Professional Documents

Culture Documents

US Internal Revenue Service: p4407

US Internal Revenue Service: p4407

Uploaded by

IRSOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: p4407

US Internal Revenue Service: p4407

Uploaded by

IRSCopyright:

Available Formats

Internal Revenue Service

Tax Exempt and Government Entities

Employee Plans

Customer Assistance

For more information about

retirement plans, including SARSEPs,

see Retirement Source for Plan

SARSEP

Salary Reduction

R

Sponsors/Employers at www.irs.gov/ep.

etirement plans provide

Simplified Employee

significant tax advantages Pension

For technical and procedural answers

to you and your employees. One to your retirement plan tax law inquiries,

Key Issues and Assistance

such plan is the Salary Reduction use the following options:

Simplified Employee Pension (877) 829-5500

Tax Exempt and Government Entities

(SARSEP) plan.This brochure Customer Account Services

addresses key issues, solutions, www.irs.gov/ep

and resources for assistance with (Visit EP Customer Services

under Related Topics)

your SARSEP plan.

Internal Revenue Service

Tax Exempt and Government Entities

What Is a Salary Reduction Customer Account Services

Simplified Employee Pension P.O. Box 2508

(SARSEP) Plan? Cincinnati, OH 45201

SARSEP retirement plans are written

arrangements set up before 1997.

Contributions consist of employer To stay informed, subscribe today to

contributions and employee deferrals the Retirement News for Employers at

made directly to an eligible employee’s www.irs.gov/ep. Click Newsletters.

individual retirement arrangement

(IRA). An eligible employee is an

employee who is at least age 21, has

worked for you in three out of the last

five years and whose total compensa- Department of the Treasury

Internal Revenue Service

tion for the year is at least $450. w w w . i r s . g o v

Publication 4407 (10-2004)

Catalog Number 38982P

SARSEP Common Mistakes SARSEP Solutions

K nowing the tax rules applicable

to your business’s retirement plan

can help you provide a better

plan for you and your employees, and help

keep you in compliance with the law. In a

Violation of the Greater Than No

More Than 25 Eligible Employees Rule

If you had more than 25 eligible employees at

any time during the prior year, you cannot accept

deferrals in the current year.

I f your SARSEP has mistakes, take steps to

bring your plan into compliance so you can

continue to provide your employees with

retirement benefits on a tax-favored basis.You

may want to contact a tax professional for help.

national sample of examined SARSEPs, the You can correct plan mistakes through the

IRS found the following common mistakes: Violation of 50% Rule Employee Plans Compliance Resolution System

At least 50% of all eligible employees must elect (EPCRS). Information on EPCRS is available

Failure of Deferral Percentage Test

to make deferrals to the plan in any year, or all through www.irs.gov/ep. Click on Correction.

The amount each highly compensated

deferrals in that year are disallowed.

employee (HCE) may defer is limited.The For information on SARSEPs and other retire-

deferral percentage test for a SARSEP

Violation of Deductible ment plans, please refer to the following free

compares the deferral percentage of each

Employer Contribution Limit publications at www.irs.gov:

HCE with the average of the deferral per-

Employer contributions are limited to 25% of each ■ Publication 560, Retirement Plans for Small

centages of all other eligible employees.

eligible employee's compensation. Business (SEP, SIMPLE, and Qualified Plans)

For details on how to perform this test,

please refer to your plan document, or ■ Publication 590, Individual

Failure To Timely Amend Plan Document Retirement Arrangements (IRAs)

the Instructions for Form 5305A-SEP, or

SARSEPs generally must be amended to keep ■ Publication 3998, Choosing a

IRS Publication 560, Retirement Plans

current with the latest tax law changes. For those Retirement Solution for Your Small Business

for Small Business (SEP, SIMPLE, and

employers that use the model Form 5305A-SEP ■ Publication 4050, Retirement Plan

Qualified Plans).

as their SARSEP plan document, the most current Correction Programs (CD-ROM)

version of the form must be used. Note: The revision ■ Publication 4224, Retirement Plan

Failure To Make the

date is located in the upper left-hand corner of the form. Correction Programs

Required Top-Heavy Contribution

Most SARSEPs, including all model SARSEPs ■ Publication 4286, SARSEP Checklist

(Form 5305A-SEP), require top-heavy contri- ■ Publication 4336, SARSEPs

butions. In general, the employer is required for Small Businesses

to make a 3% minimum top-heavy contri- To order publications, call the IRS at

bution for each eligible non-key employee. (800) 829-3676.

