Professional Documents

Culture Documents

Cost 531 2021 Assignment

Cost 531 2021 Assignment

Uploaded by

Waylee CheroOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost 531 2021 Assignment

Cost 531 2021 Assignment

Uploaded by

Waylee CheroCopyright:

Available Formats

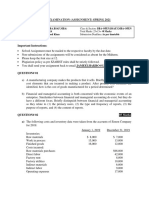

University Of Liberia

College of Business, Graduate Studies

Accounting 531 (Cost Accounting)

First Major Assignment

Name:_________________________________________________________________id#________

Instruction: Please do as would be necessary to satisfy the requirement of the questions, they are

either, True or False, Fill in blank, or Multiple Choice. Circle your rightful choice. (2pts f each)

1. In the preparation of the cost of Production report, if the beginning and

ending inventory of the work -in- process are the same than total

manufacturing cost will be equal to Cost of Goods Manufactured. True or

Fales?

2. In determining total Work In Process manufacturing costs on the cost of

Production Report,

a. beginning work in process inventory should be added to the TMC.

b. actual manufacturing overhead costs appear as a deduction.

c. manufacturing overhead applied is added to direct materials and direct

labor.

d. ending work in process inventory is deducted from beginning work in

process inventory.

3. In the preparation of the cost of Production report, if the beginning and

ending inventory of the work -in- process are the same than total

manufacturing cost will be equal:

a. Total Cost of Goods Manufactured b. Total Work In Process

c. Total Cost of Goods available for Sales d. None of the Above

4. Direct materials requisitioned from the storeroom should be charged to the

Work In Process Inventory account and the job cost sheets for the individual

jobs on which the materials were used. True or Fales?

5. Actual manufacturing overhead costs are assigned to each job by tracing

each overhead cost to a specific job.

6. Overapplied overhead means that actual manufacturing overhead costs were

greater than the manufacturing overhead costs applied to jobs

pg. 1 Richard Nagbe Koon Course Lecturer

7. When goods are sold, the Cost of Goods Sold account is debited and Work

in Process Inventory account is credited.

8. If the entry to assign factory labor showed only a debit to Work In Process

Inventory, then all labor costs were

a. indirect labor. b. direct labor. c. overtime related. d. regular hours

9. Fill in the blanks with correct word/words.

(i) .......................... process of accounting for the incurrence of cost and the control of

cost.

(ii) The objective of determining the .......................... of products is of main importance in

cost accounting.

(iii) Cost accounting provides information regarding the cost to make

and .......................... product or services.

(iv) Cost accounting helps the management in providing information for ..........................

decisions for formulating operative policies.

(v) A .......................... system provides immediate information regarding stock of raw

material, semi-finished and finished goods.

10. If manufacturing overhead has been underapplied during the year, the

adjusting entry at the end of the year will show a

a. debit to Manufacturing Overhead. B. credit to Cost of Goods Sold.

c. debit to Work in Process Inventory. d. debit to Cost of Goods Sold.

11. When the company assigns factory labor costs to jobs, the direct labor cost is

debited to:

a. Direct Labor. b. Factory Labor. c. Manufacturing Overhead. d. Work in

Process Inventory.

12.DJ Co. has a job-order cost system. The following debits (credits) appeared

in the Work in Process account for the month of March:

June 1, balance $ 12,000

June 31, direct materials 40,000

June 31, direct labor 30, 000

June 31, manufacturing overhead applied 24, 000

June 31, to finished goods (100,000)

DJ Co. applies overhead at a predetermined rate of 80% of direct labor cost.

Job No. 101, the only job still in process at the end of June, has been

pg. 2 Richard Nagbe Koon Course Lecturer

charged with manufacturing overhead of $2,200. What was the amount of

direct materials charged to Job No. 101?

a. $2,250 b. $2,500 c. $1,250 d. $1,050

13.On January 1 Maples had two jobs in process: #10006 with assigned costs of

$10,500 and #10007 with assigned costs of $14,250. During January these

three new jobs were introduced and started, #10008 through #10010, and

these three jobs, #10006 through #10008 were completed. Materials and

labor costs added during January were as follows:

Job number Materials Labor

10006 $ 0 $2,000

10007 0 1,500

10008 4,000 3,600

10009 3,800 2,000

10010 2,600 3,100

Manufacturing overhead is assigned at the rate of 200 percent of labor.

