Professional Documents

Culture Documents

Flat Tax Rate

Flat Tax Rate

Uploaded by

irfanCopyright:

Available Formats

You might also like

- Certification Exam: Review: Wall Street PrepDocument21 pagesCertification Exam: Review: Wall Street Prepduc anh100% (1)

- Burton Sensor IncDocument14 pagesBurton Sensor Incchirag shah50% (2)

- Vashist2 Exp22 Excel AppCapstone ComprehensiveAssessment ManufacturingDocument11 pagesVashist2 Exp22 Excel AppCapstone ComprehensiveAssessment ManufacturingSakshamNo ratings yet

- Jetblue PresentationDocument38 pagesJetblue Presentationpostitman33% (3)

- HO No. 1 - Financial Statements AnalysisDocument3 pagesHO No. 1 - Financial Statements AnalysisJOHANNANo ratings yet

- Homework #3 TemplateDocument18 pagesHomework #3 TemplateAnthony ButlerNo ratings yet

- Day Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On One Trade Per Daynecessary Lot Size Based On One Trade Per DayDocument8 pagesDay Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On One Trade Per Daynecessary Lot Size Based On One Trade Per DayVeeraesh MSNo ratings yet

- Amex STMTDocument1 pageAmex STMTMark GalantyNo ratings yet

- Freedom Tax AnalysisDocument2 pagesFreedom Tax Analysisshriya2413No ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Tablas de Amortizacion 1 PuntoDocument9 pagesTablas de Amortizacion 1 PuntoAsistente Admin. CistepNo ratings yet

- Arora Exp22 Excel Ch02 ML2 Vacation PropertyDocument3 pagesArora Exp22 Excel Ch02 ML2 Vacation PropertydivijNo ratings yet

- Arora Exp22 Excel Ch02 ML2 Vacation PropertyDocument3 pagesArora Exp22 Excel Ch02 ML2 Vacation PropertydivijNo ratings yet

- Tax LiabilityDocument133 pagesTax LiabilitySebastian Cruz RivasNo ratings yet

- Plazo (Mesesaldo Insoluto Pago Mensual Total CapitalDocument2 pagesPlazo (Mesesaldo Insoluto Pago Mensual Total CapitalCristhian NavarroNo ratings yet

- Crystall BallDocument15 pagesCrystall BallBISHAL AdhikariNo ratings yet

- BC Ap: Dedicated To The Adoption, Implementation, and Advancement of Building Energy CodesDocument5 pagesBC Ap: Dedicated To The Adoption, Implementation, and Advancement of Building Energy Codesbcap-oceanNo ratings yet

- State by State Breakdown: COVID-19 Testing For Nursing HomesDocument2 pagesState by State Breakdown: COVID-19 Testing For Nursing HomesCBS Austin WebteamNo ratings yet

- SENADocument4 pagesSENAJessicaNo ratings yet

- UntitledDocument7 pagesUntitledJennifer ArpiNo ratings yet

- Customizable Daily Growth PlanDocument11 pagesCustomizable Daily Growth PlanSan Andreas JacobNo ratings yet

- Tabla de AmortizacionDocument2 pagesTabla de AmortizacionjabierNo ratings yet

- Plazo (Mesesaldo Insoluto Pago Mensual TotalcapitalDocument2 pagesPlazo (Mesesaldo Insoluto Pago Mensual TotalcapitaljabierNo ratings yet

- VAN y TIR ProjectDocument12 pagesVAN y TIR ProjectEduardo FélixNo ratings yet

- Informatica ActividadesDocument74 pagesInformatica ActividadesEmily AnguayaNo ratings yet

- Money ManagementDocument13 pagesMoney ManagementMarchie VictorNo ratings yet

- Parcial2 - Actividades de La Semana 4 KevvDocument23 pagesParcial2 - Actividades de La Semana 4 KevvLuis Eduardo Meunier MendezNo ratings yet

- Finanzas ESQUEMADocument6 pagesFinanzas ESQUEMARichard Taipe ChacaltanaNo ratings yet

- Tabela-Price ImobiliariaDocument12 pagesTabela-Price Imobiliariamarcos.comercial2010No ratings yet

- Tabla de AmortizacionDocument2 pagesTabla de AmortizacionoterhNo ratings yet

- Stock Dads Compound Interest CalculatorDocument4 pagesStock Dads Compound Interest CalculatorMNo ratings yet

