Professional Documents

Culture Documents

US Internal Revenue Service: f1041t - 1994

US Internal Revenue Service: f1041t - 1994

Uploaded by

IRSCopyright:

Available Formats

You might also like

- Sheila McCorriston WithdrawalDocument14 pagesSheila McCorriston WithdrawalAnonymous BmFjIMShq9100% (2)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- W9 FormDocument1 pageW9 FormChris GreeneNo ratings yet

- Editable IRS Form 8879 For 2017-2018Document2 pagesEditable IRS Form 8879 For 2017-2018PDFstockNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Non Aero Revenue - MBA ProjectDocument68 pagesNon Aero Revenue - MBA ProjectSuresh Kumar100% (2)

- Individual Tax Returns - IRS 2009Document200 pagesIndividual Tax Returns - IRS 2009Steve EldridgeNo ratings yet

- 3911 Taxpayer Statement Regarding Refund: Section IDocument2 pages3911 Taxpayer Statement Regarding Refund: Section IWanda NesbethNo ratings yet

- Client Request FormDocument1 pageClient Request FormDenald Paz100% (1)

- Tax Decoder TestDocument8 pagesTax Decoder Testmichael100% (1)

- Request For Taxpayer Identification Number and CertificationDocument2 pagesRequest For Taxpayer Identification Number and Certificationdonald.price11306100% (1)

- Income Tax Return: Group MembersDocument12 pagesIncome Tax Return: Group MembersTophe ProvidoNo ratings yet

- 27four Tax Free Savings New Investment FormDocument8 pages27four Tax Free Savings New Investment FormLord OversightNo ratings yet

- Verification of Reported IncomeDocument3 pagesVerification of Reported IncomepdizypdizyNo ratings yet

- US Internal Revenue Service: p4162Document345 pagesUS Internal Revenue Service: p4162IRSNo ratings yet

- Company Financial Salaries Wages Deductions: Payroll Taxes in U.SDocument4 pagesCompany Financial Salaries Wages Deductions: Payroll Taxes in U.SSampath KumarNo ratings yet

- Individuals Tax Return - US 2016Document2 pagesIndividuals Tax Return - US 2016Yousef M. AqelNo ratings yet

- Union Security Trust Fund 2007Document10 pagesUnion Security Trust Fund 2007Latisha WalkerNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returndavis_dion22No ratings yet

- MSB Registration From FinCENDocument1 pageMSB Registration From FinCENCoin FireNo ratings yet

- Payroll OrlDocument4 pagesPayroll OrlJose OcandoNo ratings yet

- Fictitious Business Name Statement: Beverly Hills Ca 90210Document3 pagesFictitious Business Name Statement: Beverly Hills Ca 90210Samuel B.No ratings yet

- Lacerte - e - File - Returns (Wazhua - Com)Document58 pagesLacerte - e - File - Returns (Wazhua - Com)haiderabbaskhattakNo ratings yet

- 326 ParcelLabelingGuideDocument49 pages326 ParcelLabelingGuidelianqiang caoNo ratings yet

- IRS Form 4868Document4 pagesIRS Form 4868Anil AletiNo ratings yet

- Fss 4Document2 pagesFss 4Russell Hartill100% (1)

- Expat Tax AzDocument6 pagesExpat Tax Azkcr240No ratings yet

- US Internal Revenue Service: p4163Document134 pagesUS Internal Revenue Service: p4163IRSNo ratings yet

- Conciliation Hearing Award State of Ohio State Employment Relations Board SEPTEMBER 28, 2020Document45 pagesConciliation Hearing Award State of Ohio State Employment Relations Board SEPTEMBER 28, 2020Dominic SaturdayNo ratings yet

- Act 268 Bills of Sale Act 1950Document26 pagesAct 268 Bills of Sale Act 1950Adam Haida & CoNo ratings yet