What is the January cost of goods manufactured and transferred from

work-in- process?

a. $50,050 b. $35,850 c. $42,950 d. $25,300

Jobs 506 – 508 were the only jobs completed so the costs of these jobs is the focus of this question.

DM and DL for those jobs is $35,850, but OH had to beadded at ($2,000 + $1,500 + $3,600) x

200% = ($7,100 x 2) + $35,850 = $50,050.

14.Jonathan Mfg. adopted a job-costing system. For the current year, budgeted

cost driver activity levels for direct labor hours and direct costs were 20,000

and $100,000, respectively. In addition, budgeted variable and fixed factory

overhead were $50,000 and $25,000, respectively. Actual costs and hours

for the year were as follows.

Direct labor hours 21, 000

Direct labor costs $110,000

Machine hours 35, 000

For a particular job, 1,500 direct-labor hours were used. Using direct-labor

hours as the cost driver, what amount of overhead should be applied to the

job?

pg. 3 Richard Nagbe Koon Course Lecturer

a. $3,214 b. $5,357 c. $5,625 d. $7,500

15.Richard Company has underapplied overhead of $60,000 for the calendar

year. Before disposition of the underapplied overhead, selected year-end

balances from Richard’s accounting records are:

Sales $1,200,000

Cost of goods sold 900,000

Direct materials inventory 150,000

Work-in-process inventory 200,000

Finished goods inventory 100,000

Under Richard’s cost accounting system, over or underapplied overhead is

allocated to appropriate inventories and cost of goods sold based on year-end

balances. In its annual statement, Richard should report costs of goods sold

as

a. $858,750 b. $855,000 c. $945,000 d. $941,250

16.An increase in production level within a relevant rang most likely would

result in

a. Increasing the total cost c. Increasing the variable cost per unit

b. Decreasing the total fixed cost d. Decreasing the variable cost per unit

17. During September at Blamo Corporation, $65,000 of raw materials were

requisitioned from the storeroom for use in production. These raw materials

included both direct and indirect materials. The direct materials totaled $35,000.

The journal entry to record this requisition would include a debit to Work In

Process of: A) $65,000 B) $4,000 C) $35,000 D) $61,000

18. Gullett Corporation had $26,000 of raw materials on hand on November 1.

During the month, the company purchased an additional $75,000 of raw materials.

The journal entry to record the transferred of raw materials both direct and indirect

to production would include a:

A) debit to Work in Process and debit to Manufacturing Overhead

B) credit to Raw Materials

C) debit to Raw Materials

D) Both A and B are correct

pg. 4 Richard Nagbe Koon Course Lecturer

19. During July at XYZ Corporation, $83,000 of raw materials were requisitioned

from the storeroom for use in production. These raw materials included both direct

and indirect materials. The indirect materials totaled $5,000. The journal entry to

record the requisition from the storeroom would include a:

A) debit to Work in Process of $78,000

B) debit to Work in Process of $83,000

C) credit to Manufacturing Overhead of $4,000

D) debit to Raw Materials of $83,000

20. In October, Koon Inc. incurred $73,000 of direct labor costs and $6,000 of

indirect labor costs. The journal entry to record the accrual of these wages would

include a:

A) Debit to Manufacturing Overhead of $6,000

B) debit to Work in Process of $73,000

C) credit to Manufacturing Overhead of $79,000

D) Credit to Salaries and Wages Payable of $79,000

21. Chokopepe Corporation incurred $87,000 of actual Manufacturing Overhead

costs during September. During the same period, the Manufacturing Overhead

applied to Work in Process was $89,000. The journal entry to record the incurrence

of the actual Manufacturing Overhead costs would include a:

A) debit to Work in Process of $89,000 and credit to Manufacturing

Overhead of $89,000

B) credit to Manufacturing Overhead of $87,000

C) debit to Manufacturing Overhead of $87,000

D) credit to Work in Process of $89,000

22. Marc Corp. has a job-order costing system. The following debits (credits)

appeared in the Work in Process account for the month of April:

April 1 Balance $10,000

April Direct materials $60,000

April Direct labor $40,000

Manufacturing

April overhead $32,000

April To finished goods $(120,000)

pg. 5 Richard Nagbe Koon Course Lecturer

Marc applies overhead to jobs at a predetermined rate of 80% of direct labor cost.