- Year 0 Year 1 Year 2 Year 3 Year 4Document14 pagesYear 0 Year 1 Year 2 Year 3 Year 4nina9121No ratings yet

- FbricadeSalarios Gerenciamento1Document12 pagesFbricadeSalarios Gerenciamento1Vitor BrasilNo ratings yet

- Water Well Valuation ExampleDocument25 pagesWater Well Valuation ExamplePwint ShweNo ratings yet

- Pagos Variables: Saldo Interes IVA Seguro Abono A Capital Mensualid ADDocument10 pagesPagos Variables: Saldo Interes IVA Seguro Abono A Capital Mensualid ADAlexia CasteloNo ratings yet

- Task 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetDocument15 pagesTask 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetUurka LucyNo ratings yet

- Taller Final #5 L BarreraDocument16 pagesTaller Final #5 L BarreraFRANXIS ALMEYDANo ratings yet

- Excel Solution To 10.1-10.4Document14 pagesExcel Solution To 10.1-10.4mansiNo ratings yet

- Parcial2 - Actividades de La Semana 4Document23 pagesParcial2 - Actividades de La Semana 4Luis Eduardo Meunier MendezNo ratings yet

- Practica 1 Excel GoogleDocument3 pagesPractica 1 Excel GoogleWendyNo ratings yet

- Time To FI (RE) SpreadsheetDocument8 pagesTime To FI (RE) SpreadsheetdigiowlmedialabNo ratings yet

- Taller Funciones SolverDocument10 pagesTaller Funciones SolverLeidy Carolina MEDINA GOMEZNo ratings yet

- Present ValueDocument8 pagesPresent ValuemasumaNo ratings yet

- Gestão de Estoques ListaDocument26 pagesGestão de Estoques ListaJoão AielloNo ratings yet

- Coffee Shop Financial PlanDocument28 pagesCoffee Shop Financial PlangerardmacNo ratings yet

- Sample Data Sets For Linear Regression1Document3 pagesSample Data Sets For Linear Regression1Ahmad Haikal0% (1)

- Tabla de Amortizacion2Document5 pagesTabla de Amortizacion2Maciel DorvilleNo ratings yet

- Tabla de Amortizacion2Document5 pagesTabla de Amortizacion2Heyssy PachecoNo ratings yet

- Multiple RegressionDocument4 pagesMultiple Regressionsumit kumarNo ratings yet

- 9 - Advanced Monte CarloDocument9 pages9 - Advanced Monte CarloKevin MartinNo ratings yet

- 44.pratibha Sahoo (Micro Economics)Document4 pages44.pratibha Sahoo (Micro Economics)SHREEMAYEE PANDANo ratings yet

- Customer Email Total Amount Amount Paid Next Bill Next Bill Pay Status Comish Payment CompletedDocument64 pagesCustomer Email Total Amount Amount Paid Next Bill Next Bill Pay Status Comish Payment CompletedhamzaNo ratings yet

- 03-JUROS COMPOSTOS PlanilhaDocument12 pages03-JUROS COMPOSTOS Planilhapsidaniela.viegasNo ratings yet

- Main Compounding PlanDocument12 pagesMain Compounding PlanShafieqNo ratings yet

- Ejercicios 6-7Document5 pagesEjercicios 6-7Ana GarcíaNo ratings yet

- Reporte de Ventas Ok Market Noviembre 2022Document9 pagesReporte de Ventas Ok Market Noviembre 2022XxKevin 1519No ratings yet

- Anualidades Ordinarias MontoDocument19 pagesAnualidades Ordinarias MontoMarian GarciaNo ratings yet

- Cuadro de MarchaDocument2 pagesCuadro de Marcharaul.bramajoNo ratings yet

- Taller Calificable VPN-TIRDocument11 pagesTaller Calificable VPN-TIRMario MarinNo ratings yet

- Gerenciamento Blaze 2.0Document16 pagesGerenciamento Blaze 2.0LEOzinhoNo ratings yet

