Professional Documents

Culture Documents

Indicative Impact of GST On Wind Power Project

Indicative Impact of GST On Wind Power Project

Uploaded by

Rema DeviOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indicative Impact of GST On Wind Power Project

Indicative Impact of GST On Wind Power Project

Uploaded by

Rema DeviCopyright:

Available Formats

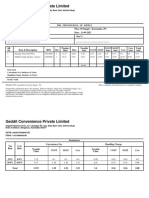

Indicative impact of GST on wind power project

Erstwhile tax structure GST Tax Structure

°A of

Sr.

Cost Category total Applicable Rate Amount Applicable Rate Amount

No .

cost Tax (%) (INR) Tax (%) (INR)

Nacelle &

1 35.95 VAT 5.00% 1.80 CGST+SGST 5.00% 1.80

Accessories

2 Blade — Rotor 22.45 VAT 5.00% 1.12 CGST+SGST 5.00% 1.12

Tower &

3 14.47 VAT 5.00% 0.72 CGST+SGST 5.00% 0.72

Accessories

Materials (for Excise 13.50% 0.59

Windfarm level

4 facilities) and 4.37 CGST+SGST 18.00% 0.79

Civil VAT 14.50% 0.63

Foundation

Unit substation Excise 12.50% 0.57

5 & foundation 4.52 CGST+SGST 18.00% 0.81

material VAT 5.00% 0.25

Excise 12.50% 0.18

6 Transformer 1.47 CGST+SGST 18.00% 0.26

VAT 5.00%

Total 83.23 5.91 5.51

Services

Installation of

Service IGST/CGST 18%

9 turbine & other 16.77 15.00% 3 3.02

Tax +SGST

services

Total 100 7 8.53

Total Procurement

108.91 108.53

Cost

Increase in Procurement Cost (.38)%

Note: These are indicative calculations and may vary with size of wind power project.

You might also like

- Blow Mould Component Cost EstimationDocument6 pagesBlow Mould Component Cost EstimationVenkateswaran venkateswaran50% (2)

- CG18 - 09 DayworkDocument4 pagesCG18 - 09 DayworkArdamitNo ratings yet

- CIR V BursmeitersDocument1 pageCIR V Bursmeiterskim zeus ga-anNo ratings yet

- Invoice 1694411360796Document2 pagesInvoice 1694411360796Dhiraj DwivediNo ratings yet

- Indirect Tax Effective RateDocument4 pagesIndirect Tax Effective RateomkargokhaleNo ratings yet

- Analysis of Rates Item No. Providing and Fixing 34/36 Watt LED Panel of Size 600 X 600 MM Suitable For GridDocument33 pagesAnalysis of Rates Item No. Providing and Fixing 34/36 Watt LED Panel of Size 600 X 600 MM Suitable For GridExecutive Engineer CD-INo ratings yet

- BillFor5 2022Document5 pagesBillFor5 2022PadmanabanNo ratings yet

- 1Document1 page1Industry ConsultNo ratings yet

- CABA8KNTG19397Document2 pagesCABA8KNTG19397SOUMYAJIT BARINo ratings yet

- March HT Bill 22-23Document5 pagesMarch HT Bill 22-23vigeNo ratings yet

- Amaron Battery Change InvoiceDocument2 pagesAmaron Battery Change InvoiceShivam MishraNo ratings yet

- Gantry Crane-2 (Pyramid Steel Structures Factory) Cost SheetDocument15 pagesGantry Crane-2 (Pyramid Steel Structures Factory) Cost SheetAdeeb ShahzadaNo ratings yet

- Rate Analysis For Pergola at 8th Floor SL - No Description Unit Qty Rate AmountDocument3 pagesRate Analysis For Pergola at 8th Floor SL - No Description Unit Qty Rate AmountvinothNo ratings yet

- Poly Carbonate - Injection Mould Component Cost EstimationDocument7 pagesPoly Carbonate - Injection Mould Component Cost EstimationVenkateswaran venkateswaranNo ratings yet

- Invoice No.: G290524-2765668 Date: 24-05-2024 Order No: 1D643ECNE59344 Place of Supply: KarnatakaDocument2 pagesInvoice No.: G290524-2765668 Date: 24-05-2024 Order No: 1D643ECNE59344 Place of Supply: KarnatakasidosintNo ratings yet

- Em Newsaga Premium CVTDocument1 pageEm Newsaga Premium CVTAngela PalmerNo ratings yet

- Liability Computation Sheet: Insured SummaryDocument3 pagesLiability Computation Sheet: Insured SummarysurendraNo ratings yet

- Ayirakulam and Puliyoor KulamDocument1 pageAyirakulam and Puliyoor KulamnaseebNo ratings yet

- Power Plant Costing-Iii-IndusDocument9 pagesPower Plant Costing-Iii-IndusgmsangeethNo ratings yet