Job No. 23, the only job still in process at the end of April has been charged with

direct labor of $5,000. The amount of direct materials charged to Job No. 23 was:

A) $6,250 B) $7,500 C) $33,000 D) $17,000

23. Write against each of the following indicating the party i.e. management, employees and

creditors, benefitted from cost accounting :

1. Using budgetary control and standard costing, costing used to control material cost, labour cost, etc.

__________

2. Installation of an efficient costing system results in the increase in productivity and earnings

capacity.____________

3. Studies and reports submitted by the cost accountant enables judging the profitability and prospects

of the enterprise.__________________

4. It enables to check the wastage in term of time and expenses._________________

24. Christiana Tue Manufacturing Company uses a job-order costing system. At

the beginning of April, Christiana Tue only had one job in process, Job #898. This

job was finished during April by incurring additional direct costs of $350 for

materials and $700 for labor. Also during April, Job #899 was started and finished.

The direct costs assigned to this job were $1,200 for materials and $950 for labor.

Job #900 was started during April but was not finished by the end of the month.

The direct costs assigned to this job were $820 for materials and $540 for labor.

Christiana Tue applies manufacturing overhead to its products at a rate of 300% of

direct labor cost. Christiana's cost of goods manufactured for April was $14,570.

What was Christiana's work in process inventory balance at the beginning of

April?

A) $3,440 B) $6,590 C) $9,570 D) $6,420

25. The following information relates to Sombee Manufacturing Company:

Total manufacturing overhead estimated for the

year $864,000

Predetermined overhead rate (based on direct $5.00 per

labor-hours) DLH

25,000

Total direct labor-hours incurred during the year DLHs

Manufacturing overhead overapplied for the year $4,600

How much manufacturing overhead cost did Sombee actually incurred?

A) $103,500 B) $119,600 C) $120,400 D)$129,600

pg. 6 Richard Nagbe Koon Course Lecturer

26. Prime cost comprises the following combination of costs: A. Direct materials

and factory overhead b. Direct labour and factory overhead c. Direct material

direct labour and direct expense d. None of these

27. Conversion and prime costs are: a. Synonymous and can be used induce

changeably B. Both include factory overhead with its variable and fixed

components c. Represent cost incurred on joint product before the split off point

d. None of these

28. In a job-order costing system, the application of manufacturing overhead would

be recorded as a debit to:

A) Raw Materials inventory. B) Finished Goods inventory.

C) Work in Process inventory. D) Cost of Goods Sold.

29. In a job-order costing system, the incurrence of indirect labor costs would

usually be recorded as a debit to:

A) Manufacturing Overhead B) Finished Goods.

C) Work in Process. D) Cost of Goods Sold.

30. If overhead is underapplied, then:

A) actual overhead cost is less than estimated overhead cost.

B) the amount of overhead cost applied to Work in Process is less than

the actual overhead cost incurred.

C) the predetermined overhead rate is too high.

D) the Manufacturing Overhead account will have a credit balance at the

end of the year.

31. Barger Company had the following information at December 31:

Finished goods inventory, January 1 $ 90,000

Finished goods inventory, December 31 $120,000

If the cost of goods manufactured during the year amounted to $1,120,000 and

annual sales were $2,609,000, how much is the amount of gross profit for the year?

a. $1,419,000

b. $1,519,000

c. $1,759,000

d. $1,435,000

pg. 7 Richard Nagbe Koon Course Lecturer

32. Christiana Manufacturing Company developed the following data:

Beginning work in process inventory $ 120,000

Direct materials used 700,000

Actual overhead 840,000

Overhead applied 510,000

Cost of goods manufactured 1,400,000

Ending work in process 90,000

How much are total manufacturing costs for the period?

a. $1,370,000 b. $1,890,000 c. $1,650,000 d. $1,830,000

33. Rachel Inc. applies overhead to production at a predetermined rate of 80%

based on direct labor cost. Job No. 130, the only job still in process at the

end of August, has been charged with manufacturing overhead of $6,400.

What was the amount of direct materials charged to Job 130 assuming the

balance in Work in Process inventory is $20,000?

a. $7,000. B. $6,400. C. $5,600. D. $20,000.

