Professional Documents

Culture Documents

BSBFIN501 Assessment Templates V1.1120

BSBFIN501 Assessment Templates V1.1120

Uploaded by

Layla Correa da SilvaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BSBFIN501 Assessment Templates V1.1120

BSBFIN501 Assessment Templates V1.1120

Uploaded by

Layla Correa da SilvaCopyright:

Available Formats

Assessment Templates

BSBFIN501 Manage budgets and financial plans

Student ID Student Name

First Name:

Last Name:

Group Work

This assessment task has been completed by the following persons and we acknowledge that it was

a fair team effort where everyone contributed equally to the work completed. We declare that no

part of this assessment has been copied from another person’s work with the exception of where we

have listed or referenced documents or work and that no part of this assessment has been written

for us by another person.

Group

Group Members’ Names

Student ID Student & Last Name

Student’s declaration:

By submitting this assessment, you are acknowledging and agreeing to the following conditions.

Check all boxes if you agree.

I have read and understood the details of the assessment

I have been informed of the conditions of the assessment and the appeals process and

understand I may appeal if I believe the assessment is not equitable, fair or just

I agree to participate in this assessment, and I am ready to be assessed

I have acknowledged all sources where appropriate in accordance with Greystone College’s

Academic Integrity Policy, and I believe other group members have done the same

I declare that no part of this assessment has been copied from another person’s work with

the exception of where I have listed or referenced documents or work and that no part of

this assessment has been written for me by another person.

Greystone College Australia BSBFIN501 Assessment Templates V3.0920

Page 1 of 22

Submitting your assessment:

Complete all assessment tasks, upload the Templates document and submit in Moodle for grading.

Videos and information on how to submit work through Moodle are in the FAQ section of your VET

Orientation course. Once your assessment is graded, you will receive an email notification. Check

your grades and submission feedback on Moodle.

Assessor’s acknowledgement:

Please verify each of the following principles of assessment by placing a tick in each box. Refer to the

assessor's handbook for further information if required.

Authentic: The assessor is assured that the evidence presented for assessment is the

☐ learner’s own work.

Valid: The assessor is assured that the learner has the skills, knowledge and attributes

☐ as described in the module or unit of competency and associated assessment

requirements.

Current: The assessor is assured that the assessment evidence demonstrates current

☐ competency. This requires the assessment evidence to be from the present or the very

recent past.

Sufficient: The assessor is assured that the quality, quantity and relevance of the

☐ assessment evidence enable a judgement to be made of a learner’s competency.

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 2 of 22

TASK 2 – Knowledge Questions Template

Please provide answers to the following 17 questions.

1. Describe each of the six (6) steps of the accounting process required to record all of the

transactions that take place, and to organise and collate this information before finally

producing financial reports that are analysed and used in decision making.

Provide a description of each of the 6 steps:

• Transactions

• Journals

• General ledger

• Trial balance

• Balance day adjustments

• Accounting reports

Transactions - are procedures in which there is an exchange of resources whether individuals

or legal entities.

Journals - which is relative to the day.

General ledger - is a field of accounting whose primary goal is to offer specific information on

a company's real and economic financial situation.

Trial balance - it's a type of accounting report in which a business documents its activities in

terms of costs, expenses, and revenue.

Balance day adjustments - When a firm operates on a non-cash basis, it records an expense

when it pays a bill and an income when it receives money. The accountant will enter

adjustment journal entries to place these revenue and spending in the relevant timeframe.

Accounting reports - When a firm operates on a non-cash basis, it records an expense when it

pays a bill and an income when it receives money. The accountant will enter adjustment

journal entries to place these revenue and spending in the relevant timeframe.

2. In 50 words or more, explain how a revenue-received transaction with a credit balance has a

corresponding debit against an asset or liability account.

The debit and credit balances are always equivalent in a revenue-received transaction vs an

asset or liability account. We reduce the liabilities by the same amount as we increase the

asset. The revenue account will then be modified in the same manner as the asset or liability

account has been modified.

3. In 50 words or more, describe the difference between cash basis and accrual basis

accounting when recording transactions, producing financial reports.

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 3 of 22

The Competence Regime requires that the occurrence be registered on the date it took place.

The Competence Regime is defined in accounting as the document's registration on the date

of the triggering event (that is, on the date of the document, regardless of when it will be paid

or received). In the Cash Regime, we treat document registration as if it were a bank account,

and we register papers on the date of payment or receipt.

4. Explain in 50 words or more the difference between the profit calculated in the trading

account compared with the profit calculated in the profit and loss account.

The results of trading activities, such as product purchases and sales, are displayed in a

trading account. The profit and loss account indicates a company's real profit or loss for a

certain accounting period. The trade account is a portion of the financial report, while the

profit & loss account indicates the company's genuine earnings.

5. List at least four (4) of the financial regulatory requirements including the relevant

legislation that businesses must comply with.

- GST reporting and other taxation-related issues on the declaration of economic

activity.

- Compliance with the Income Tax Assessment Act 1997.

- Administration and reporting guarantee levy for superannuation.

- Compliance with the Australian Accounting Standards AS/NZS.

6. Describe at least four (4) functions of the Australian Taxation Office in terms of the financial

management requirements of a business and in 50 words or more explain the Good and

Services Tax.

- revenue collection

- handling the GST on behalf of the Australian states and territories.

- managing a variety of programs that deliver community transfers and benefits.

- Managing Australia's superannuation system on a large scale

- maintaining the Australian Business Register as custodian.

