Professional Documents

Culture Documents

Boa Financials For q3 30 Sept. 2021

Boa Financials For q3 30 Sept. 2021

Uploaded by

Fuaad DodooCopyright:

Available Formats

You might also like

- World's Best SME Banks 2024-Regional Winners - Global Finance MagazineDocument9 pagesWorld's Best SME Banks 2024-Regional Winners - Global Finance MagazinebisnisdigitalNo ratings yet

- Advanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFDocument190 pagesAdvanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFErica Daprosa50% (2)

- Instant Download Ebook PDF Financial Accounting 10th Australian Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial Accounting 10th Australian Edition PDF Scribdmarian.hillis984100% (47)

- NAD 2019-2020 Annual ReportDocument1 pageNAD 2019-2020 Annual ReportNational Association of the DeafNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Anual Report CscecDocument303 pagesAnual Report CscecsachithNo ratings yet

- Arabtec FSDocument46 pagesArabtec FSShakib ApNo ratings yet

- Montefiore Health System 2019 Financial StatementsDocument27 pagesMontefiore Health System 2019 Financial StatementsJonathan LaMantiaNo ratings yet

- Internal Audit Self Assessment GuideDocument32 pagesInternal Audit Self Assessment GuideLilith LunaNo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- PSO StatementDocument1 pagePSO StatementNaseeb Ullah TareenNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- Psaf Revision Day 3 May 2023Document8 pagesPsaf Revision Day 3 May 2023Esther AkpanNo ratings yet

- Arab Bank Ir Presentation q4 2023Document30 pagesArab Bank Ir Presentation q4 2023tl3tNo ratings yet

- QFB Fact SheetDocument2 pagesQFB Fact SheetRianovel MareNo ratings yet

- The Arab Bank - Governance and Ethics - FINALDocument26 pagesThe Arab Bank - Governance and Ethics - FINALHum92reNo ratings yet

- 71465exam57501 p1Document32 pages71465exam57501 p1ManaliNo ratings yet

- q1 Ifrs Usd Earnings ReleaseDocument26 pagesq1 Ifrs Usd Earnings Releaseashokdb2kNo ratings yet

- Sail Annual Report - 2022.inddDocument11 pagesSail Annual Report - 2022.inddSandeep SharmaNo ratings yet

- Montefiore Health System Q3 2019 Financial StatementsDocument25 pagesMontefiore Health System Q3 2019 Financial StatementsJonathan LaMantiaNo ratings yet

- Baniya Kirana Stores F.Y. 2074-75 TaxDocument17 pagesBaniya Kirana Stores F.Y. 2074-75 TaxasasasNo ratings yet

- Eicher Motors BSDocument2 pagesEicher Motors BSVaishnav SunilNo ratings yet

- GCB-Q3 2023 - Interim - ReportDocument16 pagesGCB-Q3 2023 - Interim - ReportGan ZhiHanNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFKeran VarmaNo ratings yet

- 1st Qtr.2021 ReportDocument31 pages1st Qtr.2021 ReportMurad HasanNo ratings yet

- Opensys An20200518a2 1Document17 pagesOpensys An20200518a2 1Nor FarizalNo ratings yet

- PhoenixSolar-Annual Report 2015Document152 pagesPhoenixSolar-Annual Report 2015Alex MartayanNo ratings yet

- Balance Sheet: Share Capital and ReservesDocument42 pagesBalance Sheet: Share Capital and ReservesaaliaccaNo ratings yet

- 23MB0026 FAR AssignmentDocument14 pages23MB0026 FAR Assignmenthimanshu011623No ratings yet

- Results r01Document28 pagesResults r01Antony Ramiro Gutierrez RiosNo ratings yet

- 8 MIS November 2012Document129 pages8 MIS November 2012kr__santoshNo ratings yet

- MS Brothers Super Rice MillDocument9 pagesMS Brothers Super Rice MillMasud Ahmed khan100% (1)

- The Group AssetsDocument46 pagesThe Group Assetsit4728No ratings yet

- Financial Statements - Standalone and ConsolidatedDocument182 pagesFinancial Statements - Standalone and ConsolidatedPranav AdityaNo ratings yet

- Statement of Assets and Liabilities - H1 2018-19 8Document1 pageStatement of Assets and Liabilities - H1 2018-19 8saichakrapani3807No ratings yet

