Professional Documents

Culture Documents

Budgetary Control Solution

Budgetary Control Solution

Uploaded by

Ankita VaswaniCopyright:

Available Formats

You might also like

- Seven & I Management Report (For Viewing)Document74 pagesSeven & I Management Report (For Viewing)prabathnilanNo ratings yet

- Assignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundDocument5 pagesAssignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundRitika Sharma50% (2)

- ManAcc Quiz 3 - FinalDocument18 pagesManAcc Quiz 3 - FinalDeepannita ChakrabortyNo ratings yet

- Case Hardhat LTD.: 30 Per UnitDocument6 pagesCase Hardhat LTD.: 30 Per UnitRajeshkumar NayakNo ratings yet

- Illustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesDocument4 pagesIllustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesGabriel BelmonteNo ratings yet

- Buget ExcelDocument9 pagesBuget ExcelKhushbu PandeyNo ratings yet

- BA Chapter 7Document11 pagesBA Chapter 7My Duyen NguyenNo ratings yet

- Day 4Document8 pagesDay 4um23328No ratings yet

- Book 1Document35 pagesBook 1Tarun BohraNo ratings yet

- UntitledDocument10 pagesUntitledSIMRAN BURMANNo ratings yet

- Unit 8 - BudgetingDocument8 pagesUnit 8 - Budgetingkevin75108No ratings yet

- Budgetary ControlDocument14 pagesBudgetary ControlCool BuddyNo ratings yet

- DR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingDocument6 pagesDR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingSaumya JainNo ratings yet

- Chapter # 10Document2 pagesChapter # 10kqandeelNo ratings yet

- Hello SirDocument8 pagesHello Sir2022-24 ANKIT KUMAR GUPTANo ratings yet

- Assignment Gurlal SinghDocument2 pagesAssignment Gurlal SinghGurlal SinghNo ratings yet

- (M-5) Budgeting 2Document26 pages(M-5) Budgeting 2Yolo GuyNo ratings yet

- Cost Sheet AnalysisDocument7 pagesCost Sheet AnalysisShambhawi SinhaNo ratings yet

- Classic Pen HandoutsDocument1 pageClassic Pen HandoutsSuraj KumarNo ratings yet

- Classic Pen Working HandoutsDocument1 pageClassic Pen Working HandoutsTushar DuaNo ratings yet

- CH 15Document6 pagesCH 15palashNo ratings yet

- Day 4 - Class ExerciseDocument10 pagesDay 4 - Class Exerciseum23328No ratings yet

- Cma PracticeDocument3 pagesCma PracticeABDUL QAYYUMNo ratings yet

- s15 16 (AutoRecovered)Document14 pagess15 16 (AutoRecovered)R GNo ratings yet

- Activity Activity Cost Pool Cost Driver Cost Driver Quality Pool RateDocument8 pagesActivity Activity Cost Pool Cost Driver Cost Driver Quality Pool RateAman ShahNo ratings yet

- Scenario Summary: Changing CellsDocument18 pagesScenario Summary: Changing CellsReagan SsebbaaleNo ratings yet

- Job Costing ADMDocument18 pagesJob Costing ADMSiddhanta MishraNo ratings yet

- 03 Tadzoa Francis EXO 03 COSTDocument4 pages03 Tadzoa Francis EXO 03 COSTrita tamohNo ratings yet

- Cost Assignment and Cost Allocation - Costs - Case StudiesDocument5 pagesCost Assignment and Cost Allocation - Costs - Case StudiesSatyam TripathiNo ratings yet

- Particulars P1 P2Document4 pagesParticulars P1 P2sanket pareekNo ratings yet

- Cost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaDocument7 pagesCost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaShambhawi SinhaNo ratings yet

- Classic PenDocument12 pagesClassic PenSamiksha MittalNo ratings yet

- Bill French Case Study SolutionsDocument8 pagesBill French Case Study SolutionsMurat Kalender100% (1)

