Professional Documents

Culture Documents

Baf2104 Financial Management I, School Based

Baf2104 Financial Management I, School Based

Uploaded by

LemaronOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Baf2104 Financial Management I, School Based

Baf2104 Financial Management I, School Based

Uploaded by

LemaronCopyright:

Available Formats

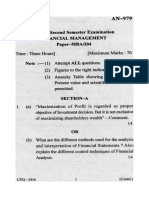

UNIVERSITY EXAMINATION 2017/2018

SCHOOL OF BUSINESS AND ECONOMICS

DEPARTMENT OF ACCOUNTING AND FINANCE

BBM/BCOM/BBIT/BIT/BREM/BECF/BSFS/BECS/BEDA/BSNE

SCHOOL BASED

UNIT CODE: BAF2104 UNIT TITLE: FINANCIAL MANAGEMENT I

DATE: AUGUST 2018 SPECIAL/SUPPLIMENTARY EXAM TIME: 2 HOURS

INSTRUCTIONS: ANSWER QUESTION ONE AND ANY OTHER TWO QUESTIONS

QUESTION ONE (30 MARKS)

(a) Briefly explain causes of agency conflict that may arise in a firm. (5 Marks)

(b) Distinguish between business risks and financial risks. (5 Marks)

c) Explain the reasons why there could be a conflict between profit maximization and

shareholder wealth maximization. (5 Marks)

d) The optional structure of a firm is given as follows:-

Shs. ‘000’

8% debt 300 000

5% preference shares 200 000

Ordinary shares (Kshs. 5 par) 500 000

1 000 000

Library Copy Page 1

Additional Information.

1. New debt can be issued by the firm at the existing coupon rate with a par

value of ksh. 10 000. The bond will trade at a discount of 275/= with a life of

ten years.

2. Preference share capital can be raised at par in unlimited amounts.

3. The firm does not have any retained earnings in its books.

4. New issue of common stock can be made but a floatation cost of 2% of the

market price will be incurred.

5. In the year just ending, the firm paid a dividend of kshs. 3 per share.

6. The investors expect dividend to grow at a constant rate of 10% per annum

indefinitely. The current market price of eh firm’s stock is shs. 60.

Required:

Assuming that the firm is in the 30% tax bracket, compute its WACC. (15 Marks)

QUESTION TWO (20 MARKS)

(a) Identify and explain the factors that affect the structure of a firm. (10 Marks)

(b) Kakuzi Ltd. reported EPS of Shs. 4 in the last financial period. The earnings are

expected to grow at the rate of 10% p.a. for 6 years. The price earnings ratio

(PIE) of the company at the end of the 6th year period is 20. The required rate of

return is 15%. Calculate the theoretical value of this share for an investor who

intends to hold on to the shares for 6 years. The dividend payout ratio is 60%.

(10 Marks)

QUESTION THREE (20 MARKS)

(a) An institute investor has an investment fund of 2 million shillings and he intends

to apportion this fund to two securities A and B as follows; Shs. 400,000 in

security A and Shs. 1,600,000 in security B. The return on each security is

dependent on the states of the economy as shown below:

Library Copy Page 2

A B

Boom 0.4 18% 24%

Average 0.5 14% 22%

Recession 0.1 12% 21%

Required:

(i) Expected return of each security and portfolio. (5 Marks)

(ii) Standard deviation for each security. (5 Marks)

(iii) Correlation coefficient between security A and B. (5 Marks)

(iv) Assess the extent of risk diversification by the investor through the

portfolio holding. (5 Marks)

QUESTION FOUR (20 MARKS)

(a) Rudwell Ltd. wishes to expand its output by purchasing a new machine worth

170,000 shillings and installation costs are estimated at 40,000 shillings. In the

4th year, this machine will call for an overhead to cost shillings 80,000. Its

expected inflows are:

Shs.

Year 1 60,000

Year 2 72,650

Year 3 35,720

Year 4 48,500

Year 5 91,630

Year 6 83,715

This company can raise finance to purchase this machine at 12% interest rate.