The Good and Services Tax (GST) is a value-added tax applied on most products and services

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 4 of 22

sold for domestic consumption. Consumers pay the GST, but businesses selling the products

and services must remit it to the government.

7. In 50 words or more, describe the purpose of an audit in financial records management.

This practice is developed to ensure the company's financial, equity, and accounting data

valid for a specific period, providing greater security to shareholders and managers while also

protecting the company's assets. In addition, the audit also serves to check all the facts and

operations that take place in the company and that converge in accounting.

8. In 50 words or more, explain why it is important when monitoring budgets to make balance-

day adjustments at the close of an accounting period, before preparing financial statements.

The budget should be examined on a regular basis to see if any modifications are needed to

improve the company's financial status. So it is essential to evaluate how the company's

budget is performing right now, and then to identify the significant issues, which may be

found in both the spending and earning sections.

9. Give at least three (3) reasons why work teams need access to budgets and financial plans

and in 50 words or less, outline the ways financial information can be shared effectively with

relevant stakeholders.

1. Fit the needs;

2. Establish priorities;

3. Think strategies to achieve the expected results.

Documentation relating to financial information may be shared at dedicated meetings. This

procedure can be performed monthly or fortnightly, depending on needs.

10. Identify at least five (5) signs that team members are under-performing and may need

support in their role to manage finances for the organisation.

- Failure to achieve the performance goals.

-That guy was overburdened by what had previously been basic tasks.

- Disruptive or disruptive behaviour that has a negative impact on co-workers.

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 5 of 22

- Fail to fulfill the duties of the position, or do so in a satisfactory manner.

- Employees do not meet the required standards when doing their duties.

11. In 50 words or more, describe the process of monitoring actual expenditure, variance and

costs controls to avoid budget over runs.

Any money spent is an investment for the long term. When discussing budgets, the term

"expenditure" is frequently used. The variance is calculated by comparing budgeted revenue

and expenditure to actual revenue and expenditure, yielding a discrepancy between the

budget and actual revenue. To avoid overruns, evaluate source material relevant to the

spending areas and collect documentation of the difference. Look for any seasonal variables

or ordering timeframes that may have contributed to the variance if the variance is

confirmed. Make a note of the circumstance by writing down the reasons and informing your

boss.

12. In 50 words or less for each, provide a description for the following types of resource data

commonly used by the work team for managing budgets and financial plans.

Account and routing numbers, current and minimum balances, bank

Bank account records data, adjustment categories, and any notes you wish to link are all

recorded in the bank account record for you to maintain and manage.

Because it applies to all types of products and services purchased by

GST calculations and the general population, it is known as a broad-based consumption

any credits tax. You will be charged 10% GST when purchasing supplies for your

business, which you can claim as a credit.

Wages and salaries, Payments, bonuses, and other goods are tracked

using bookkeeping. It's easier to keep everything organized if you

Wages/salaries books examine each component on a monthly or biweekly basis. Consider

(including PAYG, the case below:

superannuation, etc.)

Pay-as-you-go stands for pay-as-you-go. Employees are paid

depending on their annual earnings liability through taxation.

It's defined as a method for recording without always evaluating the

costs of a production task. Job costing software can be used by a

Job costing team leader or accountant to keep track of the costs of each work.

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 6 of 22

13. Using 50 words or less, outline the process of analysing and documenting resource data, and

making recommendations for improvement.

We need a team of professionals who can process, handle, and translate data in order to

analyze it using SQL, Excel, Tableau, and other tools. Individuals must be able to get insights

from the knowledge, which must be precise and organized. The financial performance

evaluation must be examined by the authentic user.

13a. In 50 words or less, outline the processes involved in reviewing and evaluating agreed

improvements.

The first step in the BPI process is to identify the need for change. A process audit is a useful

tool for identifying areas for improvement. Throughout the audit, your company's current

challenges and potential threats will be recognized. You'll need to analyze the present process

after you've decided which one you wish to improve.

14. Outline at least four (4) advantages of using software programs or electronic spreadsheets

when monitoring and analysing budgets.

-Raw data is tough to interpret. We can condense this database into beautiful and self-

explanatory graphs and drawings using visualisation tools, allowing us to see where the

budget comes from and where it will go.

-This form of software arranges data in a way that makes it simple to find and review each

entry.

-Cuts down on the amount of time it takes to create reports and make financial decisions.

- Stakeholders can access information from any location.

15. In 50 words or more, explain how planning, implementation and modifying contingency

plans is used to control financial risks for a business.

For a company's financial risks to be controlled, contingency plans must be established,

implemented, and adjusted. Because the environment impacts the extent and severity of

events' effects on business processes, the sphere of business operations should be addressed

in the formulation of an emergency plan. The plan must also take into account the financial

implications of the occurrences, as well as financial strategies for the company's survival. The

efficiency of the contingency plan is affected by how it is implemented. If the strategy isn't

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 7 of 22

implemented correctly, the company will incur even more financial losses.

16. In 50 words or less, outline the advantages of regular reporting of budgets and financial

plans.

Assist in the transparency of the company and its operations. It also aids in the discovery and

correction of arithmetic errors.

17. In 50 words or less describe the budgeting process of analysing and managing cash flow.

Budgets help prepare cash forecasts, which are then used to determine cash flow and

outflow. The company's goal is to get the cash flow in line with the budget so that there are

no more issues. Seasonal revenue and expenditure cash flow analysis can help a company

plan for the coming fiscal year.