Non-key employees are generally employees

who are not owners or high-paid officers.

SARSEP Common Mistakes SARSEP Solutions

K nowing the tax rules applicable

to your business’s retirement plan

can help you provide a better

plan for you and your employees, and help

keep you in compliance with the law. In a

Violation of the Greater Than No

More Than 25 Eligible Employees Rule

If you had more than 25 eligible employees at

any time during the prior year, you cannot accept

deferrals in the current year.

I f your SARSEP has mistakes, take steps to

bring your plan into compliance so you can

continue to provide your employees with

retirement benefits on a tax-favored basis.You

may want to contact a tax professional for help.

national sample of examined SARSEPs, the You can correct plan mistakes through the

IRS found the following common mistakes: Violation of 50% Rule Employee Plans Compliance Resolution System

At least 50% of all eligible employees must elect (EPCRS). Information on EPCRS is available

Failure of Deferral Percentage Test

to make deferrals to the plan in any year, or all through www.irs.gov/ep. Click on Correction.

The amount each highly compensated

deferrals in that year are disallowed.

employee (HCE) may defer is limited.The For information on SARSEPs and other retire-

deferral percentage test for a SARSEP

Violation of Deductible ment plans, please refer to the following free

compares the deferral percentage of each

Employer Contribution Limit publications at www.irs.gov:

HCE with the average of the deferral per-

Employer contributions are limited to 25% of each ■ Publication 560, Retirement Plans for Small

centages of all other eligible employees.

eligible employee's compensation. Business (SEP, SIMPLE, and Qualified Plans)

For details on how to perform this test,

please refer to your plan document, or ■ Publication 590, Individual

Failure To Timely Amend Plan Document Retirement Arrangements (IRAs)

the Instructions for Form 5305A-SEP, or

SARSEPs generally must be amended to keep ■ Publication 3998, Choosing a

IRS Publication 560, Retirement Plans

current with the latest tax law changes. For those Retirement Solution for Your Small Business

for Small Business (SEP, SIMPLE, and

employers that use the model Form 5305A-SEP ■ Publication 4050, Retirement Plan

Qualified Plans).

as their SARSEP plan document, the most current Correction Programs (CD-ROM)

version of the form must be used. Note: The revision ■ Publication 4224, Retirement Plan

Failure To Make the

date is located in the upper left-hand corner of the form. Correction Programs

Required Top-Heavy Contribution

Most SARSEPs, including all model SARSEPs ■ Publication 4286, SARSEP Checklist

(Form 5305A-SEP), require top-heavy contri- ■ Publication 4336, SARSEPs

butions. In general, the employer is required for Small Businesses

to make a 3% minimum top-heavy contri- To order publications, call the IRS at

bution for each eligible non-key employee. (800) 829-3676.

Non-key employees are generally employees

who are not owners or high-paid officers.

SARSEP Common Mistakes SARSEP Solutions

K nowing the tax rules applicable

to your business’s retirement plan

can help you provide a better

plan for you and your employees, and help

keep you in compliance with the law. In a

Violation of the Greater Than No

More Than 25 Eligible Employees Rule

If you had more than 25 eligible employees at

any time during the prior year, you cannot accept

deferrals in the current year.

I f your SARSEP has mistakes, take steps to

bring your plan into compliance so you can

continue to provide your employees with

retirement benefits on a tax-favored basis.You

may want to contact a tax professional for help.

national sample of examined SARSEPs, the You can correct plan mistakes through the

IRS found the following common mistakes: Violation of 50% Rule Employee Plans Compliance Resolution System

At least 50% of all eligible employees must elect (EPCRS). Information on EPCRS is available

Failure of Deferral Percentage Test

to make deferrals to the plan in any year, or all through www.irs.gov/ep. Click on Correction.

