Professional Documents

Culture Documents

1.) What Is The Importance of Financial Statements in Business?

1.) What Is The Importance of Financial Statements in Business?

Uploaded by

Kathleen MercadoCopyright:

Available Formats

You might also like

- BAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryDocument111 pagesBAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryWachirajaneNo ratings yet

- Protection For DC Substations and AC Track Feeder StationsDocument11 pagesProtection For DC Substations and AC Track Feeder Stations曾乙申100% (1)

- Chrome ListDocument23 pagesChrome ListXatuna GoqadzeNo ratings yet

- Cases Chapter 1Document4 pagesCases Chapter 1Ahike HukatenNo ratings yet

- ACCOUNTINGDocument4 pagesACCOUNTINGhazelmaeesta3No ratings yet

- Chapter 1 - Introduction To Financial AccountingDocument28 pagesChapter 1 - Introduction To Financial AccountingTaehyung KimNo ratings yet

- FinAcc Chapter 1Document8 pagesFinAcc Chapter 1IrmaNo ratings yet

- Nature and Environment of AccountingDocument15 pagesNature and Environment of AccountingMonina AmanoNo ratings yet

- Module 1 - Accounting and BusinessDocument16 pagesModule 1 - Accounting and BusinessNiña Sharie Cardenas100% (1)

- Accounting ReviewerDocument9 pagesAccounting ReviewerLearni SarabiaNo ratings yet

- Unit IvDocument9 pagesUnit IvnamrataNo ratings yet

- Module 1Document23 pagesModule 1Ma Leah TañezaNo ratings yet

- Introduction To AccountingDocument4 pagesIntroduction To Accountingkrishiv malkaniNo ratings yet

- Group3. FARR REPORT - SolfDocument8 pagesGroup3. FARR REPORT - SolfAnnguily Sumatra GaidNo ratings yet

- Accounting QuizDocument14 pagesAccounting QuizMarthen YoparyNo ratings yet

- Fabm 1 Learning Package MidDocument12 pagesFabm 1 Learning Package MidbeejaybobobanNo ratings yet

- AAT Paper 2 FinanceDocument4 pagesAAT Paper 2 FinanceRay LaiNo ratings yet

- Introduction To AccountingDocument37 pagesIntroduction To AccountingRey ViloriaNo ratings yet

- CMA Volume IDocument432 pagesCMA Volume IEthan HuntNo ratings yet

- Accounting Standard of BangladeshDocument9 pagesAccounting Standard of BangladeshZahidnsuNo ratings yet

- Fama - Unit 1Document10 pagesFama - Unit 1Shivam TiwariNo ratings yet

- 2.1 Concept of Corporate Financial ReportingDocument23 pages2.1 Concept of Corporate Financial ReportingAnilNo ratings yet

- Finance 2 - Chapter Review #1Document29 pagesFinance 2 - Chapter Review #1jojie dadorNo ratings yet

- Basic ConceptsDocument5 pagesBasic ConceptsAgatha ApolinarioNo ratings yet

- Module 1Document23 pagesModule 1esparagozanichole01No ratings yet

- Fianancial AccountingDocument298 pagesFianancial Accountingelvis page kamunanwireNo ratings yet

- M1 Handout 1the Nature and Scope of Financial AccountingDocument3 pagesM1 Handout 1the Nature and Scope of Financial AccountingAmelia TaylorNo ratings yet

- Fa I Chapter 1Document10 pagesFa I Chapter 1Tewanay BesufikadNo ratings yet

- CBSE Class 11 Accountancy Revision Notes Chapter-1 Introduction To AccountingDocument8 pagesCBSE Class 11 Accountancy Revision Notes Chapter-1 Introduction To AccountingMayank Singh Rajawat100% (1)

- Accounting Principle From 1 To 10Document10 pagesAccounting Principle From 1 To 10trishqNo ratings yet

