Professional Documents

Culture Documents

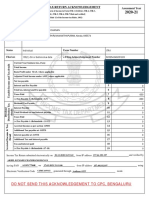

BIR Form No. 1600

BIR Form No. 1600

Uploaded by

Lorraine Steffany BanguisOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Form No. 1600

BIR Form No. 1600

Uploaded by

Lorraine Steffany BanguisCopyright:

Available Formats

birlogo

BIR Form No.

Republika ng Pilipinas Monthly Remittance Return of Value- 1600

Kagawaran ng Added Tax and Other Percentage

Pananalapi Septemb

Taxes Withheld

Kawanihan ng Rentas (ENCS)

Internas

Under RAs 1051, 7649, 8241 and 8424

1 For the Month (MM/YYYY) 2 Amended Return? 3 No. of Sheets Attached? 4 Any Taxes Withheld?

01 - January 0

Yes No Yes No

Part I Background Information

5 TIN 6 RDO Code 7 Line of Business/Occupation

8 Withholding Agent's Name (Last Name, First Name, Middle Name for Individuals) /(Registered Name for Non-Individuals) 9 Telephone Number

10 Registered Address 11 Zip Code

12 Category of Withholding Agent 13 Are you availing of tax relief under Special Law of International Tax Treaty?

Yes No

Private Government

If yes, specify -

Part II Computation of Tax

TAX REQUIRED

NATURE OF INCOME PAYMENT ATC TAX BASE TAX RATE TO

BE WITHHELD

14

14 Total Tax Required to be Withheld and Remitted

0.00

15

15 Less:return Tax Remitted in Return Previously Filed, if this is an amended

0.00

16

16 Tax Still Due / (Overremittance)

0.00

17 Add: Penalties

Surcharge Interest Compromise

17A 17B 17D

0.00

0.00 0.00

18

18 Total Amount Still Due/(Overremittance) (Sum of items 16 & 17D) 0.00

For late filers with overremittance, extend amount of Penalties (Item 17D to 18)

ALPHABETICAL LIST OF PAYEES FROM WHOM TAXES WERE

Schedule II WITHHELD

(Attach additional sheet/s if necessary)

(1)

SEQ PAYEE DETAILS Total

NO.

(3) INDIVIDUAL/

CORPORATION (LAST

(2) TIN NAME, FIRST NAME, MIDDLE

NAME FOR INDIVIDUALS OR

REGISTERED NAME FOR

NON-INDIVIDUALS)

1

2

3

4

5

6

7

8

9

10

INCOME PAYMENT/TAX WITHHELD (7) TAX (8) TAX REQUIRED

DETAILS RATE(%)

TO BE WITHHELD

(5) NATURE OF

(4) ATC (6) AMOUNT

PAYMENT

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

You might also like

- Protectionism-4 1 6Document41 pagesProtectionism-4 1 6Shafayet MirajNo ratings yet

- The Destructive New Logic That Threatens GlobalizationDocument5 pagesThe Destructive New Logic That Threatens GlobalizationdibanezparraNo ratings yet

- BIR Form 1601-EDocument2 pagesBIR Form 1601-EJerel John Calanao67% (3)

- Is Globalisation A Threat or An Opportunity To Developing CountriesDocument9 pagesIs Globalisation A Threat or An Opportunity To Developing CountriesHalyna NguyenNo ratings yet

- PDFDocument1 pagePDFKumar SamyappanNo ratings yet

- 1600 August 2022Document1 page1600 August 2022Analyn DomingoNo ratings yet

- Bacolod Es 1600 Feb 2023 PDFDocument1 pageBacolod Es 1600 Feb 2023 PDFAnalyn DomingoNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document4 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Emelyn Ventura SantosNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment SystemJinkieNo ratings yet

- BIR Form 1601-EDocument2 pagesBIR Form 1601-ELovella Phi Go100% (1)

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document5 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"May Joy DepalomaNo ratings yet

- 1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityDocument3 pages1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityReese QuinesNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document2 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)JEREMY WILLIAM COZENS-HARDYNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument4 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationHanabishi RekkaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikash singhNo ratings yet

- Quarterly Remittance Return of Final Income Taxes Withheld: Background InformationDocument2 pagesQuarterly Remittance Return of Final Income Taxes Withheld: Background InformationVincent John RigorNo ratings yet

- Ack Fy 2019-20Document1 pageAck Fy 2019-20Prashant MoreNo ratings yet

- ITR Acknowledgement FY 2019-20Document1 pageITR Acknowledgement FY 2019-20taramaNo ratings yet

- Quarterly Percentage Tax Return: 12 - December 059Document2 pagesQuarterly Percentage Tax Return: 12 - December 059Abby UmipigNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNANDAN SALESNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruneelanjansNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document2 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Games NathanNo ratings yet