Compute NPV and advice management accordingly. (10 Marks)

(b) Identify the advantages and disadvantages of using the NPV method to appraise

investment projects. (10 Marks)

Library Copy Page 3

QUESTION FIVE

Highlight Ltd is considering two possible projects. The projects are mutually exclusive

and promise to generate the following cash flows:

Points in time (yearly intervals) Project A Project B

0 -420,000 -100,000

1 150, 000 75,000

2 150,000 75,000

3 150,000 -

4 150,000 -

The firm’s cost of capital is 12%. Assume unlimited funds and that these are the only

cash flows associated with the projects.

(a) Explain the characteristics of a good investment appraisal technique

(8 Marks)

(b) Determine the net present value (NPV) and internal rate of return (IRR) for each

project. (12 Marks)

Library Copy Page 4

You might also like

- Lurpak - Turning Thought Leadership IntoDocument24 pagesLurpak - Turning Thought Leadership Intospsatta100% (1)

- Cafe Coffe Day Case Analysis - Assignment 3Document7 pagesCafe Coffe Day Case Analysis - Assignment 3Amit PathakNo ratings yet

- Getting To Product Market FitDocument17 pagesGetting To Product Market FitElena100% (1)

- Afm Past Papers (2002 - 2019)Document137 pagesAfm Past Papers (2002 - 2019)peterNo ratings yet

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalNo ratings yet

- BFC 3226 Introduction To Financial Management - 5Document3 pagesBFC 3226 Introduction To Financial Management - 5karashinokov siwoNo ratings yet

- Maf5102 Accounting and Finance Virt MainDocument4 pagesMaf5102 Accounting and Finance Virt Mainshobasabria187No ratings yet

- Question Paper Code:: Reg. No.Document26 pagesQuestion Paper Code:: Reg. No.Khanal NilambarNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- MTP 17 53 Questions 1710507531Document9 pagesMTP 17 53 Questions 1710507531janasenalogNo ratings yet

- 402 - Corporate Financial ManagementDocument2 pages402 - Corporate Financial Managementmahmudhasan5051No ratings yet

- MTP 12 25 Questions 1696939932Document5 pagesMTP 12 25 Questions 1696939932harshallahotNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- Financial Management: Acca Revision Mock 3Document13 pagesFinancial Management: Acca Revision Mock 3krishna gopalNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementgundapola100% (2)

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- Business Finance II: Exercise 1Document7 pagesBusiness Finance II: Exercise 1faisalNo ratings yet

- AFM BLOCK MODEL PAPER DEC 2021Document10 pagesAFM BLOCK MODEL PAPER DEC 2021B KNo ratings yet

- BBM 410 Final FM EXAMDocument4 pagesBBM 410 Final FM EXAMcyrusNo ratings yet

- AFM - Mock-Dec18Document6 pagesAFM - Mock-Dec18David LeeNo ratings yet

- Inter_FMSM_MTP2_Document16 pagesInter_FMSM_MTP2_renudevi06081973No ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument8 pagesThis Paper Is Not To Be Removed From The Examination HallsPaul DavisNo ratings yet

- B1 B4 B5 MergedDocument64 pagesB1 B4 B5 MergedHussein AbdallahNo ratings yet

- Maf5102 Financial Management Virt SuppDocument3 pagesMaf5102 Financial Management Virt Suppshobasabria187No ratings yet

- AS Business AnalysisDocument4 pagesAS Business AnalysisLaskar REAZNo ratings yet

- Financial-Management-Question-Paper-2022-Sem-IVDocument4 pagesFinancial-Management-Question-Paper-2022-Sem-IVadityasinghvis2510No ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- FINANCIAL MANAGEMENT PAPER 2.4 Nov 2018Document17 pagesFINANCIAL MANAGEMENT PAPER 2.4 Nov 2018Nana DespiteNo ratings yet

