biennial renewal (biennial renewals only required for

regulations require banks to file currency transaction Identifying numbers include social security number item 10e and 10f).

reports on transactions in currency of more than (SSN), employer identification number (EIN), and Part III Filer Information

$10,000. The regulations also permit a bank to ex- individual taxpayer identification number (ITIN). Item 12--Name of bank. Enter the bank’s full legal

empt certain customers from currency transaction re- 7. Enter all Post Office ZIP Codes from left to right name.

porting in accordance with 31 CFR 103.22. with at least the first five numbers, or with all nine Item 13, 14, 15 and 16--Address. Enter the bank’s

Banks are the only type of financial institutions (ZIP + 4) if known. headquarters address.

that may exempt customers from CTR filing require- 8. Addresses: Enter the permanent street address, Item 17--EIN. Enter the bank’s employer identifica-

ments. The term bank is defined in 31 CFR 103.11(c); city, two-letter state or territory abbreviation used by tion number (EIN).

and includes savings and loan associations, thrift in- the U.S. Postal Service and ZIP Code (ZIP+4 if known) Item 18--Primary regulator. Check only one of the

stitutions, and credit unions. of the exempt person or entity. A post office box following six boxes, OCC, FDIC, FRS, OTS, NCUA, or

The customers that the bank may exempt are number should not be used , unless no other address IRS.

called “exempt persons”. An exempt person may be is available. Also enter any apartment number, suite Item 19--Affiliated banks. A parent bank holding

a bank, government agency/government authority, number, or road or route number. If a P.O. Box is company or one of its bank subsidiaries may make

listed company, listed company subsidiary, eligible used for an entity, enter the street name, suite number, the designation of exempt person on behalf of all bank

non-listed business, or payroll customer, as defined and road or route number. subsidiaries of the holding company so long as the

in 31 CFR 103.22. designation lists each bank subsidiary that will treat

A bank may, but is not required to, use this form Specific Instructions the customer as an exempt person. If you are making

to notify the Treasury that the bank has revoked the such a designation, check the box in item 19. List the

designation of a customer as an exempt person. Part I Filing Information name and address of each bank subsidiary by com-

Item 1--Type of filing. Check only one of the four pleting Part III of an additional Designation of Exempt

FinCEN encourages banks to use the exemp- boxes. The bank will file an initial designation just once, Person form for each bank subsidiary. Complete the

tion procedure to the fullest extent. FinCEN also re- marking item 1a to signify the initial designation. additional forms by entering the bank’s name and ad-

F

minds banks of their continuing obligation to moni- Additionally, with regard to non-listed businesses (item dress in Items 12 through 18, and copy the informa-

tor for, and report suspicious activity with respect to 10e checked) or payroll customers (item 10f checked), tion from Part IV, items 21 through 24 of your Desig-

transactions of all customers, including currency trans- the bank must file the form biennially to renew the nation of Exempt Person form onto each additional

actions conducted by exempt persons. exempt status of these customers, marking item 1b to form. Submit the additional forms by attaching them

signify the biennial renewal. If amending a report (1c to your Designation of Exempt Person form. The data-

A

When and where to file checked) complete the amended report in its entirety. base will accept up to a total of 20 entries.

Any bank that wishes to designate a customer Item 2--Effective date of the exemption. For initial

as an exempt person must file FinCEN Form 110, designation, enter the date of the first transaction to Only one signature is required for this form

Designation of Exempt Person, with the IRS Detroit be exempted.

Computing Center no later than 30 days after the -For biennial renewal, the effective date of the Part IV Signature

R

first transaction to be exempted. exemption will be the same date the bank used in the Item 20--Signature. An authorized official of the bank

The biennial renewal must be filed by March “effective date of the exemption box” when the initial shall sign the form. (If item 1a, c, or d is checked)

15 of the second calendar year following the year of designation was filed. Item 21-- Print name. Enter the name of the bank

the initial designation, and every other March 15 -For exemptions amended, if the effective date of the official who signed the form.

thereafter. If the bank missed filing the biennial exemption is not being amended, the date entered Item 22--Title. Enter the title of the bank official who

D

renewal timely, contact DCC at 800-800-2877 for should be the same date the bank used in the “effective signed the form.

instructions. date of the exemption box” when the initial Item 23--Date of signature. Enter the current date

designation was made; or if the effective date of the the form was signed.

