Professional Documents

Culture Documents

3108 Deductions From Gross Income

3108 Deductions From Gross Income

Uploaded by

Mae Angiela TansecoCopyright:

Available Formats

You might also like

- Questions For Chapter 2 and 3Document8 pagesQuestions For Chapter 2 and 3Mae Angiela Tanseco70% (10)

- Regular Income Tax - Itemized DeductionsDocument12 pagesRegular Income Tax - Itemized DeductionsJaneNo ratings yet

- Chapter 3 Liquidation Based ValuationDocument9 pagesChapter 3 Liquidation Based ValuationMae Angiela Tanseco100% (1)

- Excel Professional Services, Inc.: Donation Donor'S TaxDocument11 pagesExcel Professional Services, Inc.: Donation Donor'S TaxMae Angiela TansecoNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- RR 13-00Document2 pagesRR 13-00saintkarri100% (2)

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document14 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)TatianaNo ratings yet

- Deductions and Exemptions: Tel. Nos. (043) 980-6659Document22 pagesDeductions and Exemptions: Tel. Nos. (043) 980-6659MaeNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Deductions From Gross IncomeDocument12 pagesDeductions From Gross IncomevsplanciaNo ratings yet

- Cambodian Taxation Reviewers 3Document23 pagesCambodian Taxation Reviewers 3Ken JomelNo ratings yet

- Week 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsDocument6 pagesWeek 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsEddie Mar JagunapNo ratings yet

- Deductions From Gross IncomeDocument30 pagesDeductions From Gross IncomeKatherine Ederosas50% (4)

- BAM031 P3 Q1 Answer FBT DeductionsDocument12 pagesBAM031 P3 Q1 Answer FBT DeductionsMary Lyn DatuinNo ratings yet

- Taxation of CorporationsDocument78 pagesTaxation of CorporationsGlory Mhay67% (12)

- TAX Final PreboardDocument23 pagesTAX Final PreboardEDUARDO JR. VILLANUEVANo ratings yet

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document3 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoNo ratings yet

- DeductionsDocument7 pagesDeductionsConcerned CitizenNo ratings yet

- Deductions From Gross IncomeDocument5 pagesDeductions From Gross IncomeWenjunNo ratings yet

- M4 P3 Inclusion Students Copy 1Document33 pagesM4 P3 Inclusion Students Copy 1Aaron BuendiaNo ratings yet

- Gross Income Deductions - Lecture Handout PDFDocument4 pagesGross Income Deductions - Lecture Handout PDFKarl RendonNo ratings yet

- Bam 031 CfeDocument43 pagesBam 031 CfeMs VampireNo ratings yet

- Bar QuestionsDocument30 pagesBar QuestionsEllaine VirayoNo ratings yet

- Qualifying Exam Taxation SET ADocument11 pagesQualifying Exam Taxation SET AChina ReyesNo ratings yet

- Taxation I ReviewerDocument19 pagesTaxation I ReviewerJay Ryan Sy BaylonNo ratings yet

- M6 - Deductions P2 Students'Document53 pagesM6 - Deductions P2 Students'micaella pasionNo ratings yet

- TRAIN (Changes) ???? Pages 2, 5 - 7Document4 pagesTRAIN (Changes) ???? Pages 2, 5 - 7blackmail1No ratings yet

- Chapter 12 v2Document18 pagesChapter 12 v2Sheilamae Sernadilla GregorioNo ratings yet

- 3rd Quizzer 1st Sem SY 2020-2021 - AKDocument6 pages3rd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNo ratings yet

- CorporationDocument83 pagesCorporationAlson Keith L CastroNo ratings yet

- 2012 Taxation Bar Exam QDocument30 pages2012 Taxation Bar Exam QClambeauxNo ratings yet

- Chapter 9 Regular Income Tax - Inclusion From Gross IncomeDocument5 pagesChapter 9 Regular Income Tax - Inclusion From Gross IncomeJason MablesNo ratings yet

- Which of The Following Is/are False?: Taxation EasyDocument5 pagesWhich of The Following Is/are False?: Taxation EasysophiaNo ratings yet

- Which of The Following Is/are False?: Taxation EasyDocument5 pagesWhich of The Following Is/are False?: Taxation EasysophiaNo ratings yet

- TAXATIONDocument5 pagesTAXATIONsophiaNo ratings yet

- Which of The Following Is/are False?: Taxation EasyDocument5 pagesWhich of The Following Is/are False?: Taxation EasysophiaNo ratings yet

- 1 Deductions From Gross Income-FinalDocument24 pages1 Deductions From Gross Income-FinalSharon Ann BasulNo ratings yet

- FinalroundDocument35 pagesFinalroundJenny Keece RaquelNo ratings yet

- Lomoar CPSD - 14985044Document13 pagesLomoar CPSD - 14985044John MaynardNo ratings yet

- Allowable Deductions NotesDocument5 pagesAllowable Deductions NotesPaula Mae DacanayNo ratings yet

- Tax RateDocument10 pagesTax Rateusha chimariyaNo ratings yet

- Rit Part IIIDocument64 pagesRit Part IIIouia iooNo ratings yet

- Session 2 - Deductions From Gross Income, Part 1Document10 pagesSession 2 - Deductions From Gross Income, Part 1ABBIE GRACE DELA CRUZNo ratings yet

- Finals - II. Deductions & ExemptionsDocument13 pagesFinals - II. Deductions & ExemptionsJovince Daño DoceNo ratings yet

- Tax Midterm ReviewerDocument18 pagesTax Midterm ReviewerAyessa GayamoNo ratings yet

- Taxation 8-Preferential Taxation: Pre-TestDocument4 pagesTaxation 8-Preferential Taxation: Pre-TestCharles Decripito Flores100% (1)

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- Non-Individual Taxation: 1. Corporations 2. Co-Ownership 3. Estates and Trusts 4. PartnershipsDocument58 pagesNon-Individual Taxation: 1. Corporations 2. Co-Ownership 3. Estates and Trusts 4. PartnershipsShiela Marie Vics60% (5)

- Personal (Or Individual) Income Tax: 1) Domain of ApplicationDocument30 pagesPersonal (Or Individual) Income Tax: 1) Domain of ApplicationChe OmarNo ratings yet

- Osd CorrectionDocument2 pagesOsd CorrectionSai BomNo ratings yet

- Chapter 13 ADocument22 pagesChapter 13 AAdmNo ratings yet

- In Come Tax TableDocument9 pagesIn Come Tax TablejorjirubiNo ratings yet

- IRR Update On TRAIN LAWDocument6 pagesIRR Update On TRAIN LAWChrislynNo ratings yet

- Ce TaxDocument65 pagesCe Taxryl100% (1)

- Income Tax Part IIDocument7 pagesIncome Tax Part IImary jhoyNo ratings yet

- Annex B: Income Tax Tables: Table 1 Tax Rates For IndividualsDocument9 pagesAnnex B: Income Tax Tables: Table 1 Tax Rates For Individualshaze_toledo5077No ratings yet

- Module 9 Deductions From Gross IncomeDocument13 pagesModule 9 Deductions From Gross IncomeNineteen AùgùstNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document21 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document3 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoNo ratings yet

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument11 pagesLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Discussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument7 pagesDiscussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument8 pagesLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Chapter 2 Asset ValuationDocument8 pagesChapter 2 Asset ValuationMae Angiela TansecoNo ratings yet