- Ezz Steel Ratio Analysis - Fall21Document10 pagesEzz Steel Ratio Analysis - Fall21farahNo ratings yet

- Financial ReportsDocument14 pagesFinancial Reportssardar amanat aliHadian00rNo ratings yet

- Lii Hen - Q1 (2017) 1Document15 pagesLii Hen - Q1 (2017) 1Jordan YiiNo ratings yet

- Bac 3 Review QNSDocument16 pagesBac 3 Review QNSsaidkhatib368No ratings yet

- Annual-Report-FML-30-June-2020 Vol 1Document1 pageAnnual-Report-FML-30-June-2020 Vol 1Bluish FlameNo ratings yet

- Hindalco Industries Balance Sheet, Hindalco Industries Financial Statement & AccountsDocument3 pagesHindalco Industries Balance Sheet, Hindalco Industries Financial Statement & AccountsSharon T100% (1)

- FinancialsDocument26 pagesFinancials崔梦炎No ratings yet

- FF 2011 enDocument55 pagesFF 2011 enWang Hon YuenNo ratings yet

- Balance Sheet As at March 31, 2020: Property, Plant and EquipmentDocument8 pagesBalance Sheet As at March 31, 2020: Property, Plant and Equipmentishwaryaishu0708No ratings yet

- Profit and Loss TableDocument3 pagesProfit and Loss Table龍徤No ratings yet

- Careplus Group Berhad: Unaudited Condensed Consolidated Statements of Comprehensive IncomeDocument21 pagesCareplus Group Berhad: Unaudited Condensed Consolidated Statements of Comprehensive IncomethamNo ratings yet

- Financial AnalysisDocument15 pagesFinancial AnalysisLiza KhanNo ratings yet

- JHM 1Qtr21 Financial Report (Amendment)Document13 pagesJHM 1Qtr21 Financial Report (Amendment)Ooi Gim SengNo ratings yet

- LSH Financial ReportDocument12 pagesLSH Financial ReportJohnny TehNo ratings yet

- Quarterly Report 20160331Document17 pagesQuarterly Report 20160331Ang SHNo ratings yet

- Aknight Quarter Report-Sept 2012Document8 pagesAknight Quarter Report-Sept 2012James WarrenNo ratings yet

- MDGH 2021 HY Consolidated Financial StatementsDocument39 pagesMDGH 2021 HY Consolidated Financial StatementsMmatos InvestimentosNo ratings yet

- SIB Result Q1 2024 FinalDocument24 pagesSIB Result Q1 2024 Finalseeme55runNo ratings yet

- Raymond Limited Financial StatementsDocument85 pagesRaymond Limited Financial StatementsVinay KukrejaNo ratings yet

- UCrest Bhd-Q4 Financial Result Ended 31.5.2022Document8 pagesUCrest Bhd-Q4 Financial Result Ended 31.5.2022Jeff WongNo ratings yet

- ZTBL 2008Document62 pagesZTBL 2008Mahmood KhanNo ratings yet

- Unaudited Financial Results 30.06.2021 1Document11 pagesUnaudited Financial Results 30.06.2021 1Kartik AroraNo ratings yet

- Profit and Loss Statement 31.12.20Document1 pageProfit and Loss Statement 31.12.20Si HadiNo ratings yet

- Consolidated Balance Sheet: Asat31 March, 2021 All Amounts Are in H Crores, Unless Otherwise StatedDocument7 pagesConsolidated Balance Sheet: Asat31 March, 2021 All Amounts Are in H Crores, Unless Otherwise StateddevrishabhNo ratings yet

- SUBEXLTD 20062022131358 QuickResultsDocument23 pagesSUBEXLTD 20062022131358 QuickResultsSocial OnlyNo ratings yet

- Q3 Interim Condensed Consolidated FS 2019Document8 pagesQ3 Interim Condensed Consolidated FS 2019FaizanSulNo ratings yet

- New Model of NetflixDocument17 pagesNew Model of NetflixPencil ArtistNo ratings yet

- UBA - June2021 FN StatementsDocument2 pagesUBA - June2021 FN StatementsFuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- John Berendt - Destination UnknownDocument10 pagesJohn Berendt - Destination UnknownaddunsireNo ratings yet

