Professional Documents

Culture Documents

Sluciones Opciones Set

Sluciones Opciones Set

Uploaded by

HajjiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sluciones Opciones Set

Sluciones Opciones Set

Uploaded by

HajjiCopyright:

Available Formats

Problems 1 through 10, part a).

Payoff #1 #2 Payoff #3

Payoff

+20

+20 +20

+10

+10 +10

0 S

+10 +20

0 S 0 S

+10 +20 +10 +20 -10

-10 -10

Payoff #4 Payoff #5 Payoff #6

+20 +20 +20

+10 +10 +10

0 S 0 S 0 S

+10 +20 +10 +20 +10 +20

-10 -10 -10

Payoff #7 Payoff #8 Payoff #9

+20 +20 +20

+10 +10 +10

0 S 0 S 0 S

+10 +20 +10 +20 +10 +20

-10 -10 -10

Payoff #10

+20

+10

0 S

+10 +20

-10

Fi8000 Practice Set #1 Check Solutions 1

Problem b) Profitable Range c) Maximum Profit c) Maximum Loss

1 S < $22.80 $12.80 Unlimited

2 S > $22.60 $7.40 $2.60

3 S > $13.10 $6.90 $13.10

4 S < $7.00 and S > $33.00 Unlimited $8.00

5 S > $24.30 Unlimited $19.30

6 S > $30.20 Unlimited $10.20

7 S < $22.80 $12.80 Unlimited

8 S < $12.00 and S > $38.00 Unlimited $13.00

9 $12.20 < S < $27.80 $2.80 $2.20

10 S < $22.00 $2.00 $3.00

11. Long Put, X=20; Short Bond, FV=10.

12. Long Put, X=15; Long Call, X=25; Long Bond, FV=10.

13. Short Put, X=20; Short Call, X=25; Long Bond, FV=5.

14. Long Put, X=20; Short Put, X=10; Long Call, X=20; Short Call, X=30.

15. Short Put, X=20; Long Call, X=25; Short Call, X=30; Long Bond, FV=10.

16. Short Put, X=30; Lon Put, X=15; Short Call, X=30; Long Bond, FV=5.

17. Note that the payoff to Call A is always greater than or equal to the payoff to Call B. Since Call A is

cheaper, we buy Call A and write (sell) Call B, pocketing $1.25 today. At expiration, we use any payoff

from Call A to payoff anything due on Call B. At worst, we get zero at expiration and at best we get $10 at

expiration. Thus, we have an arbitrage opportunity. The table shows the transactions and cash flows.

Today (time 0)

Transaction Cash Flow

Buy a call, X=50 - 5.25

Write a call, X=60 + 6.50

Net cash flow + 1.25

Expiration (time 1)

Position S < 50 S = 50 50 < S < 60 S = 60 S > 60

Long call, X=50 0 0 S – 50 10 S – 50

Short call, X=60 0 0 0 0 60 – S

Net cash flow 0 0 0 to +10 +10 +10

18. This is similar to the last problem. The payoff to Put Z is always greater than or equal to the payoff to Put

Y. Since Put Z is cheaper, we buy Put Z and write (sell) Put Y, pocketing $0.75 today. At expiration, we

use any payoff from Put Z to payoff anything due on Put Y. At worst, we get zero at expiration and at best

we get $10 at expiration. Thus, we have an arbitrage opportunity. The table shows the transactions and cash

flows.

Today (time 0)

Transaction Cash Flow

Buy a put, X=40 - 2.50

Write a put, X=30 + 3.25

Net cash flow + 0.75

Fi8000 Practice Set #1 Check Solutions 2

Expiration (time 1)

Position S < 30 S = 30 30 < S < 40 S = 40 S > 40

Long put, X=40 40 – S + 10 40 – S 0 0

Short put, X=30 S – 30 0 0 0 0

Net cash flow + 10 +10 0 to +10 0 0

19. We can now make general statements based on 17. and 18. Call options (on the same underlying stock and

the same expiration date) with lower strike prices must have premiums greater than or equal to the

premiums of call options with higher strike prices. So, C(X1) C(X2). Put options (on the same underlying

stock and the same expiration date) with lower strike prices must have premiums less than or equal to the

premiums of put options with higher strike prices. So, P(X1) P(X2).