- Going Concern Asset Based ValuationDocument21 pagesGoing Concern Asset Based ValuationMae Angiela TansecoNo ratings yet

- Chapter 4 Income Based ValuationDocument6 pagesChapter 4 Income Based ValuationMae Angiela TansecoNo ratings yet

- Chapter Four TaxDocument54 pagesChapter Four TaxEmebet Tesema100% (4)

- 4 - Notes Receivable Problems With Solutions: ListaDocument21 pages4 - Notes Receivable Problems With Solutions: Listabusiness docNo ratings yet

- Financial Planning and Analysis: The Master Budget: Solutions To ExercisesDocument12 pagesFinancial Planning and Analysis: The Master Budget: Solutions To ExercisesBlackBunny103No ratings yet

- Construction Management PDFDocument46 pagesConstruction Management PDFfrank kipkoechNo ratings yet

- Book-Tax Income Differences and Major Determining FactorsDocument11 pagesBook-Tax Income Differences and Major Determining FactorsFbsdf SdvsNo ratings yet

- CH 16 Practice SolutionsDocument9 pagesCH 16 Practice SolutionsaaaNo ratings yet

- Fixed Asset Flexfields in Oracle Assets EBS R12Document2 pagesFixed Asset Flexfields in Oracle Assets EBS R12naveenravellaNo ratings yet

- 019-Problem-Solving-with-answer-guideDocument30 pages019-Problem-Solving-with-answer-guideRestie John UlipNo ratings yet

- Excercise 19Document7 pagesExcercise 19raihan aqilNo ratings yet

- April 2013 PDFDocument22 pagesApril 2013 PDFJasonSpringNo ratings yet

- Batangas City Rural Improvement Club: Page 1 of 18Document18 pagesBatangas City Rural Improvement Club: Page 1 of 18mary roseNo ratings yet

- SQB - Chapter 7 QuestionsDocument16 pagesSQB - Chapter 7 QuestionsracsoNo ratings yet

- Valuing Equity Shares: I, T I, TDocument23 pagesValuing Equity Shares: I, T I, TkenNo ratings yet

- Unfinal Revised Thesis 12345 1Document25 pagesUnfinal Revised Thesis 12345 1MArz Azuela AlemalNo ratings yet

- Industry Analysis Report Ceramices Tiles IndustryDocument37 pagesIndustry Analysis Report Ceramices Tiles Industrybalaji bysani71% (7)

- IBKR Broker ReportDocument27 pagesIBKR Broker ReportJohn DoeNo ratings yet

- Accountancy & Auditing-IDocument4 pagesAccountancy & Auditing-Izaman virkNo ratings yet

- 7110 w10 QP 01Document12 pages7110 w10 QP 01mstudy123456No ratings yet

- PROJECT - UpdatedDocument7 pagesPROJECT - UpdatedSuraj GantayatNo ratings yet

- Chapter 6 Verification of Assets and Liabilities PM PDFDocument60 pagesChapter 6 Verification of Assets and Liabilities PM PDFVyankatrao NarwadeNo ratings yet

- IFRS16 - Lease Standard SAP Solution Through Real Estate Management - SAP BlogsDocument12 pagesIFRS16 - Lease Standard SAP Solution Through Real Estate Management - SAP BlogsFranki Giassi MeurerNo ratings yet

- Measuring Business Income CH 3Document37 pagesMeasuring Business Income CH 3eater PeopleNo ratings yet

- Ch7 Cost Accounting System - Practice SheetDocument18 pagesCh7 Cost Accounting System - Practice SheetNancy JainNo ratings yet

- Chapter 2 ExerciseDocument5 pagesChapter 2 Exercisegirlyn abadillaNo ratings yet

- Sap Fico Transaction CodesDocument17 pagesSap Fico Transaction CodesVibha Reddy HarishNo ratings yet

- G1 4 Accounting For Depreciation (D01-J14)Document37 pagesG1 4 Accounting For Depreciation (D01-J14)sridhartksNo ratings yet

- Acc 201 Introduction To Financial Accounting IDocument73 pagesAcc 201 Introduction To Financial Accounting Igarba shuaibuNo ratings yet

- Business Valuations: Net Asset Value (Nav)Document9 pagesBusiness Valuations: Net Asset Value (Nav)Artwell ZuluNo ratings yet

- Accouting Work FDocument129 pagesAccouting Work Fkisakye deborahNo ratings yet

- DepreciationDocument22 pagesDepreciationJericho CunananNo ratings yet

3108 Deductions From Gross Income

3108 Deductions From Gross Income

Uploaded by

Mae Angiela TansecoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3108 Deductions From Gross Income

3108 Deductions From Gross Income

Uploaded by

Mae Angiela TansecoCopyright:

Available Formats

Manila * Cavite * Laguna * Cebu * Cagayan De Oro * Davao

Since 1977

TAX 3.108 NARANJO/GUDANI/SIAPIAN

DEDUCTIONS FROM GROSS INCOME OCTOBER 2021

Methods of Deductions

1. Itemized Deductions

2. Optional Standard Deductions (OSD)

Note: OSD is in lieu of the itemized deduction

General Rule: The following taxpayers are allowed to use itemized deduction:

1. RC

2. NRC

3. RA

4. NRAETB

5. GPP

6. DC

7. GOCCs

8. RFC

Exceptions:

1. Purely compensation income earner

2. NRANETB

3. NRFC

MANDATORY ITEMIZED DEDUCTIONS TO THE FOLLOWING TAXPAYERS

A. Corporations, partnerships and other non-individuals are mandated to use the itemized

deductions in the following cases:

1. Those exempt under the Tax Code, as amended and other special laws, with no other taxable

income

Section 30:

a. Non-stock, non-profit organizations

b. NGOs

Section 27 C

a. Government Service Insurance System (GSIS)

b. Social Security System (SSS)

c. Philippine Health and Insurance Corporation (PHIC)

d. Local water utilities

2. Those with income subject to special/preferential tax rates

Examples:

a. Proprietary Education Institutions or Hospitals – 10%

b. Regional Operating Headquarters of Multinational Companies (10%)

c. PEZA Registered Enterprises which are subject to 5%

3. Those Domestic Corporations and Resident Foreign Corporations subject to RCIT of 30% but with

income subject to special/preferential tax rates.

Example: PEZA-registered enterprise (registered activity is subject to 5%; unregistered activity

30%)

Page 1 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

B. Individual taxpayers who are not entitled to avail of the OSD and thus use only the itemized

deduction method are as follows:

1. Those exempt under the Tax Code, as amended, and other special laws with no other taxable

income

Example: Barangay Micro Business Enterprise (BMBE)

2. Those with income subject to special/preferential tax rates

3. Those with income subject to income tax rate under Section 24 of the Tax Code, as amended, and

also with income subject to special/preferential tax rates.

