Professional Documents

Culture Documents

Case For Don Mario Company

Case For Don Mario Company

Uploaded by

Dummy GoogleOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case For Don Mario Company

Case For Don Mario Company

Uploaded by

Dummy GoogleCopyright:

Available Formats

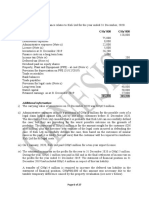

Case for Don Mario Company

Don Mario Company acquires copyright from authors, paying in advance royalties in some cases and

others, paying royalties within 30 days of year-end. Don Mario reported royalty expense of P375,000

for the year ended December 31,2X20. The following data are included in the corporation's

December balance sheet:

2X19 2X20

Prepaid royalties P60,000 P50,000

Royalties payable 75,000 90,000

Under the cash basis, what amount of royalty expense should be reported in 2X20

profit or loss?

Answer:

Royalties Expense, Accrual P 375,000

Royalties Payable, 2X19 75,000

Royalties Payable, 2X20 (90,000)

Prepaid Royalties, 2X19 (60,000)

Prepaid Royalties, 2X20 50,000

Royalties Expense, Cash Basis P 350,000

You might also like

- Solution:: Purchases, Cash Basis P 2,850,000Document2 pagesSolution:: Purchases, Cash Basis P 2,850,000Jen Deloy50% (2)

- Liabilities With Answer For StudentsDocument29 pagesLiabilities With Answer For StudentsDivine CuasayNo ratings yet

- Purchases, Cash Basis P 2,850,000Document2 pagesPurchases, Cash Basis P 2,850,000Dummy GoogleNo ratings yet

- 02 eLMS Activity 1Document2 pages02 eLMS Activity 1Bryan BristolNo ratings yet

- Galanida - 02 Elms Act 1 - IA3Document2 pagesGalanida - 02 Elms Act 1 - IA3Kate GalanidaNo ratings yet

- Receivables ProblemsDocument5 pagesReceivables ProblemsAbbygailNo ratings yet

- Elimination RoundDocument11 pagesElimination RoundDeeNo ratings yet

- Acc311 2021Document4 pagesAcc311 2021hoghidan1No ratings yet

- Prelim Review Docx 427399963 Prelim ReviewDocument42 pagesPrelim Review Docx 427399963 Prelim ReviewMarjorie PalmaNo ratings yet

- Domondon Acctg 3 Prelim ExamDocument3 pagesDomondon Acctg 3 Prelim ExamPrince Anton DomondonNo ratings yet

- Afar-1st-Pb-October-2022 - No AnsDocument15 pagesAfar-1st-Pb-October-2022 - No AnsRhea Mae CarantoNo ratings yet

- Finals Take No 2Document2 pagesFinals Take No 2Wally AranasNo ratings yet

- Lesson 2. Partnership FormationDocument6 pagesLesson 2. Partnership Formationangelinelucastoquero548No ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- ReSA B44 AFAR Final PB Exam Questions Answers and SolutionsDocument28 pagesReSA B44 AFAR Final PB Exam Questions Answers and SolutionsWesNo ratings yet

- Drafting Financial Statements: (International Stream)Document7 pagesDrafting Financial Statements: (International Stream)api-19836745No ratings yet

- Basic Accounting and PartnershipDocument11 pagesBasic Accounting and PartnershipMichelle Chandria Bernardo-FordNo ratings yet

- Current Liabilities - Assignment - With Answers - For PostingDocument3 pagesCurrent Liabilities - Assignment - With Answers - For Postingemman neri50% (2)

- Exercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessDocument4 pagesExercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessShiela Rengel0% (2)

- Illustrative Examples - Financial StatementsDocument6 pagesIllustrative Examples - Financial StatementsChuchi SubardiagaNo ratings yet

- Prelim ReviewDocument41 pagesPrelim ReviewKrisan Rivera100% (1)

- IA3 5copiesDocument6 pagesIA3 5copiesChloe CataluñaNo ratings yet

- Cash Flow Indirect and DirectDocument2 pagesCash Flow Indirect and DirectKatherine Borja0% (1)

