Professional Documents

Culture Documents

Pillar 3 Report 2021 - 931174233

Pillar 3 Report 2021 - 931174233

Uploaded by

Sophiya RanaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pillar 3 Report 2021 - 931174233

Pillar 3 Report 2021 - 931174233

Uploaded by

Sophiya RanaCopyright:

Available Formats

Pillar 3 Report

June 2021

The cooperative Rabobank

Pillar 3

Pillar 3

1. Contents

2. Introduction 4

3. Key Metrics of Risk-Weighted Exposure Amounts 5

4. Own Funds 10

5. Countercyclical Capital Buffers 15

6. Leverage Ratio 17

7. Credit Risk 21

7.1 Credit Risk Quality 22

7.2 The Use of the IRB Approach to Credit Risk 28

7.3 The Use of the Standardized Approach 40

7.4 Specialized Lending 42

7.5 Exposures to Counterparty Credit Risk 43

7.6 Disclosure of exposures subject to payment moratoria and public guarantees 48

8. Liquidity Risk 51

9. Securitization 54

10. Market Risk 57

11. Forward Looking Statement 60

12. Management Attestation 62

June 2021 - Pillar 3 3

Pillar 3

2. Introduction

This document presents Rabobank's consolidated Capital Adequacy and

Risk Management report (hereafter referred to as Pillar 3) for the period

ending June 30, 2021.

For purposes of Article 431 CRR, Rabobank has adopted a formal Global Standard on Pillar 3

Disclosure. This ensures that Rabobank’s risk disclosures comply with the Capital Requirements

Regulation 2013/575/EU (CRR) (Part Eight), the Capital Requirements Directive 2013/36/EU (CRD)

and related legislation. It also ensures the disclosures are compiled based upon a set of internally

defined principles, validations and related processes. The Global Standard on Pillar 3 Disclosure

defines overall roles and responsibilities and facilitates the disclosure preparation process and the

verification and sign off procedures. Senior representatives and subject matter experts from Finance

and Risk are responsible for Rabobank's risk disclosures and govern its respective risk disclosure

processes. Based upon our assessment and verification we believe that the risk disclosures

presented in this Pillar 3 Report in conjunction with the Annual Report 2020, the Interim Report 2021

and the Pillar 3 2020 report appropriately and comprehensively describe our overall risk profile.

In this document amounts have been rounded to EUR millions, which means that summations may

show minor deviations. In the tables, some parts are grayed out if this information is not required.

The LEI code of Coöperatieve Rabobank U.A. (Rabobank) is DG3RU1DBUFHT4ZF9WN62.

The comparison for template KM1 and OV1 was made against December 2020. Columns

representing a previous reporting period in other templats refer to March 2021.

June 2021 - Pillar 3 4

Pillar 3

3. Key Metrics of Risk-Weighted Exposure Amounts

EU KM1 - Key Metrics Template

Amounts in Millions of Euros 30-06-2021 31-12-2020

Available own funds (amounts)

Common Equity Tier 1 (CET1) capital 36,207 34,647

Tier 1 capital 40,087 39,061

Total capital 48,511 49,851

Risk-weighted exposure amounts

Total risk-weighted exposure amount 210,768 205,773

Capital ratios (as a percentage of risk-weighted exposure amount)

Common Equity Tier 1 ratio (%) 17.18 16.84

Tier 1 ratio (%) 19.02 18.98

Total capital ratio (%) 23.02 24.23

Additional own funds requirements based on SREP (as a percentage of risk-weighted exposure amount)

Additional CET1 SREP requirements (%) 0.98 0.98

Additional AT1 SREP requirements (%) 0.33 0.33

Additional T2 SREP requirements (%) 0.44 0.44

Total SREP own funds requirements (%) 9.75 9.75

Combined buffer requirement (as a percentage of risk-weighted exposure amount)

Capital conservation buffer (%) 2.50 2.50

Conservation buffer due to macro-prudential or systemic risk identified at the level of a Member State (%) 0.00 0.00

Institution specific countercyclical capital buffer (%) 0.02 0.01

Systemic risk buffer (%) 0.00 0.00

Global Systemically Important Institution buffer (%) 0.00 0.00

Other Systemically Important Institution buffer (%) 2.00 2.00

Combined buffer requirement (%) 4.52 4.51

Overall capital requirements (%) 14.27 14.26

CET1 available after meeting the total SREP own funds requirements 24,648 23,362

June 2021 - Pillar 3 5

Pillar 3

Amounts in Millions of Euros 30-06-2021 31-12-2020

Leverage ratio

Leverage ratio total exposure measure (transitional) 561,312 560,170

Leverage ratio (transitional) (%) 7.14 6.97

Additional own funds requirements to address risks of excessive leverage (as a percentage of leverage ratio total exposure amount)

Additional CET1 leverage ratio requirements (%) 0.00

Additional AT1 leverage ratio requirements (%) 0.00

Additional T2 leverage ratio requirements (%)

Total SREP leverage ratio requirements (%) 3.23

Applicable leverage buffer (%) 0.00

Overall leverage ratio requirements (%) 3.23

Liquidity Coverage Ratio

Total high-quality liquid assets (HQLA) (Weighted value - average) 137,063 119,375

Cash outflows - Total weighted value 98,955 96,284

Cash inflows - Total weighted value 39,064 34,359

Total net cash outflows (adjusted value) 59,891 61,925

Liquidity coverage ratio (%) 228.85 192.77

Net Stable Funding Ratio

Total available stable funding 468,848 451,900

Total required stable funding 354,074 354,494

NSFR ratio (%) 132.40 127.48

On June 30, 2021, our CET 1 ratio amounted to 17.2% (2020: 16.8%). This is well above our >14%

ambition. The development of the CET 1 ratio was positively influenced by the addition of net

profit to retained earnings. The risk weighted exposure amount increased due to the final result of

the Targeted Review of Internal Models (TRIM) impact, model changes and modest asset growth.

Our total capital ratio decreased to 23.0% (2020: 24.2%) following the call of a EUR 2 billion Tier 2

instrument and the amortization of the eligible amount of outstanding Tier 2 instruments, in line

with our intentions. We will allow our Total capital to trend downward towards 20%.

Our leverage ratio is well above the minimum requirements, and our Liquidity Coverage Ratio and

Net Stable Funding Ratio are also above the minimum requirements.

June 2021 - Pillar 3 6

Pillar 3

IFRS9 - Available Capital

30-06-2021 31-12-2020

CET1 capital 36,207 34,647

CET1 capital as if IFRS 9 or analogous ECLs transitional arrangements had not been applied 36,201 34,592

CET1 capital as if the temporary treatment of unrealised gains and losses measured at fair value through OCI (other comprehensive income) in accordance with Article 468 of the CRR had not been applied 36,207 34,647

Tier 1 capital 40,087 39,062

Tier 1 capital as if IFRS 9 or analogous ECLs transitional arrangements had not been applied 40,081 39,007

Tier 1 capital as if the temporary treatment of unrealised gains and losses measured at fair value through OCI in accordance with Article 468 of the CRR had not been applied 40,087 39,062

Total capital 48,511 49,851

Total capital as if IFRS 9 or analogous ECLs transitional arrangements had not been applied 48,505 49,856

Total capital as if the temporary treatment of unrealised gains and losses measured at fair value through OCI in accordance with Article 468 of the CRR had not been applied 48,511 49,851

Risk-weighted assets (amounts)

Total risk-weighted assets 210,768 205,773

Total risk-weighted assets as if IFRS 9 or analogous ECLs transitional arrangements had not been applied 210,762 205,763

Capital ratios

CET1 (as a percentage of risk exposure amount - %) 17.18 16.84

CET1 (as a percentage of risk exposure amount) as if IFRS 9 or analogous ECLs transitional arrangements had not been applied - % 17.18 16.81

CET1 (as a percentage of risk exposure amount) as if the temporary treatment of unrealised gains and losses measured at fair value through OCI in accordance with Article 468 of the CRR had not been applied - % 17.18 16.84

Tier 1 (as a percentage of risk exposure amount - %) 19.02 18.98

Tier 1 (as a percentage of risk exposure amount) as if IFRS 9 or analogous ECLs transitional arrangements had not been applied - % 19.02 18.96

Tier 1 (as a percentage of risk exposure amount) as if the temporary treatment of unrealised gains and losses measured at fair value through OCI in accordance with Article 468 of the CRR had

not been applied - % 19.02 18.98

Total capital (as a percentage of risk exposure amount - %) 23.02 24.23

Total capital (as a percentage of risk exposure amount) as if IFRS 9 or analogous ECLs transitional arrangements had not been applied - % 23.01 24.23

Total capital (as a percentage of risk exposure amount) as if the temporary treatment of unrealised gains and losses measured at fair value through OCI in accordance with Article 468 of the CRR

had not been applied - % 23.02 24.23

Leverage ratio

Leverage ratio total exposure measure 561,312 560,170

Leverage ratio - % 7.14 6.97

Leverage ratio as if IFRS 9 or analogous ECLs transitional arrangements had not been applied - % 7.14 6.96

Leverage ratio as if the temporary treatment of unrealised gains and losses measured at fair value through OCI in accordance with Article 468 of the CRR had not been applied - % 7.14 6.97

June 2021 - Pillar 3 7

Pillar 3

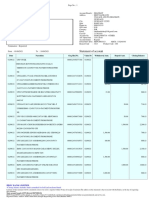

EU OV1 - Overview of Risk-Weighted Exposure Amounts

Risk weighted exposure

Total own funds requirements

amounts (RWEAs)

Amounts in Millions of Euros 30-06-2021 30-06-2021

Credit risk (excluding CCR) 168,693 13,495

Of which the standardised approach 11,774 942

Of which the foundation IRB (FIRB) approach 15,392 1,231

Of which: slotting approach

Of which: equities under the simple riskweighted approach 4,551 364

Of which the advanced IRB (AIRB) approach 113,362 9,069

Counterparty credit risk - CCR 4,778 382

Of which the standardised approach 369 29

Of which internal model method (IMM) 3,122 250

Of which exposures to a CCP 81 6

Of which credit valuation adjustment - CVA 1,206 96

Of which other CCR 0 0

Settlement risk

Securitisation exposures in the non-trading book (after the cap) 2,441 195

Of which SEC-IRBA approach 1,225 98

Of which SEC-ERBA (including IAA) 801 64

Of which SEC-SA approach 414 33

Of which 1250%/ deduction 0 0

Position, foreign exchange and commodities risks (Market risk) 6,521 522

Of which the standardised approach 3,160 253

Of which IMA 3,360 269

Large exposures

Operational risk 28,336 2,267

Of which basic indicator approach 0 0

Of which standardised approach

Of which advanced measurement approach 28,336 2,267

Amounts below the thresholds for deduction (subject

to 250% risk weight) (For information) 6,390 511

Total 210,768 16,861

June 2021 - Pillar 3 8

Pillar 3

For the calculations of the Regulatory Capital (RC), Rabobank is using the most advanced calculation

methods. We apply the Internal Rating Based (IRB) Approach for credit risk, the Internal Models

Approach (IMA) for market risk, and the Advanced Measurement Approach (AMA) for operational

risk. Only for a very small part of the portfolio the Standardised Approach is apllied for credit

risk. The majority of the total capital requirements consist of the credit risk component, including

Counterparty Credit Risk (CCR) and Securitizations. This component accounts for 83% of the total

regulatory capital. Furthermore, the market risk accounts for 3% of total regulatory capital, and

operational risk for 13%.

