Professional Documents

Culture Documents

Assignment No. 2 - Cash Flow Statement Analysis

Assignment No. 2 - Cash Flow Statement Analysis

Uploaded by

NCF- Student Assistants' OrganizationOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment No. 2 - Cash Flow Statement Analysis

Assignment No. 2 - Cash Flow Statement Analysis

Uploaded by

NCF- Student Assistants' OrganizationCopyright:

Available Formats

NAGA COLLEGE FOUNDATION, INC.

M.T. Villanueva Avenue, Naga City

College of Business and Accountancy

Financial Management

Assignment No. 2

Cash Flow Analysis

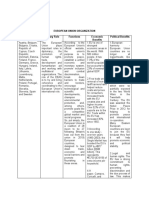

1. (CASH PAYMENTS TO MERCHANDISE SUPPLIERS) Fill in the blanks in the following schedule

CASE A CASE B CASE C

Cost of goods sold in 2010 P 649,000 P 621,000 P

_______________

Merchandise inventory:

• Beginning of 2010 P 91,000 P 57,000 P 262,000

• End of 2010 84,000 71,000 245,000

Accounts payable:

• Beginning of 2010 P 42,000 P 68,000 P 93,000

• Ending of 2010 51,000 P 85,000

__________

Cash paid to merchandise suppliers P P 623,000 P 2,824,000

in 2010 ___________

2. (CASH FLOW – OPERATING ACTIVITIES USING THE INDIRECT METHOD) Burtis Company’s net

income last year was P77,000. Changes in the company’s balance sheet accounts for the year appear

below:

Debit balances Increase Credit balances Increase

(decrease) (decrease)

Cash P 12,000 Accumulated P 32,000

depreciation

Accounts receivable (16,000) Accounts payable 26,000

Inventory 18,000 Accrued liabilities (4,000)

Prepaid expenses 7,000 Taxes payable (7,000)

Long-term 20,000 Bonds payable (20,000)

investments

Plant and equipment 70,000 Deferred taxes 14,000

Common stock 30,000

Retained earnings 40,000

The company declared and paid cash dividends of $ 37,000 last year.

Required: Construct in good form the following sections of the company’s statement of cash flows for

the year:

a. Operating activities

b. Investing activities

c. Financing Activities

3. (CASH FLOWS FOR OPERATING ACTIVITIES USING THE DIRECT METHOD) Carney Company’s

comparative balance sheet and income statement for last year appear below:

Statement of Financial Position

Ending Beginning Ending Beginning

balance balance balance balance

Cash P 59,000 P 36,000 Accounts payable P 19,000 P 33,000

Accounts 45,000 27,000 Accrued liabilities 37,000 20,000

receivable

Inventory 29,000 41,000 Taxes payable 4,000 13,000

Prepaid expenses 5,000 11,000 Bonds payable 90,000 130,000

Long-term 280,000 230,000 Deferred taxes 23,000 17,000

investments

Plant and 535,000 520,000 Common stock 130,000 100,000

equipment

Accumulated (297,000) (271,000) Retained earnings 353,000 281,000

depreciation

Total assets P 656,000 P 594,000 Total liabilities P 656,000 P 594,000

and SHE

Income statement

Sales P 900,000

Cost of goods sold (500,000) P 400,000

Operating expenses (260,000)

Net operating income P 140,000

Income taxes (42,000)

Net income P 98,000

The company declared and paid P 26,000 in cash dividends during the year.

Required: Prepare in good form the operating activities section of the company’s statement of cash

flows for the year using the direct method.

You might also like

- SolotionsDocument34 pagesSolotionsabdulrahman Abdullah100% (1)

- Cash Flow Statements Study GuideDocument37 pagesCash Flow Statements Study GuideAshekin MahadiNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting Assignmentsadif sayeed100% (2)

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- Debit Balances Increase (Decrease) Credit Balances Increase (Decrease)Document7 pagesDebit Balances Increase (Decrease) Credit Balances Increase (Decrease)Shane TabunggaoNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- Ias 07Document72 pagesIas 07Hannan Fatima EllahiNo ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Ilustrasi Cash Flow Pertemuan Ke 5 11-10-2022Document6 pagesIlustrasi Cash Flow Pertemuan Ke 5 11-10-2022nur sayNo ratings yet

- W8 - AS5 - Statement of CashFlowsDocument1 pageW8 - AS5 - Statement of CashFlowsJere Mae MarananNo ratings yet

- Direct IndirectDocument3 pagesDirect IndirectRojane Maagad IINo ratings yet

- Assignment in IA3 Statement of CashflowsDocument9 pagesAssignment in IA3 Statement of CashflowsPushTheStart GamingNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- Akuntansi Chapter 4Document23 pagesAkuntansi Chapter 4Alfian Rizal MahendraNo ratings yet