- UIIC Motor Commercial WorksheetDocument2 pagesUIIC Motor Commercial Worksheetr92475138No ratings yet

- Xpress MartDocument2 pagesXpress Marthariomsingh.karnisenaNo ratings yet

- PP - Injection Mould Component Cost EstimationDocument7 pagesPP - Injection Mould Component Cost EstimationVenkateswaran venkateswaranNo ratings yet

- Design & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueDocument1 pageDesign & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueRinjumon RinjuNo ratings yet

- Invoice 1716451435328Document2 pagesInvoice 1716451435328tejasaiteja373No ratings yet

- 15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.Document3 pages15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.manohar meenaNo ratings yet

- Estimate For Solar OffgridDocument1 pageEstimate For Solar Offgridsourav DasNo ratings yet

- 2020-21 Price List of Dip Coating SystemDocument1 page2020-21 Price List of Dip Coating Systemtitash.mondal86No ratings yet

- WL Final Detailed Estimate NFR LMG 2023 WL 144Document2 pagesWL Final Detailed Estimate NFR LMG 2023 WL 144Tanveer IqbalNo ratings yet

- Abs - Injection Mould Component Cost EstimationDocument7 pagesAbs - Injection Mould Component Cost EstimationVenkateswaran venkateswaranNo ratings yet

- New APP MembranDocument1 pageNew APP MembranPadarabinda ParidaNo ratings yet

- BoqDocument2 pagesBoqmarketing1No ratings yet

- Estimate Baghpat STP RevisedDocument23 pagesEstimate Baghpat STP Revisedankur yadavNo ratings yet

- Batteries Costing 1008Document10 pagesBatteries Costing 1008AamirMalikNo ratings yet

- Breakdown Cost + SellingDocument2 pagesBreakdown Cost + SellingshamilhilariNo ratings yet

- Bill 20201130982716507Document6 pagesBill 20201130982716507Ashutosh sonkarNo ratings yet

- IF23050633774478 InvoiceDocument1 pageIF23050633774478 InvoiceAnshum GuptaNo ratings yet

- Blank WordDocument2 pagesBlank WordSwamy RamulaNo ratings yet

- EFA Mahayahay Zion Aug 7 2023Document91 pagesEFA Mahayahay Zion Aug 7 2023Foronline GamingNo ratings yet

- Cost Structure of Jindal Worldwide LTD: Report: ExhibitsDocument2 pagesCost Structure of Jindal Worldwide LTD: Report: ExhibitsPallavi PatelNo ratings yet

- Tata Aig General Insurance Co LTD: Insured Declared Value (IDV) 557000.00Document5 pagesTata Aig General Insurance Co LTD: Insured Declared Value (IDV) 557000.00ApoorvNo ratings yet

- CWS-Proposal TP - 746Document8 pagesCWS-Proposal TP - 746Sandeep NikhilNo ratings yet

- DC26 - Tender CostingDocument123 pagesDC26 - Tender CostingAshish BhartiNo ratings yet

- Summary Financial Key NumbersDocument1 pageSummary Financial Key Numbersb4haruddin1313No ratings yet

- Power Variance Reason G.noida Jan'19Document4 pagesPower Variance Reason G.noida Jan'19AtulPalNo ratings yet

- BSC FinanceDocument2 pagesBSC Financevishaldalve0No ratings yet

- Em Newsaga Standard MTDocument1 pageEm Newsaga Standard MTAngela PalmerNo ratings yet

- BillFor3 2024Document5 pagesBillFor3 2024jagadeesan ravichandranNo ratings yet

- Circular On Service Charges For LPG Dist - For Uploading On Portal-Sept 2019Document2 pagesCircular On Service Charges For LPG Dist - For Uploading On Portal-Sept 2019AbhiNo ratings yet

- Rate Analysis For BearingsDocument1 pageRate Analysis For BearingsHarmandeep Singh BhattiNo ratings yet

- 0818 Bill 1Document1 page0818 Bill 1Anurag KhannaNo ratings yet

- L&T IIC Dwarka Project B CHECK 2000KVADocument1 pageL&T IIC Dwarka Project B CHECK 2000KVApawanNo ratings yet

- Ka 2021 435666Document8 pagesKa 2021 435666syamakantadasiNo ratings yet

- Clearing and GrubbingDocument3 pagesClearing and Grubbingusama buttNo ratings yet

- Rate Analysis For Wet Cladding: Particulars Unit Qty/Sqf Unit Rate Amount RemarkDocument5 pagesRate Analysis For Wet Cladding: Particulars Unit Qty/Sqf Unit Rate Amount RemarkAtulJainNo ratings yet

- Asa - Injection Mould Component Cost EstimationDocument7 pagesAsa - Injection Mould Component Cost EstimationVenkateswaran venkateswaranNo ratings yet