At half-year end 2021, Rabobank’s total capital requirement was EUR 16.9 billion (year end 2020:

EUR 16.5 billion). The capital requirement for credit risk increased over the past six months due

to portfolio movements and an addition to the add-on for TRIM. The increase due to portfolio

movements was recognized in the Wholesale & Rural domain, while Domestic Retail Banking and

Leasing saw slight decreases.

June 2021 - Pillar 3 9

Pillar 3

4. Own Funds

EU CC1 - Composition of Regulatory Own Funds

Amount at Source based on reference

disclosure date numbers of the balance sheet

under the regulatory scope

Amounts in Millions of Euros 30-06-2021 of consolidation

Common Equity Tier 1 (CET1) capital: instruments and reserves

1 Capital instruments and the related share premium accounts 7,825

1a of which: Rabobank Certificates 7,825 31

2 Retained earnings 29,189 30

3 Accumulated other comprehensive income (and other reserves) -1,171 30

EU-3a Funds for general banking risk

4 Amount of qualifying items referred to in Article 484 (3) and the related share premium accounts subject to phase out from CET1

5 Minority interests (amount allowed in consolidated CET1)

EU-5a Independently reviewed interim profits net of any foreseeable charge or dividend 1,755

6 Common Equity Tier 1 (CET1) capital before regulatory adjustments 37,598

Common Equity Tier 1 (CET1) capital: regulatory adjustments

7 Additional value adjustments (negative amount) -181

8 Intangible assets (net of related tax liability) (negative amount) -608 10

9 Empty set in the EU

10 Deferred tax assets that rely on future profitability excluding those arising from temporary differences (net of related tax liability where the conditions in Article 38 (3) are met)

(negative amount) -216 14

11 Fair value reserves related to gains or losses on cash flow hedges of financial instruments that are not valued at fair value 26

12 Negative amounts resulting from the calculation of expected loss amounts -194

13 Any increase in equity that results from securitised assets (negative amount)

14 Gains or losses on liabilities valued at fair value resulting from changes in own credit standing 114

15 Defined-benefit pension fund assets (negative amount) -3

16 Direct and indirect holdings by an institution of own CET1 instruments (negative amount) -25

17 Direct, indirect and synthetic holdings of the CET 1 instruments of financial sector entities where those entities have reciprocal cross holdings with the institution designed to inflate artificially

the own funds of the institution (negative amount)

18 Direct, indirect and synthetic holdings by the institution of the CET1 instruments of financial sector entities where the institution does not have a significant investment in those entities

(amount above 10% threshold and net of eligible short positions) (negative amount)

June 2021 - Pillar 3 10

Pillar 3

Amount at Source based on reference

disclosure date numbers of the balance sheet

under the regulatory scope

Amounts in Millions of Euros 30-06-2021 of consolidation

19 Direct, indirect and synthetic holdings by the institution of the CET1 instruments of financial sector entities where the institution has a significant investment in those entities (amount above

10% threshold and net of eligible short positions) (negative amount)

20 Empty set in the EU

EU-20a Exposure amount of the following items which qualify for a RW of 1250%, where the institution opts for the deduction alternative -22

EU-20b of which: qualifying holdings outside the financial sector (negative amount)

EU-20c of which: securitisation positions (negative amount) -22

EU-20d of which: free deliveries (negative amount)

21 Deferred tax assets arising from temporary differences (amount above 10% threshold, net of related tax liability where the conditions in Article 38 (3) are met) (negative amount)

22 Amount exceeding the 17,65% threshold (negative amount)

23 of which: direct, indirect and synthetic holdings by the institution of the CET1 instruments of financial sector entities where the institution has a significant investment in those entities

24 Empty set in the EU

25 of which: deferred tax assets arising from temporary differences

EU-25a Losses for the current financial year (negative amount) 0

EU-25b Foreseeable tax charges relating to CET1 items except where the institution suitably adjusts the amount of CET1 items insofar as such tax charges reduce the amount up to which those

items may be used to cover risks or losses (negative amount)

26 Empty set in the EU

27 Qualifying AT1 deductions that exceed the AT1 items of the institution (negative amount)

27a Other regulatory adjustments (including IFRS 9 transitional adjustments when relevant) -282

28 Total regulatory adjustments to Common Equity Tier 1 (CET1) -1,391

29 Common Equity Tier 1 (CET1) capital 36,207

Additional Tier 1 (AT1) capital: instruments

30 Capital instruments and the related share premium accounts 3,979

31 of which: classified as equity under applicable accounting standards 3,979 32

32 of which: classified as liabilities under applicable accounting standards

33 Amount of qualifying items referred to in Article 484 (4) and the related share premium accounts subject to phase out from AT1 as described in Article 486(3) of CRR 32

EU-33a Amount of qualifying items referred to in Article 494a(1) subject to phase out from AT1

EU-33b Amount of qualifying items referred to in Article 494b(1) subject to phase out from AT1

34 Qualifying Tier 1 capital included in consolidated AT1 capital (including minority interests not included in row 5) issued by subsidiaries and held by third parties

35 of which: instruments issued by subsidiaries subject to phase out

36 Additional Tier 1 (AT1) capital before regulatory adjustments 3,979

Additional Tier 1 (AT1) capital: regulatory adjustments

37 Direct and indirect holdings by an institution of own AT1 instruments (negative amount) -100

38 Direct, indirect and synthetic holdings of the AT1 instruments of financial sector entities where those entities have reciprocal cross holdings with the institution designed to inflate artificially

the own funds of the institution (negative amount)

June 2021 - Pillar 3 11

Pillar 3

Amount at Source based on reference

disclosure date numbers of the balance sheet

under the regulatory scope

Amounts in Millions of Euros 30-06-2021 of consolidation

39 Direct, indirect and synthetic holdings of the AT1 instruments of financial sector entities where the institution does not have a significant investment in those entities (amount above 10%

threshold and net of eligible short positions) (negative amount)

40 Direct, indirect and synthetic holdings by the institution of the AT1 instruments of financial sector entities where the institution has a significant investment in those entities (net of eligible

short positions) (negative amount)

41 Empty set in the EU

42 Qualifying T2 deductions that exceed the T2 items of the institution (negative amount)

42a Other regulatory adjustments to AT1 capital 0

43 Total regulatory adjustments to Additional Tier 1 (AT1) capital -100

44 Additional Tier 1 (AT1) capital 3,879

45 Tier 1 capital (T1 = CET1 + AT1) 40,087

Tier 2 (T2) capital: instruments

46 Capital instruments and the related share premium accounts 8,515 28

47 Amount of qualifying items referred to in Article 484 (5) and the related share premium accounts subject to phase out from T2 as described in Article 486 (4) CRR

EU-47a Amount of qualifying items referred to in Article 494a (2) subject to phase out from T2

EU-47b Amount of qualifying items referred to in Article 494b (2) subject to phase out from T2

48 Qualifying own funds instruments included in consolidated T2 capital (including minority interests and AT1 instruments not included in rows 5 or 34) issued by subsidiaries and held by

third parties

49 of which: instruments issued by subsidiaries subject to phase out

50 Credit risk adjustments 0

51 Tier 2 (T2) capital before regulatory adjustments 8,515

Tier 2 (T2) capital: regulatory adjustments

52 Direct and indirect holdings by an institution of own T2 instruments and subordinated loans (negative amount) -91

53 Direct, indirect and synthetic holdings of the T2 instruments and subordinated loans of financial sector entities where those entities have reciprocal cross holdings with the institution

designed to inflate artificially the own funds of the institution (negative amount)

54 Direct and indirect holdings of the T2 instruments and subordinated loans of financial sector entities where the institution does not have a significant investment in those entities (amount

above 10% threshold and net of eligible short positions) (negative amount)

54a Empty set in the EU

55 Direct and indirect holdings by the institution of the T2 instruments and subordinated loans of financial sector entities where the institution has a significant investment in those entities

(net of eligible short positions) (negative amount) 0

56 Empty set in the EU

EU-56a Qualifying eligible liabilities deductions that exceed the eligible liabilities items of the institution (negative amount)

56b Other regulatory adjusments to T2 capital 0

57 Total regulatory adjustments to Tier 2 (T2) capital -91

58 Tier 2 (T2) capital 8,424

59 Total capital (TC = T1 + T2) 48,511

June 2021 - Pillar 3 12

Pillar 3

Amount at Source based on reference

disclosure date numbers of the balance sheet

under the regulatory scope

Amounts in Millions of Euros 30-06-2021 of consolidation

60 Total risk exposure amount 210,768

Capital ratios and buffers

61 Common Equity Tier 1 (as a percentage of total risk exposure amount - %) 17.18

62 Tier 1 (as a percentage of total risk exposure amount - %) 19.02

63 Total capital (as a percentage of total risk exposure amount - %) 23.02

64 Institution CET1 overall capital requirement (CET1 requirement in accordance with Article 92 (1) CRR, plus additional CET1 requirement which the institution is required to hold in accordance

with point (a) of Article 104(1) CRD, plus combined buffer requirement in accordance with Article 128(6) CRD) expressed as a percentage of risk exposure amount) - % 10.00

65 of which: capital conservation buffer requirement - % 2.50

66 of which: countercyclical buffer requirement - % 0.02

67 of which: systemic risk buffer requirement - % 0.00

EU-67a of which: Global Systemically Important Institution (G-SII) or Other Systemically Important Institution (O-SII) buffer - % 2.00

68 Common Equity Tier 1 available to meet buffer (as a percentage of risk exposure amount - %) 11.69

69 [non relevant in EU regulation]

70 [non relevant in EU regulation]

71 [non relevant in EU regulation]