34. If the entry to assign factory labor showed only a debit to Work in Process

Inventory, then all labor costs were

a. direct labor. b. indirect labor. c. overtime related. d. regular hours.

35. The principal accounting record used in assigning costs to jobs is

a. a job cost sheet. b. the cost of goods manufactured schedule.

c. the Manufacturing Overhead control account.

d. the stores ledger cards.

36. In calculating a predetermined overhead rate, a recent trend in automated

manufacturing operations is to choose an activity base related to

a. direct labor hours b. indirect labor dollars. c. machine time d. raw

materials dollars.

37. Overhead application is recorded with a

a. credit to Work in Process Inventory b. credit to Manufacturing Overhead.

c. debit to Manufacturing Overhead. D. credit to job cost sheets.

pg. 8 Richard Nagbe Koon Course Lecturer

38. In a job-order costing system, the application of manufacturing overhead would be recorded as a

debit to:

A) Raw Materials inventory.

B) Finished Goods inventory.

C) Work in Process inventory.

D) Cost of Goods Sold.

39. If the Manufacturing Overhead account has a debit balance at the end of a

period, it means that

a. actual overhead costs were less than overhead costs applied to jobs.

b. actual overhead costs were greater than overhead costs applied to jobs.

c. actual overhead costs were equal to overhead costs applied to jobs.

d. no jobs have been completed.

40. If manufacturing overhead has been underapplied during the year, the

adjusting entry at the end of the year will show a

a. debit to Finished Goods Inventory b. debit to Cost of Goods Sold.

c. debit to Work in Process Inventory. d. All of the Above

41. Cost of goods manufactured equals $85,000 for 2017. Finished goods

inventory is $4,000 at the beginning of the year and $8,500 at the end of the

year. Beginning and ending work in process for 2017 are $4,000 and $5,000,

respectively. How much is cost of goods sold for the year?

a. $87,500 b. $83,000 c. $81,500 d. $80,500

42. Smith Company applies overhead on the basis of 150% of direct labor cost

of $200,000. Job No. 176 is charged with $160,000 of direct materials costs

and $170,000 of manufacturing overhead. The total manufacturing costs for

Job No. 176 is

a. $330,000. b. $630,000. c. $450,000. d. $530,000.

43. Koon Company applies overhead on the basis of 120% of direct labor cost

and the 120% is equal to $150,000. Job No. 190 is charged with $140,000 of

direct materials costs and $180,000 of manufacturing overhead. The total

manufacturing costs for Job No. 190 is

pg. 9 Richard Nagbe Koon Course Lecturer

a. $320,000. b. $500,000. c. $470,000. d. $490,000.

44. For Rachel Company, the predetermined overhead rate is 80% of direct

labor cost. During the month, $700,000 of factory labor costs are incurred of

which $140,000 is indirect labor. Actual overhead incurred was $320,000.

The amount of overhead debited to Work in Process Inventory should be:

a. $448,000 b. $320,000 c. $420,000 d. None of the above

45. Simpson Company applies overhead on the basis of 200% of direct labor

cost. Job No. 305 is charged with $180,000 of direct Labor costs and

$200,000 of manufacturing overhead. The Direct materials charged to

production Job No. 305 is: ___________________ if the Total

Manufacturing Cost is $500,000

a. $180,000 b. $380,000 c. $120,000 d. $400,000

46. Which of the following is cost behavior-oriented approach to: A. Product

costing b. Absorption cost c. Process costing d. Marginal costing.

47. Job – order costing: An item of cost that is direct for one business may be

………. for another business. A, Direct B. Indirect c. Variable d. Fixed

48. Direct labour costs would include wages paid to all the following except: a,

Machine operators b. Assembly line workers C. Janitors d. Brick layers

49. Indirect labour costs would include wages paid to the following except

A. Machine operators b. Material handlers c. Storekeepers d. Forklift operators

50. Prime cost comprises the following combination of costs: A. Direct materials

and factory overhead b. Direct labour and factory overhead c. Direct material

direct labour and direct expense d. None of these

pg. 10 Richard Nagbe Koon Course Lecturer

You might also like

- Motivation Letter - RUAS-Supply Chain ManagementDocument2 pagesMotivation Letter - RUAS-Supply Chain ManagementNahid80% (5)

