Professional Documents

Culture Documents

US Internal Revenue Service: f2210f - 1996

US Internal Revenue Service: f2210f - 1996

Uploaded by

IRSCopyright:

Available Formats

You might also like

- Tax Answers - Chapter 6Document55 pagesTax Answers - Chapter 6Jonathan Vela100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Assignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Document1 pageAssignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Tenaj KramNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- BIR Form 1702-ExDocument7 pagesBIR Form 1702-ExShiela PilarNo ratings yet

- ACTG 3400 - Taxation of Individuals Exam 2 Study GuideDocument2 pagesACTG 3400 - Taxation of Individuals Exam 2 Study GuideumerubabNo ratings yet

- US Internal Revenue Service: f2210f - 1995Document2 pagesUS Internal Revenue Service: f2210f - 1995IRSNo ratings yet

- US Internal Revenue Service: f2210f - 1997Document2 pagesUS Internal Revenue Service: f2210f - 1997IRSNo ratings yet

- US Internal Revenue Service: f2210f - 1998Document2 pagesUS Internal Revenue Service: f2210f - 1998IRSNo ratings yet

- US Internal Revenue Service: f2210f - 1999Document2 pagesUS Internal Revenue Service: f2210f - 1999IRSNo ratings yet

- US Internal Revenue Service: f2210f - 2003Document2 pagesUS Internal Revenue Service: f2210f - 2003IRSNo ratings yet

- US Internal Revenue Service: f2210 - 1996Document3 pagesUS Internal Revenue Service: f2210 - 1996IRSNo ratings yet

- US Internal Revenue Service: f2210 - 1995Document3 pagesUS Internal Revenue Service: f2210 - 1995IRSNo ratings yet

- US Internal Revenue Service: f5329 - 1995Document2 pagesUS Internal Revenue Service: f5329 - 1995IRSNo ratings yet

- Instructions For Form 1045 (2021) - Internal Revenue ServiceDocument36 pagesInstructions For Form 1045 (2021) - Internal Revenue ServiceDr. Varah SiedleckiNo ratings yet

- US Internal Revenue Service: F1040esn - 1992Document5 pagesUS Internal Revenue Service: F1040esn - 1992IRSNo ratings yet

- US Internal Revenue Service: I2210 - 1996Document5 pagesUS Internal Revenue Service: I2210 - 1996IRSNo ratings yet

- US Internal Revenue Service: I2220 - 1992Document4 pagesUS Internal Revenue Service: I2220 - 1992IRSNo ratings yet

- US Internal Revenue Service: I2210 - 1995Document5 pagesUS Internal Revenue Service: I2210 - 1995IRSNo ratings yet

- Instructions For Form 2220: Underpayment of Estimated Tax by CorporationsDocument4 pagesInstructions For Form 2220: Underpayment of Estimated Tax by CorporationsIRSNo ratings yet

- US Internal Revenue Service: f1041qft - 1999Document4 pagesUS Internal Revenue Service: f1041qft - 1999IRSNo ratings yet

- US Internal Revenue Service: f2210 - 1991Document2 pagesUS Internal Revenue Service: f2210 - 1991IRSNo ratings yet

- US Internal Revenue Service: f5329 - 1993Document2 pagesUS Internal Revenue Service: f5329 - 1993IRSNo ratings yet

- US Internal Revenue Service: f8586 - 1992Document2 pagesUS Internal Revenue Service: f8586 - 1992IRSNo ratings yet

- Instructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsDocument5 pagesInstructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsIRSNo ratings yet

- US Internal Revenue Service: f8801 - 1991Document2 pagesUS Internal Revenue Service: f8801 - 1991IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1996Document2 pagesUS Internal Revenue Service: f8830 - 1996IRSNo ratings yet

- US Internal Revenue Service: f1045 - 2001Document4 pagesUS Internal Revenue Service: f1045 - 2001IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1992Document2 pagesUS Internal Revenue Service: f8830 - 1992IRSNo ratings yet

