Professional Documents

Culture Documents

07 Apr 11

07 Apr 11

Uploaded by

nasirmahmood18Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

07 Apr 11

07 Apr 11

Uploaded by

nasirmahmood18Copyright:

Available Formats

Morning Call

April 7, 2011

Cement Dispatches Construction and Materials

Strong recovery in march is paving the way for healthy 4QFY11

Cement dispatches record a MoM increase of 25% in March

Spring of FY11 brought some respite to the dispatches starved cement sector, as

total volumes recorded a 22% MoM increase in March 2011, as per the figures

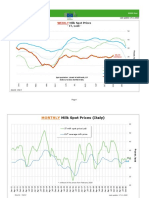

Coal price (US$/ton) released by All Pakistan Cement Manufacturers Association (APCMA). Seasonal

130 nature of the business lead to a 25% MoM improvement in the domestic volumes,

120

which were heartily supported by a 15.5% MoM jump in exports.

110 March on March comparison still mirrors a gloomy picture

100 Worrisome factor, however remains 3.8% YoY drop in the domestic sales of

March 2011 to 2.2mn tons, which reflects the slow beginning of the reconstruction

90

activity. A longer than normal stretch of winter season may have had its impact on

80 the domestic demand in March 2011, while cut in PSDP could also further result

May-10

Jul-10

Aug-10

Sep-10

Nov-10

Dec-10

Jan-10

Feb-10

Mar-10

Apr-10

Jun-10

Oct-10

Jan-11

Feb-11

Mar-11

Apr-11

in slowdown in dispatches.

Source: Bloomberg July-Mar Mar Feb

000

tons FY11 FY10 YoY Δ FY11 FY10 YoY Δ FY11 MoM Δ

Cement prices (Ex-Factory PKR/ton)

Industry 22,742 25,244 -9.9% 3,043 3,240 -6.1% 2,488 22.3%

7,000

Local 16,017 17,384 -7.9% 2,223 2,310 -3.8% 1,778 25.0%

6,000

Export 6,724 7,860 -14.5% 820 930 -11.8% 710 15.5%

Source: APCMA

5,000 9MFY11 figures still suffering decline

On 9MFY11 basis, the industry suffered a YoY contraction of 9.9% in dispatches

4,000 to 22.7mn tons. This was mainly on account of 7.9% YoY drop in domestic sales

due to the catastrophic floods that ravaged the country in 1QFY11. Slowdown in

demand from Middle East took its toll on exports, which shrank by 14.5% YoY.

Outlook

Source: AHL Research

Cement dispatches are expected to strengthen in 4QFY11 as the country enters

in reconstruction phase. We expect local demand to stand at 23.1mn in FY11,

posting a 1.8% YoY decline, whereas exports are expected to suffer a 16.2% YoY

contraction, taking total dispatches to 32mn in FY11 from 34.2mn a year back.

A 17% increase in ex-factory price since December 2011

Ex-Factory prices have been tracing a rising trajectory since December 2010,

registering a 17.1% jump. With strong recovery expected in cement sales in last

quarter coupled with a 17.1% rise in Ex-factory prices and cooling off coal prices,

the cement companies look all set to post healthy gains in 3QFY11.

Recommendation

Lucky Cement Limited (LUCK) remains our top pick in the sector as it offers a

sizeable upside potential of 41.4% to our December 2011 target price of PKR

97.1/share. The Stock is trading at FY11E PER of 5.8x, reflecting a 47.8%

discount to the average AHL Cement Universe PER of 1.1x.

Analyst

Syed Abid Ali AHL Cement Universe Target price (PKR) Current price (PKR) Upside

abid.ali@arifhabibltd.com

Lucky Cement 97.1 68.67 41.4%

021-32462589 Ext. 253

Attock Cement 69 54.9 25.7%

www.arifhabibltd.com D.G Khan Cement 30.1 25.39 18.6%

Source: AHL Estimates

Disclaimer: The information contained herein is compiled from sources AHL believes to be reliable, but we do not accept responsibility for its accuracy or completeness. It is not intended to be an

offer or a solicitation to buy or sell any securities. AHL and its officers or employees may or may not have a position in or with respect to the securities mentioned herein and they do not accept

any liability whatsoever for any direct or consequential loss arising from the use of this publication and its contents. AHL may, from time to time, have a consulting relationship with a company

1

being reported upon. All opinions and estimates contained herein constitute our judgment as of the date mentioned in the report and are subject to change without notice.