- Mile Highcycles - VarianceDocument8 pagesMile Highcycles - VarianceShahzad Sarwar AzizNo ratings yet

- Cost Sheet HanishDocument7 pagesCost Sheet Hanishashmeet sabharwalNo ratings yet

- 03 Tazoah Francis Exercise 03 CostDocument4 pages03 Tazoah Francis Exercise 03 Costrita tamohNo ratings yet

- Classic Pen SolutionDocument7 pagesClassic Pen SolutionIvy TulesiNo ratings yet

- Break Even Analysis ActivityDocument3 pagesBreak Even Analysis ActivityHriday AmpavatinaNo ratings yet

- Capital Budgeting of Sneakers and PersistanceDocument8 pagesCapital Budgeting of Sneakers and Persistancesaifullahlatif2018No ratings yet

- E5.18 Contribution Margin Per Unit Fixed ExpensesDocument5 pagesE5.18 Contribution Margin Per Unit Fixed ExpensesK59 Lai Hoang SonNo ratings yet

- CVP Relevant CostDocument15 pagesCVP Relevant CostSoumya Ranjan PandaNo ratings yet

- Group 2: Dakshayani Biscuits (: Cost Sheet)Document6 pagesGroup 2: Dakshayani Biscuits (: Cost Sheet)Vinu DNo ratings yet

- 4.2 Costs, Scale of Production and Break-Even Analysis - LearnerDocument23 pages4.2 Costs, Scale of Production and Break-Even Analysis - LearnerDhivya Lakshmirajan100% (1)

- Budget - Charts - Data CleaningDocument23 pagesBudget - Charts - Data CleaningVishi VirenNo ratings yet

- Classic Pen CompanyDocument6 pagesClassic Pen CompanySangtani PareshNo ratings yet

- Cost Volume Profit Analysis (CVP) / Break Even AnalysisDocument10 pagesCost Volume Profit Analysis (CVP) / Break Even AnalysisTaymoor AliNo ratings yet

- Ke Toan Quan Tri FinalDocument13 pagesKe Toan Quan Tri Finalkhanhlinh.vuha02No ratings yet

- Negocio de Palomitas de JasonDocument11 pagesNegocio de Palomitas de JasonElizabeth Sanabria AriasNo ratings yet

- 84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Document6 pages84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Ashutosh PatidarNo ratings yet

- Wilkerson SolutionDocument4 pagesWilkerson SolutionPriyanshi SharmaNo ratings yet

- Pittman Company Case.Document10 pagesPittman Company Case.Ankit VisputeNo ratings yet

- Worksheet MakeUp Class 042524Document38 pagesWorksheet MakeUp Class 042524mrsjeon0501No ratings yet

- Costing Problem and Solution For PracticeDocument8 pagesCosting Problem and Solution For Practicesaradindu123No ratings yet

- Cost SheetDocument5 pagesCost Sheetrajan mishraNo ratings yet

- Classic Pen SolutionDocument4 pagesClassic Pen SolutionAlaka Kumari PradhanNo ratings yet

- Costing PractiseDocument8 pagesCosting PractiseMovie MasterNo ratings yet

- Total 177357 143860 126060 40453 48770Document3 pagesTotal 177357 143860 126060 40453 48770Vatsal ChangoiwalaNo ratings yet

- Particulars 8000 10000 12000 14000Document5 pagesParticulars 8000 10000 12000 14000rajyalakshmiNo ratings yet

- Project Profile For Remica Woven Sack Tape Line 90MM With Hot Air Oven For 5.5 Tone - Per DayDocument8 pagesProject Profile For Remica Woven Sack Tape Line 90MM With Hot Air Oven For 5.5 Tone - Per DayShivang BhavsarNo ratings yet

- Accounts - FIFO and WA For FinalDocument11 pagesAccounts - FIFO and WA For FinalRohan SinghNo ratings yet

