Professional Documents

Culture Documents

Investment Quizzers Investment Quizzers

Investment Quizzers Investment Quizzers

Uploaded by

Anna TaylorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Quizzers Investment Quizzers

Investment Quizzers Investment Quizzers

Uploaded by

Anna TaylorCopyright:

Available Formats

lOMoARcPSD|8329076

Investment Quizzers

Bachelor of Science in Customs Administration (Adamson University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

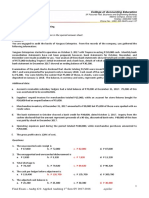

Initial Measurement FVPL VS. FVOCI – Dividend On

Agustin Company has the following transactions relating to its investments during 2021.

January 5: Acquired 10,000 shares of Abalos Company for P1,000,000 paying additional P20,000 for brokerage

fee and another P5,000 for commission.

February 14: Received dividends from Abalos declared January 2, 2021 to stockholders of record January

10, 2021, P20,000.

1) How much is the carrying amount of the investment in equity if measured at fair value through profit or loss?

EI-FVTPL 980,000

TRANSACTION COST 25,000

DIVIDEND RECEIVABLE 20,000

CASH 1,025,000

2) How much is the carrying amount of the investment in equity if the shares are considered non trading and the

company designated to report the change in fair value to other comprehensive income?

EI-FVOCI 1,005,000

DIVIDEND RECEIVABLE 25,000

CASH 1,025,000

Subsequent Measurement & Unrealized Gains and Losses – FVPL

Numbers 3, 4, 5 and 6

Jaybu Company acquired the following portfolio of equity instruments held for trading during 2022 and reported the

following balances at December 31, 2022. No sales occurred during 2022.

Security Cost Market Value, December 31, 2022

AAA Company Shares 300,000 350,000

BBB Company Shares 450,000 410,000

CCC Company Shares 540,000 640,000

DDD Company Shares 610,000 650,000

3) What is the carrying amount of the securities on December 31, 2022? @FV

A 350,000

B 410,000

C 640,000

D 650,000

TOTAL: 2,050,000

4) How much is the unrealized gain that should be taken to profit or loss statement?

@COST-@FV YR-END

1,900,000- 2050,000= UNREALIZED GAIN 150,000 CLOSED AT YEAR END IN P/L

5) How much is the unrealized gain that should be taken to other comprehensive income? ZERO

6) The unrealized gain that should be reported in the statement of financial position as of December 31, 2022 is: ZERO

(AKA CUMULATIVE GAIN)

Subsequent Measurement & Unrealized Gains and Losses – FVOCI

Numbers 7, 8 and 9

Jaybo Company purchased the following portfolio of equity instrument designated as fair value through other

comprehensive income during 2022 and reported the following balances below. No sales occurred during 2021 and

2022.

Security Cost Market value, 12/31/21 Market value, 12/31/22

Goku Ordinary Shares 800,000 820,000 910,000

Vegetta Ordinary Shares 1,400,000 1,500,000 1,000,000

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

7) How much should be reported as unrealized gain related to the securities in its 2021 other comprehensive income?

120,000

@COST VS. YEAR END @FV

820,000 820,000

1400,000 1500,000

2,200,000 2320,000

2021 YR EN ENTRY:

EI-FVOCI 120,000

UG/L 120,000

8) How much should be reported as unrealized gain related to the securities in its 2022 other comprehensive income?

ZERO, THERE IS NO UNREALIZED GAIN.

2021@FV VS. 2022YEAR END FV

820,000 910,000

1,500,000 1,000,000

2,320,000 1,910,000

2022 HOLDING LOSS 410,000

AJE:

UG 120,000

UL 290,000

EI-FVOCI 410,000

IF THE QUESTION IS LOSS:

UNREALIZED LOSS TO BE REPORTED IN OCI IS 410,000.

9) How much should Jaybo Company report as unrealized gain or loss related to the securities in its 2022 statement of

financial position?

290,000 UNREALIZED LOSS TO BE REPORTED AT SFP.

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

Subsequent Measurement & Unrealized Gains and Losses – FVPL & FVOCI

Numbers 10, 11 and 12

Pompey Inc. carries the following marketable equity securities on its books at December 31, 2021 and 2022. All

securities were purchased during 2021.

Trading Securities:

Cost Fair value 12/31/21 Fair value 12/31/22

AAA Company P 500,000 P 260,000 P 400,000

BBB Company 260,000 400,000 400,000

CCC Company 700,000 600,000 500,000

Total P1,460,000 P1,260,000 P1,300,000

Financial Assets at Fair value through OCI

Cost Fair value 12/31/21 Fair value 12/31/22

DDD Company P4,100,000 P3,600,000 P3,600,000

EEE Company 1,000,000 1,200,000 1,400,000

Total P5,100,000 P4,800,000 P5,000,000

10) The net amount to be recognized in 2021 comprehensive income is 500,000 UNREALIZED LOSS

11) The net amount to be recognized in 2022 comprehensive income is 240,000 UNREALIZED GAIN

12) The net unrealized gain/loss at December 31, 2022 in accumulated other comprehensive income in shareholders'

equity is 100,000 LOSS

Gain or Loss on Sale of FVPL

13) On January 1, 2020, Erika Company purchased equity investments held for trading.

Purchase Price Transaction Cost Market-12/31/2020

Security A 1,000,000 100,000 1,200,000

Security B 2,000,000 200,000 1,500,000

Security C 3,000,000 300,000 3,100,000

On July 1, 2021, the entity sold Security A for P1,900,000.

What amount should be reported as gain on sale for trading securities in the 2021 Income Statement?