- Unclaimed FundsDocument1 pageUnclaimed FundsCara MatthewsNo ratings yet

- Short Form Request For Individual Tax Return TranscriptDocument2 pagesShort Form Request For Individual Tax Return TranscriptTina EllisNo ratings yet

- FBN App StatementDocument2 pagesFBN App StatementBecca FriasNo ratings yet

- Registration of Foreign InvestmentDocument10 pagesRegistration of Foreign InvestmentFrancis De CastroNo ratings yet

- Statutory ClaimDocument41 pagesStatutory ClaimCarl AKA Imhotep Heru ElNo ratings yet

- Claim Form For InsuranceDocument3 pagesClaim Form For InsuranceSai PradeepNo ratings yet

- Bloomberg 2012Document316 pagesBloomberg 2012josephlordNo ratings yet

- Ve'H (O5.U H + Q ": Frlitf (TFF Califi ,,'R? Q L (O?ODocument1 pageVe'H (O5.U H + Q ": Frlitf (TFF Califi ,,'R? Q L (O?OMatthew Robert QuinnNo ratings yet

- 4506 TDocument3 pages4506 TwallerdcNo ratings yet

- 2022 Turbo Tax ReturnDocument53 pages2022 Turbo Tax Returnleachsteven67No ratings yet

- IRS Publication 4262Document312 pagesIRS Publication 4262Francis Wolfgang UrbanNo ratings yet

- IRS Publication Form 706 GSTDocument3 pagesIRS Publication Form 706 GSTFrancis Wolfgang UrbanNo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- Chapter 4 Variation of TrustsDocument3 pagesChapter 4 Variation of TrustsChan Yee ChoyNo ratings yet

- US Internal Revenue Service: f8879c - 2003Document2 pagesUS Internal Revenue Service: f8879c - 2003IRSNo ratings yet

- SFF IRS Form990 2013Document27 pagesSFF IRS Form990 2013Space Frontier FoundationNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of FloridaDocument59 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of Floridamarie_beaudette1272No ratings yet

- Activity Example 1040 TaxDocument2 pagesActivity Example 1040 TaxKevin ÁlvarezNo ratings yet

- CT W4Document2 pagesCT W4Alejandro ArredondoNo ratings yet

- Ss 5Document5 pagesSs 5DellComputer99No ratings yet

- Robinhood Securities LLC: Tax Information Account 636338105Document8 pagesRobinhood Securities LLC: Tax Information Account 636338105Sam BufordNo ratings yet

- Rent AgreementDocument3 pagesRent AgreementBijendra Singh BishtNo ratings yet

- Legal Heir 1KDocument5 pagesLegal Heir 1Kpks2012No ratings yet

- US Internal Revenue Service: p1245Document35 pagesUS Internal Revenue Service: p1245IRSNo ratings yet

- De 1000 MDocument2 pagesDe 1000 MAnonymous ghzKEH21fNo ratings yet

- FATCA and CRS Self Certification FormDocument10 pagesFATCA and CRS Self Certification FormsudemanNo ratings yet

- Payroll: Company Financial Salaries Wages DeductionsDocument5 pagesPayroll: Company Financial Salaries Wages DeductionsKavitaNo ratings yet

- Trust Tax Return 2019 PDFDocument16 pagesTrust Tax Return 2019 PDFIsabelle Che KimNo ratings yet

- F 1041 TDocument2 pagesF 1041 TIRS100% (3)

- US Internal Revenue Service: f1041t - 1998Document2 pagesUS Internal Revenue Service: f1041t - 1998IRSNo ratings yet

- US Internal Revenue Service: f1041t - 2002Document2 pagesUS Internal Revenue Service: f1041t - 2002IRSNo ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- INTRODUCTIONDocument11 pagesINTRODUCTIONMmNo ratings yet

- Unit 14 - Unemployment and Fiscal Policy - 1.0Document41 pagesUnit 14 - Unemployment and Fiscal Policy - 1.0Georgius Yeremia CandraNo ratings yet

