Professional Documents

Culture Documents

US Internal Revenue Service: f1041sd - 1991

US Internal Revenue Service: f1041sd - 1991

Uploaded by

IRSCopyright:

Available Formats

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Rockwell - A Primer For Classical Literary Tibetan-V1Document336 pagesRockwell - A Primer For Classical Literary Tibetan-V1Lydia Porter100% (13)

- US Internal Revenue Service: f1041sd - 1993Document2 pagesUS Internal Revenue Service: f1041sd - 1993IRSNo ratings yet

- US Internal Revenue Service: f1040sd - 1997Document2 pagesUS Internal Revenue Service: f1040sd - 1997IRSNo ratings yet

- Capital Gains and Losses and Built-In Gains: Attach To Form 1120S. See Separate InstructionsDocument1 pageCapital Gains and Losses and Built-In Gains: Attach To Form 1120S. See Separate InstructionsIRSNo ratings yet

- US Internal Revenue Service: f1040sd - 2001Document2 pagesUS Internal Revenue Service: f1040sd - 2001IRSNo ratings yet

- US Internal Revenue Service: f1040sd - 2003Document2 pagesUS Internal Revenue Service: f1040sd - 2003IRSNo ratings yet

- US Internal Revenue Service: f4797 - 2000Document2 pagesUS Internal Revenue Service: f4797 - 2000IRSNo ratings yet

- US Internal Revenue Service: f4797 - 1991Document2 pagesUS Internal Revenue Service: f4797 - 1991IRSNo ratings yet

- Capital Gains and Losses: Schedule DDocument2 pagesCapital Gains and Losses: Schedule DJulie AustinNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1040) 12Document2 pagesCapital Gains and Losses: Schedule D (Form 1040) 12tinpenaNo ratings yet

- Formulario D Federal Tax 2015Document2 pagesFormulario D Federal Tax 2015Johanies M. Cortés RiveraNo ratings yet

- US Internal Revenue Service: f1040sd - 1993Document2 pagesUS Internal Revenue Service: f1040sd - 1993IRSNo ratings yet

- US Internal Revenue Service: f4797 - 1998Document2 pagesUS Internal Revenue Service: f4797 - 1998IRSNo ratings yet

- f4797VENTA DE PROPIEDADDocument2 pagesf4797VENTA DE PROPIEDADGriselda DavadiNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1040) 12Document2 pagesCapital Gains and Losses: Schedule D (Form 1040) 12Chandani DesaiNo ratings yet

- US Internal Revenue Service: f4797 - 2003Document2 pagesUS Internal Revenue Service: f4797 - 2003IRSNo ratings yet

- US Internal Revenue Service: f4970 - 1996Document2 pagesUS Internal Revenue Service: f4970 - 1996IRSNo ratings yet

- US Internal Revenue Service: f4970 - 1997Document2 pagesUS Internal Revenue Service: f4970 - 1997IRSNo ratings yet

- US Internal Revenue Service: f6781 - 2001Document3 pagesUS Internal Revenue Service: f6781 - 2001IRSNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1120)Document2 pagesCapital Gains and Losses: Schedule D (Form 1120)张泽亮No ratings yet

- US Internal Revenue Service: f4970 - 2000Document2 pagesUS Internal Revenue Service: f4970 - 2000IRSNo ratings yet

- US Internal Revenue Service: f6781 - 2002Document3 pagesUS Internal Revenue Service: f6781 - 2002IRSNo ratings yet

- Sales of Business PropertyDocument2 pagesSales of Business Propertyhiamang27No ratings yet

- Capital Gains and LossesDocument1 pageCapital Gains and Losseskushaal subramonyNo ratings yet

- US Internal Revenue Service: f1041sd - 1995Document2 pagesUS Internal Revenue Service: f1041sd - 1995IRSNo ratings yet

- Taxation For Decision Makers 2017 1st Edition Escoffier Solutions ManualDocument5 pagesTaxation For Decision Makers 2017 1st Edition Escoffier Solutions Manualamandabinh1j6100% (26)

- US Internal Revenue Service: f1065sm3 AccessibleDocument3 pagesUS Internal Revenue Service: f1065sm3 AccessibleIRSNo ratings yet