ITEMIZED DEDUCTIONS

A. Expenses, in general

Requisites:

• Ordinary

• Necessary in trade, business or profession

• Actually incurred

• Direct connection on the Development, Operation or Management (DOM) of the trade, business or

practice of profession

• Reasonable

• Withholding tax is paid

• There is proof (official receipt or adequate record)

1. Compensation

Requisites:

a. personal services must have been actually rendered

b. the compensation for such services must be reasonable, including the grossed-up monetary

value of fringe benefit furnished to the employee and the applicable final tax withheld and

remitted to the BIR

c. Employers’ share in the mandatory contributions of the employees

2. Transportation and travel – whether domestic or abroad

3. Rental and utilities – the lessee must not hold title to the property

4. Entertainment, Amusement or Recreation Expenses (EAR) or Representation expense

Requisites:

a. it must be directly related to the DOM or furtherance of trade, profession or business

b. it must not be contrary to law, morals, good customs, public policy or public order

c. must be substantiated with adequate proof

d. not paid directly or indirectly to the official or employee

e. it must be within the limits prescribed by the Tax Code

Ceiling of EAR

1. Seller of goods or properties – lower of actual EAR and .5% of Net Sales (Gross sales less RAD)

2. Seller of service – lower of actual EAR and 1% of Net Revenue (Gross revenue less discounts)

3. Seller of goods and seller of service – apportionment formula

Net Sales/Net Revenue x Actual EAR

Total Net Sales and Net Revenue

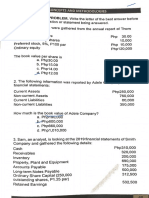

Exercises: Compute the allowable representation expense:

a. ABC Corp’s gross sales amounted to Php 1 Million. The company spent Php 8,000 for

representation.

b. ABC Corp’s gross receipts amounted to Php 1 Million. The company spent Php 8,000 for

representation.

Page 2 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

c. ABC Corp reported gross sales of Php 3 Million and gross receipts of Php 2 Million. The company

spent Php 40,000 for representation.

Sale of goods Sale of service Mixed transaction

(a) (b) (c)

Amt Rate Limit Actual (Pro- Allowed

rate)

GS

GR

Total

Note: Shifting EAR to any other expense in order to avoid being subjected to ceiling is NOT allowed. The

amount shifted shall be disallowed in its totality without prejudice to penalties which may be imposed.

B. Interest

Requisites:

1. there is a valid indebtedness (elements of a contract)

2. there must obligation to pay interest

3. the indebtedness must be connected with the taxpayer’s trade, profession or business

4. the deductible amount of interest shall be reduced by an amount equal to 33% of the interest

income subjected to final tax (tax arbitrage rule) – BEFORE CREATE

NOTE: UPON EFFECTIVITY OF THE CREATE LAW:

• The taxpayer's otherwise allowable deduction for interest expense shall be reduced by an amount

equivalent to twenty percent (20%) of interest income subjected to final tax.

• If the final withholding tax rate on interest income of 20% will be adjusted in the future, the interest

expense reduction rate shall be adjusted accordingly.

• In the case of corporations, since the income tax rates changed effective July 1, 2020, it follows

that the deduction from the interest expense of 20% shall be effective also on the said date.

• For other domestic corporations with net taxable income not exceeding Five Million Pesos

(P5,000,000) and total assets not exceeding One Hundred Million (P 100,000,000), excluding the

land on which the particular business entity's office, plant and equipment are situated, the

deduction is 0% since there is no difference in the income tax rate on the taxable income (20%)

with the tax rate applied on the interest income subjected to final tax (20%).

• In the case of individuals engaged in business or practice of profession, such deduction shall take

effect upon the effectivity of CREATE.

Non-deductible interest:

1. If within the taxable year an individual taxpayer reporting income on the cash basis incurs an

indebtedness on which an interest is paid in advance through discount or otherwise (interest is

deductible only in the year the indebtedness paid

2. Made between related parties

3. If the indebtedness is incurred to finance petroleum exploration

Optional Treatment of Interest Expense

At the option of the taxpayer, interest incurred to acquire property used in trade, business or

profession may be allowed as a capital expenditure (capitalized instead of outright expense)

Note: Interest imposed and assessed from deficiency taxes are deductible.

Page 3 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

Illustration #1: Nicanor borrowed money from the bank in the amount of Php 1 Million with an interest

rate of 10% on January 1, 2019. Nicanor has interest income of Php 50,000.00 annually for years 2019 and

2020. Compute the allowable interest expense for years 2019 and 2020.

Assuming interest income is subject to FT Assuming interest income is NOT subject to FT

ILLUSTRATION #2: For fiscal year ending June 30, 2021, assuming that JHB Corporation, aside from the

operating expenses of P17,500,000.00, incurred interest expense of P 400,000.00 which satisfied the

prescribed requirement for deductibility, but it also earned interest income of P 100,000.00, net of final

tax of twenty percent (20%), how much is the deductible interest expense?

ILLUSTRATION #3: For taxable year 2021, SGC Corp. incurred interest expense of P 500,000 on its bank

loan. For the year, its gross assets amounted to P50,000,000, exclusive of the cost of the land of

P7,100,000. It registered a gross income of P 10,000,000 and incurred operating expenses of P6,000,000,

inclusive of the interest expense. It had interest income earned for the same year amounting to P150,000.

Compute for the allowable interest expense.

TRANSITORY PROVISION ON INTEREST EXPENSE

For the rate to be used in the deduction of a certain percentage of interest income subject to final tax

from the claimed interest expense to come up with the allowable interest expense, or the interest

arbitrage, the following shall be applied for taxable year 2020 by corporations, except non-resident foreign

corporations:

Compute for the interest arbitrage using the applicable rate:

a. Divide the gross interest income subjected to final tax for the year by 12 months:

➢ Interest income subjected to final tax ÷ 12

b. Multiply the number of months applicable to old arbitrage rate by the resulting monthly gross interest

income subjected to final tax; then, multiply the product by the old arbitrage rate:

➢ number of months applicable x (a) x 33.33%

c. Multiply the number of months applicable to the new arbitrage rate by the resulting monthly gross

interest income subjected to final tax; then, multiply the product by the new arbitrage rate:

➢ Number of months applicable x (a) x (20% or 0%, as the case may be)

Add the computed interest arbitrage under items (b) and (c) above to get the amount to be deducted

from the interest expense claimed to arrive at the allowable interest expense.

ALTERNATIVE COMPUTATION OF INTEREST ARBITRAGE

Another option in the computation of the interest arbitrage is to use the rates reflected in the table

below, and multiply the same with the amount of gross interest income subjected to final tax to find the

amount of interest deductible from the interest expense claimed, with the allowable interest expense as

the end result.

Transitory rates for interest arbitrage applicable for TY 2020 for corporations under itemized deductions:

Page 4 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

For the computation of Interest Arbitrage

Annual Accounting Other domestic

Period Corporations subject to corporations with net

Regular Rates taxable income ≤5M &

total assets ≤ 1 00M,

exclusive of land

(Transition TY 2020) 30% / 25% 30% / 20%

FY 7-31-20 31.92 % 30.25%

FY 8-31-20 30.83% 27.50%

FY 9-31-20 29.75% 24.75%

FY 10-31-20 28.67% 22.00%

FY 11-31-20 27.58% 19.25%

CY 12-31-20 26.50% 16.50%

FY 1-31-21 25.42% 13.75%

FY 2-28-21 24.33% 11.00%

FY 3-31-21 23.25% 8.25%

FY 4-30-21 22.17% 5.50%

FY 5-31-21 21.08% 2.75%

FY 6-30-21 20.00% 0.00%

ILLUSTRATION: TAXPAYER IS SUBJECT TO 25% RCIT

For calendar year ended December 31, 2020, assuming that MTMI Corporation, aside from the operating

expenses of P 17,500,000.00, incurred interest expense of P 400,000.00 which satisfied the prescribed

requirement for deductibility, but it also earned interest income of P 100,000.00, net of final tax of twenty

percent (20%), how much is the allowable interest expense?

