Professional Documents

Culture Documents

Accounting For Business Combination

Accounting For Business Combination

Uploaded by

The makas AbababaCopyright:

Available Formats

You might also like

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading Examinationjoyce77% (13)

- Illustration: Business Combination Achieved in StagesDocument26 pagesIllustration: Business Combination Achieved in StagesArlene Diane Orozco100% (1)

- PonyUp StablesDocument5 pagesPonyUp StablesNatalie DaguiamNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Chapter 10 Impairment of Assets (Pas 36)Document11 pagesChapter 10 Impairment of Assets (Pas 36)Krissa Mae Longos100% (1)

- 4Document286 pages4JaceNo ratings yet

- Confidence Cement Ltd. Ratio AnalysisDocument42 pagesConfidence Cement Ltd. Ratio AnalysisShehab Mahmud0% (1)

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading ExaminationNhel AlvaroNo ratings yet

- CDD Acctg. For Bus - Co Preliminary ExaminationDocument25 pagesCDD Acctg. For Bus - Co Preliminary ExaminationMaryjoy Sarzadilla JuanataNo ratings yet

- Separate Summary of Answers For Every ProblemDocument1 pageSeparate Summary of Answers For Every ProblemcpacpacpaNo ratings yet

- Profe03 - Chapter 2 Business Combinations Specific CasesDocument12 pagesProfe03 - Chapter 2 Business Combinations Specific CasesSteffany RoqueNo ratings yet

- Business Combination Part 2Document6 pagesBusiness Combination Part 2cpacpacpaNo ratings yet

- MODULE 29 Business CombinationsDocument11 pagesMODULE 29 Business CombinationsAngelica Sanchez de VeraNo ratings yet

- Pre Buscomok PDF FreeDocument9 pagesPre Buscomok PDF FreeheyNo ratings yet

- Business Combination Part 3Document4 pagesBusiness Combination Part 3Aljenika Moncada GupiteoNo ratings yet

- Business CombinationsDocument41 pagesBusiness CombinationsShiena Marie VillapandoNo ratings yet

- ACC 113 Module 7 AnswerDocument4 pagesACC 113 Module 7 AnswerYahlianah Lee100% (2)

- Topic 6 Tutorial SolutionsDocument6 pagesTopic 6 Tutorial SolutionsKitty666No ratings yet

- Special Accounting Topics For Business CombinationDocument4 pagesSpecial Accounting Topics For Business CombinationMixx MineNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesMixx MineNo ratings yet

- Ac12 - Module1Document4 pagesAc12 - Module1Mon Rean Villaroza JuatchonNo ratings yet

- Business Combination Part 2Document8 pagesBusiness Combination Part 2Aljenika Moncada GupiteoNo ratings yet

- M6 (IAS 18) (6th)Document6 pagesM6 (IAS 18) (6th)aslamhamza949No ratings yet

- Exercise # 1Document6 pagesExercise # 1MA ValdezNo ratings yet

- Chapter 10 Impairment of Assets (Pas 36)Document11 pagesChapter 10 Impairment of Assets (Pas 36)Princess TaoinganNo ratings yet

- Business Combination Module 4Document6 pagesBusiness Combination Module 4TryonNo ratings yet

- Partnership Dissolution G7Document47 pagesPartnership Dissolution G7Erika PanganNo ratings yet

- Fischer - Fundamentals of Advanced Accounting 1eDocument27 pagesFischer - Fundamentals of Advanced Accounting 1eyechueNo ratings yet

- Accounting For Business Combination: By: Camell Divine Rey, CpaDocument46 pagesAccounting For Business Combination: By: Camell Divine Rey, Cpaaira nialaNo ratings yet

- Departmental AbcDocument23 pagesDepartmental AbcMaria DyNo ratings yet

- SBR Assigment-Liam'sDocument7 pagesSBR Assigment-Liam'sbuls eyeNo ratings yet

- 157 First Grading ExamDocument8 pages157 First Grading Examerica insiongNo ratings yet