- Test 1Document4 pagesTest 1Leslie CarrollNo ratings yet

- FA FOR BADM Unit 2Document17 pagesFA FOR BADM Unit 2GUDATA ABARANo ratings yet

- Fundamental of Accounting: Chapter 1-2Document31 pagesFundamental of Accounting: Chapter 1-2Renshey Cordova MacasNo ratings yet

- Basic English Level 1Document12 pagesBasic English Level 1Ahmed Hossam BehairyNo ratings yet

- Assignment Intermediate Accounting CH 123Document5 pagesAssignment Intermediate Accounting CH 123NELVA QABLINANo ratings yet

- ACCTG Module - Unit 1 Introduction and Framework of AccountingDocument7 pagesACCTG Module - Unit 1 Introduction and Framework of AccountingMarian Joy QuiapeNo ratings yet

- ACCOUNTS NotesDocument11 pagesACCOUNTS Noteslalteshsharma335No ratings yet

- The Language of BusinessDocument3 pagesThe Language of BusinessMoataz abd el fattahNo ratings yet

- Accounting Theory Handout 1Document43 pagesAccounting Theory Handout 1Ockouri Barnes100% (3)

- Accounting and Its EnvironmentDocument27 pagesAccounting and Its EnvironmentMarta MeaNo ratings yet

- Resume - ALK Chapter 2Document17 pagesResume - ALK Chapter 2Leona Vierman Al-ZuraNo ratings yet

- CW-3 Types of Accounting Information, Qualittaive CharacteristicsDocument2 pagesCW-3 Types of Accounting Information, Qualittaive CharacteristicsShaun.No ratings yet

- Foundations of Accounting-2Document89 pagesFoundations of Accounting-2SWAPNIL BHISE100% (1)

- Introduction To Accounting Basic AccountingDocument16 pagesIntroduction To Accounting Basic AccountingNiña VelinaNo ratings yet

- Ballada Chap1Document5 pagesBallada Chap1telleNo ratings yet

- Accounting Concepts and ConventionDocument25 pagesAccounting Concepts and ConventionOKORIE UKAMAKANo ratings yet

- Chapter 1 AuditDocument13 pagesChapter 1 AuditMisshtaC100% (1)

- Acc140 NotesDocument60 pagesAcc140 Notesitstrll21No ratings yet

- Midterm Exam (Reviewer)Document84 pagesMidterm Exam (Reviewer)Mj PamintuanNo ratings yet

- Chapter 1 AnswerDocument11 pagesChapter 1 Answerelainelxy2508No ratings yet

- Lesson 1: Introduction To AccountingDocument4 pagesLesson 1: Introduction To AccountingDante SausaNo ratings yet

- AccountingDocument5 pagesAccountingShivam ChandraNo ratings yet

- Financial Accounting 2017 Ist Semester FinalDocument100 pagesFinancial Accounting 2017 Ist Semester FinalLOVERAGE MUNEMONo ratings yet

- Accounting Standards and Financial ReportingDocument9 pagesAccounting Standards and Financial ReportingIntan Rizky AzhariNo ratings yet

- Conceptual FrameworkDocument5 pagesConceptual FrameworkMaica PontillasNo ratings yet

- Conecepts and Convention Journal NotesDocument25 pagesConecepts and Convention Journal NotesSWAPNIL BHISE100% (1)

- Subject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesDocument16 pagesSubject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesAzuma JunichiNo ratings yet

- Conceptual FrameworkDocument5 pagesConceptual Frameworkchaleen23No ratings yet

- Introduction To AccountingDocument6 pagesIntroduction To AccountingBamidele AdegboyeNo ratings yet

- AccountingDocument13 pagesAccountingAutumn SapphireNo ratings yet

- Dollars and Sense: Demystifying Financial Records for Business OwnersFrom EverandDollars and Sense: Demystifying Financial Records for Business OwnersNo ratings yet

- General Rules For Track EventsDocument5 pagesGeneral Rules For Track EventsKathleen MercadoNo ratings yet

