Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 viewsBmt3001 - Financial Management Fall Semester 2021-2022 D1 Slot

Bmt3001 - Financial Management Fall Semester 2021-2022 D1 Slot

Uploaded by

manjusri lalThis document outlines the details of the BMT3001 - Financial Management course for the Fall 2021-2022 semester. It includes the course outcomes, faculty details, assessment topics, general instructions for assessments, and rubrics. The course aims to help students understand key financial management concepts like sources of finance, investment appraisal, and risk management. Students will complete 10 assessments on topics like working capital management, cost of capital estimation, and the role of interest rates in investment decisions. Assessments require analysis of a listed company and adhering to deadlines in August through October.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- EU State Aid Control P.Werner PDFDocument878 pagesEU State Aid Control P.Werner PDFAnonymous 6C6jgnrUNo ratings yet

- Strategy Papers and Cases QuestionsDocument9 pagesStrategy Papers and Cases QuestionsMuhammad Ahmed0% (1)

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Family Business in India: Performance, Challenges and Improvement MeasuresDocument22 pagesFamily Business in India: Performance, Challenges and Improvement Measuresmanjusri lalNo ratings yet

- Bcom 6 Sem Imp Questions - All SubsDocument10 pagesBcom 6 Sem Imp Questions - All SubsAbdul Raheem100% (2)

- Module3 1 PDFDocument85 pagesModule3 1 PDFlalu0123100% (1)

- Financial Management at Beacon Pharmaceuticals LimitedDocument24 pagesFinancial Management at Beacon Pharmaceuticals LimitedFarhanUddinAhmedNo ratings yet

- 03 Principles of Option SolutionDocument12 pages03 Principles of Option SolutionsarojNo ratings yet

- FINA 408 Individual Project Fall 2017 Outline - FINALDocument3 pagesFINA 408 Individual Project Fall 2017 Outline - FINALAditya JandialNo ratings yet

- Corporate Finance Exams HistoryDocument2 pagesCorporate Finance Exams Historyمحمد ابوشريفNo ratings yet

- SEM IV - OJT ASSIGNMENT/Business Analytics Specialization/BUSINESS ETHICS & CORPORATE GOVERNANCEDocument3 pagesSEM IV - OJT ASSIGNMENT/Business Analytics Specialization/BUSINESS ETHICS & CORPORATE GOVERNANCEAnshul Mehta0% (1)

- Insurance Business and Finance: PurposeDocument6 pagesInsurance Business and Finance: Purposegp_shortnsweetNo ratings yet

- Group - Assignment Best To UsedDocument3 pagesGroup - Assignment Best To UsedNour FaizahNo ratings yet

- Institute of Actuaries of India: Subject CT2 - Finance and Financial Reporting For 2018 ExaminationsDocument7 pagesInstitute of Actuaries of India: Subject CT2 - Finance and Financial Reporting For 2018 ExaminationsAnkit BaglaNo ratings yet

- Term Paper1Document2 pagesTerm Paper1Indermohan SinghNo ratings yet

- TMA 1 Advanced Financial ManagementDocument4 pagesTMA 1 Advanced Financial ManagementfisehaNo ratings yet

- TLP - MMS Sem III-Fin Markets and Insitutions 23-24 Parashar VashisthDocument8 pagesTLP - MMS Sem III-Fin Markets and Insitutions 23-24 Parashar Vashisthjyotiguptapr7991No ratings yet

- Roll No. ..................................... : New SyllabusDocument12 pagesRoll No. ..................................... : New Syllabusmyash6136No ratings yet

- CH 05Document13 pagesCH 05Gaurav KarkiNo ratings yet

- Using Financial Statement InformationDocument11 pagesUsing Financial Statement InformationpinanaNo ratings yet

- Enron & WorldCom Case Study SolutionDocument4 pagesEnron & WorldCom Case Study SolutionAwais Ahmad67% (3)

- 9th Sem Syllabus AnalysisDocument17 pages9th Sem Syllabus AnalysisTanurag GhoshNo ratings yet

- Pestel Key Points For Case Studies and LearningDocument5 pagesPestel Key Points For Case Studies and Learningwasay aliNo ratings yet

- Pestel Key Points For Case Studies and LearningDocument5 pagesPestel Key Points For Case Studies and LearningAlizeh IfthikharNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisAman ChaudharyNo ratings yet

- Overview - Corp. Valuation (14.9.2023)Document15 pagesOverview - Corp. Valuation (14.9.2023)Sonali MoreNo ratings yet

- Corp GovDocument20 pagesCorp GovShraddha ParabNo ratings yet

- Q1. The Following Information of A Company Is Given To YouDocument5 pagesQ1. The Following Information of A Company Is Given To YouAman RastogiNo ratings yet

- Maf603 Test 1 May 2021 - QuestionDocument6 pagesMaf603 Test 1 May 2021 - QuestionSITI FATIMAH AZ-ZAHRA ABD WAHIDNo ratings yet

- Business Law AssignmentDocument1 pageBusiness Law AssignmentSonali GroverNo ratings yet

