Professional Documents

Culture Documents

Market Summary 8 April 11

Market Summary 8 April 11

Uploaded by

cblancovinasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Summary 8 April 11

Market Summary 8 April 11

Uploaded by

cblancovinasCopyright:

Available Formats

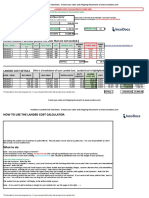

BMO Commodity Products Group

Daily Market Summary Report New York: (212) 605-1570

Chicago: (312) 845-2163

Houston: (713) 546-9782

Calgary: (403) 515-3682 & 1-888-432-0222

April 8, 2011 http://www.bmocm.com/products/marketrisk/commodity/

NYMEX Crude Oil ($USD/BBL) NYMEX Natural Gas ($USD/MMBTU) Alberta Natural Gas - AECO/NIT ($CAD/GJ) AECO Basis ($USD/MMBTU) Exchange Rates

Price Change Price Change Fixed Price Change Basis Change BofC Noon Rate 0.9566 -0.0027

Prompt $112.79 $2.49 Prompt $4.04 -$0.02 May 2011 $3.31 -$0.02 ($0.40) $0.00 CAD (CAD/USD) 0.9575 -0.0014

May 11 - Dec 11 $114.07 $2.40 May 11 - Dec 11 $4.30 -$0.02 May 11 - Dec 11 $3.44 -$0.02 ($0.52) $0.00 EUR (USD/EUR) 1.4438 0.0130

Zero-Cost Collar $100.00/$130.77 Zero-Cost Collar $4.00/$4.72 Zero-Cost Collar $3.25/$3.66 GBP (USD/GBP) 1.6349 0.0027

Zero-Cost Collar $95.00/$137.76 Zero-Cost Collar $3.75/$5.15 Zero-Cost Collar $3.00/$4.03 JPY (JPY/USD) 84.88 -0.0100

Calendar 2012 $111.54 $2.23 Calendar 2012 $4.86 -$0.04 Calendar 2012 $3.89 -$0.04 ($0.64) $0.00 $CAD Crude Oil

Zero-Cost Collar $100.00/$122.10 Zero-Cost Collar $4.50/$5.33 Zero-Cost Collar $3.50/$4.32 Q3 2011 $109.76 $2.16

Zero-Cost Collar $95.00/$127.13 Zero-Cost Collar $4.25/$5.72 Zero-Cost Collar $3.25/$4.68 Q4 2011 $109.89 $2.06

Q3 2011 $114.28 $2.42 May 11 - Oct 11 $4.19 -$0.02 May 11 - Oct 11 $3.35 -$0.02 ($0.51) $0.00 May 11 - Dec 11 $109.62 $2.14

Q4 2011 $114.07 $2.31 Nov 11 - Mar 12 $4.76 -$0.03 Nov 11 - Mar 12 $3.82 -$0.03 ($0.59) $0.00 Calendar 2012 $108.31 $2.02

Q1 2012 $113.29 $2.28 Apr 12 - Oct 12 $4.78 -$0.04 Apr 12 - Oct 12 $3.81 -$0.04 ($0.64) -$0.01 AESO Power ($CAD)

Q2 2012 $112.20 $2.24 Nov 12 - Mar 13 $5.29 -$0.04 Nov 12 - Mar 13 $4.30 -$0.04 ($0.64) -$0.01 May-Dec 11 Flat $66.56 $0.07

Q3 2012 $110.87 $2.22 Apr 13 - Oct 13 $5.20 -$0.03 Apr 13 - Oct 13 $4.21 -$0.03 ($0.67) $0.00 Calendar 2012 Flat $59.78 -$0.37

The US President and Congress are working about Natural gas continued its trek back to $4.00 today as Current Storage Levels Refined Products

as well as Jen, Brad, and Angelina would on a bearish fundamentals continue to dominate the

movie, and what that spells is a potential US landscape. Mild weather forecasts and abundance Current Change Last Year 5 Yr. Avg. NYMEX Heating Oil $3.320 $0.114

government shutdown. Why should we care? of supplies will most likely spurn another battle at US Natural Gas (BCF) 1,579 -45 1,665 1,569 HO Q3 2011 $3.365 $0.106