- VideosDocument39 pagesVideosYunier MosqueraNo ratings yet

- IPSGADocument2 pagesIPSGAEric Michael SmithNo ratings yet

- Values Values: # Ms Rel Intel Rel Ms Price Intel Price Pcs Sold (MM) Ms Profit ($MM) Intel Profit ($MM)Document3 pagesValues Values: # Ms Rel Intel Rel Ms Price Intel Price Pcs Sold (MM) Ms Profit ($MM) Intel Profit ($MM)Manikho KaibiNo ratings yet

- NPV Extra ExamplesDocument6 pagesNPV Extra ExamplesVishal suhagiyaNo ratings yet

- PMS 2020 Interview QuestionsDocument28 pagesPMS 2020 Interview QuestionsirfanNo ratings yet

- Lecture 8 CA23B1Document67 pagesLecture 8 CA23B1irfanNo ratings yet

- Key IndicatorsDocument6 pagesKey IndicatorsirfanNo ratings yet

- Updated PMS Schedule 2022 - 231002171834Document1 pageUpdated PMS Schedule 2022 - 231002171834irfanNo ratings yet

- Government of Pakistan: For Officers in Bps 17 & 18 ConfidentialDocument9 pagesGovernment of Pakistan: For Officers in Bps 17 & 18 ConfidentialirfanNo ratings yet

- Psychological PerformaDocument8 pagesPsychological PerformairfanNo ratings yet

- 05364720220607183155Document1 page05364720220607183155irfanNo ratings yet

- Précis 3Document1 pagePrécis 3irfanNo ratings yet

- Symptom ChecklistDocument3 pagesSymptom ChecklistirfanNo ratings yet

- Q1 What Is AristotleDocument10 pagesQ1 What Is AristotleirfanNo ratings yet

- UntitledDocument2 pagesUntitledirfanNo ratings yet

- PrécisDocument1 pagePrécisirfanNo ratings yet

- ,toxoplasmosisDocument21 pages,toxoplasmosisirfanNo ratings yet

- Essay Themes G1 BatchDocument1 pageEssay Themes G1 BatchirfanNo ratings yet

- Precis 5Document2 pagesPrecis 5irfanNo ratings yet

- CSS English (Precis & Composition) Paper 2021 - FPSC CSS Past Papers 2021Document6 pagesCSS English (Precis & Composition) Paper 2021 - FPSC CSS Past Papers 2021irfanNo ratings yet

- Canine Parvovirus Infection-2Document51 pagesCanine Parvovirus Infection-2irfanNo ratings yet

- LetterDocument1 pageLetterirfanNo ratings yet

- G1 Batch 2 OptDocument7 pagesG1 Batch 2 OptirfanNo ratings yet

- Importnt Grammer Ruler Gerund RuleDocument1 pageImportnt Grammer Ruler Gerund RuleirfanNo ratings yet

- Merit List 10C2020Document3 pagesMerit List 10C2020irfanNo ratings yet

- Part-Ii: Gender StudiesDocument6 pagesPart-Ii: Gender StudiesirfanNo ratings yet

- Entry TestDocument3 pagesEntry TestirfanNo ratings yet

- Coordinate G CodeDocument45 pagesCoordinate G CodeirfanNo ratings yet

- ECE 307 - Digital Lecture 1 Digital Systems, Binary Math and LogicDocument183 pagesECE 307 - Digital Lecture 1 Digital Systems, Binary Math and LogicirfanNo ratings yet

- Solid Modeling Software: Lab 8 ENGR101Document5 pagesSolid Modeling Software: Lab 8 ENGR101irfanNo ratings yet

- File 11Document3 pagesFile 11irfanNo ratings yet

- Bader Alanazi Point of ViewDocument5 pagesBader Alanazi Point of ViewirfanNo ratings yet

- Mubarak Lab 4Document4 pagesMubarak Lab 4irfanNo ratings yet

- How Many Waters of Hydration Are in The Formula?: Week 1 AllDocument15 pagesHow Many Waters of Hydration Are in The Formula?: Week 1 AllirfanNo ratings yet

- Deccan Cements - Rating Rationale PDFDocument6 pagesDeccan Cements - Rating Rationale PDFAkashNo ratings yet

- Term Paper On The Changes Between IAS 18 and IFRS 15Document18 pagesTerm Paper On The Changes Between IAS 18 and IFRS 15Nion Majumdar100% (6)

- Special Commercial Law Lecture Notes Philord Aranda Letters of CreditDocument8 pagesSpecial Commercial Law Lecture Notes Philord Aranda Letters of CreditFiels GamboaNo ratings yet

