Professional Documents

Culture Documents

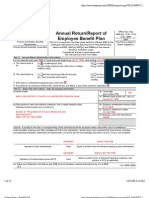

US Internal Revenue Service: f5500sf - 1997

US Internal Revenue Service: f5500sf - 1997

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: f5500sf - 1997

US Internal Revenue Service: f5500sf - 1997

Uploaded by

IRSCopyright:

Available Formats

SCHEDULE F Fringe Benefit Plan Annual Information Return OMB No.

1210-0016

(Form 5500)

Under Section 6039D of the Internal Revenue Code 97

© File as an attachment to Form 5500 or 5500-C/R. This Form is NOT

Department of the Treasury

Open to Public

Internal Revenue Service © For Paperwork Reduction Act Notice, see the Instructions for Form 5500 or 5500-C/R. Inspection

For the calendar plan year 1997 or fiscal plan year beginning , 1997, and ending , 19

1a Name of plan sponsor as shown on line 1a of Form 5500 or 5500-C/R 1b Employer identification number

1c Plan name 1d Three-digit

plan number ©

2 Check the Internal Revenue Code section that describes this fringe benefit plan:

125 (Cafeteria plan) 127 (Educational assistance program)

3 Enter the total number of employees of the employer

4 Enter the total number of employees eligible to participate in the plan

5 Enter the total number of employees participating in the plan. (See instructions.)

6 Enter the total cost of the fringe benefit plan for the plan year. (See instructions.)

7 Did the fringe benefit plan terminate in this plan year? (See instructions.) Yes No

General Instructions necessary business expense under provide for the benefits under the

Code section 162. plan. For a Code section 125 cafeteria

A Change To Note Fringe benefit plans filing only to plan, enter the amount of the salary

satisfy the requirements of Code reductions and other employer

The Taxpayer Relief Act of 1997

section 6039D(a) must complete page contributions. Other employer

retroactively extends Code section

1, Form 5500 (or Form 5500-C/R), contributions include nonelective

127, which was set to expire on May

lines 1a through 5c, check box 6d, contributions and flexible credits.

31, 1997. For tax years beginning after

and attach Schedule F (Form 5500). Nonelective contributions and

1996, the Code section 127 exclusion

Page 1 of Form 5500 (or Form employer flexible credits are the

is allowed for expenses paid for

5500-C/R) and Schedule F are filed as employer’s portion of the cost or

undergraduate courses that begin

the plan’s annual information return. premium contributed as

before June 1, 2000.

Do not file Schedule A, B, C, E, P, or employer-provided coverage under a

Employers who have questions cafeteria plan arrangement. Do not

SSA.

about the retroactive extension of this subtract benefits paid out from the

provision, including how to file for a Employers filing the same Form

plan and amounts forfeited.

refund for any overpaid social security, 5500 (or Form 5500-C/R) for both

medicare, and unemployment taxes a welfare benefit plan and a fringe ● Administrative expenses including

can call 1-800-829-1040 for benefit plan must complete all the any legal, accounting, or consulting

assistance. Also get Circular E, welfare and fringe benefit plan fees attributable to the plan, whether

Employer’s Tax Guide, for additional questions on Form 5500 (or Form paid directly by the employer or

information. 5500-C/R), check box 6a and box 6d, through the plan. Overhead expenses

and attach Schedule F (Form 5500). such as utilities and photocopying

costs are not to be included for this

Purpose of Form reporting purpose.

File Schedule F (Form 5500) for the

Specific Instructions

Line 7. Do not complete this line if the

following fringe benefit plans: Line 5. For purposes of Code section

return/report is filed for both a welfare

● A cafeteria plan described in Code 6039D, fringe benefit plan

plan and a fringe benefit plan and

section 125, “participant” means any individual

both plans have terminated during

who, for a plan year, has had at least

● An educational assistance program $1 excluded from income by reason of

this plan year. Enter the termination

described in Code section 127. information on lines 9a and 9b of the

Code section 125 or 127.