- Lecture 2 Nature and Objectives of Financial StatementsDocument22 pagesLecture 2 Nature and Objectives of Financial Statementsdev guptaNo ratings yet

- Securities and Exchange Board of India: CircularDocument13 pagesSecurities and Exchange Board of India: CircularArsh AlamNo ratings yet

- Contoh Soal Teori AkuntansiDocument3 pagesContoh Soal Teori AkuntansiYolanda AnggraenyNo ratings yet

- Al Financial Management May Jun 2017Document4 pagesAl Financial Management May Jun 2017Akash79No ratings yet

- CT2 Finance and Financial ReportingDocument7 pagesCT2 Finance and Financial ReportingSunil Pillai0% (1)

- FAR360 (Apr09) - Q & ADocument14 pagesFAR360 (Apr09) - Q & ASyazliana KasimNo ratings yet

- Corporate Finance 2marksDocument30 pagesCorporate Finance 2marksTaryn JacksonNo ratings yet

- Fin501: Financial Management MBA BRAC University Final Examination Paper: 3rd of January 2021 Total Time: Three (3) Hours Total: 60 MarksDocument16 pagesFin501: Financial Management MBA BRAC University Final Examination Paper: 3rd of January 2021 Total Time: Three (3) Hours Total: 60 MarksyousufNo ratings yet

- Siddharth Nagar, Goregaon (W), Mumbai-400 104Document3 pagesSiddharth Nagar, Goregaon (W), Mumbai-400 104Yash MaradiyaNo ratings yet

- Assignment 2/0/2016 Financial Strategy MAC4865: Additional InformationDocument8 pagesAssignment 2/0/2016 Financial Strategy MAC4865: Additional InformationdevashneeNo ratings yet

- FIN501 Assignment - GroupDocument4 pagesFIN501 Assignment - GroupSaaliha SaabiraNo ratings yet

- M.Phil Corporate Finance AssignmentDocument6 pagesM.Phil Corporate Finance AssignmentAlphaNo ratings yet

- Week 3 Module 5 Organizing A CooperativeDocument6 pagesWeek 3 Module 5 Organizing A CooperativeXtian AmahanNo ratings yet

- Assingment of MbaDocument4 pagesAssingment of MbaSenthil KumarNo ratings yet

- CH 1 - Info System Strategy TriangleDocument4 pagesCH 1 - Info System Strategy TriangleJustin L De ArmondNo ratings yet

- Capt mkt1Document5 pagesCapt mkt1api-3745584No ratings yet

- BUST422 Term ProjectDocument3 pagesBUST422 Term ProjectAylin ErdoğanNo ratings yet

- Chapter One Financial Objectives-Review of F9 KnowledgeDocument17 pagesChapter One Financial Objectives-Review of F9 Knowledgekuttan1000100% (1)

- Ketan Parekh CaseDocument30 pagesKetan Parekh CaseKushan KhatriNo ratings yet

- Final FM June 21Document2 pagesFinal FM June 21KiranchandwaniNo ratings yet

- Far660 - Special Feb 2020 QuestionDocument5 pagesFar660 - Special Feb 2020 QuestionHanis ZahiraNo ratings yet

- Corporate Governance Mock Test - Vskills Practice TestsDocument9 pagesCorporate Governance Mock Test - Vskills Practice TestsGaurav SonkeshariyaNo ratings yet

- Semester - Iii (CBCS)Document195 pagesSemester - Iii (CBCS)Sakila SNo ratings yet

- Fundamental Analysis of Cellular Service Provider Companies in IndiaDocument68 pagesFundamental Analysis of Cellular Service Provider Companies in Indiabugz_55575% (4)

- IAS Mains Commerce 1979Document4 pagesIAS Mains Commerce 1979SONALI DHARNo ratings yet

- University of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 Semester Total Marks - 100Document4 pagesUniversity of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 Semester Total Marks - 100Supriyo BiswasNo ratings yet

- Students Handout For Finance-TRWDocument42 pagesStudents Handout For Finance-TRWRENUKA THOTENo ratings yet

- CV 2023062810202090Document3 pagesCV 2023062810202090Kumar SinghNo ratings yet

- Fundamentals of Accountancy, Business & Management 1Document4 pagesFundamentals of Accountancy, Business & Management 1Rodj Eli Mikael Viernes-IncognitoNo ratings yet

- MS 4 Previous Year Question Papers by IgnouassignmentguruDocument84 pagesMS 4 Previous Year Question Papers by IgnouassignmentguruRani AgarwalNo ratings yet

- GuidanceDocument12 pagesGuidanceLInh PhươngNo ratings yet

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- In Uence of Demographic Factors On Grocery Buying BehaviourDocument20 pagesIn Uence of Demographic Factors On Grocery Buying Behaviourmanjusri lalNo ratings yet

- Book Review of Justice A Philosophical Book of Michael J. SandelDocument6 pagesBook Review of Justice A Philosophical Book of Michael J. Sandelmanjusri lalNo ratings yet