20. According to put-call parity, P = C + X

− S . Using the interest rate and prices for the call and stock,

(1 + r )T

we can replicate a long position in a put at a cost of negative $2.68! The price of a put (whose minimum

payoff is zero) must be at least zero. So, we can get paid for “buying” portfolio that replicates a long

position in the put. This must be an arbitrage opportunity since we never have a negative cash flow and we

earn a profit. The table shows the transactions and cash flows.

Today (time 0)

Transaction Cash Flow

Buy a call, X=90 - 3.50

Buy a bond, FV=90 - 81.82

Short sell the stock + 88.00

Net cash flow + 2.68

Expiration (time 1)

Position S < 90 S = 90 S > 90

Long call, X=90 0 0 S – 90

Long bond, FV=90 + 90 + 90 + 90

Short stock -S - 90 -S

Net cash flow 0 to +90 0 0

X

21. According to put-call parity, P =C+ − S . Using the interest rate and prices for the call and

(1 + r )T

stock, we can replicate a long position in a put at a cost of $6.07. This is cheaper than we could buy the real

put. So, buy the portfolio that replicates the put and sell the real put. The table shows the transactions and

cash flows to answer part a).Note that the transactions in the table are the same no matter what you

replicate (call vs. put).

b) $6.07

c) $7.93

d) $76.07

e) 0.0000%

Today (time 0)

Transaction Cash Flow

Buy a call, X=80 - 6.00

Buy a bond, FV=80 - 78.07

Short sell the stock + 78.00

Write a put, X=80 + 8.00

Net cash flow + 1.93

Fi8000 Practice Set #1 Check Solutions 3

Expiration (time 1)

Position S < 80 S = 80 S > 80

Long call, X=80 0 0 S – 80

Long bond, FV=80 + 80 + 80 + 80

Short stock -S - 80 -S

Short put, X=80 S – 80 0 0

Net cash flow 0 0 0

22. The deviation from put-call parity should be fairly small. If it is within $0.50 or so, then transaction costs

are very likely to wipe out any arbitrage profit. Also, the borrowing rate might be higher for us than the T-

bill rate. So, try the arbitrage strategy assuming that you must pay a premium in excess of 1% over the T-

bill rate. Again, this along with transaction costs should render any attempt at the arbitrage strategy costly

(i.e., no arbitrage). Also, be sure you have not chosen a dividend paying stock. What about early exercise?

These are American options. Put-call parity only applies to European options.

X

23. We can replicate the stock by rearranging the put-call parity formula as S =C+ − P . So, we

(1 + r ) T

replicate the stock by buying a call, buying a bond, and selling a put. Note that we have two strike prices,

so we can get two synthetic stock values:

X1 60

S1 = C( X 1) + − P( X 1) = 10 + − 3.50 = 63.10 and

(1 + r )T 1.06

X2 65

S2 = C ( X 2) + − P ( X 2) = 6 + − 4.50 = 62.82 . Since the replicating portfolio using

(1 + r )T 1.06

X2 is cheaper, we will buy this portfolio and sell the other portfolio that uses X1. Every time we do this, we

create a riskless position and pocket the difference between the costs of the two portfolios. We must now

show the cash flows at the relevant dates (time 0 is today and time 1 is at expiration) to show that this is an

arbitrage strategy. We enter into the positions today and check the value of those positions (assuming we

get out of the positions) at expiration. Because we are using two strike prices here, we must check the value

of our positions in 5 states of the world at expiration.

Today (time 0)

Transaction Cash Flow

Buy a call, X=65 -6.00

Buy bond, FV=65 -61.32

Write a put, X=65 +4.50

Write a call, X=60 +10.00

Sell a bond, FV=60 +56.60

Buy a put, X=60 -3.50

Net cash flow +0.28

Expiration (time 1)

Position S < 60 S = 60 60 < S < 65 S = 65 S > 65

Long call, X=65 0 0 0 0 S – 65

Long bond, FV=65 + 65 + 65 + 65 + 65 + 65

Short put, X=65 S – 65 -5 S – 65 0 0

Short call, X=60 0 0 60 – S -5 60 – S

Short bond, FV=60 - 60 - 60 - 60 - 60 - 60

Long put, X=60 60 – S 0 0 0 0

Net cash flow 0 0 0 0 0

Fi8000 Practice Set #1 Check Solutions 4

24. As with the previous problem, we can rearrange the put-call parity formula to replicate the riskfree asset

X

(i.e., the bond). So, = P + S − C . Note that the right hand side of this equation is the portfolio

(1 + r )T

that replicates the bond that pays a return or r. So, to earn this rate we would buy the put and stock and

write a call. To determine what rate this portfolio will give us, we solve for the riskfree rate,

1

r =

X T − 1 . Solving for the rate using the options with a strike price of X1, we find that

P + S −C

r1=8.6957%. Using X2, we get r2=10%. Which rate should we “buy”? When we buy (i.e., invest), we want

the highest rate of return. Therefore, we should buy the portfolio using X2, since it gives us a riskfree

return of 10%. We want to sell the portfolio that uses X1, since we will essentially borrow that money at a

rate of 8.6957%.