The amount each highly compensated

deferrals in that year are disallowed.

employee (HCE) may defer is limited.The For information on SARSEPs and other retire-

deferral percentage test for a SARSEP

Violation of Deductible ment plans, please refer to the following free

compares the deferral percentage of each

Employer Contribution Limit publications at www.irs.gov:

HCE with the average of the deferral per-

Employer contributions are limited to 25% of each ■ Publication 560, Retirement Plans for Small

centages of all other eligible employees.

eligible employee's compensation. Business (SEP, SIMPLE, and Qualified Plans)

For details on how to perform this test,

please refer to your plan document, or ■ Publication 590, Individual

Failure To Timely Amend Plan Document Retirement Arrangements (IRAs)

the Instructions for Form 5305A-SEP, or

SARSEPs generally must be amended to keep ■ Publication 3998, Choosing a

IRS Publication 560, Retirement Plans

current with the latest tax law changes. For those Retirement Solution for Your Small Business

for Small Business (SEP, SIMPLE, and

employers that use the model Form 5305A-SEP ■ Publication 4050, Retirement Plan

Qualified Plans).

as their SARSEP plan document, the most current Correction Programs (CD-ROM)

version of the form must be used. Note: The revision ■ Publication 4224, Retirement Plan

Failure To Make the

date is located in the upper left-hand corner of the form. Correction Programs

Required Top-Heavy Contribution

Most SARSEPs, including all model SARSEPs ■ Publication 4286, SARSEP Checklist

(Form 5305A-SEP), require top-heavy contri- ■ Publication 4336, SARSEPs

butions. In general, the employer is required for Small Businesses

to make a 3% minimum top-heavy contri- To order publications, call the IRS at

bution for each eligible non-key employee. (800) 829-3676.

Non-key employees are generally employees

who are not owners or high-paid officers.

Internal Revenue Service

Tax Exempt and Government Entities

Employee Plans

Customer Assistance

For more information about

retirement plans, including SARSEPs,

see Retirement Source for Plan

SARSEP

Salary Reduction

R

Sponsors/Employers at www.irs.gov/ep.

etirement plans provide

Simplified Employee

significant tax advantages Pension

For technical and procedural answers

to you and your employees. One to your retirement plan tax law inquiries,

Key Issues and Assistance

such plan is the Salary Reduction use the following options:

Simplified Employee Pension (877) 829-5500

Tax Exempt and Government Entities

(SARSEP) plan.This brochure Customer Account Services

addresses key issues, solutions, www.irs.gov/ep

and resources for assistance with (Visit EP Customer Services

under Related Topics)

your SARSEP plan.

Internal Revenue Service

Tax Exempt and Government Entities

What Is a Salary Reduction Customer Account Services

Simplified Employee Pension P.O. Box 2508

(SARSEP) Plan? Cincinnati, OH 45201

SARSEP retirement plans are written

arrangements set up before 1997.

Contributions consist of employer To stay informed, subscribe today to

contributions and employee deferrals the Retirement News for Employers at

made directly to an eligible employee’s www.irs.gov/ep. Click Newsletters.

individual retirement arrangement

(IRA). An eligible employee is an

employee who is at least age 21, has

worked for you in three out of the last

five years and whose total compensa- Department of the Treasury

Internal Revenue Service

tion for the year is at least $450. w w w . i r s . g o v

Publication 4407 (10-2004)

Catalog Number 38982P

Internal Revenue Service

Tax Exempt and Government Entities

Employee Plans

Customer Assistance

For more information about

retirement plans, including SARSEPs,

see Retirement Source for Plan

SARSEP

Salary Reduction

R

Sponsors/Employers at www.irs.gov/ep.

etirement plans provide

Simplified Employee

significant tax advantages Pension

For technical and procedural answers

to you and your employees. One to your retirement plan tax law inquiries,

Key Issues and Assistance

such plan is the Salary Reduction use the following options:

Simplified Employee Pension (877) 829-5500

Tax Exempt and Government Entities

(SARSEP) plan.This brochure Customer Account Services

addresses key issues, solutions, www.irs.gov/ep

and resources for assistance with (Visit EP Customer Services

under Related Topics)

your SARSEP plan.

Internal Revenue Service

Tax Exempt and Government Entities

What Is a Salary Reduction Customer Account Services

Simplified Employee Pension P.O. Box 2508

(SARSEP) Plan? Cincinnati, OH 45201

SARSEP retirement plans are written

arrangements set up before 1997.