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 8 of 22

18. In 100 words or less, briefly describe the difference between operational and financial budgets.

Budgets assist in the preparation of cash predictions, which are subsequently used to calculate

cash flow and outflow. The company's goal is to bring cash flow in accordance with the budget so

that no further problems arise. Seasonal income and expenditure cash flow analysis can aid a

company's fiscal year planning.

An operating budget's three main components are revenue, costs, and profits. A financial

budget includes the cash budget, capital expenditure budget, and expected balance sheet.

The operating budget balances expected revenue with expected costs. The financial budget

includes the balance sheet, which shows the assets and liabilities at any time during the year.

More quantitative detail of analysis is required to build the operating budget.

End of Questioning - 18 questions in total.

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 9 of 22

TASK 3 – Project

Portfolio of

Financial Information

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 10 of 22

Table of Contents

Budget Report..............................................................................................................................3

Briefing: Retail Outlet Managers.................................................................................................4

Briefing: Sales Staff......................................................................................................................4

Short Report................................................................................................................................5

Blog Post......................................................................................................................................6

Staff email:...................................................................................................................................7

Plan: Monitoring revenue and expenditure................................................................................8

Proposal submission: Board of Directors.....................................................................................9

Executive briefing......................................................................................................................10

Revised Budgeting and Financial Planning Procedures.............................................................11

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 11 of 22

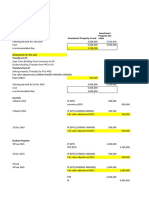

Step 1: Budget Report

Financial strategy for the next 5 years for BizOps

The Income's current revenue is expected to rise from $150 million in 2018 to $262 . million in

2023. If revenue isn't fulfilled, the remainder of the budget will suffer if we don't keep an eye on

it. Recommendation: As a result, the purpose may be to regularly monitor product sales and

spend in training/marketing (promoting) to meet sales targets.

To ensure a sustainable growth scenario, costs are currently rising proportionally at a lesser rate

than profits for the Expenditure. If we don't keep this under control, the cost will skyrocket,

limiting the surplus available for reinvestment. As a result, the recommendation is to continue

concentrating on ways to reduce spending without sacrificing efficiency, allowing income to

grow without incurring additional costs.

Profit is expected to rise steadily in the next years as sales and expenses are expected to

improve in the coming years. If we don't take care of this, BizOps will remain stagnant or

perhaps lose money, demonstrating inefficiency or an unsustainable marketing plan. The

recommendation is to keep going.

Profitability is meant to follow reinvestment, and if we don't keep track of it, the company won't

be able to reach its sales, investment, and benefit targets. BizOps will become outmoded

without constant reinvestment, losing track of what customers desire over time. The advice is to

maintain a steady state of upgrading by reinvesting a significant amount of earnings.

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 12 of 22

FORCAST FOR THE NEXT QUARTER

Step 3: Briefing: Retail Outlet Managers

Senior management demands that the budget be based on predicted sales demand, rather than

simply boosting previous figures by a predetermined percentage. Only act with the value to be

sold because this decreases the error margin. The effect on working conditions is also reducing.

This plan’s budget is based on an estimate of sales and production volume, and the accuracy of

the above-mentioned estimate determines its effectiveness. In the coming fiscal year, as a

senior manager, I've decided to implement a 15% increase in sales with a fixed budget. This

decision will serve as a guide for retail shop managers in adjusting company-wide initiatives of

any kind. The key goal, according to this, is to put our management capacity to the test each

year in order to meet a new goal. The money generated by this strategy will cover 75% of the

cost of the marketing campaign, allowing managers to improve results in each store and expand

their capabilities.

CONTINGENCY BUDGET

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 13 of 22

Step 5: Briefing: Sales Staff

Personnel in BizOps must grasp the necessity of meeting financial objectives. It's crucial, then,

that salespeople in particular are knowledgeable with the company's unique product line in

Australia, as well as its quality and innovation, emphasizing how what we offer is an

environmentally responsible answer for our customers.

Hools aren't selling well, therefore a plan has been put in place to run a special promotion and

discount sale for a month. The target audience is at the heart of the marketing strategy, which

consists of four main elements. These four elements are referred to as the 4Ps. Promotional,

personal sales, and sales promotion are all part of the promotional mix. It's also necessary to

remind employees how promotion is used in the company, which in this case is to persuade

clients to buy our products and services by convincing them that ours are better than others. As

a result, the organization will train salespeople to better understand client trends based on the

findings of the investigation. This new strategy will result in more efficient and cost-effective

development procedures, as well as a reduction in the time each salesperson spends with each

customer.

To implement the approach, the company would invest $3 million in Hool shares and offer a

10% discount on commodities for 10 days, as well as spend $30,000 on advertising to meet the

goal, with a sales price reduction equal to a 10% discount off the regular sale price. The

following are the measures to take:

Combo Discount: Instead of cutting the price of a single item, this form of discount reduces the

cost of a group of things purchased together.

Free Delivery: Providing clients with free shipping boosts a company's profitability.

Through social media, provide one-month off discounts of up to 30% on Hools on any quantity

of purchases.

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 14 of 22

Step 6: Short Report

Managing the budgeting process: The budgeting process comprises allocating revenue

and expenses in order to ensure that funds are distributed in a strategic manner. It is

recommended that you create a comprehensive budget plan because it will make

financial management and review easier. Keeping track of spending by predicting a

budget is a simple strategy that will assist you in regulating and assessing how money is

spent. Prepare the right personnel for the budgeting position to ensure that the

company's budgeting expectations are satisfied. This can be conducted during new

employee onboarding, and performance evaluations can be provided during work

training. Obtain buy-in and approval from all relevant stakeholders including those

involved in the budgeting process. This is to ensure the budget's dependability and

authenticity, which everyone involved must adhere to. Approval on paper files can be in

the form of a signature or an email confirmation.