CA 2020 SEC. A 1,200,000

SP 1,900,000

GAIN ON SALE 700,000

Gain or Loss on Sale of FVPL – Dividend On

14) C4 Company owns 8% of Isolate Inc., P100 par, 150,000 outstanding ordinary shares which was acquired on

November 20, 2022 for P1,320,000. C4 classified this as fair value through profit or loss

On December 1, 2022, Isolate declared a P2 per share cash dividend to shareholders of record January 10,

2023, payable on January 31, 2023.

On December 28, 2022, C4 sold all the shares to Xtend Company at P115 per share.

How much gain or loss on sale shall be recognized C4 on December 28, 2022? 36,000 gain on sale

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

Gain or Loss on Sale of FVOCI

15) On January 1, 2020, Sheena Company purchased nontrading equity investments which are irrevocably designated

at FVOCI:

Purchase Price Transaction Cost Market-12/31/2020

Security A 1,000,000 100,000 1,500,000

Security B 2,000,000 200,000 2,400,000

Security C 4,000,000 400,000 4,700,000

On July 1, 2021, the entity sold Security C for P5,200,000.

What amount should be credited to retained earnings as a result of the sale of the investment in 2021? 800,000

Gain or Loss on Sale of FVOCI – Partial

Sale Numbers 15 and 16

On January 1, 2019, Familia purchased 1,600 ordinary shares of another entity for P2,000,000.

During 2019, the investee paid a cash dividend of P130 per share.

At December 31, 2019, the investee’s shares were selling for P1,400 per share.

Familia irrevocably designated to classify equity investment at FVOCI.

On October 1, 2020, Familia sold half of its shares at P1,800 per share.

At December 31, 2020, the shares were selling at P1,900 per share.

16) What amount is recognized in retained in retained earnings as a result of the disposal in 2020? 440,000

17) The unrealized gain recognized in the statement of comprehensive income for the year end December 31 2020 is

400,000

Dividend Income

18) Lil Wayne Corporation received dividends from ordinary shares (15% interest) and preference share (25% interest)

investment during the current year:

A cash dividend of P100,000 from ordinary shares investment.

A cash dividend of P50,000 from preference share investment.

A stock dividend of 2,000 shares from ordinary shares investment when the market price was P12 per share.

A property dividend costing P500,000 which had a market value of P600,000.

A liquidating dividend of P5,000 from ordinary investment.

How much is the total dividend income that should be reported for the current year?

Unrealized Gains & Losses, Gain or Loss on Sale – With Share

Dividend Numbers, 18 and 19

On January 1, 2022, Pork Company purchased 20,000 ordinary shares of Beef Corporation for P700,000 which includes

P5,000 transaction cost. On December 31, 2022, the shares were selling at P32, which increased to P36 on December

31, 2023.

On June 30, 2024, Beef Corporation distributed 20% bonus issue. On July 15, 2024, Pork Company sold 15,000 shares

at P35 per share. On December 31, 2024, Beef Corporation shares were selling at P34 per share. Pork classified the

investment at fair value through profit or loss.

19) The unrealized losses that should be included in profit or loss statement for the year ended December 31 2022 is

20) The amount of gain or loss on sale on July 15, 2024 is

Investment In Shares – Cost Model

Numbers 21 and 22

During 2022, Dua Company bought the shares of another Lipa Company accounted for under cost method.

June 1, 2022 20,000 shares @ P100 2,000,000

December 1, 2022 30,000 shares @ P120 3,600,000

Transactions for 2023

January 10 Received cash dividend at P10 per share.

January 20 Received 20% share dividend.

December 10 Sold 30,000 shares at P125 per share.

21) What is the gain on sale of investment using the FIFO approach? 1,150,000

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

22) What is the gain on sale of investment using the average approach?

950,000

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

AC – Determining Initial Measurement Without Available Purchase Price

1) On January 1, 2021, Python Company purchased eight-year bonds with a face value of P2,000,000 and a stated

interest rate of 12%, payable semi-annually on June 30 and December 31. The bonds were purchased to yield 14%.

Present value (PV) factors are:

12% 14% 6% 7%

PV of 1 for 8 periods 0.4039 0.3506 0.6274 0.5820

PV of 1 for 16 periods 0.1631 0.1229 0.3936 0.3387

PV of annuity of 1 for 8 periods 4.9676 4.6389 6.2098 5.9713

PV of annuity of 1 for 16 periods 6.9740 6.2651 10.1059 9.4466

1,810,992

What is the purchase price for the

AC – bonds?

Acquired Between Interest Dates

2) On October 1, 2022, Sonar Company purchased a P2,000,000 face value 10% debt instrument for P1,977,800 and

classified this an investment at amortized cost. The effective rate for this type of investment is 12%. The debt

instrument pays interest semi-annually on June 1 and December 1.

What is amount should Sonar Company initially record the investment in bonds on October 1, 2022? 1,911,113

AC – Subsequent Measurement, Interest Income & Unrealized Gains &

Losses Numbers 3, 4, 5 and 6

Dr. Dre Corporation acquired on January 1, 2022 a 5-year, 10%, P5,000,000 face value bonds, for P4,639,400 dated

January 1, 2022. The bonds which pay interest every December 31 had a 12% prevailing interest rate on the date of

acquisition. Dr. Dre’s business model is to collect contractual cash flows and the cash flows are solely payment of

principal and interest. Prevailing interest rate on December 31, 2017 is at 9%.

3) How much is the carrying amount of Investment on December 31, 2022?

4) How much is the correct income for the year 2022?

5) How much is the correct income for the year 2023?

6) How much is the unrealized gain/loss to be reported in the company’s 2022 statement of comprehensive income?