- US Internal Revenue Service: F1040esn - 2001Document5 pagesUS Internal Revenue Service: F1040esn - 2001IRSNo ratings yet

- US Internal Revenue Service: F1040es - 1992Document7 pagesUS Internal Revenue Service: F1040es - 1992IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1994Document2 pagesUS Internal Revenue Service: f8830 - 1994IRSNo ratings yet

- US Internal Revenue Service: f8861 - 1998Document3 pagesUS Internal Revenue Service: f8861 - 1998IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1995Document2 pagesUS Internal Revenue Service: f5884 - 1995IRSNo ratings yet

- Instructions For PIT Form V5Document1 pageInstructions For PIT Form V5awlachewNo ratings yet

- Instructions For Form 2220: Underpayment of Estimated Tax by CorporationsDocument4 pagesInstructions For Form 2220: Underpayment of Estimated Tax by CorporationsIRSNo ratings yet

- US Internal Revenue Service: f8845 - 1995Document2 pagesUS Internal Revenue Service: f8845 - 1995IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1995Document2 pagesUS Internal Revenue Service: f8830 - 1995IRSNo ratings yet

- US Internal Revenue Service: f8861 - 2005Document3 pagesUS Internal Revenue Service: f8861 - 2005IRSNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesEri TakataNo ratings yet

- US Internal Revenue Service: f8820 - 1996Document2 pagesUS Internal Revenue Service: f8820 - 1996IRS0% (1)

- US Internal Revenue Service: f5884 - 1993Document2 pagesUS Internal Revenue Service: f5884 - 1993IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1993Document2 pagesUS Internal Revenue Service: f8830 - 1993IRSNo ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S) : Pager/SgmlDocument8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S) : Pager/SgmlIRSNo ratings yet

- US Internal Revenue Service: f5884 - 2003Document3 pagesUS Internal Revenue Service: f5884 - 2003IRSNo ratings yet

- US Internal Revenue Service: f8801 - 1995Document2 pagesUS Internal Revenue Service: f8801 - 1995IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1992Document2 pagesUS Internal Revenue Service: f5884 - 1992IRSNo ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S)Document8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S)IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1999Document3 pagesUS Internal Revenue Service: f5884 - 1999IRSNo ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceDocument8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceIRSNo ratings yet

- Resume of Srpeak4Document2 pagesResume of Srpeak4api-25647173No ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceDocument8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceIRSNo ratings yet

- Instructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsDocument6 pagesInstructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsIRSNo ratings yet

- US Internal Revenue Service: F1040esn - 1999Document5 pagesUS Internal Revenue Service: F1040esn - 1999IRSNo ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S)Document8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S)IRSNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon CityDocument9 pagesRepublic of The Philippines Court of Tax Appeals Quezon CityNash LedesmaNo ratings yet

- US Internal Revenue Service: I8841 - 1993Document2 pagesUS Internal Revenue Service: I8841 - 1993IRSNo ratings yet

- U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDocument4 pagesU.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSNo ratings yet

- US Internal Revenue Service: f8586 - 1996Document2 pagesUS Internal Revenue Service: f8586 - 1996IRSNo ratings yet

- US Internal Revenue Service: F1040sab - 1992Document2 pagesUS Internal Revenue Service: F1040sab - 1992IRSNo ratings yet

- US Internal Revenue Service: f5884 - 2001Document3 pagesUS Internal Revenue Service: f5884 - 2001IRSNo ratings yet

- Special Loss Discount Account and Special Estimated Tax Payments For Insurance CompaniesDocument2 pagesSpecial Loss Discount Account and Special Estimated Tax Payments For Insurance CompaniesIRSNo ratings yet

- US Internal Revenue Service: f1120pc - 1993Document8 pagesUS Internal Revenue Service: f1120pc - 1993IRSNo ratings yet