Managing cash flow: The phrase "cash flow" refers to a technique for controlling the

liquidity of earnings and results. In the same way that we must arrange our revenues

and expenses to understand how the income is divided, the method of determining cash

flow is similar to that of budgeting. After that, the first step is to go over our expenses

and compare them to our projections. This makes it easier for us to keep track of and

manage our money. One method for measuring our cash flow spending is to track

income and estimate the deficit by keeping track of cash in and out. Increase revenues

by bringing on new customers or selling more to existing ones. This could take the form

of a distinct consumer benefit or simply exceptional customer service.

Companies are required to monitor their financial statements since they assist them in

sustaining strong incomes and minimizing expenses. A technique of calculating account

profit and loss is to add up all of your monthly income, add up all of your monthly

expenses, then subtract expenses from total income to get the difference. The first step

in dealing with profit and loss is to create an income statement to keep track of it. This

will show you your profits and losses in a transparent manner, as well as point you in the

appropriate direction for cost-cutting.

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 15 of 22

Step 7: Blog Post

All viable and fixed business costs are recorded, evaluated, and documented using cost

accounting. That is to say, he must be involved in the financial statement for each department

manager at BizOps in order to make a decision. This concept will aid you in determining the

costs of products or processes so that you can report the amount appropriately on a company's

financial statements. The primary purpose of presenting this information is to provide clear

information to accountants and to understand how the budget was created. The five types of

accounts are as follows:

▫ Money created on a regular basis as a consequence of a transaction, an investment, or

other sources is referred to as income. As an example, a 20-hour-per-week BizOps

employee. Is the entire revenue generated by service or product purchases, plus

dividends and interest earned on capital assets.

▫ The tangible and intangible value-owned goods of the company are referred to as assets

(e.g. money, computer systems, patents). A good example would be the location of

BizOps' facility or a well-known brand name in the industry.

▫ The concept "liabilities" refers to the amount of money that the company owes to

others (e.g. mortgages, car loans). In the process of doing business, a corporation must

meet a legal financial burden or obligation. BizOps, for example, may owe money to a

variety of financial organizations, such as banks or trusts.

▫ The costs incurred or required in the development of a product are referred to as

expenses.

▫ The fraction of a company's total assets owned solely by its shareholders or stockholders

is referred to as equity. Is a way of raising funds that involves the sale of stock. Assets =

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 16 of 22

Equities, for example, can be rewritten from the traditional accounting equation Assets =

Liabilities + Owner's Equity.

Step 8: Staff email:

Recipient: New Staff Financial Management

Subject: ATO and Legislative Requirements

Hello Everybody,

The purpose of this email is to help you have a better grasp of the following areas, which

concern us as regulations and requirements that we must consider.

Requirements for assessing revenue at the Australian Taxation Office are as follows: If any of

the employees run a business, the majority of their earnings are tax deductible. What we

refer to as assessable income is the total amount (or total income). Consider the following:

1. Make sure the paper is intended to be a tax invoice.

2. Mention the seller's name.

3. As a reference, use the seller's Australian business number (ABN).

4. The invoice's issue date.

5. A brief description of the items for sale, including quantity and price (if appropriate).

6. The amount of GST due (if any) — this can be shown separately or as a statement that

states "Total price includes GST" if the GST amount is exactly one-eleventh of the total cost.

7. The percentage of each taxable sale on the invoice (i.e., the percentage of each sale that

includes GST).

GST collection, payment, and reconciliation: You have the option of reporting and paying GST

only once per year. This approach can only be utilized if you are a GST registered business. If

you have a GST license and your yearly income is less than $75,000 (or $150,000 for non-

profits), this means you have a GST license. You may not have to register or pay any GST

during the year if you qualify and have elected to report and pay GST every year. At the end

of the fiscal year, any remaining funds must be reported and paid. You'll be expected to exit

the deferred GST system if you're utilizing it. Here are some things to think about:

1. To begin, you must first register for GST.

Then, if the sales are taxable (i.e., they are not exempt because they are GST-free or input-

taxed), include GST in the price of taxable sales.

2.Receive and issue tax invoices for company purchases and taxable sales.

3. Claim GST credits for GST paid on your company purchases.

4. Account for GST on a cash or non-cash basis, and set aside the GST earned for BIZOps to

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 17 of 22

pay to the ATO when the project is finished.

5. Finally, file activity reports or yearly returns with the Australian Taxation Office to reflect

BIZOPs sales and purchases, and pay or receive GST.

Financial records must meet the following auditing and record-keeping requirements: You

must generally keep your paperwork in an accessible format (either written or digital) for five

years for tax purposes. We must preserve the following records as a company:

- Receipts and other proof of all transactions and purchases done on behalf of your

company.

- Taxes invoices, as well as records of wages and compensation.

- All documents pertaining to GST.

- Any commercial assets, such as land, buildings, or office equipment, as well as their

purchase, sale, and other expenses.

- Keep track of all tax returns and activity statements.

Pay as you go (PAYG) tax: As a company, we have a responsibility to help payees meet their

end-of-year tax requirements. This is accomplished by withholding PAYG withholdings from

payments made to our employees; other employees, such as contractors, with whom you

have made voluntary agreements with companies that do not provide their Australian

business number (ABN); and payments made as part of a voluntary arrangement. You will

not be entitled to a deduction if you do not comply with the PAYG withholding

responsibilities for a worker's salary. Sanctions may be applied in addition to fines.

