Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsMonthly Test Xii April 2021eco.

Monthly Test Xii April 2021eco.

Uploaded by

Shashank DewanganThis document provides the instructions and questions for an Economics monthly test for Class XII. It includes 20 multiple choice and long answer questions testing concepts in macroeconomics. The questions cover topics such as defining macroeconomics and GDP; distinguishing between real and nominal GDP; the circular flow of income; microeconomics vs macroeconomics; citizenship vs residentship; domestic territory; and calculating national income using the income and expenditure methods. Students are instructed to answer short questions in 1-2 sentences, SA questions in 60 words or less, and long answer questions with more detailed responses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Reviewer For Quiz 1Document4 pagesReviewer For Quiz 1pppppNo ratings yet

- Credit Control MethodsDocument3 pagesCredit Control Methodsprasal75% (4)

- Financial Reporting QuestionDocument5 pagesFinancial Reporting QuestionAVNEET SinghNo ratings yet

- Mid Term Examination Xii Eco 2022-23Document4 pagesMid Term Examination Xii Eco 2022-23sgouryaNo ratings yet

- National Income and Related Aggregates: Important FormulaeDocument4 pagesNational Income and Related Aggregates: Important FormulaeRounak BasuNo ratings yet

- CBSE Class 12 Economics - National Income and Related Aggregates PDFDocument4 pagesCBSE Class 12 Economics - National Income and Related Aggregates PDFRijak BhatiaNo ratings yet

- HHW Class XII - EconomicsDocument11 pagesHHW Class XII - EconomicsJanvi AhluwaliaNo ratings yet

- Holiday Home Work Class - Xii - June 2021Document4 pagesHoliday Home Work Class - Xii - June 2021montage phoneNo ratings yet

- 1b4d8final AssignmentDocument3 pages1b4d8final AssignmentmohitalambaNo ratings yet

- Federal Public Service CommissionDocument2 pagesFederal Public Service CommissionkarimNo ratings yet

- Class 1 HomeworkDocument10 pagesClass 1 HomeworkAngel MéndezNo ratings yet

- University of Bradford Financial Accounting, Afe5008-B Final ExaminationDocument9 pagesUniversity of Bradford Financial Accounting, Afe5008-B Final ExaminationDiana TuckerNo ratings yet

- 2A FS Analysis Exercises 2022Document5 pages2A FS Analysis Exercises 2022Alyssa Tolcidas0% (1)

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document11 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)12345 678910No ratings yet

- 12 Economics23 24sp11Document14 pages12 Economics23 24sp11Dr. Anuradha ChugNo ratings yet

- Accf3114 7Document10 pagesAccf3114 7Krishna 11No ratings yet

- Ma Internal Question BankDocument4 pagesMa Internal Question Bankvarmapriya712No ratings yet

- ACTIVITY # 1 - Financial Statement Analysis and RatioDocument2 pagesACTIVITY # 1 - Financial Statement Analysis and RatioSabrinaNo ratings yet

- Mocktest 02Document4 pagesMocktest 02Nga LêNo ratings yet

- Revision Worksheet 4Document3 pagesRevision Worksheet 4Diya RathoreNo ratings yet

- Managing Financial Resources and DecisionsDocument8 pagesManaging Financial Resources and Decisionsesha_eraNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Week4 QuestionpaperDocument8 pagesWeek4 QuestionpaperSouth KoreaNo ratings yet

- Exercise Sheet Week 5Document5 pagesExercise Sheet Week 5Precious MarksNo ratings yet

- WKS National Income 1Document2 pagesWKS National Income 1Mridul Mayank GoswamiNo ratings yet

- 2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document3 pages2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- Ratio Analysis Review QuestionsDocument5 pagesRatio Analysis Review QuestionsPASTORYNo ratings yet

- EFF - Imp Questions - List - MVSIRDocument24 pagesEFF - Imp Questions - List - MVSIRRahul NegiNo ratings yet