You might also like

- The Relay Testing Handbook-Generator Relay Protection Testing TOC-ToF-BibDocument36 pagesThe Relay Testing Handbook-Generator Relay Protection Testing TOC-ToF-BibMartin Goodnough100% (1)

- Assumption and Data Sources:: Kettle1 ResearchDocument5 pagesAssumption and Data Sources:: Kettle1 Researchkettle1No ratings yet

- SEB Commodities Monthly May 2010Document22 pagesSEB Commodities Monthly May 2010SEB GroupNo ratings yet

- SEB Report: Commodity Prices To Rise in Fourth QuarterDocument20 pagesSEB Report: Commodity Prices To Rise in Fourth QuarterSEB GroupNo ratings yet

- Record Early Sales of New Crop U.S. Soybeans Signal Robust Demand AheadDocument33 pagesRecord Early Sales of New Crop U.S. Soybeans Signal Robust Demand AheadAvinash KarnNo ratings yet

- Montgomery County Maryland, August 2010 Market StatisticsDocument1 pageMontgomery County Maryland, August 2010 Market StatisticsJosette SkillingNo ratings yet

- SR&ED Work Schedule Associated R&D Dec 10 08Document4 pagesSR&ED Work Schedule Associated R&D Dec 10 08metroroadNo ratings yet

- PvsystDocument44 pagesPvsystSgfvv100% (1)

- The Global Liquidity Tracker - 22 Apr 22Document13 pagesThe Global Liquidity Tracker - 22 Apr 22Apurva ShethNo ratings yet

- Myanmar NEP BBL Presenation 10-01-2014Document45 pagesMyanmar NEP BBL Presenation 10-01-2014SNamNo ratings yet

- Dr. Mark Dotzour Presentation To Beaumont Board of RealtorsDocument21 pagesDr. Mark Dotzour Presentation To Beaumont Board of RealtorsCharlie FoxworthNo ratings yet

- Introduction To M&A With Piramal Abbott DealDocument22 pagesIntroduction To M&A With Piramal Abbott DealSachidanand Singh100% (2)

- Paper & Pulp Industry-Looking AttractiveDocument14 pagesPaper & Pulp Industry-Looking AttractiverabharatNo ratings yet

- Lanvyl TubesDocument5 pagesLanvyl TubesIshmeet SinghNo ratings yet

- Eu Raw Milk Spot Prices - enDocument2 pagesEu Raw Milk Spot Prices - enlyesNo ratings yet

- PDI Army DayDocument12 pagesPDI Army DayrangsvetaNo ratings yet

- ECom Oct 10 1 Presentation)Document10 pagesECom Oct 10 1 Presentation)hussainmhNo ratings yet

- CAD54Document354 pagesCAD54Patcharaphol CharoenchonNo ratings yet

- Rand RR577-77Document1 pageRand RR577-77peter wahuNo ratings yet

- Global Commodity Prices, Monetary Transmission, and Exchange Rate Pass-Through in The Pacific IslandsDocument16 pagesGlobal Commodity Prices, Monetary Transmission, and Exchange Rate Pass-Through in The Pacific IslandslukeniaNo ratings yet

- Task Card Date Task Card DateDocument1 pageTask Card Date Task Card DateatrflyerNo ratings yet

- The Week That Just Passed March 12, 2010Document4 pagesThe Week That Just Passed March 12, 2010WallstreetableNo ratings yet

- Poly Rail & Drainage Accelerated: Project MilestonesDocument3 pagesPoly Rail & Drainage Accelerated: Project MilestonesJackie SandersNo ratings yet

- Defiance Cap - The Week That Just Passed Mar 19, 2010Document6 pagesDefiance Cap - The Week That Just Passed Mar 19, 2010WallstreetableNo ratings yet

- Unemployment DataDocument2 pagesUnemployment Datakettle1No ratings yet

- Short and Medium Term OutlookDocument6 pagesShort and Medium Term OutlookTushar LanjekarNo ratings yet

- Wcs Price Spread ImpactDocument3 pagesWcs Price Spread ImpactAndi LloydNo ratings yet

- The Outlook For Sulphur and Sulphuric Acid. CreonDocument36 pagesThe Outlook For Sulphur and Sulphuric Acid. CreonSudeep MukherjeeNo ratings yet

- Cirrus Syllabus Suite - Pilot EditionDocument112 pagesCirrus Syllabus Suite - Pilot EditionAmandoNo ratings yet

- Mwo 121010Document10 pagesMwo 121010richardck50No ratings yet

- Aluminium Warehousing, Premiums and PricesDocument11 pagesAluminium Warehousing, Premiums and Pricesfiki arifNo ratings yet