- US Internal Revenue Service: f1041sj - 1992Document2 pagesUS Internal Revenue Service: f1041sj - 1992IRSNo ratings yet

- US Internal Revenue Service: F1120idp - 2001Document2 pagesUS Internal Revenue Service: F1120idp - 2001IRSNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1040) 12Document2 pagesCapital Gains and Losses: Schedule D (Form 1040) 12Christopher RiceNo ratings yet

- IRS Form1040 Schedule D 2011Document2 pagesIRS Form1040 Schedule D 2011Alexis TocquevilleNo ratings yet

- US Internal Revenue Service: f6251 - 1995Document1 pageUS Internal Revenue Service: f6251 - 1995IRSNo ratings yet

- SCHEDULE C 1040 FormDocument2 pagesSCHEDULE C 1040 Formhenri e ewaneNo ratings yet

- US Internal Revenue Service: f6198 - 1999Document1 pageUS Internal Revenue Service: f6198 - 1999IRSNo ratings yet

- US Internal Revenue Service: f6198 - 2000Document1 pageUS Internal Revenue Service: f6198 - 2000IRSNo ratings yet

- US Internal Revenue Service: f6251 - 1997Document2 pagesUS Internal Revenue Service: f6251 - 1997IRSNo ratings yet

- US Internal Revenue Service: f8844 - 1994Document3 pagesUS Internal Revenue Service: f8844 - 1994IRSNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1040) 12Document2 pagesCapital Gains and Losses: Schedule D (Form 1040) 12api-253299751No ratings yet

- Capital Gains and Losses: Schedule D (Form 1120)Document1 pageCapital Gains and Losses: Schedule D (Form 1120)IRSNo ratings yet

- US Internal Revenue Service: f8844Document4 pagesUS Internal Revenue Service: f8844IRSNo ratings yet

- US Internal Revenue Service: f3800 - 1992Document2 pagesUS Internal Revenue Service: f3800 - 1992IRSNo ratings yet

- Gains and Losses From Section 1256 Contracts and Straddles: A B C D (A) Identification of Account (B) (Loss) (C) GainDocument4 pagesGains and Losses From Section 1256 Contracts and Straddles: A B C D (A) Identification of Account (B) (Loss) (C) GainGaro OhanogluNo ratings yet

- US Internal Revenue Service: f4562 - 1992Document2 pagesUS Internal Revenue Service: f4562 - 1992IRSNo ratings yet

- Form 8582Document3 pagesForm 8582Mira HuNo ratings yet

- US Internal Revenue Service: f1041sj - 1994Document2 pagesUS Internal Revenue Service: f1041sj - 1994IRSNo ratings yet

- 1084 - Final Enact - 1120 SDocument6 pages1084 - Final Enact - 1120 SHimani SachdevNo ratings yet

- US Internal Revenue Service: f6251 - 2000Document2 pagesUS Internal Revenue Service: f6251 - 2000IRSNo ratings yet

- US Internal Revenue Service: f8829 - 1991Document2 pagesUS Internal Revenue Service: f8829 - 1991IRSNo ratings yet

- US Internal Revenue Service: f6251 - 1996Document1 pageUS Internal Revenue Service: f6251 - 1996IRSNo ratings yet

- US Internal Revenue Service: f1041sk1 - 1996Document2 pagesUS Internal Revenue Service: f1041sk1 - 1996IRSNo ratings yet

- Empowerment Zone and Renewal Community Employment Credit: OMB No. 1545-1444 FormDocument4 pagesEmpowerment Zone and Renewal Community Employment Credit: OMB No. 1545-1444 FormIRSNo ratings yet

- Net Income (Loss) Reconciliation For Corporations With Total Assets of $10 Million or MoreDocument3 pagesNet Income (Loss) Reconciliation For Corporations With Total Assets of $10 Million or MoreHazem El SayedNo ratings yet

- Worksheet A: Instructions, Later.) Enter The Amounts On Lines 1a Through 62, 64, 66, and 68 in Functional CurrencyDocument3 pagesWorksheet A: Instructions, Later.) Enter The Amounts On Lines 1a Through 62, 64, 66, and 68 in Functional Currencyyounes keraghelNo ratings yet