- PP80TPD P1Document1 pagePP80TPD P1Zaki AdanNo ratings yet

- RRRR PDFDocument1 pageRRRR PDFgraceenggint8799No ratings yet

- Solae EPC - IndiaDocument1 pageSolae EPC - Indiagraceenggint8799No ratings yet

- Tax Invoice (12-038)Document1 pageTax Invoice (12-038)Julie Libiano Green Kraft Pte LtdNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Format of Management Representation For GST AuditDocument5 pagesFormat of Management Representation For GST AuditCA Shashank JainNo ratings yet

- CA Firm Exam Question AnswerDocument17 pagesCA Firm Exam Question Answerrohanfyaz00No ratings yet

- Team Sual Corp v. CirDocument22 pagesTeam Sual Corp v. CirSofiaNo ratings yet

- "Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or ProfessionDocument5 pages"Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or Professionas2207530No ratings yet

- CSR 16-17 Amt PDFDocument283 pagesCSR 16-17 Amt PDFgauravNo ratings yet

- Invoice: Charges and PaymentsDocument1 pageInvoice: Charges and PaymentsOCANA DISENONo ratings yet

- Sitel Philippines Corporation V. Cir FEB 8, 2017 - GR NO. 201326 TopicDocument2 pagesSitel Philippines Corporation V. Cir FEB 8, 2017 - GR NO. 201326 TopicPaula Marquez MenditaNo ratings yet

- Insights Into Issues: BREXIT and Its ImpactDocument12 pagesInsights Into Issues: BREXIT and Its ImpactGSWALIANo ratings yet

- Cost ControllerDocument34 pagesCost Controllerpawanchauhan14100% (2)

- 2016 Bar Exam Suggested Answers in Taxation by The UP Law ComplexDocument23 pages2016 Bar Exam Suggested Answers in Taxation by The UP Law Complexrobertoii_suarez67% (3)

- Subcontracting With GSTDocument3 pagesSubcontracting With GSTABHISHEK SRIVASTAVANo ratings yet

- Purchase Order Terms & Conditions: 136/13, First Floor, Shivalik RD, Malviya Nagar, Delhi 110017 98999 36214Document4 pagesPurchase Order Terms & Conditions: 136/13, First Floor, Shivalik RD, Malviya Nagar, Delhi 110017 98999 36214Pawan KumarNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherImage In DigitalNo ratings yet

- SSS Table 2014Document13 pagesSSS Table 2014Adrianne LaxamanaNo ratings yet

- Q & A Business Reg - ShopeeDocument4 pagesQ & A Business Reg - ShopeeNetty LunariaNo ratings yet

- WBIS 12D 2020 21 68 - PrintDocument9 pagesWBIS 12D 2020 21 68 - Printrounak agrwalNo ratings yet

- Unit 1 - InventoriesDocument76 pagesUnit 1 - InventoriesZamarhadebe SilosamahlubiNo ratings yet

- HTH581 Project Guidelines March 2015Document3 pagesHTH581 Project Guidelines March 2015Esther McLendez ܤNo ratings yet

- Western Mindanao Power Corporation vs. Commissioner of Internal RevenueDocument7 pagesWestern Mindanao Power Corporation vs. Commissioner of Internal RevenueJonjon BeeNo ratings yet

- CIR vs. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007Document8 pagesCIR vs. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007Gol LumNo ratings yet

- BDO Budget Booklet 2021Document20 pagesBDO Budget Booklet 2021CM MukukNo ratings yet

- SPC#01 - Advanced AutomationDocument3 pagesSPC#01 - Advanced Automationyallasports23No ratings yet

- CA Final Fully Amended For May 2019 PDFDocument313 pagesCA Final Fully Amended For May 2019 PDFjedsturmanNo ratings yet

- Module 1 - Introduction To Consumption TaxesDocument3 pagesModule 1 - Introduction To Consumption TaxesMonica MonicaNo ratings yet

- RetailingDocument59 pagesRetailingElaine Paulin PunoNo ratings yet

- PESCO ONLINE BILL Jan2023Document2 pagesPESCO ONLINE BILL Jan2023amjadali482No ratings yet

- NFLAT Workbook Class 08Document52 pagesNFLAT Workbook Class 08Tanishque Kumar100% (2)

- CAPE - Masterclass On VAT - Dr. Abdul Mannan Shikder Sir - Member (VAT Implementation & IT) NBRDocument115 pagesCAPE - Masterclass On VAT - Dr. Abdul Mannan Shikder Sir - Member (VAT Implementation & IT) NBRbanglauserNo ratings yet

- Ponencias of J. Caguioa in TAXATION LAW 2022Document58 pagesPonencias of J. Caguioa in TAXATION LAW 2022Paolo OlleroNo ratings yet