- Day 6Document4 pagesDay 6um23328No ratings yet

- Social Media AssignmntDocument40 pagesSocial Media AssignmntNorlatifahNo ratings yet

- Eco 448 Economic Planning IIDocument135 pagesEco 448 Economic Planning IIprincessprecious013No ratings yet

- Summary of Lecture 5 - ElasticityDocument5 pagesSummary of Lecture 5 - ElasticityGwyneth Ü ElipanioNo ratings yet

- Assignment ON Foreign Direct InvestmentDocument7 pagesAssignment ON Foreign Direct InvestmentVikram SinghNo ratings yet

- 2023 12 15 (I Iii) eDocument34 pages2023 12 15 (I Iii) eKajarathan SubramaniamNo ratings yet

- Confezionatrice Verticale LOGIC - EnglishDocument63 pagesConfezionatrice Verticale LOGIC - Englishmeharatif3832No ratings yet

- Lecture 1Document52 pagesLecture 1Siddhartha AgarwalNo ratings yet

- VAT Upload FormDocument6 pagesVAT Upload Formmintesnot kibruNo ratings yet

- Assignment 1 - Case Study Analysis: ECON1193B: Business Statistics 1Document7 pagesAssignment 1 - Case Study Analysis: ECON1193B: Business Statistics 1Phong LữNo ratings yet

- Reception - Sekolah Cikal Surabaya - Enrollment Guide 2024-2025 2Document13 pagesReception - Sekolah Cikal Surabaya - Enrollment Guide 2024-2025 2Naura Athiyyah SativaNo ratings yet

- Effect of Harvesting Ages On Yield and Yield Components of Sugar Cane Varieties Cultivated at Finchaa Sugar Factory, Oromia, EthiopiaDocument6 pagesEffect of Harvesting Ages On Yield and Yield Components of Sugar Cane Varieties Cultivated at Finchaa Sugar Factory, Oromia, Ethiopiadevieoktarini.unsri2017No ratings yet

- Tax Invoice SampleDocument1 pageTax Invoice SampleRahul DeyNo ratings yet

- Regression: Variables Entered/RemovedDocument2 pagesRegression: Variables Entered/RemovedAryanNo ratings yet

- Receipt in TinalunanDocument5 pagesReceipt in TinalunanMarlon D. VirtucioNo ratings yet

- A Theory of Disappointment PDFDocument38 pagesA Theory of Disappointment PDFabe daredNo ratings yet

- Project Report On Performance Appraisal HRTCDocument66 pagesProject Report On Performance Appraisal HRTCAbhishek thakurNo ratings yet

- Delivery Challan: (Under Rule 55 of The CGST Rules, 2017)Document20 pagesDelivery Challan: (Under Rule 55 of The CGST Rules, 2017)SurajPandeyNo ratings yet

- Service Plot 1 ADocument7 pagesService Plot 1 ALAKERS PRINTOLOGYNo ratings yet

- 4EC1 02 Pre-First-Assessment ExemplarsDocument21 pages4EC1 02 Pre-First-Assessment ExemplarsShibraj DebNo ratings yet

- Module 2micro ExercisesDocument13 pagesModule 2micro ExercisesAlzan ZanderNo ratings yet

- Compplete Trader Pro: Gaurav UdaniDocument46 pagesCompplete Trader Pro: Gaurav UdaniKartik BediNo ratings yet

- Platts APAG Report 01.09.2015Document14 pagesPlatts APAG Report 01.09.2015Sharifpour CommerceNo ratings yet

- Zeppini Ecoflex Catalogo EnglishDocument10 pagesZeppini Ecoflex Catalogo EnglishANGEL PRADANo ratings yet

- Cost ReviewerDocument130 pagesCost ReviewerMarjorie Nepomuceno100% (1)

- Linear Programming Linear ProgrammingDocument53 pagesLinear Programming Linear ProgrammingTisha SetiaNo ratings yet