Contributions consist of employer To stay informed, subscribe today to

contributions and employee deferrals the Retirement News for Employers at

made directly to an eligible employee’s www.irs.gov/ep. Click Newsletters.

individual retirement arrangement

(IRA). An eligible employee is an

employee who is at least age 21, has

worked for you in three out of the last

five years and whose total compensa- Department of the Treasury

Internal Revenue Service

tion for the year is at least $450. w w w . i r s . g o v

Publication 4407 (9-2004)

Catalog Number 38982P

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Benefits Administration - 1Document34 pagesBenefits Administration - 1vivek_sharma13No ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Architects DataDocument29 pagesArchitects DataYogs Patil50% (2)

- Payroll Dictionary of Payroll and HR TermsDocument28 pagesPayroll Dictionary of Payroll and HR TermsMarkandeya ChitturiNo ratings yet

- Submitted To DR Santoshi Sen Gupta: Submitted by Priyanshu, Manisha, Neeraj, Tina, AkashDocument20 pagesSubmitted To DR Santoshi Sen Gupta: Submitted by Priyanshu, Manisha, Neeraj, Tina, AkashPriyanshuChauhanNo ratings yet

- Section 125 Cafeteria Plans OverviewDocument10 pagesSection 125 Cafeteria Plans OverviewmarkNo ratings yet

- Executive Benefit Plan (EBP) (Flyer)Document2 pagesExecutive Benefit Plan (EBP) (Flyer)CFSUSNo ratings yet

- Choosing: A Retirement SolutionDocument8 pagesChoosing: A Retirement Solutionapi-309082881No ratings yet

- Tax Exempt and Government Entities (TE/GE) Employee PlansDocument34 pagesTax Exempt and Government Entities (TE/GE) Employee PlansIRSNo ratings yet

- IRS Publication 4333Document12 pagesIRS Publication 4333Francis Wolfgang UrbanNo ratings yet

- Pederson CPA Review FAR Notes PensionDocument8 pagesPederson CPA Review FAR Notes Pensionboen jaymeNo ratings yet

- Edu 2013 10 Ret Plan Exam Case Kuk671xDocument20 pagesEdu 2013 10 Ret Plan Exam Case Kuk671xjusttestitNo ratings yet

- Pre Tax - Post SGJGTaxDocument1 pagePre Tax - Post SGJGTaxAnand RishiNo ratings yet

- Guide To Taxation of Employee Disability Benefits: Standard Insurance CompanyDocument26 pagesGuide To Taxation of Employee Disability Benefits: Standard Insurance CompanyJacen BondsNo ratings yet

- SheldonAcharekar Vrs CrsDocument16 pagesSheldonAcharekar Vrs CrsNitin KanojiaNo ratings yet

- Presentation On PayrollDocument19 pagesPresentation On Payrollmudra123456789No ratings yet

- PPP For Accountants - Celernus Investment PartnersDocument8 pagesPPP For Accountants - Celernus Investment PartnersCGrantNo ratings yet

- Instructions For Form 8941Document30 pagesInstructions For Form 8941FDEFNo ratings yet

- Entrep MODULE 7Document4 pagesEntrep MODULE 7stephen allan ambalaNo ratings yet

- ADP Year End Payroll GuideDocument5 pagesADP Year End Payroll Guidefabia.a.martins3No ratings yet

- Assignment of Research Methodology ON Voluntary Retirement SchemeDocument14 pagesAssignment of Research Methodology ON Voluntary Retirement SchemeParina JainNo ratings yet

- Vrs FinalDocument13 pagesVrs FinalTapan Mangesh GharatNo ratings yet

- Summarizing Chapter 17 Herring Ton The Risk ManagementDocument4 pagesSummarizing Chapter 17 Herring Ton The Risk ManagementMd Shohag AliNo ratings yet

- Impact of Revised Wage Code On Gratuity LiabilitiesDocument3 pagesImpact of Revised Wage Code On Gratuity LiabilitiesARKAJIT DEY-DMNo ratings yet

- Downsizing: Employee Retrenchment Laws in IndiaDocument3 pagesDownsizing: Employee Retrenchment Laws in IndiaaniranNo ratings yet

- F 5305 SepDocument2 pagesF 5305 SepIRSNo ratings yet

- HRDocument51 pagesHRkaran12110% (1)

- Exit PolicyDocument16 pagesExit PolicyRangunwalaNo ratings yet

- US Internal Revenue Service: p4224Document6 pagesUS Internal Revenue Service: p4224IRSNo ratings yet

- Vrs FinalDocument11 pagesVrs FinalTapan Mangesh GharatNo ratings yet

- Voluntary Retirement Scheme1 115Document30 pagesVoluntary Retirement Scheme1 115anon_966824No ratings yet

- Understanding Compensation & Statutory Compliance: Prof. Tapash Dey,-Panel Faculty-TISS-SVEDocument34 pagesUnderstanding Compensation & Statutory Compliance: Prof. Tapash Dey,-Panel Faculty-TISS-SVESneha KadamNo ratings yet