- The Health Impacts of Globalisation: A Conceptual Framework: Globalization and Health September 2005Document13 pagesThe Health Impacts of Globalisation: A Conceptual Framework: Globalization and Health September 2005manjusri lalNo ratings yet

- Factors Affecting Marketing MixDocument11 pagesFactors Affecting Marketing Mixmanjusri lalNo ratings yet

- Impact of Demographics On OnlineDocument6 pagesImpact of Demographics On Onlinemanjusri lalNo ratings yet

- Bmt3004 - Managing Family Business: Digital Assignment 6Document3 pagesBmt3004 - Managing Family Business: Digital Assignment 6manjusri lalNo ratings yet

- Do You Know Who You Are Dealing With?Cultural Due Diligence: What, Why and HowDocument20 pagesDo You Know Who You Are Dealing With?Cultural Due Diligence: What, Why and Howmanjusri lalNo ratings yet

- Family Council of Victoria Inc.: Inquiry Into Multiculturalism in AustraliaDocument2 pagesFamily Council of Victoria Inc.: Inquiry Into Multiculturalism in Australiamanjusri lalNo ratings yet

- Consumer Behavior Towards Shopping Malls: A Systematic Narrative ReviewDocument14 pagesConsumer Behavior Towards Shopping Malls: A Systematic Narrative Reviewmanjusri lalNo ratings yet

- EJMCM - Volume 7 - Issue 8 - Pages 5106-5142Document37 pagesEJMCM - Volume 7 - Issue 8 - Pages 5106-5142manjusri lalNo ratings yet

- Unparalleled Opportunities or Unmitigated Risk - Economic GlobalizDocument54 pagesUnparalleled Opportunities or Unmitigated Risk - Economic Globalizmanjusri lalNo ratings yet

- Trade and Health:: Towards Building A National StrategyDocument149 pagesTrade and Health:: Towards Building A National Strategymanjusri lalNo ratings yet

- Public Disclosure March 2021Document3 pagesPublic Disclosure March 2021manjusri lalNo ratings yet

- B.A. (Hons.) Eco - Sem-II - Finance (GE) - WorkingCapital - RuchikaChoudharyDocument10 pagesB.A. (Hons.) Eco - Sem-II - Finance (GE) - WorkingCapital - RuchikaChoudharymanjusri lalNo ratings yet

- Trade Policy and Public Health: FurtherDocument25 pagesTrade Policy and Public Health: Furthermanjusri lalNo ratings yet

- Gardner Finance Vol 9Document9 pagesGardner Finance Vol 9manjusri lalNo ratings yet

- General Banking Portfolio of IBBLDocument3 pagesGeneral Banking Portfolio of IBBLmesbahkpcNo ratings yet

- PCM Unit - IIDocument51 pagesPCM Unit - IInmhrk1118No ratings yet

- Competitor AnalysisDocument3 pagesCompetitor AnalysisJef De VeraNo ratings yet

- Hempstone CVDocument2 pagesHempstone CVHempstone OyunguNo ratings yet

- ECO413-General Equilibrium-1&2Document31 pagesECO413-General Equilibrium-1&2ashraf khanNo ratings yet

- Cash Disbursement RegisterDocument75 pagesCash Disbursement RegisterRose ElleNo ratings yet

- Iaps 1001 - Practice NoteDocument2 pagesIaps 1001 - Practice NoteIvan Tamayo BasasNo ratings yet

- What Is Devinci's Position Within The Industry? How Does It Benefit From That Position?Document1 pageWhat Is Devinci's Position Within The Industry? How Does It Benefit From That Position?SMRITI MEGHASHILANo ratings yet

- Module 2 PLANNINGDocument96 pagesModule 2 PLANNINGSruti AcharyaNo ratings yet

- James Robertson Suzanne RobertsonDocument6 pagesJames Robertson Suzanne Robertsonabhishek pathakNo ratings yet

- Tugas Bingg (App Letter)Document6 pagesTugas Bingg (App Letter)Nurindah Suci LestariNo ratings yet

- PWC - IPO - What Workd Best-Executive Summary PDFDocument92 pagesPWC - IPO - What Workd Best-Executive Summary PDFSanath FernandoNo ratings yet

- Chapter 8Document6 pagesChapter 8Tooba AhmedNo ratings yet

- ,case Study Icici BankDocument40 pages,case Study Icici BankRuchika Garg67% (3)

- Abdul HakeemDocument5 pagesAbdul HakeemMuhammad hanzla mehmoodNo ratings yet

- Treasury ManagementDocument37 pagesTreasury Managementanujaflatoon88100% (1)

- Materi Lab 6 - Audit of The Inventory and Warehousing CycleDocument30 pagesMateri Lab 6 - Audit of The Inventory and Warehousing CycleMuflikh ZenithNo ratings yet

- Prefinal Set A Exam (Primark)Document3 pagesPrefinal Set A Exam (Primark)Zybel RosalesNo ratings yet

- Dessler 03Document13 pagesDessler 03Victoria EyelashesNo ratings yet

- CFA 2 NotesDocument44 pagesCFA 2 NoteswwongvgNo ratings yet

- HSE Performance ReportDocument63 pagesHSE Performance ReportEfendy Ady Saputra GintingNo ratings yet