Send your completed form to: exemption is being amended, enter the date of the Item 24--Telephone number. Enter the phone number

IRS Detroit Computing Center first transaction to be exempted. of the bank official who signed the form.

Attn: Designation of Exempt Person -If the DOEP form is used to revoke an exemption,

P.O. Box 33112 enter the day after the last transaction to be exempted. Part V Biennial Renewal Certification

Detroit, MI 48232-0112

Part II Exempt Person Information When filing a biennial renewal, a bank must certify

General Instructions Item 3--Legal name of the exempt person. Enter that it has applied as necessary, but at least annually, a

the full legal name of the exempt person as it is shown system of monitoring the transactions in currency for

1. This form can be e-filed through the Bank on the charter or other document creating the entity. suspicious activity. If the box in item 19 is checked,

Secrecy Act E-filing System. Go to For exempt persons that are sole proprietorship, enter the bank granting the exemption is responsible for

http://bsaefiling.fincen.treas.gov/index.jsp to the first and last name of the proprietor. completing its own monitoring and due diligence in

register. This form is also available for download on Item 4--Doing business as (DBA). If applicable, en- granting the exemption. The attached list of affiliated

the Financial Crimes Enforcement Network’s Web ter the separate DBA name of the exempt person. banks is provided only to reflect the other financial

site at www.fincen.gov, or may be ordered by Item 5, 6, 7 and 8--Address. Enter the permanent institutions that may recognize this exemption.

calling the IRS Forms Distribution Center at (800) address of the business location of the exempt per-

Item 25--Signature. An authorized official of the bank

829-3676. son. For exempt persons doing business at more than

shall sign the certification. (Item 1b is checked)

2. Complete the form in accordance with specific one physical location, enter the local headquarters ad-

Item 26-- Print name. Enter the name of the bank

instructions for each item. Unless there is a specific dress or local address of the exempt person. For sole

official who signed the certification.

instruction to the contrary, leave blank any items that proprietorship, enter the business address of the sole

Item 27--Title. Enter the title of the bank official who

do not apply. proprietorship rather than the home address of the

signed the certification.

3. Do not include supporting documents. sole proprietor, unless they are the same.

Item 28--Date of signature. Enter the date the

4. Enter all dates in MM / DD / YYYY format where Item 9--EIN or SSN. Enter the EIN of the exempt

certification was signed.

MM=month, DD=day, and YYYY=year. Precede any person. If a sole proprietorship does not have an EIN,

Item 29--Telephone number. Enter the phone

single number with a zero, i.e., 01,02, etc. enter the social security number (SSN).

number of the bank official who signed the

5. List all U.S. telephone numbers with area code Item 10--Type of exempt person. Check only one of

certification.

first and then the seven-digit phone number, using the six boxes. See 31 CFR 103.22(a).

the format (XXX) XXX-XXXX. Item 11--Change in control. Complete this item only

Paperwork Reduction Act Notice: The purpose of this form is to provide an effective means for banks and depository institutions to exempt eligible customers from currency

transaction reporting. This report is required by law, pursuant to 31 CFR 103.22. Federal law enforcement and regulatory agencies, including the U.S. Department of Treasury and

other authorized authorities, may use and share this information. You are not required to provide the requested information unless a form displays a valid OMB control number.

Public reporting and recordkeeping burden for this form is estimated to average 70 minutes per response, and includes time to gather and maintain information for the required

report, review the instructions, and complete the information collection. The record retention period is five years. Send comments regarding this burden estimate, including

suggeations for reduciing the burden, to Financial Crimes Enforcement Network, Attention: Paperwork Reduction Act, P. O. Box 39, Vienna, VA 22183-0039.

