Professional Documents

Culture Documents

NOTES

NOTES

Uploaded by

rhea kitoyanCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Graphic Engineering Size Tolerances Assignment PDFDocument2 pagesGraphic Engineering Size Tolerances Assignment PDFXacobe PiñeiroNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MANAGERIAL ECONOMICS Notes PRELIMDocument2 pagesMANAGERIAL ECONOMICS Notes PRELIMrhea kitoyanNo ratings yet

- Final ActivitiesDocument14 pagesFinal Activitiesrhea kitoyanNo ratings yet

- Poem Content: 1. Sa Aking Mga KabataDocument4 pagesPoem Content: 1. Sa Aking Mga Kabatarhea kitoyanNo ratings yet

- D. Assessment TasksDocument5 pagesD. Assessment Tasksrhea kitoyanNo ratings yet

- CaCO3 - EFPP1001 - 9744Document1 pageCaCO3 - EFPP1001 - 9744JUAN SEBASTIAN BUSTOS GARNICANo ratings yet

- Neuthane Castable Polyurethane ElastomersDocument27 pagesNeuthane Castable Polyurethane ElastomersMadhan Ms (Alumni)No ratings yet

- TDS en Primer Epw 1070Document3 pagesTDS en Primer Epw 1070zana connorNo ratings yet

- ArgueCard IVR-L 40&65Document2 pagesArgueCard IVR-L 40&65Pulse XNo ratings yet

- Jis G 4304-2012Document57 pagesJis G 4304-2012marjan banoo75% (4)

- Tubeandpipejournal20210102 DLDocument52 pagesTubeandpipejournal20210102 DLLeo CarrascoNo ratings yet

- Dutta 2001Document15 pagesDutta 2001Pooria1989No ratings yet

- WPS - Pre-Insulated PipesDocument4 pagesWPS - Pre-Insulated Pipesharis bhuttoNo ratings yet

- Armagel HT HTL Manual ENDocument32 pagesArmagel HT HTL Manual ENLee Kok RoyNo ratings yet

- Moh Moein Mubin-Ut TechnicianDocument7 pagesMoh Moein Mubin-Ut Technicianonline MNo ratings yet

- Aluminium Profile System Product Catalog AlstrutDocument244 pagesAluminium Profile System Product Catalog AlstrutsoltztezeNo ratings yet

- For Information: Two (2) X 500 MW Mong Duong 1 Thermal Power PlantDocument23 pagesFor Information: Two (2) X 500 MW Mong Duong 1 Thermal Power PlantTran KhuynhNo ratings yet

- Pa Coated Fabric Import SampleDocument17 pagesPa Coated Fabric Import Samplealiroindia56No ratings yet

- Me Law ReportDocument19 pagesMe Law ReportChristian Angelo AndoyNo ratings yet

- Innovations in 3D Concrete Printing Material Development 1706184607Document3 pagesInnovations in 3D Concrete Printing Material Development 1706184607ziphajlNo ratings yet

- STC White Paper Zta Zirconia Toughened Alumina 01062021Document4 pagesSTC White Paper Zta Zirconia Toughened Alumina 01062021王柏昆No ratings yet

- Concrete ConstructionDocument11 pagesConcrete Construction274sp8k5kcNo ratings yet

- Recent Developments in High Temperature Heat ExchaDocument15 pagesRecent Developments in High Temperature Heat Exchafateh1982No ratings yet

- Specific Cutting Force (KC & KC1) - Machining DoctorDocument1 pageSpecific Cutting Force (KC & KC1) - Machining DoctorAbdullah MustafaNo ratings yet

- LDB - SLDB ListDocument2 pagesLDB - SLDB ListSUSOVAN BISWASNo ratings yet

- Potential Use of Eucalyptus Leaves As Green Corrosion Inhibitor of Steel ReinforcementDocument8 pagesPotential Use of Eucalyptus Leaves As Green Corrosion Inhibitor of Steel Reinforcementaboodalshouha1998No ratings yet

- Rockwool SlabsDocument4 pagesRockwool SlabsBinu AyaniyattuNo ratings yet

- Mahammad FarooqDocument3 pagesMahammad FarooqMohammed AseerNo ratings yet

- 19483Document4 pages19483Jackson PhinniNo ratings yet

- While It Is True That Increases in Efficiency Generate Productivity IncreasesDocument3 pagesWhile It Is True That Increases in Efficiency Generate Productivity Increasesgod of thunder ThorNo ratings yet