- AFAR QuestionsDocument6 pagesAFAR QuestionsTerence Jeff TamondongNo ratings yet

- Afar - BC-1-2018Document4 pagesAfar - BC-1-2018Joanna Rose Deciar100% (2)

- Accounting For Business CombinationsDocument39 pagesAccounting For Business CombinationsRaisaNo ratings yet

- Abc Stock AcquisitionDocument13 pagesAbc Stock AcquisitionMary Joy AlbandiaNo ratings yet

- AC15 Quiz 1 Solution ManualDocument8 pagesAC15 Quiz 1 Solution ManualKristine Esplana ToraldeNo ratings yet

- 3 - Business CombinationDocument28 pages3 - Business Combinationjecille magalongNo ratings yet

- Goodwill & PSR Final Revision SPCCDocument43 pagesGoodwill & PSR Final Revision SPCCHeer SirwaniNo ratings yet

- IFRS 3 Business CombinationDocument52 pagesIFRS 3 Business CombinationRusselle Therese DaitolNo ratings yet

- Valuation of Goodwill and Shares 1Document31 pagesValuation of Goodwill and Shares 1p66610072No ratings yet

- Business Combination ActivityDocument5 pagesBusiness Combination ActivityAndy LaluNo ratings yet

- AUD 323 Auditing & Assurance: Concepts & ApplicationsDocument33 pagesAUD 323 Auditing & Assurance: Concepts & ApplicationsYvone Claire Fernandez SalmorinNo ratings yet

- 400 Sample EXAM1 AADocument20 pages400 Sample EXAM1 AASehoon OhNo ratings yet

- Redemption of Preference SharesDocument9 pagesRedemption of Preference SharesRahul VermaNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Ias 18Document10 pagesIas 18Butt ArhamNo ratings yet

- F3 Chapter 13Document10 pagesF3 Chapter 13Ali ShahnawazNo ratings yet

- Advanced Accounting 4th Edition Jeter Test BankDocument20 pagesAdvanced Accounting 4th Edition Jeter Test Bankbryanharrismpqrsfbokn100% (15)

- BADVAC1X Quiz 1 2Document4 pagesBADVAC1X Quiz 1 2dumpyforhimNo ratings yet

- IAC15 TheoryDocument11 pagesIAC15 TheoryMaurienne Mojica0% (1)

- Afar de Leon/De Leon/De Leon/Tan 3006-Consosolidated Statements M A Y 2 0 2 1Document5 pagesAfar de Leon/De Leon/De Leon/Tan 3006-Consosolidated Statements M A Y 2 0 2 1TatianaNo ratings yet

- AFAR.2906 - SEPARATE and CONSOLIDATED STATEMENTSDocument7 pagesAFAR.2906 - SEPARATE and CONSOLIDATED STATEMENTSRonna Mae Mendoza100% (1)

- (FA) 2 Multi-Step - Essay Practice Problem Solutions v2Document18 pages(FA) 2 Multi-Step - Essay Practice Problem Solutions v2Swapan Kumar SahaNo ratings yet

- Ge Acctg 7Document5 pagesGe Acctg 7ezraelydanNo ratings yet

- Ifrs 9 - Financial Instruments Review QuestionsDocument9 pagesIfrs 9 - Financial Instruments Review QuestionsHamad Sadiq100% (1)

- Consolidated Financial StatementDocument5 pagesConsolidated Financial StatementTriechia LaudNo ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- Adg8kk1) r8 Fq7''uDocument6 pagesAdg8kk1) r8 Fq7''uThe makas AbababaNo ratings yet

- Accounting Education Literature Review (2017)Document69 pagesAccounting Education Literature Review (2017)The makas AbababaNo ratings yet

- Overview of Business CombinationDocument4 pagesOverview of Business CombinationThe makas AbababaNo ratings yet

- Chapter 10Document10 pagesChapter 10The makas AbababaNo ratings yet

- Week1 - PEN4-WPS OfficeDocument2 pagesWeek1 - PEN4-WPS OfficeThe makas AbababaNo ratings yet