- Comparative Analysis of HDFC and Icici Mutual FundsDocument8 pagesComparative Analysis of HDFC and Icici Mutual FundsVeeravalli AparnaNo ratings yet

- AudProb Test BankDocument18 pagesAudProb Test BankKarina Barretto AgnesNo ratings yet

- Module 5 QuestionsDocument5 pagesModule 5 QuestionsJester MartinNo ratings yet

- Ebook Series Procurement and Contract Management: Essential Skills Guide Michael YoungDocument21 pagesEbook Series Procurement and Contract Management: Essential Skills Guide Michael YoungfffteamNo ratings yet

- Shazia Rahim - SD - DubaiDocument5 pagesShazia Rahim - SD - DubaiRajkumar CNo ratings yet

- Agency Mang - Client Agency RelationshipDocument33 pagesAgency Mang - Client Agency RelationshipNishant AnandNo ratings yet

Bmt3001 - Financial Management Fall Semester 2021-2022 D1 Slot

Bmt3001 - Financial Management Fall Semester 2021-2022 D1 Slot

Uploaded by

manjusri lal0 ratings0% found this document useful (0 votes)

11 views3 pagesThis document outlines the details of the BMT3001 - Financial Management course for the Fall 2021-2022 semester. It includes the course outcomes, faculty details, assessment topics, general instructions for assessments, and rubrics. The course aims to help students understand key financial management concepts like sources of finance, investment appraisal, and risk management. Students will complete 10 assessments on topics like working capital management, cost of capital estimation, and the role of interest rates in investment decisions. Assessments require analysis of a listed company and adhering to deadlines in August through October.

Original Description:

Original Title

FM questions

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the details of the BMT3001 - Financial Management course for the Fall 2021-2022 semester. It includes the course outcomes, faculty details, assessment topics, general instructions for assessments, and rubrics. The course aims to help students understand key financial management concepts like sources of finance, investment appraisal, and risk management. Students will complete 10 assessments on topics like working capital management, cost of capital estimation, and the role of interest rates in investment decisions. Assessments require analysis of a listed company and adhering to deadlines in August through October.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

11 views3 pagesBmt3001 - Financial Management Fall Semester 2021-2022 D1 Slot

Bmt3001 - Financial Management Fall Semester 2021-2022 D1 Slot

Uploaded by

manjusri lalThis document outlines the details of the BMT3001 - Financial Management course for the Fall 2021-2022 semester. It includes the course outcomes, faculty details, assessment topics, general instructions for assessments, and rubrics. The course aims to help students understand key financial management concepts like sources of finance, investment appraisal, and risk management. Students will complete 10 assessments on topics like working capital management, cost of capital estimation, and the role of interest rates in investment decisions. Assessments require analysis of a listed company and adhering to deadlines in August through October.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

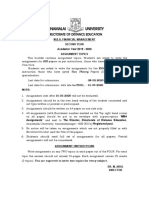

BMT3001 – FINANCIAL MANAGEMENT

Fall Semester 2021-2022 D1 Slot

Faculty Details: Vedantam Seetha Ram, Asst. Professor (Senior), VITBS.

Cabin Number: MGB–F122 Contact Details: seetharam.v@vit.ac.in

Open Hours: Monday: 12:00 AM to 1:00 PM Thursday: 4:00 PM to 5:00 PM

Class ID: VL2021220103422 (ETH) & VL2021220103423 (EPJ)

BMT 3001 FINANCIAL MANAGEMENT COURSE OUTCOME (CO) APPLICABLE

At the end of this course students are able to:

CO1 Understand the functions of financial management and financial environment as well

as sources of finance.

CO2 Understand investment appraisal and business valuation techniques.

CO3 Develop critical thinking and estimate of shares using efficient market hypothesis.

CO4 Acquire skills in risk management of foreign currency and interest rate by using

hedging techniques.

CO5 Understand and evaluate organizational performance.

Assessment Topics: VL2021220103422 (ETH)

NOTE: Do adhere to the dead line date provided.

Topic No. Assessment Topic General Instructions & Remarks

01 Financial management in 1. Has to consider a listed company

for profit Vs. Not for 2. No two students have to work on the same company

Profit organizations 3. Computations need to be shown where ever needed

4. Implications of results need to be discussed in detail

Applicable CO – CO1 5. Can use RBI, GOI, CSO and CMIE reports; IRDA,

SEBI and Stock Markets (BSE & NSE) circulars

also need to be referred if needed. Company law

board, MCA and MoF reports will also of useful.

CII and FICCI meetings and their minutes will also

be of useful

02 Working capital 1. Has to consider a listed company

management of a select 2. All the components of working capital need to be

organization covered.

3. No two students have to work on the same company

4. Computations need to be shown where ever needed

Applicable CO – CO5 5. Implications of results need to be discussed in detail

6. Can use RBI, GOI, CSO and CMIE reports; IRDA,

SEBI and Stock Markets (BSE & NSE) circulars

also need to be referred if needed

03 Sources of finance for an 1. Has to consider a listed company

organization 2. All the components of working capital and long

term capital need to be covered related to the

selected company.

