Professional Documents

Culture Documents

OBN - Small Bank Snapshot - Issue 31

OBN - Small Bank Snapshot - Issue 31

Uploaded by

Nate TobikCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OBN - Small Bank Snapshot - Issue 31

OBN - Small Bank Snapshot - Issue 31

Uploaded by

Nate TobikCopyright:

Available Formats

THE ODDBALL STOCKS NEWSLETTER | 10

Feature: “Small Bank Snapshot”

There are more OTC-listed banks than any other type of company. In fact, with a total of about 500 of

them, there are probably more OTC-listed banks than every other type of legitimate OTC-listed

company combined. We took a “snapshot” look at small banks in Issue 21 (August 2018) of the

Newsletter, exactly two years ago.

At that time the SPDR® S&P Regional Banking ETF (ticker: KRE) was trading for around $60. That

ETF, which is a decent proxy for OTC listed banks, absolutely collapsed in the March 2020 crash and

has not recovered as much as the other sectors in the market. It trades for $38, up from the lows in the

high $20s during the crash. The KRE portfolio trades for around 13 times earnings, 0.8 times book, and

a 3.8% distribution yield. The average market capitalization is $6 billion. Banks are cheap compared to

the market by those metrics. The S&P 500 ETF (SPY) trades at 27 times earnings and 3.6 times book.

Another possibly better proxy would be the First Trust NASDAQ® ABA Community Bank Index Fund

ETF (ticker: QABA), which has had a similar slump in 2020. It trades at $35 now, down from $53 in

August of 2018. (Both ETFs have had a drawdown of about one-third.) The median market

capitalization is $574 million, the average P/E of the portfolio is 11, and the price to book is 0.9x.

Note that as with all ETFs and indices, you do not get the benefit of assiduous security selection when

you buy those two. The largest holding of KRE is SVB Financial Group (Silicon Valley Bank, ticker

SIVB, which has “helped fund more than 30,000 start-ups”). And QABA has a 1.9% holding in Bank

OZK. Interestingly, there are 140 different ETFs which hold SIVB and SPY is the largest holder. (This

is starting to sound like a Horizon Kinetics letter...)

As “Catahoula” mentions in his writings, and as you will see in subsequent pages, the Oddball banks

offer attributes that you can not get via ETFs. There are risks, of course – small banks have both

weaknesses and strengths compared to the bigger banks and gigantic banks, and it is hard to say which

will outperform. Other risks that exist industry-wide regardless of size include credit losses and interest

rate changes. (If you have never read our piece on Interest Rates and Small Banks, please email

editor@oddballnewsletter.com and we will send you a copy.)

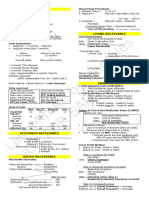

As your Oddball editors, we monitor a sample of 72 OTC-listed banks for the Oddball small bank

snapshot. On the next page, you will see a scatter plot with each bank's return on equity as the

independent variable (on the X-axis) and its price-to-tangible-book multiple as the dependent variable

on the Y-axis. Note that the return on equity is based on an average of 2018 and 2019 earnings, which

is helpful because it normalizes for the fluctuation in the 10 year bond yield over that period.

The banks are plotted as blue dots – except for famous bank activist Joe Stilwell's 13D positions, which

are plotted as orange dots. You can see that his sweet spot consists of the profitable banks with P/TBV

between 0.7 and 0.8. For an investor buying a diversified bucket of banks, the core of the “cheap”

bucket could be the green oval (discounts to TBV but still profitable) and the “quality” bucket could be

the brown circle (with ROEs near or above 10% but valuation not too far above book value).

Copyright Oddball Media, LLC 2020 ISSUE 31

THE ODDBALL STOCKS NEWSLETTER | 11

On the next page is the same plot, but with each bank's asset size represented as a bubble. There are

“cheap” banks with only $100 million of assets but also with over $1 billion of assets. The largest

bubble in the chart belongs to First National of Nebraska (ticker: FINN) which is a Catahoula bank that

has $22 billion in assets.

You can make out Bank of Utica (ticker: BKUTK) on there with $1.1 billion of assets, a price to

tangible book of 0.40, and a 6% ROE. The very top right corner (P/TBV of 2 and ROE of 21%)

belongs to CVB Financial Corp (ticker: CVBF) which owns Citizens Business Bank. The bottom right

corner (P/TBV of 0.34 and 23% ROE) belongs to Allied First Bancorp (ticker: AFBA) which Catahoula

mentioned in Issues 26 and 28.

Copyright Oddball Media, LLC 2020 ISSUE 31

THE ODDBALL STOCKS NEWSLETTER | 12

When we mentioned Joe Stilwell's picks for his activist fund, we meant the ones that he lists in his

Schedule 13D filings as having activist effort currently underway. 1 Included below is a table showing

those eight positions (which were orange dots in the first scatter plot). You can see that Mr. Stilwell

seems to have a “type”: very small (so his fund can take a meaningful voting position), discounted to

book, reasonably profitable, not majority controlled, and adequately (but not overly) capitalized.