- Module Handbook MSC Economics Freiburg Sept 2020Document82 pagesModule Handbook MSC Economics Freiburg Sept 2020starNo ratings yet

- List of Qualified/Eligible Applicants/Bidder For Eauction On 21-11-2023 ofDocument1 pageList of Qualified/Eligible Applicants/Bidder For Eauction On 21-11-2023 ofsorabh vohraNo ratings yet

- Exhibit TN1 Google' Ratio Analysis and Forecast of Free Cash FlowsDocument6 pagesExhibit TN1 Google' Ratio Analysis and Forecast of Free Cash FlowsAnkush WinniethePooh AnsalNo ratings yet

Budgetary Control Solution

Budgetary Control Solution

Uploaded by

Ankita VaswaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budgetary Control Solution

Budgetary Control Solution

Uploaded by

Ankita VaswaniCopyright:

Available Formats

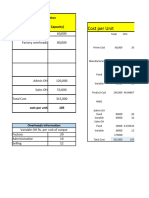

Max 5000 40% 75% 90%

Particulars Per Unit 2000 3750 4500

Direct Material 50 100000 187500 225000

Direct Labour 20 40000 75000 90000

Direct Expenses 12 24000 45000 54000

Prime Cost 164000 307500 369000

Selling Overheads = 8

Variabble(25%) 2 4000 7500 9000

Fixed (75%) 6 30000 30000 30000

Distribution Overhead = 6

Variale (75%) 4.5 9000 16875 20250

Fixed (25%) 1.5 7500 7500 7500

Fixed Overhead 4 20000 20000 20000

Total cost 234500 389375 455750

cost per unit

Total cost/No. of actual unit 117.25 103.8 101.3

Profit 20% 23.45 20.8 20.3

Selling price 140.7 124.6 121.5

Max 10000 50% 70% 80%

Particulars Per Unit 5000 7000 8000

Direct Material 18 90000 126000 144000

Direct Wages 15 75000 105000 120000

Prime cost 165000 231000 264000

Fixed Office Overhead 100000 100000 100000

Variable Overhead 12 60000 84000 96000

Semi Variable Overhead

Fixed 20% 50000 20% 10000 10000 10000

Variable 4 20000 28000 32000

Total Cost 355000 453000 502000

Cost per unit 71 64.71 62.75

loss 55000 33000 22000

SP 60 300000 420000 480000

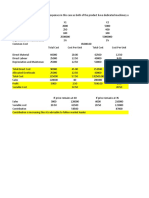

Max 100% 600000 60% 80%

Particulars Per Unit

Direct Material 600000 360000 480000

Basic Wages 200000 120000 160000

Marginal Productivity 40000 24000 32000

Prime Cost 504000 672000

Fixed Production Overhead 80,000 80,000 80,000

Variable Production Overhead 200000 120000 160000

Rigid Admin Overheads 40000 40000 40000

Selling Overhead 120000

Fixed 10% 12000 12000 12000

Variable 108000 64800 86400

Distribution Overhead 60000

Fixed 20% 12000 12000 12000

Variable 48000 28800 38400

Total Cost 861600 1100800

Profit 152047.1 194258.8

Sales 1013647 1295059

Max 12000 70% 60% 80%

Particular 70%

Prime Cost 20000 17142.86 22857.14

Electricity Exp 50000

60% Variable 30000 70% 25714.29 34285.71

40% Fixed 20000 20000 20000

Repairs 5000

35% fixed 1750 1750 1750

65% Variable 3250 70% 2785.714 3714.286

Insurance prem 20000 20000 20000

Staff Salary 10000 10000.0 10000

Total Cost 97392.9 112607.1

Total qty (units) 8400 7200.0 9600

hence cost per unit 12.5 13.5 11.73

selling price per unit 14.88 13.8 12.9

Profit 9739.286 11260.71

Total Sales 107132.1 123867.9

Given 100% Find:

Particulars 60% 70% 80% 90%

Variable Exp.