Note: Do not file Schedule F for an applicable Form 5500 or Form

Line 6. The total cost of the fringe 5500-C/R.

educational assistance program that benefit plan includes:

provides only job-related training,

which is deductible as an ordinary and ● The amount employees elect to

have an employer contribute to

Cat. No. 14687J Schedule F (Form 5500) 1997

You might also like

- Netflix 401 (K) PlanDocument51 pagesNetflix 401 (K) PlanoaifoiweuNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Mercury NewsDocument87 pagesMercury NewskmccoynycNo ratings yet

- US Internal Revenue Service: I1040sf - 1998Document7 pagesUS Internal Revenue Service: I1040sf - 1998IRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Solution Set PDocument14 pagesSolution Set PChristina JazarenoNo ratings yet

- Sloping Agricultural Land Technology - SALT 1Document25 pagesSloping Agricultural Land Technology - SALT 1cdwsg254100% (1)

- US Internal Revenue Service: f5500sf - 1993Document1 pageUS Internal Revenue Service: f5500sf - 1993IRSNo ratings yet

- US Internal Revenue Service: f5500sf - 1996Document1 pageUS Internal Revenue Service: f5500sf - 1996IRSNo ratings yet

- US Internal Revenue Service: f5500sp - 1991Document1 pageUS Internal Revenue Service: f5500sp - 1991IRSNo ratings yet

- US Internal Revenue Service: f5500cr - 1991Document6 pagesUS Internal Revenue Service: f5500cr - 1991IRSNo ratings yet

- US Internal Revenue Service: I5500sb - 2006Document9 pagesUS Internal Revenue Service: I5500sb - 2006IRSNo ratings yet

- US Internal Revenue Service: f5500cr - 1995Document6 pagesUS Internal Revenue Service: f5500cr - 1995IRSNo ratings yet

- Attention:: WWW - Efast.dol - GovDocument4 pagesAttention:: WWW - Efast.dol - GovIRSNo ratings yet

- US Internal Revenue Service: f5500 - 1995Document6 pagesUS Internal Revenue Service: f5500 - 1995IRSNo ratings yet

- US Internal Revenue Service: f5500sr - 2001Document2 pagesUS Internal Revenue Service: f5500sr - 2001IRSNo ratings yet

- US Internal Revenue Service: f5500cr - 1994Document6 pagesUS Internal Revenue Service: f5500cr - 1994IRSNo ratings yet

- US Internal Revenue Service: f5500 - 1991Document6 pagesUS Internal Revenue Service: f5500 - 1991IRSNo ratings yet

- US Internal Revenue Service: f5500sr - 2000Document2 pagesUS Internal Revenue Service: f5500sr - 2000IRSNo ratings yet

- US Internal Revenue Service: I5500sb - 2005Document9 pagesUS Internal Revenue Service: I5500sb - 2005IRSNo ratings yet

- US Internal Revenue Service: f5500cr - 1997Document6 pagesUS Internal Revenue Service: f5500cr - 1997IRSNo ratings yet

- US Internal Revenue Service: f5500sr - 1999Document2 pagesUS Internal Revenue Service: f5500sr - 1999IRSNo ratings yet

- Form 5500 Employee Benefit Plan AuditsDocument13 pagesForm 5500 Employee Benefit Plan AuditsCA Rajendra Prasad ANo ratings yet

- Instructions For Form 5500-EZ: Annual Return of One-Participant (Owners and Their Spouses) Retirement PlanDocument6 pagesInstructions For Form 5500-EZ: Annual Return of One-Participant (Owners and Their Spouses) Retirement PlanIRSNo ratings yet

- US Internal Revenue Service: f5500 - 1996Document6 pagesUS Internal Revenue Service: f5500 - 1996IRSNo ratings yet

- US Internal Revenue Service: f5500 - 2001Document4 pagesUS Internal Revenue Service: f5500 - 2001IRSNo ratings yet

- US Internal Revenue Service: I5500sb - 2004Document9 pagesUS Internal Revenue Service: I5500sb - 2004IRSNo ratings yet

- US Internal Revenue Service: f5500 - 2002Document6 pagesUS Internal Revenue Service: f5500 - 2002IRSNo ratings yet

- US Internal Revenue Service: f5500sb - 1999Document8 pagesUS Internal Revenue Service: f5500sb - 1999IRSNo ratings yet

- US Internal Revenue Service: f5500 - 1994Document6 pagesUS Internal Revenue Service: f5500 - 1994IRSNo ratings yet

- US Internal Revenue Service: I5500sb - 2003Document8 pagesUS Internal Revenue Service: I5500sb - 2003IRSNo ratings yet