- Iii Iihiiiiiiiiiiii 111111: Does User-Oriented Gas Turbine Research Pay Off?Document7 pagesIii Iihiiiiiiiiiiii 111111: Does User-Oriented Gas Turbine Research Pay Off?Morteza YazdizadehNo ratings yet

- Dedication Certificate John Clyde D. Cristobal: This Certifies ThatDocument1 pageDedication Certificate John Clyde D. Cristobal: This Certifies ThatAGSAOAY JASON F.No ratings yet

- Absorption Costing PDFDocument10 pagesAbsorption Costing PDFAnonymous leF4GPYNo ratings yet

- GLS-LS40GW Specification 20200902Document5 pagesGLS-LS40GW Specification 20200902houyamelkandoussiNo ratings yet

- The Secret Book of JamesDocument17 pagesThe Secret Book of JameslaniNo ratings yet

- SocratesDocument10 pagesSocratesarvin paruliNo ratings yet

- 11.02.2022-PHC ResultsDocument6 pages11.02.2022-PHC ResultsNILAY TEJANo ratings yet

- Flyer OASIS - MANILA TRANSPORTERDocument1 pageFlyer OASIS - MANILA TRANSPORTERNoryl John Mates SaturinasNo ratings yet

- Week 1 - The Swamp LessonDocument2 pagesWeek 1 - The Swamp LessonEccentricEdwardsNo ratings yet

- Unit - 2 Sensor Networks - Introduction & ArchitecturesDocument32 pagesUnit - 2 Sensor Networks - Introduction & Architecturesmurlak37No ratings yet

- Talent Acquisition Request Form: EducationDocument1 pageTalent Acquisition Request Form: EducationdasfortNo ratings yet

- Informative Essays TopicsDocument9 pagesInformative Essays Topicsb725c62j100% (2)

- User Manual of CUBOIDDocument50 pagesUser Manual of CUBOIDshahinur rahmanNo ratings yet

- Consultancy - Software DeveloperDocument2 pagesConsultancy - Software DeveloperImadeddinNo ratings yet

- Home Office and Branch Accounting Agency 1Document20 pagesHome Office and Branch Accounting Agency 1John Stephen PendonNo ratings yet

- British Baker Top Bakery Trends 2023Document15 pagesBritish Baker Top Bakery Trends 2023kiagus artaNo ratings yet

- Stacey Dunlap ResumeDocument3 pagesStacey Dunlap ResumestaceysdunlapNo ratings yet

- Babst Vs CA PDFDocument17 pagesBabst Vs CA PDFJustin YañezNo ratings yet

- Teacher Learning Walk Templates - 2017 - 1Document13 pagesTeacher Learning Walk Templates - 2017 - 1Zakaria Md SaadNo ratings yet

- AUDCISE Unit 3 Worksheets Agner, Jam Althea ODocument3 pagesAUDCISE Unit 3 Worksheets Agner, Jam Althea OdfsdNo ratings yet

- Emcee Script For Kindergarten Recognition (English) - 085301Document3 pagesEmcee Script For Kindergarten Recognition (English) - 085301Felinda ConopioNo ratings yet

- CONSTITUTIONAL - CHANGES - TO - BE - MADE - pdf-SOME IMPORTANT CHANGES TO BE MADE IN THE LANKAN PDFDocument32 pagesCONSTITUTIONAL - CHANGES - TO - BE - MADE - pdf-SOME IMPORTANT CHANGES TO BE MADE IN THE LANKAN PDFThavam RatnaNo ratings yet

- Whyte Human Rights and The Collateral Damage oDocument16 pagesWhyte Human Rights and The Collateral Damage ojswhy1No ratings yet

- HNDIT 1022 Web Design - New-PaperDocument6 pagesHNDIT 1022 Web Design - New-Paperravinduashan66No ratings yet

- William Angelo - Week-7.AssessmentDocument2 pagesWilliam Angelo - Week-7.Assessmentsup shawtyNo ratings yet

- Human Resource Management PrelimsDocument2 pagesHuman Resource Management PrelimsLei PalumponNo ratings yet