- Bsa2bc2 3Document1 pageBsa2bc2 3The makas AbababaNo ratings yet

- Week2: LI Ma, Raymondd. Bsa2BDocument2 pagesWeek2: LI Ma, Raymondd. Bsa2BThe makas AbababaNo ratings yet

- Chapter 5 v5 RevisedDocument18 pagesChapter 5 v5 RevisedThe makas AbababaNo ratings yet

- The Genericide of Trademarks: Acknowledged. 15 U.S.C. 1127 (2000)Document10 pagesThe Genericide of Trademarks: Acknowledged. 15 U.S.C. 1127 (2000)The makas AbababaNo ratings yet

- He May Be Subject To VATDocument6 pagesHe May Be Subject To VATThe makas AbababaNo ratings yet

- Chapter 4 v4 RevisedDocument18 pagesChapter 4 v4 RevisedThe makas AbababaNo ratings yet

- Finals Quiz No. 2Document1 pageFinals Quiz No. 2Janna Grace Dela CruzNo ratings yet

- Dwnload Full Financial Reporting and Analysis 5th Edition Revsine Solutions Manual PDFDocument35 pagesDwnload Full Financial Reporting and Analysis 5th Edition Revsine Solutions Manual PDFinactionwantwit.a8i0100% (15)

- PHEI Pricing PublicDocument3 pagesPHEI Pricing PublicMuhammad JamaludinNo ratings yet

- HDFC Life Insurance Company Company Update 5 September 2021Document10 pagesHDFC Life Insurance Company Company Update 5 September 2021vaibhav_kaushikNo ratings yet

- BCG Matrix of Gourmet Bakers & Sweets: Group Members Nauman Bilal 4714 Umair Majeed 4739Document5 pagesBCG Matrix of Gourmet Bakers & Sweets: Group Members Nauman Bilal 4714 Umair Majeed 4739maria tabassumNo ratings yet

- Chapter 2 - Partnership Liquidation-PROFE01Document4 pagesChapter 2 - Partnership Liquidation-PROFE01Steffany RoqueNo ratings yet

- Mutual Fund Advanced - Sample Paper NCFMDocument5 pagesMutual Fund Advanced - Sample Paper NCFMSankitNo ratings yet

- CEMEX ExhibitDocument16 pagesCEMEX ExhibitIwan SetiawanNo ratings yet

- Chapter 34 Identifiable Intangible Assets - XLSM - PatentDocument2 pagesChapter 34 Identifiable Intangible Assets - XLSM - PatentJaypee Verzo SaltaNo ratings yet

- Far160 - Jul 2021 - QDocument9 pagesFar160 - Jul 2021 - QNur ain Natasha ShaharudinNo ratings yet

- ch05 PDFDocument38 pagesch05 PDFerylpaez100% (5)

- Ts Grewal Solutions Class 12 Accountancy Vol 1 Chapter 3 GoodwillDocument28 pagesTs Grewal Solutions Class 12 Accountancy Vol 1 Chapter 3 GoodwillAbi AbiNo ratings yet

- R26 Mergers Acquisitions Q Bank PDFDocument11 pagesR26 Mergers Acquisitions Q Bank PDFZidane KhanNo ratings yet

- Apex Tannery Ltd. Ratio AnalysisDocument5 pagesApex Tannery Ltd. Ratio AnalysisMohammad TanveerNo ratings yet

- FMA Quiz in Class - Feb 6Document16 pagesFMA Quiz in Class - Feb 6saihasini2011No ratings yet

- Jurnal Skripsi - Edwin GunawanDocument11 pagesJurnal Skripsi - Edwin GunawanEdwin GunawanNo ratings yet

- 公司财务原理Principles of Corporate Finance (11th Edition) - 课后习题答案Chap003 - 百度文库Document15 pages公司财务原理Principles of Corporate Finance (11th Edition) - 课后习题答案Chap003 - 百度文库nathan34526100% (3)

- 73 - Final Version - Commerce PDFDocument50 pages73 - Final Version - Commerce PDFMt KumarNo ratings yet