- Case Study: Manajemen Logistik & Rantai PasokDocument30 pagesCase Study: Manajemen Logistik & Rantai PasokDede AtmokoNo ratings yet

- Test Bank Business Environment and Concepts 2Document69 pagesTest Bank Business Environment and Concepts 2Sky SoronoiNo ratings yet

- Preliminary Exam in Cost Accounting and ControlDocument5 pagesPreliminary Exam in Cost Accounting and ControlMohammadNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- Job Order Costing Difficult RoundDocument8 pagesJob Order Costing Difficult RoundsarahbeeNo ratings yet

- Acctg201 Exercises2Document18 pagesAcctg201 Exercises2sarahbeeNo ratings yet

- BSA QualifyingReviewer-6 PDFDocument12 pagesBSA QualifyingReviewer-6 PDFQueen ElleNo ratings yet

- Qualifying Exam Reviewer 2017 - CostDocument12 pagesQualifying Exam Reviewer 2017 - CostAdrian Francis100% (1)

- Job Costing and Overhead ER PDFDocument16 pagesJob Costing and Overhead ER PDFShaira VillaflorNo ratings yet

- ACCT 2022 - FS First-Exam-ADocument6 pagesACCT 2022 - FS First-Exam-AMr MDRKHMNo ratings yet

- Muhammad SalmanDocument9 pagesMuhammad SalmanSalman SaeedNo ratings yet

- EXERCISECHAPTER2Document8 pagesEXERCISECHAPTER2Bạch ThanhNo ratings yet

- Multiple Choice Questions and ExercisesDocument13 pagesMultiple Choice Questions and Exercisesmusic niNo ratings yet

- Midterm Version 1Document57 pagesMidterm Version 1faensaNo ratings yet

- Chapter 4 In-Class ExercisesDocument9 pagesChapter 4 In-Class ExercisesNguyễn Thị Thanh ThúyNo ratings yet

- D) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryDocument9 pagesD) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryPhương Thảo HoàngNo ratings yet

- Required: Help Heather Answer The Following QuestionsDocument3 pagesRequired: Help Heather Answer The Following Questionslinkin soyNo ratings yet

- Acmas 2137 Final SADocument5 pagesAcmas 2137 Final SAkakaoNo ratings yet

- Your Submission Is Being MonitoredDocument6 pagesYour Submission Is Being MonitoredShiela Mae Pon AnNo ratings yet

- Acctg15 Job-Order QuizDocument3 pagesAcctg15 Job-Order QuizJemar Murillo DalaganNo ratings yet

- Cost Accounting ReviewerDocument8 pagesCost Accounting ReviewerMary Justine Danica OliverosNo ratings yet

- Answers Homework # 14 Cost MGMT 3Document9 pagesAnswers Homework # 14 Cost MGMT 3Raman ANo ratings yet

- AkbiDocument37 pagesAkbiCenxi TVNo ratings yet

- Manegiral Accounting Unit 4 5 Test BankDocument8 pagesManegiral Accounting Unit 4 5 Test BankJean NestaNo ratings yet

- Job Order CostingDocument9 pagesJob Order CostingApple BaldemoroNo ratings yet

- Differential CostsDocument5 pagesDifferential Costselainemarzan09No ratings yet

- Exam 1Document19 pagesExam 1김현중No ratings yet

- Job Order Assignment PDFDocument3 pagesJob Order Assignment PDFAnne Marie100% (1)

- Mockboard MASDocument9 pagesMockboard MASlalala010899No ratings yet

- F 2Document6 pagesF 2Nasir Iqbal100% (1)

- Cost Accounting Midterm Exam 2018.editedDocument3 pagesCost Accounting Midterm Exam 2018.editedMarites ArcenaNo ratings yet

- Accounting Chapter 16 Brief Exercises and ExercisesDocument10 pagesAccounting Chapter 16 Brief Exercises and ExercisesAnonymous jrIMYSz9No ratings yet

- Cost AccountingDocument7 pagesCost AccountingCarl AngeloNo ratings yet

- Cost Test1Document3 pagesCost Test1yesuneh98No ratings yet

- Name: - Score: - Acctg 106 Quiz 1 2 Sem SY 21-22Document3 pagesName: - Score: - Acctg 106 Quiz 1 2 Sem SY 21-22Trine De LeonNo ratings yet