Amounts below the thresholds for deduction (before risk weighting)

72 Direct and indirect holdings of own funds and eligible liabilities of financial sector entities where the institution does not have a significant investment in those entities (amount below 10%

threshold and net of eligible short positions) 509

73 Direct and indirect holdings by the institution of the CET1 instruments of financial sector entities where the institution has a significant investment in those entities (amount below 17.65%

thresholds and net of eligible short positions) 1,956

74 Empty set in the EU

75 Deferred tax assets arising from temporary differences (amount below 17.65% threshold, net of related tax liability where the conditions in Article 38 (3) are met) 600

Applicable caps on the inclusion of provisions in Tier 2

76 Credit risk adjustments included in T2 in respect of exposures subject to standardised approach (prior to the application of the cap)

77 Cap on inclusion of credit risk adjustments in T2 under standardised approach 147

78 Credit risk adjustments included in T2 in respect of exposures subject to internal ratings-based approach (prior to the application of the cap) 0

79 Cap for inclusion of credit risk adjustments in T2 under internal ratings-based approach 726

Capital instruments subject to phase-out arrangements (only applicable between 1 Jan 2014 and 1 Jan 2022)

80 Current cap on CET1 instruments subject to phase out arrangements

81 Amount excluded from CET1 due to cap (excess over cap after redemptions and maturities)

82 Current cap on AT1 instruments subject to phase out arrangements 910

83 Amount excluded from AT1 due to cap (excess over cap after redemptions and maturities)

84 Current cap on T2 instruments subject to phase out arrangements

85 Amount excluded from T2 due to cap (excess over cap after redemptions and maturities)

June 2021 - Pillar 3 13

Pillar 3

Carrying values as reported in

EU CC2 - Reconciliation of Regulatory Own Funds to Balance Sheet in the Financial Statements published financial statements

Carrying values as reported in Amounts in Millions of Euros 30-06-2021 Reference

published financial statements

Amounts in Millions of Euros 30-06-2021 Reference Equity

Assets Reserves and retained earnings 29,946 30

Cash and cash equivalents 123,792 1 Equity instruments issued by Rabobank

Loans and advances to credit institutions 25,883 2 Rabobank Certificates 7,825 31

Financial assets held for trading 2,818 3 Capital Securities 4,020 32

Financial assets designated at fair value 2 5 11,845

Financial assets mandatorily at fair value 2,527 4 Non-controlling interests 539 34

Derivatives 23,601 6 Total equity 42,330 35

Loans and advances to customers 437,863 7 Total equity and liabilities 650,997 36

Financial assets at fair value through other comprehensive income 15,050 8

Investments in associates and joint ventures 2,203 9

Rabobank's Interim Consolidated Financial Statements have been prepared in accordance with IFRS.

Goodwill and other intangible assets 719 10

Property and equipment 4,481 11

Rabobank's scope of accounting consolidation is the same as its scope of regulatory consolidation.

Investment properties 447 12

Current tax assets 105 13

Deferred tax assets 732 14

Other assets 10,669 15

Non-current assets held for sale 105 16

Total Assets 650,997 17

Liabilities

Deposits from credit institutions 75,473 18

Deposits from customers 376,859 19

Debt securities in issue 110,573 20

Financial liabilities held for trading 1,246 21

Financial liabilities designated at fair value 4,405 22

Derivatives 20,665 23

Other liabilities 6,223 24

Provisions 609 25

Current tax liabilities 371 26

Deferred tax liabilities 359 27

Subordinated liabilities 11,884 28

Total Liabilities 608,667 29

June 2021 - Pillar 3 14

Pillar 3

5. Countercyclical Capital Buffers

EU CCyB1 - Geographical Distribution of Credit Exposures Relevant for the Calculation of the Countercyclical Buffer

Relevant credit exposures –

General credit exposures Own fund requirements

Market risk

Securitisation Relevant credit

Relevant Relevant

Exposure value Sum of long and Value of trading exposures exposures – Own fund

credit risk credit

under the Exposure value short positions of book exposures Exposure value Total Securitisation Risk-weighted requirements Countercyclical

exposures - exposures –

Amounts in Millions standardised under the IRB trading book for internal for non-trading exposure positions in the non- exposure weights buffer rate

Credit risk Market risk

of Euros approach approach exposures for SA models book value trading book Total amounts (%) (%)

010 Netherlands 2,715 334,028 0 1,677 2,750 341,169 6,542 269 57 6,867 85,840 57.3166 0.00

020 United States 1,348 47,512 3,773 52,632 1,566 0 64 1,630 20,371 13.6018 0.00

030 Brazil 2,932 5,868 350 9,149 508 0 12 520 6,494 4.3365 0.00

040 Australia 619 22,662 566 23,847 405 0 8 413 5,164 3.4484 0.00

050 United Kingdom 160 8,006 388 8,553 270 0 8 278 3,475 2.3205 0.00

060 France 120 5,683 312 6,115 229 0 6 235 2,938 1.9617 0.00

070 New Zealand 500 9,933 313 10,746 185 0 4 189 2,365 1.5790

080 Germany 364 6,444 95 6,903 182 0 2 184 2,298 1.5346 0.00

090 Canada 47 5,114 185 5,346 135 0 3 138 1,728 1.1535

100 Ireland 381 1,958 906 3,246 109 0 17 126 1,577 1.0529 0.00

110 Luxembourg 0 2,276 2,276 109 0 0 109 1,359 0.9074 0.50

120 Italy 115 2,150 117 2,383 105 0 2 107 1,336 0.8919 0.00

130 Hong Kong 6 3,182 3,188 97 0 0 97 1,217 0.8123 1.00

140 Norway 70 1,091 1,161 33 0 0 33 408 0.2723 1.00

150 Bulgaria 41 41 2 0 0 2 25 0.0167 0.50

160 Czech Republic 25 25 1 0 0 1 13 0.0088 0.50

170 Slovakia 16 16 1 0 0 1 8 0.0051 1.00

180 Other Countries 3,076 24,309 0 0 856 28,243 1,038 0 12 1,051 13,149

190 All Countries 12,453 480,298 0 1,677 10,611 505,039 11,517 269 195 11,981 149,765

Countries with an Own Fund requirment of less than EUR 100 million are included under

Other Countries.

June 2021 - Pillar 3 15

Pillar 3

EU CCyB2 - Amount of Institution-Specific Countercyclical Capital Buffer

Amounts in Millions of Euros

Total risk exposure amount 210,768

Institution specific countercyclical capital buffer rate (%) 0.0156

Institution specific countercyclical capital buffer requirement 33

June 2021 - Pillar 3 16

Pillar 3

6. Leverage Ratio

On June 18, 2021, the European Central Bank announced that exceptional circumstances warranting

The current level of the leverage ratio is well above the regulatory minimum. No explicit target has leverage ratio relief still exist, allowing banks to exclude certain exposures to central banks from the

been defined. total exposure measure as laid out in Article 429a(1)(n) CRR2. Rabobank applies this relief measure.

EU LR1 - Summary Reconciliation of Accounting Assets and Leverage Ratio Exposures

Amounts in Millions of Euros Applicable amount

1 Total assets as per published financial statements 650,997

2 Adjustment for entities which are consolidated for accounting purposes but are outside the scope of regulatory consolidation 0

3 (Adjustment for securitised exposures that meet the operational requirements for the recognition of risk transference) 0

4 (Adjustment for temporary exemption of exposures to central bank (if applicable)) -106,791

5 (Adjustment for fiduciary assets recognised on the balance sheet pursuant to the applicable accounting framework but excluded from the leverage ratio total exposure measure

in accordance with point (i) of Article 429a(1) CRR) 0

6 Adjustment for regular-way purchases and sales of financial assets subject to trade date accounting -154

7 Adjustment for eligible cash pooling transactions 0

8 Adjustments for derivative financial instruments -8,963

9 Adjustment for securities financing transactions (SFTs) 826

10 Adjustment for off-balance sheet items (ie conversion to credit equivalent amounts of off-balance sheet exposures) 31,988

11 (Adjustment for prudent valuation adjustments and specific and general provisions which have reduced Tier 1 capital) -181

EU-11a (Adjustment for exposures excluded from the leverage ratio total exposure measure in accordance with point (c ) of Article 429a(1) CRR) 0

EU-11b (Adjustment for exposures excluded from the leverage ratio total exposure measure in accordance with point (j) of Article 429a(1) CRR) 0

12 Other adjustments -6,410

13 Leverage ratio total exposure measure 561,312

June 2021 - Pillar 3 17

Pillar 3

EU LR2 - Leverage Ratio Common Disclosure

CRR leverage ratio exposures

Amounts in Millions of Euros 30-06-2021

On-balance sheet exposures (excluding derivatives and SFTs)

1 On-balance sheet items (excluding derivatives, SFTs, but including collateral) 489,998

2 Gross-up for derivatives collateral provided where deducted from the balance sheet assets pursuant to the applicable accounting framework 0

3 (Deductions of receivables assets for cash variation margin provided in derivatives transactions) -10,730

4 (Adjustment for securities received under securities financing transactions that are recognised as an asset) 0

5 (General credit risk adjustments to on-balance sheet items) 0

6 (Asset amounts deducted in determining Tier 1 capital) -1,037

7 Total on-balance sheet exposures (excluding derivatives and SFTs) 478,230

Derivative exposures

8 Replacement cost associated with SA-CCR derivatives transactions (ie net of eligible cash variation margin) 3,727

EU-8a Derogation for derivatives: replacement costs contribution under the simplified standardised approach 0

9 Add-on amounts for potential future exposure associated with SA-CCR derivatives transactions 10,280

EU-9a Derogation for derivatives: Potential future exposure contribution under the simplified standardised approach 0

EU-9b Exposure determined under Original Exposure Method 0

10 (Exempted CCP leg of client-cleared trade exposures) (SA-CCR) 0

EU-10a (Exempted CCP leg of client-cleared trade exposures) (simplified standardised approach) 0

EU-10b (Exempted CCP leg of client-cleared trade exposures) (original exposure method) 0

11 Adjusted effective notional amount of written credit derivatives 632

12 (Adjusted effective notional offsets and add-on deductions for written credit derivatives) 0

13 Total derivatives exposures 14,639

Securities financing transaction (SFT) exposures

14 Gross SFT assets (with no recognition of netting), after adjustment for sales accounting transactions 37,028

15 (Netted amounts of cash payables and cash receivables of gross SFT assets) 0

16 Counterparty credit risk exposure for SFT assets 739

EU-16a Derogation for SFTs: Counterparty credit risk exposure in accordance with Articles 429e(5) and 222 CRR 0

