Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

69 viewsPension - RR 01-83 Amend - 211118 - 115738

Pension - RR 01-83 Amend - 211118 - 115738

Uploaded by

HADTUGICopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- RevenueRegulations1 83Document4 pagesRevenueRegulations1 83Ansherina Francisco100% (1)

- Regional Franchising and Regulatory Office No. - : Form No. 012: With hearing-RFRO Revised As of 2/24/2021Document2 pagesRegional Franchising and Regulatory Office No. - : Form No. 012: With hearing-RFRO Revised As of 2/24/2021HADTUGI100% (1)

- Schedule C CONTRACT PRICE AND PAYMENT PROVISIONSDocument30 pagesSchedule C CONTRACT PRICE AND PAYMENT PROVISIONSxue jun xiangNo ratings yet

- RR 1-68Document10 pagesRR 1-68Crnc Navidad100% (1)

- Schedule CDocument22 pagesSchedule Cwangrui67% (3)

- Contrato Maurice J. Spagnoletti y Doral BankDocument33 pagesContrato Maurice J. Spagnoletti y Doral BankElcoLaoNo ratings yet

- 306Document24 pages306syikinNo ratings yet

- Revenue Regulations On Retirement Benefit Plans PDFDocument15 pagesRevenue Regulations On Retirement Benefit Plans PDFJadeNo ratings yet

- Computation of Income From SalaryDocument30 pagesComputation of Income From SalaryMayur N MalviyaNo ratings yet

- The Companies Audit of Cost Accounts Regulations 2020 CompressedDocument116 pagesThe Companies Audit of Cost Accounts Regulations 2020 CompressedMuhammad WaqarNo ratings yet

- Special Conditions of Contract: 1. PurposeDocument5 pagesSpecial Conditions of Contract: 1. PurposeWossen DemissNo ratings yet

- 5074-1989-Exemption of Retirement Benefits Pensions20210505-12-1k73811Document2 pages5074-1989-Exemption of Retirement Benefits Pensions20210505-12-1k73811Reymund S BumanglagNo ratings yet

- IT Act Changes PDFDocument7 pagesIT Act Changes PDFSanjeev KumarNo ratings yet

- Tender ConditionDocument14 pagesTender Conditionsiraj sNo ratings yet

- SSC Circular No 2010-004 (IRR of RA 9903)Document4 pagesSSC Circular No 2010-004 (IRR of RA 9903)louis adriano baguioNo ratings yet

- COA CIRCULAR NO. 82 101 I September 14 1982Document10 pagesCOA CIRCULAR NO. 82 101 I September 14 1982recx.jyke06No ratings yet

- Ohio Senate Bill To Eliminate Income TaxesDocument57 pagesOhio Senate Bill To Eliminate Income TaxesWews WebStaffNo ratings yet

- Special Conditions of Contract - ERP Clauses-FINALDocument16 pagesSpecial Conditions of Contract - ERP Clauses-FINALSukti SomNo ratings yet

- Ohio House Bill To Eliminate Income TaxesDocument58 pagesOhio House Bill To Eliminate Income TaxesWews WebStaffNo ratings yet

- 4.3 Approval of Personnel: II. General Conditions of Contract 89Document2 pages4.3 Approval of Personnel: II. General Conditions of Contract 89Anonymous ufMAGXcskMNo ratings yet

- Companies-Act-2017 (Audit Clauses)Document9 pagesCompanies-Act-2017 (Audit Clauses)Hanaan TalibNo ratings yet

- Bonus Act, 2030 (1974) Last AmendmentsDocument11 pagesBonus Act, 2030 (1974) Last AmendmentsDeep JoshiNo ratings yet

- SSA-210-R1 Agreeing The Terms of Audit EngagementsDocument22 pagesSSA-210-R1 Agreeing The Terms of Audit EngagementsAndreiNo ratings yet

- Section-V: Special Conditions of Contract (SCC) : 1.0 Definition of Terms: 1.1 1.2 2.0 General Information: 2.1Document11 pagesSection-V: Special Conditions of Contract (SCC) : 1.0 Definition of Terms: 1.1 1.2 2.0 General Information: 2.1raj1508No ratings yet

- 06 Schedule A (SC)Document5 pages06 Schedule A (SC)Steve KiarieNo ratings yet

- PaymentWagesLaw EngDocument13 pagesPaymentWagesLaw EngHZMMNo ratings yet

- Amendments To Section 42 RegulationsDocument20 pagesAmendments To Section 42 RegulationsrabiaNo ratings yet

- Audit Under Fiscal Laws - NotesDocument17 pagesAudit Under Fiscal Laws - NotesabhiNo ratings yet

- Establishment of Retirement PlanDocument3 pagesEstablishment of Retirement PlanVioleta StancuNo ratings yet

- Supervision ProjDocument14 pagesSupervision ProjHeni yitNo ratings yet

- Schedule C (Par 6.8) BG in LieuDocument28 pagesSchedule C (Par 6.8) BG in LieuwangruiNo ratings yet

- ITax Regulations GN78 of 1996Document94 pagesITax Regulations GN78 of 1996Akash TeeluckNo ratings yet

- Request For QuotationDocument7 pagesRequest For QuotationKim Patrick VictoriaNo ratings yet

- Payment and Milestone SchedulesDocument71 pagesPayment and Milestone SchedulesCu Ti100% (1)

