Professional Documents

Culture Documents

Syllabus & Exam Pattern Accounts Sem I 21-22

Syllabus & Exam Pattern Accounts Sem I 21-22

Uploaded by

Tejas PatilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Syllabus & Exam Pattern Accounts Sem I 21-22

Syllabus & Exam Pattern Accounts Sem I 21-22

Uploaded by

Tejas PatilCopyright:

Available Formats

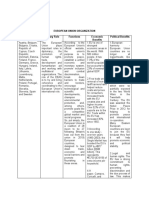

ACCOUNTANCY

SYLLABUS FOR SEMESTER I

Modul Details

e

I Introduction to Accounting Standards

a. Accounting standards:

Concepts, benefits, procedures for issue of accounting standards.

AS – 1: Disclosure of Accounting Policies

AS – 10: Property, Plant & Equipment

AS – 26: Intangible Assets

II Final Accounts

a. Expenditures: Capital, Revenue

Receipts: Capital, Revenue

b. Adjustment and Closing entries

c. b. Final accounts of Manufacturing

Concerns ( Proprietary firm)

c. Departmental Final Accounts

III Accounting from Incomplete Records

a. Introduction

b. Balancing of Subsidiary Ledgers

c. Problems on preparation of final accounts of Proprietary Trading

Concern (conversion method)

IV Accounting for Hire Purchase

a. Meaning

b. Calculation of interest

c. Accounting for hire purchase transactions by asset purchase method

based on full cash price

d. Journal entries, ledger accounts and disclosure in balance sheet for

hirer and vendor (excluding default, repossession and calculation of cash

price)

Evaluation Scheme

Type Internal Semester End

Assessment Examination

Total Marks 40 60

Minimum Passing 16 24

Mark

# Composition of Internal Assessment of 40 marks will be discussed in the lecture.

EXAMINATION PAPER PATTERN FOR SEMESTER END

Maximum Marks: 60

Questions to be asked: 04

Duration: 2 Hours

All Questions are Compulsory Carrying 15 Marks Each

Questio Particular Marks

n No

Q-1 Objective Questions

A) Sub Questions to be asked 10 and to be answered 07 15 Marks

B) Sub Questions to be asked 10 and to be answered 08

(*Multiple Choice/True or False/Fill in the blanks/Match the

column)

Q-2 Practical Question 15 Marks

OR

Q-2 Practical Question 15 Marks

Q-3 Practical Question 15 Marks

OR

Q-3 Practical Question 15 Marks

Q-4 Practical Question 15 Marks

OR

Q-4 Practical Question 15 Marks

Note: Practical questions of 15 marks may be divided into two sub questions of 7 marks or 8

Marks each.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Now or Never Nova Scotia - Final Report With Research & Engagement DocumentationDocument258 pagesNow or Never Nova Scotia - Final Report With Research & Engagement Documentationone_Nova_Scotia100% (1)

- Wetlands of India: A Review of Ramsar Sites: February 2019Document22 pagesWetlands of India: A Review of Ramsar Sites: February 2019Tejas PatilNo ratings yet

- Trisha Business PlanDocument11 pagesTrisha Business PlanTejas PatilNo ratings yet

- Economics Assissgment - FYB - Com DDocument2 pagesEconomics Assissgment - FYB - Com DTejas PatilNo ratings yet

- FC Project Drug AddictionDocument17 pagesFC Project Drug AddictionTejas PatilNo ratings yet

- Forms of Market: Prepared By: Reena D Isaac Mulund College of CommerceDocument23 pagesForms of Market: Prepared By: Reena D Isaac Mulund College of CommerceTejas PatilNo ratings yet

- 1.4 StakeholdersDocument20 pages1.4 StakeholdersRODRIGO GUTIERREZ HUAMANINo ratings yet

- Capital Structure Self Correction ProblemsDocument53 pagesCapital Structure Self Correction ProblemsTamoor BaigNo ratings yet