- US Internal Revenue Service: f8861 - 2002Document3 pagesUS Internal Revenue Service: f8861 - 2002IRSNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- Taxguru - In-Dividend Stripping and Bonus StrippingDocument10 pagesTaxguru - In-Dividend Stripping and Bonus StrippingajitNo ratings yet

- SKFDDocument27 pagesSKFDRhen Robles100% (1)

- Computation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) NilDocument5 pagesComputation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) NilPadmalata ModekurtyNo ratings yet

- GST Book PDFDocument606 pagesGST Book PDFsaddamNo ratings yet

- Taxiation AssignmentDocument9 pagesTaxiation AssignmentNoman AreebNo ratings yet

- Bitumen - Emulsion Rates 01.01.2017Document8 pagesBitumen - Emulsion Rates 01.01.2017karunamoorthi_p2209No ratings yet

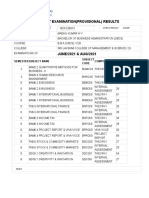

- Bangalore University - Provisional Examination ResultsDocument2 pagesBangalore University - Provisional Examination Resultscopy catNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument22 pages© The Institute of Chartered Accountants of IndiaAdventure TimeNo ratings yet

- Courtyard of Honor Inc Full Filing Nonprofit Explorer PropublicaDocument11 pagesCourtyard of Honor Inc Full Filing Nonprofit Explorer PropublicaPennLiveNo ratings yet

- 2019 InvDocument1 page2019 InvVardaan TanejaNo ratings yet

- TAX Papers - Paper 1Document2 pagesTAX Papers - Paper 1syedshahNo ratings yet

- 2022 KZN June P1 Memo 2Document8 pages2022 KZN June P1 Memo 2shandren19No ratings yet

- Economics StatisticsDocument4 pagesEconomics StatisticsPalak NikamNo ratings yet

- Buang PayslipDocument1 pageBuang Payslipnokwandadlamini2010No ratings yet

- 51198bos40905 cp4 PDFDocument41 pages51198bos40905 cp4 PDFShubham VyasNo ratings yet

- LECT # 4 - FOH & Entries Part - 1Document26 pagesLECT # 4 - FOH & Entries Part - 1muhammad.16483.acNo ratings yet

- Tax RemediesDocument5 pagesTax RemediesTruman TemperanteNo ratings yet

- Customer Invoice - Oyo Wizard India - 2022 09 15 154650579Document1 pageCustomer Invoice - Oyo Wizard India - 2022 09 15 154650579Ashok Singh Patel50% (2)

- Statement of AdviceDocument19 pagesStatement of Adviceapi-337581948No ratings yet

- Spirit SuperDocument1 pageSpirit SuperEggy PalangatNo ratings yet

- Wa0014.Document15 pagesWa0014.No nameNo ratings yet

- Taxes and CashFlow ExercisesDocument7 pagesTaxes and CashFlow ExercisesNelson NofantaNo ratings yet

- Special First Division: Court of Tax AppealsDocument42 pagesSpecial First Division: Court of Tax AppealsMel AribonNo ratings yet

- CIR Vs Interpublic Group of Companies (2019)Document19 pagesCIR Vs Interpublic Group of Companies (2019)Joshua DulceNo ratings yet

- Langer Company Bank Reconciliation Per 31 December 2017Document2 pagesLanger Company Bank Reconciliation Per 31 December 2017rahmatikhwansolihinNo ratings yet

- Commission Statement: Mitra InformationDocument3 pagesCommission Statement: Mitra InformationZia Chusnul LabibNo ratings yet

US Internal Revenue Service: f2210f - 1996

US Internal Revenue Service: f2210f - 1996

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: f2210f - 1996

US Internal Revenue Service: f2210f - 1996

Uploaded by

IRSCopyright:

Available Formats

2210-F

OMB No. 1545-0140

Underpayment of Estimated Tax by

Form

Department of the Treasury

©

Farmers and Fishermen

Attach to Form 1040, Form 1040NR, or Form 1041. Attachment

96

Internal Revenue Service © See instructions on back. Sequence No. 06A

Name(s) shown on tax return Identifying number

Note: In most cases, you do not need to file Form 2210-F. The IRS will figure any penalty you owe and send you a bill. File Form

2210-F only if one or both of the boxes in Part I apply to you. If you do not need to file Form 2210-F, you still may use it to

figure your penalty. Enter the amount from line 18 on the penalty line of your return, but do not attach Form 2210-F.