- 08act FinmarkDocument2 pages08act FinmarkKathleen MercadoNo ratings yet

- To Record Raw Materials Purchased On AccountDocument4 pagesTo Record Raw Materials Purchased On AccountKathleen MercadoNo ratings yet

- I. MULTIPLE CHOICE (5 Items X 2 Points) Name: Mercado, Kathleen DATE: 1/15/22 ScoreDocument3 pagesI. MULTIPLE CHOICE (5 Items X 2 Points) Name: Mercado, Kathleen DATE: 1/15/22 ScoreKathleen MercadoNo ratings yet

- Case Analyses: Abc Company: Create Awareness About Workplace FraudDocument2 pagesCase Analyses: Abc Company: Create Awareness About Workplace FraudKathleen MercadoNo ratings yet

- Task Performance On Global Marketing Name: Kathleen Mercado Section: Bsa-501 Date: 01/20/2022 ScoreDocument3 pagesTask Performance On Global Marketing Name: Kathleen Mercado Section: Bsa-501 Date: 01/20/2022 ScoreKathleen MercadoNo ratings yet

- Quiz On Global Human Resource Management Name: Mercado, Kathleen O. Section: Bsa - 501 Date: 01/22/2022 ScoreDocument2 pagesQuiz On Global Human Resource Management Name: Mercado, Kathleen O. Section: Bsa - 501 Date: 01/22/2022 ScoreKathleen MercadoNo ratings yet

- Name: Mercado, Kathleen Opeña - Date: 01/30/2022 Section: Bsa-501Document1 pageName: Mercado, Kathleen Opeña - Date: 01/30/2022 Section: Bsa-501Kathleen MercadoNo ratings yet

- 11TP GovernanceDocument2 pages11TP GovernanceKathleen MercadoNo ratings yet

- Name: Mercado, Kath DATE: 01/15 Score: Activity Answer The Following Items On A Separate Sheet of Paper. Show Your Computations. (4 Items X 5 Points)Document2 pagesName: Mercado, Kath DATE: 01/15 Score: Activity Answer The Following Items On A Separate Sheet of Paper. Show Your Computations. (4 Items X 5 Points)Kathleen MercadoNo ratings yet

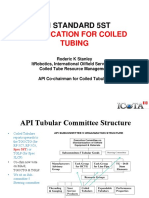

- ICoTA Canada 2010 PresentationDocument33 pagesICoTA Canada 2010 PresentationMahesh sinhaNo ratings yet

- SRM-3006-Tools en 02 06-2011Document68 pagesSRM-3006-Tools en 02 06-2011Patiala BsnlNo ratings yet

- MECH 103 - 5 Pressure Strength Testing of PipeworkDocument49 pagesMECH 103 - 5 Pressure Strength Testing of PipeworkStroom Limited100% (1)

- GR00004900 22a PDFDocument18 pagesGR00004900 22a PDFNicu PascalutaNo ratings yet

- Os Lab RecordDocument61 pagesOs Lab Recordmr.kumarulavalapudiNo ratings yet

- 5SDocument2 pages5SROSE OPEL ASPILLANo ratings yet

- Web Server COnfigurationDocument3 pagesWeb Server COnfigurationsidd shadabNo ratings yet

- AirPrime HL6 and HL8 Series at Commands Interface Guide Rev16 0Document815 pagesAirPrime HL6 and HL8 Series at Commands Interface Guide Rev16 0sdagsaghadfgsdNo ratings yet

- Filetype PDF Ip AddressDocument2 pagesFiletype PDF Ip AddressJeffNo ratings yet

- Tr2130c - Environmental Tests For EquipmentDocument17 pagesTr2130c - Environmental Tests For EquipmentKhairul AnuarNo ratings yet

- Electrical Parts List: 4-1 CS21A0MQ5X/BWTDocument10 pagesElectrical Parts List: 4-1 CS21A0MQ5X/BWTwkkchamaraNo ratings yet