- Passive Activity Credit Limitations: of The InstructionsDocument2 pagesPassive Activity Credit Limitations: of The InstructionsIRSNo ratings yet

- US Internal Revenue Service: f6781 - 2003Document4 pagesUS Internal Revenue Service: f6781 - 2003IRSNo ratings yet

- US Internal Revenue Service: f2438 - 2002Document3 pagesUS Internal Revenue Service: f2438 - 2002IRSNo ratings yet

- US Internal Revenue Service: f1040sd - 2004Document2 pagesUS Internal Revenue Service: f1040sd - 2004IRSNo ratings yet

- US Internal Revenue Service: F1120wfy - 1992Document5 pagesUS Internal Revenue Service: F1120wfy - 1992IRSNo ratings yet

- US Internal Revenue Service: f2438 - 1999Document2 pagesUS Internal Revenue Service: f2438 - 1999IRSNo ratings yet

- Alternative Minimum Tax f6251Document2 pagesAlternative Minimum Tax f6251FileYourTaxesNow100% (1)

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- Environmental Economics An Introduction 7th Edition Field Test BankDocument8 pagesEnvironmental Economics An Introduction 7th Edition Field Test Bankherbistazarole5fuyh6100% (31)

- 7106 - Biological AssetDocument2 pages7106 - Biological AssetGerardo YadawonNo ratings yet

- Guide To Power System Earthing Practice Final (June2009) PDFDocument176 pagesGuide To Power System Earthing Practice Final (June2009) PDFssamonas100% (6)

- CSE Annual Report 2021 v2Document136 pagesCSE Annual Report 2021 v2Jasmin AkterNo ratings yet

- Compitition of Yacon RootDocument8 pagesCompitition of Yacon RootArfi MaulanaNo ratings yet

- The Ailing PlanetDocument8 pagesThe Ailing PlanetAnonymous ExAwm00UPNo ratings yet

- Quadra Combo RM EngDocument1 pageQuadra Combo RM EngGabrielGrecoNo ratings yet

- StatisticsDocument116 pagesStatisticsRAIZA GRACE OAMILNo ratings yet

- KTS 442 Transfer Via BluetoothDocument6 pagesKTS 442 Transfer Via BluetoothSilvestre SNo ratings yet

- Genomic Survey of Edible Cockle (Cerastoderma Edule) in The Northeast Atlantic A Baseline For Sustainable ManagemenDocument24 pagesGenomic Survey of Edible Cockle (Cerastoderma Edule) in The Northeast Atlantic A Baseline For Sustainable ManagemenMarina PNo ratings yet

- Extrusive Intrusive: What Are Igneous Rocks?Document6 pagesExtrusive Intrusive: What Are Igneous Rocks?Edna BernabeNo ratings yet

- Presentation of ESP Application Technology: Daqing Electric Submersible Pump CompanyDocument8 pagesPresentation of ESP Application Technology: Daqing Electric Submersible Pump CompanyIman Taufik DarajatNo ratings yet

- Sto Adhesive B PDFDocument2 pagesSto Adhesive B PDFPaulo CarvalhoNo ratings yet

- SI - CORE - Rulebook WebDocument32 pagesSI - CORE - Rulebook WebintuitionNo ratings yet

- Wizard Magazine 019 (1993) c2cDocument198 pagesWizard Magazine 019 (1993) c2cAmirNo ratings yet

- Modul 4 - Perhitungan VolumetrikDocument38 pagesModul 4 - Perhitungan VolumetrikHype SupplyNo ratings yet

- D80170GC20 sg2Document270 pagesD80170GC20 sg2Misc AccountNo ratings yet

- Price List Travo LasDocument21 pagesPrice List Travo Laspei sajaNo ratings yet

- Installation & User Guide PC HP RP5800 On VIDASDocument41 pagesInstallation & User Guide PC HP RP5800 On VIDASHadi AlbitarNo ratings yet

- 09 Task Performance 1Document1 page09 Task Performance 1fransherl2004No ratings yet