- Minicases 5Document3 pagesMinicases 5dini sofiaNo ratings yet

- Tugas05 AKM1M 21013010130 Shavira Aisyah MaharaniDocument7 pagesTugas05 AKM1M 21013010130 Shavira Aisyah MaharanicaNo ratings yet

- Accountancy Auditing 2018Document7 pagesAccountancy Auditing 2018Abdul basitNo ratings yet

- Lan Services Incorporated Income Statement For The Year Ended December 31,2020Document5 pagesLan Services Incorporated Income Statement For The Year Ended December 31,2020Jasmine ActaNo ratings yet

- Additional Cash Flow ProblemsDocument3 pagesAdditional Cash Flow ProblemsChelle HullezaNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Statement of Cash Flows 4Document6 pagesStatement of Cash Flows 4Rashid W QureshiNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Accountancy-I Subjective PDFDocument4 pagesAccountancy-I Subjective PDFM Umar MughalNo ratings yet

- Accountancy and Auditing-2018Document6 pagesAccountancy and Auditing-2018Aisar Ud DinNo ratings yet

- Latihann Arus Kas & Jawaban (Indirect)Document3 pagesLatihann Arus Kas & Jawaban (Indirect)Mona FitriaNo ratings yet

- Cada IntmgtAcctg3Exer1Document7 pagesCada IntmgtAcctg3Exer1KrishNo ratings yet

- Acounting Revision QuestionsDocument10 pagesAcounting Revision QuestionsJoseph KabiruNo ratings yet

- 3 - Cash Flow Statement - Indirect Method - QuestionsDocument3 pages3 - Cash Flow Statement - Indirect Method - Questionsmikheal beyber100% (1)

- Scarry CompanyDocument3 pagesScarry CompanyBuenaventura, Elijah B.No ratings yet

- Fm2quizb4 QoDocument10 pagesFm2quizb4 QoYe YongshiNo ratings yet

- Domondon - Acctg 3 - Prelim Quiz 2Document2 pagesDomondon - Acctg 3 - Prelim Quiz 2Prince Anton DomondonNo ratings yet

- Activity Statement of CashflowDocument1 pageActivity Statement of CashflowAdrian Rodriguez PangilinanNo ratings yet

- Auditing ProblemsDocument29 pagesAuditing ProblemsPrincesNo ratings yet

- Problem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowDocument2 pagesProblem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowChristy YouNo ratings yet

- Illustrative Example - Cash FlowDocument3 pagesIllustrative Example - Cash FlowJuliaNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Statement of Cash Flow - SolutionDocument8 pagesStatement of Cash Flow - SolutionHân NabiNo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- QUIZ 2-Mid.-Problems On Statement of Cash FlowsDocument2 pagesQUIZ 2-Mid.-Problems On Statement of Cash FlowsMonica GeronaNo ratings yet

- QUIZ 2-Mid.-Problems On Statement of Cash FlowsDocument2 pagesQUIZ 2-Mid.-Problems On Statement of Cash FlowsMonica GeronaNo ratings yet

- CSS Ratio AnalysisDocument9 pagesCSS Ratio AnalysisMasood Ahmad AadamNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- Chapter 8Document27 pagesChapter 8Francesz VirayNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Accounting Exercises On Cash FlowsDocument2 pagesAccounting Exercises On Cash FlowsMicaella GoNo ratings yet

- Intacc 3 Fs ProblemsDocument25 pagesIntacc 3 Fs ProblemsUn knownNo ratings yet

- FM-Cash Budget)Document9 pagesFM-Cash Budget)Aviona GregorioNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Financial Information Used in Ratios CompletedDocument1 pageFinancial Information Used in Ratios Completeddario.ramirezNo ratings yet

- ULOb - Let's Analyze & in A NutshellDocument5 pagesULOb - Let's Analyze & in A Nutshellemem resuentoNo ratings yet

- Financial Position Report & Cash Flow Statement Analyze Transactions To The AccountDocument32 pagesFinancial Position Report & Cash Flow Statement Analyze Transactions To The AccountRafi EffendyNo ratings yet

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- Learning Module: General Provisions of Contracts: and Answering The Exercises. Honestly. AccountDocument5 pagesLearning Module: General Provisions of Contracts: and Answering The Exercises. Honestly. AccountNCF- Student Assistants' OrganizationNo ratings yet

- LE Earnin G Modu Ule: Ge Neral Provis Sions of F Cont TractsDocument7 pagesLE Earnin G Modu Ule: Ge Neral Provis Sions of F Cont TractsNCF- Student Assistants' OrganizationNo ratings yet