- 340275-2022-Clarifying Issues Relative To Revenue20221114-12-R8lqtsDocument4 pages340275-2022-Clarifying Issues Relative To Revenue20221114-12-R8lqtsRen Mar CruzNo ratings yet

- Model Agreement - KBM & KBMDocument7 pagesModel Agreement - KBM & KBMkanishk.basuNo ratings yet

- Geodetic Scope of WorkDocument24 pagesGeodetic Scope of WorkKris Aileen CortezNo ratings yet

- The Contract Labour (Regulation and Abolition) ACT, 1970Document38 pagesThe Contract Labour (Regulation and Abolition) ACT, 1970megha139No ratings yet

- ESOP and Sweat EquityDocument7 pagesESOP and Sweat EquityShehana RenjuNo ratings yet

- SWD 7000009823 050122Document21 pagesSWD 7000009823 050122Pawan PassiNo ratings yet

- Procedure of Approval of Gratuity Funds Under Income Tax Act, 1961 - Taxguru - inDocument15 pagesProcedure of Approval of Gratuity Funds Under Income Tax Act, 1961 - Taxguru - inJay SharmaNo ratings yet

- The Contract Labour (Regulation and Abolition) ACT, 1970Document37 pagesThe Contract Labour (Regulation and Abolition) ACT, 1970sunaina754No ratings yet

- Ra 6971 PDFDocument4 pagesRa 6971 PDFMonicaMoscosoNo ratings yet

- BIR Ruling (DA-243-00)Document3 pagesBIR Ruling (DA-243-00)bulasa.jefferson16No ratings yet

- S. 3760 Automatic IRA Act 5 of 2010''.Document50 pagesS. 3760 Automatic IRA Act 5 of 2010''.Joe WallinNo ratings yet

- Lien On Assets of The Company Under Labour LawsDocument2 pagesLien On Assets of The Company Under Labour LawsSamaksh KhannaNo ratings yet

- Ca Audit PDFDocument154 pagesCa Audit PDFsandesh1506No ratings yet

- Draft Contract - ManpowerDocument10 pagesDraft Contract - ManpowerMitchie Binarao BaylonNo ratings yet

- Rdig 22082022Document28 pagesRdig 22082022Mohamad EzarinNo ratings yet

- REPUBLIC ACT No 10846 (Sec.8-13)Document3 pagesREPUBLIC ACT No 10846 (Sec.8-13)School FilesNo ratings yet

- The Income Tax Act No. 16 of 2017Document8 pagesThe Income Tax Act No. 16 of 2017cholaNo ratings yet

- Title Ii Chapter XiiiDocument5 pagesTitle Ii Chapter XiiiMae CarpilaNo ratings yet

- NSSF (Contracting Out by Employers) Regulations, 2014Document9 pagesNSSF (Contracting Out by Employers) Regulations, 2014Nicholas MutembeiNo ratings yet

- Company Law SectionsDocument4 pagesCompany Law SectionsnbaghrechaNo ratings yet

- 263081-2019-Revised Securities Regulation Code SRC Rule20210728-11-K6tsx3Document61 pages263081-2019-Revised Securities Regulation Code SRC Rule20210728-11-K6tsx3Regina RozarioNo ratings yet

- Consortium Condition-JammuDocument2 pagesConsortium Condition-Jammusaket sagarNo ratings yet

- PerquisitesDocument6 pagesPerquisitesArgha DeySarkarNo ratings yet

- Tendernotice 2Document11 pagesTendernotice 2Saravana BhavanNo ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument15 pagesTest Series: November, 2021 Mock Test Paper 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingYashNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- 1962 Castro V Collector of Internal Revenu 220512 074530Document15 pages1962 Castro V Collector of Internal Revenu 220512 074530HADTUGINo ratings yet

- Petitioner Respondents F R Quiogue: Commissioner of Internal Revenue, TMX Sales, Inc. and The Court of Tax AppealsDocument8 pagesPetitioner Respondents F R Quiogue: Commissioner of Internal Revenue, TMX Sales, Inc. and The Court of Tax AppealsHADTUGINo ratings yet

- 2021 Ihl Moot Court RulesDocument10 pages2021 Ihl Moot Court RulesHADTUGINo ratings yet

- Duterte - Boracay Is Government Property - The Manila TimesDocument1 pageDuterte - Boracay Is Government Property - The Manila TimesHADTUGINo ratings yet

- The Importance of Direct ExaminationDocument5 pagesThe Importance of Direct ExaminationHADTUGINo ratings yet

- Nuremberg Moot Court 2020-LSE-Defense MemoDocument14 pagesNuremberg Moot Court 2020-LSE-Defense MemoHADTUGINo ratings yet

- Nuremberg Moot Court 2019Document14 pagesNuremberg Moot Court 2019HADTUGINo ratings yet

- Nuremberg Moot Court 2022 Case AktualisiertDocument6 pagesNuremberg Moot Court 2022 Case AktualisiertHADTUGINo ratings yet

- Strengthening The Marine Protected Area System To Conserve Marine Key Biodiversity Areas (Smart Seas Philippines)Document68 pagesStrengthening The Marine Protected Area System To Conserve Marine Key Biodiversity Areas (Smart Seas Philippines)HADTUGINo ratings yet