- Inflation: Fig 6.1: Inflation Trend Fig 6.2: CPI Overall, Food and Non FoodDocument20 pagesInflation: Fig 6.1: Inflation Trend Fig 6.2: CPI Overall, Food and Non FoodMajid MahmoodNo ratings yet

- Schedule of Shipping LatitudDocument1 pageSchedule of Shipping LatitudPasteles San JoseNo ratings yet

- Monetary Policy Statement: State Bank of PakistanDocument24 pagesMonetary Policy Statement: State Bank of PakistanrehmanejazNo ratings yet

- VolatilityFriendOrFoeDocument18 pagesVolatilityFriendOrFoejacekNo ratings yet

- 1Q 2010 Business ResultsDocument11 pages1Q 2010 Business ResultsmagicsohailNo ratings yet

- Financial Technologies (India)Document8 pagesFinancial Technologies (India)venkatesanvpmNo ratings yet

- Economic Outlook: 1.1 OverviewDocument10 pagesEconomic Outlook: 1.1 OverviewfoggymadNo ratings yet

- Rev16 PDFDocument34 pagesRev16 PDFAnonymous 298xlo3uUNo ratings yet

- Comunicado SSUINGLSDocument1 pageComunicado SSUINGLSMultiplan RINo ratings yet

- Operation and Maintenance Manual: 250-B17F 250-B17F/1 250-B17F/2 1 May 2004 Revision 10 First Edition 1 November 1989Document17 pagesOperation and Maintenance Manual: 250-B17F 250-B17F/1 250-B17F/2 1 May 2004 Revision 10 First Edition 1 November 1989Anonymous 298xlo3uUNo ratings yet

- Economic Highlights - Industrial Production Slowed Down in April - 10/6/2010Document3 pagesEconomic Highlights - Industrial Production Slowed Down in April - 10/6/2010Rhb InvestNo ratings yet

- ASX Metals and MiningDocument4 pagesASX Metals and Miningaliminsyah.caneNo ratings yet

- Maintenance PlotsDocument168 pagesMaintenance PlotsGeorgina SuleNo ratings yet

- Academy Course ScheduleDocument2 pagesAcademy Course ScheduleYannick OmbeteNo ratings yet

- 23 Aug 09 25 Sep 09 12 Oct 09 23 Oct 09 18 Jan 10 5 Aug 09 1 Feb 10Document2 pages23 Aug 09 25 Sep 09 12 Oct 09 23 Oct 09 18 Jan 10 5 Aug 09 1 Feb 10brut_fora_drinkNo ratings yet

- Economic Highlights: Industrial Production Slowed Down in FebruaryDue To Shorter Working Days - 08/04/2010Document3 pagesEconomic Highlights: Industrial Production Slowed Down in FebruaryDue To Shorter Working Days - 08/04/2010Rhb InvestNo ratings yet

- Catatan Pasokan Air PDAM MacetDocument6 pagesCatatan Pasokan Air PDAM Macetxeng leeNo ratings yet

- Economics IIPbbDocument8 pagesEconomics IIPbbKonark JainNo ratings yet

- Premarket OpeningBell ICICISec 07.02.19Document9 pagesPremarket OpeningBell ICICISec 07.02.19rchawdhry123No ratings yet

- SCP HighLevelDesignDocument8 pagesSCP HighLevelDesignhariraoNo ratings yet

- Newsl Flash08 Summer 2010 PerfDocument6 pagesNewsl Flash08 Summer 2010 Perfapi-31568155No ratings yet

- 2019-10 Monthly Housing Market OutlookDocument44 pages2019-10 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- YourLong TermPlanDocument1 pageYourLong TermPlanreyte4No ratings yet

- 05-Time Limits Maintenance ChecksDocument279 pages05-Time Limits Maintenance ChecksVasiliy Terekhov100% (1)

- Table 2: Average Unit Prices For Bitumen, Fuel Oil and DieselDocument2 pagesTable 2: Average Unit Prices For Bitumen, Fuel Oil and DieselasyrafmuhddNo ratings yet

- Outlook For The SMSF SectorDocument13 pagesOutlook For The SMSF SectorRomeoNo ratings yet

- Timber: Prospects Are Looking Better-17/03/2010Document5 pagesTimber: Prospects Are Looking Better-17/03/2010Rhb InvestNo ratings yet

- CIMB-Principal Greater China Equity Fund: Fund Objective Investment VolatilityDocument2 pagesCIMB-Principal Greater China Equity Fund: Fund Objective Investment VolatilityJackie Kennedy JustinNo ratings yet