- Nitin Yadav: Brain, Mind and Markets Lab The University of MelbourneDocument61 pagesNitin Yadav: Brain, Mind and Markets Lab The University of Melbournevanessa8pangestuNo ratings yet

- Taxonomic Revision of Crematogaster in Arabian PeninsulaDocument27 pagesTaxonomic Revision of Crematogaster in Arabian PeninsulaShehzad salmanNo ratings yet

- CH 2 Topic - Salts 2Document5 pagesCH 2 Topic - Salts 2siratNo ratings yet

- Form CF2 v4Document11 pagesForm CF2 v4Anil KumarNo ratings yet

- The National Competency-Based Teacher StandardsDocument7 pagesThe National Competency-Based Teacher StandardsJacquelyn MendozaNo ratings yet

- GSKMotorways - Expressway System - Sect 2 - EarthworksDocument51 pagesGSKMotorways - Expressway System - Sect 2 - Earthworksmohamed samirNo ratings yet

- Technical DataDocument27 pagesTechnical DataAbdul LatheefNo ratings yet

- Characteristic Coastal HabitatsDocument86 pagesCharacteristic Coastal HabitatsMasterPie1950No ratings yet

- Developing Writing Skills (2009) PDFDocument193 pagesDeveloping Writing Skills (2009) PDFnasrul yamin100% (1)

US Internal Revenue Service: f1041sd - 1991

US Internal Revenue Service: f1041sd - 1991

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: f1041sd - 1991

US Internal Revenue Service: f1041sd - 1991

Uploaded by

IRSCopyright:

Available Formats

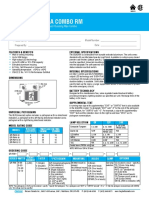

OMB No.

1545-0092

SCHEDULE D

(Form 1041) Capital Gains and Losses

© File with Form 1041. See the separate Form 1041 instructions.

Department of the Treasury

Internal Revenue Service

Name of estate or trust Employer identification number

Do not report section 644 gains on Schedule D (See Form 1041 instructions for line 1b, Schedule G.)

Part I Short-Term Capital Gains and Losses—Assets Held One Year or Less

(b) Date (c) Date (e) Cost or other basis, as

(a) Description of property (Example, (d) Gross sales (f) Gain (or loss)

acquired sold adjusted, plus expense of

100 shares 7% preferred of “Z” Co.) price (col. (d) less col. (e))

(mo., day, yr.) (mo., day, yr.) sale (see instructions)

1

2 Short-term capital gain from installment sales from Form 6252 2

3 Net short-term gain (or loss) from partnerships, S corporations, and other fiduciaries 3

4 Net gain (or loss) (combine lines 1 through 3) 4

5 Short-term capital loss carryover from 1990 Schedule D, line 28 5 ( )

6 Net short-term gain (or loss) (combine lines 4 and 5). Enter here and on line 15 below © 6

Part II Long-Term Capital Gains and Losses—Assets Held More Than One Year

8 Long-term capital gain from installment sales from Form 6252 8

9 Net long-term gain (or loss) from partnerships, S corporations, and other fiduciaries 9

10 Capital gain distributions 10

11 Enter gain, if applicable, from Form 4797 11

12 Net gain (or loss)(combine lines 7 through 11) 12

13 Long-term capital loss carryover from 1990 Schedule D, line 35 13 ( )

14 Net long-term gain (or loss) (combine lines 12 and 13). Enter here and on line 16 below © 14

Part III Summary of Parts I and II (a) Beneficiaries (b) Fiduciary (c) Total

15 Net short-term gain (or loss) from line 6, above 15

16 Net long-term gain (or loss) from line 14, above 16

17 Total net gain (or loss) (combine lines 15 and 16) © 17

If lines 16 and 17, column (c), are net gains, enter the gain on Form 1041, line 4, go to Part VI, and DO

NOT complete Parts IV and V. If line 17, column (c), is a net loss, complete Parts IV and V, as necessary.

