Professional Documents

Culture Documents

Global X Digital Innovation Japan ETF: Fund Objective

Global X Digital Innovation Japan ETF: Fund Objective

Uploaded by

jdsfkjfdsaCopyright:

Available Formats

You might also like

- CIPM OutlineDocument51 pagesCIPM OutlineLeonora KraemerNo ratings yet

- Octopus Pitch DeckDocument27 pagesOctopus Pitch DeckNKhaNo ratings yet

- Samsung Corporate GovernanceDocument26 pagesSamsung Corporate Governancezabi ullah MohammadiNo ratings yet

- Probable APC QuestionsDocument4 pagesProbable APC Questionsakg2004167% (3)

- Autonomy Pitch Book Qatalyst PDFDocument14 pagesAutonomy Pitch Book Qatalyst PDFRishabh Bansal100% (1)

- Casio Annual Report 2018Document35 pagesCasio Annual Report 2018Sarah LoNo ratings yet

- IPO Factsheet SNS Network Technology BerhadDocument2 pagesIPO Factsheet SNS Network Technology Berhadsj7953No ratings yet

- Affle Corporate PresentationDocument39 pagesAffle Corporate Presentationchiragchhillar9711No ratings yet

- Centrum Broking Intellect Design Arena Initiating CoverageDocument31 pagesCentrum Broking Intellect Design Arena Initiating CoveragekanadeceNo ratings yet

- 5.1 Ramasamy MalaysiaDocument31 pages5.1 Ramasamy MalaysiaDr. Khattab ImranNo ratings yet

- TLKM 1q21 Info MemoDocument20 pagesTLKM 1q21 Info MemopcpeceNo ratings yet

- HDFC Manufacturing Fund - NFO - Leaflet - HDFC BankDocument2 pagesHDFC Manufacturing Fund - NFO - Leaflet - HDFC Bankyeheji8177No ratings yet

- ECOFUND Factsheet ENGDocument1 pageECOFUND Factsheet ENGdave.importacionesNo ratings yet

- Hitachi en Outline 2018-2019Document13 pagesHitachi en Outline 2018-2019thoigiantroiqua123No ratings yet

- Dixon Technologies Annual Report Analysis 18 September 2021Document12 pagesDixon Technologies Annual Report Analysis 18 September 2021Equity NestNo ratings yet

- Cognizant Rejig May Make Digital Arm Nimbler, Stem Attrition, Say AnalystsDocument3 pagesCognizant Rejig May Make Digital Arm Nimbler, Stem Attrition, Say AnalystsStarNo ratings yet

- Newgen Software Technologies LTD.: Q3 FY'21 Investor UpdateDocument18 pagesNewgen Software Technologies LTD.: Q3 FY'21 Investor UpdateDevendra MahajanNo ratings yet

- Axis Global Innovation FoF NFO LeafletDocument2 pagesAxis Global Innovation FoF NFO LeafletKamalnath SinghNo ratings yet

- Happiest Minds TechnologiesLtd IPO NOTE07092020Document7 pagesHappiest Minds TechnologiesLtd IPO NOTE07092020subham mohantyNo ratings yet

- Nedap IR Presentation September 2020 PDFDocument33 pagesNedap IR Presentation September 2020 PDFJasper Laarmans Teixeira de MattosNo ratings yet

- E - Press Release - INCJ - RenesasDocument3 pagesE - Press Release - INCJ - RenesasafdgtdsghfNo ratings yet

- WhitepaperDocument53 pagesWhitepaperamandotarbiraNo ratings yet

- Company Update FY20 AuDocument34 pagesCompany Update FY20 AuA. NurhidayatiNo ratings yet

- Ar2015e 0Document276 pagesAr2015e 0ed bookerNo ratings yet

- TechnologyDocument9 pagesTechnologymy spamNo ratings yet

- Annual Report 2017 18Document204 pagesAnnual Report 2017 18Raghu UnknownNo ratings yet

- KTL IPO NoteDocument6 pagesKTL IPO Noteaksantosh2nd007No ratings yet

- Singapore POST Capex - Docx Final 2022Document3 pagesSingapore POST Capex - Docx Final 2022Jonathan SulaimanNo ratings yet

- 20220401 时代天使 2021年年报点评:隐形矫治龙头地位稳固,案例数持续高速增长 东吴证券国际经纪Document6 pages20220401 时代天使 2021年年报点评:隐形矫治龙头地位稳固,案例数持续高速增长 东吴证券国际经纪pumeili1113No ratings yet

- Sony Corp (6758) - Financial and Strategic SWOT Analysis ReviewDocument55 pagesSony Corp (6758) - Financial and Strategic SWOT Analysis ReviewAngel Chiang100% (2)

- Annual Report 2021 22Document137 pagesAnnual Report 2021 22MANSI POKARNANo ratings yet

- PT M Cash Integrasi TBK: Charting A Digital TransformationDocument7 pagesPT M Cash Integrasi TBK: Charting A Digital TransformationHamba AllahNo ratings yet

- Kahoot!Document6 pagesKahoot!Federico NiciferoNo ratings yet

- Axiata IAR2022Document119 pagesAxiata IAR2022Priscilla KitNo ratings yet

- FSN E-Commerce Ventures LTD: Market's Envy. Investors' PrideDocument25 pagesFSN E-Commerce Ventures LTD: Market's Envy. Investors' PrideSandeep WandreNo ratings yet

- IDirect IkioLighting IPOReviewDocument9 pagesIDirect IkioLighting IPOReviewHarish GoyalNo ratings yet

