Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

273 viewsChallenges That Encountered by The Customs Broker

Challenges That Encountered by The Customs Broker

Uploaded by

katlicCustoms brokers play an important role in facilitating international trade but face challenges in their work, especially during the pandemic. They have a statutory duty to exercise responsible supervision over customs business and maintain competence through continuing education. The scope of their practice includes consulting, preparing customs documents, declaring duties and taxes, and representing importers/exporters in customs and tariff matters. During the pandemic, brokers have had to deal with delays, higher costs, and changing regulations, demonstrating the importance of their role in global supply chains despite facing challenges.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Quick Guide Book On Operations Management With Analytics v2023Document197 pagesQuick Guide Book On Operations Management With Analytics v2023cristiancelerianNo ratings yet

- Challenges Encountered by Selected Customs Brokerage FirmsDocument99 pagesChallenges Encountered by Selected Customs Brokerage Firmskristine76% (17)

- Group 1: Alcantara, John Kimvel T. de Asis, Antonette C. Jaiddin, Ameer Sultan PDocument27 pagesGroup 1: Alcantara, John Kimvel T. de Asis, Antonette C. Jaiddin, Ameer Sultan PJohnKAlcantaraNo ratings yet

- 10 ThesisDocument6 pages10 ThesisMNAVNo ratings yet

- Sky High 3 CourseDocument7 pagesSky High 3 CourseHiginio von BachNo ratings yet

- Port of ManilaDocument29 pagesPort of ManilaPrecious Mae Saguid Sager75% (4)

- Question 1: What Is Technical Communication? Cite and Elaborate Three Concrete Examples ofDocument3 pagesQuestion 1: What Is Technical Communication? Cite and Elaborate Three Concrete Examples ofAlyssa Paula Altaya100% (2)

- Reflection-Paper Chapter 1 International ManagementDocument2 pagesReflection-Paper Chapter 1 International ManagementJouhara G. San JuanNo ratings yet

- Mcloughlin ComprehensionDocument10 pagesMcloughlin Comprehensionapi-352927285No ratings yet

- ThesiscipcbfrevisedDocument16 pagesThesiscipcbfrevisedJannah Sanguenza Montero100% (1)

- Assignment - ETHICS AND STANDARDS OF THE CUSTOMS BROKERAGEDocument6 pagesAssignment - ETHICS AND STANDARDS OF THE CUSTOMS BROKERAGEcris addunNo ratings yet

- 1 Background On The Philippine Regulatory Board For CustomsDocument81 pages1 Background On The Philippine Regulatory Board For CustomsCamilla ReyesNo ratings yet

- 013EBM Cajala VM Alcedo AMDocument12 pages013EBM Cajala VM Alcedo AMZarah JeanineNo ratings yet

- Challenges That Customs Brokers/Processors Encounter in Processing Import Entry in Manila International Container PortDocument9 pagesChallenges That Customs Brokers/Processors Encounter in Processing Import Entry in Manila International Container PortTravis OpizNo ratings yet

- Abstract BSCA 2010 2015Document46 pagesAbstract BSCA 2010 2015Rea TapiaNo ratings yet

- Prelim Exam Tm3 Summer ClassDocument4 pagesPrelim Exam Tm3 Summer ClassPrincess Mendoza SolatorioNo ratings yet

- Custom's Thesis (Ate Lyka)Document46 pagesCustom's Thesis (Ate Lyka)mica lacedaNo ratings yet

- Challenges Encountered by Selected Customs Brokerage FirmsDocument99 pagesChallenges Encountered by Selected Customs Brokerage FirmsJoel Orlanes Jr.No ratings yet

- Body of NarrativeDocument14 pagesBody of NarrativeMusa Batugan Jr.No ratings yet

- Narrative Report FinalsDocument10 pagesNarrative Report FinalsKaye Ann Obrador100% (1)