For Paperwork Reduction Act Notice, see page 1 of the Instructions for Form 1041. Cat. No. 11376V Schedule D (Form 1041) 1991

Schedule D (Form 1041) 1991 Page 2

Part IV Computation of Capital Loss Limitation

18 Enter here and enter as a (loss) on Form 1041, line 4, the smaller of:

(i) The net loss on line 17, column (c); or

(ii) $3,000 18 ( )

If the net loss on line 17, column (c) is more than $3,000, OR if the taxable income on line 22, page 1, of Form 1041 is

zero or less, complete Part V to determine your capital loss carryover.

Part V Computation of Capital Loss Carryovers From 1991 to 1992

Section A.—Computation of Carryover Limit

19 Enter taxable income (or loss) for 1991 from Form 1041, line 22 19

20 Enter loss from line 18, above, as a positive amount 20

21 Enter amount from Form 1041, line 20 21

22 Adjusted taxable income (Combine lines 19, 20, and 21, but do not enter less than zero.) 22

23 Enter the lesser of lines 20 or 22 23

Section B.—Short-Term Capital Loss Carryover

(Complete this part only if there is a loss on line 6, Schedule D, Part I, and line 17, column (c).)

24 Enter loss from line 6 as a positive amount 24

25 Enter gain, if any, from line 14. (If that line is blank or shows a loss, enter -0-.) 25

26 Enter amount from line 23, above 26

27 Add lines 25 and 26 27

28 Subtract line 27 from line 24. If zero or less, enter -0-. This is the fiduciary’s short-term capital

loss carryover from 1991 to 1992. If this is the final return of the estate or trust, also enter on line

12b, Schedule K-1 (Form 1041) 28

Section C.—Long-Term Capital Loss Carryover

(Complete this part only if there is a loss on line 14 and line 17, column (c).)

29 Enter loss from line 14 as a positive amount 29

30 Enter gain, if any, from line 6. (If that line is blank or shows a loss, enter -0-.) 30

31 Enter amount from line 23, above 31

32 Enter amount, if any, from line 24, above 32

33 Subtract line 32 from line 31. If zero or less, enter -0- 33

34 Add lines 30 and 33 34

35 Subtract line 34 from line 29. If zero or less, enter -0-. This is the fiduciary’s long-term capital loss

carryover from 1991 to 1992. If this is the final return of the estate or trust, also enter on line 12c,

Schedule K-1 (Form 1041) 35

Part VI Tax Computation Using Maximum Capital Gains Rate (Complete this part only if lines 16 and 17, column

(c) are net capital gains for 1991.)

36 Taxable income (from Form 1041, line 22) 36

37 Net capital gain for 1991 (Enter the smaller of line 16 or 17, column (c).) 37

38 Subtract line 37 from line 36, but not less than zero 38

39 Enter the greater of line 38 or $10,350 39

40 Tax on amount on line 39 from the 1991 Tax Rate Schedule. If $10,350, enter $2,449.50 40

41 Subtract line 39 from line 36, but not less than zero 41

42 Multiply line 41 by (.28) 42

43 Maximum capital gains tax (add lines 40 and 42) 43

44 Regular tax on amount on line 36 from the 1991 Tax Rate Schedule 44

45 Tax. (Enter the lesser of line 43 or line 44.) Enter here and on line 1a of Schedule G, Form 1041 45

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Rockwell - A Primer For Classical Literary Tibetan-V1Document336 pagesRockwell - A Primer For Classical Literary Tibetan-V1Lydia Porter100% (13)

- US Internal Revenue Service: f1041sd - 1993Document2 pagesUS Internal Revenue Service: f1041sd - 1993IRSNo ratings yet

- US Internal Revenue Service: f1040sd - 1997Document2 pagesUS Internal Revenue Service: f1040sd - 1997IRSNo ratings yet

- Capital Gains and Losses and Built-In Gains: Attach To Form 1120S. See Separate InstructionsDocument1 pageCapital Gains and Losses and Built-In Gains: Attach To Form 1120S. See Separate InstructionsIRSNo ratings yet

- US Internal Revenue Service: f1040sd - 2001Document2 pagesUS Internal Revenue Service: f1040sd - 2001IRSNo ratings yet

- US Internal Revenue Service: f1040sd - 2003Document2 pagesUS Internal Revenue Service: f1040sd - 2003IRSNo ratings yet