- Financial Accounting and Reporting Notes PDFDocument232 pagesFinancial Accounting and Reporting Notes PDFsmlingwa75% (4)

- Advanced Financial Accounting QuizDocument53 pagesAdvanced Financial Accounting Quizanon nimusNo ratings yet

- Working Capital ManagementDocument59 pagesWorking Capital ManagementkeerthiNo ratings yet

- Finance FunctionDocument25 pagesFinance FunctionKane0% (1)

- Acc Topic 7Document7 pagesAcc Topic 7BM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- CE On Quasi-ReorganizationDocument1 pageCE On Quasi-ReorganizationalyssaNo ratings yet

- Tallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Document109 pagesTallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Shovon MustaryNo ratings yet

- Monarch Industries DPR TakeoverDocument23 pagesMonarch Industries DPR TakeoverJAWED MOHAMMADNo ratings yet

- Not Configuration in SAPDocument6 pagesNot Configuration in SAPVenkat Ram NarasimhaNo ratings yet

- Balance Sheet: (Company Name)Document2 pagesBalance Sheet: (Company Name)Bleep NewsNo ratings yet

- NEW MFRS 116 Property, Plant and EquipmentDocument53 pagesNEW MFRS 116 Property, Plant and EquipmentUmairah HusnaNo ratings yet

- LB 2013-2014 Standardized Statements MinervaDocument9 pagesLB 2013-2014 Standardized Statements MinervaArmand HajdarajNo ratings yet

- Final Project Financial ManagementDocument10 pagesFinal Project Financial ManagementMaryam SaeedNo ratings yet

- 1stLecture-Partnership LiquidationDocument25 pages1stLecture-Partnership LiquidationRechelle Dalusung100% (1)

- Santoshi Patil Pattan 11Document60 pagesSantoshi Patil Pattan 11balaji xeroxNo ratings yet

- BKDP - Annual Report - 2017 PDFDocument119 pagesBKDP - Annual Report - 2017 PDFAmbo DalleNo ratings yet

- Financialmanagementworkbook 121105064928 Phpapp01Document881 pagesFinancialmanagementworkbook 121105064928 Phpapp01sunnysainani1No ratings yet

- Annual Report Analysis - Oct-14-EDEL PDFDocument259 pagesAnnual Report Analysis - Oct-14-EDEL PDFhiteshaNo ratings yet

- Project ReportDocument9 pagesProject ReportYod8 TdpNo ratings yet

- W2 - Key Tutorial 3Document5 pagesW2 - Key Tutorial 3Rules of Survival MALAYSIANo ratings yet

- Financial Accounting September 2012 Marks Plan ICAEWDocument14 pagesFinancial Accounting September 2012 Marks Plan ICAEWMuhammad Ziaul HaqueNo ratings yet

- SIM ACC 226ACCE 411 Week 4 To 5 COPY 1Document31 pagesSIM ACC 226ACCE 411 Week 4 To 5 COPY 1Mireya Yue100% (1)

- ACTG115 - Ch02 SolutionsDocument16 pagesACTG115 - Ch02 SolutionsxxmbetaNo ratings yet

- 12 Igcse - Accounting - Ratios - Unlocked PDFDocument47 pages12 Igcse - Accounting - Ratios - Unlocked PDFshivom talrejaNo ratings yet

- 4th Sem BBA Industrial ProjectDocument60 pages4th Sem BBA Industrial Projectαβђเکђ€к ηєσgเ67% (12)

- Account Formats and Statements LayoutsDocument5 pagesAccount Formats and Statements LayoutsCynNo ratings yet

Boa Financials For q3 30 Sept. 2021

Boa Financials For q3 30 Sept. 2021

Uploaded by

Fuaad DodooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Boa Financials For q3 30 Sept. 2021

Boa Financials For q3 30 Sept. 2021

Uploaded by

Fuaad DodooCopyright:

Available Formats

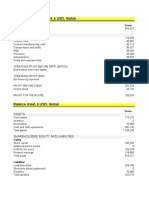

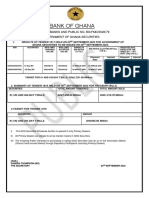

BANK OF AFRICA GHANA LIMITED

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME UNAUDITED STATEMENT OF CASH FLOWS