Direct Wages 9000 10500 12000 13500

Basic Material 24000 28000 32000 36000

Production Expenses 3000 3500 4000 4500

Prime Cost 36000 42000 48000 54000

Fixed:

Workshop Salary 9300 9300 9300 9300

Office Rent 14700 14700 14700 14700

Semi Variable Expenses:

Repairs & Maintainance 10000 10000 11000 12000

Telephone Charges 15000 15000 16500 18000

Total Cost 91000 99500 108000

Profit 35000 34500 34000

Sales (Given) 126000 134000 142000

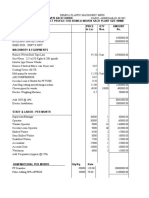

Given Units 5000 Find:

Particulars Per Unit 4000 6000

Material Cost 250000 50 200000 300000

Labour Cost 150000 30 120000 180000

Prime Cost 400000 80 320000 480000

Depriciation 100000 20 100000 100000

Power: 12500

fixed 20% 20% 2500 2500

Varibale 80% 80% 10000 2 8000 12000

Repairs & Maint.: 20000

Fixed 25% 25% 5000 5000

Varibale 75% 75% 15000 3 12000 18000

Stores 100% variable 100% 10000 2 8000 12000

Inspection: 5000

Fixed 80% 80% 4000 4000

Variable 20% 20% 1000 0.2 800 1200

Office Overhead 50000

fixed 75% 75% 37500 37500

Variale 25% 25% 12500 2.5 10000 15000

Selling Overhead: 30000

Fixed 50% 50% 15000 15000

Variable 50% 50% 15000 3 12000 18000

Total Cost 534800 720200 hence=

cost per unit 133.7 120.0333 so 25%

selling price per unit 178.2667 160.0444 assume

cost 75

profit 25

sp 100

I unit requires 1.60 hours to make

worker charges Rs. 2.50 per hour

hence, wages per unit = 2.50 * 1.60 = Rs. 4 per unit

FormuLA

Variable cost per unit = diff. in total cost/ diff. in total qty.

EX. Maintenance 102000-84000/150000-120000

18000/30000 = 0.60 per unit

Total cost = fixed cost + variable cost

Maintenance fc+(120000*0.60) 84000

120000 fc=12000

PARTICULAR Nature 120000 Units 140000 Units 150000 Units

Raw Material(7rs per unit) 100% variable 840000 980000 1050000

Direct Wages(4rs p.u) 100% variable 480000 560000 600000

Comission (1rs p.u) 100% variable 120000 140000 150000

Selling & dsistribution overhead 100% fixed 85000 85000 85000

indirect material 100% variable 264000 308000 330000

indirect Labour 100% variable 150000 175000 187500

Inspection 100% variable 90000 105000 112500

Maintenance Fixed 12000 12000 12000

variable 72000 84000 90000

Supervision fixed 54000 54000 54000

variable 144000 168000 180000

Deprication 100% fixed 90000 90000 90000

Engineering Services 100% fixed 94000 94000 94000

Total Cost 2495000 2855000 3035000

Working Note

supervision 234000-198000/150000-120000

36000/30000 = 1.2 per unit

variable 120000*1.2 = 144000

Fixed Cost 198000-144000 = 54000

You might also like

- Seven & I Management Report (For Viewing)Document74 pagesSeven & I Management Report (For Viewing)prabathnilanNo ratings yet

- Assignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundDocument5 pagesAssignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundRitika Sharma50% (2)

- ManAcc Quiz 3 - FinalDocument18 pagesManAcc Quiz 3 - FinalDeepannita ChakrabortyNo ratings yet

- Case Hardhat LTD.: 30 Per UnitDocument6 pagesCase Hardhat LTD.: 30 Per UnitRajeshkumar NayakNo ratings yet

- Illustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesDocument4 pagesIllustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesGabriel BelmonteNo ratings yet