AC – Subsequent Measurement & Interest Income – Serial

Bonds Numbers 7 & 8

On January 1, 2020 Jennifer Company purchased bonds with face amount of P8,000,000 for P7,679,000 to be held to

maturity. The stated rate on the bonds is 10% but the bonds are acquired to yield 12%. The bonds mature at the rate of

P2,000,000 annually every December 31 and the interest is payable annually also every December 31. The entity used

the effective interest method of amortizing discount.

7) What is the carrying amount of the bond investment on December 31, 2020?

8) What amount should be reported as interest revenue for 2020?

AC – Subsequent Measurement & Interest Income – Semi Annual

Numbers 9 and 10

On January 1, 2021, KKK Company paid P5,990,000 for a 10% bond with face amount of P5,000,000. Interest is

payable semi-annually on June 30 and December 31. The bond was purchased to yield 8%. The effective interest

method is used.

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

9) What is the carrying amount of the bond investment on December 31, 2021?

10) What is the interest income for 2021?

AC – Gain or Loss on Sale

11) On January 1, 2021, Norwegian Forest Company purchased bonds with face value of P5,000,000 to be measured

at amortized cost. The entity paid P4,600,000 plus transaction costs of P142,000. The bonds mature on December

31, 2023 and pay 6% interest annually on December 31 of each year with 8% effective interest. The bonds are

quoted at 105 on December 31, 2021. The bonds are sold at 110 on December 31, 2022.

What amount of gain on sale on these bonds should be reported in 2022 income statement?

FVPL – Initial Measurement

12) On January 1, 2021, Righteousness Company purchase 12% bonds with face amount of P5,000,000 for P5,500,000

including transaction cost of P100,000. The bonds provide an effective yield of 10%. The bonds are dated January

1, 2021 and pay interest annually on December 31 of each year. The entity classified the investment as trading

securities.

What is the carrying amount of the bond investment on January 1, 2021?

FV PL Between Interest Rate

On May 1, 2022, Tyga Company purchased a P2,000,000 face value 9% debt instruments for P1,860,000 including the

accrued interest. The business model in managing the financial assets is to general short-term profit from changes in

fair value of the securities.

The debt instruments pay interest semi-annually on January 1 and July 1. On December 31, 2022, the fair value of the

instruments is P1,940,000.

13) How much is the interest income for the year 2022?

14) How much is the unrealized gain or loss that should be taken to profit or loss for the year 2022

15) How much is the accrued interest on December 31, 2022?

FVPL – Interest Income and Unrealized Gains and Losses

On January 1, 2023, Creedo Company purchased 9% bonds in the face amount of P6,000,000. The bonds mature on

January 1, 2028 and were purchased for P5,550,000 to yield 11%. Creedo classified the bonds as held for trading and

interest is payable annually every December 31.

Fair value Effective rate

December 31, 2023 5,450,000 12%

December 31, 2024 6,150,000 8%

16) What is the interest income for 2023?

17) What amount of unrealized loss should be reported in profit or loss for 2023?

18) What amount of unrealized gain should be recognized in profit or loss for 2024?

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

FVPL – Gain or Loss on Sale

19) On December 1, 2022, Mundo Company purchased P5,000,000, 15% face value bonds at 98. The bonds mature

on November 30, 2032 and pay interest semi-annually every May 31 and November 30. Transaction cost incurred

in relation to the acquisition is 3% of the bonds face value. Mundo classified this investment as trading securities.

On November 30, 2025 after receiving the periodic interest, Mundo sold the investment at 101. The bonds were

quoted in the market at 98, 99, 102, 100 and 97 on December 31, 2022, 2023, 2024, 2025 and 2026, respectively.

What is the gain or loss on sale of the investment?

FVOCI – Interest Income & Unrealized Gains and Losses

Numbers 20 and 21

On January 1, 2023 Abby Company purchased 8% bonds in the face amount of P8,000,000. The bonds mature on

January 1, 2028 and were purchased for P8,671,680 to yield 6%.

Abby’s business model for this investment is to collect contractual cash flows composed of principal and interest, and

sell the asset in the open market. Interest is payable annually every December 31. The fair value of the bonds on

December 31, 2023 was P7,737,600 with an effective yield of 9%.

20) What is the interest income for 2023?

21) What amount of unrealized loss in OCI is reported in the statement of comprehensive income for 2023?

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

FVOCI – Carrying Amount & Unrealized Gains and Losses

Numbers 22, 23, 24, 25 and 26

Kristine Zairah holds debt securities within a business model whose objective is achieved both by collecting contractual

cash flows and selling the debt securities. The contractual cash flows are solely payments of principal and interest on

specified dates. The term of the P1,000,000, 7% bonds is 5 years, purchased on December 31, 2019, for P1,086,565.

The bonds were purchased to yield 5% interest. The following schedule presents the fair value of the bonds at year-end.

December 31, 2020 1,065,000

December 31, 2021 1,075,000

December 31, 2022 1,056,500

December 31, 2023 1,030,000

December 31, 2024 1,000,000

22) What amount should be reported as investment in bonds in the statement of financial position of Kristine Zairah on

December 31, 2021?

23) What amount of unrealized gain/loss should be shown as component of other comprehensive income in the 2021

statement of comprehensive income?

24) What amount of unrealized gain/loss should be shown as component of other comprehensive income in the 2022

statement of comprehensive income?

25) What amount of unrealized gain/loss should be shown as component of other comprehensive income in the 2023

statement of comprehensive income?

