Professional Documents

Culture Documents

Comment On House Bill No 7968

Comment On House Bill No 7968

Uploaded by

Jean Kenneth AlontoCopyright:

Available Formats

You might also like

- Vat Receipt: MR Kyle BoydDocument1 pageVat Receipt: MR Kyle BoydNovak Brodsky83% (6)

- Cox-Murray - Apollo The Race of The MoonDocument329 pagesCox-Murray - Apollo The Race of The MoonHipatia50% (2)

- PHILGASEA Membership Form 1Document1 pagePHILGASEA Membership Form 1Jean Kenneth AlontoNo ratings yet

- Chapter 1Document26 pagesChapter 1Ida-yatul-lahe AsigriNo ratings yet

- Meat Inspection in The Abattoir in CameroonDocument122 pagesMeat Inspection in The Abattoir in CameroonKevine Kenmoe MocheNo ratings yet

- Basics of Micro FinanceDocument49 pagesBasics of Micro FinanceFarasat Khan100% (1)

- The Functional Microfinance Bank: Strategies for SurvivalFrom EverandThe Functional Microfinance Bank: Strategies for SurvivalNo ratings yet

- Mechanisms For Reducing High Risks and Costs of Lending To SmesDocument4 pagesMechanisms For Reducing High Risks and Costs of Lending To SmesRahim NayaniNo ratings yet

- The Effect of Credit Management On The Financial Performance of The Selected Microfinance Institutions in CandelariaDocument16 pagesThe Effect of Credit Management On The Financial Performance of The Selected Microfinance Institutions in CandelariaCJ De Luna100% (1)

- Micro-Finance and Poverty AlleviationDocument3 pagesMicro-Finance and Poverty AlleviationnavreetdhaliwalNo ratings yet

- Breaking Barriers A Guide To Alternative For Minority Start-Ups - DraftDocument27 pagesBreaking Barriers A Guide To Alternative For Minority Start-Ups - DraftSteph jarbathNo ratings yet

- Role of Microfinance Institutions in Rural Development - SC Vetrivel IJITKMDocument7 pagesRole of Microfinance Institutions in Rural Development - SC Vetrivel IJITKMBharat SinghNo ratings yet

- Equity Financing Small Business AdministrationDocument8 pagesEquity Financing Small Business AdministrationrajuNo ratings yet

- The Growth of MIFsDocument2 pagesThe Growth of MIFsVincent MakauNo ratings yet

- Concept PaperDocument48 pagesConcept Paperarchana_anuragiNo ratings yet

- Microfinance Institutions in India: Concept PaperDocument21 pagesMicrofinance Institutions in India: Concept PapersearchingnobodyNo ratings yet

- Lending ClubDocument2 pagesLending ClubNaman JainNo ratings yet

- The Anatomy of Microfinance: New African Tuesday, 26 March 2013Document5 pagesThe Anatomy of Microfinance: New African Tuesday, 26 March 2013Aliou Ndiaye Thiandoum100% (1)

- "Financing Start-Ups in and After The Crisis. Factors of Start-Ups and Financiers Credit Exhaustion or Private Equity As Future ModelsDocument6 pages"Financing Start-Ups in and After The Crisis. Factors of Start-Ups and Financiers Credit Exhaustion or Private Equity As Future ModelsODIPLEXNo ratings yet

- Micro Finance (Anu)Document29 pagesMicro Finance (Anu)AnvibhaNo ratings yet

- MicrofinanceDocument6 pagesMicrofinancethisismeamit20103094No ratings yet

- Case 1 VFSDocument15 pagesCase 1 VFSDetteDeCastroNo ratings yet

- New Credit-Risk Models For The Unbanked - McKinseyDocument9 pagesNew Credit-Risk Models For The Unbanked - McKinseydagimNo ratings yet

- What Is Micro FinanceDocument7 pagesWhat Is Micro FinanceAnurag PadoleyNo ratings yet

- Lending Institution in IndiaDocument24 pagesLending Institution in IndiaMann SainiNo ratings yet