- Skills That Future Lawyers NeedDocument2 pagesSkills That Future Lawyers NeedHADTUGINo ratings yet

- Petitioners Respondents Alfredo L. EndayaDocument9 pagesPetitioners Respondents Alfredo L. EndayaHADTUGINo ratings yet

- Case ThemesDocument17 pagesCase ThemesHADTUGINo ratings yet

- 164094-2009-Keppel Cebu Shipyard Inc. v. Pioneer20210424-14-Eea4foDocument29 pages164094-2009-Keppel Cebu Shipyard Inc. v. Pioneer20210424-14-Eea4foHADTUGINo ratings yet

- OpeningstatementsDocument8 pagesOpeningstatementsHADTUGINo ratings yet

- 166783-2011-Keppel Cebu Shipyard Inc. v. Pioneer20210424-14-Pz9mxuDocument11 pages166783-2011-Keppel Cebu Shipyard Inc. v. Pioneer20210424-14-Pz9mxuHADTUGINo ratings yet

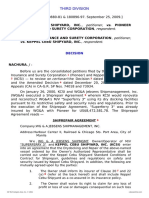

- Petitioners Respondent: Third DivisionDocument20 pagesPetitioners Respondent: Third DivisionHADTUGINo ratings yet

- Petitioners Respondents Del Rosario & Del Rosario Law Office Abraham Anonas Astorga & Macamay Law Office Siguion Reyna Montecillo & OngsiakoDocument7 pagesPetitioners Respondents Del Rosario & Del Rosario Law Office Abraham Anonas Astorga & Macamay Law Office Siguion Reyna Montecillo & OngsiakoHADTUGINo ratings yet

- Acctg Case 1Document3 pagesAcctg Case 1HADTUGINo ratings yet

- Petitioners: en BancDocument5 pagesPetitioners: en BancHADTUGINo ratings yet

- IAET Case 2Document13 pagesIAET Case 2HADTUGINo ratings yet

- IAET Case 3Document10 pagesIAET Case 3HADTUGINo ratings yet

- Chapter 7: National Income Determination: Exercise 1: Identification Exercise 4: IdentificationDocument7 pagesChapter 7: National Income Determination: Exercise 1: Identification Exercise 4: IdentificationKiahna Clare ArdaNo ratings yet

- Learning Guide: Shashamane Poly Technic CollageDocument48 pagesLearning Guide: Shashamane Poly Technic CollageGizaw TadesseNo ratings yet

- AAACL9620N INSIGHT VER 02 Service Letter 2014-15 4914106196200001 01022022 PDFDocument1 pageAAACL9620N INSIGHT VER 02 Service Letter 2014-15 4914106196200001 01022022 PDFuodal rajNo ratings yet

- Axis Bank Airport Lounge Access ProgramDocument5 pagesAxis Bank Airport Lounge Access ProgramHimanshuNo ratings yet

- Seller Portal - JioMart 21Document2 pagesSeller Portal - JioMart 21Aman PathakNo ratings yet

- Tutorial 2 Chapter 5 With AnswersDocument9 pagesTutorial 2 Chapter 5 With AnswersNoor TaherNo ratings yet

- Financial Management:: The Time Value of Money-The BasicsDocument67 pagesFinancial Management:: The Time Value of Money-The Basicsfreakguy 313No ratings yet

- Naylor PadstonesDocument24 pagesNaylor PadstonesKovacs Zsolt-IstvanNo ratings yet

- Economic Project Mohd Naved Alam Ansari B.A.LL.B (S/F) Ist Year Jamia Millia IslamiaDocument13 pagesEconomic Project Mohd Naved Alam Ansari B.A.LL.B (S/F) Ist Year Jamia Millia IslamiaMohd ArhamNo ratings yet

- NPP 2020 Final Web PDFDocument216 pagesNPP 2020 Final Web PDFMawuli AhorlumegahNo ratings yet

- 50,000 Chit - 20 Months: S.No Month Monthly Amount Chit AmountDocument1 page50,000 Chit - 20 Months: S.No Month Monthly Amount Chit Amountkchinni_428No ratings yet

- Survey of Economics Principles Applications and Tools 7th Edition Osullivan Test BankDocument48 pagesSurvey of Economics Principles Applications and Tools 7th Edition Osullivan Test Bankanthonywilliamsfdbjwekgqm100% (28)

- Sunmbo Bukoye Oladejo - 9158705127 - 20240406232518Document2 pagesSunmbo Bukoye Oladejo - 9158705127 - 20240406232518mr6522294No ratings yet

- Approaches To ValuationDocument18 pagesApproaches To ValuationSeemaNo ratings yet

- UBS Pitchbook TemplateDocument19 pagesUBS Pitchbook Templatektp24415100% (1)

- IFR Awards 2022 RoHDocument3 pagesIFR Awards 2022 RoHRonnie KurtzbardNo ratings yet

- DTC Participant in Numerical Sequence 3Document24 pagesDTC Participant in Numerical Sequence 3Ann BoudreauxNo ratings yet

- Macroeconomics: Ninth Canadian EditionDocument48 pagesMacroeconomics: Ninth Canadian EditionUzma KhanNo ratings yet

- CHP 26Document7 pagesCHP 26evelynNo ratings yet

- Flange Carbon Steel ANSI CatalogDocument4 pagesFlange Carbon Steel ANSI CatalogKhonlong TangNo ratings yet