- 1.covering MaybankDocument1 page1.covering MaybankNgan ThaoNo ratings yet

- Money (Part II) Please Go Over The Following Terms and Their DefinitionsDocument4 pagesMoney (Part II) Please Go Over The Following Terms and Their DefinitionsDelia LupascuNo ratings yet

- Aml CFT Tfs PD 31dec2019 - RHDocument188 pagesAml CFT Tfs PD 31dec2019 - RHrasinahNo ratings yet

- Annual Report of IOCL 174Document1 pageAnnual Report of IOCL 174Nikunj ParmarNo ratings yet

- Role of Government and RBI in Money Market - IndianMoneyDocument10 pagesRole of Government and RBI in Money Market - IndianMoneyKushNo ratings yet

- Garden City High School: Budget ExpensesDocument3 pagesGarden City High School: Budget ExpensesKyjuan T. KingNo ratings yet

- Capital Budgeting ContentDocument3 pagesCapital Budgeting ContentRobin ThomasNo ratings yet

- Business FinanceDocument6 pagesBusiness FinanceAbhishek WadkarNo ratings yet

- Taussig, Principles of Economics, Vol. 1Document600 pagesTaussig, Principles of Economics, Vol. 1quintus14100% (1)

- Hindustan Oil Exploration Company LimitedDocument20 pagesHindustan Oil Exploration Company LimitedBhunesh VaswaniNo ratings yet

- Much Test Very 2021Document8 pagesMuch Test Very 2021N-am Nici O TreabaNo ratings yet

- Mhike - Financial Education Policy of DEPEDDocument99 pagesMhike - Financial Education Policy of DEPEDRussel TamayoNo ratings yet

- Adobe Scan 18 Oct 2021Document25 pagesAdobe Scan 18 Oct 2021Topviralhub videosNo ratings yet

- Study Material Economics 2009Document90 pagesStudy Material Economics 2009Rohit PatelNo ratings yet

- SITXFIN002 Interpret Financial Information Homework For StudentsDocument8 pagesSITXFIN002 Interpret Financial Information Homework For StudentsMichelle MagtibayNo ratings yet

- SUBJECT: Law of Investment.: Chanakya National Law University, PatnaDocument30 pagesSUBJECT: Law of Investment.: Chanakya National Law University, PatnaPammi ShergillNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document7 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

- A Project Report HDFC BANKDocument48 pagesA Project Report HDFC BANKVikas SinghNo ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- Managing Your Card With CareDocument33 pagesManaging Your Card With CareLipsin LeeNo ratings yet

- BC 306 PI Past PapersDocument15 pagesBC 306 PI Past PapersMehar AmirNo ratings yet

- NUST Business School: DerivativesDocument5 pagesNUST Business School: DerivativesAhmad Waqas DarNo ratings yet

Flat Tax Rate

Flat Tax Rate

Uploaded by

irfanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Flat Tax Rate

Flat Tax Rate

Uploaded by

irfanCopyright:

Available Formats

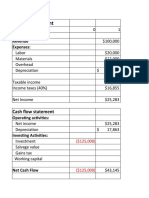

Flat Tax Rate

Base Income

$ 0 $ 30,000 $ 50,000 $ 80,000 $ 180,000

Alternate 1 0.0% 5.0% 9.0% 14.0% 22.0%

Alternate 2 0.0% 6.0% 10.0% 16.0% 26.0%

State Allowance

MA $ 2,200

NH $ 800

VT $ 650

Actual

Taxable State of Withhold- Estimated Actual Tax Flat Tax

ID # Income Residence ing Paid Taxes Paid Owed Alternate 1

1 $ 103,300 MA $ 10,235 $ 0 $ 14,954 14462

2 $ 53,003 MA 6,423 0 6,400 4770.27

3 $ 87,925 NH 6,384 0 16,589 12309.5

4 $ 525,000 VT 0 93,225 130,415 115500

5 $ 65,488 VT 9,402 0 6,412 5893.92

6 $ 193,000 VT 12,345 0 48,750 42460

7 $ 29,200 MA 2,310 0 259 0

8 $ 52,700 MA 0 7,200 4,955 4743

9 $ 96,400 NH 18,000 0 19,192 13496

10 $ 76,200 OH 6,703 4,000 8,725 6858

Total Revenues: $ 256,651 $ 220,493

Penalty

Amount Owed Penalty %

$ 0 0

100 3%

1,000 5%

5,000 7%

10,000 10%

50,000 15%

Actual Actual Penalty

Flat Tax Unpaid Unpaid Tax Unpaid Tax Penalty Penalty Alternate State

Alternate 2 Tax Alternate 1 Alternate 2 Owed Alternate 1 2 Allowance

16528 $ 4,719 $ 4,227 $ 6,293 235.95 211.35 440.51 2200

5300.3 $ (23) $ (1,653) $ (1,123) 0 0 0 2200

14068 $ 10,205 $ 5,926 $ 7,684 1020.5 414.785 537.88 800

136500 $ 37,190 $ 208,725 $ 229,725 3719 31308.75 34458.75 650

6548.8 $ (2,990) $ (3,508) $ (2,853) 0 0 0 650

50180 $ 36,405 $ 30,115 $ 37,835 3640.5 3011.5 3783.5 650

0 $ (2,051) $ (2,310) $ (2,310) 0 0 0 2200

5270 $ (2,245) $ 11,943 $ 12,470 0 1194.3 1247 2200

15424 $ 1,192 $ (4,504) $ (2,576) 59.6 0 0 800

7620 $ (1,978) $ 4,155 $ 4,917 0 207.75 245.85 #N/A

$ 257,439 $ 80,424 $ 253,116 $ 290,062 $ 8,676 $ 36,348 $ 40,713

You might also like

- Certification Exam: Review: Wall Street PrepDocument21 pagesCertification Exam: Review: Wall Street Prepduc anh100% (1)

- Burton Sensor IncDocument14 pagesBurton Sensor Incchirag shah50% (2)

- Vashist2 Exp22 Excel AppCapstone ComprehensiveAssessment ManufacturingDocument11 pagesVashist2 Exp22 Excel AppCapstone ComprehensiveAssessment ManufacturingSakshamNo ratings yet

- Jetblue PresentationDocument38 pagesJetblue Presentationpostitman33% (3)

- HO No. 1 - Financial Statements AnalysisDocument3 pagesHO No. 1 - Financial Statements AnalysisJOHANNANo ratings yet

- Homework #3 TemplateDocument18 pagesHomework #3 TemplateAnthony ButlerNo ratings yet

- Day Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On One Trade Per Daynecessary Lot Size Based On One Trade Per DayDocument8 pagesDay Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On One Trade Per Daynecessary Lot Size Based On One Trade Per DayVeeraesh MSNo ratings yet

- Amex STMTDocument1 pageAmex STMTMark GalantyNo ratings yet

- Freedom Tax AnalysisDocument2 pagesFreedom Tax Analysisshriya2413No ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Tablas de Amortizacion 1 PuntoDocument9 pagesTablas de Amortizacion 1 PuntoAsistente Admin. CistepNo ratings yet

- Arora Exp22 Excel Ch02 ML2 Vacation PropertyDocument3 pagesArora Exp22 Excel Ch02 ML2 Vacation PropertydivijNo ratings yet

- Arora Exp22 Excel Ch02 ML2 Vacation PropertyDocument3 pagesArora Exp22 Excel Ch02 ML2 Vacation PropertydivijNo ratings yet

- Tax LiabilityDocument133 pagesTax LiabilitySebastian Cruz RivasNo ratings yet

- Plazo (Mesesaldo Insoluto Pago Mensual Total CapitalDocument2 pagesPlazo (Mesesaldo Insoluto Pago Mensual Total CapitalCristhian NavarroNo ratings yet

- Crystall BallDocument15 pagesCrystall BallBISHAL AdhikariNo ratings yet

- BC Ap: Dedicated To The Adoption, Implementation, and Advancement of Building Energy CodesDocument5 pagesBC Ap: Dedicated To The Adoption, Implementation, and Advancement of Building Energy Codesbcap-oceanNo ratings yet

- State by State Breakdown: COVID-19 Testing For Nursing HomesDocument2 pagesState by State Breakdown: COVID-19 Testing For Nursing HomesCBS Austin WebteamNo ratings yet