FOR THE PERIOD ENDED 30 SEPTEMBER 2021 FOR THE PERIOD ENDED 30 SEPTEMBER 2021

2021 2020 2021 2020

GH¢'000 GH¢'000 GH¢'000 GH¢'000

Interest income 170,284 160,085 Cash flow from operating activities

Interest expense (29,090) (38,456) Profit before income tax 78,094 74,030

Net interest income 141,194 121,629 Adjustments for:

Depreciation and amortisation 11,423 10,824

Fees and commission income 20,422 18,519 Gains on disposal of property and equipment - (43)

Fees and commission expenses (1,418) (1,911) Finance cost on lease liabilities 403 478

Exchange loss on lease liabilities 458 1,263

Net fees and commission income 19,004 16,608

Profit before working capital changes 90,378 86,552

Net trading income 20,571 33,572

Other operating income 2,289 2,238 Changes in:

Loans & advances (69,666) (24,771)

Net trading and other operating income 22,860 35,810 Investment securities (725,089) 25,025

Other assets (47,547) (18,721)

Operating income 183,058 174,047 Deposits from customers 1,129 (135,088)

Net impairment loss on financial instruments (18,126) (16,985) Deposits from banks and other financial institutions 91,575 (17,008)

Personal expenses (38,068) (35,752) Borrowings 638,372 34,882

Depreciation and amortisation (11,423) (10,824) Other liabilities 29,493 23,044

Other operating expenses (37,347) (36,456)

Income tax paid (14,912) (12,157)

Profit before income tax 78,096 74,030 Cash generated from operations (6,267) (38,242)

Income tax expense (28,016) (25,505)

Investing activities

Profit for the period 50,078 48,525 Purchase of property and equipment (4,866) (3,779)

Proceeds from disposal of property and equipment - 43

Net cash flows used in investing activities (4,866) (3,736)

UNAUDITED STATEMENT OF FINANCIAL POSITION AS

Cash flows from financing activities

AT 30 SEPTEMBER 2021 (13,858)

Dividends paid (10,000)

2021 2020 Net cash flows used in financing activities (10,000) (13,858)

GH¢'000 GH¢'000 Net decrease in cash and cash equivalents (21,133) (55,836)

Assets Cash and cash equivalents at 1 January 357,532 337,198

Cash and cash equivalents 336,399 281,362

Cash and cash equivalents at 30 September 336,399 281,362

Loans and advances to customers 821,545 750,315

Investment securities 1,509,033 808,155

Deferred income tax assets 4,552 -

Intangible assets 5,305 6,535

Other assets 125,468 48,936 1.0 Risk Management Disclosures

Taking risk is core in the business of Banking. In carrying out its core business, the Bank analyses, evaluates and assumes

Right-of-use asset 17,296 21,112

Property and equipment 54,083 51,959 positions of taking calculated risks. The Bank's aim is therefore to achieve an appropriate balance between risk and return and

minimize potential adverse effects on its financial performance. The most significant risks faced by the Bank include:

Non - current assets held for sale - 30,744

Credit Risk

Total assets 2,873,681 1,999,118 Liquidity Risk and

Market Risk (i.e. risks related to mainly currency trading and interest rate risk)

Liabilities

Deposits from customers 1,205,191 948,729 1.1 Risk Management Framework

Deposits from banks 91,575 18,007 The Board of Directors has overall responsibility for the establishment and oversight of the Bank's risk management framework.

Current income tax liabilities 13,783 10,419 The Board has established a Risk and Compliance Committee for the management of risk in the Bank. The arm of the committee

Borrowings 807,657 334,682 within management is the Risk Management Department which assists it in the discharge of this responsibility. The Bank's risk

Lease liabilities 12,854 16,813 management policies are established to identify and analyse the risks faced by the Bank; to set appropriate risk limits and controls;

Other liabilities 55,947 40,134 and to monitor risks and adherence to limits. Risk management policies and systems are reviewed regularly to reflect changes in

market conditions, products and services offered.

Total liabilities 2,187,007 1,368,784

Through the compliance department, the Bank ensures it complies with all prudential and regulatory guidelines in the pursuit of

Equity profitable banking opportunities while avoiding excessive, unnecessary and uncontrollable risk exposures. Risk being an

Stated capital 422,289 422,289 inherent feature in the business of the banking, various mitigating measures are put in place to better manage it.