26) What amount of unrealized gain/loss should be shown in the 2023 statement of changes in equity?FVOCI – Gain or Loss on Sale

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

Number 27 and 28

On January 1, 2022, Goliath Corporation purchased P1,000,000 10% bonds classified as Financial Asset at Fair Value

through Other Comprehensive Income (FVTOCI). The bonds were purchased to yield 12%. Interest is payable annually

every December 31. The bonds mature on December 31, 2026. On December 31, 2022 the bonds were selling at 99.

On December 31, 2023, Goliath sold P500,000 face value bonds at 101.

Present value of 1 at 12% for 5 periods 0.5674

Present value of annuity at 12% for 5 periods 3.6048

27) How much should be recognized in 2023 OCI?

28) How much is the gain on sale of the investment in bonds to be recognized in 2023 profit or loss?

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

Goodwill in Excess

On June 30, 2020, Cape Company purchased 25% of the outstanding ordinary shares of Bit Co. at a total cost of

P2,100,000. The book value of Bit Co.’s net assets on acquisition date was P7,200,000. For the following reasons,

Cape was willing to pay more than book value for Bit Co. stock:

Bit Co. has depreciable assets with a current fair value of P180,000 more than their book value. These assets

have a remaining useful life of 10 years.

Bit co. owns a tract of land with a current fair value of P900,000 more than its carrying amount.

All other identifiable tangible and intangible assets of Bit Co. have current fair values that are equal to their

carrying amounts.

Bit reported net income of P1,620,000, earned evenly during the current year ended December 31, 2020. Also in the

current year, it declared and paid cash dividends of P315,000 to its ordinary shareholders.

Market value of Bit Co.’s ordinary shares at December 31, 2020 is P9 million. Cape Company’s financial year-end is

December 31.

1) What is the amount of goodwill paid by Cape Company?

2) What amount of investment revenue should Cape report on its income statement for the year ended December 31,

2020 under the equity method?

3) Under the equity method, the carrying value of Cape Company’s investment in ordinary shares of Bit Co. on

December 31, 2020 should be:

Bargain Purchase Option

On January 1, 2021, Flesh-n-Bone Corporation acquired 30% of Doug Corporation’s 200,000 outstanding shares

at P50 per share. Doug’s net assets had a book value on the same date at P8,200,000. On the acquisition date,

the following assets were deemed understated:

Building having a remaining useful life of 20 years was understated by P1,500,000.

Equipment having a remaining life of 10 years was understated by P500,000.

Doug reported net income for the year at P2,000,000 and paid cash dividends of P10 per share by December 31.

4) How much investment income should be reported in Flesh-n-Bone Corporation’s profit or loss for 2021?

5) What is the carrying amount of the investment in Doug as of December 31, 2021?

Inter-Company Transaction

Giants Company acquired 40% interest in an associate, 49ers Company, for P5,000,000 on January 1, 2017. At

the acquisition date, there were no differences between fair value and carrying amount of identifiable assets

and liabilities. 49ers Company reported net income of P3,000,000 for 2017 and P4,000,000 for 2018. 49ers

Company paid dividend of P500,000 in 2017 and P1,500,000 in 2018.

On July 1, 2017, 49ers Company sold an equipment for P1,500,000 to Giants Company. The carrying amount of the

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

equipment is P1,000,000 at the time of sale. The remaining life of the equipment is 5 years and Giants Company used the

straight line depreciated. On December 1, 2018, 49ers Company sold an inventory to Giants Company for P2,800,000. The

inventory had a cost of P2,000,000 and was still on hand on December 31, 2018.

6) What is the investor’s share in the profit of

the associate for 2017?

7) What is the carrying amount of the investment

in associate on December 31, 2017?

8) What is the investor’s share in the profit of

the associate for 2018?

9) What is the carrying amount of the investment

in associate on December 31, 2018?

Investment in Associates – Achieve In Stages

On January 1, 2020, Raptors Company purchased 25,000 shares of Game Company which represent a 10% interest for

P2,000,000. Raptors used the cost method. Game reported net income of P4,000,000 and paid P1,500,000 cash

dividends in 2020. On January 1, 2021, Raptors paid P5,000,000 for 50,000 additional shares of Game Company. It was

determined that the fair value of the previous 10% interest was P2,500,000 on January 1, 2021.

The fair values of the identifiable assets of Game Company equal carrying amount of P15,000,000 on purchase date

except for land whose fair value exceeded carrying amount by P2,000,000. For the year ended December 31, 2021,

Game reported net income of P8,000,000 and paid cash dividend of P20 per share.

10) What is the investment income that should be recognized in 2020?

11) What is the goodwill arising from the acquisition in 2021?

12) What total income should be recognized in 2021?

13) What is the carrying amount of the investment on December 31, 2021?

Associate Reporting OCI Item – With Below 20% Ownership

14) On January 1, 2023, Snap Company paid P3,000,000 for 30,000 shares of Croc Company which represents a 15%

interest in the net assets of the investee. The purchase price is equal to the carrying amount of the net assets

acquired. Snap’s board of directors is represented in Croc’s board of directors which gives it the ability to exercise

significant influence over the investee.

The entity received a dividend of P15 per share from the investee in 2023. The investee reported net income of

P8,000,000 and revaluation surplus of P2,500,000 in 2023.What amount should be reported as investment in Croc

Company for the year ended December 31, 2023?

Investment in Associates – With Preference Shares

Bow Wow owns 25% of the ordinary shares of Doug Corporation. Doug has 8% preference shares with total par value

of P10,000,000. Doug declared P700,000 dividends on its preference shares & reported a profit of P3,000,000 during

2017.

15) How much is the share in net profit assuming the preference shares is cumulative?