1 If you have never read a Stilwell 13D, you owe it to yourself: https://www.sec.gov/cgi-bin/browse-edgar?

action=getcompany&CIK=0001113303&owner=include&count=40&hidefilings=0

Copyright Oddball Media, LLC 2020 ISSUE 31

THE ODDBALL STOCKS NEWSLETTER | 13

Market Cap Equity/ Assets P/TBV ROE Deposit Cost 2019 Majority Control? Public?

BRBW 22,492,368 15.6% 0.57 3.2% 1.19% no? no

CNNB 26,780,625 16.7% 0.71 4.0% 1.36% no yes

NECB 100,605,541 14.8% 0.71 9.2% 1.83% MHC no

UNIF 37,730,266 14.7% 0.73 10.4% 1.22% ? no

SCAY 19,221,880 7.5% 0.74 -0.3% 0.90% MHC yes

CIBH 23,000,000 4.1% 0.79 11.7% 1.44% no no

SFBC 62,660,121 10.6% 0.80 8.8% 1.24% no yes

WAYN 42,290,134 9.8% 0.87 12.6% 0.74% no no

th

• Brunswick Bancorp (BRBW) is in the 10 percentile of cheapness of our entire small bank

sample. The largest shareholders are the Gumina family of New Jersey. Bank investor Phil

Timyan has written about them and said, “expenses are way out of line with industry norms,”

“Roman Gumina owned at least 10 unrelated entities, and money is still flowing from the bank

to some of them,” “more than half the bank's branches are too small to be profitable, and should

be closed,” and “[non-performing assets] are 4x current industry average.”

• Cincinnati Bancorp (CNNB) is the holding company for Cincinnati Federal, it converted from

a mutual holding company in January 2020. Directors and officers own only 13.52% as of the

2020 proxy statement. Stilwell owns 6.9%.

• Northeast Community Bancorp, Inc. (NECB) was sued by a Stilwell fund, which alleged that

the directors had breached their fiduciary duties by not voting to authorize a second step

conversion of the MHC. In 2016, a New York appellate court reversed a lower court victory for

Stilwell, ruling that because Stilwell bought shares of common stock of the Company pursuant

to the prospectus issued in connection with its mutual holding company reorganization and

minority stock issuance, it could not now complain about the facts that the prospectus disclosed.

• U & I Financial Corp (UNIF) is the holding company of UniBank, a Washington state

chartered commercial bank incorporated on September 1, 2006, which conducts “general

business banking that includes deposits, lending, and investing, with its primary market

encompassing the Korean American community of King, Snohomish, and Pierce Counties. The

principal office and full service branch is located in Lynnwood, Washington, 98036. In addition,

the Bank has branches in Tacoma, Bellevue, and Federal Way, Washington.”

• Seneca Cayuga Bancorp Inc. (SCAY) is the holding company of Generations Bank, and they

announced in May that the company and the Bank expect to implement a second step

conversion. The Stilwell interests own 7.72%.

• CIB Marine Bancshares Inc. is frequently discussed in the Oddball Stocks Newsletter,

including later on in this Issue. The big issue with this one is the busted preferred stock.

• Sound Financial Bancorp, Inc. (SFBC) is publicly traded. Stilwell's funds own 8.4%, FJ

Capital Management in Virginia owns 7.8%, and officers and directors own 12.4%. With their

second quarter earnings release, they mentioned that they had funded $73 million of PPP loans.

• Wayne Savings Bancshares Inc. (WAYN) de-registered in 2017. Stilwell, which owns close to

10%, ran proxy contests in 2017 and 2018 but lost both. In the second contest his nominee got

43% of the vote, and he didn't challenge management after that. Shareholder letter:

https://www.sec.gov/Archives/edgar/data/1036030/000092189517001526/dfan1410318006_05

152017.htm

Copyright Oddball Media, LLC 2020 ISSUE 31

THE ODDBALL STOCKS NEWSLETTER | 14

Two Small Bank Ponds for Fishing

The scatterplot on page four had the green oval, with “cheap” banks, and the brown circle, with

“quality” at a reasonable price banks. We'll start with the “cheap” ones:

Assets Tangible Book Market Cap P/TBV ROE Equity/Assets

AFBA 109 14 5 0.34 22.7% 13%

BKUTK 1,100 232 93 0.40 5.9% 21%

SRNN 98 12 5 0.44 -3.5% 12%

CBBI 1,202 150 74 0.50 10.0% 12%

WCFB 140 28 15 0.54 1.8% 20%

RIVE 1,117 91 50 0.54 8.3% 8%

BRBW 255 40 22 0.57 3.2% 16%

CCSB 52 8 4 0.58 -7.5% 15%

SCBS 121 10 6 0.60 6.4% 8%

PPSF 114 15 10 0.69 4.6% 13%

TDCB 176 18 12 0.70 6.6% 10%

CNNB 228 38 27 0.71 4.0% 17%

VERF 56 12 9 0.71 2.9% 21%

NECB 955 141 101 0.71 9.2% 15%

FMIA 913 120 86 0.72 9.0% 13%

FMBL 7,950 1,074 771 0.72 6.7% 14%

UNIF 354 52 38 0.73 10.4% 15%

EXSR 2,600 281 206 0.73 13.2% 11%

SCAY 347 26 19 0.74 -0.3% 8%

MNBP 408 38 28 0.76 6.5% 9%

MNBO 250 30 23 0.77 8.0% 12%

SOME 1,399 121 93 0.77 12.9% 9%

BNCC 1,042 103 81 0.79 8.9% 10%

CIBH 704 29 23 0.79 11.7% 4%

WAYN 738 78 63 0.80 7.8% 11%

SFBC 738 78 63 0.80 8.8% 11%

Notice that almost all (except three) were profitable on average for 2018 and 2019. And many have

been mentioned in the Newsletter before. Our guest writer Catahoula has mentioned FMBL, AFBA,

and EXSR. And we have written about BKUTK, WCFB, CCSB, MNBO, and CIBH. (If you would like

us to track down the Issues where we talked about any Oddball, just email editor@oddballstocks.com.)

We mentioned WCFB in Issue 30: “normally when we see a profitable bank at half of book value, it

has a controlling shareholder. But the proxy statement discloses that there is an ESOP which owns 7%

and the directors and officers combined only own one percent. Meanwhile, there are two funds that

own: Firefly Value Partners in New York has 8.4% and Western Standard in Los Angeles owns 5.3%.”

Copyright Oddball Media, LLC 2020 ISSUE 31

THE ODDBALL STOCKS NEWSLETTER | 15

Here are the potential “quality” ones from the brown circle:

Assets Tangible Book Market Cap P/B ROE Equity Assets

SBNC 3,140 295 284 0.96 16.0% 9%

NASB 2,631 262 295 1.13 13.9% 10%

AMBK 642 61 71 1.16 12.3% 9%

HCBC 303 33 33 1.00 12.1% 11%

SQCF 457 50 51 1.03 12.1% 11%

PCLB 245 28 31 1.11 12.1% 11%

FBAK 3,859 576 599 1.04 11.6% 15%

JDVB 885 85 97 1.14 11.6% 10%

QNBC 1,232 125 105 0.84 11.5% 10%

FUNC 1,461 98 106 1.08 11.2% 7%

GNBF 389 42 34 0.82 11.1% 11%

ADKT 1,237 113 131 1.15 11.1% 9%

AMBZ 2,402 193 203 1.05 11.0% 8%

CNAF 417 61 51 0.84 10.8% 15%

VABK 703 75 68 0.90 10.6% 11%

CIWV 285 28 27 0.94 10.5% 10%

DIMC 733 87 89 1.02 10.5% 12%

KEFI 573 78 65 0.83 10.1% 14%

MBKL 394 41 43 1.05 9.9% 10%

HRRB 355 31 25 0.81 9.8% 9%

DBIN 2,700 320 370 1.16 9.7% 12%

CCFN 738 94 91 0.98 9.7% 13%

HARL 770 77 88 1.14 9.6% 10%

Some of these have been mentioned by guest writer “Catahoula” in previous Issues: SBNC, NASB,

AMBK, FBAK, ADKT, and KEFI. And we mentioned CNAF in Issue 29 and DBIN in a previous

Small Bank Snapshot. Here is what Catahoula said about Southern Bank (SBNC) back in Issue 20:

“Southern Bank owns shares in First Citizens Bank in Raleigh. For every share of SBNC, you

effectively own 2.52 and 0.28 shares of FCNCA and FCNCB, respectively, collectively worth

over $1,200 / share. Book value at SBNC has been going up because the recent change in

accounting requires SBNC to “mark to market” its position in First Citizen’s. (This cuts both

ways, of course, so if First Citizen’s falls, the book value of SBNC falls too). Since 12/31/17,

SBNC’s book value is up by about $10 million due to First Citizen’s share price increases. First

Citizens is now about one-third, or $100 million, of the approximately $300 million in equity...”

An example of small bank valuation contraction over the past two years: when we mentioned Dacotah

Banks (DBIN) in the 2018 Snapshot, it was trading at 129% of book with a 6.3% ROE based on 2017

earnings. The 2018 and 2019 average ROE was higher (9.7%) but the P/B is now lower (1.16x).