Part I Reasons for Filing—If 1a below applies to you, you may be able to lower or eliminate your penalty. But

you MUST check that box and file Form 2210-F with your tax return. If 1b below applies to you, check

that box and file Form 2210-F with your tax return.

1 Check whichever boxes apply (if neither applies, see the Note above Part I):

a You request a waiver. In certain circumstances, the IRS will waive all or part of the penalty. See the instructions for Waiver

of Penalty.

b Your required annual payment (line 13 below) is based on your 1995 tax and you filed or are filing a joint return for either

1995 or 1996 but not for both years.

Part II Figure Your Underpayment

2 Enter your 1996 tax after credits from Form 1040, line 44; Form 1040NR, line 42; or Form 1041,

Schedule G, line 4 2

3 Other taxes. See instructions 3

4 Add lines 2 and 3 4

5 Earned income credit 5

6 Credit for Federal tax paid on fuels 6

7 Add lines 5 and 6 7

8 Current year tax. Subtract line 7 from line 4 8

9 Multiply line 8 by 662⁄3% 9

10 Withholding taxes. Do not include any estimated tax payments on this line. See instructions 10

11 Subtract line 10 from line 8. If less than $500, stop here; do not complete or file this form. You

do not owe the penalty 11

12 Enter the tax shown on your 1995 tax return. Caution: See instructions 12

13 Required annual payment. Enter the smaller of line 9 or line 12 13

Note: If line 10 is equal to or more than line 13, stop here; you do not owe the penalty. Do not

file Form 2210-F unless you checked box 1b above.

14 Amounts withheld during 1996 and amounts paid or credited by January 15, 1997 14

15 Underpayment. Subtract line 14 from line 13. If the result is zero or less, stop here; you do not

owe the penalty. Do not file Form 2210-F unless you checked box 1b above 15

Part III Figure the Penalty

16 Enter the date the amount on line 15 was paid or April 15, 1997, whichever is earlier 16 / / 97

17 Number of days FROM January 15, 1997, TO the date on line 16 17

Underpayment × Number of days on line 17 × © 18

18 Penalty. .09

on line 15 365

● Form 1040 filers, enter the amount from line 18 on Form 1040, line 63.

● Form 1040NR filers, enter the amount from line 18 on Form 1040NR, line 63.

● Form 1041 filers, enter the amount from line 18 on Form 1041, line 26.

Cat. No. 11745A Form 2210-F (1996)

Form 2210-F (1996) Page 2

Section references are to the Internal 662⁄3% of the tax shown on your 1996 tax Specific Instructions

Revenue Code. return or (b) the tax shown on your 1995

tax return. If you file an amended return by the due

Paperwork Reduction Act Notice date of your original return, use the

Note: In these instructions, “return” refers

We ask for the information on this form to amounts shown on your amended return to

to your original return. However, an

carry out the Internal Revenue laws of the figure your underpayment. If you file an

amended return is considered the original

United States. You are required to give us amended return after the due date of your

return if it is filed by the due date

the information. We need it to ensure that original return, use the amounts shown on

(including extensions) of the original return.

you are complying with these laws and to the original return.

Also, a joint return that replaces previously

allow us to figure and collect the right filed separate returns is considered the Exception. If you and your spouse file a

amount of tax. original return. joint return after the due date to replace

You are not required to provide the previously filed separate returns, use the

information requested on a form that is Exceptions to the Penalty amounts shown on the joint return to figure

subject to the Paperwork Reduction Act your underpayment.