Thank you for your time and consideration; I will pay close attention to any arising doubt.

Have a wonderful day,

Management of financial resources.

Step 9: Implementing & Monitoring revenue &

expenditure

Monitoring actions Responsible Priority Deadline Start End

Preparing budget variance reports

Prepare budget worsheets for Financial

High 30-July 1-July 29-July

each department manager

Assumptions and forecasts Departmenta 15- 30-

High 30-August

should be prepared l Heads August August

Make a functional and Departmenta

High 14-Sept 1-Sept 14-Sept

auxiliary budget l Heads

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 18 of 22

Collect all budgets from all Budget

High 20-Sept 15-Sept 25-Sept

departments Committee

Senior

Complete the Board Papers on

Managers / High 15-Oct 25-Sept 15-Oct

time and budget

CEO

Approval by the Board of

CEO Very High 30-Oct 15-Oct 30-Oct

Directors

Step 10: Proposal submission: Board of Directors

Currently, the financial management method aims to track up to 200 expenditure categories

and 20 income categories. Department heads allege that it takes an entire working day to reply

to all of the anomalies in their monthly budget report. It also helps with activity organization by

requiring BizOps managers to look at the relationships between their operations and

departments. As a result, I argue for good budget and financial plan management, as it is

necessary to take into account a wide range of accounting concepts, techniques, and details.

Minor expenses are important to us, but because they do not pose any substantial risk or

concern, we encourage the branch manager board to focus on the ones designated as big

expenses revenues, as their variance is greater.

Mock-up examples:

Minor expense variances:

Expense item Actual Budget Variance

Unexpected

$500 $250 %100

equipment repair

Major expense examples:

Expense item Actual Budget Variance

$3,388.32-

Casual Wages 3,600 5.88%

$3,811.68

$39,530.4 -

Stock purchases 42,000 5.88%

$44,469.6

Major sales revenue example:

Income item Actual Budget Variance

Sales revenue $66,666.4 - $99,999.6 83,333 20%

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 19 of 22

Step 11: Executive briefing

Budgeting issues Recommendations

The department managers rarely have their The best recommendation is to hold internal

preliminary budget projections submitted to deadline sessions on a regular basis and have

the Budget Committee on time. Consequently, documents ready to deliver to the Budget

the Budget Committee usually has to delay its Committee at least 14 days before the

review of all of the subsidiary budgets by about deadline. It would, however, be necessary to

two weeks. check and seek assistance.

The two-week delay puts enormous pressure Employees who are working on multiple

on the finance department as the production of projects should not be overworked and

the master budget overlaps with other should adhere to each job's deadline. To give

scheduled finance department tasks such as those who are more vital a higher priority.

GST activity reporting, payroll preparation and Holding a brainstorming session or meeting

asset register updates. where departments can discuss probable

scenarios and design solutions to avoid them

is another strategy to avoid delays and one

activity interfering with another. Finally,

before setting the actual datelines, the basic

principle is to create a shared timetable.

The finance staff feel that the budget cycle It is vital to maintain information up to date

should commence two weeks earlier, but if this on the cloud and to have a workflow strategy

were implemented it would clash with the in place to avoid such conflicts. Allowing

stocktake period in the retail outlets. extended periods of time, but no more than

one week, may also be an option.

Organizations should aim to make efficient

decisions at all times, but this can only be

done if each change is well discussed with

other departments prior to implementation.

The budget consolidation is performed If the system is upgraded and altered,

manually by entering information from hard workers will be able to complete tasks on

copy forms into a database. It would require a time and accurately. If that isn't enough,

major financial system upgrade to provide further temporary consultants may be

department managers with the ability to enter employed to teach and train workers. The

this information directly. You do some research main objective is to teach workers to ensure

and find that if the department managers that the process goes well. Additionally, going

entered their forecast budget data into a cashless and allowing more payment

standard spreadsheet template, it would then terminals to establish efficient operations is

be relatively simple to export data from this

vital. Time is equated to cash resources in

format into the financial system for budget

this case.

consolidation. This approach would require

resources for setting up the spreadsheet

templates and training department managers in

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 20 of 22

using the spreadsheet templates.

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 21 of 22

Step 12: Revised Budgeting and Financial Planning

Procedures

The BizOps budget plan aids the organization and all divisions in managing their operations,

knowing their stock levels, having a mitigation strategy, GST and plan obligations, and so on.

Financial statements display spending and variances, compare budgets, and display growth and

decreases. Show the suggestions and their implications if there have been any modifications.

The forecast predicts the amount of income that will be received, whereas the budget predicts

the amount of revenue that a company expects to generate. To begin with, conditions change

throughout the year, and the company must be able to respond to these changes and

comprehend how they effect the business. Using projections from the past can lead to more

proactive and lucrative actions. Budgeting and forecasting's versatility would also allow for

increased accuracy and improved corporate success. Using spreadsheet templates to collect

information on budget projections is one of the most crucial modifications to make.

It's also worth thinking about developing a budget committee to whom a large percentage of

the aforementioned responsibilities would be delegated. The development and updating of

policies and budget guides aids in the management of the strategy and direction on how to

make various projections; also, if the organization takes risks, it must choose the option that

provides the best return.

Make educated guesses and estimates. Costs over which you have the most control must be

anticipated. This appears to be one case in which a variety of forecasts could be beneficial.

Determine which optional costs BizOps should eliminate if the firm is failing, and where the

company should spend if it is doing well. This operation would be overseen by Mike Booth,

Managing Director of Financial Operations.