- Sample Midterm QuestionDocument3 pagesSample Midterm QuestionAleema RokaiyaNo ratings yet

- Analysis of Financial StatementDocument10 pagesAnalysis of Financial StatementAli QasimNo ratings yet

- Exercise - Week 7Document7 pagesExercise - Week 7Precious MarksNo ratings yet

- Premium Crm2023 New-2Document136 pagesPremium Crm2023 New-2Toyosi OlugbenleNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementkatrinacruzvizcondeNo ratings yet

- Sample Structured Questions. ECN3010Document4 pagesSample Structured Questions. ECN3010Hazim BadrinNo ratings yet

- 10 2004 Dec QDocument7 pages10 2004 Dec QMohd Bawa0% (1)

- Assignment on FS AnalysisDocument2 pagesAssignment on FS AnalysisAlyssa M. JamilNo ratings yet

- Al Accounting 2020-VfDocument22 pagesAl Accounting 2020-VfIdrak & Idris FaroukNo ratings yet

- Sample Paper 1Document6 pagesSample Paper 1Umesh BhardwajNo ratings yet

- Capital Budgeting CSTDDocument3 pagesCapital Budgeting CSTDSardar FaaizNo ratings yet

- St. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Document3 pagesSt. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Harsahib SinghNo ratings yet

- True or FalseDocument4 pagesTrue or FalseMuchinNo ratings yet

- Management Accounting - I: - Dr. Sandeep GoelDocument109 pagesManagement Accounting - I: - Dr. Sandeep GoelRajat Jawa100% (1)

- Accounting's AssignmentDocument4 pagesAccounting's AssignmentLinhzin LinhzinNo ratings yet

- 110309_2021_Exam_Soln for StreamDocument16 pages110309_2021_Exam_Soln for Streamjoehe2625No ratings yet

- Total Current Assets 304 252: Reporting and Interpreting Cash Flows Problem SetsDocument4 pagesTotal Current Assets 304 252: Reporting and Interpreting Cash Flows Problem SetsMostakNo ratings yet

- Exam 1 Fall 19Document9 pagesExam 1 Fall 19April Grace TrinidadNo ratings yet

- National Income and Its AggregatesDocument2 pagesNational Income and Its AggregatesAditya GuptaNo ratings yet

- 202-Financial ManagementDocument5 pages202-Financial ManagementRAHUL GHOSALENo ratings yet

- MTP1 May2022 - Paper 8 FM EcoDocument19 pagesMTP1 May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- S20Practice Sets 1-7 Rev ADocument68 pagesS20Practice Sets 1-7 Rev AarnavNo ratings yet

- Mock Test - 2023Document3 pagesMock Test - 2023Phuoc TruongNo ratings yet

- H Accounting All 2013Document16 pagesH Accounting All 2013rerhans1No ratings yet

- b3 Economics and FinanceDocument35 pagesb3 Economics and FinanceAnonymous YkMptv9jNo ratings yet

- 5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFDocument5 pages5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFUnplanned VideosNo ratings yet

- Week 5 Topic Tutorial QuestionsDocument6 pagesWeek 5 Topic Tutorial QuestionsJessica KristyNo ratings yet

- Classroom Exercises 1 - Statement of Financial Position and Comprehensive IncomeDocument2 pagesClassroom Exercises 1 - Statement of Financial Position and Comprehensive IncomeBianca JovenNo ratings yet

- 2-ECO Pre Mid Exam April 2021 (B)Document1 page2-ECO Pre Mid Exam April 2021 (B)kartikey ranaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- 1Document6 pages1SOURAV MONDALNo ratings yet

- Case Study Argentina Currency Crisis 2002Document2 pagesCase Study Argentina Currency Crisis 2002Rehab WahshNo ratings yet

- Section Appendix 4.2. Applying The IS-LM ModelDocument70 pagesSection Appendix 4.2. Applying The IS-LM ModelMbusoThabetheNo ratings yet