You will not have to pay the penalty or file

unless the form displays a valid OMB this form if any of the following applies:

control number. Books or records relating Line 3

1. You file your return and pay the tax

to a form or its instructions must be Enter the total of the following amounts on

due by March 3, 1997.

retained as long as their contents may line 3:

become material in the administration of 2. You had no tax liability for 1995, you

● Self-employment tax,

any Internal Revenue law. Generally, tax were a U.S. citizen or resident for all of

returns and return information are 1995, and your 1995 tax return was, or ● Alternative minimum tax,

confidential, as required by section 6103. would have been had you been required to ● Tax from recapture of investment,

file, for a full 12 months. low-income housing, qualified electric

The time needed to complete and file vehicle, or Indian employment credits,

this form will vary depending on individual 3. The total tax shown on your 1996

circumstances. The estimated average time return minus the amount of tax you paid ● Tax on early distributions from (a) a

is: Recordkeeping, 33 min.; Learning through withholding is less than $500. To qualified retirement plan (including your

about the law or the form, 7 min.; determine whether the total tax is less than IRA), (b) an annuity, or (c) a modified

Preparing the form, 20 min.; Copying, $500, complete lines 2 through 11. endowment contract entered into after

assembling, and sending the form to the June 20, 1988,

IRS, 20 min. Waiver of Penalty ● Section 72(m)(5) penalty tax,

If you have comments concerning the If you have an underpayment on line 15, all ● Tax on golden parachute payments,

accuracy of these time estimates or or part of the penalty for that

underpayment will be waived if the IRS ● Advance EIC payments,

suggestions for making this form simpler,

we would be happy to hear from you. See determines that: ● Tax on accumulation distribution of

the instructions for the tax return with 1. The underpayment was due to a trusts.

which this form is filed. casualty, disaster, or other unusual ● Interest due under sections 453(l)(3) and

circumstance, and it would be inequitable 453A(c) on certain installment sales of

General Instructions to impose the penalty, or property, and

2. In 1995 or 1996, you retired after age ● An increase or decrease in tax as a

Purpose of Form 62 or became disabled, and your shareholder in a qualified electing fund.

If you are an individual or a fiduciary for an underpayment was due to reasonable

estate or trust and at least two-thirds of cause. Line 10

your 1995 or 1996 gross income is from To request either of the above waivers, Enter the taxes withheld from Form 1040,

farming or fishing, use Form 2210-F to see do the following: lines 52 and 56; Form 1040NR, lines 50,

if you owe a penalty for underpaying your a. Check the box on line 1a. 53, 56, and 57; or Form 1041, line 24e.

estimated tax.

b. Complete Form 2210-F up to line 18 Line 12

For a definition of gross income from without regard to the waiver. Write the

farming and fishing and more details, see amount you want waived in parentheses Figure your 1995 tax by using the taxes

Pub. 505, Tax Withholding and Estimated on the dotted line to the left of line 18. and credits from your 1995 tax return. Use

Tax. Subtract this amount from the total penalty the same taxes and credits as shown on

you figured without regard to the waiver, lines 2, 3, 5, and 6 of this form.

The IRS Will Figure the and enter the result on line 18. If you are filing a joint return for 1996,

Penalty for You c. Attach Form 2210-F and a statement but you did not file a joint return for 1995,

In most cases, the IRS will figure the to your return explaining the reasons you add the tax shown on your 1995 return to

penalty for you. Complete your return as were unable to meet the estimated tax the tax shown on your spouse’s 1995

usual, leave the penalty line on your return requirements. return and enter the total on line 12

blank, and do not attach Form 2210-F. If (figured as explained above). If you filed a

d. If you are requesting a penalty waiver

you owe the penalty, we will send you a joint return for 1995 but you are not filing a

due to a casualty, disaster, or other

bill. And as long as you file your return by joint return for 1996, see Pub. 505 to figure

unusual circumstance, attach

April 15, 1997, we will not charge you your share of the 1995 tax to enter on line

documentation such as police and

interest on the penalty if you pay by the 12.

insurance company reports.

date specified on the bill. If you did not file a return for 1995 or if

e. If you are requesting a penalty waiver

Note: If you checked either of the boxes in your 1995 tax year was less than 12

due to retirement or disability, attach

Part I of the form, you must figure the months, do not complete line 12. Instead,

documentation that shows your retirement

penalty yourself and attach the completed enter the amount from line 9 on line 13.

date (and your age on that date) or the

form to your return. However, see Exceptions to the Penalty

date you became disabled.

on this page.