Probably because the US dollar is about a valuable $4.00 by Monday. Don't be surprised if we see sub

as a Greek promissory note to pay of existing debt. $4.00 prices by the end of trading. If we get below CAN Natural Gas (BCF) 195.44 -5.05 319.2 N/A RBOB Gasoline $3.261 $0.074

A weakened dollar + bullish geopolitical fundaments $3.96 the next key level looks to be $3.78. Below Crude Oil (MBbls) 357,664 1,952 354,189 341,654 RBOB Q3 2011 $3.153 $0.073

+ technical resistant levels falling by the wayside that well, I don't think bulls don’t want to go there at

equals a market above $112 in the front. this point. Motor Gasoline (MBbls) 216,679 -357 224,872 216,672 Fuel Oil (NYH 1%) $108.63 $1.250

Distillates (MBbls) 153,520 195 144,606 127,608 Fuel Oil (NYH 3%) $106.38 $0.750

Natural Gas at Various Basis Locations ($USD/MMBTU) Other Markets

NYMEX Natural Gas

$8 Location May 2011 May 11 - Oct 11 May 11 - Dec 11 Cal 12 Prompt IPE Brent $126.61 $4.16

$7 ANR Okla. ($0.24) ($0.24) ($0.24) ($0.27) Dated Brent $128.05 $4.22

Chicago Citygate $0.04 $0.01 $0.03 $0.02 NBP Front Month $10.04 $0.13

$6

CIG, Rockies ($0.43) ($0.44) ($0.41) ($0.40) OPEC Basket $117.65 $0.03

$5 El Paso, Permian ($0.25) ($0.24) ($0.25) ($0.31) Edm Par (USD) $107.77 $9.54

El Paso, San Juan ($0.25) ($0.25) ($0.25) ($0.34) Lloyd Edm (USD) $99.11 $2.17

$4

Houston Ship Channel ($0.04) ($0.05) ($0.07) ($0.09) Mt. Belvieu Propane $1.4000 $0.010

$3 Malin ($0.17) ($0.23) ($0.23) ($0.31) NYMEX Coal $74.13 -$1.17

NW Rockies ($0.40) ($0.41) ($0.39) ($0.36) Gold (London PM Fix) $1,469.50 $10.00

$2

Panhandle ($0.27) ($0.27) ($0.27) ($0.31) CRB Futures Index 368.70 4.22

NYMEX Crude Oil PG&E Citygate $0.12 $0.08 $0.09 ($0.01) USD Index 75.06 -0.50

$100

$90 SoCal Gas ($0.05) ($0.05) ($0.07) ($0.16) Contact Information

$80 Sumas ($0.38) ($0.37) ($0.24) ($0.29) New York Chicago

$70 TCO $0.11 $0.08 $0.12 $0.06 (212) 605-1570 (312) 845-2163

$60 Tennessee 500 ($0.06) ($0.05) ($0.05) ($0.05) George Ellis Mark Mathews

$50 Tetco M3 $0.27 $0.28 $0.42 $0.64 Christopher Coyne

$40 Transco Zone 3 $0.01 $0.01 $0.01 $0.01 Houston Calgary

$30 Transco Zone 6 $0.35 $0.35 $0.66 $1.13 (713) 546-9782 (403) 515-3682

Jan-09

May-09

Jun-09

Jan-10

May-10

Jun-10

Jan-11

Feb-09

Mar-09

Jul-09

Aug-09

Sep-09

Dec-09

Feb-10

Mar-10

Jul-10

Aug-10

Sep-10

Dec-10

Feb-11

Mar-11

Apr-09

Oct-09

Nov-09

Apr-10

Oct-10

Nov-10

Apr-11

Waha ($0.13) ($0.15) ($0.16) ($0.21) Renee Morgan 1-888-432-0222

Commodity Value Per MMBTU Richard Kieval Scott DeBusschere

Prompt Calendar 2011

Crude Oil Heating Oil Fuel Oil (NYH 1%) Fuel Oil (NYH 3%) Coal Jenn Ross Marielle James

All prices are mid-market indications as of the close of NYMEX . $19.38 $24.60 $17.28 $16.92 $3.09 Tim Holtby