- By MR - Kiyaga Geoffrey Mutebi Tel: 0924650320: Fundamentals of Credit ManagementDocument64 pagesBy MR - Kiyaga Geoffrey Mutebi Tel: 0924650320: Fundamentals of Credit ManagementGeoffreyNo ratings yet

- How To Secure Financing in A Changing EconomyDocument53 pagesHow To Secure Financing in A Changing EconomyJohn SlaterNo ratings yet

- The Bridge To Success Alternative Lending For Start UpsDocument9 pagesThe Bridge To Success Alternative Lending For Start UpsSteph jarbathNo ratings yet

- MicrolendingDocument10 pagesMicrolendingKelly Joyce Abrigar CruzNo ratings yet

- An Assessment On Financial Gap of Small and Medium Enterprises of Brunei DarussalamDocument9 pagesAn Assessment On Financial Gap of Small and Medium Enterprises of Brunei DarussalamDanial OthmanNo ratings yet

- Porters Five Force AnalysisDocument2 pagesPorters Five Force AnalysisAkshay GuptaNo ratings yet

- Introduction To Microfinance: P.V. ViswanathDocument24 pagesIntroduction To Microfinance: P.V. ViswanathsoumyaNo ratings yet

- Designing Micro-Loan ProductsDocument16 pagesDesigning Micro-Loan ProductsDan Teleyo KibetNo ratings yet

- FS On Lending BusinessDocument3 pagesFS On Lending BusinessMika FrancoNo ratings yet

- 53 Microfinance Revolution and The Grameen Bank Experience in Bangladesh20190805-48922-1a68le6-With-Cover-Page-V2Document62 pages53 Microfinance Revolution and The Grameen Bank Experience in Bangladesh20190805-48922-1a68le6-With-Cover-Page-V2Hidayatullah GanieNo ratings yet

- Access To Finance For Small and Medium Enterprises: The Sme Credit GapDocument4 pagesAccess To Finance For Small and Medium Enterprises: The Sme Credit GapAnu AmruthNo ratings yet

- Evaluating Credit WorthinessDocument4 pagesEvaluating Credit WorthinessHazyan HamdanNo ratings yet

- Business Financing Part TwoDocument8 pagesBusiness Financing Part Twomosesmalila65No ratings yet

- Abstract The Objective of This Study Was To Examine The Factors Influence Credit Rationing by Commercial Banks in KenyaDocument8 pagesAbstract The Objective of This Study Was To Examine The Factors Influence Credit Rationing by Commercial Banks in KenyaMrxNo ratings yet

- What Does Credit Crisis Mean?Document14 pagesWhat Does Credit Crisis Mean?amardeeprocksNo ratings yet

- Microfinance-Financial Intermediation (Students Notes)Document4 pagesMicrofinance-Financial Intermediation (Students Notes)MIRADOR ACCOUNTANTS KENYANo ratings yet

- Syndicated Loan ThesisDocument4 pagesSyndicated Loan Thesisafayepezt100% (3)

- Effects of Credit Management On The Profitability of Small and Medium Enterprices in KitaleDocument7 pagesEffects of Credit Management On The Profitability of Small and Medium Enterprices in KitaleElias NgeiywaNo ratings yet

- Garantias de Los CreditosDocument17 pagesGarantias de Los CreditosMarcoGarcesNo ratings yet

- Credit Risk ManagementDocument5 pagesCredit Risk ManagementshubhammsmecciiNo ratings yet

- Commercialization of MicrofinanceDocument5 pagesCommercialization of MicrofinanceJenniferNo ratings yet

- What Is Corporate Banking PDFDocument2 pagesWhat Is Corporate Banking PDFSonakshi Behl100% (1)

- Viewpoint Retail Bank Customer Centric Business ModelDocument60 pagesViewpoint Retail Bank Customer Centric Business ModelNavajyoth ReddyNo ratings yet

- Porter's Five Force On Banking IndustryDocument2 pagesPorter's Five Force On Banking IndustrySuvraman SinhaNo ratings yet