The IRS will review the information you

Who Must Pay the provide and will decide whether to grant Line 14

Underpayment Penalty your request for a waiver.

Enter the estimated tax payments you

You may owe the penalty for 1996 if you made plus any Federal income tax

did not pay at least the smaller of (a) withheld and excess social security or

railroad retirement tax paid.

You might also like

- Tax Answers - Chapter 6Document55 pagesTax Answers - Chapter 6Jonathan Vela100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Assignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Document1 pageAssignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Tenaj KramNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- BIR Form 1702-ExDocument7 pagesBIR Form 1702-ExShiela PilarNo ratings yet

- ACTG 3400 - Taxation of Individuals Exam 2 Study GuideDocument2 pagesACTG 3400 - Taxation of Individuals Exam 2 Study GuideumerubabNo ratings yet

- US Internal Revenue Service: f2210f - 1995Document2 pagesUS Internal Revenue Service: f2210f - 1995IRSNo ratings yet

- US Internal Revenue Service: f2210f - 1997Document2 pagesUS Internal Revenue Service: f2210f - 1997IRSNo ratings yet

- US Internal Revenue Service: f2210f - 1998Document2 pagesUS Internal Revenue Service: f2210f - 1998IRSNo ratings yet

- US Internal Revenue Service: f2210f - 1999Document2 pagesUS Internal Revenue Service: f2210f - 1999IRSNo ratings yet

- US Internal Revenue Service: f2210f - 2003Document2 pagesUS Internal Revenue Service: f2210f - 2003IRSNo ratings yet

- US Internal Revenue Service: f2210 - 1996Document3 pagesUS Internal Revenue Service: f2210 - 1996IRSNo ratings yet

- US Internal Revenue Service: f2210 - 1995Document3 pagesUS Internal Revenue Service: f2210 - 1995IRSNo ratings yet

- US Internal Revenue Service: f5329 - 1995Document2 pagesUS Internal Revenue Service: f5329 - 1995IRSNo ratings yet

- Instructions For Form 1045 (2021) - Internal Revenue ServiceDocument36 pagesInstructions For Form 1045 (2021) - Internal Revenue ServiceDr. Varah SiedleckiNo ratings yet

- US Internal Revenue Service: F1040esn - 1992Document5 pagesUS Internal Revenue Service: F1040esn - 1992IRSNo ratings yet

- US Internal Revenue Service: I2210 - 1996Document5 pagesUS Internal Revenue Service: I2210 - 1996IRSNo ratings yet

- US Internal Revenue Service: I2220 - 1992Document4 pagesUS Internal Revenue Service: I2220 - 1992IRSNo ratings yet

- US Internal Revenue Service: I2210 - 1995Document5 pagesUS Internal Revenue Service: I2210 - 1995IRSNo ratings yet

- Instructions For Form 2220: Underpayment of Estimated Tax by CorporationsDocument4 pagesInstructions For Form 2220: Underpayment of Estimated Tax by CorporationsIRSNo ratings yet

- US Internal Revenue Service: f1041qft - 1999Document4 pagesUS Internal Revenue Service: f1041qft - 1999IRSNo ratings yet

- US Internal Revenue Service: f2210 - 1991Document2 pagesUS Internal Revenue Service: f2210 - 1991IRSNo ratings yet

- US Internal Revenue Service: f5329 - 1993Document2 pagesUS Internal Revenue Service: f5329 - 1993IRSNo ratings yet