- Ra 9280Document7 pagesRa 9280Jay-arr ValdezNo ratings yet

- WarehouseDocument2 pagesWarehouseAce ParkerNo ratings yet

- TM8 WK 13 3T FinalDocument10 pagesTM8 WK 13 3T FinalAkenn SandaganNo ratings yet

- 1 Pre-Oral Thesis DefenseDocument25 pages1 Pre-Oral Thesis DefenseLorevy AnnNo ratings yet

- TRAIN Law Abstract PDFDocument2 pagesTRAIN Law Abstract PDFRizaRCNo ratings yet

- Frequently Asked Question - RA. 9280Document23 pagesFrequently Asked Question - RA. 9280Jeammuel ConopioNo ratings yet

- Tariff Case - 2 Cases 1.24.19 For WritinngDocument2 pagesTariff Case - 2 Cases 1.24.19 For WritinngAbby ReyesNo ratings yet

- Reaction PaperDocument1 pageReaction PaperMerari ValenciaNo ratings yet

- Related Literature (Joan)Document6 pagesRelated Literature (Joan)Santa Dela Cruz NaluzNo ratings yet

- Components of Dutiable ValueDocument25 pagesComponents of Dutiable ValueJemimah MalicsiNo ratings yet

- Elements of The Dutiable ValueDocument21 pagesElements of The Dutiable ValueJimmy Maban IINo ratings yet

- Fundamentals of TransportationDocument5 pagesFundamentals of TransportationsanoNo ratings yet

- Sample Problem No. 1: Ñas, CaviteDocument24 pagesSample Problem No. 1: Ñas, Cavite2 BNo ratings yet

- Module Customs Operations and Cargo HandlingDocument170 pagesModule Customs Operations and Cargo HandlingRosette RocoNo ratings yet

- Dutiable FreightDocument40 pagesDutiable FreightShamilleNo ratings yet

- Infante Heritage House EditedDocument13 pagesInfante Heritage House EditedJenesa Ian PioquintoNo ratings yet

- Electronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaDocument94 pagesElectronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaMa Jessica Maramag BaroroNo ratings yet

- Efficiency of The Newly Developed Fish Port and Its Impact On Local Fishing Businesses of Barangay DalahicanDocument22 pagesEfficiency of The Newly Developed Fish Port and Its Impact On Local Fishing Businesses of Barangay DalahicanPaul Julius M. RegioNo ratings yet

- Frequently Asked Question On: (Customs Modermization Project)Document41 pagesFrequently Asked Question On: (Customs Modermization Project)RiaNo ratings yet

- Customs Valuation System PrelimDocument26 pagesCustoms Valuation System Prelim2 BNo ratings yet

- Ethics SaDocument10 pagesEthics SaJes MinNo ratings yet

- Ako Ang Finale Joane NarrativeDocument40 pagesAko Ang Finale Joane NarrativeJames WilliamNo ratings yet

- Final RRLDocument23 pagesFinal RRLWelvic B. Tagod100% (1)

- Chapter 1 5Document47 pagesChapter 1 5renz calderonNo ratings yet

- DONE-Chapter 6 CompleteDocument3 pagesDONE-Chapter 6 CompleteDaphne De LeonNo ratings yet

- E2m Import Assessment SystemDocument27 pagesE2m Import Assessment SystemCHLOJJ Trading100% (3)

- Ra 10844Document2 pagesRa 10844Allaine ParkerNo ratings yet

- Final Business ResearchDocument40 pagesFinal Business Researchchariza alapNo ratings yet

- Tariff Competency Exam - Post-Test 7Document4 pagesTariff Competency Exam - Post-Test 7Jimenez C. Shainah MarieNo ratings yet

- RA 9280 Customs Broker Act of 2004Document12 pagesRA 9280 Customs Broker Act of 2004Roy GonzaNo ratings yet