- Mirae Company Analysis EXCL 10 Feb 2023 Initiate Trading Buy TPDocument17 pagesMirae Company Analysis EXCL 10 Feb 2023 Initiate Trading Buy TPsrimulyaningsih283No ratings yet

- Hitachi Digital StrategyDocument32 pagesHitachi Digital StrategyNAZANINNo ratings yet

- ICICI Securities Ltd. - PCG HNI Note - SMIFS ResearchDocument11 pagesICICI Securities Ltd. - PCG HNI Note - SMIFS ResearchShweta ChaudharyNo ratings yet

- AIQ FactsheetDocument2 pagesAIQ FactsheetRanjan SharmaNo ratings yet

- Annual Report 2022Document4 pagesAnnual Report 2022dertmzkn40No ratings yet

- The Nasdaq Technology Dividend Index: A Great Complement To Broad Dividend PortfoliosDocument7 pagesThe Nasdaq Technology Dividend Index: A Great Complement To Broad Dividend PortfoliosIvan FerdianNo ratings yet

- NTT New Medium-Term Management StrategyDocument29 pagesNTT New Medium-Term Management StrategyAllen Li100% (1)

- KPIT Technologies - Initiating Coverage - Centrum 26022020Document32 pagesKPIT Technologies - Initiating Coverage - Centrum 26022020Adarsh ReddyNo ratings yet

- SUBEXLTD 28102021225228 InvestorPresentationDocument30 pagesSUBEXLTD 28102021225228 InvestorPresentationleoharshadNo ratings yet

- Rakuten Group Introduction Updated June 2021Document50 pagesRakuten Group Introduction Updated June 2021Girish Mamtani100% (1)

- Why Japan?: 5 Reasons To Invest in JAPANDocument12 pagesWhy Japan?: 5 Reasons To Invest in JAPANmukul pandeyNo ratings yet

- Campus Activewear Limited IPO: NeutralDocument7 pagesCampus Activewear Limited IPO: NeutralAkash PawarNo ratings yet

- Pictet-Human-R EUR - FACTSHEET - LU2247920262 - EN - DEFAULT - 31jan2022Document4 pagesPictet-Human-R EUR - FACTSHEET - LU2247920262 - EN - DEFAULT - 31jan2022ATNo ratings yet

- Noch Deutsche Texte: Our Path To Sustainable Value CreationDocument66 pagesNoch Deutsche Texte: Our Path To Sustainable Value CreationvsewagvirgoNo ratings yet

- Siemens AR 2010Document342 pagesSiemens AR 2010rajeshamexsNo ratings yet

- Nifty India Digital Exchange Traded Fun7Document1 pageNifty India Digital Exchange Traded Fun7Henna KadyanNo ratings yet

- Advantech Corp. (2395.TW) - Good Industry 4.0 Concept But Limited Notable Catalysts Initiate at NeutralDocument30 pagesAdvantech Corp. (2395.TW) - Good Industry 4.0 Concept But Limited Notable Catalysts Initiate at NeutralJoachim HagegeNo ratings yet

- SCNL Investor PPT - Q2 FY20Document69 pagesSCNL Investor PPT - Q2 FY20fghjmkNo ratings yet

- Proteanegovtechnologieslimitedrhp Ibcomments v2 2023Document11 pagesProteanegovtechnologieslimitedrhp Ibcomments v2 2023mohit_999No ratings yet

- Encore Event Technologies Group Pty LimitedDocument19 pagesEncore Event Technologies Group Pty Limitedvickyang2047No ratings yet

- Infosys Annual Report AnalysisDocument9 pagesInfosys Annual Report AnalysisAbhishek PaulNo ratings yet

- Mid-Term Management Plan 2020: January 30, 2018 NEC CorporationDocument46 pagesMid-Term Management Plan 2020: January 30, 2018 NEC CorporationTanmoy IimcNo ratings yet

- Tata Nifty India Digital Exchange Traded Fund - LeafletDocument4 pagesTata Nifty India Digital Exchange Traded Fund - LeafletSatyam TiwariNo ratings yet

- Corporate Presentation Q2 - 2022pdfDocument24 pagesCorporate Presentation Q2 - 2022pdfgussalimNo ratings yet

- IoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsFrom EverandIoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsNo ratings yet

- Ucits Etf A Unique European FormatDocument4 pagesUcits Etf A Unique European FormatjdsfkjfdsaNo ratings yet

- A Beginner'S Guide: EtfsDocument12 pagesA Beginner'S Guide: EtfsjdsfkjfdsaNo ratings yet

- Best Practices For Effective ETF Trading: Remember A Few BasicsDocument4 pagesBest Practices For Effective ETF Trading: Remember A Few BasicsjdsfkjfdsaNo ratings yet

- 1nvest Factsheet - ETF RHODocument2 pages1nvest Factsheet - ETF RHOjdsfkjfdsaNo ratings yet

- Family Financial Planning FIN533Document22 pagesFamily Financial Planning FIN533SITI FATIMAH AMALINA ABDUL RAZAKNo ratings yet

- Notes BMGT 211 Introduction To Risk and Insurance May 2020-1Document94 pagesNotes BMGT 211 Introduction To Risk and Insurance May 2020-1jeremieNo ratings yet

- 7 United India Cashless Garages (Car) in PanchkulDocument1 page7 United India Cashless Garages (Car) in PanchkulManish Singh KhatriNo ratings yet