- US Internal Revenue Service: f8586 - 1992Document2 pagesUS Internal Revenue Service: f8586 - 1992IRSNo ratings yet

- Instructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsDocument5 pagesInstructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsIRSNo ratings yet

- US Internal Revenue Service: f8801 - 1991Document2 pagesUS Internal Revenue Service: f8801 - 1991IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1996Document2 pagesUS Internal Revenue Service: f8830 - 1996IRSNo ratings yet

- US Internal Revenue Service: f1045 - 2001Document4 pagesUS Internal Revenue Service: f1045 - 2001IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1992Document2 pagesUS Internal Revenue Service: f8830 - 1992IRSNo ratings yet

- US Internal Revenue Service: F1040esn - 2001Document5 pagesUS Internal Revenue Service: F1040esn - 2001IRSNo ratings yet

- US Internal Revenue Service: F1040es - 1992Document7 pagesUS Internal Revenue Service: F1040es - 1992IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1994Document2 pagesUS Internal Revenue Service: f8830 - 1994IRSNo ratings yet

- US Internal Revenue Service: f8861 - 1998Document3 pagesUS Internal Revenue Service: f8861 - 1998IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1995Document2 pagesUS Internal Revenue Service: f5884 - 1995IRSNo ratings yet

- Instructions For PIT Form V5Document1 pageInstructions For PIT Form V5awlachewNo ratings yet

- Instructions For Form 2220: Underpayment of Estimated Tax by CorporationsDocument4 pagesInstructions For Form 2220: Underpayment of Estimated Tax by CorporationsIRSNo ratings yet

- US Internal Revenue Service: f8845 - 1995Document2 pagesUS Internal Revenue Service: f8845 - 1995IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1995Document2 pagesUS Internal Revenue Service: f8830 - 1995IRSNo ratings yet

- US Internal Revenue Service: f8861 - 2005Document3 pagesUS Internal Revenue Service: f8861 - 2005IRSNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesEri TakataNo ratings yet

- US Internal Revenue Service: f8820 - 1996Document2 pagesUS Internal Revenue Service: f8820 - 1996IRS0% (1)

- US Internal Revenue Service: f5884 - 1993Document2 pagesUS Internal Revenue Service: f5884 - 1993IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1993Document2 pagesUS Internal Revenue Service: f8830 - 1993IRSNo ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S) : Pager/SgmlDocument8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S) : Pager/SgmlIRSNo ratings yet

- US Internal Revenue Service: f5884 - 2003Document3 pagesUS Internal Revenue Service: f5884 - 2003IRSNo ratings yet

- US Internal Revenue Service: f8801 - 1995Document2 pagesUS Internal Revenue Service: f8801 - 1995IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1992Document2 pagesUS Internal Revenue Service: f5884 - 1992IRSNo ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S)Document8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S)IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1999Document3 pagesUS Internal Revenue Service: f5884 - 1999IRSNo ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceDocument8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceIRSNo ratings yet

- Resume of Srpeak4Document2 pagesResume of Srpeak4api-25647173No ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceDocument8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S) : Internal Revenue ServiceIRSNo ratings yet

- Instructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsDocument6 pagesInstructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsIRSNo ratings yet

- US Internal Revenue Service: F1040esn - 1999Document5 pagesUS Internal Revenue Service: F1040esn - 1999IRSNo ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S)Document8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S)IRSNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon CityDocument9 pagesRepublic of The Philippines Court of Tax Appeals Quezon CityNash LedesmaNo ratings yet

- US Internal Revenue Service: I8841 - 1993Document2 pagesUS Internal Revenue Service: I8841 - 1993IRSNo ratings yet

- U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDocument4 pagesU.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSNo ratings yet

- US Internal Revenue Service: f8586 - 1996Document2 pagesUS Internal Revenue Service: f8586 - 1996IRSNo ratings yet

- US Internal Revenue Service: F1040sab - 1992Document2 pagesUS Internal Revenue Service: F1040sab - 1992IRSNo ratings yet