- ANNEX 10 - Aeronautical Telecomunications (Volume V)Document48 pagesANNEX 10 - Aeronautical Telecomunications (Volume V)Syahid MachedaNo ratings yet

- As 4795.1-2011 Butterfly Valves For Waterworks Purposes Wafer and LuggedDocument7 pagesAs 4795.1-2011 Butterfly Valves For Waterworks Purposes Wafer and LuggedSAI Global - APACNo ratings yet

- Disclosure To Promote The Right To InformationDocument17 pagesDisclosure To Promote The Right To InformationMurali SomasundharamNo ratings yet

- Over ProvisioningDocument3 pagesOver ProvisioningscribdslaskNo ratings yet

- American Crane PDFDocument12 pagesAmerican Crane PDFJuan Carlos RuizNo ratings yet

- Indg207 - Wear Your DoesmeterDocument6 pagesIndg207 - Wear Your DoesmeteralimarhoonNo ratings yet

- Railway Hardware ListDocument80 pagesRailway Hardware ListOmkarNo ratings yet

- Mapeo Isup SipDocument6 pagesMapeo Isup SipDario AlfaroNo ratings yet

- PUR FO 01-09 Supplier Data SheetDocument7 pagesPUR FO 01-09 Supplier Data SheetManmohan SinghNo ratings yet

- Video Disk Communications Protocol: June 1999Document58 pagesVideo Disk Communications Protocol: June 1999mjfranklinNo ratings yet

- 74ALS374 - Dtype Flip FlopDocument7 pages74ALS374 - Dtype Flip FlopDwp BhaskaranNo ratings yet

- 211000-FireSprinklerandStandpipeSystems 508Document27 pages211000-FireSprinklerandStandpipeSystems 508jkhgvdj mnhsnjkhgNo ratings yet

- System Impacts From Interconnection of Distributed Resources: Current Status and Identification of Needs For Further DevelopmentDocument44 pagesSystem Impacts From Interconnection of Distributed Resources: Current Status and Identification of Needs For Further DevelopmentMichael DavisNo ratings yet

- 2014 Jamboree Searcher ManualDocument99 pages2014 Jamboree Searcher ManualdrandaNo ratings yet

- Asco Series 551 553 Direct Mount Inline Spool CatalogDocument4 pagesAsco Series 551 553 Direct Mount Inline Spool CatalogNaseer HydenNo ratings yet

- Differentiated HSE Pitch-NarrativeDocument3 pagesDifferentiated HSE Pitch-NarrativeKinoiNo ratings yet

- Guideline For Road in Uppwd PDFDocument31 pagesGuideline For Road in Uppwd PDFAmol saxenaNo ratings yet

1.) What Is The Importance of Financial Statements in Business?

1.) What Is The Importance of Financial Statements in Business?

Uploaded by

Kathleen MercadoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1.) What Is The Importance of Financial Statements in Business?

1.) What Is The Importance of Financial Statements in Business?

Uploaded by

Kathleen MercadoCopyright:

Available Formats

Mercado, Kathleen O.

01 Activity 1

BSA-301 Intermediate Accounting

1.) What is the importance of financial statements in business?

Financial statements are important for it contain significant information about

the business’ financial health. It helps the companies in decision making from

analyzing the financial statements that support growth and long-term

profitability. Businesses can evaluate efficiencies, profit margins, and if they

are looking for investors, financial statements will be the information they

need to investigate for investing and determine if disbursements are worthy

investments that create profit.

2.) What happens if companies do not practice the proper recording of

transactions and events?

Without accurate recording of transactions, contracts and delivery receipts

would cause corruption. There also will not have basis for checks and

balances when finding discrepancies. There is also a risk of having an off-the-

books accounts. There is also a law, where establishment and use of slush

fund breach into bribery and relevant laws.

3.) What is the importance of accounting?

Running a business needs data, records, reports, analysis, accurate

information about assets, debts, liabilities, profits that is in Accounting, that’s

why it is important in an business, which business is essential to us.