- Ethnomedical Knowledge of Plants and Healthcare Practices Among The Kalanguya Tribe in Tinoc, Ifugao, Luzon, PhilippinesDocument13 pagesEthnomedical Knowledge of Plants and Healthcare Practices Among The Kalanguya Tribe in Tinoc, Ifugao, Luzon, PhilippinesJeff Bryan Arellano HimorNo ratings yet

US Internal Revenue Service: f1041t - 1994

US Internal Revenue Service: f1041t - 1994

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: f1041t - 1994

US Internal Revenue Service: f1041t - 1994

Uploaded by

IRSCopyright:

Available Formats

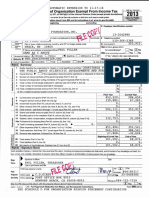

Form 1041-T Allocation of Estimated Tax

Payments to Beneficiaries

OMB No. 1545-1020

Department of the Treasury (Under Code section 643(g))

Internal Revenue Service For the calendar year 1994 or fiscal year beginning ,1994, and ending ,19

Name of trust (or decendent’s estate) Employer identification number

Fill In Fiduciary’s Name and title of fiduciary Telephone number (optional)

Name and ( )

Address Only If

You Are Filing Number, street, and room or suite no. (If a P.O. box, see instructions.)

This Form

Separately and

City, state, and ZIP code If you are filing this form for the final year

Not With Form

1041 of the estate or trust, check this box ©

1 Total amount of estimated taxes to be allocated to beneficiaries. Enter here and on Form 1041, line 24b © $

2 Allocation to beneficiaries:

(d)

(c) (e)

(a) (b) Amount of estimated

Beneficiary’s identifying Proration

No. Beneficiary’s name and address tax payment allocated

number percentage

to beneficiary

1

%

2

%

3

%

4

%

5

%

6

%

7

%

8

%

9

%

10

%

3 Total from additional sheet(s) 3

4 Total amounts allocated. (Must equal line 1, above.) 4

Sign Here Only Under penalties of perjury, I declare that I have examined this allocation, including accompanying schedules and statements, and to the best

If You Are Filing of my knowledge and belief, it is true, correct, and complete.

This Form

Separately and

Not With Form

1041 © Signature of fiduciary or officer representing fiduciary Date

Paperwork Reduction Act Notice Recordkeeping 20 min.

We ask for the information on this form to carry out Learning about the

the Internal Revenue laws of the United States. You law or the form 4 min.

are required to give us the information. We need it to Preparing the form 21 min.

ensure that you are complying with these laws and to Copying, assembling, and

allow us to figure the correct amount of allocated tax sending the form to the IRS 17 min.

payments.

If you have comments concerning the accuracy of

The time needed to complete and file this form will these time estimates or suggestions for making this

vary depending on individual circumstances. The form more simple, we would be happy to hear from

estimated average time is: you. You can write to both the Internal Revenue

Service, Attention: Reports Clearance Officer, PC:FP,

(Continued on reverse)

Cat. No. 64305W Form 1041-T (1994)

Form 1041-T (1994) Page 2

Washington, DC 20224; and the Office of California (all other counties), Hawaii Fresno, CA 93888

Management and Budget, Paperwork Reduction

Project (1545-1020), Washington, DC 20503. DO NOT Illinois, Iowa, Minnesota, Missouri,

Kansas City, MO 64999

Wisconsin

send the form to either of these offices. Instead, see

Where To File below. Alabama, Arkansas, Louisiana,

Memphis, TN 37501

Mississippi, North Carolina, Tennessee

General Instructions Delaware, District of Columbia,

Section references are to the Internal Revenue Code. Maryland, Pennsylvania, Virginia, any Philadelphia, PA 19255

U.S. possession, or foreign country

Purpose of Form

A trust or, for its final tax year, a decedent’s estate Specific Instructions

may elect under section 643(g) to have any part of its

estimated tax payments treated as made by a Address

beneficiary or beneficiaries. The fiduciary files Form Include the suite, room, or other unit number after the

1041-T to make the election. Once made, the election street address. If the post office does not deliver mail

is irrevocable. to the street address and the fiduciary has a P.O. box,

show the box number instead of the street address.