- Economic Review Fullbook English-03Document250 pagesEconomic Review Fullbook English-03mazharreea100% (2)

- Mec-005 EngDocument55 pagesMec-005 EngnitikanehiNo ratings yet

- Causes of Financial Crisis: Bubble, A Financial Bubble, A Speculative Mania or A Balloon) Is "Trade in High Volumes atDocument7 pagesCauses of Financial Crisis: Bubble, A Financial Bubble, A Speculative Mania or A Balloon) Is "Trade in High Volumes atyohannes kindalemNo ratings yet

- Chapter 2: Measuring National Output and National Income: Macro Economics Numerical Problem Solving ExercisesDocument11 pagesChapter 2: Measuring National Output and National Income: Macro Economics Numerical Problem Solving Exercisesahmed housniNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument4 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionTrúc LinhNo ratings yet

- International Business: by Charles W.L. HillDocument36 pagesInternational Business: by Charles W.L. Hilllovelyday9876No ratings yet

- Laissez-Faire Economics: Your Rs.500 Coupon Code Is: wlc1CXS8935W Your Rs.1000 Coupon Code Is: wlc2QZCB54AZDocument1 pageLaissez-Faire Economics: Your Rs.500 Coupon Code Is: wlc1CXS8935W Your Rs.1000 Coupon Code Is: wlc2QZCB54AZgunjanjainghsNo ratings yet

- Mid-Term I Review QuestionsDocument7 pagesMid-Term I Review Questionsbigbadbear3100% (1)

- The Federal Reserve SystemDocument17 pagesThe Federal Reserve SystemBrithney ButalidNo ratings yet

- Gross Domestic ProductDocument8 pagesGross Domestic ProductNiño Rey LopezNo ratings yet

- Chapter 5 QuizDocument3 pagesChapter 5 QuizShannah100% (1)

- Thinking Like An EconomistDocument20 pagesThinking Like An EconomistDabelisthaNo ratings yet

- Fifth National Development PlanDocument353 pagesFifth National Development PlanChola MukangaNo ratings yet

- Money Theories, Money and Monetary PolicyDocument33 pagesMoney Theories, Money and Monetary PolicyFhremond ApoleNo ratings yet

- Agency Budget TemplateDocument7 pagesAgency Budget TemplateJohn ZappeNo ratings yet

- Philippine Fiscal PolicyDocument11 pagesPhilippine Fiscal PolicyHoney De LeonNo ratings yet

- Types of Unemployment andDocument13 pagesTypes of Unemployment andSaipeoNo ratings yet

- Assignment On Inflation - Bangladesh PerspectiveDocument5 pagesAssignment On Inflation - Bangladesh PerspectiveFahim EmOn100% (5)

- 15 Government BudgetDocument8 pages15 Government BudgetpeeyushNo ratings yet

- Ch.4 - Measurement of National Income ( (Macro Economics - 12th Class) ) Green BookDocument120 pagesCh.4 - Measurement of National Income ( (Macro Economics - 12th Class) ) Green BookMayank Mall0% (1)

- Chapter No.35Document5 pagesChapter No.35Kamal SinghNo ratings yet

- Diagram of Four Phases of Business CycleDocument3 pagesDiagram of Four Phases of Business CycleAmrit TejaniNo ratings yet

- People As Resources AssignmentDocument1 pagePeople As Resources Assignmentgurdeepsarora8738No ratings yet

- Student Paper One Ib EconomicsDocument7 pagesStudent Paper One Ib Economicsilgyu1207No ratings yet

- Aggregate Economic Variables and Stock Markets in IndiaDocument24 pagesAggregate Economic Variables and Stock Markets in IndiaUttam RungtaNo ratings yet

- Gujarat Technological UniversityDocument12 pagesGujarat Technological University220170107139No ratings yet

Monthly Test Xii April 2021eco.

Monthly Test Xii April 2021eco.