- Partnership LiquidationDocument6 pagesPartnership LiquidationMonica MangobaNo ratings yet

- Seatwork-Liabilities1st2023 StudentDocument5 pagesSeatwork-Liabilities1st2023 StudentpadayonmhieNo ratings yet

- Quiz SFPDocument2 pagesQuiz SFPMikaella SaduralNo ratings yet

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- Financial Statements Answers FFFFFFFFFFF PDFDocument27 pagesFinancial Statements Answers FFFFFFFFFFF PDFJHEYNo ratings yet

- Accn08bquiz1 pt2 PDF FreeDocument5 pagesAccn08bquiz1 pt2 PDF FreeChi ChiNo ratings yet

- Net Sales Cash Accounts Receivable Merchandise Inventory Preapid Expense Property, Palnt, and EquipmentDocument6 pagesNet Sales Cash Accounts Receivable Merchandise Inventory Preapid Expense Property, Palnt, and EquipmentMadina MamasalievaNo ratings yet

- Iguana: Profit TowsonDocument11 pagesIguana: Profit TowsonJingwen YangNo ratings yet

- Buscom Exam NotesDocument1 pageBuscom Exam NotesMa. Althea SierrasNo ratings yet

- Buscom Exam NotesDocument1 pageBuscom Exam NotesMa. Althea SierrasNo ratings yet

- Statement of CashflowDocument9 pagesStatement of CashflowOwen Lustre50% (2)

- ACC30 Accounting For Partnerships Lesson Plan LiquidationDocument4 pagesACC30 Accounting For Partnerships Lesson Plan Liquidationccgomez0% (1)

- 01 Audit of Income Tax Exercise SetDocument2 pages01 Audit of Income Tax Exercise SetBecky GonzagaNo ratings yet

- Domondon - Acctg 3 - Prelim Quiz 2Document2 pagesDomondon - Acctg 3 - Prelim Quiz 2Prince Anton DomondonNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- CMPC 131 1-Partneship-FormationDocument7 pagesCMPC 131 1-Partneship-FormationGab IgnacioNo ratings yet

- Tax Quiz 1Document3 pagesTax Quiz 1KimbabNo ratings yet

- Home Office, Branch Accounting & Business CombinationDocument5 pagesHome Office, Branch Accounting & Business CombinationPaupauNo ratings yet

- DocxDocument14 pagesDocxMutiara MahuletteNo ratings yet

- Exercise 2 Statement of Financial PositionDocument8 pagesExercise 2 Statement of Financial Positionjumawaymichaeljeffrey65No ratings yet

- Solved StatamentsDocument16 pagesSolved StatamentsHaris AhnedNo ratings yet

- 01 Quiz 1Document3 pages01 Quiz 1Emperor SavageNo ratings yet

- Samiullah-4012, Major AssignmentDocument13 pagesSamiullah-4012, Major AssignmentSamiullahNo ratings yet

- 2018 Jun Q-7-8Document2 pages2018 Jun Q-7-8何健珩No ratings yet

- 3 ACCT 2AB P. DissolutionDocument6 pages3 ACCT 2AB P. DissolutionMary Angeline LopezNo ratings yet

- 24 (Recovered)Document18 pages24 (Recovered)Averyl Lei Sta.AnaNo ratings yet

- Intacc ReceivablesDocument9 pagesIntacc Receivablesaugustokita5No ratings yet

- Financial Accounting Major Assignment1Document7 pagesFinancial Accounting Major Assignment1Elham JabarkhailNo ratings yet

- Some Advac Problems by DayagDocument6 pagesSome Advac Problems by DayagElijah Montefalco100% (1)

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Financial Accounting and Reporting Problems Freebie PDFDocument46 pagesFinancial Accounting and Reporting Problems Freebie PDFC/PVT DAET, SHAINA JOYNo ratings yet

- 3 Exam Part IDocument6 pages3 Exam Part IRJ DAVE DURUHANo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- The Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeFrom EverandThe Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeNo ratings yet