17 Agent transaction exposures 0

EU-17a (Exempted CCP leg of client-cleared SFT exposure) 0

18 Total securities financing transaction exposures 37,767

June 2021 - Pillar 3 18

Pillar 3

CRR leverage ratio exposures

Amounts in Millions of Euros 30-06-2021

Other off-balance sheet exposures

19 Off-balance sheet exposures at gross notional amount 97,546

20 (Adjustments for conversion to credit equivalent amounts) -65,558

21 (General provisions associated with off-balance sheet exposures deducted in determining Tier 1 capital) 0

22 Off-balance sheet exposures 31,988

Excluded exposures

EU-22a (Exposures excluded from the leverage ratio total exposure measure in accordance with point (c ) of Article 429a(1) CRR) 0

EU-22b (Exposures exempted in accordance with point (j) of Article 429a (1) CRR (on and off balance sheet)) 0

EU-22c (-) Excluded exposures of public development banks - Public sector investments 0

EU-22d (Excluded promotional loans of public development banks:

- Promotional loans granted by a public development credit institution

- Promotional loans granted by an entity directly set up by the central government, regional governments or local authorities of a Member State

- Promotional loans granted by an entity set up by the central government, regional governments or local authorities of a Member State through an intermediate credit institution) 0

EU-22e ( Excluded passing-through promotional loan exposures by non-public development banks (or units):

- Promotional loans granted by a public development credit institution

- Promotional loans granted by an entity directly set up by the central government, regional governments or local authorities of a Member State

- Promotional loans granted by an entity set up by the central government, regional governments or local authorities of a Member State through an intermediate credit institution) 0

EU-22f (Excluded guaranteed parts of exposures arising from export credits ) -1,312

EU-22g (Excluded excess collateral deposited at triparty agents ) 0

EU-22h (Excluded CSD related services of CSD/institutions in accordance with point (o) of Article 429a(1) CRR) 0

EU-22i (Excluded CSD related services of designated institutions in accordance with point (p) of Article 429a(1) CRR) 0

EU-22j (Reduction of the exposure value of pre-financing or intermediate loans ) 0

EU-22k (Total exempted exposures) -1,312

Capital and total exposure measure

23 Tier 1 capital 40,087

24 Leverage ratio total exposure measure 561,312

Leverage ratio

25 Leverage ratio (%) 7.14

EU-25 Leverage ratio (without the adjustment due to excluded exposures of public development banks - Public sector investments) (%) 7.14

25a Leverage ratio (excluding the impact of any applicable temporary exemption of central bank reserves) (%) 6.00

26 Regulatory minimum leverage ratio requirement (%) 3.23

EU-26 Additional leverage ratio requirements (%) 0.00

27 Required leverage buffer (%) 0.00

Choice on transitional arrangements and relevant exposures

EU-27 Choice on transitional arrangements for the definition of the capital measure Transitional

June 2021 - Pillar 3 19

Pillar 3

EU LR3 - Split Up of On Balance Sheet Exposures (Excl. Derivatives, SFT's and Exempted Exposures)

Amounts in Millions of Euros CRR leverage ratio exposures

EU-1 Total on-balance sheet exposures (excluding derivatives, SFTs, and exempted exposures), of which: 477,956

EU-2 Trading book exposures 7,791

EU-3 Banking book exposures, of which: 470,164

EU-4 Covered bonds 0

EU-5 Exposures treated as sovereigns 32,500

EU-6 Exposures to regional governments, MDB, international organisations and PSE not treated as sovereigns 0

EU-7 Institutions 8,990

EU-8 Secured by mortgages of immovable properties 287,512

EU-9 Retail exposures 31,650

EU-10 Corporate 81,068

EU-11 Exposures in default 8,898

EU-12 Other exposures (eg equity, securitisations, and other non-credit obligation assets) 19,546

June 2021 - Pillar 3 20

Pillar 3

7. Credit Risk

For additional information about credit risks, we refer to paragraph Risks and Uncertainties in our

Interim Report 2021.

June 2021 - Pillar 3 21

Pillar 3

7.1 Credit Risk Quality

EU CR1 - Performing and Non-Performing Exposures and Related Provisions

Accumulated impairment, accumulated negative changes in fair value due to Collaterals and financial

Gross carrying amount/nominal amount

credit risk and provisions guarantees received

Non-performing exposures

Performing exposures - Accumulated - Accumulated impairment,

Performing exposures Non-performing exposures

impairment and provisions accumulated negative changes in fair

value due to credit risk and provisions

On On non-

of which: of which: of which: of which: of which: of which: of which: of which: Accumulated performing performing

Amounts in Millions of Euros stage 1 stage 2 stage 2 stage 3 stage 1 stage 2 stage 2 stage 3 partial write-off exposures exposures

Cash balances at central banks and other

demand deposits 124,068 124,066 1 0 0 -1 -1 0 0 0

Loans and advances 450,942 415,229 34,539 12,276 283 11,957 -1,343 -488 -855 -2,818 -4 -2,814 -25 381,068 7,217

Central banks 6 6 0 0 0

General governments 2,123 2,068 53 4 4 -3 -3 -1 -1 -1 990 3

Credit institutions 25,518 24,668 398 -2 -1 -1 19,696

Other financial corporations 33,365 32,227 1,138 545 2 508 -24 -14 -11 -120 0 -120 0 21,668 147

Non-financial corporations 196,365 167,367 28,341 10,628 260 10,367 -1,245 -442 -803 -2,603 -4 -2,599 -25 148,525 6,075

Of which: SMEs 105,804 92,050 13,752 5,894 138 5,756 -710 -222 -488 -1,117 -3 -1,114 -25 92,603 4,432

Households 193,565 188,894 4,608 1,099 21 1,078 -68 -29 -39 -94 0 -94 0 190,189 992

Debt Securities 14,865 14,723 98 -2 -2 0

Central banks 345 345 0 0

General governments 10,110 10,109 0 -1 -1 0

Credit institutions 3,920 3,822 98 -1 -1 0

Other financial corporations 326 282 0 0

Non-financial corporations 165 165 0 0

Off-balance sheet exposures 97,526 94,353 3,173 1,127 54 1,073 37 26 11 95 0 95 10,281 140

Central banks 47 47 0 0

General governments 699 675 23 0 0 0 0 0 0 0 21

Credit institutions 1,631 1,630 1 0 0 0 9

Other financial corporations 9,837 9,678 160 307 0 307 1 1 0 24 0 24 344 39

Non-financial corporations 72,909 69,935 2,974 817 54 763 32 21 11 71 0 71 9,905 101

Households 12,403 12,388 15 3 0 3 3 3 0 0 0 0 2 0

Total 687,401 648,371 37,811 13,403 337 13,030 -1,382 -516 -866 -2,913 -4 -2,909 -25 391,350 7,357

June 2021 - Pillar 3 22

Pillar 3

Non Performing Loans (NPLs) are still trending downward. The inflow of NPLs is still low in the Dutch

CR1_A - Maturity of Exposures

SME and mid corporate market and has stabilized in the corporate and wholesale domains, mainly

Net exposure value due to government support measures (including tax delays), and by a much more resilient economy

> 1 year <= 5 No stated

Amounts in Millions of Euros On demand <= 1 year years > 5 years maturity Total

than expected. The outflow of NPLs is effectively managed by special asset management. The NPL

Loans and advances 49,229 67,259 103,793 233,419 6,011 459,711 ratio decreased from 2.46% at year-end 2020 to 2.09% as of June 30, 2021; at the same time the stage

Debt securities 1,035 2,157 4,521 9,115 0 16,828 3 ratio decreased from 3.0% per year-end 2020 to 2.6% as at June 30,2021.

Total 50,263 69,416 108,314 242,534 6,011 476,538

CR2 - Changes in the Stock of Non-Performing Loans and Advances

Amounts in Millions of Euros Gross carrying amount

Initial stock of non-performing loans and advances as of December 31, 2020 13,882

Inflows to non-performing portfolios 2,534

Outflows from non-performing portfolios -3,766

Outflows due to write-offs -373

Outflow due to other situations 0

Final stock of non-performing loans and advances as of June 30, 2021 12,276

June 2021 - Pillar 3 23

Pillar 3

CQ1: Credit Quality of Forborne Exposures

Accumulated impairment, accumulated negative Collaterals received and financial guarantees

Gross carrying amount/ Nominal amount of exposures with forbearance measures

changes in fair value due to credit risk and provisions received on forborne exposures

Non-performing forborne Of which: Collateral

and financial

guarantees received

on non-performing

On performing On non-performing exposures with

Amounts in Millions of Euros Performing forborne Of which defaulted Of which impaired forborne exposures forborne exposures forbearance measures

Cash balances at central banks and other

demand deposits

Loans and advances 6,187 7,399 7,223 7,223 -57 -1,388 9,508 4,274

Central banks

General governments 1 0 0 0 0 0 1 0

Credit institutions

Other financial corporations 112 188 187 187 -1 -25 110 67

Non-financial corporations 4,019 6,629 6,462 6,462 -49 -1,336 6,822 3,647

Households 2,055 582 575 575 -7 -27 2,575 560

Debt Securities

Loan commitments given 515 274 220 220 1 12 273 7

Total 6,702 7,673 7,443 7,443 -56 -1,376 9,781 4,281

In the first half of 2021, the performing part of the forbearance portfolio shows slight decreases asset management. The total exposure on clients managed by special asset management decreased

compared to year end 2020. Also, the non-performing forborne loans are continuing their compared to year-end 2020.

decreasing trend, falling below the historical average. The forborne portfolio is managed by special

CQ4 - Quality of Non-Performing Exposures by Geography1

Gross carrying/Nominal amount Accumulated negative

Provisions on off-balance changes in fair value

of which: non-performing

of which: subject Accumulated sheet commitments and due to credit risk on non-

Amounts in Millions of Euros of which: defaulted to impairment impairment financial guarantee given performing exposures

On balance sheet exposures 478,083 12,276 11,992 476,831 -4,163

Australia 18,483 267 267 18,483 -53

Brazil 9,537 965 965 9,536 -471

Canada 6,107 104 104 6,107 -76

Germany 7,892 93 93 7,892 -56

France 13,885 320 320 13,809 -96

United Kingdom 21,716 402 402 21,681 -84

June 2021 - Pillar 3 24

Pillar 3

Gross carrying/Nominal amount Accumulated negative

Provisions on off-balance changes in fair value

of which: non-performing

of which: subject Accumulated sheet commitments and due to credit risk on non-

Amounts in Millions of Euros of which: defaulted to impairment impairment financial guarantee given performing exposures

Netherlands 302,605 7,135 7,084 301,651 -2,601

New Zealand 8,839 304 304 8,839 -34

United States 45,766 1,437 1,237 45,758 -202

Other Countries 43,254 1,250 1,217 43,075 -487

Off balance sheet exposures 98,653 1,127 1,073 132

Australia 4,527 9 9 2

Brazil 412 0 0 0

Canada 1,790 6 6 0

Germany 1,907 5 5 1

France 1,763 0 0 1

United Kingdom 3,843 37 37 1

Netherlands 47,415 940 887 101

New Zealand 1,618 15 15 1

United States 21,867 69 69 3

Other Countries 13,510 46 46 22

Total 576,736 13,403 13,065 476,831 -4,163 132

1 All countries with an exposure under 1% of the total amount are combined under Other countries

The majority of the on-balance exposures is originated in the Netherlands.