Uploaded by

Shashank Dewangan0 ratings0% found this document useful (0 votes)

8 views2 pagesThis document provides the instructions and questions for an Economics monthly test for Class XII. It includes 20 multiple choice and long answer questions testing concepts in macroeconomics. The questions cover topics such as defining macroeconomics and GDP; distinguishing between real and nominal GDP; the circular flow of income; microeconomics vs macroeconomics; citizenship vs residentship; domestic territory; and calculating national income using the income and expenditure methods. Students are instructed to answer short questions in 1-2 sentences, SA questions in 60 words or less, and long answer questions with more detailed responses.

Original Description:

Monthly test

Original Title

Monthly test xii april 2021eco.

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides the instructions and questions for an Economics monthly test for Class XII. It includes 20 multiple choice and long answer questions testing concepts in macroeconomics. The questions cover topics such as defining macroeconomics and GDP; distinguishing between real and nominal GDP; the circular flow of income; microeconomics vs macroeconomics; citizenship vs residentship; domestic territory; and calculating national income using the income and expenditure methods. Students are instructed to answer short questions in 1-2 sentences, SA questions in 60 words or less, and long answer questions with more detailed responses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views2 pagesMonthly Test Xii April 2021eco.

Monthly Test Xii April 2021eco.

Uploaded by

Shashank DewanganThis document provides the instructions and questions for an Economics monthly test for Class XII. It includes 20 multiple choice and long answer questions testing concepts in macroeconomics. The questions cover topics such as defining macroeconomics and GDP; distinguishing between real and nominal GDP; the circular flow of income; microeconomics vs macroeconomics; citizenship vs residentship; domestic territory; and calculating national income using the income and expenditure methods. Students are instructed to answer short questions in 1-2 sentences, SA questions in 60 words or less, and long answer questions with more detailed responses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

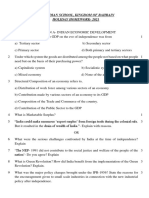

KENDRIYA VIDYALAYA SECL JHAGRAKHAND

MONTHLY TEST (APRIL) 2021-2022

CLASS-XII SUB-ECONOMICS

TIME-1.30 HOURS MM-40

General instructions-

1. All questions are compulsory.

2. Marks related to each questions are indicated against it.

3. Question no.1 to 10 are very short questions.They are required to be answer in one or two

sentences.

4. Question no.11- 15 are SA1 types questions .Answer should not exceed 60 words.

5. Question no. 16 and17 are SA2 types questions.Answer should not exceed 70 words.

6.Question no. 18 - 20are long answer types questions,write answer as required.

Q1.Define Macro-economics. 1

Q2.What is GDP? 1

Q3.What do you mean by final Goods? 1

Q4.Give two example of Durable consumer Goods. 1

Q5. What is meant by transfers income? 1

Q6. Define “Depreciation’ OR ‘Consumption of fixed capital. 1

Q7.Which aggregate of National income is known as Domestic income? 1

Q 8. NNPat fc = GNPat mp -------------------------- 1

Q9. GDPat mp =NNPat fc---------------------------------- 1

Q10. Russian Embassy in India, belongs to which Domestic territory? 1

Q11.What is meant by Real GDP and Nominal GDP? Which one is better indicator? 2

Q12.What is Externalities? Give one example of each Negative and Positive Externalities. 2

Q13.What do you mean by “circular flow of income”? 2

Q14.Distinguish between Microeconomics and Macroeconomics. 2

Q15.Define the “Net factor income from abroad”(NFIA) and NIT . 2

Q16.What are the difference between citizenship and Residentship? 3

Q17.Explain the concepts of “Domestic territory” 3

Q18.Explain the components of “Income Method” to calculate National income. 4

Q19.Calculate NDP at fc 4

Items Rs (in crores)