Continuously reviewing and evaluating these procedures is an essential element of the process.

The budget committee might issue reports on a regular basis to track how the implemented

modifications are reacting to the company's budget dynamics.

Greystone College Australia BSBFIN501 Assessment Templates V1.1120 Page 22 of 22

You might also like

- BSBSUS601 - Assessment Task 1Document8 pagesBSBSUS601 - Assessment Task 1Natti NonglekNo ratings yet

- HAS Manual Group 3Document53 pagesHAS Manual Group 3syakirah100% (4)

- BSBLDR601 Assessment Task 02 v1.0Document12 pagesBSBLDR601 Assessment Task 02 v1.0Jaydeep Kushwaha100% (1)

- BSBLDR601 Assessment Task 01 v1.0Document4 pagesBSBLDR601 Assessment Task 01 v1.0Jaydeep KushwahaNo ratings yet

- BSBFIN601 Project Portfolio 1Document21 pagesBSBFIN601 Project Portfolio 1Zumer Fatima100% (1)

- BSBSTR502 LAP F v1.1 Sub File 1 UnfinishedDocument74 pagesBSBSTR502 LAP F v1.1 Sub File 1 UnfinishedLyly NguyenNo ratings yet

- SA.2-BSBLDR523 - Attachment 1-Project Portfolio Template (Ver.1)Document15 pagesSA.2-BSBLDR523 - Attachment 1-Project Portfolio Template (Ver.1)star trendz0% (1)

- BSBCRT511: Develop Critical Thinking in OthersDocument13 pagesBSBCRT511: Develop Critical Thinking in Othersstar trendz67% (3)

- BSBCRT511 - Project Portfolio - Phuoc Duong - 15 FebDocument14 pagesBSBCRT511 - Project Portfolio - Phuoc Duong - 15 FebPhuoc Duong100% (3)

- BSBFIN501 Contingency Plan TASK 3 Assessment 1Document2 pagesBSBFIN501 Contingency Plan TASK 3 Assessment 1Ivson SilvaNo ratings yet

- Assessment Task 3 - BSBSUS511 V1.1 PimDocument14 pagesAssessment Task 3 - BSBSUS511 V1.1 Pimpicha67% (3)

- BSBTWK503 Section 1 Project PortfolioDocument9 pagesBSBTWK503 Section 1 Project PortfolioGurpreet DhillonNo ratings yet

- Assessment 501Document46 pagesAssessment 501Harmanpreet Kaur50% (2)

- Manage Meeting Bsbadm502 6164036: Provide Answers To All of The Questions BelowDocument25 pagesManage Meeting Bsbadm502 6164036: Provide Answers To All of The Questions BelowhemantNo ratings yet

- BSBOPS502 Task 2 - Cathal RaffertyDocument12 pagesBSBOPS502 Task 2 - Cathal RaffertyBui An0% (1)

- BSBXCM501 Project Portfolio - Docx - NehachoudharyDocument20 pagesBSBXCM501 Project Portfolio - Docx - NehachoudharyFasih ur Rehman AbidNo ratings yet

- Name-Baljinder Rikhi Assessment Task - Student ID - AC142 Submitted ToDocument19 pagesName-Baljinder Rikhi Assessment Task - Student ID - AC142 Submitted ToABC50% (2)

- Cover Sheet: (Strikeout Whichever Is Not Applicable)Document15 pagesCover Sheet: (Strikeout Whichever Is Not Applicable)Jaydeep Kushwaha0% (1)

- Assessment Task 1 - BSBSTR502 V1.1Document9 pagesAssessment Task 1 - BSBSTR502 V1.1ZomakSoluionNo ratings yet

- Assessment Task 3 - BSBSTR502 V1.1Document12 pagesAssessment Task 3 - BSBSTR502 V1.1ZomakSoluion100% (1)

- BSBLDR523 Lead and Manage Effective Workplace Relationships Assessment BookletDocument21 pagesBSBLDR523 Lead and Manage Effective Workplace Relationships Assessment BookletJeremiah Noromor Ronquillo100% (2)

- BSBTWK503 Task 2Document7 pagesBSBTWK503 Task 2star trendz100% (1)

- AH - PK-2537-BSBTWK503 - Assessment Task 3Document71 pagesAH - PK-2537-BSBTWK503 - Assessment Task 3daniyal khan100% (1)

- BSBCRT511 Project PortfolioDocument13 pagesBSBCRT511 Project PortfolioAkriti Dangol50% (2)

- Assessment Task 2Document15 pagesAssessment Task 2Hira Raza0% (2)

- BSBLDR511 Develop and Use Emotional IntelligenceDocument13 pagesBSBLDR511 Develop and Use Emotional IntelligenceLayla Correa da SilvaNo ratings yet

- BSBLDR511 Develop and Use Emotional Intelligence: Student Name: Oktaviana Student ID: TWIOO9220Document26 pagesBSBLDR511 Develop and Use Emotional Intelligence: Student Name: Oktaviana Student ID: TWIOO9220oktaviana liauw100% (1)

- BSBPEF502 Develop and Use Emotional Intelligence Assessment TaskDocument9 pagesBSBPEF502 Develop and Use Emotional Intelligence Assessment TaskJames Ooi0% (1)

- Assessment BSBMGT517Document14 pagesAssessment BSBMGT517Edward Andrey50% (2)

- Aged Debtor ReportDocument43 pagesAged Debtor ReportTanmoy Naskar100% (1)

- Staff Emotional Intelligence ReportDocument4 pagesStaff Emotional Intelligence Reporttanveer ahmedNo ratings yet