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Super Secret Tax DocumentDocument4 pagesSuper Secret Tax Documentk11235886% (7)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Defining Business Need: Diploma in Procurement and SupplyDocument43 pagesDefining Business Need: Diploma in Procurement and SupplyRoshanNo ratings yet

- Ldentification: Request For andDocument1 pageLdentification: Request For andclaraNo ratings yet

- 5 - Irs 57Document2 pages5 - Irs 57Hï FrequencyNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationcoldsunlightNo ratings yet

- OWNER OPERATOR HIRING PACKET - LeoDocument16 pagesOWNER OPERATOR HIRING PACKET - LeoDinesh KumarNo ratings yet

- W - 9 Request For Taxpayer Identification Number and CertificationDocument1 pageW - 9 Request For Taxpayer Identification Number and Certificationxgnw8bc6tdNo ratings yet

- TimeClock Plus LLC LOCKBOX W-9 2023 (6) 1Document1 pageTimeClock Plus LLC LOCKBOX W-9 2023 (6) 1rofira9450No ratings yet

- Tax ID-W9Document1 pageTax ID-W9traduccionesluisahurtadoNo ratings yet

- NKC Form w9 SignedDocument4 pagesNKC Form w9 SignedLakes EvansNo ratings yet

- Authorized Dealer and W9 FormDocument3 pagesAuthorized Dealer and W9 FormJuan Esteban HenaoNo ratings yet

- W-9 FormDocument4 pagesW-9 FormLouiseDulceNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationMalahk Ben MikielNo ratings yet

- W9 Blank FormDocument4 pagesW9 Blank FormKathy AcostaNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFMoises TovarNo ratings yet

- Blank W-9 2014Document4 pagesBlank W-9 2014Carrie AlbersNo ratings yet

- Form W9 PDFDocument4 pagesForm W9 PDFtmturnbullNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationJason VelazquezNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFJon MannNo ratings yet

- Fatca PDFDocument4 pagesFatca PDFalexcentruNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAnton Elena-CarmenNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFchristopherNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFAnonymous wGM3bC2NNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationEric PraterNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationfrankiedd18No ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAprilNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFVictoria BeeNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFAldar AltanbayarNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAnonymous 2g7ZwR2hY4No ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationClifford HallNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFRosita Barbosa AndalioNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAnonymous 2g7ZwR2hY4No ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationgayan sadaruwanNo ratings yet

- Form W-9 PDFDocument4 pagesForm W-9 PDFRobert MooreNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationJason VelazquezNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationjoshblackmanNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationKelsey Monson100% (1)

- W-9 Blank FormDocument4 pagesW-9 Blank FormMonnommiNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationMarc HardingNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationfastchennaiNo ratings yet

- fw9 3 PDFDocument4 pagesfw9 3 PDFRoosevelito MaitreNo ratings yet

- w9 PDFDocument4 pagesw9 PDFoceanic23No ratings yet

- fw9 PDFDocument4 pagesfw9 PDFjengNo ratings yet

- W9 Form PDFDocument4 pagesW9 Form PDFNicoleNo ratings yet

- fw9 PDFDocument4 pagesfw9 PDFmikeNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationLouiseDulceNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationhanakog5972No ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationtestNo ratings yet

- w-9 FormDocument4 pagesw-9 Formapi-350005045No ratings yet

- Identification Number and Certificationrequest For Taxpayer: Purpose of FormDocument6 pagesIdentification Number and Certificationrequest For Taxpayer: Purpose of FormJacqueline CostictNo ratings yet

- Img 0001 PDFDocument9 pagesImg 0001 PDFAnonymous mzkNojivNo ratings yet

- Newmass W9Document2 pagesNewmass W9Christian PazNo ratings yet

- Irs Form w-9 Uc BerkeleyDocument1 pageIrs Form w-9 Uc BerkeleyMike De JesusNo ratings yet

- New Customer Info PacketDocument7 pagesNew Customer Info Packet3ga GroupNo ratings yet

- Snow Media LLC w9Document6 pagesSnow Media LLC w9Carlos DanielNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationZak CascaNo ratings yet

- Mesh w9 PDFDocument4 pagesMesh w9 PDFKevin ColemanNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationYut ChiaNo ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- Articles of Incorporation and By-Laws (Stock Corporation)Document14 pagesArticles of Incorporation and By-Laws (Stock Corporation)SnowbellNo ratings yet