1.Subsidies 1

2.Sales 100

3.Closing stock 10

4.Indirect taxes 5

5.Intermediate consumption 30

6.Opening stock 20

7.Depreciation 15

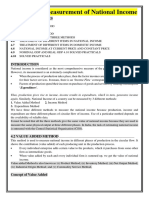

Q20.Calculate National income by Income and Expenditure method- 6

Particulars Rs( in crores)

1.Government final consumption expenditure 50

2.Rent 150

3.Opening stock 20

4.Interest 80

5.Profit 70

6.Private final consumption expenditure 480

7.Gross fixed capital formation 90

8.Closing stock 35

9.Net export (-5)

10.Net indirect tax 60

11.Compensation of employees 200

12.Consumption of fixed capital 20

13.Mixed income of self employed 50

14.Net factor income from abroad 20

You might also like

- Reviewer For Quiz 1Document4 pagesReviewer For Quiz 1pppppNo ratings yet

- Credit Control MethodsDocument3 pagesCredit Control Methodsprasal75% (4)

- Financial Reporting QuestionDocument5 pagesFinancial Reporting QuestionAVNEET SinghNo ratings yet

- Mid Term Examination Xii Eco 2022-23Document4 pagesMid Term Examination Xii Eco 2022-23sgouryaNo ratings yet

- National Income and Related Aggregates: Important FormulaeDocument4 pagesNational Income and Related Aggregates: Important FormulaeRounak BasuNo ratings yet

- CBSE Class 12 Economics - National Income and Related Aggregates PDFDocument4 pagesCBSE Class 12 Economics - National Income and Related Aggregates PDFRijak BhatiaNo ratings yet

- HHW Class XII - EconomicsDocument11 pagesHHW Class XII - EconomicsJanvi AhluwaliaNo ratings yet

- Holiday Home Work Class - Xii - June 2021Document4 pagesHoliday Home Work Class - Xii - June 2021montage phoneNo ratings yet

- 1b4d8final AssignmentDocument3 pages1b4d8final AssignmentmohitalambaNo ratings yet

- Federal Public Service CommissionDocument2 pagesFederal Public Service CommissionkarimNo ratings yet

- Class 1 HomeworkDocument10 pagesClass 1 HomeworkAngel MéndezNo ratings yet

- University of Bradford Financial Accounting, Afe5008-B Final ExaminationDocument9 pagesUniversity of Bradford Financial Accounting, Afe5008-B Final ExaminationDiana TuckerNo ratings yet

- 2A FS Analysis Exercises 2022Document5 pages2A FS Analysis Exercises 2022Alyssa Tolcidas0% (1)

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document11 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)12345 678910No ratings yet

- 12 Economics23 24sp11Document14 pages12 Economics23 24sp11Dr. Anuradha ChugNo ratings yet

- Accf3114 7Document10 pagesAccf3114 7Krishna 11No ratings yet

- Ma Internal Question BankDocument4 pagesMa Internal Question Bankvarmapriya712No ratings yet

- ACTIVITY # 1 - Financial Statement Analysis and RatioDocument2 pagesACTIVITY # 1 - Financial Statement Analysis and RatioSabrinaNo ratings yet

- Mocktest 02Document4 pagesMocktest 02Nga LêNo ratings yet

- Revision Worksheet 4Document3 pagesRevision Worksheet 4Diya RathoreNo ratings yet

- Managing Financial Resources and DecisionsDocument8 pagesManaging Financial Resources and Decisionsesha_eraNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Week4 QuestionpaperDocument8 pagesWeek4 QuestionpaperSouth KoreaNo ratings yet

- Exercise Sheet Week 5Document5 pagesExercise Sheet Week 5Precious MarksNo ratings yet

- WKS National Income 1Document2 pagesWKS National Income 1Mridul Mayank GoswamiNo ratings yet

- 2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document3 pages2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- Ratio Analysis Review QuestionsDocument5 pagesRatio Analysis Review QuestionsPASTORYNo ratings yet

- EFF - Imp Questions - List - MVSIRDocument24 pagesEFF - Imp Questions - List - MVSIRRahul NegiNo ratings yet