- The Impact of Credit Management On SmallDocument14 pagesThe Impact of Credit Management On SmallPia CallantaNo ratings yet

- Finance in MSME - YOGESHDocument6 pagesFinance in MSME - YOGESHMister YoNo ratings yet

- Small Business Lending in The Digital AgeDocument27 pagesSmall Business Lending in The Digital AgeCrowdfundInsiderNo ratings yet

- Bed 2202 Cooperative and Microfinance ManagementDocument9 pagesBed 2202 Cooperative and Microfinance ManagementJosephNo ratings yet

- CL Banks p3Document16 pagesCL Banks p3Joseph Barisonzi100% (1)

- Solving Unemployment: by Dina ShalabDocument7 pagesSolving Unemployment: by Dina ShalabDina ShalabNo ratings yet

- Syndicated Loans: Business Credit, Most Loan Syndications Take The Form of A Direct-Lender Relationship, inDocument4 pagesSyndicated Loans: Business Credit, Most Loan Syndications Take The Form of A Direct-Lender Relationship, inSanjeet PandeyNo ratings yet

- Microfinance Note 1Document12 pagesMicrofinance Note 1Vandi GbetuwaNo ratings yet

- Lecture 2 - Business Application of FintechDocument19 pagesLecture 2 - Business Application of Fintechanon_888020909No ratings yet

- Advantages and Disadvantages of MicrofinanceDocument11 pagesAdvantages and Disadvantages of MicrofinanceprashantNo ratings yet

- Financial Advice For People Who Aren't Rich - The New York TimesDocument5 pagesFinancial Advice For People Who Aren't Rich - The New York TimesRaceMoChridheNo ratings yet

- Finance Decument WPS OfficeDocument5 pagesFinance Decument WPS Officevdav hadhNo ratings yet

- Manuscript Final ThesisDocument60 pagesManuscript Final ThesisEya VillapuzNo ratings yet

- Capital Strategies for Micro-Businesses: Micro-Business Mastery, #1From EverandCapital Strategies for Micro-Businesses: Micro-Business Mastery, #1No ratings yet

- Pds Form Latest This YearDocument6 pagesPds Form Latest This YearJean Kenneth AlontoNo ratings yet

- My LBC 126Document10 pagesMy LBC 126Jean Kenneth AlontoNo ratings yet

- Auditing Plant, Property, and Equipment - An Overview: Capital AssetsDocument7 pagesAuditing Plant, Property, and Equipment - An Overview: Capital AssetsJean Kenneth AlontoNo ratings yet

- MECH 374 Numerical Methods in EngineeringDocument8 pagesMECH 374 Numerical Methods in Engineeringrodi10100% (8)

- Raghavendran V Piping Supervisor: ResumeDocument5 pagesRaghavendran V Piping Supervisor: Resumeandi dipayadnyaNo ratings yet

- Paan TobaccoDocument8 pagesPaan TobaccoZaibunnisa WasiqNo ratings yet

- PrelimsDocument1 pagePrelimsCristina LaniohanNo ratings yet

- Brian Cooksey - An Introduction To APIs-Zapier Inc (2014)Document100 pagesBrian Cooksey - An Introduction To APIs-Zapier Inc (2014)zakaria abbadiNo ratings yet

- Lisa Olle Declaration in SupportDocument5 pagesLisa Olle Declaration in SupportMikey CampbellNo ratings yet

- Thompson Nadler Lount Judgmental BiasesDocument27 pagesThompson Nadler Lount Judgmental BiasesWazeerullah KhanNo ratings yet

- Opti Plex 7080Document38 pagesOpti Plex 7080brayerly143No ratings yet

- RSTWS LTE Market View CMW500 Communication Test FunctionDocument131 pagesRSTWS LTE Market View CMW500 Communication Test FunctionHong ShanNo ratings yet