- Bba 502Document3 pagesBba 502imb2023009No ratings yet

- Financial Management Pyq Sem 6.Document14 pagesFinancial Management Pyq Sem 6.subhagoswami100No ratings yet

- FM Pyq22Document4 pagesFM Pyq22anubhavsinghpvt10No ratings yet

- SFMDocument29 pagesSFMShrinivas PrabhuneNo ratings yet

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhNo ratings yet

- BBB 2210 Financial Management Year III Semester IIDocument3 pagesBBB 2210 Financial Management Year III Semester IIJAMES MUHIANo ratings yet

- SFM Old MTP Dec 21Document6 pagesSFM Old MTP Dec 21Kanchana SubbaramNo ratings yet

- 2021Document4 pages2021Pritam KumarNo ratings yet

- Code No.: 12461: (7 Pages)Document7 pagesCode No.: 12461: (7 Pages)Vinu VaviNo ratings yet

- FM CAT (AutoRecovered)Document4 pagesFM CAT (AutoRecovered)joseph mbuguaNo ratings yet

- CF Paper Summer 2015Document4 pagesCF Paper Summer 2015Vicky ThakkarNo ratings yet

- Ba Fin430finalDocument4 pagesBa Fin430finalIzzy BbyNo ratings yet

- BSF 1102 - Principles of Finance - November 2022Document6 pagesBSF 1102 - Principles of Finance - November 2022JulianNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological Universitysiddharth devnaniNo ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- Cost of Capital PaperrDocument6 pagesCost of Capital Paperrakshaykumarsingh24072005No ratings yet

- 0442 Fourth Semester 5 Year B.B.A.,LL.B. (Hons.) Examination, December 2012 Financial ManagementDocument60 pages0442 Fourth Semester 5 Year B.B.A.,LL.B. (Hons.) Examination, December 2012 Financial Management18651 SYEDA AFSHANNo ratings yet

- Mba722 Group Assignments September 2023Document4 pagesMba722 Group Assignments September 2023Rudo MukurungeNo ratings yet

- Advanced Stage Business Analysis May Jun 2013Document3 pagesAdvanced Stage Business Analysis May Jun 2013Zahidul Amin FarhadNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- Financial Management-P III - Nov 08Document4 pagesFinancial Management-P III - Nov 08gundapolaNo ratings yet

- Bfi 4301 Financial Management Paper 1Document10 pagesBfi 4301 Financial Management Paper 1Paul AtariNo ratings yet

- P8 FM ECO Q MTP 1 Nov 23Document5 pagesP8 FM ECO Q MTP 1 Nov 23spyverse01No ratings yet

- Сем 3 (задание 1)Document18 pagesСем 3 (задание 1)Максим НовакNo ratings yet

- AFM Test 1Document3 pagesAFM Test 1Syeda IsmailNo ratings yet

- 2013MBA Sem II Financial Management - pdf2013Document3 pages2013MBA Sem II Financial Management - pdf2013Riya AgrawalNo ratings yet

- December 2010 Examination: FM12 Financial Management Time: Three Hours Maximum Marks: 100Document5 pagesDecember 2010 Examination: FM12 Financial Management Time: Three Hours Maximum Marks: 100Eashan YadavNo ratings yet

- ADL 13 Ver2+Document9 pagesADL 13 Ver2+DistPub eLearning Solution100% (1)

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationRITZ BROWNNo ratings yet

- Afm RTP 2021Document42 pagesAfm RTP 2021rpj.group2018No ratings yet

- Bec524 and Bec524e Test 2 October 2022Document5 pagesBec524 and Bec524e Test 2 October 2022Walter tawanda MusosaNo ratings yet

- Iii Semester Endterm Examination November 2016Document3 pagesIii Semester Endterm Examination November 2016Gautam KumarNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Sales Director in Charlotte NC Resume Richard HammondDocument3 pagesSales Director in Charlotte NC Resume Richard HammondRichardHammondNo ratings yet

- Use of Social Media As An Effective Marketing ToolDocument14 pagesUse of Social Media As An Effective Marketing Toolnikita agarwalNo ratings yet