How To File

Attach Form 1041-T to Form 1041 ONLY if you are Line 1

making the election with Form 1041, U.S. Income Tax Enter the amount of estimated tax payments made by

Return for Estates and Trusts. Otherwise, file Form the trust or decedent’s estate that the fiduciary elects

1041-T separately. to treat as a payment made by the beneficiaries. This

amount is treated as if paid or credited to the

When To File beneficiaries on the last day of the tax year of the trust

For the election to be valid, a trust or decedent’s or decedent’s estate. Be sure to include it on Form

estate must file Form 1041-T by the 65th day after the 1041, Schedule B, line 12.

close of the tax year as shown at the top of the form.

For a calendar year trust, that date is March 6, 1995. If Line 2

the due date falls on a Saturday, Sunday, or legal Column (b)—Beneficiary’s name and address.—

holiday, file on the next business day. Group the beneficiaries to whom you are allocating

estimated tax payments into two categories. First, list

Period Covered all the individual beneficiaries (those who have social

File the 1994 form for calendar year 1994 and fiscal security numbers (SSNs)). Second, list all the other

years beginning in 1994 and ending in 1995. If the beneficiaries.

form is for a fiscal year or a short tax year, fill in the Column (c)—Beneficiary’s identifying number.—For

tax year space at the top of the form. each beneficiary, enter the SSN (for individuals) or EIN

Where To File (for all other entities). Failure to enter a valid SSN or

EIN may cause a delay in processing and could result

Please mail to the

following Internal

in the imposition of penalties on the beneficiary. For

Revenue Service those beneficiaries who file a joint return, you can

If you are located in Center assist the IRS in crediting the proper account by

Ä Ä providing the SSN, if known, of the beneficiary’s

New Jersey, New York (New York spouse. However, this is an optional entry.

City, and counties of Nassau, Holtsville, NY 00501 Column (d)—Amount of estimated tax payment

Rockland, Suffolk, and Westchester)

allocated to beneficiary.—For each beneficiary, also

Connecticut, Maine, Massachusetts, enter this amount on Schedule K-1 (Form 1041), line

New Hampshire, New York (all other Andover, MA 05501

counties), Rhode Island, Vermont 13a.

Florida, Georgia, South Carolina Atlanta, GA 39901 Column (e)—Proration percentage.—For each listed

Indiana, Kentucky, Michigan, Ohio,

beneficiary, divide the amount shown in column (d) by

Cincinnati, OH 45999 the amount shown on line 1 and enter the result as a

West Virginia

Kansas, New Mexico, Oklahoma, Texas Austin, TX 73301

percentage.

Alaska, Arizona, California (counties of Line 3

Alpine, Amador, Butte, Calaveras, If you are allocating a payment of estimated taxes to

Colusa, Contra Costa, Del Norte, El

Dorado, Glenn, Humboldt, Lake, Lassen,

more than 10 beneficiaries, list the additional

Marin, Mendocino, Modoc, Napa, beneficiaries on an attached sheet that follows the

Nevada, Placer, Plumas, Sacramento,

Ogden, UT 84201

format of line 2. Enter on line 3 the total from the

San Joaquin, Shasta, Sierra, Siskiyou, attached sheet(s).