- Institute of Food Security (Food Corporation of India) Gurgaon Management Trainee Batch:V/2010 Objective Test:Commercial (Sales&Export)Document2 pagesInstitute of Food Security (Food Corporation of India) Gurgaon Management Trainee Batch:V/2010 Objective Test:Commercial (Sales&Export)Swarup MukherjeeNo ratings yet

- Concrete Mixer Machine TSCM-260 RichonDocument7 pagesConcrete Mixer Machine TSCM-260 RichonAngin MalamNo ratings yet

- Digital Marketing: Group AssignmentDocument20 pagesDigital Marketing: Group AssignmentSambhav TripathiNo ratings yet

- Avnet TP Sap Arp PL May14Document77 pagesAvnet TP Sap Arp PL May14Kathak DancerNo ratings yet

- Jessica: Allman Bros. Intro (Acoustic) (Reverb)Document8 pagesJessica: Allman Bros. Intro (Acoustic) (Reverb)Josue Daniel ResendizNo ratings yet

- Sovid Solutions News ReleaseDocument1 pageSovid Solutions News Releaseapi-629939210No ratings yet

- Invoice: (Your Company Name)Document1 pageInvoice: (Your Company Name)Kemal ZiyadNo ratings yet

- 2013 Sappia BollatiDocument7 pages2013 Sappia BollatiRakshithNo ratings yet

- Dr. Wifanto-Management Liver Metastasis CRCDocument46 pagesDr. Wifanto-Management Liver Metastasis CRCAfkar30No ratings yet

- Experiment No. (6) Study of Dispersion Compensation Schemes: ObjectDocument9 pagesExperiment No. (6) Study of Dispersion Compensation Schemes: ObjectFaez FawwazNo ratings yet

- Heat Recovery Steam Generator For Cheng Cycle Application: Reprinted From 1988Document5 pagesHeat Recovery Steam Generator For Cheng Cycle Application: Reprinted From 1988Herberth SilitongaNo ratings yet

- 600 ngữ pháp chọn lọc luyện thi THPT Quốc GiaDocument32 pages600 ngữ pháp chọn lọc luyện thi THPT Quốc GiaNguyen Chi Cuong100% (1)

- Manual Bluetti Eb150Document12 pagesManual Bluetti Eb150Rafa Lozoya AlbacarNo ratings yet

- Tire Gas DiffusionDocument3 pagesTire Gas DiffusionfhdeutschmannNo ratings yet

- 2 Storey - 4 Classrooms, PUNTAII Elementary School EDITED-2F SANIDocument1 page2 Storey - 4 Classrooms, PUNTAII Elementary School EDITED-2F SANIGin Gineer100% (1)

- Presentación de Stefanini PDFDocument24 pagesPresentación de Stefanini PDFramontxu06No ratings yet

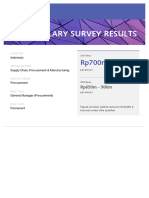

- Robert Walters Salary SurveyDocument5 pagesRobert Walters Salary SurveySyaiful BahriNo ratings yet

Comment On House Bill No 7968

Comment On House Bill No 7968

Uploaded by

Jean Kenneth AlontoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comment On House Bill No 7968

Comment On House Bill No 7968

Uploaded by

Jean Kenneth AlontoCopyright:

Available Formats

microfinance plays the role of business incubator by compensating for the difficulties faced by very

small firms and startups in obtaining credit from established financial intermediaries. These

difficulties arise because lending to small businesses is typically considered riskier and more costly

than lending to larger firms. Small businesses are often more susceptible to changes in the broader

economy and generally have a much higher rate of failure than larger operations, although the

survival rate of small firms increases with age (Knaup, 2005)

Besides being riskier, lending to small firms can be more expensive. It costs more per dollar loaned

both to evaluate their credit applications and to monitor their ongoing performance. Many small

businesses lack detailed balance sheets and other financial information used by underwriters in

making lending decisions. And the small firm does not issue publicly traded debt or other securities

whose values in the marketplace serve as a signal of its profit expectations.