- North America Downstream Outlook 2020Document104 pagesNorth America Downstream Outlook 2020Alex WangNo ratings yet

- مكانة الوكالة الوطنية لتطوير الإستثمار في تشجيع الإستثمار في الجزائر باستخدام التحفيزات الجبائيةDocument30 pagesمكانة الوكالة الوطنية لتطوير الإستثمار في تشجيع الإستثمار في الجزائر باستخدام التحفيزات الجبائيةعبد الحميدNo ratings yet

- Exercises For Practical DSGE Modelling: Alina Barnett Martin EllisonDocument36 pagesExercises For Practical DSGE Modelling: Alina Barnett Martin Ellisonengli abdelNo ratings yet

- Chapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessDocument51 pagesChapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessabateNo ratings yet

- Me Unit 1Document29 pagesMe Unit 1Sangram SahooNo ratings yet

- International Financial Management Abridged 10 Edition: by Jeff MaduraDocument13 pagesInternational Financial Management Abridged 10 Edition: by Jeff MaduraHiếu Nhi TrịnhNo ratings yet

- Presentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Document20 pagesPresentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Buddhapratap RathoreNo ratings yet

- C01 Accounting in Action - EDITEDDocument53 pagesC01 Accounting in Action - EDITEDRaella FernandezNo ratings yet

- Chapter 10 Translation of Foreign Currency Financial Statements PDFDocument28 pagesChapter 10 Translation of Foreign Currency Financial Statements PDFKim Taehyung91% (23)

- PDF CropDocument4 pagesPDF Crop04vijilNo ratings yet

Pension - RR 01-83 Amend - 211118 - 115738

Pension - RR 01-83 Amend - 211118 - 115738

Uploaded by

HADTUGI0 ratings0% found this document useful (0 votes)

69 views4 pagesOriginal Title

Pension - RR 01-83 Amend_211118_115738

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

69 views4 pagesPension - RR 01-83 Amend - 211118 - 115738

Pension - RR 01-83 Amend - 211118 - 115738

Uploaded by

HADTUGICopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

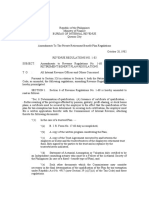

October 28, 1982

REVENUE REGULATIONS NO. 01-83

SUBJECT : Amendments to Revenue Regulations No. 1-68 or the Private

Retirement Benefit Plan Regulations

TO : All Internal Revenue Officers and Others Concerned

Pursuant to Section 326 in relation to Section 4, both of the National

Internal Revenue Code, as amended, the following regulations, amending

Revenue Regulations No. 1-68, are hereby promulgated. acd

SECTION 1. Section 6 of Revenue Regulations No. 1-68 hereby

amended to read as follows:

"Sec. 6. Determination of qualification. (A) Issuance of certificate

of qualification. — Before availing of the privileges afforded by pension,

gratuity, profit-sharing, or stock bonus plans, a certificate must be

secured by the employer to the effect that the qualification of the plan

for tax-exemption has been determined. In securing such certification,

the employer must file a written application therefor with the

Commissioner of Internal Revenue, attaching thereto the following

documents: acd

"(1) In the case of a trusteed Plan. -

"(a) B.I.R. Form No. 17.60 duly accomplished;

"(b) A copy of the written program constituting the Plan;

"(c) A copy of the Trust Agreement executed by and between

the employer as trustor and the trustee/trustees of the employees

retirement trust fund, duly signed by the parties to the trust and

acceptance by the trustee/trustees indicated;

"(d) Statement of Actuarial Assumption or Valuation duly

certified to by an independent consulting actuary who must be a

Fellow of the Actuarial Society of the Philippines (in the case of a

fixed-benefit type of Plan); and

"(e) Such other documents which the Commissioner may

consider necessary in the final determination of the qualification of

the Plan for tax-exemption under Republic Act No. 4917 (now

Section 29(c)(7)(A) of the Tax Code and these regulations.

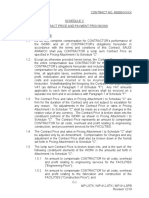

(2) In the case of a non-trusteed/insured Plan. —

"(a) B.I. R. Form No. 17.60 duly accomplished;

"(b) A copy of the written program constituting the Plan;

"(c) A copy of the Deposit Administration Contract Deferred

Annuity Contract executed by and between the employer or the

insured or policyholder and the Insurance Company as the insurer;

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

and

"(d) Such other documents which the Commissioner may

consider necessary in the final determination of the publication of

the Plan for tax-exemption. acd

(3) In the case of Multi-employer Plans. —

"The same documentation requirements as in paragraph (A)

(1) or paragraph (A)(2), as the case may be, this Section should be

submitted for each of the participating employers together with

the Participating Agreement.

"Upon receipt of the application, the same together with the

supporting documents shall be referred to the Government and

Tax Exempt Corporation Division for field investigation and

verification of the employee's trust's (Retirement Plan) compliance

with the requirements provided for by Section 29(c)(7)(A) of the

Tax Code and these regulations, after which the Commissioner of

Internal Revenue shall decide whether or not the plan is so

qualified. If the Commissioner decides that the plan is qualified, he

shall issue a certificate of qualification, upon payment of the

corresponding fee prescribed in paragraph (B) of this Section.