- BSBFIM501 Assessment Leadership and ManagementDocument23 pagesBSBFIM501 Assessment Leadership and ManagementAmanda Pires100% (1)

- SA.2 BSBLDR522 - Assessment Project Student Info (Ver. 1)Document17 pagesSA.2 BSBLDR522 - Assessment Project Student Info (Ver. 1)Pradip Khanal100% (1)

- BSBLDR523 Project PortfolioDocument26 pagesBSBLDR523 Project PortfolioSabindra JoshiNo ratings yet

- Assessment Task 1 - BSBSUS511 V1.1Document11 pagesAssessment Task 1 - BSBSUS511 V1.1ZomakSoluion100% (1)

- Assessment Task 1 AnswersDocument16 pagesAssessment Task 1 AnswersPrabina BajracharyaNo ratings yet

- BSBPEF502 Project PortfolioDocument17 pagesBSBPEF502 Project PortfolioPrachi Agarwal0% (1)

- Assessment Summary / Cover Sheet: BSBFIM501 Manage Budgets and Financial PlansDocument43 pagesAssessment Summary / Cover Sheet: BSBFIM501 Manage Budgets and Financial Plansrida zulquarnainNo ratings yet

- BSBPMG430 Undertake Project Work: Task SummaryDocument21 pagesBSBPMG430 Undertake Project Work: Task SummaryGabrieleNo ratings yet

- BSBPEF502 Project Portfolio Vincent TanDocument23 pagesBSBPEF502 Project Portfolio Vincent Tanvncenttan100% (1)

- Assessment Task 1: Written Questions: BSB50420Diploma of Leadership and ManagementDocument5 pagesAssessment Task 1: Written Questions: BSB50420Diploma of Leadership and Managementkarma Sherpa100% (1)

- BSBLDR523 SAT - Task 2 - Project Portfolio (Ver. 1)Document8 pagesBSBLDR523 SAT - Task 2 - Project Portfolio (Ver. 1)Sandun KodippiliNo ratings yet

- Case Study - Naturecare: Information Relevant To Identifying, Developing and Managing Organisational ChangeDocument5 pagesCase Study - Naturecare: Information Relevant To Identifying, Developing and Managing Organisational ChangeBhanu AUGMENTNo ratings yet

- BSBLDR523 Student Guide 04-03-21Document34 pagesBSBLDR523 Student Guide 04-03-21Laxmi Deepika100% (1)

- BSBMGT517Document11 pagesBSBMGT517syedibad25% (4)

- BSBOPS504 Manage Business Risk: Assessment Task 1Document8 pagesBSBOPS504 Manage Business Risk: Assessment Task 1star trendzNo ratings yet

- BSBCRT511 - Assessment Task 1 v2Document11 pagesBSBCRT511 - Assessment Task 1 v2Fernanda Matzenbacher100% (1)

- BSBLDR522 Task 2Document51 pagesBSBLDR522 Task 2Muhammad Zainal Abidin0% (1)

- BSBTWK502 - Student AssessmentDocument25 pagesBSBTWK502 - Student Assessmentgurpreet100% (1)

- BSBMGT517 Project AssessmentDocument29 pagesBSBMGT517 Project AssessmentJenny YipNo ratings yet

- BSBFIN601 MANAGE ORGANISATIONAL FINANCES - Question Task 2Document4 pagesBSBFIN601 MANAGE ORGANISATIONAL FINANCES - Question Task 2Gabriel Jay Lasam50% (2)

- BSBTWK503 - Unit Assessment Pack Template Version 9 FinalDocument65 pagesBSBTWK503 - Unit Assessment Pack Template Version 9 FinalFrancis Dave Peralta Bitong100% (3)

- BSBSUS511 - Project Portfolio DONEDocument39 pagesBSBSUS511 - Project Portfolio DONEGurnoor Singh0% (1)

- BSBSUS511 Assessment Task 2Document13 pagesBSBSUS511 Assessment Task 2Anoosha MazharNo ratings yet

- BSBCRT611 Project PortfolioDocument15 pagesBSBCRT611 Project PortfolioJohnNo ratings yet

- BSBLDR511 - Task 3Document24 pagesBSBLDR511 - Task 3ottoNo ratings yet

- BSBTWK503 Project Portfolio.v1.0Document20 pagesBSBTWK503 Project Portfolio.v1.0Syed NaseerNo ratings yet

- BSBOPS502: Manage Business Operational PlansDocument7 pagesBSBOPS502: Manage Business Operational Plansstar trendzNo ratings yet

- BSBLDR601 Task 2 V1.1-1 - 1413179009Document36 pagesBSBLDR601 Task 2 V1.1-1 - 1413179009Habibi AliNo ratings yet

- BSBFIM501 Assessment Templates V3.0920Document20 pagesBSBFIM501 Assessment Templates V3.0920Layla Correa da SilvaNo ratings yet

- BSBFIM501 Assessment Templates V3.0920Document18 pagesBSBFIM501 Assessment Templates V3.0920Layla Correa da SilvaNo ratings yet

- BSBFIM501 Assessment Templates V3.0920Document19 pagesBSBFIM501 Assessment Templates V3.0920Layla CorreaNo ratings yet

- BSBWOR501 Assessment V2.1017Document13 pagesBSBWOR501 Assessment V2.1017Layla Correa da SilvaNo ratings yet

- BSBRSK501 Manage Risk: Assessment Cover SheetDocument14 pagesBSBRSK501 Manage Risk: Assessment Cover SheetLayla Correa da SilvaNo ratings yet