- Policy 555839668 1899087538702Document5 pagesPolicy 555839668 1899087538702utkarsh ambreNo ratings yet

- Outpatient One Pager Version 1.0 Apr 20Document1 pageOutpatient One Pager Version 1.0 Apr 20naval730107No ratings yet

- Statement of Account 157008615988:: 31-May-2021: 01-May-2021 To 31-May-2021Document3 pagesStatement of Account 157008615988:: 31-May-2021: 01-May-2021 To 31-May-2021Suvam MohapatraNo ratings yet

- Bangko Sentral NG Pilipinas Citizen's CharterDocument5 pagesBangko Sentral NG Pilipinas Citizen's CharterAlex ReyesNo ratings yet

- BAR Q's INSURANCEDocument29 pagesBAR Q's INSURANCETenshi OideNo ratings yet

- Questions & Answers: Tax Laws in Tanzania.: Publication TLT-01Document11 pagesQuestions & Answers: Tax Laws in Tanzania.: Publication TLT-01Dennis OndiekiNo ratings yet

- Sap Infor TypeDocument12 pagesSap Infor TypeDEEP KHATINo ratings yet

- Risk in Business El Yaagoubi Zineb Boussoughi Nahid Hiba El Khoudri Ayoub Zdaik LamiaeDocument11 pagesRisk in Business El Yaagoubi Zineb Boussoughi Nahid Hiba El Khoudri Ayoub Zdaik LamiaeAchraf El aouameNo ratings yet

- KA05AH8323Document2 pagesKA05AH8323Balu CNo ratings yet

- Fidelity and Body PartsDocument61 pagesFidelity and Body PartsTripathi OjNo ratings yet

- Full File Correctly FormattedDocument10 pagesFull File Correctly FormattedUlii PntNo ratings yet

- Case Study PRE-SEEN MAY 2021.editedDocument14 pagesCase Study PRE-SEEN MAY 2021.editedDAVID OWUSUNo ratings yet

- Leo33 - Most Frecvent Questions About Leo ProgramDocument2 pagesLeo33 - Most Frecvent Questions About Leo ProgramTanasa-LucaClaudiaIulianaNo ratings yet

- Blueberry Crop Provisions 23 012Document5 pagesBlueberry Crop Provisions 23 012vivekNo ratings yet

- Relaxo Cogs CashDocument40 pagesRelaxo Cogs CashRonakk MoondraNo ratings yet

- Introduction To Income TaxationDocument3 pagesIntroduction To Income TaxationescrowNo ratings yet

- Business Law INUCASTY NewDocument65 pagesBusiness Law INUCASTY NewIshimwe ChristianNo ratings yet

- Medical Defence Union V Department of TradeDocument2 pagesMedical Defence Union V Department of Tradechikondidaka37No ratings yet

- International Finance - Assignment 1Document3 pagesInternational Finance - Assignment 1Betty MudondoNo ratings yet

- BUYERBuyer Insurance-961710Document10 pagesBUYERBuyer Insurance-961710Arwal BranchNo ratings yet

- Macquarie Credit Card Insurance Terms ConditionsDocument50 pagesMacquarie Credit Card Insurance Terms ConditionshemilNo ratings yet

- BEDA - CaseZ-Doctrines-InsuranceDocument5 pagesBEDA - CaseZ-Doctrines-InsuranceMalcolm CruzNo ratings yet

- Mba 1 in PDFDocument41 pagesMba 1 in PDFtheshoeslover1No ratings yet

- CEE+3348+3 Lesson+Three+-+Bidding+Law+and+BondsDocument67 pagesCEE+3348+3 Lesson+Three+-+Bidding+Law+and+BondsChachi CNo ratings yet

- UHS May UpdateDocument2 pagesUHS May UpdateSEIU Local 1No ratings yet

Global X Digital Innovation Japan ETF: Fund Objective

Global X Digital Innovation Japan ETF: Fund Objective

Uploaded by

jdsfkjfdsaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global X Digital Innovation Japan ETF: Fund Objective

Global X Digital Innovation Japan ETF: Fund Objective

Uploaded by

jdsfkjfdsaCopyright:

Available Formats

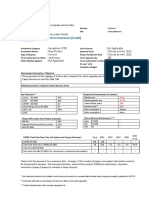

Global X Digital Innovation Japan ETF

2626 As of 10/29/2021

FUND OBJECTIVE FUND DETAILS

The Global X Digital Innovation Japan ETF seeks to provide investment results that Inception Date 1/25/2021

correspond generally to the price and yield performance, before fees and expenses, of the Solactive Digital

Solactive Digital Innovation Japan Index. Underlying Index

Innovation Japan Index

KEY FEATURES Number of Holdings 60

Assets Under Management ¥17.63(100mil)

High Growth Potential NAV (per 100 units) ¥208,206

The Global X Digital Innovation Japan ETF enables investors to access high 0.649% per annum

growth potential through companies whose principal business is related to the

Management Fee

(0.59% before tax)

digital innovation. Distribution Frequency Semi-Annually

Closing date 1/24,7/24

Unconstrained Approach

The Global X Digital Innovation Japan ETF's composition transcends classic TRADING DETAILS

sector, industry, and geographic classifications by tracking an emerging Securities code 2626

theme. ISIN JP3049210002

Exchange Tokyo Stock Exchange

ETF Efficiency Bloomberg INAV Ticker 2626IV

In a single trade, The Global X Digital Innovation Japan ETF delivers access Index Ticker SOLINJPP

to dozens of companies with high exposure to the digital innovation theme.