Income surplus account 64,555 52,025

All risk management policies are formulated at the board level through the Board Risk and Compliance Committee. The Bank,

Regulatory credit risk reserve 61,351 50,448

through its training and management standards, and procedures, aims to develop a disciplined and constructive control

Statutory reserve 138,479 105,572

environment, in which all employees appreciate their roles and obligations.

Total equity 686,674 630,334

Total liabilities and equity 2,873,681 1,999,118 1.2 Quantitative and Qualitative Disclosures

Quantitative disclosures

2021 2020

Capital Adequacy Ratio 42.06% 43.73%

The financial statements were approved by the board of directors and Non-Performing Loan Ratio 12.97% 20.22%

signed on its behalf by: Liquid Ratio 279.67% 174.27%

Kobby Andah Francis Kalitsi Compliance with statutory requirement

............................................ ............................................ 2021 2020

Managing Director Chairman Default in Statutory Liquidity Nil Nil

Default in Statutory Liquidity Sanctions (GH¢’000) Nil Nil

Other Regulatory Penalties (GH¢’000) Nil Nil

You might also like

- World's Best SME Banks 2024-Regional Winners - Global Finance MagazineDocument9 pagesWorld's Best SME Banks 2024-Regional Winners - Global Finance MagazinebisnisdigitalNo ratings yet

- Advanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFDocument190 pagesAdvanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFErica Daprosa50% (2)

- Instant Download Ebook PDF Financial Accounting 10th Australian Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial Accounting 10th Australian Edition PDF Scribdmarian.hillis984100% (47)

- NAD 2019-2020 Annual ReportDocument1 pageNAD 2019-2020 Annual ReportNational Association of the DeafNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Anual Report CscecDocument303 pagesAnual Report CscecsachithNo ratings yet

- Arabtec FSDocument46 pagesArabtec FSShakib ApNo ratings yet

- Montefiore Health System 2019 Financial StatementsDocument27 pagesMontefiore Health System 2019 Financial StatementsJonathan LaMantiaNo ratings yet

- Internal Audit Self Assessment GuideDocument32 pagesInternal Audit Self Assessment GuideLilith LunaNo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- PSO StatementDocument1 pagePSO StatementNaseeb Ullah TareenNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- Psaf Revision Day 3 May 2023Document8 pagesPsaf Revision Day 3 May 2023Esther AkpanNo ratings yet

- Arab Bank Ir Presentation q4 2023Document30 pagesArab Bank Ir Presentation q4 2023tl3tNo ratings yet

- QFB Fact SheetDocument2 pagesQFB Fact SheetRianovel MareNo ratings yet

- The Arab Bank - Governance and Ethics - FINALDocument26 pagesThe Arab Bank - Governance and Ethics - FINALHum92reNo ratings yet

- 71465exam57501 p1Document32 pages71465exam57501 p1ManaliNo ratings yet

- q1 Ifrs Usd Earnings ReleaseDocument26 pagesq1 Ifrs Usd Earnings Releaseashokdb2kNo ratings yet

- Sail Annual Report - 2022.inddDocument11 pagesSail Annual Report - 2022.inddSandeep SharmaNo ratings yet

- Montefiore Health System Q3 2019 Financial StatementsDocument25 pagesMontefiore Health System Q3 2019 Financial StatementsJonathan LaMantiaNo ratings yet

- Baniya Kirana Stores F.Y. 2074-75 TaxDocument17 pagesBaniya Kirana Stores F.Y. 2074-75 TaxasasasNo ratings yet

- Eicher Motors BSDocument2 pagesEicher Motors BSVaishnav SunilNo ratings yet

- GCB-Q3 2023 - Interim - ReportDocument16 pagesGCB-Q3 2023 - Interim - ReportGan ZhiHanNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFKeran VarmaNo ratings yet

- 1st Qtr.2021 ReportDocument31 pages1st Qtr.2021 ReportMurad HasanNo ratings yet

- Opensys An20200518a2 1Document17 pagesOpensys An20200518a2 1Nor FarizalNo ratings yet

- PhoenixSolar-Annual Report 2015Document152 pagesPhoenixSolar-Annual Report 2015Alex MartayanNo ratings yet

- Balance Sheet: Share Capital and ReservesDocument42 pagesBalance Sheet: Share Capital and ReservesaaliaccaNo ratings yet