ILLUSTRATION: TAXPAYER IS SUBJECT TO 25% RCIT

GPS Corporation secured in 2018 a bank loan for its business expansion, and incurred interest expense of

P2,000,000 in CY 2020 on the said bank loan. In the same year, it likewise earned interest income of

P300,000 subjected to final tax of 20%. For CY 2020, its gross income amounted to P 20,000,000. Its gross

assets, excluding the value of the land where its building and plant are situated, is P 100,000,000. Its

operating expenses amounted to P10,000,000, inclusive of the interest expense of P2,000,000.

ILLUSTRATION: TAXPAYER IS SUBJECT TO 20%

MAFD Corporation incurred interest expense of P 500,000 in CY 2020 on its bank loan. The said loan was

secured in 2019 to finance the construction of its warehouse. In CY 2020, its gross assets amounted to

P50,000,000, excluding the land with a cost of P5,500,000. It recorded a gross income of P 10,000,000

and incurred operating expenses of P6,000,000, inclusive of the interest expense. It had interest income

earned for the same year amounting to P150,000. Compute for the allowable interest expense:

Page 5 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

C. Taxes

In general, taxes paid or accrued within the taxable year in connection with the taxpayer’s trade or

business or exercise of a profession are deductible.

Example of deductible Taxes:

National Taxes Local Taxes

Annual Registration Fee (Php 500.00) Registration fees from LGUs

Fringe benefit tax (if not claimed in salaries) License fees

Documentary stamp tax Mayor’s permit fee

Percentage tax (3%)* Local business tax

Excise tax Community tax certificate (cedula)

Real property tax

Payment for barangay clearance

Non-deductible Taxes:

1. Income tax and withholding taxes (final tax, withholding tax on compensation, expanded

withholding tax, capital gains tax even if paid for by the taxpayer/withholding agent) Note: FBT

allowed

2. Income tax imposed by a foreign country (if the taxpayer opted to claim them as deduction rather

than as tax credit)

3. Estate or donor’s tax

4. Taxes assessed against local benefits of a kind tending to increase the value of the property

assessed (Special assessment)

5. Value-added tax

Note:

1. No deduction is allowed for deficiency taxes, surcharges and/or penalties.

2. For Non-VAT taxpayers, the VAT paid is part of cost or expense.

OPTIONAL TREATMENT ON FOREIGN TAX PAYMENTS

Applicable to resident citizens and domestic corporations

1. tax credit or

2. deduction from income

LIMITATIONS ON CREDIT

1. The amount of the credit in respect to the tax paid or incurred to any country shall not exceed the

same proportion of the tax against which such credit is taken, which the taxpayer's taxable income

from sources within such country bears to his entire taxable income for the same taxable year

2. The total amount of the credit shall not exceed the same proportion of the tax against which such

credit is taken, which the taxpayer's taxable income from sources without the Philippines taxable

bears to his entire taxable income for the same taxable year.

FORMULA

1. Limit 1: Per Country – lower of the actual amount of foreign tax paid and the amount which reflects

the ratio which the gross income from the foreign country bears with the total world taxable

income to the Philippine income tax

Country x Taxable Income x Philippine income tax

Total World Taxable Income

2. Limit 2: Total Foreign Country: lower of the aggregate lower values of the per-country and the

amount which reflects the ratio of the taxable income from all foreign countries bears with the

total world taxable income to the Philippine tax

Page 6 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

Total Foreign Taxable Income x Philippine income tax

Total World Taxable Income

D. Losses

Ordinary Loss/Transaction Loss/Casualty loss

Requisites:

1. loss must be actually sustained during the taxable year

i. incurred in trade, profession or business

ii. of property connected with the trade, business or profession

iii. loss arises from fires, storms, shipwreck, or other casualties, or from robbery, theft or

embezzlement

2. not compensated for by insurance or other forms of indemnity

3. the loss must be reported to the BIR within 45 days from the date of loss or discovery

4. not claimed as a deduction in the estate tax return for individual income taxpayer only

Net Operating Loss Carry Over (NOLCO)

The net operating loss of the business or enterprise for any taxable year immediately preceding the

current taxable year, which had not been previously offset as deduction from gross income shall be carried

over as a deduction from gross income for the next three (3) consecutive taxable years immediately

following the year of such loss.

NOTE: Qualified businesses or enterprises which incurred net operating loss for taxable years 2020 and

2021 to carry over the same as a deduction from its gross income for the next five (5) consecutive taxable

years immediately following the year of such loss (RR 25-2020 to implement Sec. 4 (bbbb) of Republic Act

No. 11494 or the Bayanihan To Recover As One Act), provided the following conditions are met:

1. NOLCO shall be separately shown in the taxpayer's income tax return;

2. Unused NOLCO shall be presented in the Notes to the Financial Statements showing, in detail,

the taxable year in which the net operating loss was sustained or incurred, and any amount

thereof claimed as NOLCO deduction within five (5) consecutive years immediately following the

year of such loss;

3. NOLCO for taxable years 2020 and 2021 shall be presented in the Notes to the Financial

Statements separately from the NOLCO for other taxable years.

The net operating loss carry-over shall be allowed only if there has been no substantial change in the

ownership of the business or enterprise in that -

i. Not less than seventy-five percent (75%) in nominal value of outstanding issued shares, if the

business is in the name of a corporation, is held by or on behalf of the same persons; or

ii. Not less than seventy-five percent (75%) of the paid up capital of the corporation, if the business

is in the name of a corporation, is held by or on behalf of the same persons.

Note:

1. Any net loss incurred in a taxable year during which the taxpayer was exempt from income tax

shall not be allowed as a deduction.

2. Net operating loss means the excess if allowable deduction over gross income in a taxable year

Illustration:

Nicanor has made available the following information:

2015 2016 2017 2018 2019

GI/(NOL) (3,000) 2,000 1,000 (1,000) 2,000

Applied NOLCO 0 (2,000) 0 0 (1,000)

Taxable Income (3,000) 0 1,000 (1,000) 1,000

Capital Loss

Page 7 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

Capital losses are deductible only to the extent of capital gains. Net capital loss carry-over can be

deducted in the succeeding year for individual taxpayers. (see HO in Capital and Ordinary Assets.)

Wagering losses

Losses from wagering transactions shall be allowed only to the extent of the gains from transactions.

Compute the deductible wagering loss.

Win Php 1,000

Loss (500)

Win 1,000

Loss (3,000)

Win 500

Loss (500)

Answer:

Abandonment Losses

1. Partial or Full abandonment of petroleum operation – all accumulated exploration and

development expenditures pertaining thereto shall be allowed as a deduction. In all cases notices

of abandonment shall be filed with the Commissioner

2. Subsequent abandonment of producing wells – the unamortized costs thereof, as well as the

undepreciated costs of equipment directly used therein, shall be allowed as a deduction in the year

such well, equipment or facility is abandoned by the contractor

Note: if the abandoned well is re-entered and production is resumed, or if such equipment or facility is

restored into service, the said costs shall be included as part of gross income in the year of resumption or

restoration and shall be amortized or depreciated, as the case may be (concept of tax benefit).