ASSETS UNDER MANAGEMENT / FUND PERFORMANCE CHART FUND DISTRIBUTIONS

(1/25/2021~10/29/2021) per 100 units, before taxes (Yen)

230,000 Assets Under Management 400 7/24/21 1,400

Solactive Digital Innovation Japan Index

225,000 350

FUND at NAV (reinvestment, Yen)

FUND at NAV (reinvestment)

220,000 300

AUM (100mil Yen)

215,000 250

210,000 200

205,000 150

200,000 100

195,000 50

190,000 0

Inception 4/23/21 7/29/21 10/29/21

PERFORMANCE TOP 10 HOLDINGS % of AUM

One Year to Three Since Total:48.50%

One Year

Month Date Year Inception SONY GROUP CORP 5.29% KDDI CORP 4.82%

SOFTBANK CORP 5.18% SOFTBANK GROUP CORP 4.79%

FUND at NAV -1.99 % ----- ----- ----- -0.19 %

Z HOLDINGS CORP 4.96% FUJIFILM HOLDINGS CORP 4.59%

FUND at NAV RAKUTEN GROUP INC 4.96% NINTENDO CO LTD 4.55%

-1.99 % ----- ----- ----- +0.51 %

(reinvestment) BANDAI NAMCO HOLDINGS INC 4.83% SECOM CO LTD 4.52%

Solactive Digital Innovation

-1.93 % ----- ----- ----- -0.32 %

Japan Index

Fund performance assumes that dividends (before taxes) are reinvested in the fund. NAV value is calculated after deducting trust fees. In the graph, the value

of (Solactive Digital Innovation Japan Index) is modified to match the fund NAV at the time of inception.The performance data quoted represents past

performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when

sold or redeemed, may be worth more or less than their original cost. High short term performance of the fund is unusual and investors should not expect such

performance to be repeated.

Global X Japan Co. Ltd. Registration No. : Director of Kanto Local

Finance Bureau (Financial Instruments Firms) No.3174 Member of Kioicho PREX 11F, 4-5-21,

Japan Investment Advisers Association Member of The Investment Kojimachi, Chiyoda-ku, Tokyo

Trusts Association, Japan

2626 Global X Digital Innovation Japan ETF As of 10/29/2021

INDUSTRY BREAKDOWN % of AUM

l Information & Communication 54.71%

l Services 18.90%

l Other Products 9.38%

l Electric Appliances 5.51%

l Chemicals 4.77%

l Retail Trade 4.13%

l Securities & Commodities Futures 1.80%

l --- ---

l --- ---

l Others* 0.79%

*Others include cash and cash equivalents.

Concept & Key Points

1. Focus on the most digitally innovative companies in Japan

2. Classify Digital Innovation into 11 sub-themes in 4 fields

(1) Education and Medical : Online education, Online healthcare

(2) Leisure : Gaming, Game streaming, Social media

(3) Work : Remote communication, Cloud computing, Cyber security, etc.

(4) Shopping : E-commerce, Electronic payment

3. Market capitalization weighting (capped at 5%, floored at 0.2%)

4. Reconstitution and rebalancing portfolio, twice a year in April and October

Index construction process

Investment Univesrse Step 1 Among stocks listed in Japan, stocks below are included:

All stocks listed in Japan - With market cap JPY 30 bil or above

- With average daily trading volume JPY 300 mil or above

Portfolio Candidates

Stocks related to the 11 sub-themes Stocks related to the 11 sub-themes are identified by Solactive's

Step 2 keyword search.

Stocks that are judged to be unrelated to the 11 sub-themes

based on their business content and other factors are excluded.

Final Portfolio Candidates are ranked based on their degree of relevance.

60 constituents

Step 3 Negative screening is conducted to exclude stocks that do not

conform to ESG concepts.

Weight is market capitalization weighting, with a cap of 5%, and

a floor of 0.2% per stock.

Portfolio Reconstitution and rebalancing

(60 constituents) twice a year (April and October)

Global X Japan Co. Ltd. Registration No. : Director of Kanto Local

Finance Bureau (Financial Instruments Firms) No.3174 Member of Kioicho PREX 11F, 4-5-21,

Japan Investment Advisers Association Member of The Investment Kojimachi, Chiyoda-ku, Tokyo

Trusts Association, Japan

Investment Risks

The Fund will invest in financial instruments whose prices fluctuate and as a result the NAV per unit of the Fund will also fluctuate. Therefore the invested amount will not be guaranteed and a loss of

principal may be caused. All the gains and losses accrued to the trust assets will be attributable to the investors. Investment trusts are not deposits.

Major factors to cause fluctuation of NAV per unit:

Price Volatility risks / Credit risks (Stock Price Volatility), Other risks

The performance of the NAV may not completely match that of the index. The factors to cause fluctuation of NAV per unit are not limited to those mentioned above. Please read “Investment Risks” in the

fund’s Prospectus describing in detail.

Fee Structure

<Fees directly charged to customers>

Subscription commission: Determined by the Distributor. (Subscription Commission is a consideration for explanation of products, provision of product information and investment information, and execution of

application at the time of the subscription of the Fund)

Redemption Fee: Nil

Exchange commission: Determined by the Distributor.

(Exchange Commission is a consideration for administrative procedures for exchange of units of the Fund.)

<Fees indirectly charged during holding period>

Management Fee (Trust Fee):

Trust fee is calculated daily as sum of 1 and 2 as shown below during the holding period.