- BSBPMG522 Assessment Templates V1.0220Document13 pagesBSBPMG522 Assessment Templates V1.0220Layla Correa da SilvaNo ratings yet

- BSBFIM501 Assessment Templates V3.0920Document18 pagesBSBFIM501 Assessment Templates V3.0920Layla Correa da SilvaNo ratings yet

- BSBRSK501 Risk-Management-Plan-TemplateDocument5 pagesBSBRSK501 Risk-Management-Plan-TemplateLayla Correa da SilvaNo ratings yet

- BSBFIM501 Assessment Templates V3.0920Document20 pagesBSBFIM501 Assessment Templates V3.0920Layla Correa da SilvaNo ratings yet

- BSBMKG418 Develop and Apply Knowledge of Marketing Communications IndustryDocument9 pagesBSBMKG418 Develop and Apply Knowledge of Marketing Communications IndustryLayla Correa da SilvaNo ratings yet

- Lonsdale Institute Pty LTD Assessment Task: Unit Code Unit Name Assessment Code Due DateDocument15 pagesLonsdale Institute Pty LTD Assessment Task: Unit Code Unit Name Assessment Code Due DateLayla Correa da SilvaNo ratings yet

- Unit Code Unit Name Assessment Code Due Date Student Name Student IDDocument7 pagesUnit Code Unit Name Assessment Code Due Date Student Name Student IDLayla Correa da SilvaNo ratings yet

- Moses ResumeDocument3 pagesMoses ResumehenryNo ratings yet

- New Fashion Collection: Mintmadefashi ONDocument25 pagesNew Fashion Collection: Mintmadefashi ONDhruv TayalNo ratings yet

- Business Law & RegulationDocument2 pagesBusiness Law & RegulationAshley Kate HapeNo ratings yet

- MNCAR Notable Transactions Q2Document5 pagesMNCAR Notable Transactions Q2Jason SandquistNo ratings yet

- Group 9Document10 pagesGroup 9normieotaku2001No ratings yet

- RA 9485 Anti Red Tape Act of 2007Document3 pagesRA 9485 Anti Red Tape Act of 2007lejigeNo ratings yet

- A Study On "Port Industry" - An Empirical ResearchDocument55 pagesA Study On "Port Industry" - An Empirical ResearchDimpu Sarath KumarNo ratings yet

- Judge Marc Van Der Woude IBC PresentationDocument18 pagesJudge Marc Van Der Woude IBC PresentationTrevor SoamesNo ratings yet

- 2017 January 08Document36 pages2017 January 08siva kNo ratings yet

- Strategic Management Chapter-10Document22 pagesStrategic Management Chapter-10Towhidul HoqueNo ratings yet

- Maf 671 Case 2 The Price Is RightDocument22 pagesMaf 671 Case 2 The Price Is Rightsyah RashidNo ratings yet

- Lounge Access List World PDFDocument4 pagesLounge Access List World PDFashwin16No ratings yet

- Livelihood Sustainabilityof Street Vendors AStudyin Dhaka CityDocument8 pagesLivelihood Sustainabilityof Street Vendors AStudyin Dhaka CityNathaniel PohNo ratings yet

- Exam 2 Q&ADocument7 pagesExam 2 Q&AJennifer WillardNo ratings yet

- Module 3Document6 pagesModule 3trixie maeNo ratings yet

- Catalog Page - 31octDocument6 pagesCatalog Page - 31octoooNo ratings yet

- 10%-CS005 - Kimolongit Box Culvert-Tender DocumentDocument124 pages10%-CS005 - Kimolongit Box Culvert-Tender Documentbest essaysNo ratings yet

- 2162bc PDF EngDocument11 pages2162bc PDF EngAdrian GuzmanNo ratings yet

- Sanction LetterDocument2 pagesSanction Letter313 65 Cheithanya Kumar MNo ratings yet

- Improving Organisational Performance ProDocument309 pagesImproving Organisational Performance ProJob seekerNo ratings yet

- UK Ecommerce Market SizeDocument10 pagesUK Ecommerce Market SizeSimona MolonfaleanNo ratings yet

- Mid-Term Exam For Cross Cultural ManagementDocument4 pagesMid-Term Exam For Cross Cultural ManagementNhung Phan Nguyễn HồngNo ratings yet

- Snake LTD - Class WorkingsDocument2 pagesSnake LTD - Class Workingsmusa morinNo ratings yet

- Market StructureDocument37 pagesMarket StructureJëssiçä R. ArëllanöNo ratings yet

- An Organizational Study of Pragathi Gramin Bank & Survey On Customer SatisfactionDocument15 pagesAn Organizational Study of Pragathi Gramin Bank & Survey On Customer SatisfactionSatveer SinghNo ratings yet

- The Mediating Effect of Intellectual Capital, Management Accounting Information Systems, Internal Process Performance, and Customer PerformanceDocument22 pagesThe Mediating Effect of Intellectual Capital, Management Accounting Information Systems, Internal Process Performance, and Customer PerformancechristaNo ratings yet

- Retail Offer Advantage Through Brand Orienttaion in Luxury High Fashion StoresDocument161 pagesRetail Offer Advantage Through Brand Orienttaion in Luxury High Fashion StoresSugan PragasamNo ratings yet

- Annual Report of IOCL 196Document1 pageAnnual Report of IOCL 196Nikunj ParmarNo ratings yet

- Cash and Cash EquivalentsDocument16 pagesCash and Cash EquivalentsÇåsäō Ärts67% (3)