Accounting gives the management information regarding the financial position

of the business, in the proper execution of the functions of the management,

planning, controlling the business.

4.) What are the historical developments of accounting from Sumerian

Times to Modern Accounting?

Around 4000 B.C., the Sumerians would put seals in the envelope, to know

how many tokens are inside and would know if its tampered. Following their

leaders and the standards it possesses. There are more complex tokens were

used, denoting different units or type of goods. In modern accounting, there

are standards, regulations and ethical standards accountants need to follow.

Even businesses, corporations, government must follow in our daily lives.

5.) Explain at least one (1) function of any accounting standard-setting

bodies for financial reporting in the Philippines.

Financial Reporting Standards Council (FRSC) is the accounting standard-

setting body created by the Professional Regulation Commission upon the

recommendation of the Board of Accountancy to assist the Board in carrying

out its powers and functions provided under R.A. No. 9298. Its main function

is to establish and improve the accounting standards that will be generally

accepted in the Philippines. The highest hierarchy of GAAP in the Philippines

was promulgated by FRSC, adopted the pronouncements made by IASB and

approves the implementation of the local version.

6.) Enumerate the two (2) qualitative characteristics for financial reporting

and its subtopics.

Fundamental Qualitative Characteristics – relate to the content or

substance of financial information.

Relevance – enables the financial information to make difference

in a decision made by users.

Faithful Representation – information to be complete, neutral, and

free from error.

Enhancing Qualitative Characteristics – relate to the presentation or

form of financial information.

Comparability – enables users to identify and understand

similarities in, and difference among items.

Verifiability – allows different knowledge and independent

observers to reach consensus.

Timeliness – information is available to decision-makers in times

of decision-making.

Understandability – requires financial information to be presented

clear, intelligible, and concise.

You might also like

- BAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryDocument111 pagesBAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryWachirajaneNo ratings yet

- Protection For DC Substations and AC Track Feeder StationsDocument11 pagesProtection For DC Substations and AC Track Feeder Stations曾乙申100% (1)

- Chrome ListDocument23 pagesChrome ListXatuna GoqadzeNo ratings yet

- Cases Chapter 1Document4 pagesCases Chapter 1Ahike HukatenNo ratings yet

- ACCOUNTINGDocument4 pagesACCOUNTINGhazelmaeesta3No ratings yet

- Chapter 1 - Introduction To Financial AccountingDocument28 pagesChapter 1 - Introduction To Financial AccountingTaehyung KimNo ratings yet

- FinAcc Chapter 1Document8 pagesFinAcc Chapter 1IrmaNo ratings yet

- Nature and Environment of AccountingDocument15 pagesNature and Environment of AccountingMonina AmanoNo ratings yet

- Module 1 - Accounting and BusinessDocument16 pagesModule 1 - Accounting and BusinessNiña Sharie Cardenas100% (1)

- Accounting ReviewerDocument9 pagesAccounting ReviewerLearni SarabiaNo ratings yet

- Unit IvDocument9 pagesUnit IvnamrataNo ratings yet

- Module 1Document23 pagesModule 1Ma Leah TañezaNo ratings yet

- Introduction To AccountingDocument4 pagesIntroduction To Accountingkrishiv malkaniNo ratings yet

- Group3. FARR REPORT - SolfDocument8 pagesGroup3. FARR REPORT - SolfAnnguily Sumatra GaidNo ratings yet

- Accounting QuizDocument14 pagesAccounting QuizMarthen YoparyNo ratings yet

- Fabm 1 Learning Package MidDocument12 pagesFabm 1 Learning Package MidbeejaybobobanNo ratings yet

- AAT Paper 2 FinanceDocument4 pagesAAT Paper 2 FinanceRay LaiNo ratings yet

- Introduction To AccountingDocument37 pagesIntroduction To AccountingRey ViloriaNo ratings yet

- CMA Volume IDocument432 pagesCMA Volume IEthan HuntNo ratings yet

- Accounting Standard of BangladeshDocument9 pagesAccounting Standard of BangladeshZahidnsuNo ratings yet