1. The amount obtained by multiplying the total net assets of the trust assets by the ratio up to 0.649% per annum (0.59% before tax).

2. The amount obtained by multiplying lending charges due to lending of stocks held in the trust assets by up to 55% (50% before tax).

Other Expenses and Brokerage Commissions

Fund Listing Expenses and Annual Fees for Use of Trademarks of the Index with tax levied on them can be borne by the unitholders, and can be paid from the trust assets.

Commissions associated with securities transactions (including brokerage commissions on trade of securities, fees for future transactions and option transactions) and auditing fees shall be charged to the

trust assets.

※As expenses for brokerage commissions on trade of securities, etc. shall vary depending on circumstances, specific rate of fees or the maximum amounts thereof cannot be disclosed in advance.

※Please see further details described under “Expenses and Taxes of the Fund” in the Prospectus.

About the copyright of the index

THIS FUND IS NOT SPONSORED, ENDORSED, SOLD OR PROMOTED BY SOLACTIVE AG (“SOLACTIVE”) OR ANY OF ITS AFFILIATES. (COLLECTIVELY, THE “SOLACTIVE PARTIES”). THE SOLACTIVE

INDEX IS THE EXCLUSIVE PROPERTY OF SOLACTIVE. SOLACTIVE AND THE SOLACTIVE INDEX NAME IS A SERVICE MARK(S) OF SOLACTIVE OR ITS AFFILIATES AND HAVE BEEN LICENSED FOR

USE FOR CERTAIN PURPOSES BY Global X Japan Co. Ltd. NONE OF THE SOLACTIVE PARTIES MAKES ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, TO THE ISSUER OR

OWNERS OF THIS FUND OR ANY OTHER PERSON OR ENTITY REGARDING THE ADVISABILITY OF INVESTING IN FUNDS GENERALLY OR IN THIS FUND PARTICULARLY OR THE ABILITY OF ANY

SOLACTIVE INDEX TO TRACK CORRESPONDING STOCK MARKET PERFORMANCE. SOLACTIVE OR ITS AFFILIATES ARE THE LICENSORS OF CERTAIN TRADEMARKS, SERVICE MARKS AND

TRADE NAMES AND OF THE SOLACTIVE INDEX WHICH IS DETERMINED, COMPOSED AND CALCULATED BY SOLACTIVE WITHOUT REGARD TO THIS FUND OR THE ISSUER OR OWNERS OF THIS

FUND OR ANY OTHER PERSON OR ENTITY. NONE OF THE SOLACTIVE PARTIES HAS ANY OBLIGATION TO TAKE THE NEEDS OF THE ISSUER OR OWNERS OF THIS FUND OR ANY OTHER

PERSON OR ENTITY INTO CONSIDERATION IN DETERMINING, COMPOSING OR CALCULATING THE SOLACTIVE INDEX. NONE OF THE SOLACTIVE PARTIES IS RESPONSIBLE FOR OR HAS

PARTICIPATED IN THE DETERMINATION OF THE TIMING OF, PRICES AT, OR QUANTITIES OF THIS FUND TO BE ISSUED OR IN THE DETERMINATION OR CALCULATION OF THE EQUATION BY OR

THE CONSIDERATION INTO WHICH THIS FUND IS REDEEMABLE. FURTHER, NONE OF THE SOLACTIVE PARTIES HAS ANY OBLIGATION OR LIABILITY TO THE ISSUER OR OWNERS OF THIS FUND

OR ANY OTHER PERSON OR ENTITY IN CONNECTION WITH THE ADMINISTRATION, MARKETING OR OFFERING OF THIS FUND.

ALTHOUGH SOLACTIVE SHALL OBTAIN INFORMATION FOR INCLUSION IN OR FOR USE IN THE CALCULATION OF THE SOLACTIVE INDEX FROM SOURCES THAT SOLACTIVE CONSIDERS

RELIABLE, NONE OF THE SOLACTIVE PARTIES WARRANTS OR GUARANTEES THE ORIGINALITY, ACCURACY AND/OR THE COMPLETENESS OF ANY SOLACTIVE INDEX OR ANY DATA INCLUDED

THEREIN. NONE OF THE SOLACTIVE PARTIES MAKES ANY WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY THE ISSUER OF THE FUND, OWNERS OF THE FUND, OR

ANY OTHER PERSON OR ENTITY, FROM THE USE OF ANY SOLACTIVE INDEX OR ANY DATA INCLUDED THEREIN. NONE OF THE SOLACTIVE PARTIES SHALL HAVE ANY LIABILITY FOR ANY

ERRORS, OMISSIONS OR INTERRUPTIONS OF OR IN CONNECTION WITH ANY SOLACTIVE INDEX OR ANY DATA INCLUDED THEREIN. FURTHER, NONE OF THE SOLACTIVE PARTIES MAKES ANY

EXPRESS OR IMPLIED WARRANTIES OF ANY KIND, AND THE SOLACTIVE PARTIES HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR

PURPOSE, WITH RESPECT TO EACH SOLACTIVE INDEX AND ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL ANY OF THE SOLACTIVE

PARTIES HAVE ANY LIABILITY FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR ANY OTHER DAMAGES (INCLUDING LOST PROFITS) EVEN IF NOTIFIED OF THE

POSSIBILITY OF SUCH DAMAGES.