- A Project Submitted ToDocument42 pagesA Project Submitted ToTrupti ToraskarNo ratings yet

- 27-Separate Financial Statements PDFDocument10 pages27-Separate Financial Statements PDFChelsea Anne VidalloNo ratings yet

- A Study On Investor's Preference Towards Equity in AhmedabadDocument20 pagesA Study On Investor's Preference Towards Equity in AhmedabadShruti MitraNo ratings yet

- Amalgamation NotesDocument9 pagesAmalgamation NotesAlPHA NiNjANo ratings yet

- Seminar ReportDocument20 pagesSeminar ReportBinit KumarNo ratings yet

- CH 01Document54 pagesCH 01Ngân Hà ĐỗNo ratings yet

- M3 - Tugas Akuntansi Keuangan Menengah 1A - 1B - Salma Putri RDocument9 pagesM3 - Tugas Akuntansi Keuangan Menengah 1A - 1B - Salma Putri Rrully movizarNo ratings yet

- Kasneb Financial Accounting For More Free Past Papers Visit May 2014 Question OneDocument6 pagesKasneb Financial Accounting For More Free Past Papers Visit May 2014 Question OneTimo Paul100% (1)

- FPIs - Deemed FPIs (Erstwhile FIIs - QFIs) As On Nov 10 2020Document1,350 pagesFPIs - Deemed FPIs (Erstwhile FIIs - QFIs) As On Nov 10 2020jitucallingNo ratings yet

- P1 - Inventory Valuation and GP MethodDocument2 pagesP1 - Inventory Valuation and GP MethodJoanna Caballero100% (1)

- Materiali TY: S. M. Soral, Retd. SaoDocument24 pagesMateriali TY: S. M. Soral, Retd. Saojai doiNo ratings yet

Accounting For Business Combination

Accounting For Business Combination

Uploaded by

The makas AbababaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Business Combination

Accounting For Business Combination

Uploaded by

The makas AbababaCopyright:

Available Formats

Chapter 2

ACCOUNTING FOR BUSINESS COMBINATION

Introduction

A business combination may be accomplished through exchange of equity interests between the

acquirer and the acquiree (or its former owners). The general principle is that the consideration

transferred (the shares issued by the acquirer) is measured at fair value.

Specific Objectives

At the end of the lesson, the students should be able to:

Account for business combinations (a) accomplished through share-for share exchanges

(b) achieved in stages, and (c) achieved without transfer of consideration

Duration: 6 hours (Lecture/Discussion/Problem Solving)

LESSON PROPER

1) The acquisition method applies to all business combinations, including those that do not

involve a purchase transaction. If a business combination is achieved:

a) Without transfer of consideration- the fair value of the acquirer’s interest in the acquiree

is substituted for the consideration transferred in computing for goodwill.

b) By contract alone- all interests not held by the acquirer are attributed to the Non-

controlling interest (NCI) , even if the resulting NCI is 100%.

2) Provisional amounts may be used if accounting is incomplete by the end of the business

combination year. The provisional amounts are adjusted retrospectively for information obtained

during the measurement period (i.e. maximum of 12 months from the acquisition date) that

provides evidence of facts and circumstances that existed as of the acquisition date.

3) The consideration transferred includes only those that are transferred to the previous owners of

the acquiree. It excludes those that are retained by the combined entity after the combination and

those that are in effect used to settle a pre-existing relationship.

4) A reacquired right in a business combination is recognized as an intangible asset measured at

the “at market” value.

5)The gain or loss on settlement of a pre-existing relationship is measured as follows:

a) If contractual- at the lower of: (a) “off-market” value, favorable or unfavorable

determined based on the acquirer’s perspective; or (b) any settlement amount stated in

the contract.

b) If non-contractual- at fair value

6)A contingent consideration is measured at acquisition-date fair value and included in the

consideration transferred.

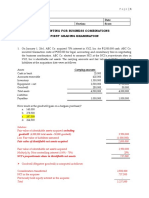

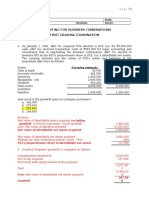

Illustrative Example: Business combination without transfer of consideration.

