Professional Documents

Culture Documents

Activity Chapter 6

Activity Chapter 6

Uploaded by

Randelle James FiestaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity Chapter 6

Activity Chapter 6

Uploaded by

Randelle James FiestaCopyright:

Available Formats

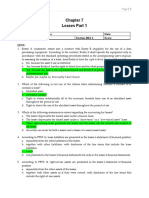

ACTIVITY CHAPTER 6

1. On July 31, 20x0, Dome Co. issued ₱1,000,000 of 10%, 15-year bonds at par and

used a portion of the proceeds to call its 600 outstanding 11%, ₱1,000 face value

bonds, due on July 31, 2x10, at 102. On that date, unamortized bond premium

relating to the 11% bonds was ₱65,000. In its 20x0 income statement, what amount

should Dome report as gain or loss, before income taxes, from retirement of bonds?

Ans. 53,000 gain

Solution:

Redemption price (600 x 1,000 x 102%) 612,000

Less: Carrying amount of bonds:

Face amount (600 x 1,000) 600,000

Unamortized premium 65,000 665,000

Gain on retirement 53,000

2. During 20x4 Peterson Company experienced financial difficulties and is likely to

default on a ₱500,000, 15%, three-year note dated January 1, 20X2, payable to

Forest National Bank. On December 31, 20X4, the bank agreed to settle the note

and unpaid interest of ₱75,000 for 20X4 for ₱50,000 cash and marketable securities

having a carrying amount of ₱375,000. Peterson's acquisition cost of the securities is

₱385,000. What amount should Peterson report as a gain from the debt restructuring

in its 20x4 income statement?

Ans. 150,000

Solution:

Payment for the liability: 50,000

Carrying amount of investment securities 375,000 425,000

Carrying amount of liability settled:

Principal 500,000

Accrued interest 75,000 575,000

Gain on settlement 150,000

3. Casey Corporation entered into a troubled-debt restructuring agreement with First

State Bank. First State agreed to accept land with a carrying amount of ₱85,000 and

a fair value of ₱120,000 in exchange for a note with a carrying amount of ₱185,000.

What amount should Casey report as gain in its income statement?

Ans. 100,000

Solution:

(185,000 carrying amt. of note - 85,000 carrying amt. of land) = 100,000 gain

4. Wood Corp., a debtor undergoing financial difficulties granted an equity interest to

a creditor in full settlement of a ₱28,000 debt owed to the creditor. At the date of this

transaction, the equity interest had a fair value of ₱25,000 and par value of ₱20,000.

What amount should Wood recognize as gain on restructuring of debt?

Ans. 3,000

Solution:

(28,000 debt owed to the creditor – 25,000 fair value) = 3,000

5. In 20X2, May Corp. acquired land by paying ₱75,000 down and signing a note

with a maturity value of ₱1,000,000. On the note’s due date, December 31, 20X7,

May owed ₱40,000 of accrued interest and ₱1,000,000 principal on the note. May

was in financial difficulty and was unable to make any payments. May and the bank

agreed to amend the note as follows:

• The ₱40,000 of interest due on December 31, 20X7, was forgiven

• The principal of the note was reduced from ₱1,000,000 to ₱950,000 and the

maturity date extended 1 year to December 31, 20X8.

• May would be required to make one interest payment totaling ₱30,000 on

December 31, 20X8.

• The original effective interest rate is 10% while the current market rate on

December 31, 20X7 is 12%.

As a result of the troubled debt restructuring, May should report a gain, before taxes,

in its 20X7 income statement of

Ans. 149,092

Solution:

The modification is analyzed as follows:

Old terms New terms

Principal 1,000,000 950,000

Accrued interest 40,000 30,000

Remaining term ('n') 1 year

The present value of the modified liability is computed as follows:

Future cash flows PV of 1 @10%, n=1 Present value

Principal 950,000 0.90909 863,636

Interest 30,000 0.90909 27,273

Present value of the modified liability 890,908

The difference between the old liability and the new liability is tested for substantiality.

Carrying amount of old liability 1,040,000

(1M principal + 40,000 accrued interest)

Present value of modified liability 890,908

Difference 149,092

Difference 149,092

Divide by: Carrying amount of old liability 1,040,000

14.34%

You might also like

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- Quiz Chapter-10 She-Part-1 2021Document4 pagesQuiz Chapter-10 She-Part-1 2021Hafsah Amod DisomangcopNo ratings yet

- Answer Key Inter Acctg 2Document66 pagesAnswer Key Inter Acctg 2URBANO CREATIONS PRINTING & GRAPHICS100% (2)

- Audit of Long Term Liabilities 2Document5 pagesAudit of Long Term Liabilities 2Cesar EsguerraNo ratings yet