- Assignment On Human Resource Management MB 206 Mba 2 Semester Submitted To-Sir S. Bose Submitted by - Atul AnandDocument3 pagesAssignment On Human Resource Management MB 206 Mba 2 Semester Submitted To-Sir S. Bose Submitted by - Atul AnandAtulNo ratings yet

- HUMRESDocument7 pagesHUMRESjane dillanNo ratings yet

- Ilawunit 1Document56 pagesIlawunit 1ManishKumarRoasanNo ratings yet

- BIFFPP-Step 9 CPA BermudaDocument18 pagesBIFFPP-Step 9 CPA BermudaRG-eviewerNo ratings yet

- Compensation: Incentive Plans: Profit SharingDocument5 pagesCompensation: Incentive Plans: Profit SharingFlorie Ann AguilarNo ratings yet

- Gratuity Valuation From - 1000Document151 pagesGratuity Valuation From - 1000Ghada AldukhiNo ratings yet

- HRM Reward and IncentivesDocument45 pagesHRM Reward and IncentivesElnur MahmudovNo ratings yet

- Organisation For Economic Co-Operation and Development: Hosted by The Government of BrazilDocument11 pagesOrganisation For Economic Co-Operation and Development: Hosted by The Government of Brazildata4csasNo ratings yet

- ManagementLetter - Possible PointsDocument103 pagesManagementLetter - Possible Pointsaian joseph100% (3)

- Good Small Business Actionlist: Introducing A Cafeteria Benefits ProgramDocument5 pagesGood Small Business Actionlist: Introducing A Cafeteria Benefits ProgramhdfcblgoaNo ratings yet

- Air India Limited: 1. Cost To Company For Calculation of Draft RBPDocument10 pagesAir India Limited: 1. Cost To Company For Calculation of Draft RBPghanghas_ankitNo ratings yet

- Shalu GuptaDocument5 pagesShalu GuptaRitesh SinghNo ratings yet

- Assignment 3 - Short Report On FSADocument9 pagesAssignment 3 - Short Report On FSAGhina ShaikhNo ratings yet

- Lab Sandeep Kumar Raina b54 Roll No 27 10 - Lab - Week5 - s7 9 - Application AssignmentDocument4 pagesLab Sandeep Kumar Raina b54 Roll No 27 10 - Lab - Week5 - s7 9 - Application Assignmentsandeepraina0% (1)

- Pathways - IPPDocument1 pagePathways - IPParsenic210No ratings yet

- About Your Retirement: Slide 1Document21 pagesAbout Your Retirement: Slide 1IRSNo ratings yet

- Business Rules For Deduction - Benefit Plans ConfigurationDocument5 pagesBusiness Rules For Deduction - Benefit Plans ConfigurationCesarNo ratings yet

- Configuration of Tax Calculation Procedure TAXINNDocument6 pagesConfiguration of Tax Calculation Procedure TAXINNpawanNo ratings yet

- PSG Module 7Document30 pagesPSG Module 7Deepak KumarNo ratings yet

- Paying EmployeeDocument2 pagesPaying EmployeeMohammad YoussefiNo ratings yet

- Executive RemunerationDocument7 pagesExecutive Remunerationkrsatyam10No ratings yet

- BAHR 222 - Week 1-2Document16 pagesBAHR 222 - Week 1-2Prescious Joy Donaire100% (1)

- Employers Provident Fund (Epf) : Employer CoverageDocument8 pagesEmployers Provident Fund (Epf) : Employer Coveragevarunreddycool0% (1)

- Incentive Pay: Casual Incentives-The Simplicity Inherent in The Casual IncentiveDocument14 pagesIncentive Pay: Casual Incentives-The Simplicity Inherent in The Casual IncentiveShaine CalabiaNo ratings yet

- Corm 1Document38 pagesCorm 1MAYURIKANo ratings yet

- PayrollFundamentalsWorkbook AnswersDocument34 pagesPayrollFundamentalsWorkbook AnswersParamintaramaha ParamintaramahaNo ratings yet

- Tutorial in Week 11 (Based On Week 10 Lecture) Beginning 14 May 2018 TOPIC: Executive Compensation Solutions Q1 AttachedDocument5 pagesTutorial in Week 11 (Based On Week 10 Lecture) Beginning 14 May 2018 TOPIC: Executive Compensation Solutions Q1 AttachedhabibNo ratings yet