Disclaimer: Warning before handling this material

This material was prepared by Global X Japan Co. Ltd. to provide information about its funds’ performance and other operation-related facts. Potential investors should refer to and read the prospectus of

such fund product for more detailed information prior to their investment decision. Since investment trusts will invest in stocks whose prices fluctuate, the NAV of this fund could possibly decline and cause a

loss in investment. The investors’ principals thus are not guaranteed and the fund contains risk that the NAV may fall below its par value. All the gains and losses accrued to the trust assets will be

attributable to the investors. Investment trusts are different from deposits and insurance policies. Investment trusts are not protected by the Deposit Insurance Corporation of Japan and insurance

policyholders protection corporations. Investment trusts which are not purchased from securities companies are not protected by the Japan Investor Protection Fund. The information, statements, forecasts

and projections contained herein, including any expression of opinion, are based upon sources believed to be reliable, but their accuracy, correctness or completeness are not guaranteed. The performance

of investments, if referred to herein, is based on past data and is neither necessarily an indication nor a guarantee of future performance of investments. The performance data in this material does not

consider any tax or fees if there were any, and will not provide a final return for potential investors. Global X Japan Co. Ltd. made all reasonable efforts to ensure that the information contained herein is

current, but it is subject to change without notice. The dividend amount is to be determined, based on the dividend distribution policy of such fund product, by the investment manager, who will not promise or

guarantee any fixed amount of dividend before investment. In some cases, the investment manager might decide to skip a dividend payment for the correspondent period due to performance reason. Global X

is a registered trademark of Global X Management Company LLC. Any replication, citation, reprinting, transmission or otherwise of Global X – by any means and for any purpose – without permission is

prohibited. Global X LLC is a registered investment advisor with the United States Securities and Exchange Commission.

Global X Japan Co. Ltd. Registration No. : Director of Kanto Local

Finance Bureau (Financial Instruments Firms) No.3174 Member of Kioicho PREX 11F, 4-5-21,

Japan Investment Advisers Association Member of The Investment Kojimachi, Chiyoda-ku, Tokyo

Trusts Association, Japan

You might also like

- CIPM OutlineDocument51 pagesCIPM OutlineLeonora KraemerNo ratings yet

- Octopus Pitch DeckDocument27 pagesOctopus Pitch DeckNKhaNo ratings yet

- Samsung Corporate GovernanceDocument26 pagesSamsung Corporate Governancezabi ullah MohammadiNo ratings yet

- Probable APC QuestionsDocument4 pagesProbable APC Questionsakg2004167% (3)

- Autonomy Pitch Book Qatalyst PDFDocument14 pagesAutonomy Pitch Book Qatalyst PDFRishabh Bansal100% (1)

- Casio Annual Report 2018Document35 pagesCasio Annual Report 2018Sarah LoNo ratings yet

- IPO Factsheet SNS Network Technology BerhadDocument2 pagesIPO Factsheet SNS Network Technology Berhadsj7953No ratings yet

- Affle Corporate PresentationDocument39 pagesAffle Corporate Presentationchiragchhillar9711No ratings yet

- Centrum Broking Intellect Design Arena Initiating CoverageDocument31 pagesCentrum Broking Intellect Design Arena Initiating CoveragekanadeceNo ratings yet

- 5.1 Ramasamy MalaysiaDocument31 pages5.1 Ramasamy MalaysiaDr. Khattab ImranNo ratings yet

- TLKM 1q21 Info MemoDocument20 pagesTLKM 1q21 Info MemopcpeceNo ratings yet

- HDFC Manufacturing Fund - NFO - Leaflet - HDFC BankDocument2 pagesHDFC Manufacturing Fund - NFO - Leaflet - HDFC Bankyeheji8177No ratings yet

- ECOFUND Factsheet ENGDocument1 pageECOFUND Factsheet ENGdave.importacionesNo ratings yet

- Hitachi en Outline 2018-2019Document13 pagesHitachi en Outline 2018-2019thoigiantroiqua123No ratings yet

- Dixon Technologies Annual Report Analysis 18 September 2021Document12 pagesDixon Technologies Annual Report Analysis 18 September 2021Equity NestNo ratings yet

- Cognizant Rejig May Make Digital Arm Nimbler, Stem Attrition, Say AnalystsDocument3 pagesCognizant Rejig May Make Digital Arm Nimbler, Stem Attrition, Say AnalystsStarNo ratings yet

- Newgen Software Technologies LTD.: Q3 FY'21 Investor UpdateDocument18 pagesNewgen Software Technologies LTD.: Q3 FY'21 Investor UpdateDevendra MahajanNo ratings yet

- Axis Global Innovation FoF NFO LeafletDocument2 pagesAxis Global Innovation FoF NFO LeafletKamalnath SinghNo ratings yet

- Happiest Minds TechnologiesLtd IPO NOTE07092020Document7 pagesHappiest Minds TechnologiesLtd IPO NOTE07092020subham mohantyNo ratings yet

- Nedap IR Presentation September 2020 PDFDocument33 pagesNedap IR Presentation September 2020 PDFJasper Laarmans Teixeira de MattosNo ratings yet

- E - Press Release - INCJ - RenesasDocument3 pagesE - Press Release - INCJ - RenesasafdgtdsghfNo ratings yet

- WhitepaperDocument53 pagesWhitepaperamandotarbiraNo ratings yet

- Company Update FY20 AuDocument34 pagesCompany Update FY20 AuA. NurhidayatiNo ratings yet