- Community Risk Reduction Taskforce 2018 - 2020 Strategic PlanDocument1 pageCommunity Risk Reduction Taskforce 2018 - 2020 Strategic PlanAnonymous VtK7R8eRNo ratings yet

- The Cost of CapitalDocument12 pagesThe Cost of CapitalLeyla Malijan100% (1)

- #1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldDocument5 pages#1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldMarie Frances SaysonNo ratings yet

- Written Exam Bookkeeping NC Iii: I. Directions. Encircle The Correct Answer From The Given Options BelowDocument5 pagesWritten Exam Bookkeeping NC Iii: I. Directions. Encircle The Correct Answer From The Given Options BelowMay Ann VillanuevaNo ratings yet

- 114.709: Managing Employment Relations (ER) : Week Four: Regulation IDocument12 pages114.709: Managing Employment Relations (ER) : Week Four: Regulation IKalolo FihakiNo ratings yet

- Summary of Should You Take Your Brand To Where Tha Action IsDocument3 pagesSummary of Should You Take Your Brand To Where Tha Action Isrhydama khadgiNo ratings yet

- Investment BankingDocument19 pagesInvestment BankingYash JaiswalNo ratings yet

- B 20170522Document94 pagesB 20170522larryNo ratings yet

- Minesh Final MsDocument59 pagesMinesh Final MsAmey KoliNo ratings yet

- Examiners' Commentaries 2014: FN3092 Corporate FinanceDocument19 pagesExaminers' Commentaries 2014: FN3092 Corporate FinanceBianca KangNo ratings yet

- Jetstar Pacific AirlinesDocument19 pagesJetstar Pacific AirlinesChevalier UnderMoonNo ratings yet

- Syllabus CPM DiplomaDocument6 pagesSyllabus CPM DiplomaGirman ranaNo ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- CHAPTER 4 Entrepreneurial MindDocument8 pagesCHAPTER 4 Entrepreneurial MindXOLCHITNo ratings yet

- Risk Management PlanDocument3 pagesRisk Management Planit argentinaNo ratings yet

- 179848-Article Text-459072-1-10-20181119Document9 pages179848-Article Text-459072-1-10-20181119Oyebola Akin-DeluNo ratings yet

- Princess Julienne Y. Yu 2GphDocument4 pagesPrincess Julienne Y. Yu 2GphPRINCESS JULIENNE YUNo ratings yet

- After Sales Services of Selected Car Insurance Companies - Chapter 1 5 - RevisedDocument68 pagesAfter Sales Services of Selected Car Insurance Companies - Chapter 1 5 - RevisedMariel AdventoNo ratings yet

- Afu 08504 - If - Forex Market - TQDocument4 pagesAfu 08504 - If - Forex Market - TQAbdulkarim Hamisi KufakunogaNo ratings yet

- Test Bank For Essentials of Marketing Management 1st Edition MarshallDocument92 pagesTest Bank For Essentials of Marketing Management 1st Edition MarshallXolani MpilaNo ratings yet

- Manager Project Financial Advertising in Chicago IL Resume Deborah KozieDocument2 pagesManager Project Financial Advertising in Chicago IL Resume Deborah KozieDeborah KozieNo ratings yet

- GNFC Neem Project - The Ecosystem of Shared ValueDocument15 pagesGNFC Neem Project - The Ecosystem of Shared ValueIsha AggNo ratings yet

- ICICI ProjectDocument90 pagesICICI ProjectSrusti ParekhNo ratings yet

- OD119185277796277000Document4 pagesOD119185277796277000Awadhesh PalNo ratings yet

- Ax Blog 2Document293 pagesAx Blog 2pjanssen2306No ratings yet

- Unit Four Tactical Decision MakingDocument21 pagesUnit Four Tactical Decision MakingDzukanji SimfukweNo ratings yet

- Engaging Hotel Associates in The New Normal by Rakesh KatyayaniDocument1 pageEngaging Hotel Associates in The New Normal by Rakesh KatyayaniEclatNo ratings yet