- 第46届世界技能大赛数控铣项目湖北省选拔赛样题2 091801Document1 page第46届世界技能大赛数控铣项目湖北省选拔赛样题2 091801omarNo ratings yet

- STP WP BrochureDocument8 pagesSTP WP BrochureRana MahatoNo ratings yet

- Catalogo Domus Wet Cleaning en 2020-142Document7 pagesCatalogo Domus Wet Cleaning en 2020-142Đinh Trọng NghĩaNo ratings yet

- Article - Cementos Avellaneda's Calcined Clay Kiln Conversion - ICR Aug 2021Document3 pagesArticle - Cementos Avellaneda's Calcined Clay Kiln Conversion - ICR Aug 2021AayoushNo ratings yet

NOTES

NOTES

Uploaded by

rhea kitoyanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NOTES

NOTES

Uploaded by

rhea kitoyanCopyright:

Available Formats

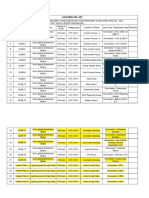

DATA ABOUT I LOVE COST ACCOUNTING COMPANY’S PRODUCTION AND INVENTORIES FOR THE

MONTH OF JANUARY ARE AS FOLLOWS:

Purchases-RM 143,440

Freight in 5,000

Purchase returns and allowances 2,440

Direct Labor 175,000

Actual factory overhead 120,000

Inventories: January1 January30

Finished goods 68,000 56,000

Work in process 110,000 135,000

Raw materials 52,000 44,000

The company applies factory overhead to production at 80% of direct labor cost. Over-or

underapplied is closed to cost of goods sold at year-end. The company’s accounting period is on the

calendar year basis.

FORMULA:

Prime cost= DM+DL

Conversion cost= DL+FOH

Total Manufacturing Costs= DM+DL+FOH

Total Manufacturing Costs= PC+FOH

Total Manufacturing Costs= CC+DM

1. Prime Cost January was

Direct Materials

Beginning Raw Materials Inventory 52,000

Add: Net Purchases of Raw Materials 146,000

Deduct: Ending Raw Materials Inventory 44,000

Direct Materials Used in production 154,000

Direct Labor 175,000

Prime Cost 329,000

2. Conversion cost for January was

CONVERSION COST (DIRECT LABOR + FACTORY OVERHEAD)

Direct Labor 175,000

Factory Overhead 140,000 (175,000 x 80%)

CONVERSION COST 315,000

3. Manufacturing cost for the month of January

MANUFACTURING COST (DIRECT MATERIALS + DIRECT LABOR + FACTORY OVERHEAD)

Direct Materials 154,000

Direct Labor 175,000

Factory Overhead 140,000

TOTAL MANUFACTURING COST 469,000

4. The cost of goods transferred to the finished goods inventory account for the

month of January was

COST OF GOODS MANUFACTURED

Beginning work in process 110,000

Ad: Total manufacturing cost 469,000

Total work in process for the period 579,000

Less: Ending work in process (135,000)

COST OF GOODS MANUFACTURED 444,000

5. Cost of goods sold for January

COST OF GOODS SOLD

Beginning Finished Goods 68,000

Add: Cost of goods manufactured 444,000

Cost of goods available for sale 512,000

Less: Ending finished goods (56,000)

COST OF GOODS SOLD 456,000

6. The amount of over/underapplied overhead factory for the month of January was

OVER/UNDERAPPLIED OVERHEAD FACTORY

Actual factory overhead 120,000

Less: Estimated Factory Overhead 140,000 (175,000 x 80%)

Underapplied/(Overapplied) (20,000)

*Pag negative, overapplied.