The challenge here is to make sure that we never have a negative cash flow. If we were to naïvely buy the

portfolio using X1 and sell the portfolio using X2, then we would end up with negative cash flows. This

would violate the conditions for an arbitrage strategy. Since we are buying and selling bonds (really we are

buying and selling portfolios that replicate bonds), let’s make sure that we buy and sell bonds so that our

total “face value” (i.e., payment at maturity) is the same between what we buy and sell. Since the X1

“bond” (portfolio using X1) has a face value of $100 and the X2 “bond” has a face value of $110, we can

use 11 of the X1 “bond” and 10 of the X2 “bond” so that the total of both (i.e., the total face value) is

$1,100 at maturity or expiration. Again, we must show the transactions and cash flows to open the positions

today and the payoffs or values of these positions at expiration.

Note that I have left the “short 11 shares” and “long 10 shares” as separate transactions in order to make

this more transparent. Of course, we could just use “short 1 share,” leaving the result unchanged.

Today (time 0)

Transaction Cash Flow

Write 11 puts, X=100 + 132

Sell short 11 shares of + 1155

stock

Buy 11 calls, X=100 - 275

Write 10 calls, X=110 + 150

Buy 10 shares of stock - 1050

Buy 10 puts, X=110 - 100

Net cash flow +12

Expiration (time 1)

Position S < 100 S = 100 100 < S < 110 S = 110 S > 110

Short 11 puts, X=100 11S – 1100 0 0 0 0

Short 11 shares - 11S - 1100 - 11S - 1210 - 11S

Long 11 calls, X=100 0 0 11S – 1100 + 110 11S – 1100

Short 10 calls, X=110 0 0 0 0 1100 – 10S

Long 10 shares + 10S + 1000 + 10S + 1100 + 10S

Long 10 puts, X=110 1100 – 10S + 100 1100 – 10S 0 0

Net cash flow 0 0 0 0 0

Fi8000 Practice Set #1 Check Solutions 5

25. a) $5.1542; N=0.8866, B=-41.84

b) $0.2311; N=-0.1134, B=6.24

26. a) $3.6165; N=0.6465, B=-29.35

b) $0.6934; N=-0.3535, B=18.72

c) The call premium increases and put premium decreases as the price of the underlying asset increases.

27. a) $1.5947; N=0.2743, B=-12.94

b) $1.4793; N=-0.7257, B=39.94

c) The call premium decreases and the put premium increases as the strike price increases.

28. a) $5.8302; N=0.7775, B=-35.38

b) $0.9071; N=-0.2225, B=12.70

c) The call and put premiums increase with an increase in volatility.

29. a) $5.9436; N=0.8866, B=-41.05

b) $0.1134; N=-0.1134, B=6.12

c) The call premium increases and the put premium decreases with an increase in the riskfree rate.

30. a) and c) $7.0564; Cu=$9.1631, Cd=$2.1357

b) and d) $0.2842; Pu=$0, Pd=$1.1386

e) The put and call premiums increase with an increase in time to expiration. Note: this is true, in general,

for all call options, but not for put options.

31. a) $3.4560; Cu=$4.8546, Cd=$0

b) $1.3067; Pu=$0.4993, Pd=$3.8105

c) $3.4560; Cu=$4.8546, Cd=$0

d) $1.8347; Pu=$0.4993, Pd=$5.9259

e) The is no value to early exercise for an American call, but there is value to the early exercise option for

some put options.

32. Since the market price for the real call is $4.75 and the price of the synthetic call (replicating portfolio) is

$5.1542, we should buy the real call and short sell the replicating portfolio. Below are the transactions and

cash flows that occur today (time 0) and at expiration (time 1). We show that we satisfy the three

conditions of an arbitrage opportunity.