- As 13 - Investment AccountsDocument6 pagesAs 13 - Investment AccountsJiya Mary JamesNo ratings yet

- Placement Class - 2 (Math) Dharmendra SirDocument10 pagesPlacement Class - 2 (Math) Dharmendra SirJason WestNo ratings yet

- Aleena Amir EM Quiz 7Document3 pagesAleena Amir EM Quiz 7Aleena AmirNo ratings yet

- Chapter 02 - Stock Investment - Investor Accounting and ReportingDocument26 pagesChapter 02 - Stock Investment - Investor Accounting and ReportingTina Lundstrom100% (3)

- E-Commerce, E-Commerce Consumer Applications E-Commerce Organizational Applications, Prospects of E-CommerceDocument24 pagesE-Commerce, E-Commerce Consumer Applications E-Commerce Organizational Applications, Prospects of E-Commerce2304 Abhishek vermaNo ratings yet

- Marketing Research Report On Watch IndustryDocument32 pagesMarketing Research Report On Watch Industryambesh Srivastava100% (26)

- UEU Akuntansi Untuk Manajer Pertemuan 9Document33 pagesUEU Akuntansi Untuk Manajer Pertemuan 9ingridNo ratings yet

- Luxury Retail Tourism Marketing in New York City NY Resume Melanie RudinDocument2 pagesLuxury Retail Tourism Marketing in New York City NY Resume Melanie RudinMelanieRudin0% (1)

- Amore PacificDocument12 pagesAmore PacificAditiaSoviaNo ratings yet

- Monopolystic CompetitionDocument4 pagesMonopolystic CompetitionKrishna KediaNo ratings yet

- Tim Holtz Winter 2012 PDFDocument43 pagesTim Holtz Winter 2012 PDFPotemkina Elena100% (3)

- Chapter 16-Sales Promotion, Events and SponsorshipDocument36 pagesChapter 16-Sales Promotion, Events and Sponsorshipsmid_90100% (1)

- (Nov 11, 2016) CMR - Cash Out To Marek PDFDocument2 pages(Nov 11, 2016) CMR - Cash Out To Marek PDFDavid HundeyinNo ratings yet

- Branding: SAQ#1 Activity 1 1. How Is A Product Different From A Brand?Document2 pagesBranding: SAQ#1 Activity 1 1. How Is A Product Different From A Brand?TurlingNo ratings yet

- Ch15 Managing Current Assets - Part2Document38 pagesCh15 Managing Current Assets - Part2Khalil AbdoNo ratings yet

- International Business Chapter 1Document3 pagesInternational Business Chapter 1Gene'sNo ratings yet

- 48119589Document22 pages48119589maryamsohrabianNo ratings yet

- Case Study On Karvy 0910Document66 pagesCase Study On Karvy 0910Sanju Reddy100% (2)

- Fast Track To Financial Freedom PDFDocument38 pagesFast Track To Financial Freedom PDFJulio R. López ToruñoNo ratings yet

- Tanisha (FX) - What Is F and Why We Should Choose FDocument4 pagesTanisha (FX) - What Is F and Why We Should Choose FNguyễn Thị Huyền TrangNo ratings yet

- Company ProfileDocument21 pagesCompany ProfileQiniso MkhwanaziNo ratings yet

- Walmart SM Group4Document3 pagesWalmart SM Group4AmberNo ratings yet

- A Comprehensive Review On Investment Management of Al-Arafah Islami Bank Limited & Dutch-Bangla Bank Limited".Document20 pagesA Comprehensive Review On Investment Management of Al-Arafah Islami Bank Limited & Dutch-Bangla Bank Limited".Abanti Binte FarookNo ratings yet

- Analysis of Financial Performance 7ELEVEN SDN BHDDocument11 pagesAnalysis of Financial Performance 7ELEVEN SDN BHDMarisha RizalNo ratings yet

- Market Failure Tutor2uDocument28 pagesMarket Failure Tutor2usharmat1963No ratings yet