Solano, Sonoma, Sutter, Tehama, Trinity,

Yolo, and Yuba), Colorado, Idaho,

Montana, Nebraska, Nevada, North

Dakota, Oregon, South Dakota, Utah,

Washington, Wyoming

Printed on recycled paper

You might also like

- Sheila McCorriston WithdrawalDocument14 pagesSheila McCorriston WithdrawalAnonymous BmFjIMShq9100% (2)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- W9 FormDocument1 pageW9 FormChris GreeneNo ratings yet

- Editable IRS Form 8879 For 2017-2018Document2 pagesEditable IRS Form 8879 For 2017-2018PDFstockNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Non Aero Revenue - MBA ProjectDocument68 pagesNon Aero Revenue - MBA ProjectSuresh Kumar100% (2)

- Individual Tax Returns - IRS 2009Document200 pagesIndividual Tax Returns - IRS 2009Steve EldridgeNo ratings yet

- 3911 Taxpayer Statement Regarding Refund: Section IDocument2 pages3911 Taxpayer Statement Regarding Refund: Section IWanda NesbethNo ratings yet

- Client Request FormDocument1 pageClient Request FormDenald Paz100% (1)

- Tax Decoder TestDocument8 pagesTax Decoder Testmichael100% (1)

- Request For Taxpayer Identification Number and CertificationDocument2 pagesRequest For Taxpayer Identification Number and Certificationdonald.price11306100% (1)

- Income Tax Return: Group MembersDocument12 pagesIncome Tax Return: Group MembersTophe ProvidoNo ratings yet

- 27four Tax Free Savings New Investment FormDocument8 pages27four Tax Free Savings New Investment FormLord OversightNo ratings yet

- Verification of Reported IncomeDocument3 pagesVerification of Reported IncomepdizypdizyNo ratings yet

- US Internal Revenue Service: p4162Document345 pagesUS Internal Revenue Service: p4162IRSNo ratings yet

- Company Financial Salaries Wages Deductions: Payroll Taxes in U.SDocument4 pagesCompany Financial Salaries Wages Deductions: Payroll Taxes in U.SSampath KumarNo ratings yet

- Individuals Tax Return - US 2016Document2 pagesIndividuals Tax Return - US 2016Yousef M. AqelNo ratings yet

- Union Security Trust Fund 2007Document10 pagesUnion Security Trust Fund 2007Latisha WalkerNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returndavis_dion22No ratings yet

- MSB Registration From FinCENDocument1 pageMSB Registration From FinCENCoin FireNo ratings yet

- Payroll OrlDocument4 pagesPayroll OrlJose OcandoNo ratings yet

- Fictitious Business Name Statement: Beverly Hills Ca 90210Document3 pagesFictitious Business Name Statement: Beverly Hills Ca 90210Samuel B.No ratings yet

- Lacerte - e - File - Returns (Wazhua - Com)Document58 pagesLacerte - e - File - Returns (Wazhua - Com)haiderabbaskhattakNo ratings yet

- 326 ParcelLabelingGuideDocument49 pages326 ParcelLabelingGuidelianqiang caoNo ratings yet

- IRS Form 4868Document4 pagesIRS Form 4868Anil AletiNo ratings yet

- Fss 4Document2 pagesFss 4Russell Hartill100% (1)

- Expat Tax AzDocument6 pagesExpat Tax Azkcr240No ratings yet

- US Internal Revenue Service: p4163Document134 pagesUS Internal Revenue Service: p4163IRSNo ratings yet

- Conciliation Hearing Award State of Ohio State Employment Relations Board SEPTEMBER 28, 2020Document45 pagesConciliation Hearing Award State of Ohio State Employment Relations Board SEPTEMBER 28, 2020Dominic SaturdayNo ratings yet

- Act 268 Bills of Sale Act 1950Document26 pagesAct 268 Bills of Sale Act 1950Adam Haida & CoNo ratings yet

- Unclaimed FundsDocument1 pageUnclaimed FundsCara MatthewsNo ratings yet

- Short Form Request For Individual Tax Return TranscriptDocument2 pagesShort Form Request For Individual Tax Return TranscriptTina EllisNo ratings yet

- FBN App StatementDocument2 pagesFBN App StatementBecca FriasNo ratings yet

- Registration of Foreign InvestmentDocument10 pagesRegistration of Foreign InvestmentFrancis De CastroNo ratings yet

- Statutory ClaimDocument41 pagesStatutory ClaimCarl AKA Imhotep Heru ElNo ratings yet