- Discussion - Job CostingDocument3 pagesDiscussion - Job CostingHannah Jane ToribioNo ratings yet

- SCM Assignment Activity Sept 20 2020 Answer Key PDF FreeDocument5 pagesSCM Assignment Activity Sept 20 2020 Answer Key PDF FreeChizu ChizuNo ratings yet

- Ma1 Mock 2 Acca Afd Students Can Graps Their Concepts by Attempting This MockDocument9 pagesMa1 Mock 2 Acca Afd Students Can Graps Their Concepts by Attempting This MockMino MinaNo ratings yet

- Part 1: Introduction To Managerial AccountingDocument7 pagesPart 1: Introduction To Managerial AccountingJoemel F. RizardoNo ratings yet

- 02.02.2024 Accounting Cycle For A Manufacturing Company1Document34 pages02.02.2024 Accounting Cycle For A Manufacturing Company1Dennis N. IndigNo ratings yet

- Department of Accounting and Information SystemDocument8 pagesDepartment of Accounting and Information SystemLabib SafeenNo ratings yet

- F2 Mock Questions 201603Document12 pagesF2 Mock Questions 201603Renato WilsonNo ratings yet

- DEPA Cost Acctng.Document39 pagesDEPA Cost Acctng.Maria DyNo ratings yet

- ISV Managerial Accounting, 4e: Final Exam: Chapters 1-14Document85 pagesISV Managerial Accounting, 4e: Final Exam: Chapters 1-14Mikaela SeminianoNo ratings yet

- MCP TutorialDocument3 pagesMCP TutorialPaola HuyongNo ratings yet

- Process CostingDocument18 pagesProcess CostingCheliah Mae ImperialNo ratings yet

- Acct. 1bDocument34 pagesAcct. 1bCaroline BeebeNo ratings yet

- ADMS2510 Fall 2009 Final Exam-Part One-With SolutionsDocument8 pagesADMS2510 Fall 2009 Final Exam-Part One-With SolutionsDavid ChenNo ratings yet

- Managerial Accouting TestDocument16 pagesManagerial Accouting TestBùi Yến NhiNo ratings yet

- Midterm Exam Solution Fall 2012Document13 pagesMidterm Exam Solution Fall 2012Daniel Lamarre100% (4)

- Worksheet For Cost and Management Accounting I (Acct 211)Document9 pagesWorksheet For Cost and Management Accounting I (Acct 211)ዝምታ ተሻለNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetNessa MarasiganNo ratings yet

- Attempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting PeriodDocument18 pagesAttempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting Periodpragadeeshwaran100% (2)

- Brewer Chapter 2 Alt ProbDocument6 pagesBrewer Chapter 2 Alt ProbAtif RehmanNo ratings yet

- Professor Mawdudur Rahman Your Name: .: MGT ACT Midterm DIU-1Document10 pagesProfessor Mawdudur Rahman Your Name: .: MGT ACT Midterm DIU-1Tanvir AhmedNo ratings yet

- Tutorial 3 - Process CostingDocument5 pagesTutorial 3 - Process Costingsouayeh wejdenNo ratings yet

- Managerial Acc AssignmentDocument3 pagesManagerial Acc AssignmentDũng PhanNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Econ 533 Take Home Midterm ExamDocument2 pagesEcon 533 Take Home Midterm ExamWaylee CheroNo ratings yet

- Capital Budgeting Practice ProblemDocument3 pagesCapital Budgeting Practice ProblemWaylee CheroNo ratings yet

- University of Liberia Graduate School Econ 531 AssignmentDocument9 pagesUniversity of Liberia Graduate School Econ 531 AssignmentWaylee CheroNo ratings yet

- Final Exam Umu - 02.08.2020Document2 pagesFinal Exam Umu - 02.08.2020Waylee CheroNo ratings yet

- Cryptocurrency: Advantages and DisadvantagesDocument4 pagesCryptocurrency: Advantages and DisadvantagesWaylee CheroNo ratings yet

- EBP Audits: Document So Your Steps Can Be RetracedDocument2 pagesEBP Audits: Document So Your Steps Can Be RetracedWaylee CheroNo ratings yet