*Canadian natural gas storage data based on the Enerdata survey

The information, opinions, estimates, projections and other materials contained herein are provided as of the date hereof and are subject to change without notice. Some of the information, opinions, estimates, projections and other materials contained herein have been obtained from numerous sources and Bank of Montreal (“BMO”) and its affiliates make every effort to ensure that the contents thereof have been compiled or derived from sources

believed to be reliable and to contain information and opinions which are accurate and complete. However, neither BMO nor its affiliates have independently verified or make any representation or warranty, express or implied, in respect thereof, take no responsibility for any errors and omissions which may be contained herein or accept any liability whatsoever for any loss arising from any use of or reliance on the information, opinions,

estimates, projections and other materials contained herein whether relied upon by the recipient or user or any other third party (including, without limitation, any customer of the recipient or user). Information may be available to BMO and/or its affiliates that is not reflected herein. The information, opinions, estimates, projections and other materials contained herein are not to be construed as an offer to sell, a solicitation for or an offer to buy,

any products or services referenced herein (including, without limitation, any commodities, securities or other financial instruments), nor shall such information, opinions, estimates, projections and other materials be considered as investment advice or as a recommendation to enter into any transaction. Additional information is available by contacting BMO or its relevant affiliate directly. BMO and/or its affiliates may make a market or deal as

principal in the products (including, without limitation, any commodities, securities or other financial instruments) referenced herein. BMO, its affiliates, and/or their respective shareholders, directors, officers and/or employees may from time to time have long or short positions in any such products (including, without limitation, commodities, securities or other financial instruments). BMO Nesbitt Burns Inc. and/or BMO Capital Markets Corp.,

subsidiaries of BMO, may act as financial advisor and/or underwriter for certain of the corporations mentioned herein and may receive remuneration for same. “BMO Capital Markets” is a trade name used by the Bank of Montreal Investment Banking Group, which includes the wholesale/institutional arms of Bank of Montreal, BMO Nesbitt Burns Inc., BMO Nesbitt Burns Ltée/Ltd., BMO Capital Markets Corp. and Harris N.A., and BMO

Capital Markets Limited.

To U.K. residents:The contents hereof are not directed at investors located in the UK, other than persons falling within the definition contained in Part VI Financial Services and Markets Act 2000 (Financial Promotion) Order 2001.

™ - “BMO (M-bar roundel symbol) Capital Markets” is a trade-mark of Bank of Montreal, used under licence.

© Copyright Bank of Montreal 2000

You might also like

- Quiz 7 Aw Evaluation Group 4 Es Econ Engineering EconomicsDocument4 pagesQuiz 7 Aw Evaluation Group 4 Es Econ Engineering EconomicsJB RSNJNNo ratings yet

- 3-Way Collars For ProducersDocument5 pages3-Way Collars For Producerscblancovinas100% (1)

- Qatar CompaniesDocument11 pagesQatar Companiesrahulplacements100% (1)

- Flyback PinoutsDocument7 pagesFlyback Pinoutszeldeni100% (3)

- Bathroom Fittings and Fixtures Project ProfileDocument11 pagesBathroom Fittings and Fixtures Project Profilerani agnihotriNo ratings yet

- FORMAULADocument4 pagesFORMAULAPOLARNo ratings yet

- MoneyDocument6 pagesMoneyPhillip budhaNo ratings yet

- Tonnage Calc-4Document12 pagesTonnage Calc-4Emba MadrasNo ratings yet

- Landed Cost CalculatorDocument6 pagesLanded Cost CalculatorMi Mi100% (2)

- COMPARATIVA DE PRECIOS PI-PERT-AL-PERT December-2022 PRICEDocument1 pageCOMPARATIVA DE PRECIOS PI-PERT-AL-PERT December-2022 PRICEPeter Urrutia de leonNo ratings yet

- SumUp Daily Payout ReportDocument2 pagesSumUp Daily Payout ReportRosa MouraNo ratings yet

- Jimmy Rivard - Post Secondary Budget - Monthly Budget Spreadsheet 1Document9 pagesJimmy Rivard - Post Secondary Budget - Monthly Budget Spreadsheet 1api-531482085No ratings yet