The development of more-sophisticated techniques in small business loan underwriting, including

the use of credit scoring, has helped make small business lending more attractive to larger

institutions as well (Cowan and Cowan, 2006).

Of course, many start-up businesses don't make it; that's an inescapable aspect of the risks that

small business entrepreneurs face. But the services provided by microenterprise programs offer

borrowers a strong foundation in the fundamentals of running a business and give their businesses a

better chance to grow and flourish in a competitive marketplace.

Another promising avenue for the future of microfinance is the development of more partnerships

with mainstream banking institutions. Mainstream banks typically don't offer the array of supportive

services found at microlenders. But by partnering with a microlender that incubates very small

businesses, mainstream institutions can gain new customers when the borrowers "graduate" from

the microfinance program and seek larger loans. And these new customers will be more creditworthy

borrowers because of the early support they received from the microfinance organization.

Acción Texas and other microfinance organizations have established several mutually beneficial

partnerships with large banking institutions. Such partnerships serve as two-way referral systems

between the microlenders and large banks and help break down the barriers between mainstream

institutions and underserved entrepreneurs.

Although some businesses will inevitably fall by the wayside, those that flourish and grow are likely

to have better management and better long-term prospects than they would have without the

support of microenterprise programs. Successful microbusinesses provide jobs as well as valuable

products and services to their communities. Not least important, they can provide economic

independence and self-reliance for the owner-entrepreneurs.

You might also like

- Vat Receipt: MR Kyle BoydDocument1 pageVat Receipt: MR Kyle BoydNovak Brodsky83% (6)

- Cox-Murray - Apollo The Race of The MoonDocument329 pagesCox-Murray - Apollo The Race of The MoonHipatia50% (2)

- PHILGASEA Membership Form 1Document1 pagePHILGASEA Membership Form 1Jean Kenneth AlontoNo ratings yet

- Chapter 1Document26 pagesChapter 1Ida-yatul-lahe AsigriNo ratings yet

- Meat Inspection in The Abattoir in CameroonDocument122 pagesMeat Inspection in The Abattoir in CameroonKevine Kenmoe MocheNo ratings yet

- Basics of Micro FinanceDocument49 pagesBasics of Micro FinanceFarasat Khan100% (1)

- The Functional Microfinance Bank: Strategies for SurvivalFrom EverandThe Functional Microfinance Bank: Strategies for SurvivalNo ratings yet

- Mechanisms For Reducing High Risks and Costs of Lending To SmesDocument4 pagesMechanisms For Reducing High Risks and Costs of Lending To SmesRahim NayaniNo ratings yet

- The Effect of Credit Management On The Financial Performance of The Selected Microfinance Institutions in CandelariaDocument16 pagesThe Effect of Credit Management On The Financial Performance of The Selected Microfinance Institutions in CandelariaCJ De Luna100% (1)

- Micro-Finance and Poverty AlleviationDocument3 pagesMicro-Finance and Poverty AlleviationnavreetdhaliwalNo ratings yet

- Breaking Barriers A Guide To Alternative For Minority Start-Ups - DraftDocument27 pagesBreaking Barriers A Guide To Alternative For Minority Start-Ups - DraftSteph jarbathNo ratings yet

- Role of Microfinance Institutions in Rural Development - SC Vetrivel IJITKMDocument7 pagesRole of Microfinance Institutions in Rural Development - SC Vetrivel IJITKMBharat SinghNo ratings yet

- Equity Financing Small Business AdministrationDocument8 pagesEquity Financing Small Business AdministrationrajuNo ratings yet

- The Growth of MIFsDocument2 pagesThe Growth of MIFsVincent MakauNo ratings yet

- Concept PaperDocument48 pagesConcept Paperarchana_anuragiNo ratings yet

- Microfinance Institutions in India: Concept PaperDocument21 pagesMicrofinance Institutions in India: Concept PapersearchingnobodyNo ratings yet