Applicable CO – CO1 3. Valuation techniques need to be discussed and the

best suitable method need to be applied for

assessment of the select organization

4. No two students have to work on the same company

5. Computations need to be shown where ever needed

6. Implications of results need to be discussed in detail

7. Can use RBI, GOI, CSO and CMIE reports; IRDA,

SEBI and Stock Markets (BSE & NSE) circulars

also need to be referred if needed. Company law

board, MCA and MoF reports will also of useful.

04 Estimation of cost of 1. Has to consider a listed company

capital 2. No two students have to work on the same company

3. Computations need to be shown where ever needed

Applicable CO – CO2 4. Implications of results need to be discussed in detail

5. Can use RBI, GOI, CSO and CMIE reports; IRDA,

SEBI and Stock Markets (BSE & NSE) circulars

also need to be referred if needed

05 Capital structure 1. Has to consider a listed company

assessment 2. No two students have to work on the same company

3. Computations need to be shown where ever needed

Applicable CO – CO2 4. Implications of results need to be discussed in detail

5. Can use RBI, GOI, CSO and CMIE reports; IRDA,

SEBI and Stock Markets (BSE & NSE) circulars

also need to be referred if needed

06 Finance for small & 1. Has to consider a listed company

medium enterprises and 2. All the components of working capital as well as

their effectiveness long term capital need to be covered.

3. No two students have to work on the same company

4. Computations need to be shown where ever needed

Applicable CO – CO2 5. Implications of results need to be discussed in detail

6. Can use RBI, GOI, CSO and CMIE reports; IRDA,

SEBI and Stock Markets (BSE & NSE) circulars

also need to be referred if needed

07 Valuation of shares 1. Has to consider a listed company

procedure followed in a 2. Valuation techniques need to be discussed and the

select organization best suitable method need to be applied for

computational requirements

3. No two students have to work on the same company

Applicable CO – CO3 4. Computations need to be shown where ever needed

5. Implications of results need to be discussed in detail

6. Can use RBI, GOI, CSO and CMIE reports; IRDA,

SEBI and Stock Markets (BSE & NSE) circulars

also need to be referred if needed. Company law

board, MCA and MoF reports will also of useful.

08 Role of EMH in share 1. Has to consider a listed company

price determination 2. No two students have to work on the same company

3. Computations need to be shown where ever needed

Applicable CO – CO3 4. Implications of results need to be discussed in detail

5. Can use RBI, GOI, CSO and CMIE reports; IRDA,

SEBI and Stock Markets (BSE & NSE) circulars

also need to be referred if needed. Company law

board, MCA and MoF reports will also of useful.

09 Influence of interest rates 1. Has to consider a listed company

in investment decision 2. No two students have to work on the same company

making by an 3. Computations need to be shown where ever needed

organization 4. Implications of results need to be discussed in detail

5. Can use RBI, GOI, CSO and CMIE reports; IRDA,

Applicable CO – CO4 SEBI and Stock Markets (BSE & NSE) circulars

also need to be referred if needed. Company law

board, MCA and MoF reports will also of useful.

10 Influence of exchange 1. Has to consider a listed company

rate differences in 2. No two students have to work on the same company

decision making by an 3. Computations need to be shown where ever needed

organization 4. Implications of results need to be discussed in detail

5. Can use RBI, GOI, CSO and CMIE reports; IRDA,

Applicable CO – CO4 SEBI and Stock Markets (BSE & NSE) circulars

also need to be referred if needed. Company law

board, MCA and MoF reports will also of useful.

Rubrics applicable for all the Assessments I to X: VL2021220103422 (ETH)

Expected Outcome Max. Marks

1. Introduction about topic selected 2

2. Body of the assignment – Data and its description with Source 3

3. Analysis and Inferences 3

4. Use of Complete References 2

Total 10

Last date of Assessment – I Submission 25th August, 2021

Last date of Assessment – II Submission 7th September, 2021

Last date of Assessment – III Submission 21st September, 2021

Last date of Assessment – IV Submission 5th October, 2021

Last date of Assessment – V Submission 20th October, 2021

Last date of Assessment – VI Submission 30th October, 2021

Last date of Assessment – VII Submission 15th November, 2021

Last date of Assessment – VIII Submission 25th November, 2021

Last date of Assessment – XI Submission 5th December, 2021

Last date of Assessment – X Submission 10th December, 2021

You might also like

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- EU State Aid Control P.Werner PDFDocument878 pagesEU State Aid Control P.Werner PDFAnonymous 6C6jgnrUNo ratings yet

- Strategy Papers and Cases QuestionsDocument9 pagesStrategy Papers and Cases QuestionsMuhammad Ahmed0% (1)

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Family Business in India: Performance, Challenges and Improvement MeasuresDocument22 pagesFamily Business in India: Performance, Challenges and Improvement Measuresmanjusri lalNo ratings yet