- US Internal Revenue Service: f4797 - 2000Document2 pagesUS Internal Revenue Service: f4797 - 2000IRSNo ratings yet

- US Internal Revenue Service: f4797 - 1991Document2 pagesUS Internal Revenue Service: f4797 - 1991IRSNo ratings yet

- Capital Gains and Losses: Schedule DDocument2 pagesCapital Gains and Losses: Schedule DJulie AustinNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1040) 12Document2 pagesCapital Gains and Losses: Schedule D (Form 1040) 12tinpenaNo ratings yet

- Formulario D Federal Tax 2015Document2 pagesFormulario D Federal Tax 2015Johanies M. Cortés RiveraNo ratings yet

- US Internal Revenue Service: f1040sd - 1993Document2 pagesUS Internal Revenue Service: f1040sd - 1993IRSNo ratings yet

- US Internal Revenue Service: f4797 - 1998Document2 pagesUS Internal Revenue Service: f4797 - 1998IRSNo ratings yet

- f4797VENTA DE PROPIEDADDocument2 pagesf4797VENTA DE PROPIEDADGriselda DavadiNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1040) 12Document2 pagesCapital Gains and Losses: Schedule D (Form 1040) 12Chandani DesaiNo ratings yet

- US Internal Revenue Service: f4797 - 2003Document2 pagesUS Internal Revenue Service: f4797 - 2003IRSNo ratings yet

- US Internal Revenue Service: f4970 - 1996Document2 pagesUS Internal Revenue Service: f4970 - 1996IRSNo ratings yet

- US Internal Revenue Service: f4970 - 1997Document2 pagesUS Internal Revenue Service: f4970 - 1997IRSNo ratings yet

- US Internal Revenue Service: f6781 - 2001Document3 pagesUS Internal Revenue Service: f6781 - 2001IRSNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1120)Document2 pagesCapital Gains and Losses: Schedule D (Form 1120)张泽亮No ratings yet

- US Internal Revenue Service: f4970 - 2000Document2 pagesUS Internal Revenue Service: f4970 - 2000IRSNo ratings yet

- US Internal Revenue Service: f6781 - 2002Document3 pagesUS Internal Revenue Service: f6781 - 2002IRSNo ratings yet

- Sales of Business PropertyDocument2 pagesSales of Business Propertyhiamang27No ratings yet

- Capital Gains and LossesDocument1 pageCapital Gains and Losseskushaal subramonyNo ratings yet

- US Internal Revenue Service: f1041sd - 1995Document2 pagesUS Internal Revenue Service: f1041sd - 1995IRSNo ratings yet

- Taxation For Decision Makers 2017 1st Edition Escoffier Solutions ManualDocument5 pagesTaxation For Decision Makers 2017 1st Edition Escoffier Solutions Manualamandabinh1j6100% (26)

- US Internal Revenue Service: f1065sm3 AccessibleDocument3 pagesUS Internal Revenue Service: f1065sm3 AccessibleIRSNo ratings yet

- US Internal Revenue Service: f1041sj - 1992Document2 pagesUS Internal Revenue Service: f1041sj - 1992IRSNo ratings yet

- US Internal Revenue Service: F1120idp - 2001Document2 pagesUS Internal Revenue Service: F1120idp - 2001IRSNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1040) 12Document2 pagesCapital Gains and Losses: Schedule D (Form 1040) 12Christopher RiceNo ratings yet

- IRS Form1040 Schedule D 2011Document2 pagesIRS Form1040 Schedule D 2011Alexis TocquevilleNo ratings yet

- US Internal Revenue Service: f6251 - 1995Document1 pageUS Internal Revenue Service: f6251 - 1995IRSNo ratings yet

- SCHEDULE C 1040 FormDocument2 pagesSCHEDULE C 1040 Formhenri e ewaneNo ratings yet

- US Internal Revenue Service: f6198 - 1999Document1 pageUS Internal Revenue Service: f6198 - 1999IRSNo ratings yet

- US Internal Revenue Service: f6198 - 2000Document1 pageUS Internal Revenue Service: f6198 - 2000IRSNo ratings yet

- US Internal Revenue Service: f6251 - 1997Document2 pagesUS Internal Revenue Service: f6251 - 1997IRSNo ratings yet