- Title Iv Import Clearance and Formalities Goods DeclarationDocument42 pagesTitle Iv Import Clearance and Formalities Goods Declarationdennilyn recaldeNo ratings yet

- Sec of Finance V CtaDocument6 pagesSec of Finance V CtaRose AnnNo ratings yet

- E2MDocument2 pagesE2MEdward JohnNo ratings yet

- Midterm WarehousingDocument8 pagesMidterm WarehousingAngelo Ace M. MañalacNo ratings yet

- Draft PH Bureau of Customs Rules On Temporary Storage of GoodsDocument7 pagesDraft PH Bureau of Customs Rules On Temporary Storage of GoodsPortCalls100% (1)

- ACKNOWLEDGEMENTDocument4 pagesACKNOWLEDGEMENTSari Sari Store VideoNo ratings yet

- CASE STUDY Down With DumpingDocument2 pagesCASE STUDY Down With DumpingJona FranciscoNo ratings yet

- Answers Are Here: HRM 351 Final ExamDocument8 pagesAnswers Are Here: HRM 351 Final ExammoulisansNo ratings yet

- Related Literature On Train LawDocument16 pagesRelated Literature On Train LawRusselNo ratings yet

- Unlicensed Customs Broker - LegresDocument2 pagesUnlicensed Customs Broker - LegresRegine LangrioNo ratings yet

- HB 1653 Presentation (CCBI July 07, 2011)Document21 pagesHB 1653 Presentation (CCBI July 07, 2011)P Dg ReyesNo ratings yet

- Assignment From Victor QuiahDocument20 pagesAssignment From Victor QuiahSamah ShenhaNo ratings yet

- Ejemplo de La Actividad 5. Mtra Miriam Torres Bermudez. Analisis Del DiscursoDocument2 pagesEjemplo de La Actividad 5. Mtra Miriam Torres Bermudez. Analisis Del DiscursoHilda VillagranNo ratings yet

- Harry Potter Book ReviewDocument14 pagesHarry Potter Book ReviewNathasha GaneshNo ratings yet

- Sydni Fahringer ResumeDocument1 pageSydni Fahringer Resumeapi-317683708No ratings yet

- AnGeom Bridging 2Document10 pagesAnGeom Bridging 2blackmasqueNo ratings yet

- A Typology of P Keh Whiteness in EducationDocument16 pagesA Typology of P Keh Whiteness in EducationDiego Matos PimentelNo ratings yet

- Resilience in Infrastructure Systems A Comprehensive ReviewDocument17 pagesResilience in Infrastructure Systems A Comprehensive ReviewcherrielNo ratings yet

- DLL Physical ScienceDocument9 pagesDLL Physical ScienceTOt's VinNo ratings yet

- Handbook of Child Psychology V 601 1084Document484 pagesHandbook of Child Psychology V 601 1084Alessio TinerviaNo ratings yet

- 01 Homework 1 - ARGDocument1 page01 Homework 1 - ARGkaye pagcoNo ratings yet

- TelephoneDirectoryIIITA 20july18840Document5 pagesTelephoneDirectoryIIITA 20july18840Vivek LasunaNo ratings yet

- Ai Final ProjectDocument8 pagesAi Final ProjectJean Ice Zack De LeonNo ratings yet

- Leadership Self TestDocument4 pagesLeadership Self TestzaidNo ratings yet

- Airline ReservationDocument18 pagesAirline ReservationAshutosh PandeyNo ratings yet

- Reprinted With Permission: General Organization of A Literature Review Paper by Professor Lynne BondDocument1 pageReprinted With Permission: General Organization of A Literature Review Paper by Professor Lynne BondEngr Aizaz AhmadNo ratings yet

- Unit 6 MoneyDocument39 pagesUnit 6 MoneyMAISARAH AZYAN BINTI MOHAMAD KPM-GuruNo ratings yet