- Bcom 6 Sem Imp Questions - All SubsDocument10 pagesBcom 6 Sem Imp Questions - All SubsAbdul Raheem100% (2)

- Module3 1 PDFDocument85 pagesModule3 1 PDFlalu0123100% (1)

- Financial Management at Beacon Pharmaceuticals LimitedDocument24 pagesFinancial Management at Beacon Pharmaceuticals LimitedFarhanUddinAhmedNo ratings yet

- 03 Principles of Option SolutionDocument12 pages03 Principles of Option SolutionsarojNo ratings yet

- FINA 408 Individual Project Fall 2017 Outline - FINALDocument3 pagesFINA 408 Individual Project Fall 2017 Outline - FINALAditya JandialNo ratings yet

- Corporate Finance Exams HistoryDocument2 pagesCorporate Finance Exams Historyمحمد ابوشريفNo ratings yet

- SEM IV - OJT ASSIGNMENT/Business Analytics Specialization/BUSINESS ETHICS & CORPORATE GOVERNANCEDocument3 pagesSEM IV - OJT ASSIGNMENT/Business Analytics Specialization/BUSINESS ETHICS & CORPORATE GOVERNANCEAnshul Mehta0% (1)

- Insurance Business and Finance: PurposeDocument6 pagesInsurance Business and Finance: Purposegp_shortnsweetNo ratings yet

- Group - Assignment Best To UsedDocument3 pagesGroup - Assignment Best To UsedNour FaizahNo ratings yet

- Institute of Actuaries of India: Subject CT2 - Finance and Financial Reporting For 2018 ExaminationsDocument7 pagesInstitute of Actuaries of India: Subject CT2 - Finance and Financial Reporting For 2018 ExaminationsAnkit BaglaNo ratings yet

- Term Paper1Document2 pagesTerm Paper1Indermohan SinghNo ratings yet

- TMA 1 Advanced Financial ManagementDocument4 pagesTMA 1 Advanced Financial ManagementfisehaNo ratings yet

- TLP - MMS Sem III-Fin Markets and Insitutions 23-24 Parashar VashisthDocument8 pagesTLP - MMS Sem III-Fin Markets and Insitutions 23-24 Parashar Vashisthjyotiguptapr7991No ratings yet

- Roll No. ..................................... : New SyllabusDocument12 pagesRoll No. ..................................... : New Syllabusmyash6136No ratings yet

- CH 05Document13 pagesCH 05Gaurav KarkiNo ratings yet

- Using Financial Statement InformationDocument11 pagesUsing Financial Statement InformationpinanaNo ratings yet

- Enron & WorldCom Case Study SolutionDocument4 pagesEnron & WorldCom Case Study SolutionAwais Ahmad67% (3)

- 9th Sem Syllabus AnalysisDocument17 pages9th Sem Syllabus AnalysisTanurag GhoshNo ratings yet

- Pestel Key Points For Case Studies and LearningDocument5 pagesPestel Key Points For Case Studies and Learningwasay aliNo ratings yet

- Pestel Key Points For Case Studies and LearningDocument5 pagesPestel Key Points For Case Studies and LearningAlizeh IfthikharNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisAman ChaudharyNo ratings yet

- Overview - Corp. Valuation (14.9.2023)Document15 pagesOverview - Corp. Valuation (14.9.2023)Sonali MoreNo ratings yet

- Corp GovDocument20 pagesCorp GovShraddha ParabNo ratings yet

- Q1. The Following Information of A Company Is Given To YouDocument5 pagesQ1. The Following Information of A Company Is Given To YouAman RastogiNo ratings yet

- Maf603 Test 1 May 2021 - QuestionDocument6 pagesMaf603 Test 1 May 2021 - QuestionSITI FATIMAH AZ-ZAHRA ABD WAHIDNo ratings yet

- Business Law AssignmentDocument1 pageBusiness Law AssignmentSonali GroverNo ratings yet

- Lecture 2 Nature and Objectives of Financial StatementsDocument22 pagesLecture 2 Nature and Objectives of Financial Statementsdev guptaNo ratings yet

- Securities and Exchange Board of India: CircularDocument13 pagesSecurities and Exchange Board of India: CircularArsh AlamNo ratings yet

- Contoh Soal Teori AkuntansiDocument3 pagesContoh Soal Teori AkuntansiYolanda AnggraenyNo ratings yet

- Al Financial Management May Jun 2017Document4 pagesAl Financial Management May Jun 2017Akash79No ratings yet

- CT2 Finance and Financial ReportingDocument7 pagesCT2 Finance and Financial ReportingSunil Pillai0% (1)

- FAR360 (Apr09) - Q & ADocument14 pagesFAR360 (Apr09) - Q & ASyazliana KasimNo ratings yet

- Corporate Finance 2marksDocument30 pagesCorporate Finance 2marksTaryn JacksonNo ratings yet