- Lending ClubDocument2 pagesLending ClubNaman JainNo ratings yet

- The Anatomy of Microfinance: New African Tuesday, 26 March 2013Document5 pagesThe Anatomy of Microfinance: New African Tuesday, 26 March 2013Aliou Ndiaye Thiandoum100% (1)

- "Financing Start-Ups in and After The Crisis. Factors of Start-Ups and Financiers Credit Exhaustion or Private Equity As Future ModelsDocument6 pages"Financing Start-Ups in and After The Crisis. Factors of Start-Ups and Financiers Credit Exhaustion or Private Equity As Future ModelsODIPLEXNo ratings yet

- Micro Finance (Anu)Document29 pagesMicro Finance (Anu)AnvibhaNo ratings yet

- MicrofinanceDocument6 pagesMicrofinancethisismeamit20103094No ratings yet

- Case 1 VFSDocument15 pagesCase 1 VFSDetteDeCastroNo ratings yet

- New Credit-Risk Models For The Unbanked - McKinseyDocument9 pagesNew Credit-Risk Models For The Unbanked - McKinseydagimNo ratings yet

- What Is Micro FinanceDocument7 pagesWhat Is Micro FinanceAnurag PadoleyNo ratings yet

- Lending Institution in IndiaDocument24 pagesLending Institution in IndiaMann SainiNo ratings yet

- By MR - Kiyaga Geoffrey Mutebi Tel: 0924650320: Fundamentals of Credit ManagementDocument64 pagesBy MR - Kiyaga Geoffrey Mutebi Tel: 0924650320: Fundamentals of Credit ManagementGeoffreyNo ratings yet

- How To Secure Financing in A Changing EconomyDocument53 pagesHow To Secure Financing in A Changing EconomyJohn SlaterNo ratings yet

- The Bridge To Success Alternative Lending For Start UpsDocument9 pagesThe Bridge To Success Alternative Lending For Start UpsSteph jarbathNo ratings yet

- MicrolendingDocument10 pagesMicrolendingKelly Joyce Abrigar CruzNo ratings yet

- An Assessment On Financial Gap of Small and Medium Enterprises of Brunei DarussalamDocument9 pagesAn Assessment On Financial Gap of Small and Medium Enterprises of Brunei DarussalamDanial OthmanNo ratings yet

- Porters Five Force AnalysisDocument2 pagesPorters Five Force AnalysisAkshay GuptaNo ratings yet

- Introduction To Microfinance: P.V. ViswanathDocument24 pagesIntroduction To Microfinance: P.V. ViswanathsoumyaNo ratings yet

- Designing Micro-Loan ProductsDocument16 pagesDesigning Micro-Loan ProductsDan Teleyo KibetNo ratings yet

- FS On Lending BusinessDocument3 pagesFS On Lending BusinessMika FrancoNo ratings yet

- 53 Microfinance Revolution and The Grameen Bank Experience in Bangladesh20190805-48922-1a68le6-With-Cover-Page-V2Document62 pages53 Microfinance Revolution and The Grameen Bank Experience in Bangladesh20190805-48922-1a68le6-With-Cover-Page-V2Hidayatullah GanieNo ratings yet

- Access To Finance For Small and Medium Enterprises: The Sme Credit GapDocument4 pagesAccess To Finance For Small and Medium Enterprises: The Sme Credit GapAnu AmruthNo ratings yet

- Evaluating Credit WorthinessDocument4 pagesEvaluating Credit WorthinessHazyan HamdanNo ratings yet

- Business Financing Part TwoDocument8 pagesBusiness Financing Part Twomosesmalila65No ratings yet

- Abstract The Objective of This Study Was To Examine The Factors Influence Credit Rationing by Commercial Banks in KenyaDocument8 pagesAbstract The Objective of This Study Was To Examine The Factors Influence Credit Rationing by Commercial Banks in KenyaMrxNo ratings yet

- What Does Credit Crisis Mean?Document14 pagesWhat Does Credit Crisis Mean?amardeeprocksNo ratings yet