- CMTRDocument16 pagesCMTRAida ZaraNo ratings yet

- Rishi Thesis On Kwati 2073-77Document90 pagesRishi Thesis On Kwati 2073-77Usha BbattaNo ratings yet

- Ojt Narrative Report CarlaDocument37 pagesOjt Narrative Report CarlaTrisha ApalisNo ratings yet

- Assessment of Tertiary Education in NigeriaDocument11 pagesAssessment of Tertiary Education in NigeriaResearch ParkNo ratings yet

- Grade 9 - Final Version - TGP - EdDocument6 pagesGrade 9 - Final Version - TGP - EdroseNo ratings yet

- CHRISTIAN ResearchDocument62 pagesCHRISTIAN ResearchCristilyn BrionesNo ratings yet

- A Level Oral Examiner Info PackDocument33 pagesA Level Oral Examiner Info PackRafet TanrıoğluNo ratings yet

- PHD Thesis On Building MaintenanceDocument8 pagesPHD Thesis On Building Maintenancetunwpmzcf100% (2)

- Week 7 Kindergarten Lesson PlanDocument2 pagesWeek 7 Kindergarten Lesson Planapi-445021282No ratings yet

- الدكتور مصطفى الشناق رئيس جمعية الجهاز الهضمي والكبد الأردنية Medics Index Member 10122010 ResumeDocument29 pagesالدكتور مصطفى الشناق رئيس جمعية الجهاز الهضمي والكبد الأردنية Medics Index Member 10122010 ResumejordanmedicsNo ratings yet

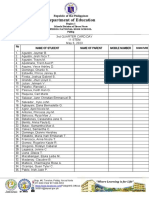

- Card Day Attendance 2023Document4 pagesCard Day Attendance 2023Maribel AnganaNo ratings yet

- IOSH Managing Safely v5 - Detailed ChangesDocument1 pageIOSH Managing Safely v5 - Detailed ChangesMunavir kNo ratings yet

- Instructor Clinical Evaluation ToolsDocument11 pagesInstructor Clinical Evaluation ToolsJoric MagusaraNo ratings yet

Challenges That Encountered by The Customs Broker

Challenges That Encountered by The Customs Broker

Uploaded by

katlic0 ratings0% found this document useful (0 votes)

273 views2 pagesCustoms brokers play an important role in facilitating international trade but face challenges in their work, especially during the pandemic. They have a statutory duty to exercise responsible supervision over customs business and maintain competence through continuing education. The scope of their practice includes consulting, preparing customs documents, declaring duties and taxes, and representing importers/exporters in customs and tariff matters. During the pandemic, brokers have had to deal with delays, higher costs, and changing regulations, demonstrating the importance of their role in global supply chains despite facing challenges.

Original Description:

Original Title

Challenges That Encountered By The Customs Broker

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCustoms brokers play an important role in facilitating international trade but face challenges in their work, especially during the pandemic. They have a statutory duty to exercise responsible supervision over customs business and maintain competence through continuing education. The scope of their practice includes consulting, preparing customs documents, declaring duties and taxes, and representing importers/exporters in customs and tariff matters. During the pandemic, brokers have had to deal with delays, higher costs, and changing regulations, demonstrating the importance of their role in global supply chains despite facing challenges.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

273 views2 pagesChallenges That Encountered by The Customs Broker

Challenges That Encountered by The Customs Broker

Uploaded by

katlicCustoms brokers play an important role in facilitating international trade but face challenges in their work, especially during the pandemic. They have a statutory duty to exercise responsible supervision over customs business and maintain competence through continuing education. The scope of their practice includes consulting, preparing customs documents, declaring duties and taxes, and representing importers/exporters in customs and tariff matters. During the pandemic, brokers have had to deal with delays, higher costs, and changing regulations, demonstrating the importance of their role in global supply chains despite facing challenges.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

‘Permejo, Anjelic O.