- Claim Form For InsuranceDocument3 pagesClaim Form For InsuranceSai PradeepNo ratings yet

- Bloomberg 2012Document316 pagesBloomberg 2012josephlordNo ratings yet

- Ve'H (O5.U H + Q ": Frlitf (TFF Califi ,,'R? Q L (O?ODocument1 pageVe'H (O5.U H + Q ": Frlitf (TFF Califi ,,'R? Q L (O?OMatthew Robert QuinnNo ratings yet

- 4506 TDocument3 pages4506 TwallerdcNo ratings yet

- 2022 Turbo Tax ReturnDocument53 pages2022 Turbo Tax Returnleachsteven67No ratings yet

- IRS Publication 4262Document312 pagesIRS Publication 4262Francis Wolfgang UrbanNo ratings yet

- IRS Publication Form 706 GSTDocument3 pagesIRS Publication Form 706 GSTFrancis Wolfgang UrbanNo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- Chapter 4 Variation of TrustsDocument3 pagesChapter 4 Variation of TrustsChan Yee ChoyNo ratings yet

- US Internal Revenue Service: f8879c - 2003Document2 pagesUS Internal Revenue Service: f8879c - 2003IRSNo ratings yet

- SFF IRS Form990 2013Document27 pagesSFF IRS Form990 2013Space Frontier FoundationNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of FloridaDocument59 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of Floridamarie_beaudette1272No ratings yet

- Activity Example 1040 TaxDocument2 pagesActivity Example 1040 TaxKevin ÁlvarezNo ratings yet

- CT W4Document2 pagesCT W4Alejandro ArredondoNo ratings yet

- Ss 5Document5 pagesSs 5DellComputer99No ratings yet

- Robinhood Securities LLC: Tax Information Account 636338105Document8 pagesRobinhood Securities LLC: Tax Information Account 636338105Sam BufordNo ratings yet

- Rent AgreementDocument3 pagesRent AgreementBijendra Singh BishtNo ratings yet

- Legal Heir 1KDocument5 pagesLegal Heir 1Kpks2012No ratings yet

- US Internal Revenue Service: p1245Document35 pagesUS Internal Revenue Service: p1245IRSNo ratings yet

- De 1000 MDocument2 pagesDe 1000 MAnonymous ghzKEH21fNo ratings yet

- FATCA and CRS Self Certification FormDocument10 pagesFATCA and CRS Self Certification FormsudemanNo ratings yet

- Payroll: Company Financial Salaries Wages DeductionsDocument5 pagesPayroll: Company Financial Salaries Wages DeductionsKavitaNo ratings yet

- Trust Tax Return 2019 PDFDocument16 pagesTrust Tax Return 2019 PDFIsabelle Che KimNo ratings yet

- F 1041 TDocument2 pagesF 1041 TIRS100% (3)

- US Internal Revenue Service: f1041t - 1998Document2 pagesUS Internal Revenue Service: f1041t - 1998IRSNo ratings yet

- US Internal Revenue Service: f1041t - 2002Document2 pagesUS Internal Revenue Service: f1041t - 2002IRSNo ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- INTRODUCTIONDocument11 pagesINTRODUCTIONMmNo ratings yet

- Unit 14 - Unemployment and Fiscal Policy - 1.0Document41 pagesUnit 14 - Unemployment and Fiscal Policy - 1.0Georgius Yeremia CandraNo ratings yet

- Iii Iihiiiiiiiiiiii 111111: Does User-Oriented Gas Turbine Research Pay Off?Document7 pagesIii Iihiiiiiiiiiiii 111111: Does User-Oriented Gas Turbine Research Pay Off?Morteza YazdizadehNo ratings yet

- Dedication Certificate John Clyde D. Cristobal: This Certifies ThatDocument1 pageDedication Certificate John Clyde D. Cristobal: This Certifies ThatAGSAOAY JASON F.No ratings yet