- Buget ExcelDocument9 pagesBuget ExcelKhushbu PandeyNo ratings yet

- BA Chapter 7Document11 pagesBA Chapter 7My Duyen NguyenNo ratings yet

- Day 4Document8 pagesDay 4um23328No ratings yet

- Book 1Document35 pagesBook 1Tarun BohraNo ratings yet

- UntitledDocument10 pagesUntitledSIMRAN BURMANNo ratings yet

- Unit 8 - BudgetingDocument8 pagesUnit 8 - Budgetingkevin75108No ratings yet

- Budgetary ControlDocument14 pagesBudgetary ControlCool BuddyNo ratings yet

- DR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingDocument6 pagesDR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingSaumya JainNo ratings yet

- Chapter # 10Document2 pagesChapter # 10kqandeelNo ratings yet

- Hello SirDocument8 pagesHello Sir2022-24 ANKIT KUMAR GUPTANo ratings yet

- Assignment Gurlal SinghDocument2 pagesAssignment Gurlal SinghGurlal SinghNo ratings yet

- (M-5) Budgeting 2Document26 pages(M-5) Budgeting 2Yolo GuyNo ratings yet

- Cost Sheet AnalysisDocument7 pagesCost Sheet AnalysisShambhawi SinhaNo ratings yet

- Classic Pen HandoutsDocument1 pageClassic Pen HandoutsSuraj KumarNo ratings yet

- Classic Pen Working HandoutsDocument1 pageClassic Pen Working HandoutsTushar DuaNo ratings yet

- CH 15Document6 pagesCH 15palashNo ratings yet

- Day 4 - Class ExerciseDocument10 pagesDay 4 - Class Exerciseum23328No ratings yet

- Cma PracticeDocument3 pagesCma PracticeABDUL QAYYUMNo ratings yet

- s15 16 (AutoRecovered)Document14 pagess15 16 (AutoRecovered)R GNo ratings yet

- Activity Activity Cost Pool Cost Driver Cost Driver Quality Pool RateDocument8 pagesActivity Activity Cost Pool Cost Driver Cost Driver Quality Pool RateAman ShahNo ratings yet

- Scenario Summary: Changing CellsDocument18 pagesScenario Summary: Changing CellsReagan SsebbaaleNo ratings yet

- Job Costing ADMDocument18 pagesJob Costing ADMSiddhanta MishraNo ratings yet

- 03 Tadzoa Francis EXO 03 COSTDocument4 pages03 Tadzoa Francis EXO 03 COSTrita tamohNo ratings yet

- Cost Assignment and Cost Allocation - Costs - Case StudiesDocument5 pagesCost Assignment and Cost Allocation - Costs - Case StudiesSatyam TripathiNo ratings yet

- Particulars P1 P2Document4 pagesParticulars P1 P2sanket pareekNo ratings yet

- Cost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaDocument7 pagesCost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaShambhawi SinhaNo ratings yet

- Classic PenDocument12 pagesClassic PenSamiksha MittalNo ratings yet

- Bill French Case Study SolutionsDocument8 pagesBill French Case Study SolutionsMurat Kalender100% (1)

- Mile Highcycles - VarianceDocument8 pagesMile Highcycles - VarianceShahzad Sarwar AzizNo ratings yet

- Cost Sheet HanishDocument7 pagesCost Sheet Hanishashmeet sabharwalNo ratings yet

- 03 Tazoah Francis Exercise 03 CostDocument4 pages03 Tazoah Francis Exercise 03 Costrita tamohNo ratings yet

- Classic Pen SolutionDocument7 pagesClassic Pen SolutionIvy TulesiNo ratings yet

- Break Even Analysis ActivityDocument3 pagesBreak Even Analysis ActivityHriday AmpavatinaNo ratings yet

- Capital Budgeting of Sneakers and PersistanceDocument8 pagesCapital Budgeting of Sneakers and Persistancesaifullahlatif2018No ratings yet