- Acctg 201 Midterm Quiz 3Document10 pagesAcctg 201 Midterm Quiz 3Minie KimNo ratings yet

- Bonds Payable Quiz Part 2Document5 pagesBonds Payable Quiz Part 2justine reine cornico100% (1)

- ACG3141 Chap 14 PDFDocument35 pagesACG3141 Chap 14 PDFLexter Dave C EstoqueNo ratings yet

- Intermediate Accounting 2 Second Grading Examination: Name: Date: Professor: Section: ScoreDocument25 pagesIntermediate Accounting 2 Second Grading Examination: Name: Date: Professor: Section: ScoreNah Hamza100% (1)

- Chapter 1 - Current LiabilitiesDocument6 pagesChapter 1 - Current LiabilitiesXiena100% (1)

- Mumbai Map BrochureDocument24 pagesMumbai Map BrochureDarshan JoshiNo ratings yet

- The Pal Grave Handbook of Contemporar Y Interna Tional OnomyDocument711 pagesThe Pal Grave Handbook of Contemporar Y Interna Tional OnomyNou Channarith100% (2)

- DepEd Income Generating Project Proposal and Terminal Report (Format) - TeacherPH PDFDocument12 pagesDepEd Income Generating Project Proposal and Terminal Report (Format) - TeacherPH PDFshindigzsari100% (3)

- Activity Chapter 5: Effect On December 31, 20X1: Using Straight Line MethodDocument2 pagesActivity Chapter 5: Effect On December 31, 20X1: Using Straight Line MethodRandelle James FiestaNo ratings yet

- Cae05-Chapter 4 Notes Receivables & Payable Problem DiscussionDocument12 pagesCae05-Chapter 4 Notes Receivables & Payable Problem DiscussionSteffany RoqueNo ratings yet

- Chapter 3 Bonds Payable Other ConceptsDocument7 pagesChapter 3 Bonds Payable Other ConceptschristianNo ratings yet

- Entity A Issues Convertible Bonds With Face Amount ofDocument1 pageEntity A Issues Convertible Bonds With Face Amount ofNicole AguinaldoNo ratings yet

- FIN 072 - SAS - Day 17 - IN - Second Period ExamDocument12 pagesFIN 072 - SAS - Day 17 - IN - Second Period ExamEverly Mae ElondoNo ratings yet

- Prelim Exam - Intermediate AccountingDocument4 pagesPrelim Exam - Intermediate AccountingLea Gabrielle Fariola0% (1)

- Fixed Income Securities Assignment - Yashasvi Sharma-MBA (FA)Document3 pagesFixed Income Securities Assignment - Yashasvi Sharma-MBA (FA)Diwakar SHARMANo ratings yet

- This Study Resource Was: Academic Council'S The LobbyDocument4 pagesThis Study Resource Was: Academic Council'S The LobbyMicaela EncinasNo ratings yet

- Chapter 3 Problems - Ia Part 2Document16 pagesChapter 3 Problems - Ia Part 2KathleenCusipagNo ratings yet

- 9TH Bonds Payable Part IIDocument8 pages9TH Bonds Payable Part IIAnthony DyNo ratings yet

- ACC 108 - Day 17 - SASDocument14 pagesACC 108 - Day 17 - SASEverly Mae ElondoNo ratings yet

- Employee Benefits TheoryDocument8 pagesEmployee Benefits TheoryMicaela EncinasNo ratings yet

- Ia2 Final ExamDocument18 pagesIa2 Final ExamMark AdrianNo ratings yet

- Income Taxes Problem SolvingDocument3 pagesIncome Taxes Problem SolvingLara FloresNo ratings yet

- Shareholders' Equity (Part 1) : Share Premium Retained EarningsDocument3 pagesShareholders' Equity (Part 1) : Share Premium Retained EarningsJamie Rose Aragones0% (3)

- Activity Chapter 4: Ans. 2,320 SolutionDocument2 pagesActivity Chapter 4: Ans. 2,320 SolutionRandelle James Fiesta0% (1)

- Activity 10Document2 pagesActivity 10Randelle James FiestaNo ratings yet

- Ventura, Mary Mickaella R - Revenue From Contracts - p.209 - Group3Document5 pagesVentura, Mary Mickaella R - Revenue From Contracts - p.209 - Group3Mary VenturaNo ratings yet

- FinLiab QuizDocument8 pagesFinLiab QuizAeris StrongNo ratings yet

- Accounting For Income Tax Comprehensive Problem 1: Additional InformationDocument1 pageAccounting For Income Tax Comprehensive Problem 1: Additional InformationAngel Keith MercadoNo ratings yet

- Rezy Pablio Mabao - SAS 3Document7 pagesRezy Pablio Mabao - SAS 3Reymark BaldoNo ratings yet