E. Bad Debts

Requisites:

1. There must be an existing valid and legally demandable indebtedness

2. Debt must be connected with the taxpayer’s trade, business or practice of profession

3. Debt must not be between related parties

4. Debt must be charged off the books of accounts as of the end of taxable year

5. Debt must be actually ascertained to be worthless and uncollectible as of the end of taxable year

Note: Above rules apply to corporations including banks and insurance companies, individuals, estate and

trust that is engaged in trade or business or a professional engaged in the practice of profession

F. Depreciation

Depreciation refers to the exhaustion, wear and tear (including reasonable allowance for

obsolescence) of property used in the trade or business.

Requisites:

1. the property must be used in trade, profession or business

2. the property must have a limited useful life

3. the provision must be charged off during the taxable year

4. the provision must be reasonable

Non-deductible depreciation:

1. Value of motor vehicle exceeds Php 2,400,000.00

2. Exception: If the taxpayer is required by the nature of business to buy vehicles (e.g.

transport network companies)

NOTES:

a. Only one land transport is allowed for use of an official or employee

Page 8 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

b. Any or all expenses attributable to the motor vehicle is NOT deductible and not creditable

against output tax

c. Input tax on motor vehicle NOT creditable against output tax

d. Loss from sale is non-deductible loss

e. No depreciation is allowed for yacht, helicopter, airplane or aircraft with value over Php 2.4

Million unless it is the main business of the company

Methods of Depreciation under the Tax Code:

1. Straight line

2. Declining balance

3. Sum of the years

4. Other methods which may be prescribed by the Secretary of Finance upon recommendation of the

Commissioner of Internal Revenue

Petroleum Operations:

The taxpayer may choose either declining-balance method or straight-line method at the option

of the contractor.

Useful life of depreciable asset:

1. used in or related to the production of petroleum – 10 years or shorter as may be permitted

by the Commissioner of Internal Revenue

2. not used in or not related to the production of petroleum – 5 years under straight line method

Mining Operations:

For all properties used in mining operations, other than petroleum operation:

1. 10 year useful life or less – At normal rate of depreciation

2. More than 10 years useful life – depreciated over any number of years between 5 and the

expected life. Provided the taxpayer notifies the CIR at the beginning of the deprecation period

of the rate to be used.

G. Depletion of Oil and Gas Wells and Mines

Depletion pertains to exhaustion of natural resources due to production that is allowed as deduction

to recover cost of the property or wasting asset in accordance with the cost-depletion method. When

the allowance for depletion shall equal the capital invested no further allowance shall be granted (i.e.

up to the capital investment only).

Exploration Expenditures – expenditures paid or incurred in ascertaining the existence, location and

extent, or quality of any deposit or ore or other minerals before the beginning of the development

stage of the mine or deposit.

Development Expenditures – expenditures paid or incurred during the development stage of the mine.

The development stage begins when ore or other minerals are shown to exist in commercial quality

and quantity and end upon commencement of actual commercial extraction.

H. Charitable and Other Contributions

Requisites:

1. the contribution or gift must be actually paid/given

2. it must be given to an organization specified by law

3. net income of the specified institution must not inure to the benefit of any private stockholder or

individual

4. the person making the contribution must be engaged in trade, business or profession

Classification of contributions

I. Fully deductible contributions

a. Donation to the government, any of its agencies or political subdivisions including fully owned

government and controlled corporations to be used exclusively in undertaking priority

activities as determined by National Economic Development Authority (NEDA): (CHEESHY)

Page 9 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

1. Culture

2. Human settlement

3. Education

4. Economic developments

5. Sports

6. Health

7. Youth development

NOTE: If donation to the government is NOT a priority activity - subject to limit.

b. Donation to foreign institution or international organization in compliance with agreement or

treaties or due to special laws

c. Donations to accredited domestic non-government organizations:

1. Charitable

2. Cultural

3. Educational

4. Rehabilitation of veterans

5. Religious

6. Scientific

7. Social welfare institutions

8. Youth and sports development

9. Any combination of the listed purposes

Requisites:

1. the administrative expense must not exceed 30% of the total expenses

2. Upon dissolution, assets must be distributed to another non-profit domestic corporation of to

the Government

NOTE:

1. If not complied with, the donation is subject to limit

2. Accreditor for NGO’s is Philippine Council for NGO Certification, Inc (PCNC)

BAYANIHAN TO HEAL AS ONE ACT

Full Deduction if donation is made to the following:

1. National Government or any entity created by any of its agencies (including public hospitals) which

is not conducted for profit, or to any political subdivision of the government including fully-owned

government corporations

2. Accredited non-stock, non-profit corporations, institutions, foundations, NGO

• Educational

• Charitable

• Religious

• Cultural

• Social welfare

• Trust or philanthropic organizations

• Research institutions or organizations

3. Private hospitals and/or non-stock, non-profit educational and/or charitable, religious, cultural or

social welfare corporation, institution, foundation, non-government organization (even if non-

accredited), trust or philanthropic organization and/or research institution

4. Local private corporations, civic organizations, and/or international organizations/institutions*

provided that they shall:

• Actually, directly and exclusively distribute and/or transfer said donations/gifts to,

• Partner as conduit/logistical machinery with, accredited NGOs and/or national government or any

entity created by any of its agencies which is NOT conducted for profit or any political subdivision

Page 10 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

Full Deduction if the Donations are:

1. Cash donations

2. Donations of all critical or needed healthcare equipment or supplies in combatting COVID

3. Relief goods such as, but not limited to food packs (rice, canned goods, noodles, etc.) and water

4. Use of property, whether real or personal (shuttle service, use of lots/buildings

II. Contributions subject to limit

1. Donations to the Government of the Philippines, or agencies or political subdivisions exclusively

for public purposes (non-priority activities)

2. Donation to non-government organization or to domestic corporations organized exclusively for

the following purposes:

1. Religious

2. Charitable

3. Scientific

4. Youth and sports development

5. Cultural

6. Educational

7. Rehabilitation of veterans

8. Social welfare

LIMITATION OF DEDUCTION:

Taxable income before deduction of contributions

1. 10% for Individual

2. 5% for Corporations

ALLOWABLE Deductible Contribution – Lower of

1. actual contribution or

2. computed limitation

Valuation

The amount of any charitable contribution of property other than money shall be based on the

acquisition cost of said property.

Illustration:

The following appeared in the audited financial statements of a taxpayer:

Gross Income Php 1,000,000

Less: Deductions:

Salaries Php 100,000

Depreciation 100,000

Utilities 100,000

Rental 100,000

Donation 100,000 500,000

Taxable Income Php 500,000

Compute the 1) allowable contribution and 2) non-deductible donation:

Individual taxpayer Non-individual taxpayer

Page 11 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

I. Research and Development

In General. - a taxpayer may treat research or development expenditures which are paid or incurred by

him during the taxable year in connection with his trade, business or profession as ordinary and necessary

expenses which are not chargeable to capital account. The expenditures so treated shall be allowed as

deduction during the taxable year when paid or incurred.