ABC Co. owns 40% interest in the 90,000 outstanding shares of XYZ Co. ABC accounts for the

investment under the equity method. XYZ Co. subsequently reacquires 30,000 shares from other

investors. Information on the acquisition date are as follows:

a) The previously held 40% interest has a fair value of P180,000.

b) XYZ’s net identifiable assets have a fair value of P1,000,000.

c) ABC Co. elects to measure NCI at proportionate share.

Requirement: Compute for the goodwill.

Solution:

Consideration transferred (1M x 60%) 600,000

Non controlling interest in the acquiree (40% x1M) 400,000

Previously held equity interest in the acquiree -

________

Total 1,000,000

Fair value of net identifiable assets acquired (1,000,000)

Goodwill 0.00

========

Notes:

a) XYZ’s treasury share transaction increased ABC’s interest to 60% (36,000/60,000).

Consequently, the NCI is 40%.

b) The acquisition-date fair value of ABC’s interest in XYZ is substituted for the

consideration transferred (instead of attributing an amount to the previously held equity

interest) because there is no consideration transferred and there is no change in the number

of shares held by ABC.

Share-for-Share Exchanges

As stated above, the share issued by the acquirer are measured at fair value. However, there may

be cases where the fair value of the acquiree’s interests may be more reliably measurable than the

acquirer’s. In such cases, the acquirer computes for goodwill using the FV of the acquiree’s equity

interest.

Business Combination achieved in stages:

A business combination is “achieved in stages” when the acquirer obtains control of an acquiree

in more than one transaction. F

For example, Entity A acquires 20% interest in Entity B in Year 1. This transaction is not a

business combination because Entity A has not yet obrtained control of Entity B. In year 2, Entity

A acquires additional 40% interest in Entity B, thereby bringing its interest to a total of 60%. The

second acquisition qualifies as a business combination because Entity A has obtained control of

Entity B.

A business combination acquired in stages is also called “step acquisition”.

In accounting for a business combination achieved in stages, the acquirer:

1. Remeasures the previously held equity interest in the acquiree at acquisition date fair value,

and

2. Recognizes gain or loss on the remeasurement in:

a. Profit or loss- if the previously held equity interest was classified as FVPL, Investment

in Associate or Investment in Joint Venture; or

b. Other Comprehensive Income- if the previously held equity interest was classified as

FVOCI.

c.

Activity:

Students will be required to answer exercises/problems be uploaded in the LMS.

You might also like

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading Examinationjoyce77% (13)

- Illustration: Business Combination Achieved in StagesDocument26 pagesIllustration: Business Combination Achieved in StagesArlene Diane Orozco100% (1)

- PonyUp StablesDocument5 pagesPonyUp StablesNatalie DaguiamNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Chapter 10 Impairment of Assets (Pas 36)Document11 pagesChapter 10 Impairment of Assets (Pas 36)Krissa Mae Longos100% (1)

- 4Document286 pages4JaceNo ratings yet

- Confidence Cement Ltd. Ratio AnalysisDocument42 pagesConfidence Cement Ltd. Ratio AnalysisShehab Mahmud0% (1)

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading ExaminationNhel AlvaroNo ratings yet

- CDD Acctg. For Bus - Co Preliminary ExaminationDocument25 pagesCDD Acctg. For Bus - Co Preliminary ExaminationMaryjoy Sarzadilla JuanataNo ratings yet

- Separate Summary of Answers For Every ProblemDocument1 pageSeparate Summary of Answers For Every ProblemcpacpacpaNo ratings yet

- Profe03 - Chapter 2 Business Combinations Specific CasesDocument12 pagesProfe03 - Chapter 2 Business Combinations Specific CasesSteffany RoqueNo ratings yet

- Business Combination Part 2Document6 pagesBusiness Combination Part 2cpacpacpaNo ratings yet

- MODULE 29 Business CombinationsDocument11 pagesMODULE 29 Business CombinationsAngelica Sanchez de VeraNo ratings yet