- Chapter 7 - Leases Part 1Document4 pagesChapter 7 - Leases Part 1JEFFERSON CUTE100% (1)

- Quiz - Chapter 32 - She Part 1 PrintingDocument3 pagesQuiz - Chapter 32 - She Part 1 PrintingAllen Kate50% (2)

- Bam 242 - P2 Examination - (Part 1) : I. Multiple Choice Questions. 1 Point EachDocument20 pagesBam 242 - P2 Examination - (Part 1) : I. Multiple Choice Questions. 1 Point EachRosemarie VillanuevaNo ratings yet

- Requirement: Determine The Financial Liabilities To Be Disclosed in The NotesDocument4 pagesRequirement: Determine The Financial Liabilities To Be Disclosed in The NotesInvisible CionNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument6 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- EXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinDocument12 pagesEXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinNikky Bless LeonarNo ratings yet

- Gin BilogDocument14 pagesGin BilogHans Pierre AlfonsoNo ratings yet

- Receivables, While The Related Loan Will Be Reported Under Current LiabilitiesDocument2 pagesReceivables, While The Related Loan Will Be Reported Under Current LiabilitiesMark Michael LegaspiNo ratings yet

- Intermediate Accounting 2 - Notes Payable - Problems October 10, 2020Document11 pagesIntermediate Accounting 2 - Notes Payable - Problems October 10, 2020Sarah GNo ratings yet

- Lesson3 - Warranty LiabilityDocument15 pagesLesson3 - Warranty LiabilityCirelle Faye Silva0% (1)

- Quiz 1 in Ia3Document6 pagesQuiz 1 in Ia3Dorothy NadelaNo ratings yet

- Earnings Per Share: Name: Date: Professor: Section: Score: QuizDocument5 pagesEarnings Per Share: Name: Date: Professor: Section: Score: QuizLovErsMaeBasergo0% (1)

- Employee Benefits (Part 2) : Problem 1: True or FalseDocument21 pagesEmployee Benefits (Part 2) : Problem 1: True or FalseChi Chi100% (1)

- Quiz Pas 28 Investments in Assoc. JVDocument2 pagesQuiz Pas 28 Investments in Assoc. JVLlyana paula SuyuNo ratings yet

- Quiz - Chapter 4 - Provisions, Cont. Liab. & Cont. Assets - 2021Document3 pagesQuiz - Chapter 4 - Provisions, Cont. Liab. & Cont. Assets - 2021Martin ManuelNo ratings yet

- Chapter 6 Employee Benefits 2Document16 pagesChapter 6 Employee Benefits 2Thalia Rhine AberteNo ratings yet

- Assignment For Accounting Policies, Estimate and Errors: Problem 3Document3 pagesAssignment For Accounting Policies, Estimate and Errors: Problem 3Fria Mae Aycardo AbellanoNo ratings yet

- 1.chapter 1 Current Liabilities Problem 1Document3 pages1.chapter 1 Current Liabilities Problem 1ellyzamae quiraoNo ratings yet

- Quiz Chapter 7 Leases Part 1 2021Document2 pagesQuiz Chapter 7 Leases Part 1 2021Jennifer Reloso100% (1)

- Quiz PFRS 11 Joint ArrangementsDocument2 pagesQuiz PFRS 11 Joint ArrangementsCatherine BolisayNo ratings yet

- Cfe Bam 031Document15 pagesCfe Bam 031Ms VampireNo ratings yet

- Intacc2 Chapter 3 Answer KeysDocument24 pagesIntacc2 Chapter 3 Answer KeysATHALIAH LUNA MERCADEJASNo ratings yet

- Cae08 - Activity Chapter 2Document4 pagesCae08 - Activity Chapter 2Jr VillariezNo ratings yet

- Arpia Lovely Rose Quiz Chapter 7 Leases Part 1Document3 pagesArpia Lovely Rose Quiz Chapter 7 Leases Part 1Lovely ArpiaNo ratings yet

- Exercise 1: Required: Classify The Reports in Part A-E Into One of The Three Major Purposes of Accounting Systems OnDocument2 pagesExercise 1: Required: Classify The Reports in Part A-E Into One of The Three Major Purposes of Accounting Systems OnMyunimintNo ratings yet

- Final Term Debt RestructuringDocument8 pagesFinal Term Debt RestructuringAG VenturesNo ratings yet

- Homework Accounting 12Document5 pagesHomework Accounting 12Waleed ArshadNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- Pa4-Chapter-3.Garcia J John Vincent DDocument5 pagesPa4-Chapter-3.Garcia J John Vincent DJohn Vincent GarciaNo ratings yet

- SolvedMoMi LeverageProb PDFDocument4 pagesSolvedMoMi LeverageProb PDFAnmol Miller SandhuNo ratings yet