7. The cost of goods sold for the month of January should be increased (decreased) by the amount of

over/under-applied factory overhead of

Actual FOH<Applied FOH= Overapplied deduction of COS or COGS (20,000)

Direct Materials

Beginning Raw Materials Inventory 52,000

Add: Net Purchases of Raw Materials 146,000

Deduct: Ending Raw Materials Inventory 44,000

Direct Materials Used in production 154,000

Direct Labor 175,000

Manufacturing Overhead

Total Manufacturing costs

Add: Beginning WIP Inventory

Deduct: Ending WIP Inventory

Cost of Goods Manufactured for the year

Add: Beginning Finished Goods Inventory

Deduct: Ending Finished Goods Inventory

Cost of Goods Sold

COST IN RELATION TO VOLUME OF ACTIVITY

TOTAL PER UNIT

1. FIXED COST CONSTANT VARY

2. VARIABLE COST VARY CONSTANT

=COST/UNIT *NUMBER OF UNITS OR VOLUME

3. MIXED COST= Contain both fixed and variable costs.

= FIXED COST + VARIABLE COST

COSTS IN RELATION TO MANUFACTURING DEPARTMENTS

1. PRODUCING DEPARTMENT- one whose costs may be charged to the product (DM, DL &

FOH)

2. SERVICE DEPATMENT- one that is not directly engaged in production but renders a

particular type of service for the benefit of other departments.

COSTS IN RELATION TO ANALYSIS FOR DECISION MAKING

1. RELEVANT COSTS- it can be changed or influenced by a decision.

CHARACTERISTICS: (must possess both)

A. Future costs

B. Different between decision alternatives

2. IRRELEVANT COSTS-it cannot be avoided

OTHER COSTS FOR DECISION MAKING

DIFFERENTIAL COST- difference between any two alternative courses of action

The difference in cost is an: >INCREASE>DECREASE

AVOIDABLE COST-can eliminated by the virtue of an alternative*UNAVOIDABLE

COST

POSTPONABLE COSTS- may be deferred or shifted to a future date without

adversely affecting current operations.

OUT-OF-POCKET COST- future outlay of financial resources as a consequence of

a decision.

OPPORTUNITY COST- income of benefit sacrificed or forgone when an alternative

is selected over another.

IMPUTED COSTS- are assumed or hypothetical costs

*opportunity cost and imputed costs do not require cash outlay, but both are

relevant cost.

SUNK COST- cost already been incurred and cannot be changed by any decision.

HISTOTICAL COST

QUALITY COST- cost associated with conforming to standards

2 CATEGORIES OF QUALITY COST

A. COST OF COMPLIANCE WITH STANDARDS:

1. PREVENTION COST- preventing product defects

2. APPRAISAL COST- “INSPECTION COST”, incurred to identify defective product

before shipped to customers.

B. COST OF NON-COMPLIANCE WITH STANDARDS

3. FAILURE COST

A. INTERNAL- scrap or rework

B. EXTERNAL- warranty, replacements, legal action and loss in sales due to

reputation of poor quality.

COST IN RELATION TO PERSONS REGULATING THEM

CONTROLLABLE COSTS- can be regulated by the management

EX.(DM<DL&FOH)

NONCONTROLLABLE COSTS- cannot be regulated

EX. (DEPPRECIATION, INSURANCE,RENT,SALARIES)

COST IN RELATION TO TIMING OF COST COMPUTATION OR PREPARATION

HISTORICAL COSTS- determined after the event

PREDETERMINED COSTS- before the event

1. BUDGETED COSTS-

2. STANDARD COSTS-

COST IN RELATION TO TIMING OF CHARGES AGAINST REVENUES

PRODUCT COST OR INVENTORIABLE COSTS- attached to the product

1. DM

2. DL

3. FOH

PERIOD COSTS

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Graphic Engineering Size Tolerances Assignment PDFDocument2 pagesGraphic Engineering Size Tolerances Assignment PDFXacobe PiñeiroNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MANAGERIAL ECONOMICS Notes PRELIMDocument2 pagesMANAGERIAL ECONOMICS Notes PRELIMrhea kitoyanNo ratings yet

- Final ActivitiesDocument14 pagesFinal Activitiesrhea kitoyanNo ratings yet

- Poem Content: 1. Sa Aking Mga KabataDocument4 pagesPoem Content: 1. Sa Aking Mga Kabatarhea kitoyanNo ratings yet

- D. Assessment TasksDocument5 pagesD. Assessment Tasksrhea kitoyanNo ratings yet

- CaCO3 - EFPP1001 - 9744Document1 pageCaCO3 - EFPP1001 - 9744JUAN SEBASTIAN BUSTOS GARNICANo ratings yet