- Sample Midterm QuestionDocument3 pagesSample Midterm QuestionAleema RokaiyaNo ratings yet

- Analysis of Financial StatementDocument10 pagesAnalysis of Financial StatementAli QasimNo ratings yet

- Exercise - Week 7Document7 pagesExercise - Week 7Precious MarksNo ratings yet

- Premium Crm2023 New-2Document136 pagesPremium Crm2023 New-2Toyosi OlugbenleNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementkatrinacruzvizcondeNo ratings yet

- Sample Structured Questions. ECN3010Document4 pagesSample Structured Questions. ECN3010Hazim BadrinNo ratings yet

- 10 2004 Dec QDocument7 pages10 2004 Dec QMohd Bawa0% (1)

- Assignment on FS AnalysisDocument2 pagesAssignment on FS AnalysisAlyssa M. JamilNo ratings yet

- Al Accounting 2020-VfDocument22 pagesAl Accounting 2020-VfIdrak & Idris FaroukNo ratings yet

- Sample Paper 1Document6 pagesSample Paper 1Umesh BhardwajNo ratings yet

- Capital Budgeting CSTDDocument3 pagesCapital Budgeting CSTDSardar FaaizNo ratings yet

- St. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Document3 pagesSt. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Harsahib SinghNo ratings yet

- True or FalseDocument4 pagesTrue or FalseMuchinNo ratings yet

- Management Accounting - I: - Dr. Sandeep GoelDocument109 pagesManagement Accounting - I: - Dr. Sandeep GoelRajat Jawa100% (1)

- Accounting's AssignmentDocument4 pagesAccounting's AssignmentLinhzin LinhzinNo ratings yet

- 110309_2021_Exam_Soln for StreamDocument16 pages110309_2021_Exam_Soln for Streamjoehe2625No ratings yet

- Total Current Assets 304 252: Reporting and Interpreting Cash Flows Problem SetsDocument4 pagesTotal Current Assets 304 252: Reporting and Interpreting Cash Flows Problem SetsMostakNo ratings yet

- Exam 1 Fall 19Document9 pagesExam 1 Fall 19April Grace TrinidadNo ratings yet

- National Income and Its AggregatesDocument2 pagesNational Income and Its AggregatesAditya GuptaNo ratings yet

- 202-Financial ManagementDocument5 pages202-Financial ManagementRAHUL GHOSALENo ratings yet

- MTP1 May2022 - Paper 8 FM EcoDocument19 pagesMTP1 May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiaShrwan SinghNo ratings yet

- S20Practice Sets 1-7 Rev ADocument68 pagesS20Practice Sets 1-7 Rev AarnavNo ratings yet

- Mock Test - 2023Document3 pagesMock Test - 2023Phuoc TruongNo ratings yet

- H Accounting All 2013Document16 pagesH Accounting All 2013rerhans1No ratings yet

- b3 Economics and FinanceDocument35 pagesb3 Economics and FinanceAnonymous YkMptv9jNo ratings yet

- 5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFDocument5 pages5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFUnplanned VideosNo ratings yet

- Week 5 Topic Tutorial QuestionsDocument6 pagesWeek 5 Topic Tutorial QuestionsJessica KristyNo ratings yet

- Classroom Exercises 1 - Statement of Financial Position and Comprehensive IncomeDocument2 pagesClassroom Exercises 1 - Statement of Financial Position and Comprehensive IncomeBianca JovenNo ratings yet

- 2-ECO Pre Mid Exam April 2021 (B)Document1 page2-ECO Pre Mid Exam April 2021 (B)kartikey ranaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- 1Document6 pages1SOURAV MONDALNo ratings yet

- Case Study Argentina Currency Crisis 2002Document2 pagesCase Study Argentina Currency Crisis 2002Rehab WahshNo ratings yet