- Kemajuan Fizikal SG Sat 050709Document1 pageKemajuan Fizikal SG Sat 050709wghazNo ratings yet

- ThesisDocument129 pagesThesisOvaid MehmoodNo ratings yet

- Digestibility Evaluation of Fish Meal, Rice Bran, Soya Bean Meal, Pollard On Ongole Cross Breed Cattle and Frisien Holstein Cross BreedDocument7 pagesDigestibility Evaluation of Fish Meal, Rice Bran, Soya Bean Meal, Pollard On Ongole Cross Breed Cattle and Frisien Holstein Cross BreedFailal Ulfi MauliahNo ratings yet

- Twinkle For Heather Challenge V2Document63 pagesTwinkle For Heather Challenge V2gillian.cartwrightNo ratings yet

- Fashion Through The Decades PowerpointDocument11 pagesFashion Through The Decades PowerpointNigar khanNo ratings yet

- Testing and CommissioningDocument18 pagesTesting and CommissioningAbdullah Afif100% (2)

- Pronoun Reference - Exercise 5: Correction Should Sound Natural and Be LogicalDocument4 pagesPronoun Reference - Exercise 5: Correction Should Sound Natural and Be LogicalPreecha ChanlaNo ratings yet

- Tabletop Gaming - Best Games of 2019Document198 pagesTabletop Gaming - Best Games of 2019Paulina Barszez100% (1)

- No More War PDF - Pauling, Linus, 1901Document260 pagesNo More War PDF - Pauling, Linus, 1901pdf ebook free downloadNo ratings yet

- Lalon'S Bank Written Math:: Pipe and Cisterns Math Problems Part 1Document5 pagesLalon'S Bank Written Math:: Pipe and Cisterns Math Problems Part 1Zia UddinNo ratings yet

- PROPOSALDocument62 pagesPROPOSALJam Dela CruzNo ratings yet

- A Review On Rasamanjari: It's Contribution in Pharmaceutical ScienceDocument3 pagesA Review On Rasamanjari: It's Contribution in Pharmaceutical ScienceEditor IJTSRDNo ratings yet

- Anode InfoDocument5 pagesAnode InfoEberg NlnoNo ratings yet

- Astm D2563-94Document24 pagesAstm D2563-94Santiago AngelNo ratings yet

- Asian Paints PDCDocument11 pagesAsian Paints PDCAshish BaidNo ratings yet

- Solar MPPT PresentationDocument21 pagesSolar MPPT PresentationPravat SatpathyNo ratings yet

- Lesson 2 Space in Relation To MovementsDocument7 pagesLesson 2 Space in Relation To MovementsJhanin BuenavistaNo ratings yet

- Chapter 10b Kinetic Theory For Ideal GasesDocument3 pagesChapter 10b Kinetic Theory For Ideal GasesPathmanathan NadesonNo ratings yet

- CL 55-60 AnDocument14 pagesCL 55-60 AnFrida KahloNo ratings yet

- CiapDocument64 pagesCiapFakh KrulNo ratings yet

- 3D Marine Seismic Survey Design PDFDocument129 pages3D Marine Seismic Survey Design PDFgeophenryNo ratings yet

- Growth and DevelopmentDocument57 pagesGrowth and DevelopmentKelvin kipkuruiNo ratings yet

- Hand Out MEOW PHYF111Document3 pagesHand Out MEOW PHYF111Shreya GuptaNo ratings yet

- 06 - Heights and DistancesDocument2 pages06 - Heights and DistancesRekha BhasinNo ratings yet

- AASHTO - LRFD - Construction Specs-2nd Edition-2 PDFDocument664 pagesAASHTO - LRFD - Construction Specs-2nd Edition-2 PDFSharfaraz Hossain100% (1)

- 03 2018 CHT Scheme & Syllabus VTUDocument57 pages03 2018 CHT Scheme & Syllabus VTUtejNo ratings yet

- TLE 8 - Handicraft Production Lesson 2: Elements of Design: Information SectionDocument9 pagesTLE 8 - Handicraft Production Lesson 2: Elements of Design: Information SectionMarist ChefNo ratings yet

- 2017 District Superintendent ReportDocument12 pages2017 District Superintendent ReportRob Steinbrook100% (1)

- Basic Troubleshooting CLARKDocument21 pagesBasic Troubleshooting CLARKRaul E. SoliNo ratings yet

- Budget of Work in Mathematics IIIDocument7 pagesBudget of Work in Mathematics IIIWehn LustreNo ratings yet