- Microfinance-Financial Intermediation (Students Notes)Document4 pagesMicrofinance-Financial Intermediation (Students Notes)MIRADOR ACCOUNTANTS KENYANo ratings yet

- Syndicated Loan ThesisDocument4 pagesSyndicated Loan Thesisafayepezt100% (3)

- Effects of Credit Management On The Profitability of Small and Medium Enterprices in KitaleDocument7 pagesEffects of Credit Management On The Profitability of Small and Medium Enterprices in KitaleElias NgeiywaNo ratings yet

- Garantias de Los CreditosDocument17 pagesGarantias de Los CreditosMarcoGarcesNo ratings yet

- Credit Risk ManagementDocument5 pagesCredit Risk ManagementshubhammsmecciiNo ratings yet

- Commercialization of MicrofinanceDocument5 pagesCommercialization of MicrofinanceJenniferNo ratings yet

- What Is Corporate Banking PDFDocument2 pagesWhat Is Corporate Banking PDFSonakshi Behl100% (1)

- Viewpoint Retail Bank Customer Centric Business ModelDocument60 pagesViewpoint Retail Bank Customer Centric Business ModelNavajyoth ReddyNo ratings yet

- Porter's Five Force On Banking IndustryDocument2 pagesPorter's Five Force On Banking IndustrySuvraman SinhaNo ratings yet

- The Impact of Credit Management On SmallDocument14 pagesThe Impact of Credit Management On SmallPia CallantaNo ratings yet

- Finance in MSME - YOGESHDocument6 pagesFinance in MSME - YOGESHMister YoNo ratings yet

- Small Business Lending in The Digital AgeDocument27 pagesSmall Business Lending in The Digital AgeCrowdfundInsiderNo ratings yet

- Bed 2202 Cooperative and Microfinance ManagementDocument9 pagesBed 2202 Cooperative and Microfinance ManagementJosephNo ratings yet

- CL Banks p3Document16 pagesCL Banks p3Joseph Barisonzi100% (1)

- Solving Unemployment: by Dina ShalabDocument7 pagesSolving Unemployment: by Dina ShalabDina ShalabNo ratings yet

- Syndicated Loans: Business Credit, Most Loan Syndications Take The Form of A Direct-Lender Relationship, inDocument4 pagesSyndicated Loans: Business Credit, Most Loan Syndications Take The Form of A Direct-Lender Relationship, inSanjeet PandeyNo ratings yet

- Microfinance Note 1Document12 pagesMicrofinance Note 1Vandi GbetuwaNo ratings yet

- Lecture 2 - Business Application of FintechDocument19 pagesLecture 2 - Business Application of Fintechanon_888020909No ratings yet

- Advantages and Disadvantages of MicrofinanceDocument11 pagesAdvantages and Disadvantages of MicrofinanceprashantNo ratings yet

- Financial Advice For People Who Aren't Rich - The New York TimesDocument5 pagesFinancial Advice For People Who Aren't Rich - The New York TimesRaceMoChridheNo ratings yet

- Finance Decument WPS OfficeDocument5 pagesFinance Decument WPS Officevdav hadhNo ratings yet

- Manuscript Final ThesisDocument60 pagesManuscript Final ThesisEya VillapuzNo ratings yet

- Capital Strategies for Micro-Businesses: Micro-Business Mastery, #1From EverandCapital Strategies for Micro-Businesses: Micro-Business Mastery, #1No ratings yet

- Pds Form Latest This YearDocument6 pagesPds Form Latest This YearJean Kenneth AlontoNo ratings yet

- My LBC 126Document10 pagesMy LBC 126Jean Kenneth AlontoNo ratings yet

- Auditing Plant, Property, and Equipment - An Overview: Capital AssetsDocument7 pagesAuditing Plant, Property, and Equipment - An Overview: Capital AssetsJean Kenneth AlontoNo ratings yet

- MECH 374 Numerical Methods in EngineeringDocument8 pagesMECH 374 Numerical Methods in Engineeringrodi10100% (8)