- Neuthane Castable Polyurethane ElastomersDocument27 pagesNeuthane Castable Polyurethane ElastomersMadhan Ms (Alumni)No ratings yet

- TDS en Primer Epw 1070Document3 pagesTDS en Primer Epw 1070zana connorNo ratings yet

- ArgueCard IVR-L 40&65Document2 pagesArgueCard IVR-L 40&65Pulse XNo ratings yet

- Jis G 4304-2012Document57 pagesJis G 4304-2012marjan banoo75% (4)

- Tubeandpipejournal20210102 DLDocument52 pagesTubeandpipejournal20210102 DLLeo CarrascoNo ratings yet

- Dutta 2001Document15 pagesDutta 2001Pooria1989No ratings yet

- WPS - Pre-Insulated PipesDocument4 pagesWPS - Pre-Insulated Pipesharis bhuttoNo ratings yet

- Armagel HT HTL Manual ENDocument32 pagesArmagel HT HTL Manual ENLee Kok RoyNo ratings yet

- Moh Moein Mubin-Ut TechnicianDocument7 pagesMoh Moein Mubin-Ut Technicianonline MNo ratings yet

- Aluminium Profile System Product Catalog AlstrutDocument244 pagesAluminium Profile System Product Catalog AlstrutsoltztezeNo ratings yet

- For Information: Two (2) X 500 MW Mong Duong 1 Thermal Power PlantDocument23 pagesFor Information: Two (2) X 500 MW Mong Duong 1 Thermal Power PlantTran KhuynhNo ratings yet

- Pa Coated Fabric Import SampleDocument17 pagesPa Coated Fabric Import Samplealiroindia56No ratings yet

- Me Law ReportDocument19 pagesMe Law ReportChristian Angelo AndoyNo ratings yet

- Innovations in 3D Concrete Printing Material Development 1706184607Document3 pagesInnovations in 3D Concrete Printing Material Development 1706184607ziphajlNo ratings yet

- STC White Paper Zta Zirconia Toughened Alumina 01062021Document4 pagesSTC White Paper Zta Zirconia Toughened Alumina 01062021王柏昆No ratings yet

- Concrete ConstructionDocument11 pagesConcrete Construction274sp8k5kcNo ratings yet

- Recent Developments in High Temperature Heat ExchaDocument15 pagesRecent Developments in High Temperature Heat Exchafateh1982No ratings yet

- Specific Cutting Force (KC & KC1) - Machining DoctorDocument1 pageSpecific Cutting Force (KC & KC1) - Machining DoctorAbdullah MustafaNo ratings yet

- LDB - SLDB ListDocument2 pagesLDB - SLDB ListSUSOVAN BISWASNo ratings yet

- Potential Use of Eucalyptus Leaves As Green Corrosion Inhibitor of Steel ReinforcementDocument8 pagesPotential Use of Eucalyptus Leaves As Green Corrosion Inhibitor of Steel Reinforcementaboodalshouha1998No ratings yet

- Rockwool SlabsDocument4 pagesRockwool SlabsBinu AyaniyattuNo ratings yet

- Mahammad FarooqDocument3 pagesMahammad FarooqMohammed AseerNo ratings yet

- 19483Document4 pages19483Jackson PhinniNo ratings yet

- While It Is True That Increases in Efficiency Generate Productivity IncreasesDocument3 pagesWhile It Is True That Increases in Efficiency Generate Productivity Increasesgod of thunder ThorNo ratings yet

- 第46届世界技能大赛数控铣项目湖北省选拔赛样题2 091801Document1 page第46届世界技能大赛数控铣项目湖北省选拔赛样题2 091801omarNo ratings yet

- STP WP BrochureDocument8 pagesSTP WP BrochureRana MahatoNo ratings yet

- Catalogo Domus Wet Cleaning en 2020-142Document7 pagesCatalogo Domus Wet Cleaning en 2020-142Đinh Trọng NghĩaNo ratings yet

- Article - Cementos Avellaneda's Calcined Clay Kiln Conversion - ICR Aug 2021Document3 pagesArticle - Cementos Avellaneda's Calcined Clay Kiln Conversion - ICR Aug 2021AayoushNo ratings yet