BSCA 3101

Theoretical Framework/ Literature

Challenges That Encountered By

The Customs Broker in the Practice of Profession During Pandemic

In any industry, overcoming challenges is consequential to become

globally competitive. It is significant to successfully deliver the services they

offer. Import and export industry is not excluded. Clients complain about the

inconvenience of the delays in the process, how it makes their shipment

costly, or how they end up paying higher fees than expected. But most people

do not really understand the details in the process and the challenges the

customs brokers encounter in the process (Cuevas, A.et.al, 2018).

Under 19 U.S.C. 1641(b)(4), a customs broker has the statutory

duty to exercise responsible supervision and control over the customs

business that he or she conducts. Maintaining current knowledge and

competence is an inherent part of the statutory duty of the customs broker. A

customs broker reasonably can be expected to uphold such responsible

supervision over his or her employees and control over his or her customs

business only by acquiring and maintaining the knowledge of customs and

related laws. Requiring a customs broker to fulfill a continuing education

requirement during the course of his or her work is a way to ensure that

the customs broker keeps up with an ever-changing customs practice

following the passing of the broker exam and subsequent receipt of the

license (federalregister, 2020).

Customs brokers play a role in mediating transactions between

importers and the BOC. Republic Act No. 9280, otherwise known as the

Customs Brokers Act of 2004, as amended by Republic Act No. 9853,

describes the scope of the practice of customs broker. To wit: SEC. 6. Scope

of the Practice of Customs Brokers, Customs Broker Profession

involves services consisting of consultation, preparation of customs

requisite document for imports and exports, declaration of customs

duties and taxes, preparation signing, filing, lodging and processing of

import and export entries; representing importers and exporters before any

government agency and private entities in cases related to valuation and

classification of imported articles and rendering of other professional services

in matters relating to customs and tariff laws its procedures and practices.

A customs brokers and shall be considered in the practices of the

profession if the nature and character of his/her employment in private

enterprises requires professional knowledge in the field of customs and

tariff administration. He/She is also deemed in the practice of custom

Broker profession if he/she teaches customs and tariff administration subjects

in any university, college or school duly recognized by the government (Llanto

G., Quimba FM., 2021).

Sources

https://www.federalregister.gov/documents/2020/10/28/2020-

22604/continuing-education-for-licensed-customs-brokers

https://www.phcc.gov.ph/wp-content/uploads/2021/03/PCC-Issues-Paper-

2021-04-Competition-Policy-Issues-in-Cargo-Services.pdf

http://apjarba.apjmr.com/wp-content/uploads/2019/08/APJARBA-2018-

005.pdf

https://www.prc.gov.ph/sites/default/files/Customs%20Broker_PRIMER.pdf

You might also like

- Quick Guide Book On Operations Management With Analytics v2023Document197 pagesQuick Guide Book On Operations Management With Analytics v2023cristiancelerianNo ratings yet

- Challenges Encountered by Selected Customs Brokerage FirmsDocument99 pagesChallenges Encountered by Selected Customs Brokerage Firmskristine76% (17)

- Group 1: Alcantara, John Kimvel T. de Asis, Antonette C. Jaiddin, Ameer Sultan PDocument27 pagesGroup 1: Alcantara, John Kimvel T. de Asis, Antonette C. Jaiddin, Ameer Sultan PJohnKAlcantaraNo ratings yet

- 10 ThesisDocument6 pages10 ThesisMNAVNo ratings yet

- Sky High 3 CourseDocument7 pagesSky High 3 CourseHiginio von BachNo ratings yet

- Port of ManilaDocument29 pagesPort of ManilaPrecious Mae Saguid Sager75% (4)

- Question 1: What Is Technical Communication? Cite and Elaborate Three Concrete Examples ofDocument3 pagesQuestion 1: What Is Technical Communication? Cite and Elaborate Three Concrete Examples ofAlyssa Paula Altaya100% (2)

- Reflection-Paper Chapter 1 International ManagementDocument2 pagesReflection-Paper Chapter 1 International ManagementJouhara G. San JuanNo ratings yet