- Fama - Unit 1Document10 pagesFama - Unit 1Shivam TiwariNo ratings yet

- 2.1 Concept of Corporate Financial ReportingDocument23 pages2.1 Concept of Corporate Financial ReportingAnilNo ratings yet

- Finance 2 - Chapter Review #1Document29 pagesFinance 2 - Chapter Review #1jojie dadorNo ratings yet

- Basic ConceptsDocument5 pagesBasic ConceptsAgatha ApolinarioNo ratings yet

- Module 1Document23 pagesModule 1esparagozanichole01No ratings yet

- Fianancial AccountingDocument298 pagesFianancial Accountingelvis page kamunanwireNo ratings yet

- M1 Handout 1the Nature and Scope of Financial AccountingDocument3 pagesM1 Handout 1the Nature and Scope of Financial AccountingAmelia TaylorNo ratings yet

- Fa I Chapter 1Document10 pagesFa I Chapter 1Tewanay BesufikadNo ratings yet

- CBSE Class 11 Accountancy Revision Notes Chapter-1 Introduction To AccountingDocument8 pagesCBSE Class 11 Accountancy Revision Notes Chapter-1 Introduction To AccountingMayank Singh Rajawat100% (1)

- Accounting Principle From 1 To 10Document10 pagesAccounting Principle From 1 To 10trishqNo ratings yet

- Test 1Document4 pagesTest 1Leslie CarrollNo ratings yet

- FA FOR BADM Unit 2Document17 pagesFA FOR BADM Unit 2GUDATA ABARANo ratings yet

- Fundamental of Accounting: Chapter 1-2Document31 pagesFundamental of Accounting: Chapter 1-2Renshey Cordova MacasNo ratings yet

- Basic English Level 1Document12 pagesBasic English Level 1Ahmed Hossam BehairyNo ratings yet

- Assignment Intermediate Accounting CH 123Document5 pagesAssignment Intermediate Accounting CH 123NELVA QABLINANo ratings yet

- ACCTG Module - Unit 1 Introduction and Framework of AccountingDocument7 pagesACCTG Module - Unit 1 Introduction and Framework of AccountingMarian Joy QuiapeNo ratings yet

- ACCOUNTS NotesDocument11 pagesACCOUNTS Noteslalteshsharma335No ratings yet

- The Language of BusinessDocument3 pagesThe Language of BusinessMoataz abd el fattahNo ratings yet

- Accounting Theory Handout 1Document43 pagesAccounting Theory Handout 1Ockouri Barnes100% (3)

- Accounting and Its EnvironmentDocument27 pagesAccounting and Its EnvironmentMarta MeaNo ratings yet

- Resume - ALK Chapter 2Document17 pagesResume - ALK Chapter 2Leona Vierman Al-ZuraNo ratings yet

- CW-3 Types of Accounting Information, Qualittaive CharacteristicsDocument2 pagesCW-3 Types of Accounting Information, Qualittaive CharacteristicsShaun.No ratings yet

- Foundations of Accounting-2Document89 pagesFoundations of Accounting-2SWAPNIL BHISE100% (1)

- Introduction To Accounting Basic AccountingDocument16 pagesIntroduction To Accounting Basic AccountingNiña VelinaNo ratings yet

- Ballada Chap1Document5 pagesBallada Chap1telleNo ratings yet

- Accounting Concepts and ConventionDocument25 pagesAccounting Concepts and ConventionOKORIE UKAMAKANo ratings yet

- Chapter 1 AuditDocument13 pagesChapter 1 AuditMisshtaC100% (1)

- Acc140 NotesDocument60 pagesAcc140 Notesitstrll21No ratings yet

- Midterm Exam (Reviewer)Document84 pagesMidterm Exam (Reviewer)Mj PamintuanNo ratings yet