- Pre Buscomok PDF FreeDocument9 pagesPre Buscomok PDF FreeheyNo ratings yet

- Business Combination Part 3Document4 pagesBusiness Combination Part 3Aljenika Moncada GupiteoNo ratings yet

- Business CombinationsDocument41 pagesBusiness CombinationsShiena Marie VillapandoNo ratings yet

- ACC 113 Module 7 AnswerDocument4 pagesACC 113 Module 7 AnswerYahlianah Lee100% (2)

- Topic 6 Tutorial SolutionsDocument6 pagesTopic 6 Tutorial SolutionsKitty666No ratings yet

- Special Accounting Topics For Business CombinationDocument4 pagesSpecial Accounting Topics For Business CombinationMixx MineNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesMixx MineNo ratings yet

- Ac12 - Module1Document4 pagesAc12 - Module1Mon Rean Villaroza JuatchonNo ratings yet

- Business Combination Part 2Document8 pagesBusiness Combination Part 2Aljenika Moncada GupiteoNo ratings yet

- M6 (IAS 18) (6th)Document6 pagesM6 (IAS 18) (6th)aslamhamza949No ratings yet

- Exercise # 1Document6 pagesExercise # 1MA ValdezNo ratings yet

- Chapter 10 Impairment of Assets (Pas 36)Document11 pagesChapter 10 Impairment of Assets (Pas 36)Princess TaoinganNo ratings yet

- Business Combination Module 4Document6 pagesBusiness Combination Module 4TryonNo ratings yet

- Partnership Dissolution G7Document47 pagesPartnership Dissolution G7Erika PanganNo ratings yet

- Fischer - Fundamentals of Advanced Accounting 1eDocument27 pagesFischer - Fundamentals of Advanced Accounting 1eyechueNo ratings yet

- Accounting For Business Combination: By: Camell Divine Rey, CpaDocument46 pagesAccounting For Business Combination: By: Camell Divine Rey, Cpaaira nialaNo ratings yet

- Departmental AbcDocument23 pagesDepartmental AbcMaria DyNo ratings yet

- SBR Assigment-Liam'sDocument7 pagesSBR Assigment-Liam'sbuls eyeNo ratings yet

- 157 First Grading ExamDocument8 pages157 First Grading Examerica insiongNo ratings yet

- AFAR QuestionsDocument6 pagesAFAR QuestionsTerence Jeff TamondongNo ratings yet

- Afar - BC-1-2018Document4 pagesAfar - BC-1-2018Joanna Rose Deciar100% (2)

- Accounting For Business CombinationsDocument39 pagesAccounting For Business CombinationsRaisaNo ratings yet

- Abc Stock AcquisitionDocument13 pagesAbc Stock AcquisitionMary Joy AlbandiaNo ratings yet

- AC15 Quiz 1 Solution ManualDocument8 pagesAC15 Quiz 1 Solution ManualKristine Esplana ToraldeNo ratings yet

- 3 - Business CombinationDocument28 pages3 - Business Combinationjecille magalongNo ratings yet

- Goodwill & PSR Final Revision SPCCDocument43 pagesGoodwill & PSR Final Revision SPCCHeer SirwaniNo ratings yet

- IFRS 3 Business CombinationDocument52 pagesIFRS 3 Business CombinationRusselle Therese DaitolNo ratings yet

- Valuation of Goodwill and Shares 1Document31 pagesValuation of Goodwill and Shares 1p66610072No ratings yet

- Business Combination ActivityDocument5 pagesBusiness Combination ActivityAndy LaluNo ratings yet

- AUD 323 Auditing & Assurance: Concepts & ApplicationsDocument33 pagesAUD 323 Auditing & Assurance: Concepts & ApplicationsYvone Claire Fernandez SalmorinNo ratings yet

- 400 Sample EXAM1 AADocument20 pages400 Sample EXAM1 AASehoon OhNo ratings yet

- Redemption of Preference SharesDocument9 pagesRedemption of Preference SharesRahul VermaNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Ias 18Document10 pagesIas 18Butt ArhamNo ratings yet