- US Internal Revenue Service: I5500sp - 2003Document1 pageUS Internal Revenue Service: I5500sp - 2003IRSNo ratings yet

- US Internal Revenue Service: f5500sb - 1994Document3 pagesUS Internal Revenue Service: f5500sb - 1994IRSNo ratings yet

- NRA 2015 Defined Benefit Plan 5500Document19 pagesNRA 2015 Defined Benefit Plan 5500jpeppardNo ratings yet

- Filing PDFDocument82 pagesFiling PDFjgalenNo ratings yet

- US Internal Revenue Service: f5500sb - 2003Document7 pagesUS Internal Revenue Service: f5500sb - 2003IRSNo ratings yet

- US Internal Revenue Service: I5500ez - 1995Document6 pagesUS Internal Revenue Service: I5500ez - 1995IRSNo ratings yet

- US Internal Revenue Service: f5500sf - 1999Document1 pageUS Internal Revenue Service: f5500sf - 1999IRSNo ratings yet

- US Internal Revenue Service: f5500sb - 1995Document5 pagesUS Internal Revenue Service: f5500sb - 1995IRSNo ratings yet

- US Internal Revenue Service: f5500sr - 2003Document2 pagesUS Internal Revenue Service: f5500sr - 2003IRSNo ratings yet

- US Internal Revenue Service: I5500ezDocument11 pagesUS Internal Revenue Service: I5500ezIRSNo ratings yet

- NRA 2016 401 (K) - Form 5500Document15 pagesNRA 2016 401 (K) - Form 5500jpeppardNo ratings yet

- Retirement & Pension Plan For NYCDCC Employees 2006Document13 pagesRetirement & Pension Plan For NYCDCC Employees 2006Latisha WalkerNo ratings yet

- US Internal Revenue Service: I5500sb - 2002Document8 pagesUS Internal Revenue Service: I5500sb - 2002IRSNo ratings yet

- US Internal Revenue Service: I5500sp - 2004Document1 pageUS Internal Revenue Service: I5500sp - 2004IRSNo ratings yet

- US Internal Revenue Service: F8453e - 1994Document2 pagesUS Internal Revenue Service: F8453e - 1994IRSNo ratings yet

- NRA Defined Benefit Plan - 2016 5500Document26 pagesNRA Defined Benefit Plan - 2016 5500jpeppardNo ratings yet

- US Internal Revenue Service: I5500sb - 1994Document4 pagesUS Internal Revenue Service: I5500sb - 1994IRSNo ratings yet

- US Internal Revenue Service: I5500sb - 1999Document8 pagesUS Internal Revenue Service: I5500sb - 1999IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1993Document2 pagesUS Internal Revenue Service: f5884 - 1993IRSNo ratings yet

- US Internal Revenue Service: I1040sf - 2003Document6 pagesUS Internal Revenue Service: I1040sf - 2003IRSNo ratings yet

- US Internal Revenue Service: I5500sb - 2000Document9 pagesUS Internal Revenue Service: I5500sb - 2000IRSNo ratings yet

- Notice To Employee Instructions For Employee: (Continued From The Back of Copy B.)Document1 pageNotice To Employee Instructions For Employee: (Continued From The Back of Copy B.)redditor1276No ratings yet

- US Internal Revenue Service: I5500sb - 1998Document8 pagesUS Internal Revenue Service: I5500sb - 1998IRSNo ratings yet

- Attention:: WWW - Efast.dol - GovDocument8 pagesAttention:: WWW - Efast.dol - GovIRSNo ratings yet

- US Internal Revenue Service: I1040sf - 2004Document6 pagesUS Internal Revenue Service: I1040sf - 2004IRSNo ratings yet

- W2 InstructionsDocument3 pagesW2 Instructionswarriorsinrecoveryalex.rNo ratings yet

- US Internal Revenue Service: f5500sb - 1993Document3 pagesUS Internal Revenue Service: f5500sb - 1993IRSNo ratings yet

- US Internal Revenue Service: I1040sfDocument7 pagesUS Internal Revenue Service: I1040sfIRSNo ratings yet

- Instructions For Form 941: (Rev. July 2020)Document20 pagesInstructions For Form 941: (Rev. July 2020)Kugilan BalakrishnanNo ratings yet

- US Internal Revenue Service: I5500ez - 2005Document9 pagesUS Internal Revenue Service: I5500ez - 2005IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1992Document2 pagesUS Internal Revenue Service: f5884 - 1992IRSNo ratings yet