However, if he decides that the Plan is not qualified, he shall

inform the employer of his decision and the reasons supporting the

same. cd i

"During the period that the Plan is in operation, amendments

thereto may be introduced. Such amendments should also be

submitted for certification that the amendment or amendments do

not affect the qualification of the Plan. If found to be beneficial to

the employee-members of the Plan, an amendatory certification of

qualification shall be issued by the Commissioner of Internal

Revenue, upon payment of the corresponding fee prescribed in

paragraph (B) of this section.

"(B) Fees to be paid by the employer:

"1. Upon issuance of the certificate of qualification -

employers not having more than

"(a)

50

employers P250

employers having more than 50

"(b)

but

not over 100 employees P350

"(c) employers having more than 100

employees P500

"2. Upon issuance of an amendatory certificate of

qualification -

employers not having more than

"(a)

50

employees P200

employers having more than 50

"(b)

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

but

not over 100 employees P300

"(c) employers having more than 100

employees P450

"Provided, however, that employers not having more than

five (5) employees shall be exempt from the fees prescribed by

these regulations. cd

"Said fees shall accrue to the General Fund and shall be

deposited with the National Treasury."

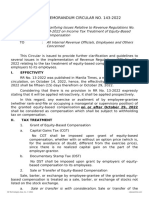

SECTION 2. Revenue Regulations No. 1-68 is hereby amended by

adding a new section to be known as Section 7, and to read as follows:

"Sec. 7. Filing and examination of annual information return . —

When a certificate of qualification is issued by the Commissioner of

Internal Revenue, the employees' (trusteed Retirement Plan) trust

need not thereafter make and file a return of its income. However, the

trustees or fiduciaries of qualified (trusteed) Retirement Plan should file

on or before April 15 of each year, with the Government and Tax

Exemption Corporation Division of the Bureau of Internal Revenue, an

annual information return (B.I.R. Form No. ___ ) under oath, stating its

gross income or total amount in the trust fund; total employer's

contributions for past and current service liabilities; total employees'

contributions, if any; earnings/yield from investments of the fund,

nature of investment/investments, name and address of Bank or

Investment House, expenses incurred; and payments of benefits under

the Plan during the preceding year, together with a certification

showing whether or not there is any amendment or modification in the

Plan rules and regulations, Trust Agreement Actuarial valuation or

assumptions, funding, Collective Bargaining Agreement, if any, manner

of operation and activities as well as sources and disposition of the

trust fund.

"The annual information return shall be examined by examiner,

of the Government and Tax Exempt Corporation Division and the report

of examination shall be processed as in the case of a regular return."

SECTION 3. Section 7 of the Revenue Regulations No. 1-68 hereby

renumbered as Section 8 and amended to read as follows: cdt

"Sec. 8. Coverage of the exemption. — Republic Act No. 4917

(now Section 29(c)(7)(A) of the Tax Code) took effect on June 17, 1967.

Employees retiring after this date under a benefit plan established

prior to said date but which qualifies as herein provided shall be

entitled to exemption. Such plan must, however, be submitted for

determination of its qualification as provided for in Section 6 of these

regulations.

"Exemption shall also apply to employees involuntarily separated

from the services of their employers after said date.

"Tax-exemption privileges under a qualified Retirement Plan shall

retroact to the date of effectivity of the Plan."

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

SECTION 4. Revenue Regulations No. 1-68 is hereby amended by

adding a new section to be known as Section 9, to read as follows:

"Sec. 9. Penalty Provision . — By virtue of Section 337 of the

National Internal Revenue Code, any person required to make an

annual information return or to supply information required under

these regulations who fails to make such return or to supply such

information at the time specified therein shall be liable to a fine of not

more than three hundred pesos or imprisonment for not more than six

months, or both."

SECTION 5. Effectivity. — These regulations shall take effect thirty (30)

days after their publication in newspapers of general circulation in the

Philippines. cdasia

(SGD.) CESAR VIRATA

Minister of Finance

Recommended by:

(SGD.) RUBEN B. ANCHETA

Acting Commissioner

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- RevenueRegulations1 83Document4 pagesRevenueRegulations1 83Ansherina Francisco100% (1)

- Regional Franchising and Regulatory Office No. - : Form No. 012: With hearing-RFRO Revised As of 2/24/2021Document2 pagesRegional Franchising and Regulatory Office No. - : Form No. 012: With hearing-RFRO Revised As of 2/24/2021HADTUGI100% (1)

- Schedule C CONTRACT PRICE AND PAYMENT PROVISIONSDocument30 pagesSchedule C CONTRACT PRICE AND PAYMENT PROVISIONSxue jun xiangNo ratings yet

- RR 1-68Document10 pagesRR 1-68Crnc Navidad100% (1)

- Schedule CDocument22 pagesSchedule Cwangrui67% (3)

- Contrato Maurice J. Spagnoletti y Doral BankDocument33 pagesContrato Maurice J. Spagnoletti y Doral BankElcoLaoNo ratings yet

- 306Document24 pages306syikinNo ratings yet

- Revenue Regulations On Retirement Benefit Plans PDFDocument15 pagesRevenue Regulations On Retirement Benefit Plans PDFJadeNo ratings yet

- Computation of Income From SalaryDocument30 pagesComputation of Income From SalaryMayur N MalviyaNo ratings yet