OPTIONAL Amortization of Certain Research and Development Expenditures

At the election of the taxpayer, the following research and development expenditures may be treated as

deferred expenses:

a. Paid or incurred by the taxpayer in connection with his trade, business or profession

b. Not treated as expenses

c. Chargeable to capital account but not chargeable to property of a character which is subject to

depreciation or depletion

In computing taxable income, such deferred expenses shall be allowed as deduction ratably distributed

over a period of not less than sixty (60) months as may be elected by the taxpayer (beginning with the

month in which the taxpayer first realizes benefits from such expenditures).

The election provided by may be made for any taxable year beginning after the effectivity of this Code,

but only if made not later than the time prescribed by law for filing the return for such taxable year. The

method so elected, and the period selected by the taxpayer, shall be adhered to in computing taxable

income for the taxable year for which the election is made and for all subsequent taxable years unless

with the approval of the Commissioner, a change to a different method is authorized with respect to a

part or all of such expenditures. The election shall not apply to any expenditure paid or incurred during

any taxable year for which the taxpayer makes the election.

Limitations on Deduction

This shall not apply to:

a. Any expenditure for the acquisition or improvement of land, or for the improvement of property

to be used in connection with research and development of a character which is subject to

depreciation and depletion

b. Any expenditure paid or incurred for the purpose of ascertaining the existence, location, extent,

or quality of any deposit of ore or other mineral including oil or gas.

J. Pension Trust Contributions

An employer establishing or maintaining a pension trust to provide for the payment of reasonable

pensions to his employees shall be allowed as a deduction (in addition to the contributions to such

trust during the taxable year to cover the pension liability accruing during the year, allowed as a

deduction) a reasonable amount transferred or paid into such trust during the taxable year in excess

of such contributions, but only if such amount (1) has not theretofore been allowed as a deduction,

and (2) is apportioned in equal parts over a period of ten (10) consecutive years beginning with the

year in which the transfer or payment is made.

Current Service Cost – actually computed value of services rendered by a plan employee during the

year

Page 12 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

Past Service Cost – value of services rendered by employees in the past that partially satisfy vesting

conditions

Illustration of Trust:

OTHER DEDUCTIONS

1. 20% Senior Citizens Discount – deduction from gross income

2. 20% Persons’ with Disability Discount – deduction from gross income

3. 20% Discounts to National Athletes, Coaches and Trainers – deduction from gross income

4. 5% Contribution to the PERA account – deduction from gross income

SPECIAL ADDITIONAL DEDUCTIONS BY VIRTUE OF SPECIAL LAWS

Special Laws Law Additional Deduction Conditions

Magna Carta for Senior RA 15% of the total amount paid as 1. Employment is at

Citizens (Employment of 9994 salaries and wages to SC least 6 months

Senior Citizens) 2. Annual taxable

income must not

exceed the poverty

level

Magna Carta for PWD RA 25% of the total amount paid as 1. Certificate of

(Employment of PWD) 10070 salaries employment of

PWD

2. DOLE certification of

disability, skills and

qualifications

TESDA Law (Employment RA 50% of the value of training

of Learners and 7796 expenses for learners

Apprentice)

PEZA Law (Training RA 50% of the value of training

Expenses) 7916 expenses for learners

Jewelry Act (Training RA 50% of the value of training

Expenses) 8502 expenses

Adopt-A-School RA 50% of the value of contribution

8535 or donation

Philippine Green Jobs Act RA 50% of the skills training

10771

NON-DEDUCTIBLE ITEMS FROM GROSS INCOME

1. Any payment directly or indirectly to an official or employee of the Government (local or national,

including government-owned and controlled corporations) or of a foreign government, or to a private

individual, corporation, General Professional Partnership or a similar entity, if it constitutes bribe,

kickback or other similar payments

2. Personal, living, or family expenses

3. Any amount paid out for new buildings or for permanent improvements, or betterments made to

increase the value of any property or estate

4. Any amount expended in restoring property or in making good the exhaustion thereof for which an

allowance is or has been made

5. Premiums paid on any life insurance policy covering the life of any officer or employee, or of any

person financially interested in any trade or business carried on by the taxpayer, individual or

Page 13 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

corporate, when the taxpayer is directly or indirectly a beneficiary under such policy losses from sales

or exchanges of property directly or indirectly between related parties.

Related parties:

1. Members of a family

2. Except in cases of distribution in liquidation, between individual and corporation with more that

50% ownership owned by the individual in the corporation

3. Except in cases of distribution in liquidation, between two corporations more than 50% is owned

by or for the same individual

4. Grantor and fiduciary of any trust

5. Fiduciaries of trusts with the same grantor

6. Fiduciary of a trust and beneficiary of such trust

OPTIONAL STANDARD DEDUCTIONS (OSD)

Individual Taxpayer – 40% of gross sales/receipts

Non-individual Taxpayer including GPP– 40% of gross income

Requirements:

- The qualified taxpayer must signify in the 1st quarter income tax return his intention to elect the

optional standard deduction or the initial return

- Election of OSD shall be irrevocable for the taxable year for which the return was made (no

amendment as to method is allowed)

- Individual taxpayer who opted for OSD is not required to attach audited financial statements in the ITR

(Corporation still required even if OSD)

- May keep records pertaining to sales only (individual) or gross income (corporation)

Not applicable to:

• Non-resident alien engaged in trade

• Exempt Taxpayers

• Preferential Rate Taxpayers

• Compensation Income Earners

• Taxpayers who chose 8% optional tax rate

OSD FOR GPP

A General Professional Partnership (GPP) may avail of the OSD only once, either by the GPP or the partners

comprising the Partnership.

ILLUSTRATIONS:

OSD FOR INDIVIDUAL TAXPAYER

Problem 1 - Ms. Awra is a well-known accountant who offers auditing and taxation services. Since Ms.

Awra's career flourished, her total gross receipts amounted to Php 4,250,000.00 for taxable year 2019.

Her recorded cost of service and operating expenses was Php 2,150,000.00 and Php 1,000,000.00,

respectively. She opted to avail of the 40% OSD. Total tax withheld (expanded withholding tax) by her

clients amounted to Php 425,000 from which she received her BIR Form 2307s.

Compute the income tax payable:

NOTES:

Page 14 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

1. The individual taxpayer elected OSD in the computation of her taxable income and the election is

irrevocable for the taxable year for which the return was made.

2. Taxpayer is not required to submit her financial statements with his tax return.

3. The gross receipts exceeded the VAT threshold of P3,000,000.00, thus the taxpayer is subject to

the graduated income tax rates and liable for VAT, in addition to income tax.

Problem 2 - Ms. Suzy Bey operates a convenience store while she offers bookkeeping services to her

clients. In 2019, her sales amounted to Php 1,800,000.00, in addition to her gross receipts from

bookkeeping services of Php 400,000.00. Her recorded cost of goods sold and operating expenses were

P1,325,000.00 and P320,000.00, respectively.

A. If Ms. Suzy Bey will opt to avail of the OSD, compute the income tax due:

NOTES:

1. The taxpayer elected OSD in the computation of her taxable income, thus the graduated income

tax rate shall be applied

2. The election of OSD is irrevocable for the taxable year for which the return is made.

3. Taxpayer is not required to submit her financial statements with her tax return

4. Taxpayer is liable for business tax - Percentage Tax, in addition to income tax.

B. Compute Ms. Suzy Bey' s income tax liability if she signifies in her 1st Quarter return her intention

to be taxed at 8% income tax rate:

NOTES:

1. The gross sales and receipts did not exceed the VAT threshold of P3,000,000.00

2. Taxpayer opted to be taxed at 8%o income tax rate on gross sales/receipts

3. Taxpayer's source of income is purely from self-employment; thus, she is entitled to the amount

allowed as deduction of P250,000.00.