Time 0 Time 1

Transaction CF Position CF (up) CF (down)

Short sell 0.8866 shares Short 0.8866 shares of

+$46.9904 -$50.7496 -$43.0596

of stock stock

Invest $41.8362 in the

-$41.8362 Long riskfree bond +$43.5096 +$43.5096

riskfree bond

Buy one real call -$4.7500 Long one call +$7.2400 $0.0000

Net cash flow +$0.4042 New cash flow $0.0000 $0.0000

33. Now the market price for the real call is higher than the price of the synthetic call. So, we should buy the

replicating portfolio and sell the real call.

Time 0 Time 1

Transaction CF Position CF (up) CF (down)

Buy 0.8866 shares of Long 0.8866 shares of

-$46.9904 +$50.7496 +$43.0596

stock stock

Borrow $41.8362 in the

+$41.8362 Short riskfree bond -$43.5096 -$43.5096

riskfree bond

Write a real call +$5.3750 Short one call -$7.2400 $0.0000

Net cash flow +$0.2208 New cash flow $0.0000 $0.0000

Fi8000 Practice Set #1 Check Solutions 6

34. The market price for the real put is higher than the price of the synthetic put. So, we should buy the

replicating portfolio and sell the real put.

Time 0 Time 1

Transaction CF Position CF (up) CF (down)

Short sell 0.1134 shares Short 0.1134 shares of

+$6.0096 -$6.4904 -$5.5645

of stock stock

Invest $6.2408 in the

-$6.2408 Long riskfree bond +$6.4904 +$6.4904

riskfree bond

Write a real put -$0.5000 Short one put $0.0000 -$0.9259

Net cash flow +$0.2688 New cash flow $0.0000 $0.0000

35. The market price for the real call is higher than the price of the synthetic call. So, we should buy the

replicating portfolio and sell the real call. Because we have multiple time periods, we must rebalance our

portfolio at time 1 in order to replicate the payoffs of the call. Note that the rebalancing transactions cost us

nothing. In other words, the replicating portfolio is self-financing.

Time 0

Transaction CF

Buy 0.5945 shares of

-$31.5085

stock

Borrow $28.0525 against

+$28.0525

the riskfree bond

Write a real call +$4.0000

Net cash flow +$0.5440

Time 1 (stock goes up to $57.24)

Current position Desired position Rebalancing transaction CF

Long 0.5945 shares of Long 0.7732 shares of Buy 0.1787 shares of -$10.2400

stock stock stock

Owe $29.1745 Borrow $39.4046 Borrow $10.2400 more +$10.2400

Short one call Short one call - $0.0000

Net cash flow $0.0000

Time 1 (stock goes down to $49.07)

Current position Desired position Rebalancing transaction CF

Long 0.5945 shares of Long 0 shares of stock Sell 0. 5945 shares of +$29.1745

stock stock

Owe $29.1745 Owe nothing Repay loan -$29.1745

Short one call Short one call - $0.0000

Net cash flow $0.0000

Time 2 (stock price starts from $57.24 at time 1)

Position CF (S=$61.8192) CF (S=$53.0000)

Long 0.7732 shares of +$47.8000 +$40.9808

stock

Owe $40.9808 -$40.9808 -$40.9808

Short one call -$6.8192 $0.0000

Net cash flow $0.0000 $0.0000

Time 2 (stock price starts from $49.07 at time 1)

Position CF (S=$53.0000) CF (S=$45.4390)

Long 0 shares $0.0000 $0.0000

Owe nothing $0.0000 $0.0000

Short one call $0.0000 $0.0000

Net cash flow $0.0000 $0.0000

Fi8000 Practice Set #1 Check Solutions 7

Problems 36 through 40. You should use the Black-Scholes spreadsheet that I created.

Problem 41. Create your own spreadsheet and solve for the volatility. Recall that the option premiums increase as

the volatility increases.

Problem 42. It should be the case that the volatility implied (calculated) from the Black-Schole model (again, use a

spreadsheet that you’ve created) for the higher risk stocks should be higher.