- Energy Weekly UpdateDocument55 pagesEnergy Weekly UpdatejulianNo ratings yet

- 22.03.10 - Modelo CIBC Adaptado MH - V3 - INCLUDING 3rd Parties Ore PurchasesDocument148 pages22.03.10 - Modelo CIBC Adaptado MH - V3 - INCLUDING 3rd Parties Ore PurchasesCarlos Enrique Rodrìguez FloresNo ratings yet

- Payments Export 2021 03 09T02 - 52 - 38.739ZDocument2 pagesPayments Export 2021 03 09T02 - 52 - 38.739ZMuhamad TaufikNo ratings yet

- Una SylvaDocument140 pagesUna SylvaEduardo MontenegroNo ratings yet

- Kit - DX Blame ST 100WDocument3 pagesKit - DX Blame ST 100WBLESSNo ratings yet

- Account No: 934913324 Monthly Statement Period: JANUARY - 2023Document9 pagesAccount No: 934913324 Monthly Statement Period: JANUARY - 2023Priyanka NarwalNo ratings yet

- "Extra Costs": ENTER PRODUCT DETAILS (Delete The Lines That Are Not Needed.)Document6 pages"Extra Costs": ENTER PRODUCT DETAILS (Delete The Lines That Are Not Needed.)callraza19100% (1)

- Jan-21 Diferença Do Estoque: Data Item QTD PÇ Unit ValorDocument4 pagesJan-21 Diferença Do Estoque: Data Item QTD PÇ Unit ValorwanderNo ratings yet

- Restoration Funding - UNDocument140 pagesRestoration Funding - UNJuan Ignacio FeuerhakeNo ratings yet

- Irrigated Azuki Beans 10 11Document2 pagesIrrigated Azuki Beans 10 11cinthian86No ratings yet

- Stock Name Nihd 3/3/2006 Overall (A1) Subtrent (A2)Document2 pagesStock Name Nihd 3/3/2006 Overall (A1) Subtrent (A2)what is thisNo ratings yet

- ConfluenceDocument2 pagesConfluencewhat is thisNo ratings yet

- LP Strongmin NM P7722B-01Document1 pageLP Strongmin NM P7722B-01orlandoyoberNo ratings yet

- Jarden Stock Pitch Competition 2020 Financial ModelDocument17 pagesJarden Stock Pitch Competition 2020 Financial ModelDweep KapadiaNo ratings yet

- FBS Forex MMDocument6 pagesFBS Forex MMAbdul KhaliqNo ratings yet

- Kit - 300WDocument3 pagesKit - 300WBLESSNo ratings yet

- GP 2Document1 pageGP 25qgfzm78vqNo ratings yet

- 2015-16 and Before Registrations 2018-19 Academic Year Fee TableDocument1 page2015-16 and Before Registrations 2018-19 Academic Year Fee TableCan MutluNo ratings yet

- Coin Profitability 2022Document8 pagesCoin Profitability 2022faniawan536No ratings yet

- 2024 03Document8 pages2024 03Harish GoyalNo ratings yet

- Lpâ It Ju NM Z20222a-01Document1 pageLpâ It Ju NM Z20222a-01orlandoyoberNo ratings yet

- Zhou, Alan. Sumitomo Corporation DisclosedDocument5 pagesZhou, Alan. Sumitomo Corporation DisclosedAlan ZhouNo ratings yet

- Fidelity Investments 5Document1 pageFidelity Investments 5Jack Carroll (Attorney Jack B. Carroll)No ratings yet

- The Price List of Resin Lens Index DIA Item Power Uncoated HC HMCDocument1 pageThe Price List of Resin Lens Index DIA Item Power Uncoated HC HMCRodrigo DelgadilloNo ratings yet

- Jan-21 Diferença Do Estoque: Data Item QTD PÇ Unit ValorDocument3 pagesJan-21 Diferença Do Estoque: Data Item QTD PÇ Unit ValorwanderNo ratings yet

- Options and Corporate FinanceDocument30 pagesOptions and Corporate FinanceBussines LearnNo ratings yet

- JURNAL BARU - Versi BETADocument37 pagesJURNAL BARU - Versi BETAMitraNo ratings yet

- Jan-21 Diferença Do Estoque: Data Item QTD PÇ Unit ValorDocument3 pagesJan-21 Diferença Do Estoque: Data Item QTD PÇ Unit ValorwanderNo ratings yet