- E5.18 Contribution Margin Per Unit Fixed ExpensesDocument5 pagesE5.18 Contribution Margin Per Unit Fixed ExpensesK59 Lai Hoang SonNo ratings yet

- CVP Relevant CostDocument15 pagesCVP Relevant CostSoumya Ranjan PandaNo ratings yet

- Group 2: Dakshayani Biscuits (: Cost Sheet)Document6 pagesGroup 2: Dakshayani Biscuits (: Cost Sheet)Vinu DNo ratings yet

- 4.2 Costs, Scale of Production and Break-Even Analysis - LearnerDocument23 pages4.2 Costs, Scale of Production and Break-Even Analysis - LearnerDhivya Lakshmirajan100% (1)

- Budget - Charts - Data CleaningDocument23 pagesBudget - Charts - Data CleaningVishi VirenNo ratings yet

- Classic Pen CompanyDocument6 pagesClassic Pen CompanySangtani PareshNo ratings yet

- Cost Volume Profit Analysis (CVP) / Break Even AnalysisDocument10 pagesCost Volume Profit Analysis (CVP) / Break Even AnalysisTaymoor AliNo ratings yet

- Ke Toan Quan Tri FinalDocument13 pagesKe Toan Quan Tri Finalkhanhlinh.vuha02No ratings yet

- Negocio de Palomitas de JasonDocument11 pagesNegocio de Palomitas de JasonElizabeth Sanabria AriasNo ratings yet

- 84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Document6 pages84 1.05 54 B. Direct Labour 14 0.175 28 Add: Factory O/h 42 0.525 84 Units Produced 80 120Ashutosh PatidarNo ratings yet

- Wilkerson SolutionDocument4 pagesWilkerson SolutionPriyanshi SharmaNo ratings yet

- Pittman Company Case.Document10 pagesPittman Company Case.Ankit VisputeNo ratings yet

- Worksheet MakeUp Class 042524Document38 pagesWorksheet MakeUp Class 042524mrsjeon0501No ratings yet

- Costing Problem and Solution For PracticeDocument8 pagesCosting Problem and Solution For Practicesaradindu123No ratings yet

- Cost SheetDocument5 pagesCost Sheetrajan mishraNo ratings yet

- Classic Pen SolutionDocument4 pagesClassic Pen SolutionAlaka Kumari PradhanNo ratings yet

- Costing PractiseDocument8 pagesCosting PractiseMovie MasterNo ratings yet

- Total 177357 143860 126060 40453 48770Document3 pagesTotal 177357 143860 126060 40453 48770Vatsal ChangoiwalaNo ratings yet

- Particulars 8000 10000 12000 14000Document5 pagesParticulars 8000 10000 12000 14000rajyalakshmiNo ratings yet

- Project Profile For Remica Woven Sack Tape Line 90MM With Hot Air Oven For 5.5 Tone - Per DayDocument8 pagesProject Profile For Remica Woven Sack Tape Line 90MM With Hot Air Oven For 5.5 Tone - Per DayShivang BhavsarNo ratings yet

- Accounts - FIFO and WA For FinalDocument11 pagesAccounts - FIFO and WA For FinalRohan SinghNo ratings yet

- Day 6Document4 pagesDay 6um23328No ratings yet

- Social Media AssignmntDocument40 pagesSocial Media AssignmntNorlatifahNo ratings yet

- Eco 448 Economic Planning IIDocument135 pagesEco 448 Economic Planning IIprincessprecious013No ratings yet

- Summary of Lecture 5 - ElasticityDocument5 pagesSummary of Lecture 5 - ElasticityGwyneth Ü ElipanioNo ratings yet

- Assignment ON Foreign Direct InvestmentDocument7 pagesAssignment ON Foreign Direct InvestmentVikram SinghNo ratings yet