Fi8000 Practice Set #1 Check Solutions 8

You might also like

- FIN347 DraftDocument11 pagesFIN347 DraftMUHAMMAD AIMANNo ratings yet

- Describing The Business Transaction (20 Items X 2 Points) : Property of STIDocument1 pageDescribing The Business Transaction (20 Items X 2 Points) : Property of STInew genshinNo ratings yet

- Name: Lourd Justin T. Delicana Course and Code: GE4Document5 pagesName: Lourd Justin T. Delicana Course and Code: GE4Lourd Justin DelicanaNo ratings yet

- Futures & Options Trader Magazine - Sept 2009Document33 pagesFutures & Options Trader Magazine - Sept 2009fmntimeNo ratings yet

- IBM Stock ValuationDocument23 pagesIBM Stock ValuationZ_BajgiranNo ratings yet

- Point Nine Term Sheet TemplateDocument2 pagesPoint Nine Term Sheet TemplateAdam SadowskiNo ratings yet

- Pares Que Suman 20Document1 pagePares Que Suman 20cristina de la fuenteNo ratings yet

- Describing The Business Transaction (20 Items X 2 Points) : Property of STIDocument1 pageDescribing The Business Transaction (20 Items X 2 Points) : Property of STInew genshinNo ratings yet

- 4.2 OptionsDocument12 pages4.2 OptionsTimy WongNo ratings yet

- Colour by Number Mandala 3Document1 pageColour by Number Mandala 3Mercedes ManavellaNo ratings yet

- Colour by Number Mandala 3Document1 pageColour by Number Mandala 3laura riverosNo ratings yet

- Metrado de CunetasDocument44 pagesMetrado de CunetasLEONCIOCARRASCONo ratings yet

- This or That Quiz FormDocument2 pagesThis or That Quiz FormNORINI BINTI MUHARI MoeNo ratings yet

- Le Comple Ment A 100 BDGDocument2 pagesLe Comple Ment A 100 BDGimartinetNo ratings yet

- Exercise 1 CADDocument2 pagesExercise 1 CADCarlo AlbitosNo ratings yet

- OPERATIONAL AMPLIFIER (Example 8 and 9 Solution)Document2 pagesOPERATIONAL AMPLIFIER (Example 8 and 9 Solution)Jay G. Lopez BSEE 1-ANo ratings yet

- Linear Programming For GCDocument14 pagesLinear Programming For GCMarriel Palle TahilNo ratings yet

- 3 - Perfilado y Compactado en Zona de Corte - Perf - CorteDocument10 pages3 - Perfilado y Compactado en Zona de Corte - Perf - CorteFidel JesusNo ratings yet

- Chapter 3 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document8 pagesChapter 3 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese PingolNo ratings yet

- La SumaDocument6 pagesLa Sumawilber coaquira condoriNo ratings yet

- Pares Que Suman 20.5Document1 pagePares Que Suman 20.5CatarinaSantosNo ratings yet

- Adding 10s 1Document2 pagesAdding 10s 1Vinugi De SilvaNo ratings yet

- Eastborne Reality 1Document7 pagesEastborne Reality 1rahulNo ratings yet

- Sol. Man. - Chapter 3 - The Accounting EquationDocument9 pagesSol. Man. - Chapter 3 - The Accounting EquationAmie Jane Miranda100% (2)

- Reference Point LOAD CASE (Unfactored) : Foundation Point Loads - 3bay Hangar (KN)Document2 pagesReference Point LOAD CASE (Unfactored) : Foundation Point Loads - 3bay Hangar (KN)PlacekNo ratings yet

- StatDocument1 pageStatEvendur EverwoodNo ratings yet

- Addition Focus 10 v25 001Document2 pagesAddition Focus 10 v25 001Daniela Osorio YaikinNo ratings yet

- Ibf KeyDocument2 pagesIbf KeyEdelvies Mae BatawangNo ratings yet

- Mediocre Medical Centres - WithformulaviewsDocument13 pagesMediocre Medical Centres - WithformulaviewsUmair RaheemNo ratings yet

- Add 2 Digits 2Document1 pageAdd 2 Digits 2Wi Mae RiNo ratings yet

- Excel Tabel Kelompok 4Document3 pagesExcel Tabel Kelompok 4Kicky AldisarNo ratings yet

- FINA3203 Solution 2Document6 pagesFINA3203 Solution 2simonsin6a30No ratings yet

- Financial Transaction Worksheet, Luca ProblemDocument3 pagesFinancial Transaction Worksheet, Luca ProblemFeiya LiuNo ratings yet

- 1st Centers RompecabezasDocument10 pages1st Centers RompecabezasMaria Ignacia Sanfuentes OteroNo ratings yet