- Chapter 1 AnswerDocument11 pagesChapter 1 Answerelainelxy2508No ratings yet

- Lesson 1: Introduction To AccountingDocument4 pagesLesson 1: Introduction To AccountingDante SausaNo ratings yet

- AccountingDocument5 pagesAccountingShivam ChandraNo ratings yet

- Financial Accounting 2017 Ist Semester FinalDocument100 pagesFinancial Accounting 2017 Ist Semester FinalLOVERAGE MUNEMONo ratings yet

- Accounting Standards and Financial ReportingDocument9 pagesAccounting Standards and Financial ReportingIntan Rizky AzhariNo ratings yet

- Conceptual FrameworkDocument5 pagesConceptual FrameworkMaica PontillasNo ratings yet

- Conecepts and Convention Journal NotesDocument25 pagesConecepts and Convention Journal NotesSWAPNIL BHISE100% (1)

- Subject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesDocument16 pagesSubject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesAzuma JunichiNo ratings yet

- Conceptual FrameworkDocument5 pagesConceptual Frameworkchaleen23No ratings yet

- Introduction To AccountingDocument6 pagesIntroduction To AccountingBamidele AdegboyeNo ratings yet

- AccountingDocument13 pagesAccountingAutumn SapphireNo ratings yet

- Dollars and Sense: Demystifying Financial Records for Business OwnersFrom EverandDollars and Sense: Demystifying Financial Records for Business OwnersNo ratings yet

- General Rules For Track EventsDocument5 pagesGeneral Rules For Track EventsKathleen MercadoNo ratings yet

- 08act FinmarkDocument2 pages08act FinmarkKathleen MercadoNo ratings yet

- To Record Raw Materials Purchased On AccountDocument4 pagesTo Record Raw Materials Purchased On AccountKathleen MercadoNo ratings yet

- I. MULTIPLE CHOICE (5 Items X 2 Points) Name: Mercado, Kathleen DATE: 1/15/22 ScoreDocument3 pagesI. MULTIPLE CHOICE (5 Items X 2 Points) Name: Mercado, Kathleen DATE: 1/15/22 ScoreKathleen MercadoNo ratings yet

- Case Analyses: Abc Company: Create Awareness About Workplace FraudDocument2 pagesCase Analyses: Abc Company: Create Awareness About Workplace FraudKathleen MercadoNo ratings yet

- Task Performance On Global Marketing Name: Kathleen Mercado Section: Bsa-501 Date: 01/20/2022 ScoreDocument3 pagesTask Performance On Global Marketing Name: Kathleen Mercado Section: Bsa-501 Date: 01/20/2022 ScoreKathleen MercadoNo ratings yet

- Quiz On Global Human Resource Management Name: Mercado, Kathleen O. Section: Bsa - 501 Date: 01/22/2022 ScoreDocument2 pagesQuiz On Global Human Resource Management Name: Mercado, Kathleen O. Section: Bsa - 501 Date: 01/22/2022 ScoreKathleen MercadoNo ratings yet

- Name: Mercado, Kathleen Opeña - Date: 01/30/2022 Section: Bsa-501Document1 pageName: Mercado, Kathleen Opeña - Date: 01/30/2022 Section: Bsa-501Kathleen MercadoNo ratings yet

- 11TP GovernanceDocument2 pages11TP GovernanceKathleen MercadoNo ratings yet

- Name: Mercado, Kath DATE: 01/15 Score: Activity Answer The Following Items On A Separate Sheet of Paper. Show Your Computations. (4 Items X 5 Points)Document2 pagesName: Mercado, Kath DATE: 01/15 Score: Activity Answer The Following Items On A Separate Sheet of Paper. Show Your Computations. (4 Items X 5 Points)Kathleen MercadoNo ratings yet

- ICoTA Canada 2010 PresentationDocument33 pagesICoTA Canada 2010 PresentationMahesh sinhaNo ratings yet

- SRM-3006-Tools en 02 06-2011Document68 pagesSRM-3006-Tools en 02 06-2011Patiala BsnlNo ratings yet