- Change Control - Continuous Quality Improvement in FDA and ISO EnvironmentsDocument7 pagesChange Control - Continuous Quality Improvement in FDA and ISO EnvironmentsmastercontroldotcomNo ratings yet

- Contracts Exam 20911Document13 pagesContracts Exam 20911Mark Richard Hilbert (Rossetti)No ratings yet

- Severino Vs SeverinoDocument2 pagesSeverino Vs SeverinoNap Gonzales100% (1)

- Singapore Telecommunications ActDocument144 pagesSingapore Telecommunications ActPangihutan HutaurukNo ratings yet

- CRDB Bank Job Opportunities Senior Specialist Occupational Safety ComplianceDocument3 pagesCRDB Bank Job Opportunities Senior Specialist Occupational Safety ComplianceAnonymous FnM14a0No ratings yet

- PepsiCo Case Material 2009Document259 pagesPepsiCo Case Material 2009Muhammad ZubairNo ratings yet

- Pa MV-11Document2 pagesPa MV-11Nick RosatiNo ratings yet

- NF DeclarationDocument1 pageNF DeclarationSimbarashe MarisaNo ratings yet

- Competition Policy and Industrial Development - Mario Possas & Heloísa Borges (v4)Document31 pagesCompetition Policy and Industrial Development - Mario Possas & Heloísa Borges (v4)Heloisa BorgesNo ratings yet

- Executive Order 032 Series of 2018Document10 pagesExecutive Order 032 Series of 2018elayNo ratings yet

- 2002 QuestionDocument5 pages2002 Questionmohamad ashmuniNo ratings yet

- The Application of Restraint of Trade or No Competition Clauses in Independent Contractor AgreementsDocument2 pagesThe Application of Restraint of Trade or No Competition Clauses in Independent Contractor AgreementsEmmanuel Nhachi100% (1)

- Is 4711 2008Document9 pagesIs 4711 2008Rishab TanejaNo ratings yet

- Group Deprn White PaperDocument120 pagesGroup Deprn White PaperajeeshmbNo ratings yet

- Data Protection IndonesiaDocument8 pagesData Protection Indonesiacontra flowNo ratings yet

- Control of Measuring, Inspection and Test EquipmentDocument3 pagesControl of Measuring, Inspection and Test EquipmentAnonymous rSvCmFNo ratings yet

- Active and Intelligent Food Packaging-Legal Aspects and Safety ConcernsDocument10 pagesActive and Intelligent Food Packaging-Legal Aspects and Safety ConcernsmozierlanNo ratings yet

- E-Sanhita JulyDocument20 pagesE-Sanhita Julyapi-3778658No ratings yet

- Promissory EstoppelDocument16 pagesPromissory Estoppelsunil_garg1421100% (1)

- Hlurb Jurisdiction BrieferDocument2 pagesHlurb Jurisdiction BrieferDavid CagahastianNo ratings yet

- US V Abbott Labs - Baby Formula Consent DecreeDocument33 pagesUS V Abbott Labs - Baby Formula Consent DecreeLaw&CrimeNo ratings yet

- Regional Cooperative ProfileDocument36 pagesRegional Cooperative ProfileRj BitonioNo ratings yet

- Manila Prince Hotel Vs Gsis - DigestDocument3 pagesManila Prince Hotel Vs Gsis - DigestEzekiel Japhet Cedillo EsguerraNo ratings yet

- 02 Karen Leary Analysis PDFDocument11 pages02 Karen Leary Analysis PDFNandana RajeevNo ratings yet

- Pineda v. Williams-Sonoma S178241 (Cal. Supreme Court Feb. 10, 2011)Document17 pagesPineda v. Williams-Sonoma S178241 (Cal. Supreme Court Feb. 10, 2011)Venkat BalasubramaniNo ratings yet

- B01.ug - .Cao - .00024-007 MoeDocument110 pagesB01.ug - .Cao - .00024-007 MoeJindarat KasemsooksakulNo ratings yet

- AHIPDocument5 pagesAHIPPeter SullivanNo ratings yet

- Act 422 Ports Privatization Act 1990Document20 pagesAct 422 Ports Privatization Act 1990Adam Haida & CoNo ratings yet