- Raghavendran V Piping Supervisor: ResumeDocument5 pagesRaghavendran V Piping Supervisor: Resumeandi dipayadnyaNo ratings yet

- Paan TobaccoDocument8 pagesPaan TobaccoZaibunnisa WasiqNo ratings yet

- PrelimsDocument1 pagePrelimsCristina LaniohanNo ratings yet

- Brian Cooksey - An Introduction To APIs-Zapier Inc (2014)Document100 pagesBrian Cooksey - An Introduction To APIs-Zapier Inc (2014)zakaria abbadiNo ratings yet

- Lisa Olle Declaration in SupportDocument5 pagesLisa Olle Declaration in SupportMikey CampbellNo ratings yet

- Thompson Nadler Lount Judgmental BiasesDocument27 pagesThompson Nadler Lount Judgmental BiasesWazeerullah KhanNo ratings yet

- Opti Plex 7080Document38 pagesOpti Plex 7080brayerly143No ratings yet

- RSTWS LTE Market View CMW500 Communication Test FunctionDocument131 pagesRSTWS LTE Market View CMW500 Communication Test FunctionHong ShanNo ratings yet

- Institute of Food Security (Food Corporation of India) Gurgaon Management Trainee Batch:V/2010 Objective Test:Commercial (Sales&Export)Document2 pagesInstitute of Food Security (Food Corporation of India) Gurgaon Management Trainee Batch:V/2010 Objective Test:Commercial (Sales&Export)Swarup MukherjeeNo ratings yet

- Concrete Mixer Machine TSCM-260 RichonDocument7 pagesConcrete Mixer Machine TSCM-260 RichonAngin MalamNo ratings yet

- Digital Marketing: Group AssignmentDocument20 pagesDigital Marketing: Group AssignmentSambhav TripathiNo ratings yet

- Avnet TP Sap Arp PL May14Document77 pagesAvnet TP Sap Arp PL May14Kathak DancerNo ratings yet

- Jessica: Allman Bros. Intro (Acoustic) (Reverb)Document8 pagesJessica: Allman Bros. Intro (Acoustic) (Reverb)Josue Daniel ResendizNo ratings yet

- Sovid Solutions News ReleaseDocument1 pageSovid Solutions News Releaseapi-629939210No ratings yet

- Invoice: (Your Company Name)Document1 pageInvoice: (Your Company Name)Kemal ZiyadNo ratings yet

- 2013 Sappia BollatiDocument7 pages2013 Sappia BollatiRakshithNo ratings yet

- Dr. Wifanto-Management Liver Metastasis CRCDocument46 pagesDr. Wifanto-Management Liver Metastasis CRCAfkar30No ratings yet

- Experiment No. (6) Study of Dispersion Compensation Schemes: ObjectDocument9 pagesExperiment No. (6) Study of Dispersion Compensation Schemes: ObjectFaez FawwazNo ratings yet

- Heat Recovery Steam Generator For Cheng Cycle Application: Reprinted From 1988Document5 pagesHeat Recovery Steam Generator For Cheng Cycle Application: Reprinted From 1988Herberth SilitongaNo ratings yet

- 600 ngữ pháp chọn lọc luyện thi THPT Quốc GiaDocument32 pages600 ngữ pháp chọn lọc luyện thi THPT Quốc GiaNguyen Chi Cuong100% (1)

- Manual Bluetti Eb150Document12 pagesManual Bluetti Eb150Rafa Lozoya AlbacarNo ratings yet

- Tire Gas DiffusionDocument3 pagesTire Gas DiffusionfhdeutschmannNo ratings yet

- 2 Storey - 4 Classrooms, PUNTAII Elementary School EDITED-2F SANIDocument1 page2 Storey - 4 Classrooms, PUNTAII Elementary School EDITED-2F SANIGin Gineer100% (1)

- Presentación de Stefanini PDFDocument24 pagesPresentación de Stefanini PDFramontxu06No ratings yet

- Robert Walters Salary SurveyDocument5 pagesRobert Walters Salary SurveySyaiful BahriNo ratings yet