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- Stock - Practice QuestionsDocument1 pageStock - Practice QuestionsWaylee CheroNo ratings yet

- BAL CAse StudyDocument12 pagesBAL CAse Studysen_bit67% (3)

- Chapter 1 - Business Functions and Business ProcessesDocument45 pagesChapter 1 - Business Functions and Business ProcessesĐạt PhạmNo ratings yet

- Service Response Logistics: Prepared by Mark A. Jacobs, PHDDocument35 pagesService Response Logistics: Prepared by Mark A. Jacobs, PHDtinieNo ratings yet

- Portuguese IATF 16949 Frequently Asked Questions October 2017Document12 pagesPortuguese IATF 16949 Frequently Asked Questions October 2017Rafael NogueiraNo ratings yet

- CH 4 - Inventories-1Document44 pagesCH 4 - Inventories-1Hammad AhmedNo ratings yet

- OEE Calculator - Sylution - 2010 - 01 - 21Document1 pageOEE Calculator - Sylution - 2010 - 01 - 21metugaNo ratings yet

- The 3rd PSC Meeting For DELSA Phase III Project PresentationDocument37 pagesThe 3rd PSC Meeting For DELSA Phase III Project Presentationmuhamadfaidcisse nazriNo ratings yet

- The Imd Mba: Master of Business Administration Class of 202Document22 pagesThe Imd Mba: Master of Business Administration Class of 202ahmadsohanNo ratings yet

- Raz lf18 TruckingDocument16 pagesRaz lf18 TruckingChrista Claire SevillaNo ratings yet

- SAP MM - DocumentationDocument158 pagesSAP MM - DocumentationrajaNo ratings yet

- MIS ReportDocument41 pagesMIS Reportdave_bhavesh109No ratings yet

- KuehneDocument5 pagesKuehneNoorul HaqueNo ratings yet

- Blockchain DAPP For Supply ChainDocument17 pagesBlockchain DAPP For Supply Chainsweta LJNo ratings yet

- Horlicks ReportDocument20 pagesHorlicks Reportkirnoor0% (1)

- G1&2-The Retail ChampionDocument19 pagesG1&2-The Retail Championmehul bariNo ratings yet

- Epicor Insights 2019 Preliminary Agenda 010419Document5 pagesEpicor Insights 2019 Preliminary Agenda 010419Mahesh MalveNo ratings yet

- Wal-Marts Successfully Integrated Supply Chain AnDocument17 pagesWal-Marts Successfully Integrated Supply Chain AnZepodoxNo ratings yet

- Master Thesis OutlineDocument7 pagesMaster Thesis Outlinebsr8frht100% (2)

- International BusinessDocument66 pagesInternational BusinessHarpal Singh MassanNo ratings yet

- Activity Number 1: Pangasinasn State University Lingayen, Pangasinan NAME: Ethel N. Ulanday Section: Bsba - 3BDocument3 pagesActivity Number 1: Pangasinasn State University Lingayen, Pangasinan NAME: Ethel N. Ulanday Section: Bsba - 3BJellu Casta OinezaNo ratings yet

- Greenlam Industries Limited - Daily RecordsDocument33 pagesGreenlam Industries Limited - Daily RecordsSandeep ReddyNo ratings yet

- Retail FormatsDocument36 pagesRetail FormatsShaurya Thakur100% (1)

- Implementation of 5S and KOBETSU KAIZEN (TPM Pillar) in A Manufacturing OrganizationDocument5 pagesImplementation of 5S and KOBETSU KAIZEN (TPM Pillar) in A Manufacturing OrganizationAnonymous kw8Yrp0R5rNo ratings yet

- SIPOCDocument27 pagesSIPOCAlex Vincent100% (1)

- P&SCMDocument2 pagesP&SCMAnsil SafeerNo ratings yet

- Designing and Managing Integrated Marketing ChannelsDocument41 pagesDesigning and Managing Integrated Marketing Channels121733601011 MADENA KEERTHI PRIYANo ratings yet

- PL ShipmentDocument1 pagePL ShipmentCarlos HueteNo ratings yet

- Kuliah - 2 - Channel StructureDocument44 pagesKuliah - 2 - Channel StructureWildan HakimNo ratings yet