- US Internal Revenue Service: f8844 - 1994Document3 pagesUS Internal Revenue Service: f8844 - 1994IRSNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1040) 12Document2 pagesCapital Gains and Losses: Schedule D (Form 1040) 12api-253299751No ratings yet

- Capital Gains and Losses: Schedule D (Form 1120)Document1 pageCapital Gains and Losses: Schedule D (Form 1120)IRSNo ratings yet

- US Internal Revenue Service: f8844Document4 pagesUS Internal Revenue Service: f8844IRSNo ratings yet

- US Internal Revenue Service: f3800 - 1992Document2 pagesUS Internal Revenue Service: f3800 - 1992IRSNo ratings yet

- Gains and Losses From Section 1256 Contracts and Straddles: A B C D (A) Identification of Account (B) (Loss) (C) GainDocument4 pagesGains and Losses From Section 1256 Contracts and Straddles: A B C D (A) Identification of Account (B) (Loss) (C) GainGaro OhanogluNo ratings yet

- US Internal Revenue Service: f4562 - 1992Document2 pagesUS Internal Revenue Service: f4562 - 1992IRSNo ratings yet

- Form 8582Document3 pagesForm 8582Mira HuNo ratings yet

- US Internal Revenue Service: f1041sj - 1994Document2 pagesUS Internal Revenue Service: f1041sj - 1994IRSNo ratings yet

- 1084 - Final Enact - 1120 SDocument6 pages1084 - Final Enact - 1120 SHimani SachdevNo ratings yet

- US Internal Revenue Service: f6251 - 2000Document2 pagesUS Internal Revenue Service: f6251 - 2000IRSNo ratings yet

- US Internal Revenue Service: f8829 - 1991Document2 pagesUS Internal Revenue Service: f8829 - 1991IRSNo ratings yet

- US Internal Revenue Service: f6251 - 1996Document1 pageUS Internal Revenue Service: f6251 - 1996IRSNo ratings yet

- US Internal Revenue Service: f1041sk1 - 1996Document2 pagesUS Internal Revenue Service: f1041sk1 - 1996IRSNo ratings yet

- Empowerment Zone and Renewal Community Employment Credit: OMB No. 1545-1444 FormDocument4 pagesEmpowerment Zone and Renewal Community Employment Credit: OMB No. 1545-1444 FormIRSNo ratings yet

- Net Income (Loss) Reconciliation For Corporations With Total Assets of $10 Million or MoreDocument3 pagesNet Income (Loss) Reconciliation For Corporations With Total Assets of $10 Million or MoreHazem El SayedNo ratings yet

- Worksheet A: Instructions, Later.) Enter The Amounts On Lines 1a Through 62, 64, 66, and 68 in Functional CurrencyDocument3 pagesWorksheet A: Instructions, Later.) Enter The Amounts On Lines 1a Through 62, 64, 66, and 68 in Functional Currencyyounes keraghelNo ratings yet

- Passive Activity Credit Limitations: of The InstructionsDocument2 pagesPassive Activity Credit Limitations: of The InstructionsIRSNo ratings yet

- US Internal Revenue Service: f6781 - 2003Document4 pagesUS Internal Revenue Service: f6781 - 2003IRSNo ratings yet

- US Internal Revenue Service: f2438 - 2002Document3 pagesUS Internal Revenue Service: f2438 - 2002IRSNo ratings yet

- US Internal Revenue Service: f1040sd - 2004Document2 pagesUS Internal Revenue Service: f1040sd - 2004IRSNo ratings yet

- US Internal Revenue Service: F1120wfy - 1992Document5 pagesUS Internal Revenue Service: F1120wfy - 1992IRSNo ratings yet

- US Internal Revenue Service: f2438 - 1999Document2 pagesUS Internal Revenue Service: f2438 - 1999IRSNo ratings yet

- Alternative Minimum Tax f6251Document2 pagesAlternative Minimum Tax f6251FileYourTaxesNow100% (1)

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- Environmental Economics An Introduction 7th Edition Field Test BankDocument8 pagesEnvironmental Economics An Introduction 7th Edition Field Test Bankherbistazarole5fuyh6100% (31)