June 2021 - Pillar 3 25

Pillar 3

CQ5 - Credit Quality of Loans and Advances to Non-Financial Corporations by Industry

Gross carrying amount

Accumulated negative changes in

of which: non-performing

of which: loans and advances fair value due to credit risk on non-

Amounts in Millions of Euros of which: defaulted subject to impairment Accumulated impairment performing exposures

Agriculture, forestry and fishing 71,704 4,234 4,168 71,664 -708

Mining and quarrying 1,334 20 20 1,334 -11

Manufacturing 32,928 1,863 1,858 32,864 -1,101

Electricity, gas, steam and air conditioning supply 4,405 78 76 4,387 -58

Water supply 575 43 15 575 -9

Construction 6,656 521 510 6,656 -260

Wholesale and retail trade 32,776 1,008 991 32,651 -513

Transport and storage 7,140 860 857 7,140 -230

Accommodation and food service activities 5,413 322 314 5,413 -145

Information and communication 2,331 43 43 2,331 -53

Real estate activities 18,949 726 706 18,949 -234

Financial and insurance actvities 969 69 35 969 -27

Professional, scientific and technical activities 3,756 117 117 3,756 -115

Administrative and support service activities 4,949 270 269 4,949 -146

Public administration and defense, compulsory

social security 35 2 2 35 -1

Education 801 15 15 801 -12

Human health services and social work activities 6,457 167 109 6,457 -76

Arts, entertainment and recreation 1,503 129 123 1,502 -56

Other services 4,312 140 140 3,904 -93

Total 206,993 10,628 10,367 206,336 -3,848

Most of the loans and advances to non-financial corporations are concentrated in the Agriculture,

Forestry and Fishing industry (35% of the total), followed by Manufacturing (17% of the total),

Wholesale and retail trade (16% of the total) and Real Estate Activities (10% of the total).

Exposures within vulnerable subsectors are placed in Stage 2 and relate almost fully to non-F&A

subsectors as per June 2021. Vulnerable subsectors are Commercial Real Estate (retail and leisure),

Accommodation & Food Services (hotels, restaurants and pubs), Wholesale and Retail Trade

(automotive and retail fashion and shoes), Arts, Entertainment & Recreation (sport facilities, fitness

and amusement and theme parks), Administrative and Support Service Activities (rental & leasing

and travel agencies).

June 2021 - Pillar 3 26

Pillar 3

CQ7 - Collateral Obtained by Taking Possession and Execution Processes

Collateral obtained by taking

possession accumulated

Value at initial Accumulated

Amounts in Millions of Euros recognition negative changes

Property Plant and Equipment (PP&E) 0 0

Other than Property Plant and Equipment 0 0

Residential immovable property 0 0

Commercial Immovable property 0 0

Movable property (auto, shipping, etc.) 0 0

Equity and debt instruments 0 0

Other 0 0

Total 0 0

CR3 - Disclosure of the Use of Credit Risk Mitigation Techniques

Secured carrying amount

Of which secured by financial guarantees

Of which secured by

Amounts in Millions of Euros Unsecured carrying amount Of which secured by collateral credit derivatives

Loans and advances 199,001 388,285 354,402 33,884

Debt securities 14,865

Total 213,866 388,285 354,402 33,884

Of which non-performing exposures 5,059 7,217 6,624 593

Of which defaulted 5,059 6,932 6,340 593

There was an increase of the secured exposure both by collateral and financial guarantees compared

to year-end 2020.

June 2021 - Pillar 3 27

Pillar 3

7.2 The Use of the IRB Approach to Credit Risk

CR8 - RWEA Flow Statements of Credit Risk Exposures Under the IRB Approach

Amounts in Millions of Euros Risk weighted exposure amount

Risk weighted exposure amount as at the end of the previous reporting period 118,735

Asset size (+/-) 211

Asset quality (+/-) -3,292

Model updates (+/-) -641

Methodology and policy (+/-) 2,826

Acquisitions and disposals (+/-) 0

Foreign exchange movements (+/-) -366

Other (+/-) 0

Risk weighted exposure amount as at the end of the reporting period 117,474

CR6 - Credit Risk Exposure by Exposure Class and PD Range - A-IRB

Exposure Risk weighted Density of risk

Amounts in Millions of Euros Exposure Exposure Exposure weighted exposure weighted

Off-balance- weighted Exposure post weighted weighted average amount after exposure Value adjust-

On-balance sheet exposures average CCF CCF and post average PD Number of average LGD maturity supporting amount Expected loss ments and

Exposure class PD scale sheet exposures pre-CCF (%) CRM (%) obligors (%) (in years) factors (%) amount provisions

CGCB 0.00 to <0.15 136,256 249 108.57 136,796 0.00 135 33.98 1 225 0.16 0 -1

CGCB 0.00 to <0.10 135,983 249 108.57 136,520 0.00 127 33.91 1 131 0.10 0 -1

CGCB 0.10 to <0.15 273 0 0.83 276 0.11 8 71.64 1 94 34.03 0 0

CGCB 0.15 to <0.25 2 2 0.22 3 30.47 1 0 23.16 0 0

CGCB 0.25 to <0.50 319 252 99.58 572 0.38 7 22.70 4 185 32.34 1 0

CGCB 0.50 to <0.75 15 0 90.65 15 0.75 4 6.73 2 2 11.32 0 0

CGCB 0.75 to <2.50 450 450 1.12 6 79.00 1 673 149.57 4 -1

CGCB 0.75 to <1.75 450 450 1.12 6 79.00 0 673 149.57 4 -1

CGCB 1.75 to <2.5

CGCB 2.50 to <10.00 354 37 90.31 391 5.14 12 24.03 3 253 64.62 3 -1

CGCB 2.5 to <5 166 0 2.50 168 3.12 8 52.74 1 229 136.32 3 0

CGCB 5 to <10 188 37 90.31 223 6.67 4 2.34 4 23 10.47 0 -1

CGCB 10.00 to <100.00 195 15 90.33 210 12.77 0 2.60 4 29 13.79 1 -2

CGCB 10 to <20 195 15 90.33 210 12.77 4 2.60 4 29 13.79 1 -2

CGCB 20 to <30

CGCB 30.00 to <100.00

June 2021 - Pillar 3 28

Pillar 3

Exposure Risk weighted Density of risk

Amounts in Millions of Euros Exposure Exposure Exposure weighted exposure weighted

Off-balance- weighted Exposure post weighted weighted average amount after exposure Value adjust-

On-balance sheet exposures average CCF CCF and post average PD Number of average LGD maturity supporting amount Expected loss ments and

Exposure class PD scale sheet exposures pre-CCF (%) CRM (%) obligors (%) (in years) factors (%) amount provisions

CGCB 100.00 (Default)

Subtotal CGCB 137,590 554 138,436 171 1,366 0.00 8 -4

Institutions 0.00 to <0.15 4,999 3,211 95.98 8,099 0.08 260 29.33 2 1,395 17.23 2 0

Institutions 0.00 to <0.10 2,335 1,870 96.18 4,147 0.06 175 20.41 3 496 11.97 0 0

Institutions 0.10 to <0.15 2,663 1,341 95.70 3,952 0.11 85 38.70 2 899 22.75 2 0

Institutions 0.15 to <0.25 93 91 97.33 182 0.21 32 29.23 2 55 30.22 0 0

Institutions 0.25 to <0.50 175 114 84.22 298 0.38 43 32.41 1 126 42.41 0 0

Institutions 0.50 to <0.75 61 358 97.21 409 0.73 71 26.02 3 246 60.12 1 0

Institutions 0.75 to <2.50 108 73 94.42 173 1.48 51 25.09 4 133 76.73 1 0

Institutions 0.75 to <1.75 108 73 94.42 173 1.48 45 25.08 4 132 76.72 1 0

Institutions 1.75 to <2.5 0 0 2.05 6 31.62 2 0 80.91 0 0

Institutions 2.50 to <10.00 6,053 295 100.19 436 4.35 38 33.38 2 456 104.69 6 -1

Institutions 2.5 to <5 30 295 100.19 325 3.53 25 40.16 2 398 122.73 5 0

Institutions 5 to <10 6,023 111 6.76 13 13.61 2 58 52.05 1 -1

Institutions 10.00 to <100.00 9 0 102.50 8 12.76 6 29.16 2 12 141.48 0 0

Institutions 10 to <20 9 0 102.50 8 12.76 6 29.16 2 12 141.48 0 0

Institutions 20 to <30

Institutions 30.00 to <100.00

Institutions 100.00 (Default) 3 3 100.00 4 19.99 2 1 33.71 1 0

Subtotal Institutions 11,501 4,142 9,608 505 2,424 0.00 11 -3

Corporates-SME 0.00 to <0.15 665 500 116.03 1,321 0.13 1587 8.97 4 76 5.76 0 0

Corporates-SME 0.00 to <0.10 30 23 0.06 7 26.61 2 3 11.05 0 0

Corporates-SME 0.10 to <0.15 635 500 116.03 1,298 0.13 1580 8.66 4 74 5.67 0 0

Corporates-SME 0.15 to <0.25 1,130 552 90.21 1,768 0.21 1937 10.41 4 144 8.13 0 0

Corporates-SME 0.25 to <0.50 6,153 1,809 98.63 8,441 0.43 7041 9.48 4 943 11.17 3 -3

Corporates-SME 0.50 to <0.75 7,515 1,463 95.05 9,409 0.72 6490 9.66 4 1,420 15.09 7 -4

Corporates-SME 0.75 to <2.50 24,757 3,242 96.13 28,957 1.55 18023 12.33 4 7,352 25.39 59 -25

Corporates-SME 0.75 to <1.75 19,094 2,553 97.55 22,605 1.33 14090 11.21 4 4,822 21.33 34 -17