- Section Appendix 4.2. Applying The IS-LM ModelDocument70 pagesSection Appendix 4.2. Applying The IS-LM ModelMbusoThabetheNo ratings yet

- Economic Review Fullbook English-03Document250 pagesEconomic Review Fullbook English-03mazharreea100% (2)

- Mec-005 EngDocument55 pagesMec-005 EngnitikanehiNo ratings yet

- Causes of Financial Crisis: Bubble, A Financial Bubble, A Speculative Mania or A Balloon) Is "Trade in High Volumes atDocument7 pagesCauses of Financial Crisis: Bubble, A Financial Bubble, A Speculative Mania or A Balloon) Is "Trade in High Volumes atyohannes kindalemNo ratings yet

- Chapter 2: Measuring National Output and National Income: Macro Economics Numerical Problem Solving ExercisesDocument11 pagesChapter 2: Measuring National Output and National Income: Macro Economics Numerical Problem Solving Exercisesahmed housniNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument4 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionTrúc LinhNo ratings yet

- International Business: by Charles W.L. HillDocument36 pagesInternational Business: by Charles W.L. Hilllovelyday9876No ratings yet

- Laissez-Faire Economics: Your Rs.500 Coupon Code Is: wlc1CXS8935W Your Rs.1000 Coupon Code Is: wlc2QZCB54AZDocument1 pageLaissez-Faire Economics: Your Rs.500 Coupon Code Is: wlc1CXS8935W Your Rs.1000 Coupon Code Is: wlc2QZCB54AZgunjanjainghsNo ratings yet

- Mid-Term I Review QuestionsDocument7 pagesMid-Term I Review Questionsbigbadbear3100% (1)

- The Federal Reserve SystemDocument17 pagesThe Federal Reserve SystemBrithney ButalidNo ratings yet

- Gross Domestic ProductDocument8 pagesGross Domestic ProductNiño Rey LopezNo ratings yet

- Chapter 5 QuizDocument3 pagesChapter 5 QuizShannah100% (1)

- Thinking Like An EconomistDocument20 pagesThinking Like An EconomistDabelisthaNo ratings yet

- Fifth National Development PlanDocument353 pagesFifth National Development PlanChola MukangaNo ratings yet

- Money Theories, Money and Monetary PolicyDocument33 pagesMoney Theories, Money and Monetary PolicyFhremond ApoleNo ratings yet

- Agency Budget TemplateDocument7 pagesAgency Budget TemplateJohn ZappeNo ratings yet

- Philippine Fiscal PolicyDocument11 pagesPhilippine Fiscal PolicyHoney De LeonNo ratings yet

- Types of Unemployment andDocument13 pagesTypes of Unemployment andSaipeoNo ratings yet

- Assignment On Inflation - Bangladesh PerspectiveDocument5 pagesAssignment On Inflation - Bangladesh PerspectiveFahim EmOn100% (5)

- 15 Government BudgetDocument8 pages15 Government BudgetpeeyushNo ratings yet

- Ch.4 - Measurement of National Income ( (Macro Economics - 12th Class) ) Green BookDocument120 pagesCh.4 - Measurement of National Income ( (Macro Economics - 12th Class) ) Green BookMayank Mall0% (1)

- Chapter No.35Document5 pagesChapter No.35Kamal SinghNo ratings yet

- Diagram of Four Phases of Business CycleDocument3 pagesDiagram of Four Phases of Business CycleAmrit TejaniNo ratings yet

- People As Resources AssignmentDocument1 pagePeople As Resources Assignmentgurdeepsarora8738No ratings yet

- Student Paper One Ib EconomicsDocument7 pagesStudent Paper One Ib Economicsilgyu1207No ratings yet

- Aggregate Economic Variables and Stock Markets in IndiaDocument24 pagesAggregate Economic Variables and Stock Markets in IndiaUttam RungtaNo ratings yet

- Gujarat Technological UniversityDocument12 pagesGujarat Technological University220170107139No ratings yet