- Pay SchemeDocument5 pagesPay SchemeTruce ArevaloNo ratings yet

- QuickbooksDocument1 pageQuickbooksnicolassoryan1No ratings yet

- Honda Mode $06Document34 pagesHonda Mode $06Marty WebbNo ratings yet

- Adam Belyamani Soala EnergyDocument35 pagesAdam Belyamani Soala EnergyAjay TulpuleNo ratings yet

- Ganhos GastosDocument12 pagesGanhos GastosHenrique Araujo AzevedoNo ratings yet

- IC Salon Daily Sales Report Form 11436Document5 pagesIC Salon Daily Sales Report Form 11436rajNo ratings yet

- Jan-21 Diferença Do Estoque: Data Item QTD PÇ Unit ValorDocument3 pagesJan-21 Diferença Do Estoque: Data Item QTD PÇ Unit ValorwanderNo ratings yet

- Pago de Agua - SACMEXDocument4 pagesPago de Agua - SACMEXDesireéNo ratings yet

- Product 1 2 3 4 5 6 7 Total Price Burger Cola Fries Only B Only C Only F B+C B+F C+F All 3 Max Surp Bought? RevenueDocument1 pageProduct 1 2 3 4 5 6 7 Total Price Burger Cola Fries Only B Only C Only F B+C B+F C+F All 3 Max Surp Bought? RevenueKalyani KNo ratings yet

- VS41464Document1 pageVS41464Dixon MirandaNo ratings yet

- Compras 2018-2020 Yeimy Johana MorenoDocument2 pagesCompras 2018-2020 Yeimy Johana MorenoAngelly EscobarNo ratings yet

- Year Beginning Balance Contributions Withdrawals Interest ExpenseDocument7 pagesYear Beginning Balance Contributions Withdrawals Interest ExpensePho6No ratings yet

- Kripto - Excel2 Youtube UrazHocaDocument75 pagesKripto - Excel2 Youtube UrazHocaRecep KayaNo ratings yet

- Micro Eportfolio Monopoly Spreadsheet Data - SPG 18 1Document3 pagesMicro Eportfolio Monopoly Spreadsheet Data - SPG 18 1api-334921583No ratings yet

- Fund Performance MetlifeDocument11 pagesFund Performance MetlifeDeepak DharmarajNo ratings yet

- Cme Fee Schedule 2024 03 01Document11 pagesCme Fee Schedule 2024 03 01hiter67364No ratings yet

- Plan de Trading Evo GlobalDocument2 pagesPlan de Trading Evo GlobalmedinapaucarchristopherNo ratings yet

- Final Invoice Supplier RUC Product Origin Contract GWMT Tare Weight NWMT H2O DMT Franchise NDMT Assay Final Price Q/P Price DateDocument49 pagesFinal Invoice Supplier RUC Product Origin Contract GWMT Tare Weight NWMT H2O DMT Franchise NDMT Assay Final Price Q/P Price DateorlandoyoberNo ratings yet

- GRB Dairy Foods-Aws Estimation For S4hanaDocument9 pagesGRB Dairy Foods-Aws Estimation For S4hanaVenugopal RamanathanNo ratings yet

- LF Strongmin Nm-Z13221a-01Document1 pageLF Strongmin Nm-Z13221a-01orlandoyoberNo ratings yet

- Journal Bearings (Standard Sizes) : Price SheetDocument3 pagesJournal Bearings (Standard Sizes) : Price SheetChandra SimanjuntakNo ratings yet

- Currency Bid Rate Ask/Offer Rate: 1. 2. 3. 4. How Much CAD Received When Selling CHF10, 000,000? 5Document4 pagesCurrency Bid Rate Ask/Offer Rate: 1. 2. 3. 4. How Much CAD Received When Selling CHF10, 000,000? 5Dinhphung Le100% (1)

- IA Ch. 9 - JohannaDocument35 pagesIA Ch. 9 - JohannaSagitarius SagitariaNo ratings yet

- Excessive Spec AhDocument3 pagesExcessive Spec AhcblancovinasNo ratings yet

- Risk Management Keeps Failing The Ultimate TestDocument5 pagesRisk Management Keeps Failing The Ultimate TestcblancovinasNo ratings yet