- 2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFDocument1 page2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFLokeshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- RK 1Document1 pageRK 1Sharada ShankarNo ratings yet

- Indian Income Tax Return Acknowledgement: PAN NameDocument1 pageIndian Income Tax Return Acknowledgement: PAN NameNakul KhannaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun VeeraniNo ratings yet

- Chandra Kant PDFDocument1 pageChandra Kant PDFSujan SamantaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnnie SNo ratings yet

- Itr V 20 21Document1 pageItr V 20 21SiddharthNo ratings yet

- 2020 08 09 14 14 06 346 - 1596962646346 - XXXPP5497X - Acknowledgement PDFDocument1 page2020 08 09 14 14 06 346 - 1596962646346 - XXXPP5497X - Acknowledgement PDFUpen PalNo ratings yet

- Screenshot 2023-10-16 at 11.38.24 AMDocument1 pageScreenshot 2023-10-16 at 11.38.24 AMappurajan51No ratings yet

- 2020 09 29 12 10 23 809 - 1601361623809 - XXXPT4878X - Acknowledgement PDFDocument1 page2020 09 29 12 10 23 809 - 1601361623809 - XXXPT4878X - Acknowledgement PDFpratyush thakurNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDeepak PathakNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAkhil c.kNo ratings yet

- Sarath 201-21 NewDocument1 pageSarath 201-21 Newbindu mathaiNo ratings yet

- RACS Itr 2020-2021Document1 pageRACS Itr 2020-2021Lakshay SharmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRavi KumarNo ratings yet

- 2020 07 22 22 44 18 838 - 1595438058838 - XXXPK9292X - AcknowledgementDocument1 page2020 07 22 22 44 18 838 - 1595438058838 - XXXPK9292X - AcknowledgementGautam MNo ratings yet

- Ack Afcpy3063l 2021-22 163749600170721Document1 pageAck Afcpy3063l 2021-22 163749600170721Rakesh SinghNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605Lorraine Steffany BanguisNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurulokeshNo ratings yet

- 2020 09 13 10 56 29 221 - 1599974789221 - XXXPR9253X - AcknowledgementDocument1 page2020 09 13 10 56 29 221 - 1599974789221 - XXXPR9253X - Acknowledgementraoanagha27No ratings yet

- Return 2021Document1 pageReturn 2021rgd8b7kzr6No ratings yet

- Himanshu Aggarwal Itr 21 22Document1 pageHimanshu Aggarwal Itr 21 22prateek gangwaniNo ratings yet

- 2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFDocument1 page2020 10 17 15 39 31 472 - 1602929371472 - XXXPP3112X - Acknowledgement PDFParmeshwar PrasadNo ratings yet

- 2020 07 31 16 05 55 486 - 1596191755486 - XXXPK8367X - AcknowledgementDocument1 page2020 07 31 16 05 55 486 - 1596191755486 - XXXPK8367X - AcknowledgementSiva Jyothi KNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNavis AntonyNo ratings yet

- Aswin 2021Document1 pageAswin 2021Hari HaranNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruProfit MartNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSACHIN MENEZESNo ratings yet

- 9 M - 28-Dec-2020 - 917355441Document1 page9 M - 28-Dec-2020 - 917355441Arihant SatpathyNo ratings yet

- Samvith - Financials - FY 2020-21Document6 pagesSamvith - Financials - FY 2020-21raghav shettyNo ratings yet

- Ack Adzpt7753r 2021-22 124979810040222Document1 pageAck Adzpt7753r 2021-22 124979810040222Nitin KhadatkarNo ratings yet

- 2021 03 21 19 20 27 091 - 1616334627091 - XXXPG9371X - AcknowledgementDocument1 page2021 03 21 19 20 27 091 - 1616334627091 - XXXPG9371X - Acknowledgementgangabhavani kNo ratings yet

- 2020 09 04 21 12 58 581 - 1599234178581 - XXXPP0300X - AcknowledgementDocument1 page2020 09 04 21 12 58 581 - 1599234178581 - XXXPP0300X - AcknowledgementAnshu SinghNo ratings yet

- J Itr 2020-21Document1 pageJ Itr 2020-21prabhjeet singh antalNo ratings yet

- Neetu Singh - FY 2019 20 - Detailed ITRVDocument1 pageNeetu Singh - FY 2019 20 - Detailed ITRVRakesh PatilNo ratings yet

- Ack Bzeps9336p 2021-22 153670790111221Document1 pageAck Bzeps9336p 2021-22 153670790111221HMS 786No ratings yet

- Bir Form 1600 FinalDocument4 pagesBir Form 1600 Finaljhonnamaemaygue08No ratings yet