- 23MB0026 FAR AssignmentDocument14 pages23MB0026 FAR Assignmenthimanshu011623No ratings yet

- Results r01Document28 pagesResults r01Antony Ramiro Gutierrez RiosNo ratings yet

- 8 MIS November 2012Document129 pages8 MIS November 2012kr__santoshNo ratings yet

- MS Brothers Super Rice MillDocument9 pagesMS Brothers Super Rice MillMasud Ahmed khan100% (1)

- The Group AssetsDocument46 pagesThe Group Assetsit4728No ratings yet

- Financial Statements - Standalone and ConsolidatedDocument182 pagesFinancial Statements - Standalone and ConsolidatedPranav AdityaNo ratings yet

- Statement of Assets and Liabilities - H1 2018-19 8Document1 pageStatement of Assets and Liabilities - H1 2018-19 8saichakrapani3807No ratings yet

- Ezz Steel Ratio Analysis - Fall21Document10 pagesEzz Steel Ratio Analysis - Fall21farahNo ratings yet

- Financial ReportsDocument14 pagesFinancial Reportssardar amanat aliHadian00rNo ratings yet

- Lii Hen - Q1 (2017) 1Document15 pagesLii Hen - Q1 (2017) 1Jordan YiiNo ratings yet

- Bac 3 Review QNSDocument16 pagesBac 3 Review QNSsaidkhatib368No ratings yet

- Annual-Report-FML-30-June-2020 Vol 1Document1 pageAnnual-Report-FML-30-June-2020 Vol 1Bluish FlameNo ratings yet

- Hindalco Industries Balance Sheet, Hindalco Industries Financial Statement & AccountsDocument3 pagesHindalco Industries Balance Sheet, Hindalco Industries Financial Statement & AccountsSharon T100% (1)

- FinancialsDocument26 pagesFinancials崔梦炎No ratings yet

- FF 2011 enDocument55 pagesFF 2011 enWang Hon YuenNo ratings yet

- Balance Sheet As at March 31, 2020: Property, Plant and EquipmentDocument8 pagesBalance Sheet As at March 31, 2020: Property, Plant and Equipmentishwaryaishu0708No ratings yet

- Profit and Loss TableDocument3 pagesProfit and Loss Table龍徤No ratings yet

- Careplus Group Berhad: Unaudited Condensed Consolidated Statements of Comprehensive IncomeDocument21 pagesCareplus Group Berhad: Unaudited Condensed Consolidated Statements of Comprehensive IncomethamNo ratings yet

- Financial AnalysisDocument15 pagesFinancial AnalysisLiza KhanNo ratings yet

- JHM 1Qtr21 Financial Report (Amendment)Document13 pagesJHM 1Qtr21 Financial Report (Amendment)Ooi Gim SengNo ratings yet

- LSH Financial ReportDocument12 pagesLSH Financial ReportJohnny TehNo ratings yet

- Quarterly Report 20160331Document17 pagesQuarterly Report 20160331Ang SHNo ratings yet

- Aknight Quarter Report-Sept 2012Document8 pagesAknight Quarter Report-Sept 2012James WarrenNo ratings yet

- MDGH 2021 HY Consolidated Financial StatementsDocument39 pagesMDGH 2021 HY Consolidated Financial StatementsMmatos InvestimentosNo ratings yet

- SIB Result Q1 2024 FinalDocument24 pagesSIB Result Q1 2024 Finalseeme55runNo ratings yet

- Raymond Limited Financial StatementsDocument85 pagesRaymond Limited Financial StatementsVinay KukrejaNo ratings yet

- UCrest Bhd-Q4 Financial Result Ended 31.5.2022Document8 pagesUCrest Bhd-Q4 Financial Result Ended 31.5.2022Jeff WongNo ratings yet

- ZTBL 2008Document62 pagesZTBL 2008Mahmood KhanNo ratings yet

- Unaudited Financial Results 30.06.2021 1Document11 pagesUnaudited Financial Results 30.06.2021 1Kartik AroraNo ratings yet

- Profit and Loss Statement 31.12.20Document1 pageProfit and Loss Statement 31.12.20Si HadiNo ratings yet

- Consolidated Balance Sheet: Asat31 March, 2021 All Amounts Are in H Crores, Unless Otherwise StatedDocument7 pagesConsolidated Balance Sheet: Asat31 March, 2021 All Amounts Are in H Crores, Unless Otherwise StateddevrishabhNo ratings yet