- Fin501: Financial Management MBA BRAC University Final Examination Paper: 3rd of January 2021 Total Time: Three (3) Hours Total: 60 MarksDocument16 pagesFin501: Financial Management MBA BRAC University Final Examination Paper: 3rd of January 2021 Total Time: Three (3) Hours Total: 60 MarksyousufNo ratings yet

- Siddharth Nagar, Goregaon (W), Mumbai-400 104Document3 pagesSiddharth Nagar, Goregaon (W), Mumbai-400 104Yash MaradiyaNo ratings yet

- Assignment 2/0/2016 Financial Strategy MAC4865: Additional InformationDocument8 pagesAssignment 2/0/2016 Financial Strategy MAC4865: Additional InformationdevashneeNo ratings yet

- FIN501 Assignment - GroupDocument4 pagesFIN501 Assignment - GroupSaaliha SaabiraNo ratings yet

- M.Phil Corporate Finance AssignmentDocument6 pagesM.Phil Corporate Finance AssignmentAlphaNo ratings yet

- Week 3 Module 5 Organizing A CooperativeDocument6 pagesWeek 3 Module 5 Organizing A CooperativeXtian AmahanNo ratings yet

- Assingment of MbaDocument4 pagesAssingment of MbaSenthil KumarNo ratings yet

- CH 1 - Info System Strategy TriangleDocument4 pagesCH 1 - Info System Strategy TriangleJustin L De ArmondNo ratings yet

- Capt mkt1Document5 pagesCapt mkt1api-3745584No ratings yet

- BUST422 Term ProjectDocument3 pagesBUST422 Term ProjectAylin ErdoğanNo ratings yet

- Chapter One Financial Objectives-Review of F9 KnowledgeDocument17 pagesChapter One Financial Objectives-Review of F9 Knowledgekuttan1000100% (1)

- Ketan Parekh CaseDocument30 pagesKetan Parekh CaseKushan KhatriNo ratings yet

- Final FM June 21Document2 pagesFinal FM June 21KiranchandwaniNo ratings yet

- Far660 - Special Feb 2020 QuestionDocument5 pagesFar660 - Special Feb 2020 QuestionHanis ZahiraNo ratings yet

- Corporate Governance Mock Test - Vskills Practice TestsDocument9 pagesCorporate Governance Mock Test - Vskills Practice TestsGaurav SonkeshariyaNo ratings yet

- Semester - Iii (CBCS)Document195 pagesSemester - Iii (CBCS)Sakila SNo ratings yet

- Fundamental Analysis of Cellular Service Provider Companies in IndiaDocument68 pagesFundamental Analysis of Cellular Service Provider Companies in Indiabugz_55575% (4)

- IAS Mains Commerce 1979Document4 pagesIAS Mains Commerce 1979SONALI DHARNo ratings yet

- University of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 Semester Total Marks - 100Document4 pagesUniversity of Engineering & Management, Jaipur: University Examination MBA, 2 Year, 4 Semester Total Marks - 100Supriyo BiswasNo ratings yet

- Students Handout For Finance-TRWDocument42 pagesStudents Handout For Finance-TRWRENUKA THOTENo ratings yet

- CV 2023062810202090Document3 pagesCV 2023062810202090Kumar SinghNo ratings yet

- Fundamentals of Accountancy, Business & Management 1Document4 pagesFundamentals of Accountancy, Business & Management 1Rodj Eli Mikael Viernes-IncognitoNo ratings yet

- MS 4 Previous Year Question Papers by IgnouassignmentguruDocument84 pagesMS 4 Previous Year Question Papers by IgnouassignmentguruRani AgarwalNo ratings yet

- GuidanceDocument12 pagesGuidanceLInh PhươngNo ratings yet

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- In Uence of Demographic Factors On Grocery Buying BehaviourDocument20 pagesIn Uence of Demographic Factors On Grocery Buying Behaviourmanjusri lalNo ratings yet

- Book Review of Justice A Philosophical Book of Michael J. SandelDocument6 pagesBook Review of Justice A Philosophical Book of Michael J. Sandelmanjusri lalNo ratings yet

- The Health Impacts of Globalisation: A Conceptual Framework: Globalization and Health September 2005Document13 pagesThe Health Impacts of Globalisation: A Conceptual Framework: Globalization and Health September 2005manjusri lalNo ratings yet

- Factors Affecting Marketing MixDocument11 pagesFactors Affecting Marketing Mixmanjusri lalNo ratings yet

- Impact of Demographics On OnlineDocument6 pagesImpact of Demographics On Onlinemanjusri lalNo ratings yet

- Bmt3004 - Managing Family Business: Digital Assignment 6Document3 pagesBmt3004 - Managing Family Business: Digital Assignment 6manjusri lalNo ratings yet

- Do You Know Who You Are Dealing With?Cultural Due Diligence: What, Why and HowDocument20 pagesDo You Know Who You Are Dealing With?Cultural Due Diligence: What, Why and Howmanjusri lalNo ratings yet

- Family Council of Victoria Inc.: Inquiry Into Multiculturalism in AustraliaDocument2 pagesFamily Council of Victoria Inc.: Inquiry Into Multiculturalism in Australiamanjusri lalNo ratings yet