- Activity 3 - Financial RatiosDocument3 pagesActivity 3 - Financial RatiosNCF- Student Assistants' OrganizationNo ratings yet

- eFDS 25 Pangunahing Kaalaman Sa PagbabangkoDocument5 pageseFDS 25 Pangunahing Kaalaman Sa PagbabangkoShai SdmpNo ratings yet

- Part FourDocument3 pagesPart FourHannah CorpuzNo ratings yet

- Ysr Cheyutha 2022-23 Wea WWDS Field Verification Form 1.0Document1 pageYsr Cheyutha 2022-23 Wea WWDS Field Verification Form 1.0vijeyacumarrdNo ratings yet

- Mos QuestionsDocument3 pagesMos QuestionsDurgesh AgnihotriNo ratings yet

- Unit Four Tactical Decision MakingDocument21 pagesUnit Four Tactical Decision MakingDzukanji SimfukweNo ratings yet

- Colliers Manila Industrial H1 2021 v1Document4 pagesColliers Manila Industrial H1 2021 v1Mcke YapNo ratings yet

- Princess Julienne Y. Yu 2GphDocument4 pagesPrincess Julienne Y. Yu 2GphPRINCESS JULIENNE YUNo ratings yet

- Alt InvDocument13 pagesAlt Invparvati anilkumarNo ratings yet

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- Impact of Using ICT - Agrani Bank BangladeshDocument37 pagesImpact of Using ICT - Agrani Bank BangladeshshafiulalamchowdhuryNo ratings yet

- PSCP San M Ariano FinalDocument77 pagesPSCP San M Ariano FinalMdrrmo AngadananNo ratings yet

- A Case Study Report On Plastic Industries IncDocument8 pagesA Case Study Report On Plastic Industries IncShraddha SharmaNo ratings yet

- #1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldDocument5 pages#1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldMarie Frances SaysonNo ratings yet

- THE CIRCULAR FLOW OF ECONOMIC ACTIVITY - Study MaterialDocument2 pagesTHE CIRCULAR FLOW OF ECONOMIC ACTIVITY - Study MaterialEllen RoaNo ratings yet

- T8-R44-P2-Hull-RMFI-Ch24-v3 - Study NotesDocument22 pagesT8-R44-P2-Hull-RMFI-Ch24-v3 - Study Notesshantanu bhargavaNo ratings yet

- Module 7: Elasticity of Demand: Basic Microeconomics JaporDocument6 pagesModule 7: Elasticity of Demand: Basic Microeconomics JaporVera CalusinNo ratings yet

- The Role of Gender and Women's Leadership in Water GovernanceDocument10 pagesThe Role of Gender and Women's Leadership in Water GovernanceADBGADNo ratings yet

- 304 Ope Som-Mcq-2019Document7 pages304 Ope Som-Mcq-2019Prafull P KulkarniNo ratings yet

- Environmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForDocument13 pagesEnvironmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForLaichul MachfudhorNo ratings yet

- Swot Analysis Krispy KremeDocument30 pagesSwot Analysis Krispy KremeAnonymous nj3pIshNo ratings yet

- Internship Report On Merchandising Activities ofDocument56 pagesInternship Report On Merchandising Activities ofNoshaba MaqsoodNo ratings yet

- EntrepreneurshipDocument22 pagesEntrepreneurshipHercel Louise HernandezNo ratings yet

- Foreign Exchange Market: Presentation OnDocument19 pagesForeign Exchange Market: Presentation OnKavya lakshmikanthNo ratings yet

- Concept Paper ThesisDocument5 pagesConcept Paper ThesisSteven Z. CondeNo ratings yet

- 03 - Mental Accounting - HANDOUTDocument8 pages03 - Mental Accounting - HANDOUTtkkt1015No ratings yet

- Asean Integration 2015: Challenges and Opportunities For EducatorsDocument19 pagesAsean Integration 2015: Challenges and Opportunities For EducatorsButch CrisostomoNo ratings yet

- GIN - 05820402 - Priyadarshan Hasigala Narayanaswamy - STA - Passport and US VisaDocument5 pagesGIN - 05820402 - Priyadarshan Hasigala Narayanaswamy - STA - Passport and US VisaALexNo ratings yet

- Risk Management PlanDocument3 pagesRisk Management Planit argentinaNo ratings yet

- Telenor Term ReportDocument32 pagesTelenor Term ReportMuhammd MoizNo ratings yet

- Dlp-Epp 6 - Week 1 - Day 4 - 3rd QuarterDocument1 pageDlp-Epp 6 - Week 1 - Day 4 - 3rd QuarterSHARON MAY CRUZNo ratings yet