- Ar2015e 0Document276 pagesAr2015e 0ed bookerNo ratings yet

- TechnologyDocument9 pagesTechnologymy spamNo ratings yet

- Annual Report 2017 18Document204 pagesAnnual Report 2017 18Raghu UnknownNo ratings yet

- KTL IPO NoteDocument6 pagesKTL IPO Noteaksantosh2nd007No ratings yet

- Singapore POST Capex - Docx Final 2022Document3 pagesSingapore POST Capex - Docx Final 2022Jonathan SulaimanNo ratings yet

- 20220401 时代天使 2021年年报点评:隐形矫治龙头地位稳固,案例数持续高速增长 东吴证券国际经纪Document6 pages20220401 时代天使 2021年年报点评:隐形矫治龙头地位稳固,案例数持续高速增长 东吴证券国际经纪pumeili1113No ratings yet

- Sony Corp (6758) - Financial and Strategic SWOT Analysis ReviewDocument55 pagesSony Corp (6758) - Financial and Strategic SWOT Analysis ReviewAngel Chiang100% (2)

- Annual Report 2021 22Document137 pagesAnnual Report 2021 22MANSI POKARNANo ratings yet

- PT M Cash Integrasi TBK: Charting A Digital TransformationDocument7 pagesPT M Cash Integrasi TBK: Charting A Digital TransformationHamba AllahNo ratings yet

- Kahoot!Document6 pagesKahoot!Federico NiciferoNo ratings yet

- Axiata IAR2022Document119 pagesAxiata IAR2022Priscilla KitNo ratings yet

- FSN E-Commerce Ventures LTD: Market's Envy. Investors' PrideDocument25 pagesFSN E-Commerce Ventures LTD: Market's Envy. Investors' PrideSandeep WandreNo ratings yet

- IDirect IkioLighting IPOReviewDocument9 pagesIDirect IkioLighting IPOReviewHarish GoyalNo ratings yet

- Mirae Company Analysis EXCL 10 Feb 2023 Initiate Trading Buy TPDocument17 pagesMirae Company Analysis EXCL 10 Feb 2023 Initiate Trading Buy TPsrimulyaningsih283No ratings yet

- Hitachi Digital StrategyDocument32 pagesHitachi Digital StrategyNAZANINNo ratings yet

- ICICI Securities Ltd. - PCG HNI Note - SMIFS ResearchDocument11 pagesICICI Securities Ltd. - PCG HNI Note - SMIFS ResearchShweta ChaudharyNo ratings yet

- AIQ FactsheetDocument2 pagesAIQ FactsheetRanjan SharmaNo ratings yet

- Annual Report 2022Document4 pagesAnnual Report 2022dertmzkn40No ratings yet

- The Nasdaq Technology Dividend Index: A Great Complement To Broad Dividend PortfoliosDocument7 pagesThe Nasdaq Technology Dividend Index: A Great Complement To Broad Dividend PortfoliosIvan FerdianNo ratings yet

- NTT New Medium-Term Management StrategyDocument29 pagesNTT New Medium-Term Management StrategyAllen Li100% (1)

- KPIT Technologies - Initiating Coverage - Centrum 26022020Document32 pagesKPIT Technologies - Initiating Coverage - Centrum 26022020Adarsh ReddyNo ratings yet

- SUBEXLTD 28102021225228 InvestorPresentationDocument30 pagesSUBEXLTD 28102021225228 InvestorPresentationleoharshadNo ratings yet

- Rakuten Group Introduction Updated June 2021Document50 pagesRakuten Group Introduction Updated June 2021Girish Mamtani100% (1)

- Why Japan?: 5 Reasons To Invest in JAPANDocument12 pagesWhy Japan?: 5 Reasons To Invest in JAPANmukul pandeyNo ratings yet

- Campus Activewear Limited IPO: NeutralDocument7 pagesCampus Activewear Limited IPO: NeutralAkash PawarNo ratings yet

- Pictet-Human-R EUR - FACTSHEET - LU2247920262 - EN - DEFAULT - 31jan2022Document4 pagesPictet-Human-R EUR - FACTSHEET - LU2247920262 - EN - DEFAULT - 31jan2022ATNo ratings yet

- Noch Deutsche Texte: Our Path To Sustainable Value CreationDocument66 pagesNoch Deutsche Texte: Our Path To Sustainable Value CreationvsewagvirgoNo ratings yet

- Siemens AR 2010Document342 pagesSiemens AR 2010rajeshamexsNo ratings yet

- Nifty India Digital Exchange Traded Fun7Document1 pageNifty India Digital Exchange Traded Fun7Henna KadyanNo ratings yet

- Advantech Corp. (2395.TW) - Good Industry 4.0 Concept But Limited Notable Catalysts Initiate at NeutralDocument30 pagesAdvantech Corp. (2395.TW) - Good Industry 4.0 Concept But Limited Notable Catalysts Initiate at NeutralJoachim HagegeNo ratings yet

- SCNL Investor PPT - Q2 FY20Document69 pagesSCNL Investor PPT - Q2 FY20fghjmkNo ratings yet

- Proteanegovtechnologieslimitedrhp Ibcomments v2 2023Document11 pagesProteanegovtechnologieslimitedrhp Ibcomments v2 2023mohit_999No ratings yet

- Encore Event Technologies Group Pty LimitedDocument19 pagesEncore Event Technologies Group Pty Limitedvickyang2047No ratings yet

- Infosys Annual Report AnalysisDocument9 pagesInfosys Annual Report AnalysisAbhishek PaulNo ratings yet