16) How much is the share in net income assuming the preference shares is non-cumulative?

Gain or Loss on Sale of Associate

Persian Cat Company acquired 30% of another entity’s voting shares on January 1, 2016 for P2,000,000. The investor

used the equity model to account for investment in associate. During 2016, the investee earned P800,000 and paid

dividends of P500,000. During 2017, the investee earned P1,000,000 and paid dividends of P300,000 on April 1

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

and P300,000 on October 1. The investee’s income was earned evenly throughout the year. On July 1, 2017, the

investor sold half of the investment in associate for P1,320,000 cash.

What is the gain on sale of the investment in 2017?

Gain or Loss on Sale Plus Other Related Income on Year of Sale

Gold Company acquired 30% of Silver Company’s voting share capital for P2,000,000 on January 1, 2023. Gold’s 30%

interest in Silver gave Gold the ability to exercise significant influence. During 2023, Silver earned P1,500,000 and paid

dividend of P800,000. Silver reported earnings P3,000,000 for the year ended December 31, 2024. The income was

earned evenly throughout 2024.

On July 1, 2024, Gold sold half of the investment in Silver for P1,800,000 cash. Silver paid dividend of P1,000,000 on

October 1, 2024. The fair value of the retained investment is P1,900,000 on July 1, 2024 and P2,300,000 on December

31, 2024. The retained investment is to be held as financial asset at FVOCI.

17) On December 31, 2023, what is the carrying amount of the investment in associate?

18) What total amount of income in profit or loss should be reported in 2024?

Inclusions & Exclusions

1) Cynthia Villar Company has the following property items at December 31, 2023:

Land which at the date of acquisition is not intended for any specific use in the future 1,000,000

Land held for future plant site 2,000,000

Building being leased out under operating lease 8,000,000

Building being leased out under finance lease 2,500,000

Equipment being leased under operating lease 1,500,000

Land and building acquired under finance leases being used by the entity as its general and

administrative headquarter 9,200,000

Condominium building that is being constructed intended for sale in the ordinary course of 5,000,000

business

Building leased out under operating lease, insignificant portion is used for administrative purposes 6,000,000

Hotel building owned which significant services are provided to the guests 7,000,000

How much should be classified as investment properties on December 31, 2023?

Inclusions & Exclusions

2) Minty Corporation’s properties included the following items:

Land held as potential plant site, P5,000,000.

A vacant building to be leased out under an operating lease, P20,000,000.

Property held for sale in the ordinary course of its business, P30,000,000.

Property acquired exclusively with a view to subsequent disposal in the near future, P4,000,000.

Property occupied by employees paying market rent, P3,000,000.

Property occupied by employees paying below market rent, P1,000,000.

Property held for administrative purposes, P10,000,000.

A hotel owned and managed, P50,000,000.

A building being leased out to a subsidiary, P8,000,000.

Property that is being constructed for use as an investment property, P2,000,000.

A building, which cannot be sold or leased out separately, used in the production of goods and around 2% of

the area being leased out to canteen operators, P7,000,000.

How much should be reported as investment properties in Minty Corporation’s separate financial statements?

Cost Method – Carrying Amount & Income/Expense Related

Numbers 03 and 04

Santana Company acquired a building on January 1, 2022 for P900,000. At that date the building had a useful life of 30

years. At December 31, 2022 the fair value of the building was P960,000. The building was classified as an investment

property and accounted for under the cost method.

3) What is the carrying amount of the investment property as of the year ended December 31, 2022?

4) What is the amount to be recognized in the income statement for the year 2022?

Fair Value Method – Carrying Amount & Income/Expense Related

Numbers 05 and 06

50 Cent Company acquired a building on January 1, 2022 for P18,000,000. At that date, the building had a useful life of 40

years. The fair value of the building was P20,000,000 at December 31, 2022. The building was appropriately classified

as investment property and accounted for using the fair value model.

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

5) What is the carrying amount of the investment property as of the year ended December 31, 2022?

6) What is the amount to be recognized in the income statement for the year 2022?

Fair Value Method – Unrealized Gains And Losses, Two Years

7) Panic Co. owns three properties which are classified as investment properties. Details of the properties are as

follows:

Initial Cost Fair value December 31, 2021 Fair value December 31, 2022

Property A 2,700,000 3,200,000 3,500,000

Property B 3,450,000 3,000,000 2,800,000

Property C 3,300,000 3,900,000 3,400,000

Each property was acquired in 2020 with a useful life of 50 years. The entity’s accounting policy is to use the fair value

model for investment properties. What is the gain or loss to be recognized for the year ended December 31, 2022?

Gain Or Loss On Sale Of Investment Property

8) 3 Doors Down Company purchased an investment property on January 1, 2022 at a cost of P2,200,000. The

property had a useful life of 40 years and on December 31, 2022 had a fair value of P3,000,000. On December 31,

2023 the property was sold for net proceeds of P2,900,000.

What is the gain or loss to be recognized for the year ended December 31, 2023 if 3 Doors Down under the following

models:

Cost Model Fair Value Model

Classifying-Out from Investment Property – Under FV

Model Numbers 09 and 10

On January 1, 2023, Blitz Company acquired an investment property at a total cost of P5,000,000. At December 31,

2023, the carrying amount of the property in the company’s books is P6,000,000. On December 31, 2024, Blitz

Company decided to use the property and immediately reclassified as plant asset (owner occupied property).

9) What would be the initial cost of the plant asset if it has a fair value of P6,500,000 at conversion date?

10) What amount of revaluation surplus Blitz Company would recognize at the time of conversion?