Corporates-SME 1.75 to <2.5 5,664 689 90.87 6,352 2.34 3933 16.33 4 2,531 39.84 24 -8

Corporates-SME 2.50 to <10.00 17,753 2,218 98.08 20,305 4.38 11492 16.78 4 8,764 43.16 156 -63

Corporates-SME 2.5 to <5 10,900 1,462 98.36 12,660 3.24 6865 15.78 4 4,760 37.60 66 -26

Corporates-SME 5 to <10 6,854 756 97.53 7,646 6.27 4627 18.44 4 4,004 52.37 90 -37

Corporates-SME 10.00 to <100.00 1,264 140 91.68 1,385 15.22 1061 24.41 3 1,307 94.39 53 -23

June 2021 - Pillar 3 29

Pillar 3

Exposure Risk weighted Density of risk

Amounts in Millions of Euros Exposure Exposure Exposure weighted exposure weighted

Off-balance- weighted Exposure post weighted weighted average amount after exposure Value adjust-

On-balance sheet exposures average CCF CCF and post average PD Number of average LGD maturity supporting amount Expected loss ments and

Exposure class PD scale sheet exposures pre-CCF (%) CRM (%) obligors (%) (in years) factors (%) amount provisions

Corporates-SME 10 to <20 1,167 118 93.45 1,270 14.12 980 23.63 3 1,132 89.14 43 -19

Corporates-SME 20 to <30 96 22 82.03 114 27.13 79 33.26 3 175 153.57 10 -4

Corporates-SME 30.00 to <100.00 1 0 100.00 1 51.76 2 6.56 5 0 24.03 0 0

Corporates-SME 100.00 (Default) 3,050 256 93.09 3,327 100.00 2283 16.44 4 929 27.93 476 -371

Subtotal Corporates-SME 62,287 10,181 74,913 49914 20,935 0.00 755 -489

Corporates-SL 0.00 to <0.15 1,039 151 61.92 1,140 0.10 0 7.05 0 74 6.51 0 0

Corporates-SL 0.00 to <0.10 418 83 61.43 473 0.07 0 7.35 0 26 5.47 0 0

Corporates-SL 0.10 to <0.15 621 68 62.52 667 0.13 0 6.84 0 48 7.25 0 0

Corporates-SL 0.15 to <0.25 1,142 107 85.21 1,241 0.19 0 12.96 0 235 18.90 0 0

Corporates-SL 0.25 to <0.50 4,929 486 67.13 5,299 0.38 0 8.63 0 831 15.69 2 -1

Corporates-SL 0.50 to <0.75 3,024 951 62.53 3,661 0.65 0 11.69 0 978 26.71 3 -2

Corporates-SL 0.75 to <2.50 7,175 1,129 47.50 7,791 1.34 0 9.67 0 1,819 23.35 10 -4

Corporates-SL 0.75 to <1.75 5,439 1,076 47.08 6,005 1.13 0 10.10 0 1,452 24.19 7 -3

Corporates-SL 1.75 to <2.5 1,736 53 56.08 1,786 2.04 0 8.23 0 367 20.53 3 -2

Corporates-SL 2.50 to <10.00 1,522 107 88.98 1,635 3.75 0 9.96 0 484 29.63 6 -3

Corporates-SL 2.5 to <5 1,342 106 88.91 1,452 3.38 0 9.58 0 406 27.98 5 -3

Corporates-SL 5 to <10 180 1 101.17 183 6.68 0 12.96 0 78 42.75 2 -1

Corporates-SL 10.00 to <100.00 264 6 93.66 273 13.43 0 14.07 0 167 61.09 5 -2

Corporates-SL 10 to <20 235 6 93.62 243 12.25 0 14.17 0 146 60.28 4 -2

Corporates-SL 20 to <30 30 0 101.24 30 22.98 0 13.34 0 20 67.65 1 0

Corporates-SL 30.00 to <100.00

Corporates-SL 100.00 (Default) 789 18 77.07 816 100.00 0 26.89 0 227 27.78 222 -186

Subtotal Corporates-SL 19,884 2,954 21,856 4126 4,815 0.00 249 -199

Corporates-Other 0.00 to <0.15 10,385 17,255 73.46 23,724 0.10 0 25.54 0 4,304 18.14 7 -2

Corporates-Other 0.00 to <0.10 3,956 8,038 62.87 9,161 0.05 0 21.14 0 1,039 11.34 1 0

Corporates-Other 0.10 to <0.15 6,429 9,217 82.69 14,563 0.13 0 28.30 0 3,265 22.42 5 -2

Corporates-Other 0.15 to <0.25 7,190 5,262 76.65 11,766 0.22 0 27.81 0 3,328 28.28 7 -3

Corporates-Other 0.25 to <0.50 17,745 14,425 74.55 29,291 0.40 0 25.64 0 10,946 37.37 30 -9

Corporates-Other 0.50 to <0.75 8,928 6,120 73.97 13,470 0.73 0 25.25 0 6,805 50.52 25 -8

Corporates-Other 0.75 to <2.50 14,755 8,755 66.52 20,721 1.44 0 26.11 0 14,025 67.68 81 -39

Corporates-Other 0.75 to <1.75 13,114 6,718 77.13 18,437 1.33 0 24.94 0 11,553 62.66 61 -32

Corporates-Other 1.75 to <2.5 1,640 2,037 31.50 2,285 2.31 0 35.61 0 2,472 108.17 19 -8

Corporates-Other 2.50 to <10.00 9,993 2,363 84.16 11,950 4.24 0 27.34 0 11,390 95.31 137 -113

June 2021 - Pillar 3 30

Pillar 3

Exposure Risk weighted Density of risk

Amounts in Millions of Euros Exposure Exposure Exposure weighted exposure weighted

Off-balance- weighted Exposure post weighted weighted average amount after exposure Value adjust-

On-balance sheet exposures average CCF CCF and post average PD Number of average LGD maturity supporting amount Expected loss ments and

Exposure class PD scale sheet exposures pre-CCF (%) CRM (%) obligors (%) (in years) factors (%) amount provisions

Corporates-Other 2.5 to <5 6,497 1,932 83.40 8,152 3.28 0 26.88 0 7,159 87.82 72 -70

Corporates-Other 5 to <10 3,496 431 87.58 3,799 6.29 0 28.33 0 4,231 111.37 65 -42

Corporates-Other 10.00 to <100.00 451 165 85.44 574 15.21 0 39.58 0 1,230 214.29 39 -17

Corporates-Other 10 to <20 393 142 86.58 498 13.35 0 33.48 0 826 165.81 23 -11

Corporates-Other 20 to <30 57 22 78.15 75 27.29 0 80.57 0 402 539.10 16 -6

Corporates-Other 30.00 to <100.00 2 1 36.02 0 28.52 0 2 162.59 0 0

Corporates-Other 100.00 (Default) 4,349 635 29.86 4,645 100.00 0 25.10 0 1,339 28.82 1,256 -1,136

Subtotal Corporates-Other 73,796 54,979 116,142 11152 53,366 0.00 1,582 -1,327

Retail-SRE-SME 0.00 to <0.15 1,077 284 84.07 1,315 0.12 11992 8.11 0 28 2.12 0 0

Retail-SRE-SME 0.00 to <0.10 189 80 84.30 256 0.09 3607 8.11 0 4 1.64 0 0

Retail-SRE-SME 0.10 to <0.15 888 204 83.98 1,059 0.13 8385 8.11 0 24 2.23 0 0

Retail-SRE-SME 0.15 to <0.25 1,691 341 82.44 1,971 0.20 13785 11.13 0 85 4.33 0 0

Retail-SRE-SME 0.25 to <0.50 2,806 414 79.84 3,134 0.37 18333 14.44 0 276 8.79 2 -2

Retail-SRE-SME 0.50 to <0.75 2,033 195 76.36 2,179 0.62 11160 16.07 0 308 14.12 2 -1

Retail-SRE-SME 0.75 to <2.50 5,985 357 72.10 6,231 1.39 28488 16.02 0 1,478 23.72 14 -9

Retail-SRE-SME 0.75 to <1.75 4,513 271 72.21 4,700 1.15 20989 16.07 0 1,003 21.33 9 -6

Retail-SRE-SME 1.75 to <2.5 1,472 86 71.77 1,532 2.13 7499 15.86 0 475 31.04 5 -4

Retail-SRE-SME 2.50 to <10.00 2,921 147 81.66 3,052 4.78 15397 18.26 0 1,708 55.98 27 -22

Retail-SRE-SME 2.5 to <5 1,858 99 78.35 1,938 3.46 9504 17.27 0 872 44.99 12 -8

Retail-SRE-SME 5 to <10 1,063 49 88.40 1,113 7.08 5893 19.99 0 836 75.12 16 -14

Retail-SRE-SME 10.00 to <100.00 861 25 94.35 893 20.14 4485 23.85 0 1,077 120.55 44 -28

Retail-SRE-SME 10 to <20 578 20 93.85 603 13.63 3109 23.42 0 693 114.96 20 -16

Retail-SRE-SME 20 to <30 149 3 96.79 155 24.17 750 24.35 0 210 135.96 9 -6

Retail-SRE-SME 30.00 to <100.00 133 1 95.83 136 44.33 626 25.20 0 174 127.80 15 -6

Retail-SRE-SME 100.00 (Default) 687 29 31.22 690 100.00 2794 21.29 0 251 36.32 130 -101

Subtotal Retail-SRE-SME 18,060 1,792 19,466 106434 5,211 0.00 220 -164

Retail-SRE-NoSME 0.00 to <0.15 77,467 3,774 74.29 79,722 0.09 1 5.68 0 1,172 1.47 4 -1

Retail-SRE-NoSME 0.00 to <0.10 45,601 3,189 73.32 47,465 0.07 0 5.41 0 516 1.09 2 0

Retail-SRE-NoSME 0.10 to <0.15 31,866 584 79.60 32,257 0.12 0 6.07 0 656 2.03 2 0

Retail-SRE-NoSME 0.15 to <0.25 41,166 422 80.90 41,478 0.19 0 8.10 0 1,589 3.83 7 -1

Retail-SRE-NoSME 0.25 to <0.50 38,265 254 83.07 38,468 0.35 0 11.23 0 3,131 8.14 15 -3

Retail-SRE-NoSME 0.50 to <0.75 12,514 4,190 20.91 13,391 0.60 0 13.50 0 1,916 14.31 11 -2

Retail-SRE-NoSME 0.75 to <2.50 15,030 59 85.74 15,088 1.25 0 16.61 0 4,331 28.70 32 -8