- 2023 12 15 (I Iii) eDocument34 pages2023 12 15 (I Iii) eKajarathan SubramaniamNo ratings yet

- Confezionatrice Verticale LOGIC - EnglishDocument63 pagesConfezionatrice Verticale LOGIC - Englishmeharatif3832No ratings yet

- Lecture 1Document52 pagesLecture 1Siddhartha AgarwalNo ratings yet

- VAT Upload FormDocument6 pagesVAT Upload Formmintesnot kibruNo ratings yet

- Assignment 1 - Case Study Analysis: ECON1193B: Business Statistics 1Document7 pagesAssignment 1 - Case Study Analysis: ECON1193B: Business Statistics 1Phong LữNo ratings yet

- Reception - Sekolah Cikal Surabaya - Enrollment Guide 2024-2025 2Document13 pagesReception - Sekolah Cikal Surabaya - Enrollment Guide 2024-2025 2Naura Athiyyah SativaNo ratings yet

- Effect of Harvesting Ages On Yield and Yield Components of Sugar Cane Varieties Cultivated at Finchaa Sugar Factory, Oromia, EthiopiaDocument6 pagesEffect of Harvesting Ages On Yield and Yield Components of Sugar Cane Varieties Cultivated at Finchaa Sugar Factory, Oromia, Ethiopiadevieoktarini.unsri2017No ratings yet

- Tax Invoice SampleDocument1 pageTax Invoice SampleRahul DeyNo ratings yet

- Regression: Variables Entered/RemovedDocument2 pagesRegression: Variables Entered/RemovedAryanNo ratings yet

- Receipt in TinalunanDocument5 pagesReceipt in TinalunanMarlon D. VirtucioNo ratings yet

- A Theory of Disappointment PDFDocument38 pagesA Theory of Disappointment PDFabe daredNo ratings yet

- Project Report On Performance Appraisal HRTCDocument66 pagesProject Report On Performance Appraisal HRTCAbhishek thakurNo ratings yet

- Delivery Challan: (Under Rule 55 of The CGST Rules, 2017)Document20 pagesDelivery Challan: (Under Rule 55 of The CGST Rules, 2017)SurajPandeyNo ratings yet

- Service Plot 1 ADocument7 pagesService Plot 1 ALAKERS PRINTOLOGYNo ratings yet

- 4EC1 02 Pre-First-Assessment ExemplarsDocument21 pages4EC1 02 Pre-First-Assessment ExemplarsShibraj DebNo ratings yet

- Module 2micro ExercisesDocument13 pagesModule 2micro ExercisesAlzan ZanderNo ratings yet

- Compplete Trader Pro: Gaurav UdaniDocument46 pagesCompplete Trader Pro: Gaurav UdaniKartik BediNo ratings yet

- Platts APAG Report 01.09.2015Document14 pagesPlatts APAG Report 01.09.2015Sharifpour CommerceNo ratings yet

- Zeppini Ecoflex Catalogo EnglishDocument10 pagesZeppini Ecoflex Catalogo EnglishANGEL PRADANo ratings yet

- Cost ReviewerDocument130 pagesCost ReviewerMarjorie Nepomuceno100% (1)

- Linear Programming Linear ProgrammingDocument53 pagesLinear Programming Linear ProgrammingTisha SetiaNo ratings yet

- Module Handbook MSC Economics Freiburg Sept 2020Document82 pagesModule Handbook MSC Economics Freiburg Sept 2020starNo ratings yet

- List of Qualified/Eligible Applicants/Bidder For Eauction On 21-11-2023 ofDocument1 pageList of Qualified/Eligible Applicants/Bidder For Eauction On 21-11-2023 ofsorabh vohraNo ratings yet

- Exhibit TN1 Google' Ratio Analysis and Forecast of Free Cash FlowsDocument6 pagesExhibit TN1 Google' Ratio Analysis and Forecast of Free Cash FlowsAnkush WinniethePooh AnsalNo ratings yet