- The Companies Audit of Cost Accounts Regulations 2020 CompressedDocument116 pagesThe Companies Audit of Cost Accounts Regulations 2020 CompressedMuhammad WaqarNo ratings yet

- Special Conditions of Contract: 1. PurposeDocument5 pagesSpecial Conditions of Contract: 1. PurposeWossen DemissNo ratings yet

- 5074-1989-Exemption of Retirement Benefits Pensions20210505-12-1k73811Document2 pages5074-1989-Exemption of Retirement Benefits Pensions20210505-12-1k73811Reymund S BumanglagNo ratings yet

- IT Act Changes PDFDocument7 pagesIT Act Changes PDFSanjeev KumarNo ratings yet

- Tender ConditionDocument14 pagesTender Conditionsiraj sNo ratings yet

- SSC Circular No 2010-004 (IRR of RA 9903)Document4 pagesSSC Circular No 2010-004 (IRR of RA 9903)louis adriano baguioNo ratings yet

- COA CIRCULAR NO. 82 101 I September 14 1982Document10 pagesCOA CIRCULAR NO. 82 101 I September 14 1982recx.jyke06No ratings yet

- Ohio Senate Bill To Eliminate Income TaxesDocument57 pagesOhio Senate Bill To Eliminate Income TaxesWews WebStaffNo ratings yet

- Special Conditions of Contract - ERP Clauses-FINALDocument16 pagesSpecial Conditions of Contract - ERP Clauses-FINALSukti SomNo ratings yet

- Ohio House Bill To Eliminate Income TaxesDocument58 pagesOhio House Bill To Eliminate Income TaxesWews WebStaffNo ratings yet

- 4.3 Approval of Personnel: II. General Conditions of Contract 89Document2 pages4.3 Approval of Personnel: II. General Conditions of Contract 89Anonymous ufMAGXcskMNo ratings yet

- Companies-Act-2017 (Audit Clauses)Document9 pagesCompanies-Act-2017 (Audit Clauses)Hanaan TalibNo ratings yet

- Bonus Act, 2030 (1974) Last AmendmentsDocument11 pagesBonus Act, 2030 (1974) Last AmendmentsDeep JoshiNo ratings yet

- SSA-210-R1 Agreeing The Terms of Audit EngagementsDocument22 pagesSSA-210-R1 Agreeing The Terms of Audit EngagementsAndreiNo ratings yet

- Section-V: Special Conditions of Contract (SCC) : 1.0 Definition of Terms: 1.1 1.2 2.0 General Information: 2.1Document11 pagesSection-V: Special Conditions of Contract (SCC) : 1.0 Definition of Terms: 1.1 1.2 2.0 General Information: 2.1raj1508No ratings yet

- 06 Schedule A (SC)Document5 pages06 Schedule A (SC)Steve KiarieNo ratings yet

- PaymentWagesLaw EngDocument13 pagesPaymentWagesLaw EngHZMMNo ratings yet

- Amendments To Section 42 RegulationsDocument20 pagesAmendments To Section 42 RegulationsrabiaNo ratings yet

- Audit Under Fiscal Laws - NotesDocument17 pagesAudit Under Fiscal Laws - NotesabhiNo ratings yet

- Establishment of Retirement PlanDocument3 pagesEstablishment of Retirement PlanVioleta StancuNo ratings yet

- Supervision ProjDocument14 pagesSupervision ProjHeni yitNo ratings yet

- Schedule C (Par 6.8) BG in LieuDocument28 pagesSchedule C (Par 6.8) BG in LieuwangruiNo ratings yet

- ITax Regulations GN78 of 1996Document94 pagesITax Regulations GN78 of 1996Akash TeeluckNo ratings yet

- Request For QuotationDocument7 pagesRequest For QuotationKim Patrick VictoriaNo ratings yet

- Payment and Milestone SchedulesDocument71 pagesPayment and Milestone SchedulesCu Ti100% (1)

- 340275-2022-Clarifying Issues Relative To Revenue20221114-12-R8lqtsDocument4 pages340275-2022-Clarifying Issues Relative To Revenue20221114-12-R8lqtsRen Mar CruzNo ratings yet

- Model Agreement - KBM & KBMDocument7 pagesModel Agreement - KBM & KBMkanishk.basuNo ratings yet

- Geodetic Scope of WorkDocument24 pagesGeodetic Scope of WorkKris Aileen CortezNo ratings yet

- The Contract Labour (Regulation and Abolition) ACT, 1970Document38 pagesThe Contract Labour (Regulation and Abolition) ACT, 1970megha139No ratings yet

- ESOP and Sweat EquityDocument7 pagesESOP and Sweat EquityShehana RenjuNo ratings yet

- SWD 7000009823 050122Document21 pagesSWD 7000009823 050122Pawan PassiNo ratings yet

- Procedure of Approval of Gratuity Funds Under Income Tax Act, 1961 - Taxguru - inDocument15 pagesProcedure of Approval of Gratuity Funds Under Income Tax Act, 1961 - Taxguru - inJay SharmaNo ratings yet

- The Contract Labour (Regulation and Abolition) ACT, 1970Document37 pagesThe Contract Labour (Regulation and Abolition) ACT, 1970sunaina754No ratings yet