- Consumer Behavior Towards Shopping Malls: A Systematic Narrative ReviewDocument14 pagesConsumer Behavior Towards Shopping Malls: A Systematic Narrative Reviewmanjusri lalNo ratings yet

- EJMCM - Volume 7 - Issue 8 - Pages 5106-5142Document37 pagesEJMCM - Volume 7 - Issue 8 - Pages 5106-5142manjusri lalNo ratings yet

- Unparalleled Opportunities or Unmitigated Risk - Economic GlobalizDocument54 pagesUnparalleled Opportunities or Unmitigated Risk - Economic Globalizmanjusri lalNo ratings yet

- Trade and Health:: Towards Building A National StrategyDocument149 pagesTrade and Health:: Towards Building A National Strategymanjusri lalNo ratings yet

- Public Disclosure March 2021Document3 pagesPublic Disclosure March 2021manjusri lalNo ratings yet

- B.A. (Hons.) Eco - Sem-II - Finance (GE) - WorkingCapital - RuchikaChoudharyDocument10 pagesB.A. (Hons.) Eco - Sem-II - Finance (GE) - WorkingCapital - RuchikaChoudharymanjusri lalNo ratings yet

- Trade Policy and Public Health: FurtherDocument25 pagesTrade Policy and Public Health: Furthermanjusri lalNo ratings yet

- Gardner Finance Vol 9Document9 pagesGardner Finance Vol 9manjusri lalNo ratings yet

- General Banking Portfolio of IBBLDocument3 pagesGeneral Banking Portfolio of IBBLmesbahkpcNo ratings yet

- PCM Unit - IIDocument51 pagesPCM Unit - IInmhrk1118No ratings yet

- Competitor AnalysisDocument3 pagesCompetitor AnalysisJef De VeraNo ratings yet

- Hempstone CVDocument2 pagesHempstone CVHempstone OyunguNo ratings yet

- ECO413-General Equilibrium-1&2Document31 pagesECO413-General Equilibrium-1&2ashraf khanNo ratings yet

- Cash Disbursement RegisterDocument75 pagesCash Disbursement RegisterRose ElleNo ratings yet

- Iaps 1001 - Practice NoteDocument2 pagesIaps 1001 - Practice NoteIvan Tamayo BasasNo ratings yet

- What Is Devinci's Position Within The Industry? How Does It Benefit From That Position?Document1 pageWhat Is Devinci's Position Within The Industry? How Does It Benefit From That Position?SMRITI MEGHASHILANo ratings yet

- Module 2 PLANNINGDocument96 pagesModule 2 PLANNINGSruti AcharyaNo ratings yet

- James Robertson Suzanne RobertsonDocument6 pagesJames Robertson Suzanne Robertsonabhishek pathakNo ratings yet

- Tugas Bingg (App Letter)Document6 pagesTugas Bingg (App Letter)Nurindah Suci LestariNo ratings yet

- PWC - IPO - What Workd Best-Executive Summary PDFDocument92 pagesPWC - IPO - What Workd Best-Executive Summary PDFSanath FernandoNo ratings yet

- Chapter 8Document6 pagesChapter 8Tooba AhmedNo ratings yet

- ,case Study Icici BankDocument40 pages,case Study Icici BankRuchika Garg67% (3)

- Abdul HakeemDocument5 pagesAbdul HakeemMuhammad hanzla mehmoodNo ratings yet

- Treasury ManagementDocument37 pagesTreasury Managementanujaflatoon88100% (1)

- Materi Lab 6 - Audit of The Inventory and Warehousing CycleDocument30 pagesMateri Lab 6 - Audit of The Inventory and Warehousing CycleMuflikh ZenithNo ratings yet

- Prefinal Set A Exam (Primark)Document3 pagesPrefinal Set A Exam (Primark)Zybel RosalesNo ratings yet

- Dessler 03Document13 pagesDessler 03Victoria EyelashesNo ratings yet

- CFA 2 NotesDocument44 pagesCFA 2 NoteswwongvgNo ratings yet

- HSE Performance ReportDocument63 pagesHSE Performance ReportEfendy Ady Saputra GintingNo ratings yet

- Comparative Analysis of HDFC and Icici Mutual FundsDocument8 pagesComparative Analysis of HDFC and Icici Mutual FundsVeeravalli AparnaNo ratings yet

- AudProb Test BankDocument18 pagesAudProb Test BankKarina Barretto AgnesNo ratings yet

- Module 5 QuestionsDocument5 pagesModule 5 QuestionsJester MartinNo ratings yet

- Ebook Series Procurement and Contract Management: Essential Skills Guide Michael YoungDocument21 pagesEbook Series Procurement and Contract Management: Essential Skills Guide Michael YoungfffteamNo ratings yet

- Shazia Rahim - SD - DubaiDocument5 pagesShazia Rahim - SD - DubaiRajkumar CNo ratings yet

- Agency Mang - Client Agency RelationshipDocument33 pagesAgency Mang - Client Agency RelationshipNishant AnandNo ratings yet