4. Taxpayer is not liable for percentage tax under Section 116 of the Tax Code, as amended, since the

8% income tax rate is also in lieu of the percentage tax.

OSD FOR NON-INDIVIDUAL TAXPAYER

Problem 3 - The gross sales of CTRP Corporation for 2019 amounted to Php 6,000,000.00, with cost of

sales amounting to Php 4,000,000.00. It incurred operating expenses amounting to Php 1,000,000.00, and

on the filing of its First Quarter Income Tax Return, it signified its intention to avail of the OSD.

Compute the income tax due:

Page 15 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

OSD FOR GENERAL PROFESSIONAL PARTNERSHIP (GPP)

Problem 1 - Buknoy is a partner of ABC & Co., CPAs, a general professional partnership, and owns 25%

interest. The gross receipts of the GPP amounted to Php 10,000,000.00 for taxable year 2019. The

recorded cost of service and operating expenses of the GPP were Php 2,750,000.00 and Php 1,500,000.00,

respectively.

A. Compute the net income for distribution to partners if the GPP availed of the OSD:

NOTES:

1. There is no income tax liabiliry for ABC & Co., CPAs since it is a general professional partnership

under Section 26 of the Tax Code, as amended.

2. The GPP elected OSD in the computation of its net income and its election is irrevocable for the

taxable year for which the return is made.

3. The GPP is liable to business tax.

B. Compute the income tax liability of Buknoy:

NOTES:

1. Individual partner is not allowed to claim further deduction from his distributive share since this is

already net of cost and expenses.

2. Taxpayer is not allowed to avail of the 8% income tax rate option since their distributive share from

GPP is already net of cost and expenses.

Problem 2 - Ms. Siri is a partner of CCF & Co., a general professional partnership, and owns 25% interest.

The gross receipts of CCF & Co. amounted to Php 10,000,000.00 for taxable year 2019. The recorded cost

of service and operating expenses of CCF & Co. were Php 2,750,000.00 and Php 1,500,000.00, respectively.

A. Compute the Net Income of CCF & Co.:

Page 16 of 17 www.teamprtc.com.ph FAR.3100

EXCEL PROFESSIONAL SERVICES, INC.

B. Compute the income tax liability of Ms. Siri:

NOTES:

1. There is no income tax liability for CCF & Co. being a general professional partnership under Section

26 of the Tax Code, as amended.

2. The GPP elected itemized deduction in the computation of its net income and its election is

irrevocable for the taxable year for which the return is made.

3. The GPP is liable to business tax.

4. Individual Partner is not allowed any deduction on his distributive share since this is already net of

cost and expenses

5. Taxpayer is not allowed to avail of the 8% income tax rate option since her distributive share from

GPP is already net of cost and expenses.

END

Page 17 of 17 www.teamprtc.com.ph FAR.3100

You might also like

- Questions For Chapter 2 and 3Document8 pagesQuestions For Chapter 2 and 3Mae Angiela Tanseco70% (10)

- Regular Income Tax - Itemized DeductionsDocument12 pagesRegular Income Tax - Itemized DeductionsJaneNo ratings yet

- Chapter 3 Liquidation Based ValuationDocument9 pagesChapter 3 Liquidation Based ValuationMae Angiela Tanseco100% (1)

- Excel Professional Services, Inc.: Donation Donor'S TaxDocument11 pagesExcel Professional Services, Inc.: Donation Donor'S TaxMae Angiela TansecoNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- RR 13-00Document2 pagesRR 13-00saintkarri100% (2)

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document14 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)TatianaNo ratings yet

- Deductions and Exemptions: Tel. Nos. (043) 980-6659Document22 pagesDeductions and Exemptions: Tel. Nos. (043) 980-6659MaeNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Deductions From Gross IncomeDocument12 pagesDeductions From Gross IncomevsplanciaNo ratings yet

- Cambodian Taxation Reviewers 3Document23 pagesCambodian Taxation Reviewers 3Ken JomelNo ratings yet

- Week 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsDocument6 pagesWeek 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsEddie Mar JagunapNo ratings yet

- Deductions From Gross IncomeDocument30 pagesDeductions From Gross IncomeKatherine Ederosas50% (4)

- BAM031 P3 Q1 Answer FBT DeductionsDocument12 pagesBAM031 P3 Q1 Answer FBT DeductionsMary Lyn DatuinNo ratings yet

- Taxation of CorporationsDocument78 pagesTaxation of CorporationsGlory Mhay67% (12)

- TAX Final PreboardDocument23 pagesTAX Final PreboardEDUARDO JR. VILLANUEVANo ratings yet

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document3 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoNo ratings yet

- DeductionsDocument7 pagesDeductionsConcerned CitizenNo ratings yet

- Deductions From Gross IncomeDocument5 pagesDeductions From Gross IncomeWenjunNo ratings yet

- M4 P3 Inclusion Students Copy 1Document33 pagesM4 P3 Inclusion Students Copy 1Aaron BuendiaNo ratings yet

- Gross Income Deductions - Lecture Handout PDFDocument4 pagesGross Income Deductions - Lecture Handout PDFKarl RendonNo ratings yet

- Bam 031 CfeDocument43 pagesBam 031 CfeMs VampireNo ratings yet

- Bar QuestionsDocument30 pagesBar QuestionsEllaine VirayoNo ratings yet

- Qualifying Exam Taxation SET ADocument11 pagesQualifying Exam Taxation SET AChina ReyesNo ratings yet

- Taxation I ReviewerDocument19 pagesTaxation I ReviewerJay Ryan Sy BaylonNo ratings yet

- M6 - Deductions P2 Students'Document53 pagesM6 - Deductions P2 Students'micaella pasionNo ratings yet

- TRAIN (Changes) ???? Pages 2, 5 - 7Document4 pagesTRAIN (Changes) ???? Pages 2, 5 - 7blackmail1No ratings yet

- Chapter 12 v2Document18 pagesChapter 12 v2Sheilamae Sernadilla GregorioNo ratings yet

- 3rd Quizzer 1st Sem SY 2020-2021 - AKDocument6 pages3rd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNo ratings yet

- CorporationDocument83 pagesCorporationAlson Keith L CastroNo ratings yet

- 2012 Taxation Bar Exam QDocument30 pages2012 Taxation Bar Exam QClambeauxNo ratings yet

- Chapter 9 Regular Income Tax - Inclusion From Gross IncomeDocument5 pagesChapter 9 Regular Income Tax - Inclusion From Gross IncomeJason MablesNo ratings yet

- Which of The Following Is/are False?: Taxation EasyDocument5 pagesWhich of The Following Is/are False?: Taxation EasysophiaNo ratings yet

- Which of The Following Is/are False?: Taxation EasyDocument5 pagesWhich of The Following Is/are False?: Taxation EasysophiaNo ratings yet

- TAXATIONDocument5 pagesTAXATIONsophiaNo ratings yet

- Which of The Following Is/are False?: Taxation EasyDocument5 pagesWhich of The Following Is/are False?: Taxation EasysophiaNo ratings yet