- Ra 6971 PDFDocument4 pagesRa 6971 PDFMonicaMoscosoNo ratings yet

- BIR Ruling (DA-243-00)Document3 pagesBIR Ruling (DA-243-00)bulasa.jefferson16No ratings yet

- S. 3760 Automatic IRA Act 5 of 2010''.Document50 pagesS. 3760 Automatic IRA Act 5 of 2010''.Joe WallinNo ratings yet

- Lien On Assets of The Company Under Labour LawsDocument2 pagesLien On Assets of The Company Under Labour LawsSamaksh KhannaNo ratings yet

- Ca Audit PDFDocument154 pagesCa Audit PDFsandesh1506No ratings yet

- Draft Contract - ManpowerDocument10 pagesDraft Contract - ManpowerMitchie Binarao BaylonNo ratings yet

- Rdig 22082022Document28 pagesRdig 22082022Mohamad EzarinNo ratings yet

- REPUBLIC ACT No 10846 (Sec.8-13)Document3 pagesREPUBLIC ACT No 10846 (Sec.8-13)School FilesNo ratings yet

- The Income Tax Act No. 16 of 2017Document8 pagesThe Income Tax Act No. 16 of 2017cholaNo ratings yet

- Title Ii Chapter XiiiDocument5 pagesTitle Ii Chapter XiiiMae CarpilaNo ratings yet

- NSSF (Contracting Out by Employers) Regulations, 2014Document9 pagesNSSF (Contracting Out by Employers) Regulations, 2014Nicholas MutembeiNo ratings yet

- Company Law SectionsDocument4 pagesCompany Law SectionsnbaghrechaNo ratings yet

- 263081-2019-Revised Securities Regulation Code SRC Rule20210728-11-K6tsx3Document61 pages263081-2019-Revised Securities Regulation Code SRC Rule20210728-11-K6tsx3Regina RozarioNo ratings yet

- Consortium Condition-JammuDocument2 pagesConsortium Condition-Jammusaket sagarNo ratings yet

- PerquisitesDocument6 pagesPerquisitesArgha DeySarkarNo ratings yet

- Tendernotice 2Document11 pagesTendernotice 2Saravana BhavanNo ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument15 pagesTest Series: November, 2021 Mock Test Paper 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingYashNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- 1962 Castro V Collector of Internal Revenu 220512 074530Document15 pages1962 Castro V Collector of Internal Revenu 220512 074530HADTUGINo ratings yet

- Petitioner Respondents F R Quiogue: Commissioner of Internal Revenue, TMX Sales, Inc. and The Court of Tax AppealsDocument8 pagesPetitioner Respondents F R Quiogue: Commissioner of Internal Revenue, TMX Sales, Inc. and The Court of Tax AppealsHADTUGINo ratings yet

- 2021 Ihl Moot Court RulesDocument10 pages2021 Ihl Moot Court RulesHADTUGINo ratings yet

- Duterte - Boracay Is Government Property - The Manila TimesDocument1 pageDuterte - Boracay Is Government Property - The Manila TimesHADTUGINo ratings yet

- The Importance of Direct ExaminationDocument5 pagesThe Importance of Direct ExaminationHADTUGINo ratings yet

- Nuremberg Moot Court 2020-LSE-Defense MemoDocument14 pagesNuremberg Moot Court 2020-LSE-Defense MemoHADTUGINo ratings yet

- Nuremberg Moot Court 2019Document14 pagesNuremberg Moot Court 2019HADTUGINo ratings yet

- Nuremberg Moot Court 2022 Case AktualisiertDocument6 pagesNuremberg Moot Court 2022 Case AktualisiertHADTUGINo ratings yet

- Strengthening The Marine Protected Area System To Conserve Marine Key Biodiversity Areas (Smart Seas Philippines)Document68 pagesStrengthening The Marine Protected Area System To Conserve Marine Key Biodiversity Areas (Smart Seas Philippines)HADTUGINo ratings yet

- Skills That Future Lawyers NeedDocument2 pagesSkills That Future Lawyers NeedHADTUGINo ratings yet

- Petitioners Respondents Alfredo L. EndayaDocument9 pagesPetitioners Respondents Alfredo L. EndayaHADTUGINo ratings yet

- Case ThemesDocument17 pagesCase ThemesHADTUGINo ratings yet

- 164094-2009-Keppel Cebu Shipyard Inc. v. Pioneer20210424-14-Eea4foDocument29 pages164094-2009-Keppel Cebu Shipyard Inc. v. Pioneer20210424-14-Eea4foHADTUGINo ratings yet

- OpeningstatementsDocument8 pagesOpeningstatementsHADTUGINo ratings yet

- 166783-2011-Keppel Cebu Shipyard Inc. v. Pioneer20210424-14-Pz9mxuDocument11 pages166783-2011-Keppel Cebu Shipyard Inc. v. Pioneer20210424-14-Pz9mxuHADTUGINo ratings yet

- Petitioners Respondent: Third DivisionDocument20 pagesPetitioners Respondent: Third DivisionHADTUGINo ratings yet

- Petitioners Respondents Del Rosario & Del Rosario Law Office Abraham Anonas Astorga & Macamay Law Office Siguion Reyna Montecillo & OngsiakoDocument7 pagesPetitioners Respondents Del Rosario & Del Rosario Law Office Abraham Anonas Astorga & Macamay Law Office Siguion Reyna Montecillo & OngsiakoHADTUGINo ratings yet