June 2021 - Pillar 3 31

Pillar 3

Exposure Risk weighted Density of risk

Amounts in Millions of Euros Exposure Exposure Exposure weighted exposure weighted

Off-balance- weighted Exposure post weighted weighted average amount after exposure Value adjust-

On-balance sheet exposures average CCF CCF and post average PD Number of average LGD maturity supporting amount Expected loss ments and

Exposure class PD scale sheet exposures pre-CCF (%) CRM (%) obligors (%) (in years) factors (%) amount provisions

Retail-SRE-NoSME 0.75 to <1.75 12,594 48 86.76 12,641 1.10 0 16.29 0 3,266 25.83 23 -6

Retail-SRE-NoSME 1.75 to <2.5 2,436 11 81.40 2,448 2.07 0 18.27 0 1,065 43.51 9 -3

Retail-SRE-NoSME 2.50 to <10.00 3,954 10 90.09 3,970 4.57 0 16.69 0 2,362 59.50 29 -15

Retail-SRE-NoSME 2.5 to <5 2,695 7 90.38 2,705 3.45 0 17.61 0 1,514 55.96 16 -7

Retail-SRE-NoSME 5 to <10 1,258 3 89.51 1,264 6.97 0 14.70 0 848 67.07 13 -8

Retail-SRE-NoSME 10.00 to <100.00 1,071 2 91.34 1,076 23.83 0 12.65 0 825 76.68 32 -12

Retail-SRE-NoSME 10 to <20 643 1 92.72 646 13.88 0 12.98 0 506 78.30 12 -7

Retail-SRE-NoSME 20 to <30 198 0 89.59 199 24.40 0 11.70 0 160 80.50 6 -2

Retail-SRE-NoSME 30.00 to <100.00 231 1 89.85 232 51.02 0 12.53 0 160 68.90 15 -3

Retail-SRE-NoSME 100.00 (Default) 961 2 25.27 967 100.00 0 12.92 0 1,024 105.94 52 -46

Subtotal Retail-SRE-NoSME 190,428 8,714 194,159 1148586 16,350 0.00 183 -88

Retail-Other-SME 0.00 to <0.15 299 164 84.48 417 0.11 12839 19.88 0 22 5.20 0 0

Retail-Other-SME 0.00 to <0.10 88 61 84.45 134 0.08 4443 20.55 0 5 4.02 0 0

Retail-Other-SME 0.10 to <0.15 211 103 84.49 283 0.13 8396 19.56 0 16 5.76 0 0

Retail-Other-SME 0.15 to <0.25 1,015 266 83.76 1,164 0.21 44335 24.24 0 109 9.36 1 0

Retail-Other-SME 0.25 to <0.50 2,535 496 83.03 2,739 0.38 102504 25.11 0 385 14.04 3 -2

Retail-Other-SME 0.50 to <0.75 2,164 269 81.62 2,224 0.63 74417 24.17 0 413 18.58 3 -3

Retail-Other-SME 0.75 to <2.50 10,327 520 76.52 9,830 1.48 338626 24.61 0 2,607 26.52 36 -30

Retail-Other-SME 0.75 to <1.75 7,410 414 77.95 7,076 1.23 243177 24.72 0 1,793 25.34 22 -18

Retail-Other-SME 1.75 to <2.5 2,918 106 70.95 2,753 2.12 95449 24.32 0 814 29.57 14 -13

Retail-Other-SME 2.50 to <10.00 8,136 239 77.08 7,722 4.67 238985 24.96 0 2,676 34.66 90 -93

Retail-Other-SME 2.5 to <5 5,074 143 74.96 4,797 3.51 154302 25.25 0 1,612 33.60 42 -42

Retail-Other-SME 5 to <10 3,062 95 80.27 2,925 6.56 84683 24.49 0 1,064 36.39 47 -51

Retail-Other-SME 10.00 to <100.00 1,663 60 90.26 1,620 20.59 44419 27.33 0 881 54.37 91 -121

Retail-Other-SME 10 to <20 1,054 42 89.13 1,039 13.15 29304 27.24 0 504 48.51 38 -70

Retail-Other-SME 20 to <30 302 11 91.40 290 25.87 8144 30.62 0 206 70.97 23 -26

Retail-Other-SME 30.00 to <100.00 306 7 95.19 291 41.87 6971 24.38 0 171 58.74 30 -25

Retail-Other-SME 100.00 (Default) 864 30 39.47 830 100.00 19390 33.13 0 319 38.36 266 -309

Subtotal Retail-Other-SME 27,002 2,043 26,547 875515 7,412 0.00 490 -558

Retail-Other-NoSME 0.00 to <0.15 26 273 56.11 179 0.14 6047 12.43 0 7 4.08 0 0

Retail-Other-NoSME 0.00 to <0.10 1 158 0.00 1 0.09 999 43.95 0 0 10.69 0 0

Retail-Other-NoSME 0.10 to <0.15 24 115 133.30 178 0.14 5048 12.20 0 7 4.03 0 0

Retail-Other-NoSME 0.15 to <0.25 174 185 115.70 390 0.20 15338 14.66 0 25 6.46 0 0

June 2021 - Pillar 3 32

Pillar 3

Exposure Risk weighted Density of risk

Amounts in Millions of Euros Exposure Exposure Exposure weighted exposure weighted

Off-balance- weighted Exposure post weighted weighted average amount after exposure Value adjust-

On-balance sheet exposures average CCF CCF and post average PD Number of average LGD maturity supporting amount Expected loss ments and

Exposure class PD scale sheet exposures pre-CCF (%) CRM (%) obligors (%) (in years) factors (%) amount provisions

Retail-Other-NoSME 0.25 to <0.50 390 1,292 122.79 1,996 0.40 32233 42.16 0 559 28.03 3 -2

Retail-Other-NoSME 0.50 to <0.75 396 164 127.36 609 0.62 31933 37.07 0 192 31.56 1 -1

Retail-Other-NoSME 0.75 to <2.50 910 152 126.11 1,112 1.28 76789 38.50 0 492 44.23 5 -3

Retail-Other-NoSME 0.75 to <1.75 742 136 125.29 919 1.11 61022 39.65 0 404 43.94 4 -3

Retail-Other-NoSME 1.75 to <2.5 169 16 132.97 192 2.12 15767 33.02 0 88 45.60 1 -1

Retail-Other-NoSME 2.50 to <10.00 297 1 130.07 298 4.80 28271 24.16 0 112 37.62 3 -3

Retail-Other-NoSME 2.5 to <5 171 1 130.07 172 3.41 16737 24.95 0 64 37.52 1 -1

Retail-Other-NoSME 5 to <10 127 126 6.70 11534 23.07 0 48 37.76 2 -1

Retail-Other-NoSME 10.00 to <100.00 39 44 21.92 3037 47.57 0 51 115.46 5 -1

Retail-Other-NoSME 10 to <20 15 15 13.94 1383 28.93 0 9 59.29 1 -1

Retail-Other-NoSME 20 to <30 21 25 23.59 1225 59.12 0 38 148.19 4 -1

Retail-Other-NoSME 30.00 to <100.00 3 3 45.30 429 43.23 0 4 118.61 1 0

Retail-Other-NoSME 100.00 (Default) 70 0 133.03 89 100.00 2989 44.23 0 45 51.15 36 -31

Subtotal Retail-Other-NoSME 2,303 2,068 4,716 196637 1,484 0.00 55 -42

Total A-IRB 0.00 to <0.15 232,211 25,860 77.47 252,714 0.04 691762 23.69 1 7,304 2.89 13 -5

Total A-IRB 0.00 to <0.10 188,601 13,729 70.15 198,181 0.02 486952 26.10 1 2,221 1.12 3 -2

Total A-IRB 0.10 to <0.15 43,610 12,132 85.76 54,532 0.12 204810 14.90 1 5,083 9.32 10 -3

Total A-IRB 0.15 to <0.25 53,604 7,226 79.86 59,962 0.20 269352 12.66 1 5,569 9.29 16 -5

Total A-IRB 0.25 to <0.50 73,316 19,543 80.60 90,237 0.38 320853 16.95 1 17,382 19.26 59 -21

Total A-IRB 0.50 to <0.75 36,650 13,710 60.64 45,366 0.67 183224 17.12 2 12,279 27.07 53 -21

Total A-IRB 0.75 to <2.50 79,498 14,287 73.10 90,353 1.43 523702 18.25 2 32,909 36.42 241 -121

Total A-IRB 0.75 to <1.75 63,463 11,289 79.53 73,005 1.25 390618 17.90 2 25,098 34.38 165 -84

Total A-IRB 1.75 to <2.5 16,035 2,998 48.87 17,347 2.21 133084 19.72 2 7,812 45.03 77 -37

Total A-IRB 2.50 to <10.00 50,983 5,418 90.51 49,760 4.42 313344 20.69 2 28,206 56.68 458 -314

Total A-IRB 2.5 to <5 28,732 4,046 89.78 32,369 3.33 200309 20.43 2 17,015 52.57 222 -157

Total A-IRB 5 to <10 22,251 1,372 92.67 17,390 6.44 113035 21.18 2 11,191 64.35 236 -157

Total A-IRB 10.00 to <100.00 5,817 413 89.13 6,083 18.78 57848 23.41 1 5,578 91.70 271 -207

Total A-IRB 10 to <20 4,289 346 89.98 4,531 13.55 37737 22.54 2 3,856 85.10 140 -127

Total A-IRB 20 to <30 852 58 83.13 887 25.36 11118 30.07 1 1,211 136.52 69 -46

Total A-IRB 30.00 to <100.00 676 10 94.72 666 45.59 8993 20.48 0 512 76.86 61 -34

Total A-IRB 100.00 (Default) 10,772 969 47.74 11,368 100.00 32955 22.16 2 4,134 36.37 2,439 -2,180

Total A-IRB 542,852 87,427 605,843 2393040 113,362 18.71 3,551 -2,874

June 2021 - Pillar 3 33

Pillar 3

CR6 - Credit risk exposure by exposure class and PD Range - F-IRB

Exposure Risk weighted Density of risk

Amounts in Millions of Euros Exposure Exposure Exposure weighted exposure weighted

Off-balance- weighted Exposure post weighted weighted average amount after exposure Value adjust-

On-balance sheet exposures average CCF CCF and post average PD Number of average LGD maturity supporting amount Expected loss ments and

Exposure class PD scale sheet exposures pre-CCF (%) CRM (%) obligors (%) (in years) factors (%) amount provisions