Classifying-In to Investment Property – Under Cost Model

11) Diffun, Inc. owns a building purchased on January 1, 2012 for P50 million. The building was used as the company’s

head office. The building has an estimated useful life of 25 years. In 2016, the company transferred its head office

and decided to lease out the old building. Tenants began occupying the old building by the end of 2016. On

December 31, 2016, the company reclassified the building as investment property to be carried under the cost

model. The fair value on the date of reclassification was P42 million. How much should be recognized in the

2016 profit or loss as a result of the transfer from owner-occupied to investment property?

Classifying-In to Investment Property – Under Fair Value Model

12) An office building used by Cute for administrative purposes with a depreciated historical cost of P2 million. At 1

January 2016 it had a remaining life of 20 years.After a re-organization on 1 July 2016, the property was leased

to a third party and reclassified as an investment property applying Cute’s policy of the fair value model. An

independent valuer assessed the property to have a fair value of P2.3 million at 1 July 2016, which had risen to

P2.34 million at 31 December 2016. Net amount in other comprehensive income

Downloaded by Anna Taylor (taylor99joy@gmail.com)

lOMoARcPSD|8329076

Downloaded by Anna Taylor (taylor99joy@gmail.com)

You might also like

- Cash Problems Proof of CashDocument25 pagesCash Problems Proof of CashAnna Taylor75% (4)

- Case 3Document13 pagesCase 3Prezi Toli100% (1)

- Resa p1 First PB 1015Document21 pagesResa p1 First PB 1015Din Rose GonzalesNo ratings yet

- Sample Custodial Trust AgreementDocument6 pagesSample Custodial Trust AgreementMich Angeles100% (1)

- FAR PreBoard (1) CPAR BATCH90Document18 pagesFAR PreBoard (1) CPAR BATCH90Bella ChoiNo ratings yet

- Module 6 Audit of InvestmentsDocument15 pagesModule 6 Audit of InvestmentsKez MaxNo ratings yet

- This Study Resource Was: B. Cost of Designing Products For Specific CustomersDocument6 pagesThis Study Resource Was: B. Cost of Designing Products For Specific CustomersSha RaNo ratings yet

- JJJDocument12 pagesJJJCamille ManalastasNo ratings yet

- Audit of InvDocument19 pagesAudit of InvMae-shane SagayoNo ratings yet

- Bank Recon Prob 1Document3 pagesBank Recon Prob 1Joanna Paula Edem100% (2)

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- P2 1PB 2nd Sem 1314 With SolDocument15 pagesP2 1PB 2nd Sem 1314 With SolRhad EstoqueNo ratings yet

- (Problems) - Audit of ReceivablesDocument16 pages(Problems) - Audit of Receivablesapatos80% (5)

- Taxation H01 - Fundamental Principles of TaxationDocument9 pagesTaxation H01 - Fundamental Principles of TaxationAnna TaylorNo ratings yet

- Backbase The ROI of Omni Channel WhitepaperDocument21 pagesBackbase The ROI of Omni Channel Whitepaperpk8barnesNo ratings yet

- GenMath11 - Q2 - Mod5 - Demesa CE 1 Ce 2 EDITEDDocument31 pagesGenMath11 - Q2 - Mod5 - Demesa CE 1 Ce 2 EDITEDAngel Lou Datu50% (6)

- ReporttDocument7 pagesReporttaryan nicoleNo ratings yet

- Examination About Investment 2Document2 pagesExamination About Investment 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- 9.1 Equity Investments at Fair Value PDFDocument4 pages9.1 Equity Investments at Fair Value PDFJorufel PapasinNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- May 2020 - AP Drill 3 (Investments and Inventories) - Answer KeyDocument7 pagesMay 2020 - AP Drill 3 (Investments and Inventories) - Answer KeyROMAR A. PIGANo ratings yet

- Bsa 7Document2 pagesBsa 7Gray JavierNo ratings yet

- InventoriesDocument64 pagesInventoriesJoey WassigNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- This Study Resource WasDocument9 pagesThis Study Resource WasMarjorie PalmaNo ratings yet

- Examination About Investment 10Document2 pagesExamination About Investment 10BLACKPINKLisaRoseJisooJennieNo ratings yet

- AnswerQuiz - Module 7Document3 pagesAnswerQuiz - Module 7Alyanna AlcantaraNo ratings yet

- ACC-122 Inventory QuizDocument2 pagesACC-122 Inventory QuizPea Del Monte Añana100% (1)

- This Study Resource Was: Logo HereDocument5 pagesThis Study Resource Was: Logo HereMarcus MonocayNo ratings yet

- Examination About Investment 14Document3 pagesExamination About Investment 14BLACKPINKLisaRoseJisooJennieNo ratings yet

- QUIZ 4.1 Investments PDFDocument4 pagesQUIZ 4.1 Investments PDFGirly CrisostomoNo ratings yet

- Adapon Ia1 Posttest3 InventoriesDocument8 pagesAdapon Ia1 Posttest3 InventoriesJOSCEL SYJONGTIANNo ratings yet

- Final Exam 12 PDF FreeDocument17 pagesFinal Exam 12 PDF FreeEmey CalbayNo ratings yet

- 1 Cash and Cash Equivalents 3Document14 pages1 Cash and Cash Equivalents 3Abegail AdoraNo ratings yet

- Farap 4503Document12 pagesFarap 4503Marya Nvlz100% (1)

- 13 Acctg Ed 1 - Loan ReceivableDocument17 pages13 Acctg Ed 1 - Loan ReceivableNath BongalonNo ratings yet

- Simulated Final Exam. IntAccDocument6 pagesSimulated Final Exam. IntAccNicah AcojonNo ratings yet