- F3 Chapter 13Document10 pagesF3 Chapter 13Ali ShahnawazNo ratings yet

- Advanced Accounting 4th Edition Jeter Test BankDocument20 pagesAdvanced Accounting 4th Edition Jeter Test Bankbryanharrismpqrsfbokn100% (15)

- BADVAC1X Quiz 1 2Document4 pagesBADVAC1X Quiz 1 2dumpyforhimNo ratings yet

- IAC15 TheoryDocument11 pagesIAC15 TheoryMaurienne Mojica0% (1)

- Afar de Leon/De Leon/De Leon/Tan 3006-Consosolidated Statements M A Y 2 0 2 1Document5 pagesAfar de Leon/De Leon/De Leon/Tan 3006-Consosolidated Statements M A Y 2 0 2 1TatianaNo ratings yet

- AFAR.2906 - SEPARATE and CONSOLIDATED STATEMENTSDocument7 pagesAFAR.2906 - SEPARATE and CONSOLIDATED STATEMENTSRonna Mae Mendoza100% (1)

- (FA) 2 Multi-Step - Essay Practice Problem Solutions v2Document18 pages(FA) 2 Multi-Step - Essay Practice Problem Solutions v2Swapan Kumar SahaNo ratings yet

- Ge Acctg 7Document5 pagesGe Acctg 7ezraelydanNo ratings yet

- Ifrs 9 - Financial Instruments Review QuestionsDocument9 pagesIfrs 9 - Financial Instruments Review QuestionsHamad Sadiq100% (1)

- Consolidated Financial StatementDocument5 pagesConsolidated Financial StatementTriechia LaudNo ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- Adg8kk1) r8 Fq7''uDocument6 pagesAdg8kk1) r8 Fq7''uThe makas AbababaNo ratings yet

- Accounting Education Literature Review (2017)Document69 pagesAccounting Education Literature Review (2017)The makas AbababaNo ratings yet

- Overview of Business CombinationDocument4 pagesOverview of Business CombinationThe makas AbababaNo ratings yet

- Chapter 10Document10 pagesChapter 10The makas AbababaNo ratings yet

- Week1 - PEN4-WPS OfficeDocument2 pagesWeek1 - PEN4-WPS OfficeThe makas AbababaNo ratings yet

- Bsa2bc2 3Document1 pageBsa2bc2 3The makas AbababaNo ratings yet

- Week2: LI Ma, Raymondd. Bsa2BDocument2 pagesWeek2: LI Ma, Raymondd. Bsa2BThe makas AbababaNo ratings yet

- Chapter 5 v5 RevisedDocument18 pagesChapter 5 v5 RevisedThe makas AbababaNo ratings yet

- The Genericide of Trademarks: Acknowledged. 15 U.S.C. 1127 (2000)Document10 pagesThe Genericide of Trademarks: Acknowledged. 15 U.S.C. 1127 (2000)The makas AbababaNo ratings yet

- He May Be Subject To VATDocument6 pagesHe May Be Subject To VATThe makas AbababaNo ratings yet

- Chapter 4 v4 RevisedDocument18 pagesChapter 4 v4 RevisedThe makas AbababaNo ratings yet

- Finals Quiz No. 2Document1 pageFinals Quiz No. 2Janna Grace Dela CruzNo ratings yet

- Dwnload Full Financial Reporting and Analysis 5th Edition Revsine Solutions Manual PDFDocument35 pagesDwnload Full Financial Reporting and Analysis 5th Edition Revsine Solutions Manual PDFinactionwantwit.a8i0100% (15)

- PHEI Pricing PublicDocument3 pagesPHEI Pricing PublicMuhammad JamaludinNo ratings yet

- HDFC Life Insurance Company Company Update 5 September 2021Document10 pagesHDFC Life Insurance Company Company Update 5 September 2021vaibhav_kaushikNo ratings yet

- BCG Matrix of Gourmet Bakers & Sweets: Group Members Nauman Bilal 4714 Umair Majeed 4739Document5 pagesBCG Matrix of Gourmet Bakers & Sweets: Group Members Nauman Bilal 4714 Umair Majeed 4739maria tabassumNo ratings yet