- 2020 09 03 21 10 10 959 - 1599147610959 - XXXPS0467X - AcknowledgementDocument1 page2020 09 03 21 10 10 959 - 1599147610959 - XXXPS0467X - Acknowledgement150819850No ratings yet

- 2020 12 28 22 12 10 345 - 1609173730345 - XXXPR1222X - AcknowledgementDocument1 page2020 12 28 22 12 10 345 - 1609173730345 - XXXPR1222X - Acknowledgementsekhar bandiNo ratings yet

- BIR Form No. 2551MDocument1 pageBIR Form No. 2551MLorraine Steffany BanguisNo ratings yet

- BIR Form No. 2551Document1 pageBIR Form No. 2551Lorraine Steffany BanguisNo ratings yet

- Percentage Tax Return: BIR Form NoDocument1 pagePercentage Tax Return: BIR Form NoLorraine Steffany BanguisNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605Lorraine Steffany BanguisNo ratings yet

- JP Morgan Chase Company: Navarro, Antonette Louisse L. BSA-1DDocument2 pagesJP Morgan Chase Company: Navarro, Antonette Louisse L. BSA-1Deys shopNo ratings yet

- p2 Exam With AnsDocument8 pagesp2 Exam With AnsEuli Mae SomeraNo ratings yet

- An Indian Perspective On New Development Bank & Asian Infrastructure Investment BankDocument11 pagesAn Indian Perspective On New Development Bank & Asian Infrastructure Investment BankCFA IndiaNo ratings yet

- Mansha VermaDocument24 pagesMansha Vermaharishankargolaverma123No ratings yet

- RMC No. 94-2021Document2 pagesRMC No. 94-2021JelaineNo ratings yet

- Mobile Banking On The Increase in Developing CountriesDocument2 pagesMobile Banking On The Increase in Developing CountriesAulia SabrinaNo ratings yet

- 0a1d01080000001709195 ESTATEMENT 012022 0a1d010800000017Document5 pages0a1d01080000001709195 ESTATEMENT 012022 0a1d010800000017Chandan VNo ratings yet

- Basic Financial Management: Course Code:-FIN302Document18 pagesBasic Financial Management: Course Code:-FIN302Sabab ZamanNo ratings yet

- Club-Mahindra Case StudyDocument9 pagesClub-Mahindra Case StudyAkhilesh MenonNo ratings yet

- Unit 1 Introdution To BankingDocument2 pagesUnit 1 Introdution To Bankingaakash patilNo ratings yet

- Tariffs and Trade BarriersDocument7 pagesTariffs and Trade BarriersVara PrasadNo ratings yet

- Quiz 1:resident Status: Year of Assessment Period of Stay No. of Days Resident Status Pursuant To SectionDocument3 pagesQuiz 1:resident Status: Year of Assessment Period of Stay No. of Days Resident Status Pursuant To SectionJong HannahNo ratings yet

- Balance of PaymentDocument25 pagesBalance of PaymentSnehithNo ratings yet

- Form 15CA - Filed FormDocument2 pagesForm 15CA - Filed FormkotisanampudiNo ratings yet

- Euro To Idr - Google SearchDocument1 pageEuro To Idr - Google SearchPutri WaNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentABUBKARNo ratings yet

- MACROECONOMIC AGGREGATES (At Constant Prices) : Base Year:2011-12Document3 pagesMACROECONOMIC AGGREGATES (At Constant Prices) : Base Year:2011-12Vishnu KanthNo ratings yet

- HRPL 2144.SK.2019-20Document1 pageHRPL 2144.SK.2019-20Sunil PatelNo ratings yet

- OpTransactionHistory23 07 2022Document12 pagesOpTransactionHistory23 07 2022Rakesh KumarNo ratings yet

- 3 (C) 57 Repealed ChaptersDocument3 pages3 (C) 57 Repealed ChaptersMaryNo ratings yet

- Foreign Exchange Management Policy in IndiaDocument6 pagesForeign Exchange Management Policy in Indiaapi-371236767% (3)

- IATADocument5 pagesIATAzainNo ratings yet

- Module-1 International Financial Environment: Rewards & Risk of International FinanceDocument17 pagesModule-1 International Financial Environment: Rewards & Risk of International FinanceAbhishek AbhiNo ratings yet

- NATO Plus Five 23-06-2023 PresentationDocument13 pagesNATO Plus Five 23-06-2023 PresentationKishorerajSelvarajNo ratings yet

- The E-Commerce Pivot in Vietnam: Industry ReportDocument64 pagesThe E-Commerce Pivot in Vietnam: Industry ReportLinh Bùi100% (1)

- GAIL INDIA's P&L StatementDocument2 pagesGAIL INDIA's P&L StatementAtul AnandNo ratings yet