- FAR.2917 - Bank Reconciliation PDFDocument4 pagesFAR.2917 - Bank Reconciliation PDFEyes Saw0% (1)

- This Study Resource Was Shared Via: Solution 23-2 Answer DDocument5 pagesThis Study Resource Was Shared Via: Solution 23-2 Answer DDummy GoogleNo ratings yet

- Proof of Cash Problems 4 PDF FreeDocument9 pagesProof of Cash Problems 4 PDF FreeAngieNo ratings yet

- 91 - Final Preaboard AFAR Solutions (WEEKENDS)Document9 pages91 - Final Preaboard AFAR Solutions (WEEKENDS)Joris YapNo ratings yet

- Cash and Cash Equivalents: Answer: CDocument142 pagesCash and Cash Equivalents: Answer: CGarp BarrocaNo ratings yet

- Audit of Receivables: Problem No. 1Document6 pagesAudit of Receivables: Problem No. 1Kathrina RoxasNo ratings yet

- Reviewer in PPEDocument16 pagesReviewer in PPEDewi Leigh Ann Mangubat50% (2)

- This Study Resource Was: Problem 1Document2 pagesThis Study Resource Was: Problem 1Michelle J UrbodaNo ratings yet

- Examination About Investment 7Document3 pagesExamination About Investment 7BLACKPINKLisaRoseJisooJennieNo ratings yet

- 13 Investment in Equity SecuritiesDocument146 pages13 Investment in Equity SecuritiesDan Di100% (1)

- Finals Answer KeyDocument6 pagesFinals Answer Keymarx marolinaNo ratings yet

- FAR Preweek (B44)Document10 pagesFAR Preweek (B44)Haydy AntonioNo ratings yet

- AACONAPPS2 A433 - Audit of ReceivablesDocument23 pagesAACONAPPS2 A433 - Audit of ReceivablesDawson Dela CruzNo ratings yet

- Nfjpia Cup - Auditing Problems SGV & Co. Easy Question #1: Answer: P126,816Document18 pagesNfjpia Cup - Auditing Problems SGV & Co. Easy Question #1: Answer: P126,816Merliza Jusayan100% (1)

- Cannon Ball Review With Exercises Part 2 PDFDocument30 pagesCannon Ball Review With Exercises Part 2 PDFLayNo ratings yet

- Estimating Ending InventoryDocument1 pageEstimating Ending InventorywarsidiNo ratings yet

- Sol Invty I ActivitiesDocument13 pagesSol Invty I ActivitiesKelsey VersaceNo ratings yet

- 4th Assessment STUDENTDocument5 pages4th Assessment STUDENTJOHANNA TORRESNo ratings yet

- 9.3 Debt InvestmentsDocument7 pages9.3 Debt InvestmentsJorufel PapasinNo ratings yet

- This Study Resource Was: FAR EasyDocument9 pagesThis Study Resource Was: FAR EasyPM HauglgolNo ratings yet

- Audit-Of Inventory ACHA - KJDocument47 pagesAudit-Of Inventory ACHA - KJKhrisna Joy AchaNo ratings yet

- Intermediate Accounting Volume by Empleo & Robles Solution Manual Chapter 1Document1 pageIntermediate Accounting Volume by Empleo & Robles Solution Manual Chapter 1thanzskieee41% (17)

- Afar.2905 Business Combination Mergers PDFDocument5 pagesAfar.2905 Business Combination Mergers PDFCyrille Keith FranciscoNo ratings yet

- ProblemsDocument368 pagesProblemsAnne EstrellaNo ratings yet

- Nissan FinalDocument4 pagesNissan FinalPrince Jayanmar BerbaNo ratings yet

- Investments: Problem 1Document4 pagesInvestments: Problem 1Frederick AbellaNo ratings yet

- Aud Sample UpdatedDocument36 pagesAud Sample Updatedreynald john dela cruzNo ratings yet

- FA@FV and AC. Initial Subsequent Measurement. ReclassificationDocument4 pagesFA@FV and AC. Initial Subsequent Measurement. ReclassificationMiccah Jade CastilloNo ratings yet

- Quiz 3 UploadDocument6 pagesQuiz 3 UploadandreamrieNo ratings yet

- W Final ExamDocument42 pagesW Final ExamAnna TaylorNo ratings yet

- Chapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeDocument9 pagesChapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeAnna TaylorNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasAnna TaylorNo ratings yet

- Following File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamDocument7 pagesFollowing File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamAnna TaylorNo ratings yet

- Sampling Techniques: 4.1 Population and SamplesDocument20 pagesSampling Techniques: 4.1 Population and SamplesAnna TaylorNo ratings yet

- This Study Resource WasDocument9 pagesThis Study Resource WasAnna TaylorNo ratings yet

- CH 3Document24 pagesCH 3Anna TaylorNo ratings yet

- Chapter 5 Caselette Audit of InventoryDocument33 pagesChapter 5 Caselette Audit of InventoryAnna Taylor100% (1)

- 3.1.5 Audit of Inventories ANSWERDocument38 pages3.1.5 Audit of Inventories ANSWERAnna TaylorNo ratings yet

- Audit of Inventories Roque 2018Document61 pagesAudit of Inventories Roque 2018Anna TaylorNo ratings yet

- Practi Calaccounti Ngtworevi Ewers/TestbanksDocument47 pagesPracti Calaccounti Ngtworevi Ewers/TestbanksAnna TaylorNo ratings yet

- Tabular and Graphical Presentation Using Excel: 2.1 Summarizing Categorical DataDocument15 pagesTabular and Graphical Presentation Using Excel: 2.1 Summarizing Categorical DataAnna TaylorNo ratings yet