- 7106 - Biological AssetDocument2 pages7106 - Biological AssetGerardo YadawonNo ratings yet

- Guide To Power System Earthing Practice Final (June2009) PDFDocument176 pagesGuide To Power System Earthing Practice Final (June2009) PDFssamonas100% (6)

- CSE Annual Report 2021 v2Document136 pagesCSE Annual Report 2021 v2Jasmin AkterNo ratings yet

- Compitition of Yacon RootDocument8 pagesCompitition of Yacon RootArfi MaulanaNo ratings yet

- The Ailing PlanetDocument8 pagesThe Ailing PlanetAnonymous ExAwm00UPNo ratings yet

- Quadra Combo RM EngDocument1 pageQuadra Combo RM EngGabrielGrecoNo ratings yet

- StatisticsDocument116 pagesStatisticsRAIZA GRACE OAMILNo ratings yet

- KTS 442 Transfer Via BluetoothDocument6 pagesKTS 442 Transfer Via BluetoothSilvestre SNo ratings yet

- Genomic Survey of Edible Cockle (Cerastoderma Edule) in The Northeast Atlantic A Baseline For Sustainable ManagemenDocument24 pagesGenomic Survey of Edible Cockle (Cerastoderma Edule) in The Northeast Atlantic A Baseline For Sustainable ManagemenMarina PNo ratings yet

- Extrusive Intrusive: What Are Igneous Rocks?Document6 pagesExtrusive Intrusive: What Are Igneous Rocks?Edna BernabeNo ratings yet

- Presentation of ESP Application Technology: Daqing Electric Submersible Pump CompanyDocument8 pagesPresentation of ESP Application Technology: Daqing Electric Submersible Pump CompanyIman Taufik DarajatNo ratings yet

- Sto Adhesive B PDFDocument2 pagesSto Adhesive B PDFPaulo CarvalhoNo ratings yet

- SI - CORE - Rulebook WebDocument32 pagesSI - CORE - Rulebook WebintuitionNo ratings yet

- Wizard Magazine 019 (1993) c2cDocument198 pagesWizard Magazine 019 (1993) c2cAmirNo ratings yet

- Modul 4 - Perhitungan VolumetrikDocument38 pagesModul 4 - Perhitungan VolumetrikHype SupplyNo ratings yet

- D80170GC20 sg2Document270 pagesD80170GC20 sg2Misc AccountNo ratings yet

- Price List Travo LasDocument21 pagesPrice List Travo Laspei sajaNo ratings yet

- Installation & User Guide PC HP RP5800 On VIDASDocument41 pagesInstallation & User Guide PC HP RP5800 On VIDASHadi AlbitarNo ratings yet

- 09 Task Performance 1Document1 page09 Task Performance 1fransherl2004No ratings yet

- Nitin Yadav: Brain, Mind and Markets Lab The University of MelbourneDocument61 pagesNitin Yadav: Brain, Mind and Markets Lab The University of Melbournevanessa8pangestuNo ratings yet

- Taxonomic Revision of Crematogaster in Arabian PeninsulaDocument27 pagesTaxonomic Revision of Crematogaster in Arabian PeninsulaShehzad salmanNo ratings yet

- CH 2 Topic - Salts 2Document5 pagesCH 2 Topic - Salts 2siratNo ratings yet

- Form CF2 v4Document11 pagesForm CF2 v4Anil KumarNo ratings yet

- The National Competency-Based Teacher StandardsDocument7 pagesThe National Competency-Based Teacher StandardsJacquelyn MendozaNo ratings yet

- GSKMotorways - Expressway System - Sect 2 - EarthworksDocument51 pagesGSKMotorways - Expressway System - Sect 2 - Earthworksmohamed samirNo ratings yet

- Technical DataDocument27 pagesTechnical DataAbdul LatheefNo ratings yet

- Characteristic Coastal HabitatsDocument86 pagesCharacteristic Coastal HabitatsMasterPie1950No ratings yet

- Developing Writing Skills (2009) PDFDocument193 pagesDeveloping Writing Skills (2009) PDFnasrul yamin100% (1)