- Mid-Term Management Plan 2020: January 30, 2018 NEC CorporationDocument46 pagesMid-Term Management Plan 2020: January 30, 2018 NEC CorporationTanmoy IimcNo ratings yet

- Tata Nifty India Digital Exchange Traded Fund - LeafletDocument4 pagesTata Nifty India Digital Exchange Traded Fund - LeafletSatyam TiwariNo ratings yet

- Corporate Presentation Q2 - 2022pdfDocument24 pagesCorporate Presentation Q2 - 2022pdfgussalimNo ratings yet

- IoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsFrom EverandIoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsNo ratings yet

- Ucits Etf A Unique European FormatDocument4 pagesUcits Etf A Unique European FormatjdsfkjfdsaNo ratings yet

- A Beginner'S Guide: EtfsDocument12 pagesA Beginner'S Guide: EtfsjdsfkjfdsaNo ratings yet

- Best Practices For Effective ETF Trading: Remember A Few BasicsDocument4 pagesBest Practices For Effective ETF Trading: Remember A Few BasicsjdsfkjfdsaNo ratings yet

- 1nvest Factsheet - ETF RHODocument2 pages1nvest Factsheet - ETF RHOjdsfkjfdsaNo ratings yet

- Family Financial Planning FIN533Document22 pagesFamily Financial Planning FIN533SITI FATIMAH AMALINA ABDUL RAZAKNo ratings yet

- Notes BMGT 211 Introduction To Risk and Insurance May 2020-1Document94 pagesNotes BMGT 211 Introduction To Risk and Insurance May 2020-1jeremieNo ratings yet

- 7 United India Cashless Garages (Car) in PanchkulDocument1 page7 United India Cashless Garages (Car) in PanchkulManish Singh KhatriNo ratings yet

- Policy 555839668 1899087538702Document5 pagesPolicy 555839668 1899087538702utkarsh ambreNo ratings yet

- Outpatient One Pager Version 1.0 Apr 20Document1 pageOutpatient One Pager Version 1.0 Apr 20naval730107No ratings yet

- Statement of Account 157008615988:: 31-May-2021: 01-May-2021 To 31-May-2021Document3 pagesStatement of Account 157008615988:: 31-May-2021: 01-May-2021 To 31-May-2021Suvam MohapatraNo ratings yet

- Bangko Sentral NG Pilipinas Citizen's CharterDocument5 pagesBangko Sentral NG Pilipinas Citizen's CharterAlex ReyesNo ratings yet

- BAR Q's INSURANCEDocument29 pagesBAR Q's INSURANCETenshi OideNo ratings yet

- Questions & Answers: Tax Laws in Tanzania.: Publication TLT-01Document11 pagesQuestions & Answers: Tax Laws in Tanzania.: Publication TLT-01Dennis OndiekiNo ratings yet

- Sap Infor TypeDocument12 pagesSap Infor TypeDEEP KHATINo ratings yet

- Risk in Business El Yaagoubi Zineb Boussoughi Nahid Hiba El Khoudri Ayoub Zdaik LamiaeDocument11 pagesRisk in Business El Yaagoubi Zineb Boussoughi Nahid Hiba El Khoudri Ayoub Zdaik LamiaeAchraf El aouameNo ratings yet

- KA05AH8323Document2 pagesKA05AH8323Balu CNo ratings yet

- Fidelity and Body PartsDocument61 pagesFidelity and Body PartsTripathi OjNo ratings yet

- Full File Correctly FormattedDocument10 pagesFull File Correctly FormattedUlii PntNo ratings yet

- Case Study PRE-SEEN MAY 2021.editedDocument14 pagesCase Study PRE-SEEN MAY 2021.editedDAVID OWUSUNo ratings yet

- Leo33 - Most Frecvent Questions About Leo ProgramDocument2 pagesLeo33 - Most Frecvent Questions About Leo ProgramTanasa-LucaClaudiaIulianaNo ratings yet

- Blueberry Crop Provisions 23 012Document5 pagesBlueberry Crop Provisions 23 012vivekNo ratings yet

- Relaxo Cogs CashDocument40 pagesRelaxo Cogs CashRonakk MoondraNo ratings yet

- Introduction To Income TaxationDocument3 pagesIntroduction To Income TaxationescrowNo ratings yet

- Business Law INUCASTY NewDocument65 pagesBusiness Law INUCASTY NewIshimwe ChristianNo ratings yet

- Medical Defence Union V Department of TradeDocument2 pagesMedical Defence Union V Department of Tradechikondidaka37No ratings yet

- International Finance - Assignment 1Document3 pagesInternational Finance - Assignment 1Betty MudondoNo ratings yet

- BUYERBuyer Insurance-961710Document10 pagesBUYERBuyer Insurance-961710Arwal BranchNo ratings yet

- Macquarie Credit Card Insurance Terms ConditionsDocument50 pagesMacquarie Credit Card Insurance Terms ConditionshemilNo ratings yet

- BEDA - CaseZ-Doctrines-InsuranceDocument5 pagesBEDA - CaseZ-Doctrines-InsuranceMalcolm CruzNo ratings yet

- Mba 1 in PDFDocument41 pagesMba 1 in PDFtheshoeslover1No ratings yet

- CEE+3348+3 Lesson+Three+-+Bidding+Law+and+BondsDocument67 pagesCEE+3348+3 Lesson+Three+-+Bidding+Law+and+BondsChachi CNo ratings yet

- UHS May UpdateDocument2 pagesUHS May UpdateSEIU Local 1No ratings yet