- Midterm Assignment 5Document2 pagesMidterm Assignment 5Randelle James FiestaNo ratings yet

- Activity 10Document2 pagesActivity 10Randelle James FiestaNo ratings yet

- Post Test Chapter 1Document4 pagesPost Test Chapter 1Randelle James FiestaNo ratings yet

- Activity Chapter 5-Profe04: What Is Audit Sampling?Document1 pageActivity Chapter 5-Profe04: What Is Audit Sampling?Randelle James FiestaNo ratings yet

- Post Quiz 1Document3 pagesPost Quiz 1Randelle James FiestaNo ratings yet

- Activity-Chapter 7: Ans. None of These SolutionDocument1 pageActivity-Chapter 7: Ans. None of These SolutionRandelle James FiestaNo ratings yet

- Impact of Foreign Investments On Economic Growth of India: December 2018Document6 pagesImpact of Foreign Investments On Economic Growth of India: December 2018Ashish JainNo ratings yet

- GBM UNIT 3 NotesDocument21 pagesGBM UNIT 3 NotesGracyNo ratings yet

- Full PG Brochure - NewDocument58 pagesFull PG Brochure - NewBayram CELEBİOGLUNo ratings yet

- AD Business PlanDocument21 pagesAD Business PlanGetie TigetNo ratings yet

- Turkish Ferrous ExportersDocument153 pagesTurkish Ferrous ExportersphuebookNo ratings yet

- Economics Commentary (Macro - Economics)Document4 pagesEconomics Commentary (Macro - Economics)ariaNo ratings yet

- Payment Stage: Interest PayableDocument13 pagesPayment Stage: Interest Payablekrisha milloNo ratings yet

- Financial Analysis On VEDANTA LTDDocument17 pagesFinancial Analysis On VEDANTA LTDsrakshitha980No ratings yet

- Proforma Invoice: TOTAL 18000 79200Document2 pagesProforma Invoice: TOTAL 18000 79200Samiul BariNo ratings yet

- Rekening Koran Desember Februari 2023Document3 pagesRekening Koran Desember Februari 2023Panji PrakosoNo ratings yet

- Middle East Technical UniversityDocument16 pagesMiddle East Technical Universityiremnur keleşNo ratings yet

- Surat Balasan China TianyingDocument3 pagesSurat Balasan China TianyingAdithyar RachmanNo ratings yet

- Chap 19Document28 pagesChap 19N.S.RavikumarNo ratings yet

- ASEB1102 Module 1 The Role of Agric in Economic DevelopmentDocument3 pagesASEB1102 Module 1 The Role of Agric in Economic Developmentdylan munyanyiNo ratings yet

- भारतीय इतिहासDocument60 pagesभारतीय इतिहासAkash NagarNo ratings yet

- Mambukal CMPDocument29 pagesMambukal CMPNegros Occidental Investment & Promotions CenterNo ratings yet

- Pleaser Single Sole Vol 1Document83 pagesPleaser Single Sole Vol 1Woman ShopNo ratings yet

- ARCADIS 2022 Global Construction Disputes Report PDFDocument28 pagesARCADIS 2022 Global Construction Disputes Report PDFJawad AhammadNo ratings yet

- Pas 2 Inventories: I. NatureDocument2 pagesPas 2 Inventories: I. NatureR.A.No ratings yet

- Understanding Order ProcessDocument7 pagesUnderstanding Order ProcessfilipNo ratings yet

- RThe Impact of The War in Northern Ethiopia On Micro Small and Medium Sized Enterprises MSMEs and Marginal Economic Actors MEAspdfDocument17 pagesRThe Impact of The War in Northern Ethiopia On Micro Small and Medium Sized Enterprises MSMEs and Marginal Economic Actors MEAspdfnani100% (1)

- Deliverable Commodities Under RegistrationDocument6 pagesDeliverable Commodities Under RegistrationPhương NguyễnNo ratings yet

- Previous 2020-2021Document26 pagesPrevious 2020-2021syedsajjadaliNo ratings yet

- The Contemporary World Finals ReviewerDocument16 pagesThe Contemporary World Finals Reviewersharlene.zapicoNo ratings yet

- SOUTHERN STEEL BERHAD (P5-009993) eRENEWAL - MS144 - 2014 - SMDocument3 pagesSOUTHERN STEEL BERHAD (P5-009993) eRENEWAL - MS144 - 2014 - SMNabilah HashimNo ratings yet

- Principles of Valuation: Class 2 Financial Management, 15.414Document32 pagesPrinciples of Valuation: Class 2 Financial Management, 15.414premgnc1983No ratings yet

- 3rdQ-Summative Exam-Applied EconDocument5 pages3rdQ-Summative Exam-Applied EconËlõysë ÖlbāpNo ratings yet