- Absorption Costing PDFDocument10 pagesAbsorption Costing PDFAnonymous leF4GPYNo ratings yet

- GLS-LS40GW Specification 20200902Document5 pagesGLS-LS40GW Specification 20200902houyamelkandoussiNo ratings yet

- The Secret Book of JamesDocument17 pagesThe Secret Book of JameslaniNo ratings yet

- SocratesDocument10 pagesSocratesarvin paruliNo ratings yet

- 11.02.2022-PHC ResultsDocument6 pages11.02.2022-PHC ResultsNILAY TEJANo ratings yet

- Flyer OASIS - MANILA TRANSPORTERDocument1 pageFlyer OASIS - MANILA TRANSPORTERNoryl John Mates SaturinasNo ratings yet

- Week 1 - The Swamp LessonDocument2 pagesWeek 1 - The Swamp LessonEccentricEdwardsNo ratings yet

- Unit - 2 Sensor Networks - Introduction & ArchitecturesDocument32 pagesUnit - 2 Sensor Networks - Introduction & Architecturesmurlak37No ratings yet

- Talent Acquisition Request Form: EducationDocument1 pageTalent Acquisition Request Form: EducationdasfortNo ratings yet

- Informative Essays TopicsDocument9 pagesInformative Essays Topicsb725c62j100% (2)

- User Manual of CUBOIDDocument50 pagesUser Manual of CUBOIDshahinur rahmanNo ratings yet

- Consultancy - Software DeveloperDocument2 pagesConsultancy - Software DeveloperImadeddinNo ratings yet

- Home Office and Branch Accounting Agency 1Document20 pagesHome Office and Branch Accounting Agency 1John Stephen PendonNo ratings yet

- British Baker Top Bakery Trends 2023Document15 pagesBritish Baker Top Bakery Trends 2023kiagus artaNo ratings yet

- Stacey Dunlap ResumeDocument3 pagesStacey Dunlap ResumestaceysdunlapNo ratings yet

- Babst Vs CA PDFDocument17 pagesBabst Vs CA PDFJustin YañezNo ratings yet

- Teacher Learning Walk Templates - 2017 - 1Document13 pagesTeacher Learning Walk Templates - 2017 - 1Zakaria Md SaadNo ratings yet

- AUDCISE Unit 3 Worksheets Agner, Jam Althea ODocument3 pagesAUDCISE Unit 3 Worksheets Agner, Jam Althea OdfsdNo ratings yet

- Emcee Script For Kindergarten Recognition (English) - 085301Document3 pagesEmcee Script For Kindergarten Recognition (English) - 085301Felinda ConopioNo ratings yet

- CONSTITUTIONAL - CHANGES - TO - BE - MADE - pdf-SOME IMPORTANT CHANGES TO BE MADE IN THE LANKAN PDFDocument32 pagesCONSTITUTIONAL - CHANGES - TO - BE - MADE - pdf-SOME IMPORTANT CHANGES TO BE MADE IN THE LANKAN PDFThavam RatnaNo ratings yet

- Whyte Human Rights and The Collateral Damage oDocument16 pagesWhyte Human Rights and The Collateral Damage ojswhy1No ratings yet

- HNDIT 1022 Web Design - New-PaperDocument6 pagesHNDIT 1022 Web Design - New-Paperravinduashan66No ratings yet

- William Angelo - Week-7.AssessmentDocument2 pagesWilliam Angelo - Week-7.Assessmentsup shawtyNo ratings yet

- Human Resource Management PrelimsDocument2 pagesHuman Resource Management PrelimsLei PalumponNo ratings yet

- Ethnomedical Knowledge of Plants and Healthcare Practices Among The Kalanguya Tribe in Tinoc, Ifugao, Luzon, PhilippinesDocument13 pagesEthnomedical Knowledge of Plants and Healthcare Practices Among The Kalanguya Tribe in Tinoc, Ifugao, Luzon, PhilippinesJeff Bryan Arellano HimorNo ratings yet