- Mcloughlin ComprehensionDocument10 pagesMcloughlin Comprehensionapi-352927285No ratings yet

- ThesiscipcbfrevisedDocument16 pagesThesiscipcbfrevisedJannah Sanguenza Montero100% (1)

- Assignment - ETHICS AND STANDARDS OF THE CUSTOMS BROKERAGEDocument6 pagesAssignment - ETHICS AND STANDARDS OF THE CUSTOMS BROKERAGEcris addunNo ratings yet

- 1 Background On The Philippine Regulatory Board For CustomsDocument81 pages1 Background On The Philippine Regulatory Board For CustomsCamilla ReyesNo ratings yet

- 013EBM Cajala VM Alcedo AMDocument12 pages013EBM Cajala VM Alcedo AMZarah JeanineNo ratings yet

- Challenges That Customs Brokers/Processors Encounter in Processing Import Entry in Manila International Container PortDocument9 pagesChallenges That Customs Brokers/Processors Encounter in Processing Import Entry in Manila International Container PortTravis OpizNo ratings yet

- Abstract BSCA 2010 2015Document46 pagesAbstract BSCA 2010 2015Rea TapiaNo ratings yet

- Prelim Exam Tm3 Summer ClassDocument4 pagesPrelim Exam Tm3 Summer ClassPrincess Mendoza SolatorioNo ratings yet

- Custom's Thesis (Ate Lyka)Document46 pagesCustom's Thesis (Ate Lyka)mica lacedaNo ratings yet

- Challenges Encountered by Selected Customs Brokerage FirmsDocument99 pagesChallenges Encountered by Selected Customs Brokerage FirmsJoel Orlanes Jr.No ratings yet

- Body of NarrativeDocument14 pagesBody of NarrativeMusa Batugan Jr.No ratings yet

- Narrative Report FinalsDocument10 pagesNarrative Report FinalsKaye Ann Obrador100% (1)

- Ra 9280Document7 pagesRa 9280Jay-arr ValdezNo ratings yet

- WarehouseDocument2 pagesWarehouseAce ParkerNo ratings yet

- TM8 WK 13 3T FinalDocument10 pagesTM8 WK 13 3T FinalAkenn SandaganNo ratings yet

- 1 Pre-Oral Thesis DefenseDocument25 pages1 Pre-Oral Thesis DefenseLorevy AnnNo ratings yet

- TRAIN Law Abstract PDFDocument2 pagesTRAIN Law Abstract PDFRizaRCNo ratings yet

- Frequently Asked Question - RA. 9280Document23 pagesFrequently Asked Question - RA. 9280Jeammuel ConopioNo ratings yet

- Tariff Case - 2 Cases 1.24.19 For WritinngDocument2 pagesTariff Case - 2 Cases 1.24.19 For WritinngAbby ReyesNo ratings yet

- Reaction PaperDocument1 pageReaction PaperMerari ValenciaNo ratings yet

- Related Literature (Joan)Document6 pagesRelated Literature (Joan)Santa Dela Cruz NaluzNo ratings yet

- Components of Dutiable ValueDocument25 pagesComponents of Dutiable ValueJemimah MalicsiNo ratings yet

- Elements of The Dutiable ValueDocument21 pagesElements of The Dutiable ValueJimmy Maban IINo ratings yet

- Fundamentals of TransportationDocument5 pagesFundamentals of TransportationsanoNo ratings yet

- Sample Problem No. 1: Ñas, CaviteDocument24 pagesSample Problem No. 1: Ñas, Cavite2 BNo ratings yet

- Module Customs Operations and Cargo HandlingDocument170 pagesModule Customs Operations and Cargo HandlingRosette RocoNo ratings yet

- Dutiable FreightDocument40 pagesDutiable FreightShamilleNo ratings yet

- Infante Heritage House EditedDocument13 pagesInfante Heritage House EditedJenesa Ian PioquintoNo ratings yet

- Electronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaDocument94 pagesElectronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaMa Jessica Maramag BaroroNo ratings yet

- Efficiency of The Newly Developed Fish Port and Its Impact On Local Fishing Businesses of Barangay DalahicanDocument22 pagesEfficiency of The Newly Developed Fish Port and Its Impact On Local Fishing Businesses of Barangay DalahicanPaul Julius M. RegioNo ratings yet

- Frequently Asked Question On: (Customs Modermization Project)Document41 pagesFrequently Asked Question On: (Customs Modermization Project)RiaNo ratings yet

- Customs Valuation System PrelimDocument26 pagesCustoms Valuation System Prelim2 BNo ratings yet

- Ethics SaDocument10 pagesEthics SaJes MinNo ratings yet

- Ako Ang Finale Joane NarrativeDocument40 pagesAko Ang Finale Joane NarrativeJames WilliamNo ratings yet

- Final RRLDocument23 pagesFinal RRLWelvic B. Tagod100% (1)

- Chapter 1 5Document47 pagesChapter 1 5renz calderonNo ratings yet

- DONE-Chapter 6 CompleteDocument3 pagesDONE-Chapter 6 CompleteDaphne De LeonNo ratings yet

- E2m Import Assessment SystemDocument27 pagesE2m Import Assessment SystemCHLOJJ Trading100% (3)

- Ra 10844Document2 pagesRa 10844Allaine ParkerNo ratings yet

- Final Business ResearchDocument40 pagesFinal Business Researchchariza alapNo ratings yet

- Tariff Competency Exam - Post-Test 7Document4 pagesTariff Competency Exam - Post-Test 7Jimenez C. Shainah MarieNo ratings yet

- RA 9280 Customs Broker Act of 2004Document12 pagesRA 9280 Customs Broker Act of 2004Roy GonzaNo ratings yet

- Title Iv Import Clearance and Formalities Goods DeclarationDocument42 pagesTitle Iv Import Clearance and Formalities Goods Declarationdennilyn recaldeNo ratings yet

- Sec of Finance V CtaDocument6 pagesSec of Finance V CtaRose AnnNo ratings yet

- E2MDocument2 pagesE2MEdward JohnNo ratings yet

- Midterm WarehousingDocument8 pagesMidterm WarehousingAngelo Ace M. MañalacNo ratings yet

- Draft PH Bureau of Customs Rules On Temporary Storage of GoodsDocument7 pagesDraft PH Bureau of Customs Rules On Temporary Storage of GoodsPortCalls100% (1)

- ACKNOWLEDGEMENTDocument4 pagesACKNOWLEDGEMENTSari Sari Store VideoNo ratings yet

- CASE STUDY Down With DumpingDocument2 pagesCASE STUDY Down With DumpingJona FranciscoNo ratings yet

- Answers Are Here: HRM 351 Final ExamDocument8 pagesAnswers Are Here: HRM 351 Final ExammoulisansNo ratings yet

- Related Literature On Train LawDocument16 pagesRelated Literature On Train LawRusselNo ratings yet

- Unlicensed Customs Broker - LegresDocument2 pagesUnlicensed Customs Broker - LegresRegine LangrioNo ratings yet

- HB 1653 Presentation (CCBI July 07, 2011)Document21 pagesHB 1653 Presentation (CCBI July 07, 2011)P Dg ReyesNo ratings yet

- Assignment From Victor QuiahDocument20 pagesAssignment From Victor QuiahSamah ShenhaNo ratings yet

- Ejemplo de La Actividad 5. Mtra Miriam Torres Bermudez. Analisis Del DiscursoDocument2 pagesEjemplo de La Actividad 5. Mtra Miriam Torres Bermudez. Analisis Del DiscursoHilda VillagranNo ratings yet