- Acctg Case 1Document3 pagesAcctg Case 1HADTUGINo ratings yet

- Petitioners: en BancDocument5 pagesPetitioners: en BancHADTUGINo ratings yet

- IAET Case 2Document13 pagesIAET Case 2HADTUGINo ratings yet

- IAET Case 3Document10 pagesIAET Case 3HADTUGINo ratings yet

- Chapter 7: National Income Determination: Exercise 1: Identification Exercise 4: IdentificationDocument7 pagesChapter 7: National Income Determination: Exercise 1: Identification Exercise 4: IdentificationKiahna Clare ArdaNo ratings yet

- Learning Guide: Shashamane Poly Technic CollageDocument48 pagesLearning Guide: Shashamane Poly Technic CollageGizaw TadesseNo ratings yet

- AAACL9620N INSIGHT VER 02 Service Letter 2014-15 4914106196200001 01022022 PDFDocument1 pageAAACL9620N INSIGHT VER 02 Service Letter 2014-15 4914106196200001 01022022 PDFuodal rajNo ratings yet

- Axis Bank Airport Lounge Access ProgramDocument5 pagesAxis Bank Airport Lounge Access ProgramHimanshuNo ratings yet

- Seller Portal - JioMart 21Document2 pagesSeller Portal - JioMart 21Aman PathakNo ratings yet

- Tutorial 2 Chapter 5 With AnswersDocument9 pagesTutorial 2 Chapter 5 With AnswersNoor TaherNo ratings yet

- Financial Management:: The Time Value of Money-The BasicsDocument67 pagesFinancial Management:: The Time Value of Money-The Basicsfreakguy 313No ratings yet

- Naylor PadstonesDocument24 pagesNaylor PadstonesKovacs Zsolt-IstvanNo ratings yet

- Economic Project Mohd Naved Alam Ansari B.A.LL.B (S/F) Ist Year Jamia Millia IslamiaDocument13 pagesEconomic Project Mohd Naved Alam Ansari B.A.LL.B (S/F) Ist Year Jamia Millia IslamiaMohd ArhamNo ratings yet

- NPP 2020 Final Web PDFDocument216 pagesNPP 2020 Final Web PDFMawuli AhorlumegahNo ratings yet

- 50,000 Chit - 20 Months: S.No Month Monthly Amount Chit AmountDocument1 page50,000 Chit - 20 Months: S.No Month Monthly Amount Chit Amountkchinni_428No ratings yet

- Survey of Economics Principles Applications and Tools 7th Edition Osullivan Test BankDocument48 pagesSurvey of Economics Principles Applications and Tools 7th Edition Osullivan Test Bankanthonywilliamsfdbjwekgqm100% (28)

- Sunmbo Bukoye Oladejo - 9158705127 - 20240406232518Document2 pagesSunmbo Bukoye Oladejo - 9158705127 - 20240406232518mr6522294No ratings yet

- Approaches To ValuationDocument18 pagesApproaches To ValuationSeemaNo ratings yet

- UBS Pitchbook TemplateDocument19 pagesUBS Pitchbook Templatektp24415100% (1)

- IFR Awards 2022 RoHDocument3 pagesIFR Awards 2022 RoHRonnie KurtzbardNo ratings yet

- DTC Participant in Numerical Sequence 3Document24 pagesDTC Participant in Numerical Sequence 3Ann BoudreauxNo ratings yet

- Macroeconomics: Ninth Canadian EditionDocument48 pagesMacroeconomics: Ninth Canadian EditionUzma KhanNo ratings yet

- CHP 26Document7 pagesCHP 26evelynNo ratings yet

- Flange Carbon Steel ANSI CatalogDocument4 pagesFlange Carbon Steel ANSI CatalogKhonlong TangNo ratings yet

- North America Downstream Outlook 2020Document104 pagesNorth America Downstream Outlook 2020Alex WangNo ratings yet

- مكانة الوكالة الوطنية لتطوير الإستثمار في تشجيع الإستثمار في الجزائر باستخدام التحفيزات الجبائيةDocument30 pagesمكانة الوكالة الوطنية لتطوير الإستثمار في تشجيع الإستثمار في الجزائر باستخدام التحفيزات الجبائيةعبد الحميدNo ratings yet

- Exercises For Practical DSGE Modelling: Alina Barnett Martin EllisonDocument36 pagesExercises For Practical DSGE Modelling: Alina Barnett Martin Ellisonengli abdelNo ratings yet

- Chapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessDocument51 pagesChapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessabateNo ratings yet

- Me Unit 1Document29 pagesMe Unit 1Sangram SahooNo ratings yet

- International Financial Management Abridged 10 Edition: by Jeff MaduraDocument13 pagesInternational Financial Management Abridged 10 Edition: by Jeff MaduraHiếu Nhi TrịnhNo ratings yet

- Presentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Document20 pagesPresentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Buddhapratap RathoreNo ratings yet

- C01 Accounting in Action - EDITEDDocument53 pagesC01 Accounting in Action - EDITEDRaella FernandezNo ratings yet

- Chapter 10 Translation of Foreign Currency Financial Statements PDFDocument28 pagesChapter 10 Translation of Foreign Currency Financial Statements PDFKim Taehyung91% (23)

- PDF CropDocument4 pagesPDF Crop04vijilNo ratings yet