- SENADocument4 pagesSENAJessicaNo ratings yet

- UntitledDocument7 pagesUntitledJennifer ArpiNo ratings yet

- Customizable Daily Growth PlanDocument11 pagesCustomizable Daily Growth PlanSan Andreas JacobNo ratings yet

- Tabla de AmortizacionDocument2 pagesTabla de AmortizacionjabierNo ratings yet

- Plazo (Mesesaldo Insoluto Pago Mensual TotalcapitalDocument2 pagesPlazo (Mesesaldo Insoluto Pago Mensual TotalcapitaljabierNo ratings yet

- VAN y TIR ProjectDocument12 pagesVAN y TIR ProjectEduardo FélixNo ratings yet

- Informatica ActividadesDocument74 pagesInformatica ActividadesEmily AnguayaNo ratings yet

- Money ManagementDocument13 pagesMoney ManagementMarchie VictorNo ratings yet

- Parcial2 - Actividades de La Semana 4 KevvDocument23 pagesParcial2 - Actividades de La Semana 4 KevvLuis Eduardo Meunier MendezNo ratings yet

- Finanzas ESQUEMADocument6 pagesFinanzas ESQUEMARichard Taipe ChacaltanaNo ratings yet

- Tabela-Price ImobiliariaDocument12 pagesTabela-Price Imobiliariamarcos.comercial2010No ratings yet

- Tabla de AmortizacionDocument2 pagesTabla de AmortizacionoterhNo ratings yet

- Stock Dads Compound Interest CalculatorDocument4 pagesStock Dads Compound Interest CalculatorMNo ratings yet

- Year 0 Year 1 Year 2 Year 3 Year 4Document14 pagesYear 0 Year 1 Year 2 Year 3 Year 4nina9121No ratings yet

- FbricadeSalarios Gerenciamento1Document12 pagesFbricadeSalarios Gerenciamento1Vitor BrasilNo ratings yet

- Water Well Valuation ExampleDocument25 pagesWater Well Valuation ExamplePwint ShweNo ratings yet

- Pagos Variables: Saldo Interes IVA Seguro Abono A Capital Mensualid ADDocument10 pagesPagos Variables: Saldo Interes IVA Seguro Abono A Capital Mensualid ADAlexia CasteloNo ratings yet

- Task 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetDocument15 pagesTask 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetUurka LucyNo ratings yet

- Taller Final #5 L BarreraDocument16 pagesTaller Final #5 L BarreraFRANXIS ALMEYDANo ratings yet

- Excel Solution To 10.1-10.4Document14 pagesExcel Solution To 10.1-10.4mansiNo ratings yet

- Parcial2 - Actividades de La Semana 4Document23 pagesParcial2 - Actividades de La Semana 4Luis Eduardo Meunier MendezNo ratings yet

- Practica 1 Excel GoogleDocument3 pagesPractica 1 Excel GoogleWendyNo ratings yet

- Time To FI (RE) SpreadsheetDocument8 pagesTime To FI (RE) SpreadsheetdigiowlmedialabNo ratings yet

- Taller Funciones SolverDocument10 pagesTaller Funciones SolverLeidy Carolina MEDINA GOMEZNo ratings yet

- Present ValueDocument8 pagesPresent ValuemasumaNo ratings yet

- Gestão de Estoques ListaDocument26 pagesGestão de Estoques ListaJoão AielloNo ratings yet

- Coffee Shop Financial PlanDocument28 pagesCoffee Shop Financial PlangerardmacNo ratings yet

- Sample Data Sets For Linear Regression1Document3 pagesSample Data Sets For Linear Regression1Ahmad Haikal0% (1)

- Tabla de Amortizacion2Document5 pagesTabla de Amortizacion2Maciel DorvilleNo ratings yet

- Tabla de Amortizacion2Document5 pagesTabla de Amortizacion2Heyssy PachecoNo ratings yet

- Multiple RegressionDocument4 pagesMultiple Regressionsumit kumarNo ratings yet

- 9 - Advanced Monte CarloDocument9 pages9 - Advanced Monte CarloKevin MartinNo ratings yet

- 44.pratibha Sahoo (Micro Economics)Document4 pages44.pratibha Sahoo (Micro Economics)SHREEMAYEE PANDANo ratings yet