- 2022 - 2 FSA SPD - Commuter Benefit AccountDocument7 pages2022 - 2 FSA SPD - Commuter Benefit AccountJose Fernando PerezNo ratings yet

- Labour Law Cia 1 Law ReportDocument8 pagesLabour Law Cia 1 Law ReportA VISAK 21121001No ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- Rashtriya Ispat Nigam Limited Visakhapatnam Steel Plant: A Study On"Industrial Relations"Document102 pagesRashtriya Ispat Nigam Limited Visakhapatnam Steel Plant: A Study On"Industrial Relations"Sateesh KumarNo ratings yet

- Robbins Eob13e Ppt01Document30 pagesRobbins Eob13e Ppt01joanyimNo ratings yet

- 4 Managing Sales ForceDocument72 pages4 Managing Sales Forcekishor khadkaNo ratings yet

- Commerce NotesDocument83 pagesCommerce NotesSharon AmondiNo ratings yet

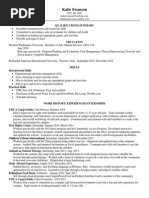

- Katie SwansonDocument1 pageKatie Swansonapi-254829665No ratings yet

- Level 3 Certificate in Principles of HR Practice QCF PHR3Document35 pagesLevel 3 Certificate in Principles of HR Practice QCF PHR3Lonesome Dove SunNo ratings yet

- Ethics CompilationDocument17 pagesEthics CompilationCleofe Mae Piñero AseñasNo ratings yet

- CCT303 Communication ChangesDocument8 pagesCCT303 Communication ChangesVictoria NjiiriNo ratings yet

- Administrative Tribunals in IndiaDocument19 pagesAdministrative Tribunals in Indiapermanika100% (2)

- Organisaional Theory Design & Development NotesDocument131 pagesOrganisaional Theory Design & Development Notesjyothisvarma67% (12)

- Human Resources Management & Labour RelationDocument93 pagesHuman Resources Management & Labour RelationMichael WrightNo ratings yet

- TR - Cable TV Installation NC IIDocument66 pagesTR - Cable TV Installation NC IIKarenNo ratings yet

- Elizabeth Hayes - Curriculum VitaeDocument2 pagesElizabeth Hayes - Curriculum Vitaeapi-505790706No ratings yet

- Teachers and School Heads Salaries and allowances-ECAM23001ENNDocument42 pagesTeachers and School Heads Salaries and allowances-ECAM23001ENNDinka PavelicNo ratings yet

- Deber 1Document4 pagesDeber 1JoselynNo ratings yet

- Original - 1404405373 - Personal Learning PaperDocument6 pagesOriginal - 1404405373 - Personal Learning PaperShahbaz Ahmed100% (1)

- Phillippine Retirement Authority Annual Report 2014Document80 pagesPhillippine Retirement Authority Annual Report 2014Benedict BaluyutNo ratings yet

- Union SecurityDocument3 pagesUnion SecurityApple Ple21No ratings yet

- Human Resource DevlopmentDocument140 pagesHuman Resource DevlopmentMegha OmshreeNo ratings yet

- The State and The Market Pulin B. NayakDocument6 pagesThe State and The Market Pulin B. NayakTom Waspe100% (1)

- Tipos de Contratos Contract TypesDocument3 pagesTipos de Contratos Contract TypestamorenoNo ratings yet

- WTP NotesDocument9 pagesWTP Notessanjee2No ratings yet

- Moureen Kyaligonza: Address: Kampala, Uganda Email: - Telephone: +256 704922510/+256 773059754Document4 pagesMoureen Kyaligonza: Address: Kampala, Uganda Email: - Telephone: +256 704922510/+256 773059754Queen Mary AbwooliNo ratings yet

- Bus Writing Linc5Document50 pagesBus Writing Linc5manuNo ratings yet

- Scomi Group BHDDocument49 pagesScomi Group BHDAbigailLim SieEngNo ratings yet

- 10 of Today's Common Human Resource Challenges: Atlas StaffingDocument20 pages10 of Today's Common Human Resource Challenges: Atlas StaffingSe SathyaNo ratings yet

- Question 3 - CVP AnalysisDocument13 pagesQuestion 3 - CVP AnalysisMsKhan0078100% (1)

- Diesel Motor Mechanic EVR - July 2023Document5 pagesDiesel Motor Mechanic EVR - July 2023Delson Jon BonifacioNo ratings yet

- Motivation and LeadershipDocument22 pagesMotivation and Leadershipdevanshi jainNo ratings yet