- Prástamo ABC by $100kDocument3 pagesPrástamo ABC by $100kMNo ratings yet

- Screenshot 2023-11-20 at 11.28.09 PMDocument1 pageScreenshot 2023-11-20 at 11.28.09 PMxyznik9No ratings yet

- Financial Transaction Worksheet, Luca ProblemDocument3 pagesFinancial Transaction Worksheet, Luca ProblemFeiya LiuNo ratings yet

- Global Customer Support Manager Salaries (Ogive) : Salary Range Frequency Class Limits Cumulative FrequencyDocument2 pagesGlobal Customer Support Manager Salaries (Ogive) : Salary Range Frequency Class Limits Cumulative FrequencyAdam ZafryNo ratings yet

- Global Customer Support Manager Salaries (Ogive) : Salary Range Frequency Class Limits Cumulative FrequencyDocument2 pagesGlobal Customer Support Manager Salaries (Ogive) : Salary Range Frequency Class Limits Cumulative FrequencyAdam ZafryNo ratings yet

- Pertemuan 15 Soal & Jawaban!Document6 pagesPertemuan 15 Soal & Jawaban!2111102441008No ratings yet

- FinDer, 2023-24, Sample Midterm Exam QS, SolutionDocument3 pagesFinDer, 2023-24, Sample Midterm Exam QS, SolutionYash KshatriyaNo ratings yet

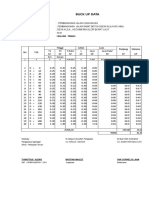

- Buck Up Rabbat Beton MargetaDocument20 pagesBuck Up Rabbat Beton MargetaocyNo ratings yet

- Basic Vocabulary PicturesDocument4 pagesBasic Vocabulary PicturesAngélica Venegas M.No ratings yet

- Addition Focus 20 v50 AllDocument20 pagesAddition Focus 20 v50 AllRinarinarinNo ratings yet

- HALAHDocument2 pagesHALAHHilal ToNo ratings yet

- T N 5521 Number Bonds To 10 and 20 Using Number Shapes Activity SheetDocument4 pagesT N 5521 Number Bonds To 10 and 20 Using Number Shapes Activity SheetNeil PhillipsonNo ratings yet

- Non Negative Assumption Solution by Graphical Method:: Linear ProgrammingDocument11 pagesNon Negative Assumption Solution by Graphical Method:: Linear ProgrammingSayantani SamantaNo ratings yet

- Carnet de Calcul Mental Ceinture Orange 2Document10 pagesCarnet de Calcul Mental Ceinture Orange 2Amandine Matthieu Charra AugatNo ratings yet

- IcDocument12 pagesIcaplicacionestecnologicaucvNo ratings yet

- Mathematics 2Document5 pagesMathematics 2cbennett17No ratings yet

- ML Class (7-8)Document34 pagesML Class (7-8)Shafaq NigarNo ratings yet

- 26 - Station Tataouine T 10 Ans T 20 Ans T 50 Ans T 100 AnsDocument2 pages26 - Station Tataouine T 10 Ans T 20 Ans T 50 Ans T 100 AnsezzoudhNo ratings yet

- Paguio Aivan Gabriel Laboratory-1Document2 pagesPaguio Aivan Gabriel Laboratory-1AivanGabrielPaguioNo ratings yet

- Paguio Aivan Gabriel Laboratory-1Document2 pagesPaguio Aivan Gabriel Laboratory-1AivanGabrielPaguioNo ratings yet

- Kuliah EET Terakhir 22.10.2020Document9 pagesKuliah EET Terakhir 22.10.2020Magdalene SiahaanNo ratings yet

- Wahid ConsultingDocument4 pagesWahid ConsultingMahsun Huda100% (2)

- 1K Savings Challenge TceDocument1 page1K Savings Challenge TceadamthaqimNo ratings yet

- Cell Name Original Value Final ValueDocument4 pagesCell Name Original Value Final ValueTania AnggiNo ratings yet

- Principles of MaicroeconomicsDocument46 pagesPrinciples of MaicroeconomicsNasser AlghanimNo ratings yet

- Adding 10 To A 2 Digit Number Worksheets - 3Document2 pagesAdding 10 To A 2 Digit Number Worksheets - 3alisonNo ratings yet