- Chapter 2 - Partnership Liquidation-PROFE01Document4 pagesChapter 2 - Partnership Liquidation-PROFE01Steffany RoqueNo ratings yet

- Mutual Fund Advanced - Sample Paper NCFMDocument5 pagesMutual Fund Advanced - Sample Paper NCFMSankitNo ratings yet

- CEMEX ExhibitDocument16 pagesCEMEX ExhibitIwan SetiawanNo ratings yet

- Chapter 34 Identifiable Intangible Assets - XLSM - PatentDocument2 pagesChapter 34 Identifiable Intangible Assets - XLSM - PatentJaypee Verzo SaltaNo ratings yet

- Far160 - Jul 2021 - QDocument9 pagesFar160 - Jul 2021 - QNur ain Natasha ShaharudinNo ratings yet

- ch05 PDFDocument38 pagesch05 PDFerylpaez100% (5)

- Ts Grewal Solutions Class 12 Accountancy Vol 1 Chapter 3 GoodwillDocument28 pagesTs Grewal Solutions Class 12 Accountancy Vol 1 Chapter 3 GoodwillAbi AbiNo ratings yet

- R26 Mergers Acquisitions Q Bank PDFDocument11 pagesR26 Mergers Acquisitions Q Bank PDFZidane KhanNo ratings yet

- Apex Tannery Ltd. Ratio AnalysisDocument5 pagesApex Tannery Ltd. Ratio AnalysisMohammad TanveerNo ratings yet

- FMA Quiz in Class - Feb 6Document16 pagesFMA Quiz in Class - Feb 6saihasini2011No ratings yet

- Jurnal Skripsi - Edwin GunawanDocument11 pagesJurnal Skripsi - Edwin GunawanEdwin GunawanNo ratings yet

- 公司财务原理Principles of Corporate Finance (11th Edition) - 课后习题答案Chap003 - 百度文库Document15 pages公司财务原理Principles of Corporate Finance (11th Edition) - 课后习题答案Chap003 - 百度文库nathan34526100% (3)

- 73 - Final Version - Commerce PDFDocument50 pages73 - Final Version - Commerce PDFMt KumarNo ratings yet

- A Project Submitted ToDocument42 pagesA Project Submitted ToTrupti ToraskarNo ratings yet

- 27-Separate Financial Statements PDFDocument10 pages27-Separate Financial Statements PDFChelsea Anne VidalloNo ratings yet

- A Study On Investor's Preference Towards Equity in AhmedabadDocument20 pagesA Study On Investor's Preference Towards Equity in AhmedabadShruti MitraNo ratings yet

- Amalgamation NotesDocument9 pagesAmalgamation NotesAlPHA NiNjANo ratings yet

- Seminar ReportDocument20 pagesSeminar ReportBinit KumarNo ratings yet

- CH 01Document54 pagesCH 01Ngân Hà ĐỗNo ratings yet

- M3 - Tugas Akuntansi Keuangan Menengah 1A - 1B - Salma Putri RDocument9 pagesM3 - Tugas Akuntansi Keuangan Menengah 1A - 1B - Salma Putri Rrully movizarNo ratings yet

- Kasneb Financial Accounting For More Free Past Papers Visit May 2014 Question OneDocument6 pagesKasneb Financial Accounting For More Free Past Papers Visit May 2014 Question OneTimo Paul100% (1)

- FPIs - Deemed FPIs (Erstwhile FIIs - QFIs) As On Nov 10 2020Document1,350 pagesFPIs - Deemed FPIs (Erstwhile FIIs - QFIs) As On Nov 10 2020jitucallingNo ratings yet

- P1 - Inventory Valuation and GP MethodDocument2 pagesP1 - Inventory Valuation and GP MethodJoanna Caballero100% (1)

- Materiali TY: S. M. Soral, Retd. SaoDocument24 pagesMateriali TY: S. M. Soral, Retd. Saojai doiNo ratings yet