- Customer Email Total Amount Amount Paid Next Bill Next Bill Pay Status Comish Payment CompletedDocument64 pagesCustomer Email Total Amount Amount Paid Next Bill Next Bill Pay Status Comish Payment CompletedhamzaNo ratings yet

- 03-JUROS COMPOSTOS PlanilhaDocument12 pages03-JUROS COMPOSTOS Planilhapsidaniela.viegasNo ratings yet

- Main Compounding PlanDocument12 pagesMain Compounding PlanShafieqNo ratings yet

- Ejercicios 6-7Document5 pagesEjercicios 6-7Ana GarcíaNo ratings yet

- Reporte de Ventas Ok Market Noviembre 2022Document9 pagesReporte de Ventas Ok Market Noviembre 2022XxKevin 1519No ratings yet

- Anualidades Ordinarias MontoDocument19 pagesAnualidades Ordinarias MontoMarian GarciaNo ratings yet

- Cuadro de MarchaDocument2 pagesCuadro de Marcharaul.bramajoNo ratings yet

- Taller Calificable VPN-TIRDocument11 pagesTaller Calificable VPN-TIRMario MarinNo ratings yet

- Gerenciamento Blaze 2.0Document16 pagesGerenciamento Blaze 2.0LEOzinhoNo ratings yet

- VideosDocument39 pagesVideosYunier MosqueraNo ratings yet

- IPSGADocument2 pagesIPSGAEric Michael SmithNo ratings yet

- Values Values: # Ms Rel Intel Rel Ms Price Intel Price Pcs Sold (MM) Ms Profit ($MM) Intel Profit ($MM)Document3 pagesValues Values: # Ms Rel Intel Rel Ms Price Intel Price Pcs Sold (MM) Ms Profit ($MM) Intel Profit ($MM)Manikho KaibiNo ratings yet

- NPV Extra ExamplesDocument6 pagesNPV Extra ExamplesVishal suhagiyaNo ratings yet

- PMS 2020 Interview QuestionsDocument28 pagesPMS 2020 Interview QuestionsirfanNo ratings yet

- Lecture 8 CA23B1Document67 pagesLecture 8 CA23B1irfanNo ratings yet

- Key IndicatorsDocument6 pagesKey IndicatorsirfanNo ratings yet

- Updated PMS Schedule 2022 - 231002171834Document1 pageUpdated PMS Schedule 2022 - 231002171834irfanNo ratings yet

- Government of Pakistan: For Officers in Bps 17 & 18 ConfidentialDocument9 pagesGovernment of Pakistan: For Officers in Bps 17 & 18 ConfidentialirfanNo ratings yet

- Psychological PerformaDocument8 pagesPsychological PerformairfanNo ratings yet

- 05364720220607183155Document1 page05364720220607183155irfanNo ratings yet

- Précis 3Document1 pagePrécis 3irfanNo ratings yet

- Symptom ChecklistDocument3 pagesSymptom ChecklistirfanNo ratings yet

- Q1 What Is AristotleDocument10 pagesQ1 What Is AristotleirfanNo ratings yet

- UntitledDocument2 pagesUntitledirfanNo ratings yet

- PrécisDocument1 pagePrécisirfanNo ratings yet

- ,toxoplasmosisDocument21 pages,toxoplasmosisirfanNo ratings yet

- Essay Themes G1 BatchDocument1 pageEssay Themes G1 BatchirfanNo ratings yet

- Precis 5Document2 pagesPrecis 5irfanNo ratings yet

- CSS English (Precis & Composition) Paper 2021 - FPSC CSS Past Papers 2021Document6 pagesCSS English (Precis & Composition) Paper 2021 - FPSC CSS Past Papers 2021irfanNo ratings yet

- Canine Parvovirus Infection-2Document51 pagesCanine Parvovirus Infection-2irfanNo ratings yet

- LetterDocument1 pageLetterirfanNo ratings yet

- G1 Batch 2 OptDocument7 pagesG1 Batch 2 OptirfanNo ratings yet

- Importnt Grammer Ruler Gerund RuleDocument1 pageImportnt Grammer Ruler Gerund RuleirfanNo ratings yet

- Merit List 10C2020Document3 pagesMerit List 10C2020irfanNo ratings yet

- Part-Ii: Gender StudiesDocument6 pagesPart-Ii: Gender StudiesirfanNo ratings yet