- 1 Deductions From Gross Income-FinalDocument24 pages1 Deductions From Gross Income-FinalSharon Ann BasulNo ratings yet

- FinalroundDocument35 pagesFinalroundJenny Keece RaquelNo ratings yet

- Lomoar CPSD - 14985044Document13 pagesLomoar CPSD - 14985044John MaynardNo ratings yet

- Allowable Deductions NotesDocument5 pagesAllowable Deductions NotesPaula Mae DacanayNo ratings yet

- Tax RateDocument10 pagesTax Rateusha chimariyaNo ratings yet

- Rit Part IIIDocument64 pagesRit Part IIIouia iooNo ratings yet

- Session 2 - Deductions From Gross Income, Part 1Document10 pagesSession 2 - Deductions From Gross Income, Part 1ABBIE GRACE DELA CRUZNo ratings yet

- Finals - II. Deductions & ExemptionsDocument13 pagesFinals - II. Deductions & ExemptionsJovince Daño DoceNo ratings yet

- Tax Midterm ReviewerDocument18 pagesTax Midterm ReviewerAyessa GayamoNo ratings yet

- Taxation 8-Preferential Taxation: Pre-TestDocument4 pagesTaxation 8-Preferential Taxation: Pre-TestCharles Decripito Flores100% (1)

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- Non-Individual Taxation: 1. Corporations 2. Co-Ownership 3. Estates and Trusts 4. PartnershipsDocument58 pagesNon-Individual Taxation: 1. Corporations 2. Co-Ownership 3. Estates and Trusts 4. PartnershipsShiela Marie Vics60% (5)

- Personal (Or Individual) Income Tax: 1) Domain of ApplicationDocument30 pagesPersonal (Or Individual) Income Tax: 1) Domain of ApplicationChe OmarNo ratings yet

- Osd CorrectionDocument2 pagesOsd CorrectionSai BomNo ratings yet

- Chapter 13 ADocument22 pagesChapter 13 AAdmNo ratings yet

- In Come Tax TableDocument9 pagesIn Come Tax TablejorjirubiNo ratings yet

- IRR Update On TRAIN LAWDocument6 pagesIRR Update On TRAIN LAWChrislynNo ratings yet

- Ce TaxDocument65 pagesCe Taxryl100% (1)

- Income Tax Part IIDocument7 pagesIncome Tax Part IImary jhoyNo ratings yet

- Annex B: Income Tax Tables: Table 1 Tax Rates For IndividualsDocument9 pagesAnnex B: Income Tax Tables: Table 1 Tax Rates For Individualshaze_toledo5077No ratings yet

- Module 9 Deductions From Gross IncomeDocument13 pagesModule 9 Deductions From Gross IncomeNineteen AùgùstNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document21 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document3 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoNo ratings yet

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument11 pagesLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Discussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument7 pagesDiscussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument8 pagesLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Chapter 2 Asset ValuationDocument8 pagesChapter 2 Asset ValuationMae Angiela TansecoNo ratings yet

- Going Concern Asset Based ValuationDocument21 pagesGoing Concern Asset Based ValuationMae Angiela TansecoNo ratings yet

- Chapter 4 Income Based ValuationDocument6 pagesChapter 4 Income Based ValuationMae Angiela TansecoNo ratings yet

- Chapter Four TaxDocument54 pagesChapter Four TaxEmebet Tesema100% (4)

- 4 - Notes Receivable Problems With Solutions: ListaDocument21 pages4 - Notes Receivable Problems With Solutions: Listabusiness docNo ratings yet

- Financial Planning and Analysis: The Master Budget: Solutions To ExercisesDocument12 pagesFinancial Planning and Analysis: The Master Budget: Solutions To ExercisesBlackBunny103No ratings yet

- Construction Management PDFDocument46 pagesConstruction Management PDFfrank kipkoechNo ratings yet

- Book-Tax Income Differences and Major Determining FactorsDocument11 pagesBook-Tax Income Differences and Major Determining FactorsFbsdf SdvsNo ratings yet

- CH 16 Practice SolutionsDocument9 pagesCH 16 Practice SolutionsaaaNo ratings yet

- Fixed Asset Flexfields in Oracle Assets EBS R12Document2 pagesFixed Asset Flexfields in Oracle Assets EBS R12naveenravellaNo ratings yet

- 019-Problem-Solving-with-answer-guideDocument30 pages019-Problem-Solving-with-answer-guideRestie John UlipNo ratings yet

- Excercise 19Document7 pagesExcercise 19raihan aqilNo ratings yet

- April 2013 PDFDocument22 pagesApril 2013 PDFJasonSpringNo ratings yet

- Batangas City Rural Improvement Club: Page 1 of 18Document18 pagesBatangas City Rural Improvement Club: Page 1 of 18mary roseNo ratings yet

- SQB - Chapter 7 QuestionsDocument16 pagesSQB - Chapter 7 QuestionsracsoNo ratings yet

- Valuing Equity Shares: I, T I, TDocument23 pagesValuing Equity Shares: I, T I, TkenNo ratings yet

- Unfinal Revised Thesis 12345 1Document25 pagesUnfinal Revised Thesis 12345 1MArz Azuela AlemalNo ratings yet

- Industry Analysis Report Ceramices Tiles IndustryDocument37 pagesIndustry Analysis Report Ceramices Tiles Industrybalaji bysani71% (7)

- IBKR Broker ReportDocument27 pagesIBKR Broker ReportJohn DoeNo ratings yet

- Accountancy & Auditing-IDocument4 pagesAccountancy & Auditing-Izaman virkNo ratings yet

- 7110 w10 QP 01Document12 pages7110 w10 QP 01mstudy123456No ratings yet

- PROJECT - UpdatedDocument7 pagesPROJECT - UpdatedSuraj GantayatNo ratings yet

- Chapter 6 Verification of Assets and Liabilities PM PDFDocument60 pagesChapter 6 Verification of Assets and Liabilities PM PDFVyankatrao NarwadeNo ratings yet

- IFRS16 - Lease Standard SAP Solution Through Real Estate Management - SAP BlogsDocument12 pagesIFRS16 - Lease Standard SAP Solution Through Real Estate Management - SAP BlogsFranki Giassi MeurerNo ratings yet

- Measuring Business Income CH 3Document37 pagesMeasuring Business Income CH 3eater PeopleNo ratings yet

- Ch7 Cost Accounting System - Practice SheetDocument18 pagesCh7 Cost Accounting System - Practice SheetNancy JainNo ratings yet

- Chapter 2 ExerciseDocument5 pagesChapter 2 Exercisegirlyn abadillaNo ratings yet

- Sap Fico Transaction CodesDocument17 pagesSap Fico Transaction CodesVibha Reddy HarishNo ratings yet

- G1 4 Accounting For Depreciation (D01-J14)Document37 pagesG1 4 Accounting For Depreciation (D01-J14)sridhartksNo ratings yet

- Acc 201 Introduction To Financial Accounting IDocument73 pagesAcc 201 Introduction To Financial Accounting Igarba shuaibuNo ratings yet

- Business Valuations: Net Asset Value (Nav)Document9 pagesBusiness Valuations: Net Asset Value (Nav)Artwell ZuluNo ratings yet

- Accouting Work FDocument129 pagesAccouting Work Fkisakye deborahNo ratings yet

- DepreciationDocument22 pagesDepreciationJericho CunananNo ratings yet