- SUBEXLTD 20062022131358 QuickResultsDocument23 pagesSUBEXLTD 20062022131358 QuickResultsSocial OnlyNo ratings yet

- Q3 Interim Condensed Consolidated FS 2019Document8 pagesQ3 Interim Condensed Consolidated FS 2019FaizanSulNo ratings yet

- New Model of NetflixDocument17 pagesNew Model of NetflixPencil ArtistNo ratings yet

- UBA - June2021 FN StatementsDocument2 pagesUBA - June2021 FN StatementsFuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- John Berendt - Destination UnknownDocument10 pagesJohn Berendt - Destination UnknownaddunsireNo ratings yet

- Financial Accounting and Reporting Notes PDFDocument232 pagesFinancial Accounting and Reporting Notes PDFsmlingwa75% (4)

- Advanced Financial Accounting QuizDocument53 pagesAdvanced Financial Accounting Quizanon nimusNo ratings yet

- Working Capital ManagementDocument59 pagesWorking Capital ManagementkeerthiNo ratings yet

- Finance FunctionDocument25 pagesFinance FunctionKane0% (1)

- Acc Topic 7Document7 pagesAcc Topic 7BM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- CE On Quasi-ReorganizationDocument1 pageCE On Quasi-ReorganizationalyssaNo ratings yet

- Tallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Document109 pagesTallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Shovon MustaryNo ratings yet

- Monarch Industries DPR TakeoverDocument23 pagesMonarch Industries DPR TakeoverJAWED MOHAMMADNo ratings yet

- Not Configuration in SAPDocument6 pagesNot Configuration in SAPVenkat Ram NarasimhaNo ratings yet

- Balance Sheet: (Company Name)Document2 pagesBalance Sheet: (Company Name)Bleep NewsNo ratings yet

- NEW MFRS 116 Property, Plant and EquipmentDocument53 pagesNEW MFRS 116 Property, Plant and EquipmentUmairah HusnaNo ratings yet

- LB 2013-2014 Standardized Statements MinervaDocument9 pagesLB 2013-2014 Standardized Statements MinervaArmand HajdarajNo ratings yet

- Final Project Financial ManagementDocument10 pagesFinal Project Financial ManagementMaryam SaeedNo ratings yet

- 1stLecture-Partnership LiquidationDocument25 pages1stLecture-Partnership LiquidationRechelle Dalusung100% (1)

- Santoshi Patil Pattan 11Document60 pagesSantoshi Patil Pattan 11balaji xeroxNo ratings yet

- BKDP - Annual Report - 2017 PDFDocument119 pagesBKDP - Annual Report - 2017 PDFAmbo DalleNo ratings yet

- Financialmanagementworkbook 121105064928 Phpapp01Document881 pagesFinancialmanagementworkbook 121105064928 Phpapp01sunnysainani1No ratings yet

- Annual Report Analysis - Oct-14-EDEL PDFDocument259 pagesAnnual Report Analysis - Oct-14-EDEL PDFhiteshaNo ratings yet

- Project ReportDocument9 pagesProject ReportYod8 TdpNo ratings yet

- W2 - Key Tutorial 3Document5 pagesW2 - Key Tutorial 3Rules of Survival MALAYSIANo ratings yet

- Financial Accounting September 2012 Marks Plan ICAEWDocument14 pagesFinancial Accounting September 2012 Marks Plan ICAEWMuhammad Ziaul HaqueNo ratings yet

- SIM ACC 226ACCE 411 Week 4 To 5 COPY 1Document31 pagesSIM ACC 226ACCE 411 Week 4 To 5 COPY 1Mireya Yue100% (1)

- ACTG115 - Ch02 SolutionsDocument16 pagesACTG115 - Ch02 SolutionsxxmbetaNo ratings yet

- 12 Igcse - Accounting - Ratios - Unlocked PDFDocument47 pages12 Igcse - Accounting - Ratios - Unlocked PDFshivom talrejaNo ratings yet

- 4th Sem BBA Industrial ProjectDocument60 pages4th Sem BBA Industrial Projectαβђเکђ€к ηєσgเ67% (12)

- Account Formats and Statements LayoutsDocument5 pagesAccount Formats and Statements LayoutsCynNo ratings yet