- US Internal Revenue Service: f5884 - 2001Document3 pagesUS Internal Revenue Service: f5884 - 2001IRSNo ratings yet

- Special Loss Discount Account and Special Estimated Tax Payments For Insurance CompaniesDocument2 pagesSpecial Loss Discount Account and Special Estimated Tax Payments For Insurance CompaniesIRSNo ratings yet

- US Internal Revenue Service: f1120pc - 1993Document8 pagesUS Internal Revenue Service: f1120pc - 1993IRSNo ratings yet

- US Internal Revenue Service: f8861 - 2002Document3 pagesUS Internal Revenue Service: f8861 - 2002IRSNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- Taxguru - In-Dividend Stripping and Bonus StrippingDocument10 pagesTaxguru - In-Dividend Stripping and Bonus StrippingajitNo ratings yet

- SKFDDocument27 pagesSKFDRhen Robles100% (1)

- Computation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) NilDocument5 pagesComputation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) NilPadmalata ModekurtyNo ratings yet

- GST Book PDFDocument606 pagesGST Book PDFsaddamNo ratings yet

- Taxiation AssignmentDocument9 pagesTaxiation AssignmentNoman AreebNo ratings yet

- Bitumen - Emulsion Rates 01.01.2017Document8 pagesBitumen - Emulsion Rates 01.01.2017karunamoorthi_p2209No ratings yet

- Bangalore University - Provisional Examination ResultsDocument2 pagesBangalore University - Provisional Examination Resultscopy catNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument22 pages© The Institute of Chartered Accountants of IndiaAdventure TimeNo ratings yet

- Courtyard of Honor Inc Full Filing Nonprofit Explorer PropublicaDocument11 pagesCourtyard of Honor Inc Full Filing Nonprofit Explorer PropublicaPennLiveNo ratings yet

- 2019 InvDocument1 page2019 InvVardaan TanejaNo ratings yet

- TAX Papers - Paper 1Document2 pagesTAX Papers - Paper 1syedshahNo ratings yet

- 2022 KZN June P1 Memo 2Document8 pages2022 KZN June P1 Memo 2shandren19No ratings yet

- Economics StatisticsDocument4 pagesEconomics StatisticsPalak NikamNo ratings yet

- Buang PayslipDocument1 pageBuang Payslipnokwandadlamini2010No ratings yet

- 51198bos40905 cp4 PDFDocument41 pages51198bos40905 cp4 PDFShubham VyasNo ratings yet

- LECT # 4 - FOH & Entries Part - 1Document26 pagesLECT # 4 - FOH & Entries Part - 1muhammad.16483.acNo ratings yet

- Tax RemediesDocument5 pagesTax RemediesTruman TemperanteNo ratings yet

- Customer Invoice - Oyo Wizard India - 2022 09 15 154650579Document1 pageCustomer Invoice - Oyo Wizard India - 2022 09 15 154650579Ashok Singh Patel50% (2)

- Statement of AdviceDocument19 pagesStatement of Adviceapi-337581948No ratings yet

- Spirit SuperDocument1 pageSpirit SuperEggy PalangatNo ratings yet

- Wa0014.Document15 pagesWa0014.No nameNo ratings yet

- Taxes and CashFlow ExercisesDocument7 pagesTaxes and CashFlow ExercisesNelson NofantaNo ratings yet

- Special First Division: Court of Tax AppealsDocument42 pagesSpecial First Division: Court of Tax AppealsMel AribonNo ratings yet

- CIR Vs Interpublic Group of Companies (2019)Document19 pagesCIR Vs Interpublic Group of Companies (2019)Joshua DulceNo ratings yet

- Langer Company Bank Reconciliation Per 31 December 2017Document2 pagesLanger Company Bank Reconciliation Per 31 December 2017rahmatikhwansolihinNo ratings yet

- Commission Statement: Mitra InformationDocument3 pagesCommission Statement: Mitra InformationZia Chusnul LabibNo ratings yet