- 2006 Form 5500 Carpenter Pension PlanDocument22 pages2006 Form 5500 Carpenter Pension PlanLatisha WalkerNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- Strategic PlanningDocument12 pagesStrategic PlanningTessie MangrobangNo ratings yet

- D375 Child Parts UCPDocument56 pagesD375 Child Parts UCPAsim GhoshNo ratings yet

- Indias Stalled RiseDocument12 pagesIndias Stalled RiseParul RajNo ratings yet

- Farm TractorsDocument157 pagesFarm TractorsEnrique SuárezNo ratings yet

- CIR 941& 963 - Orientation - Apr18Document2 pagesCIR 941& 963 - Orientation - Apr18Jose Ramon VillatuyaNo ratings yet

- Capm VS AptDocument3 pagesCapm VS AptDai Siu MaiNo ratings yet

- VC ProspectDocument11 pagesVC ProspectShrutiMarwahNo ratings yet

- Leadership The Ford MotorDocument12 pagesLeadership The Ford Motoralexos2012No ratings yet

- Rationale For State InterventionDocument3 pagesRationale For State InterventionSheldon JosephNo ratings yet

- A Guide To Unemployment Benefits in SCDocument2 pagesA Guide To Unemployment Benefits in SCSC AppleseedNo ratings yet

- Production Support ProcessDocument26 pagesProduction Support ProcessMonikha100% (2)

- APA Formatting and Citation (For Essays)Document46 pagesAPA Formatting and Citation (For Essays)babyboyz MiguZaNo ratings yet

- A2Z ProfileDocument3 pagesA2Z ProfileMs FaizaNo ratings yet

- Defination and MeaningDocument4 pagesDefination and MeaningSherry SherNo ratings yet

- Rev1-Gift MarketDocument29 pagesRev1-Gift MarketmoumitaNo ratings yet

- MCQS:-: Provision Related To DeductorDocument4 pagesMCQS:-: Provision Related To DeductorManoj BothraNo ratings yet

- India - Cement Directory 2012: © Ibis Research Information Services Private LimitedDocument72 pagesIndia - Cement Directory 2012: © Ibis Research Information Services Private LimitedPiyush A JoshiNo ratings yet

- Congestion Zone On The Daily Chart. The Stock Found Support and Bounced FromDocument7 pagesCongestion Zone On The Daily Chart. The Stock Found Support and Bounced FromxytiseNo ratings yet

- Department of Labor and Employment: Hon. Christopher A. MamauagDocument1 pageDepartment of Labor and Employment: Hon. Christopher A. MamauagFamily Liggayu DiariesNo ratings yet

- Government Accounting: Accounting For Income and Other Cash ReceiptsDocument18 pagesGovernment Accounting: Accounting For Income and Other Cash ReceiptsJoan May PeraltaNo ratings yet

- 2 Ndquiz 1 To 22 LecrepeatingignoreDocument19 pages2 Ndquiz 1 To 22 LecrepeatingignoreKhurramSadiqNo ratings yet

- Chap01-01c Rapid Product Development and Manufacturing (RPD&M) PDFDocument37 pagesChap01-01c Rapid Product Development and Manufacturing (RPD&M) PDFPrashant AshishNo ratings yet

- Bearish Candle - Stick PatternDocument48 pagesBearish Candle - Stick Patternpdhamgaye49No ratings yet

- 12 Philippine Peso Per Us Dollar Exchange Rate: Period 2018 2019 2020 2021 2022 Monthly AverageDocument1 page12 Philippine Peso Per Us Dollar Exchange Rate: Period 2018 2019 2020 2021 2022 Monthly AverageHector Andrei NicolasNo ratings yet

- SST 212 Microeconomics SIM Unit 1Document24 pagesSST 212 Microeconomics SIM Unit 1France FuertesNo ratings yet

- Can Insorance SampleDocument19 pagesCan Insorance Samplepradeep singh karkiNo ratings yet

- Companies List 2011Document2 pagesCompanies List 2011Zulfadzli RidzuanNo ratings yet

- Invoice 25 2019 UK1537 Tessa Penequito Dinessa2017@Document1 pageInvoice 25 2019 UK1537 Tessa Penequito Dinessa2017@Asset OtiuqenepNo ratings yet