CGCB 0.00 to <0.15 18.71

CGCB 0.00 to <0.10

CGCB 0.10 to <0.15

CGCB 0.15 to <0.25

CGCB 0.25 to <0.50

CGCB 0.50 to <0.75

CGCB 0.75 to <2.50

CGCB 0.75 to <1.75

CGCB 1.75 to <2.5

CGCB 2.50 to <10.00 27 20.00 5 2.52 1 45.00 2 9 170.92 0 0

CGCB 2.5 to <5 27 20.00 5 2.52 1 45.00 2 9 170.92 0 0

CGCB 5 to <10

CGCB 10.00 to <100.00 19 20.00 4 19.15 1 45.00 2 10 253.47 0 0

CGCB 10 to <20 19 20.00 4 19.15 1 45.00 2 10 253.47 0 0

CGCB 20 to <30

CGCB 30.00 to <100.00

CGCB 100.00 (Default)

Subtotal CGCB 47 9 2 19 0.00 0 0

Institutions 0.00 to <0.15 1,833 778 23.72 2,017 0.11 104 45.00 2 989 49.02 1 0

Institutions 0.00 to <0.10 66 322 27.13 154 0.06 42 45.00 2 51 32.87 0 0

Institutions 0.10 to <0.15 1,766 456 21.30 1,863 0.12 62 45.00 2 938 50.36 1 0

Institutions 0.15 to <0.25 25 58 21.06 37 0.22 16 45.00 2 23 63.37 0 0

Institutions 0.25 to <0.50 486 93 22.22 506 0.43 50 45.00 2 498 98.31 1 0

Institutions 0.50 to <0.75 65 37 30.83 77 0.75 20 45.00 2 95 124.37 0 0

Institutions 0.75 to <2.50 135 165 26.74 180 1.36 51 45.00 2 262 145.99 1 0

Institutions 0.75 to <1.75 135 165 26.74 180 1.36 51 45.00 2 262 145.99 1 0

Institutions 1.75 to <2.5

Institutions 2.50 to <10.00 444 139 20.72 473 3.80 69 45.00 2 864 182.61 8 0

Institutions 2.5 to <5 276 95 20.93 296 2.65 42 45.00 2 478 161.34 4 0

Institutions 5 to <10 168 44 20.29 177 5.72 27 45.00 2 386 218.20 5 0

Institutions 10.00 to <100.00 23 13 26.81 27 13.12 8 45.00 2 76 285.72 2 0

June 2021 - Pillar 3 34

Pillar 3

Exposure Risk weighted Density of risk

Amounts in Millions of Euros Exposure Exposure Exposure weighted exposure weighted

Off-balance- weighted Exposure post weighted weighted average amount after exposure Value adjust-

On-balance sheet exposures average CCF CCF and post average PD Number of average LGD maturity supporting amount Expected loss ments and

Exposure class PD scale sheet exposures pre-CCF (%) CRM (%) obligors (%) (in years) factors (%) amount provisions

Institutions 10 to <20 23 13 26.81 27 13.12 8 45.00 2 76 285.72 2 0

Institutions 20 to <30

Institutions 30.00 to <100.00

Institutions 100.00 (Default)

Subtotal Institutions 3,011 1,283 3,316 318 2,808 0.00 13 0

Corporates-SME 0.00 to <0.15

Corporates-SME 0.00 to <0.10

Corporates-SME 0.10 to <0.15

Corporates-SME 0.15 to <0.25

Corporates-SME 0.25 to <0.50

Corporates-SME 0.50 to <0.75

Corporates-SME 0.75 to <2.50 12 12 2.08 1 45.00 2 12 99.18 0 0

Corporates-SME 0.75 to <1.75

Corporates-SME 1.75 to <2.5 12 12 2.08 1 45.00 2 12 99.18 0 0

Corporates-SME 2.50 to <10.00

Corporates-SME 2.5 to <5

Corporates-SME 5 to <10

Corporates-SME 10.00 to <100.00

Corporates-SME 10 to <20

Corporates-SME 20 to <30

Corporates-SME 30.00 to <100.00

Corporates-SME 100.00 (Default)

Subtotal Corporates-SME 12 12 1 12 0.00 0 0

Corporates-Other 0.00 to <0.15 172 257 0.15 0 45.00 0 107 41.90 0 0

Corporates-Other 0.00 to <0.10

Corporates-Other 0.10 to <0.15 172 257 0.15 0 45.00 0 107 41.90 0 0

Corporates-Other 0.15 to <0.25 438 4 50.00 448 0.22 0 45.00 0 232 51.83 0 0

Corporates-Other 0.25 to <0.50 157 79 50.00 296 0.34 0 45.00 0 194 65.59 0 0

Corporates-Other 0.50 to <0.75 130 148 0.74 0 45.00 0 137 93.02 0 0

Corporates-Other 0.75 to <2.50 389 34 50.00 422 1.37 0 45.00 0 483 114.47 3 -1

Corporates-Other 0.75 to <1.75 377 34 50.00 403 1.34 0 45.00 0 459 113.82 2 -1

Corporates-Other 1.75 to <2.5 13 18 2.08 0 45.00 0 24 128.83 0 0

Corporates-Other 2.50 to <10.00

June 2021 - Pillar 3 35

Pillar 3

Exposure Risk weighted Density of risk

Amounts in Millions of Euros Exposure Exposure Exposure weighted exposure weighted

Off-balance- weighted Exposure post weighted weighted average amount after exposure Value adjust-

On-balance sheet exposures average CCF CCF and post average PD Number of average LGD maturity supporting amount Expected loss ments and

Exposure class PD scale sheet exposures pre-CCF (%) CRM (%) obligors (%) (in years) factors (%) amount provisions

Corporates-Other 2.5 to <5

Corporates-Other 5 to <10

Corporates-Other 10.00 to <100.00 54 54 10.55 0 45.00 0 118 218.36 3 -4

Corporates-Other 10 to <20 54 54 10.55 0 45.00 0 118 218.36 3 -4

Corporates-Other 20 to <30

Corporates-Other 30.00 to <100.00

Corporates-Other 100.00 (Default) 239 0 0.00 239 100.00 0 26.44 0 0 0.00 69 -64

Subtotal Corporates-Other 1,580 118 1,863 43 1,273 0.00 75 -70

Total F-IRB 0.00 to <0.15 2,005 778 23.72 2,274 0.11 106 45.00 2 1,096 48.22 1 0

Total F-IRB 0.00 to <0.10 66 322 27.13 154 0.06 42 45.00 2 51 32.87 0 0

Total F-IRB 0.10 to <0.15 1,938 456 21.30 2,120 0.12 64 45.00 2 1,046 49.33 1 0

Total F-IRB 0.15 to <0.25 463 63 23.01 485 0.22 21 45.00 2 256 52.71 0 0

Total F-IRB 0.25 to <0.50 642 172 35.03 802 0.40 58 45.00 2 692 86.23 1 0

Total F-IRB 0.50 to <0.75 195 37 30.83 225 0.74 26 45.00 2 233 103.73 1 0

Total F-IRB 0.75 to <2.50 537 200 30.76 614 1.38 63 45.00 2 757 123.39 4 -1

Total F-IRB 0.75 to <1.75 512 200 30.76 583 1.35 60 45.00 2 721 123.73 4 -1

Total F-IRB 1.75 to <2.5 25 31 2.08 3 45.00 2 36 116.84 0 0

Total F-IRB 2.50 to <10.00 444 166 20.60 479 3.78 70 45.00 2 873 182.48 8 0

Total F-IRB 2.5 to <5 276 122 20.72 302 2.64 43 45.00 2 487 161.51 4 0

Total F-IRB 5 to <10 168 44 20.29 177 5.72 27 45.00 2 386 218.20 5 0

Total F-IRB 10.00 to <100.00 77 32 22.73 85 11.75 10 45.00 2 204 241.15 4 -4

Total F-IRB 10 to <20 77 32 22.73 85 11.75 10 45.00 2 204 241.15 4 -4

Total F-IRB 20 to <30

Total F-IRB 30.00 to <100.00

Total F-IRB 100.00 (Default) 239 0 0.00 239 100.00 10 26.44 2 0 0.00 69 -64

Total F-IRB 4,603 1,447 5,201 364 4,112 79.05 89 -70

F-IRB exposure increased by around EUR 3.2 billion compared to year-end 2020, mainly driven by

the transfer of the Trade Related Banking Exposure (TRBE) portfolio from SA to F-IRB.

June 2021 - Pillar 3 36

Pillar 3

Rabobank hardly uses credit derivatives to hedge its credit risk. Therefore there is no effect

CR7 - Effect on the RWEAs of Credit Derivatives Used as CRM Techniques

on RWEAs.

Pre-credit

derivatives risk Actual risk

weighted weighted

exposure exposure

Amounts in Millions of Euros amount amount

Exposures under FIRB 4,112 4,112

Central governments and central banks 19 19

Institutions 2,808 2,808

Corporates 1,285 1,285

of which SMEs 12 12

of which Specialised lending

Exposures under AIRB 113,362 113,362

Central governments and central banks 1,366 1,366

Institutions 2,424 2,424

Corporates 79,115 79,115

of Corporates - which SMEs 20,935 20,935

of which Corporates - Specialised lending 4,815 4,815

Retail 30,456 30,456

of which Retail – SMEs - Secured by immovable property collateral 5,211 5,211

of which Retail – non-SMEs - Secured by immovable property collateral 16,350 16,350

of which Retail – Qualifying revolving

of which Retail – SMEs - Other 7,412 7,412

of which Retail – Non-SMEs- Other 1,484 1,484

Total (including FIRB exposures and AIRB exposures) 117,474 117,474

June 2021 - Pillar 3 37

Pillar 3

CR7_A - Disclosure of the Extent of the Use of CRM Techniques - A-IRB

Credit risk Mitigation methods

Credit risk Mitigation techniques

in the calculation of RWEAs

Unfunded credit

Funded credit Protection (FCP)

Protection (UFCP)

Part of exposures covered by Other funded

Part of exposures covered by Other eligible collaterals

credit protection

Part of Part of Part of Part of

Part of exposures exposures Part of exposures exposures Part of RWEA with

exposures covered by Part of covered by exposures covered by covered by Part of exposures RWEA without substitution

covered by Immovable exposures Other covered by Life Instruments exposures covered by substitution effects (both

Financial property covered by physical Cash on insurance held by a covered by Credit effects reduction and

Total Collaterals Collaterals Receivables collateral deposit policies third party Guarantees Derivatives (reduction sustitution

Amounts in Millions of Euros exposures (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) effects only) effects)