- Harry Potter Book ReviewDocument14 pagesHarry Potter Book ReviewNathasha GaneshNo ratings yet

- Sydni Fahringer ResumeDocument1 pageSydni Fahringer Resumeapi-317683708No ratings yet

- AnGeom Bridging 2Document10 pagesAnGeom Bridging 2blackmasqueNo ratings yet

- A Typology of P Keh Whiteness in EducationDocument16 pagesA Typology of P Keh Whiteness in EducationDiego Matos PimentelNo ratings yet

- Resilience in Infrastructure Systems A Comprehensive ReviewDocument17 pagesResilience in Infrastructure Systems A Comprehensive ReviewcherrielNo ratings yet

- DLL Physical ScienceDocument9 pagesDLL Physical ScienceTOt's VinNo ratings yet

- Handbook of Child Psychology V 601 1084Document484 pagesHandbook of Child Psychology V 601 1084Alessio TinerviaNo ratings yet

- 01 Homework 1 - ARGDocument1 page01 Homework 1 - ARGkaye pagcoNo ratings yet

- TelephoneDirectoryIIITA 20july18840Document5 pagesTelephoneDirectoryIIITA 20july18840Vivek LasunaNo ratings yet

- Ai Final ProjectDocument8 pagesAi Final ProjectJean Ice Zack De LeonNo ratings yet

- Leadership Self TestDocument4 pagesLeadership Self TestzaidNo ratings yet

- Airline ReservationDocument18 pagesAirline ReservationAshutosh PandeyNo ratings yet

- Reprinted With Permission: General Organization of A Literature Review Paper by Professor Lynne BondDocument1 pageReprinted With Permission: General Organization of A Literature Review Paper by Professor Lynne BondEngr Aizaz AhmadNo ratings yet

- Unit 6 MoneyDocument39 pagesUnit 6 MoneyMAISARAH AZYAN BINTI MOHAMAD KPM-GuruNo ratings yet

- CMTRDocument16 pagesCMTRAida ZaraNo ratings yet

- Rishi Thesis On Kwati 2073-77Document90 pagesRishi Thesis On Kwati 2073-77Usha BbattaNo ratings yet

- Ojt Narrative Report CarlaDocument37 pagesOjt Narrative Report CarlaTrisha ApalisNo ratings yet

- Assessment of Tertiary Education in NigeriaDocument11 pagesAssessment of Tertiary Education in NigeriaResearch ParkNo ratings yet

- Grade 9 - Final Version - TGP - EdDocument6 pagesGrade 9 - Final Version - TGP - EdroseNo ratings yet

- CHRISTIAN ResearchDocument62 pagesCHRISTIAN ResearchCristilyn BrionesNo ratings yet

- A Level Oral Examiner Info PackDocument33 pagesA Level Oral Examiner Info PackRafet TanrıoğluNo ratings yet

- PHD Thesis On Building MaintenanceDocument8 pagesPHD Thesis On Building Maintenancetunwpmzcf100% (2)

- Week 7 Kindergarten Lesson PlanDocument2 pagesWeek 7 Kindergarten Lesson Planapi-445021282No ratings yet

- الدكتور مصطفى الشناق رئيس جمعية الجهاز الهضمي والكبد الأردنية Medics Index Member 10122010 ResumeDocument29 pagesالدكتور مصطفى الشناق رئيس جمعية الجهاز الهضمي والكبد الأردنية Medics Index Member 10122010 ResumejordanmedicsNo ratings yet

- Card Day Attendance 2023Document4 pagesCard Day Attendance 2023Maribel AnganaNo ratings yet

- IOSH Managing Safely v5 - Detailed ChangesDocument1 pageIOSH Managing Safely v5 - Detailed ChangesMunavir kNo ratings yet

- Instructor Clinical Evaluation ToolsDocument11 pagesInstructor Clinical Evaluation ToolsJoric MagusaraNo ratings yet