- MECH 103 - 5 Pressure Strength Testing of PipeworkDocument49 pagesMECH 103 - 5 Pressure Strength Testing of PipeworkStroom Limited100% (1)

- GR00004900 22a PDFDocument18 pagesGR00004900 22a PDFNicu PascalutaNo ratings yet

- Os Lab RecordDocument61 pagesOs Lab Recordmr.kumarulavalapudiNo ratings yet

- 5SDocument2 pages5SROSE OPEL ASPILLANo ratings yet

- Web Server COnfigurationDocument3 pagesWeb Server COnfigurationsidd shadabNo ratings yet

- AirPrime HL6 and HL8 Series at Commands Interface Guide Rev16 0Document815 pagesAirPrime HL6 and HL8 Series at Commands Interface Guide Rev16 0sdagsaghadfgsdNo ratings yet

- Filetype PDF Ip AddressDocument2 pagesFiletype PDF Ip AddressJeffNo ratings yet

- Tr2130c - Environmental Tests For EquipmentDocument17 pagesTr2130c - Environmental Tests For EquipmentKhairul AnuarNo ratings yet

- Electrical Parts List: 4-1 CS21A0MQ5X/BWTDocument10 pagesElectrical Parts List: 4-1 CS21A0MQ5X/BWTwkkchamaraNo ratings yet

- ANNEX 10 - Aeronautical Telecomunications (Volume V)Document48 pagesANNEX 10 - Aeronautical Telecomunications (Volume V)Syahid MachedaNo ratings yet

- As 4795.1-2011 Butterfly Valves For Waterworks Purposes Wafer and LuggedDocument7 pagesAs 4795.1-2011 Butterfly Valves For Waterworks Purposes Wafer and LuggedSAI Global - APACNo ratings yet

- Disclosure To Promote The Right To InformationDocument17 pagesDisclosure To Promote The Right To InformationMurali SomasundharamNo ratings yet

- Over ProvisioningDocument3 pagesOver ProvisioningscribdslaskNo ratings yet

- American Crane PDFDocument12 pagesAmerican Crane PDFJuan Carlos RuizNo ratings yet

- Indg207 - Wear Your DoesmeterDocument6 pagesIndg207 - Wear Your DoesmeteralimarhoonNo ratings yet

- Railway Hardware ListDocument80 pagesRailway Hardware ListOmkarNo ratings yet

- Mapeo Isup SipDocument6 pagesMapeo Isup SipDario AlfaroNo ratings yet

- PUR FO 01-09 Supplier Data SheetDocument7 pagesPUR FO 01-09 Supplier Data SheetManmohan SinghNo ratings yet

- Video Disk Communications Protocol: June 1999Document58 pagesVideo Disk Communications Protocol: June 1999mjfranklinNo ratings yet

- 74ALS374 - Dtype Flip FlopDocument7 pages74ALS374 - Dtype Flip FlopDwp BhaskaranNo ratings yet

- 211000-FireSprinklerandStandpipeSystems 508Document27 pages211000-FireSprinklerandStandpipeSystems 508jkhgvdj mnhsnjkhgNo ratings yet

- System Impacts From Interconnection of Distributed Resources: Current Status and Identification of Needs For Further DevelopmentDocument44 pagesSystem Impacts From Interconnection of Distributed Resources: Current Status and Identification of Needs For Further DevelopmentMichael DavisNo ratings yet

- 2014 Jamboree Searcher ManualDocument99 pages2014 Jamboree Searcher ManualdrandaNo ratings yet

- Asco Series 551 553 Direct Mount Inline Spool CatalogDocument4 pagesAsco Series 551 553 Direct Mount Inline Spool CatalogNaseer HydenNo ratings yet

- Differentiated HSE Pitch-NarrativeDocument3 pagesDifferentiated HSE Pitch-NarrativeKinoiNo ratings yet

- Guideline For Road in Uppwd PDFDocument31 pagesGuideline For Road in Uppwd PDFAmol saxenaNo ratings yet