- Phibro CNDocument4 pagesPhibro CNcblancovinasNo ratings yet

- Phibro CNDocument4 pagesPhibro CNcblancovinasNo ratings yet

- Downstream GCC Market - May2018 PDFDocument84 pagesDownstream GCC Market - May2018 PDFvaruninderNo ratings yet

- Brochure DISCOVERY EnergyDocument20 pagesBrochure DISCOVERY EnergyDiego RangelNo ratings yet

- Manhattan Test 1 AnswersDocument48 pagesManhattan Test 1 AnswersChen Cg100% (1)

- Request For Proposal (RFP) Taunsa 120 MW ProjectDocument150 pagesRequest For Proposal (RFP) Taunsa 120 MW ProjectEverlasting Memories50% (2)

- Model P4480 Kill A Watt Graphic Timer Operation Manual: Safety InstructionsDocument9 pagesModel P4480 Kill A Watt Graphic Timer Operation Manual: Safety Instructionspulse59No ratings yet

- Measurement of Insulation Resistance IR Part 1Document5 pagesMeasurement of Insulation Resistance IR Part 1hafizg100% (1)

- Compressir Lubrication Theory DanfossDocument7 pagesCompressir Lubrication Theory DanfossSlavikNZNo ratings yet

- Torishima MHB Pump BrochureDocument6 pagesTorishima MHB Pump BrochureManuel L Lombardero100% (1)

- Intermediate Accounting I PpeDocument2 pagesIntermediate Accounting I PpeJoovs JoovhoNo ratings yet

- Ramady M Mahdi W Opec in A Shale Oil World Where To Next PDFDocument293 pagesRamady M Mahdi W Opec in A Shale Oil World Where To Next PDFBalanuța IanaNo ratings yet

- Yuken 8 EDFHG-AMN English LeafletDocument4 pagesYuken 8 EDFHG-AMN English LeafletJose2806No ratings yet

- Modularization For Ground Engineering Construction in The Anyue Gasfield Sichuan Basin With The Designed Annual Gas Processing Capacity of Six Billion M 3Document7 pagesModularization For Ground Engineering Construction in The Anyue Gasfield Sichuan Basin With The Designed Annual Gas Processing Capacity of Six Billion M 3Maruf MuhammadNo ratings yet

- ESSO STANDARD EASTERN, INC. v. CADocument2 pagesESSO STANDARD EASTERN, INC. v. CARNicolo BallesterosNo ratings yet

- BHELDocument4 pagesBHELAatman VoraNo ratings yet

- State of Green Business 2017 ReportDocument111 pagesState of Green Business 2017 ReportEmanuel Gomez AuadNo ratings yet

- GFDGFDGDocument32 pagesGFDGFDGKelli Moura Kimarrison SouzaNo ratings yet

- 2017 07 VMI Product Folder MAXX v3 SmallDocument4 pages2017 07 VMI Product Folder MAXX v3 SmallPatricio FNo ratings yet

- LrqaDocument24 pagesLrqakoushkiNo ratings yet

- PSX Project Excel Sheet WorkingDocument12 pagesPSX Project Excel Sheet WorkingBILAL KHANNo ratings yet

- Godrej & Boyce IntroDocument64 pagesGodrej & Boyce Introrajeev1216No ratings yet

- 26 2833 01 Silicone Antifoams For Oil Gas Processing Selection GuideDocument2 pages26 2833 01 Silicone Antifoams For Oil Gas Processing Selection GuideZhan FangNo ratings yet

- Cimtas Group PDFDocument40 pagesCimtas Group PDFUtku KepcenNo ratings yet

- Format Final Report - Balancing ISODocument68 pagesFormat Final Report - Balancing ISOAdeImanudin100% (1)

- Ballast Pump, Sea Water PumpDocument4 pagesBallast Pump, Sea Water PumpKarina Puteri WardaniNo ratings yet

- Optimal Pump Scheduling For Peak Load Management: Abstract-In Water Pumping Systems, There IsDocument5 pagesOptimal Pump Scheduling For Peak Load Management: Abstract-In Water Pumping Systems, There IsFrancis WilliamNo ratings yet

- Valere Smps Gs150aDocument41 pagesValere Smps Gs150areddi_mohanNo ratings yet