- Practice Questions Psa 210 Amp 300 PDF FreeDocument10 pagesPractice Questions Psa 210 Amp 300 PDF FreeAnna TaylorNo ratings yet

- Gross Estate (Exclusions/Exemptions) : Exemption of Certain Acquisitions and TransmissionsDocument22 pagesGross Estate (Exclusions/Exemptions) : Exemption of Certain Acquisitions and TransmissionsAnna TaylorNo ratings yet

- Unit C: The Professional Practice of Public AccountingDocument64 pagesUnit C: The Professional Practice of Public AccountingAnna TaylorNo ratings yet

- Expenditure Program, by Object, Fy 2019 - 2021 (In Thousand Pesos) Table B.1Document5 pagesExpenditure Program, by Object, Fy 2019 - 2021 (In Thousand Pesos) Table B.1Anna TaylorNo ratings yet

- Review Questions Unit BDocument17 pagesReview Questions Unit BAnna TaylorNo ratings yet

- Transfer TaxDocument3 pagesTransfer TaxAnna TaylorNo ratings yet

- LMC - AEC 09 - Chapter 03Document52 pagesLMC - AEC 09 - Chapter 03Anna TaylorNo ratings yet

- G12 Buss Finance W3 LASDocument16 pagesG12 Buss Finance W3 LASEvelyn DeliquinaNo ratings yet

- IntroductionDocument7 pagesIntroductionAmal ChandraNo ratings yet

- Nature of Banking and Functions of A BankerDocument22 pagesNature of Banking and Functions of A BankerYashitha CaverammaNo ratings yet

- Problem Set 1 Simple InterestDocument2 pagesProblem Set 1 Simple InterestJeda NjobuNo ratings yet

- Boeing ProspectusDocument50 pagesBoeing ProspectuscarecaNo ratings yet

- Chapter 6 Bonds ValuationDocument39 pagesChapter 6 Bonds ValuationNUR FAZERA AHMADNo ratings yet

- Digests 1Document5 pagesDigests 1Jopet EstolasNo ratings yet

- Service Condit On 01.08.2016Document57 pagesService Condit On 01.08.2016Venkat SubbuNo ratings yet

- (Frederic - S. - Mishkin) - Economics - of - Moneyy, - Banking - and - Financial MarketsDocument22 pages(Frederic - S. - Mishkin) - Economics - of - Moneyy, - Banking - and - Financial MarketsNouran MohamedNo ratings yet

- Ronald I. McKinnon - The Unloved Dollar Standard - From Bretton Woods To The Rise of China-Oxford University Press (2012) PDFDocument237 pagesRonald I. McKinnon - The Unloved Dollar Standard - From Bretton Woods To The Rise of China-Oxford University Press (2012) PDFMartin ArrutiNo ratings yet

- The Money GPS - Guiding You Through An Uncertain EconomyDocument42 pagesThe Money GPS - Guiding You Through An Uncertain Economyfabrignani@yahoo.com100% (2)

- Interest-Free Banking System: Objections, Reservations and Their EvaluationDocument19 pagesInterest-Free Banking System: Objections, Reservations and Their EvaluationSaqlain KhanNo ratings yet

- Salient Features of The Revised Irr OF R.A. 9520Document21 pagesSalient Features of The Revised Irr OF R.A. 9520AJ NaragNo ratings yet

- 89 - Team Demons - Sales Presentation ReportDocument13 pages89 - Team Demons - Sales Presentation ReportAtharva SanglikarNo ratings yet

- Solutions Manual: Introducing Corporate Finance 2eDocument9 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- Business Plan CreatingDocument25 pagesBusiness Plan CreatingTasnim Medha, 170061016No ratings yet

- Monetary PolicyDocument21 pagesMonetary PolicyApple Jane Galisa SeculaNo ratings yet

- General Mathematics: Quarter 2 - Module 1: Simple and Compound InterestsDocument27 pagesGeneral Mathematics: Quarter 2 - Module 1: Simple and Compound InterestsBilal SalvadorNo ratings yet

- Eastern Assurance v. CADocument2 pagesEastern Assurance v. CAMarion Nerisse Kho100% (1)

- Study Now. Pay Later Scheme in The Philippines Student LoanDocument11 pagesStudy Now. Pay Later Scheme in The Philippines Student Loanjulia sabasNo ratings yet

- Navy Federal Credit Union StatementDocument5 pagesNavy Federal Credit Union StatementfreakenscoutNo ratings yet

- Corporate Reporting (International) : September/December 2017 - Sample QuestionsDocument9 pagesCorporate Reporting (International) : September/December 2017 - Sample QuestionsVinny Lu VLNo ratings yet

- Journal of Behavioral and Experimental Finance: Cecilia Hermansson, Sara JonssonDocument12 pagesJournal of Behavioral and Experimental Finance: Cecilia Hermansson, Sara JonssonlaluaNo ratings yet

- 2014 CFA Level 3 Mock Exam Morning - AnsDocument51 pages2014 CFA Level 3 Mock Exam Morning - AnsElsiiieNo ratings yet

- CR01Document7 pagesCR01JudielAnnHeredianoNo ratings yet

- Sbi and BobDocument22 pagesSbi and Bobdeekshith maniNo ratings yet

- Impact of Macroeconomics Variables On Stock Prices: Emperical Evidance in Case of Kse (Karachi Stock Exchange)Document8 pagesImpact of Macroeconomics Variables On Stock Prices: Emperical Evidance in Case of Kse (Karachi Stock Exchange)Sehrish KayaniNo ratings yet