- Entry TestDocument3 pagesEntry TestirfanNo ratings yet

- Coordinate G CodeDocument45 pagesCoordinate G CodeirfanNo ratings yet

- ECE 307 - Digital Lecture 1 Digital Systems, Binary Math and LogicDocument183 pagesECE 307 - Digital Lecture 1 Digital Systems, Binary Math and LogicirfanNo ratings yet

- Solid Modeling Software: Lab 8 ENGR101Document5 pagesSolid Modeling Software: Lab 8 ENGR101irfanNo ratings yet

- File 11Document3 pagesFile 11irfanNo ratings yet

- Bader Alanazi Point of ViewDocument5 pagesBader Alanazi Point of ViewirfanNo ratings yet

- Mubarak Lab 4Document4 pagesMubarak Lab 4irfanNo ratings yet

- How Many Waters of Hydration Are in The Formula?: Week 1 AllDocument15 pagesHow Many Waters of Hydration Are in The Formula?: Week 1 AllirfanNo ratings yet

- Deccan Cements - Rating Rationale PDFDocument6 pagesDeccan Cements - Rating Rationale PDFAkashNo ratings yet

- Term Paper On The Changes Between IAS 18 and IFRS 15Document18 pagesTerm Paper On The Changes Between IAS 18 and IFRS 15Nion Majumdar100% (6)

- Special Commercial Law Lecture Notes Philord Aranda Letters of CreditDocument8 pagesSpecial Commercial Law Lecture Notes Philord Aranda Letters of CreditFiels GamboaNo ratings yet

- 1.covering MaybankDocument1 page1.covering MaybankNgan ThaoNo ratings yet

- Money (Part II) Please Go Over The Following Terms and Their DefinitionsDocument4 pagesMoney (Part II) Please Go Over The Following Terms and Their DefinitionsDelia LupascuNo ratings yet

- Aml CFT Tfs PD 31dec2019 - RHDocument188 pagesAml CFT Tfs PD 31dec2019 - RHrasinahNo ratings yet

- Annual Report of IOCL 174Document1 pageAnnual Report of IOCL 174Nikunj ParmarNo ratings yet

- Role of Government and RBI in Money Market - IndianMoneyDocument10 pagesRole of Government and RBI in Money Market - IndianMoneyKushNo ratings yet

- Garden City High School: Budget ExpensesDocument3 pagesGarden City High School: Budget ExpensesKyjuan T. KingNo ratings yet

- Capital Budgeting ContentDocument3 pagesCapital Budgeting ContentRobin ThomasNo ratings yet

- Business FinanceDocument6 pagesBusiness FinanceAbhishek WadkarNo ratings yet

- Taussig, Principles of Economics, Vol. 1Document600 pagesTaussig, Principles of Economics, Vol. 1quintus14100% (1)

- Hindustan Oil Exploration Company LimitedDocument20 pagesHindustan Oil Exploration Company LimitedBhunesh VaswaniNo ratings yet

- Much Test Very 2021Document8 pagesMuch Test Very 2021N-am Nici O TreabaNo ratings yet

- Mhike - Financial Education Policy of DEPEDDocument99 pagesMhike - Financial Education Policy of DEPEDRussel TamayoNo ratings yet

- Adobe Scan 18 Oct 2021Document25 pagesAdobe Scan 18 Oct 2021Topviralhub videosNo ratings yet

- Study Material Economics 2009Document90 pagesStudy Material Economics 2009Rohit PatelNo ratings yet

- SITXFIN002 Interpret Financial Information Homework For StudentsDocument8 pagesSITXFIN002 Interpret Financial Information Homework For StudentsMichelle MagtibayNo ratings yet

- SUBJECT: Law of Investment.: Chanakya National Law University, PatnaDocument30 pagesSUBJECT: Law of Investment.: Chanakya National Law University, PatnaPammi ShergillNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document7 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

- A Project Report HDFC BANKDocument48 pagesA Project Report HDFC BANKVikas SinghNo ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- Managing Your Card With CareDocument33 pagesManaging Your Card With CareLipsin LeeNo ratings yet

- BC 306 PI Past PapersDocument15 pagesBC 306 PI Past PapersMehar AmirNo ratings yet

- NUST Business School: DerivativesDocument5 pagesNUST Business School: DerivativesAhmad Waqas DarNo ratings yet