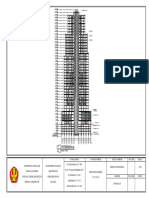

- 34 - Zahra - Denah 2 Lt-Pot Tangga2Document1 page34 - Zahra - Denah 2 Lt-Pot Tangga2Zahra AnggreaniNo ratings yet

- Transport eDocument5 pagesTransport eJose CardenasNo ratings yet

- GABP Posiciones de Opciones ResueltaDocument53 pagesGABP Posiciones de Opciones ResueltaHajjiNo ratings yet

- There Are No Bad Assets - 6-21Document1 pageThere Are No Bad Assets - 6-21HajjiNo ratings yet

- Princeton BCFDocument40 pagesPrinceton BCFHajjiNo ratings yet

- Fixed Income InvestingDocument6 pagesFixed Income InvestingHajjiNo ratings yet

- Test Bank Chapter 2Document3 pagesTest Bank Chapter 2HajjiNo ratings yet

- 8 Underlying, With Bullish and Bearish Strategies For EachDocument3 pages8 Underlying, With Bullish and Bearish Strategies For EachHajjiNo ratings yet

- CSC Ch19 Exchange Traded FundsDocument9 pagesCSC Ch19 Exchange Traded Fundslily northNo ratings yet

- Quiz 1Document2 pagesQuiz 1Camille BagadiongNo ratings yet

- Biocon: Inputs Share Price CalculationDocument5 pagesBiocon: Inputs Share Price CalculationAryaman JunejaNo ratings yet

- Case 2 Apple - Case QuestionsDocument2 pagesCase 2 Apple - Case Questionsvikas singhNo ratings yet

- Answer Illustration 3Document11 pagesAnswer Illustration 3mkesisbereket100% (1)

- Liam Mescall Imp ProbsDocument3 pagesLiam Mescall Imp ProbsLiam MescallNo ratings yet

- Vivek BajajDocument36 pagesVivek BajajSunil VarierNo ratings yet

- Bull Call SpreadDocument3 pagesBull Call SpreadpkkothariNo ratings yet

- Auditing Investments 1Document2 pagesAuditing Investments 1Sabel FordNo ratings yet

- KYC FormDocument52 pagesKYC FormSalil NaikNo ratings yet

- Time Value of Money: - PV FV/ (1+r) - PVA AMT ( (1 - (1+r) ) /R) - FV PV (1+r) - FVA AMT ( ( (1+r) - 1) /R)Document16 pagesTime Value of Money: - PV FV/ (1+r) - PVA AMT ( (1 - (1+r) ) /R) - FV PV (1+r) - FVA AMT ( ( (1+r) - 1) /R)waqas ahmedNo ratings yet

- Beatrice Peabody CaseDocument14 pagesBeatrice Peabody CaseSindhura Mahendran100% (9)

- AK 2 - Exercise Session 7Document2 pagesAK 2 - Exercise Session 7Reta AzkaNo ratings yet

- SEBI Guidelines For IPODocument5 pagesSEBI Guidelines For IPOabhiraj_bangeraNo ratings yet

- Nestle and Alcon - The Value of ADocument33 pagesNestle and Alcon - The Value of Akjpcs120% (1)

- Sulekha - Sept 25, 2008 - Qualified Institutional Placements Value Down 42 PercentDocument2 pagesSulekha - Sept 25, 2008 - Qualified Institutional Placements Value Down 42 PercentJagannadhamNo ratings yet

- MF ISIN CodeDocument49 pagesMF ISIN CodeshriramNo ratings yet

- Keown Valuation and Charactheristic of StockDocument44 pagesKeown Valuation and Charactheristic of Stockmaya husniaNo ratings yet

- Multiple Choice Questions On TreasuryDocument8 pagesMultiple Choice Questions On Treasuryparthasarathi_in100% (1)

- Chapter 24Document18 pagesChapter 24kennyNo ratings yet

- GOTO Fenomena Worst IPODocument3 pagesGOTO Fenomena Worst IPOAnya ForgerNo ratings yet

- Iron OreDocument36 pagesIron OreknowledgeINDIAN0% (1)

- This Study Resource WasDocument9 pagesThis Study Resource WasVishalNo ratings yet

- Name: - ScoreDocument1 pageName: - ScoreIvy MercadoNo ratings yet

- A Study On Ipo MarketDocument104 pagesA Study On Ipo MarketJay PatelNo ratings yet

- DCF Simple Exercises1Document12 pagesDCF Simple Exercises1Lauren JamesNo ratings yet