Copyright Oddball Media, LLC 2020 ISSUE 31

You might also like

- Capital Allocation: Principles, Strategies, and Processes for Creating Long-Term Shareholder ValueFrom EverandCapital Allocation: Principles, Strategies, and Processes for Creating Long-Term Shareholder ValueNo ratings yet

- Hanover Foods Corp 2021 Annual ReportDocument31 pagesHanover Foods Corp 2021 Annual ReportNate TobikNo ratings yet

- PdfsDocument9 pagesPdfsjoeNo ratings yet

- Secrets of SovereignDocument13 pagesSecrets of SovereignredcovetNo ratings yet

- ValueInvestorInsight Issue 284Document24 pagesValueInvestorInsight Issue 284kennethtsleeNo ratings yet

- Brandes on Value: The Independent InvestorFrom EverandBrandes on Value: The Independent InvestorRating: 5 out of 5 stars5/5 (2)

- AFBA - Proxy Statement For Merger - March 2022Document64 pagesAFBA - Proxy Statement For Merger - March 2022Nate TobikNo ratings yet

- OBN - AFBA - Issue 36 (August 2021)Document1 pageOBN - AFBA - Issue 36 (August 2021)Nate TobikNo ratings yet

- OBN - AFBA - Issue 36 (August 2021)Document1 pageOBN - AFBA - Issue 36 (August 2021)Nate TobikNo ratings yet

- Eric Speron Pages From Oddball - Newsletter - Issue - 36Document7 pagesEric Speron Pages From Oddball - Newsletter - Issue - 36Nate Tobik100% (1)

- Value Investor Insight Jan 31 2021Document20 pagesValue Investor Insight Jan 31 2021Gabriel AntonieNo ratings yet

- East Coast Asset ManagementDocument14 pagesEast Coast Asset Managementevolve_usNo ratings yet

- Eric Khrom of Khrom Capital 2013 Q1 LetterDocument4 pagesEric Khrom of Khrom Capital 2013 Q1 LetterallaboutvalueNo ratings yet

- Value Investor Insight Issue 239Document24 pagesValue Investor Insight Issue 239STNo ratings yet

- Value Investor Insight 2006-12Document20 pagesValue Investor Insight 2006-12Lucas Beaumont100% (1)

- Jim Chanos ImportantDocument40 pagesJim Chanos Importantkabhijit04No ratings yet

- Third Point Investor PresentationDocument29 pagesThird Point Investor PresentationValueWalkNo ratings yet

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketFrom EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNo ratings yet

- FHLB Proxy Statement 2021Document109 pagesFHLB Proxy Statement 2021Nate TobikNo ratings yet

- Ohio Art Reverse Split Notice of MeetingDocument2 pagesOhio Art Reverse Split Notice of MeetingNate Tobik100% (1)

- OBN - UNIF - Issue 33 (January 2021)Document1 pageOBN - UNIF - Issue 33 (January 2021)Nate TobikNo ratings yet

- Focus InvestorDocument5 pagesFocus Investora65b66inc7288No ratings yet

- 10 Years PAt Dorsy PDFDocument32 pages10 Years PAt Dorsy PDFGurjeevNo ratings yet

- Seth Klarman Letter 1999 PDFDocument32 pagesSeth Klarman Letter 1999 PDFBean LiiNo ratings yet

- Schloss-10 11 06Document3 pagesSchloss-10 11 06Logic Gate CapitalNo ratings yet

- Arlington Value's 2013 LetterDocument7 pagesArlington Value's 2013 LetterValueWalk100% (7)

- OBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Document2 pagesOBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Nate TobikNo ratings yet

- Catahoula ExcerptDocument6 pagesCatahoula ExcerptNate TobikNo ratings yet

- Value Investors Club - AMAZONDocument11 pagesValue Investors Club - AMAZONMichael Lee100% (1)

- Value Investor May 2011Document23 pagesValue Investor May 2011KC Loh Kwan ChuanNo ratings yet

- BloombergBrief HF Newsletter 201458Document12 pagesBloombergBrief HF Newsletter 201458Himanshu GoyalNo ratings yet

- Walter Schloss List of StocksDocument7 pagesWalter Schloss List of StocksDistressedDebtInvestNo ratings yet

- Li Lu's 2010 Lecture at Columbia My Previous Transcript View A More Recent LectureDocument14 pagesLi Lu's 2010 Lecture at Columbia My Previous Transcript View A More Recent Lecturepa_langstrom100% (1)

- OBN - BKUTK - Issue 32 (November 2020)Document1 pageOBN - BKUTK - Issue 32 (November 2020)Nate TobikNo ratings yet

- RV Capital June 2015 LetterDocument8 pagesRV Capital June 2015 LetterCanadianValueNo ratings yet

- Sellers 24102004Document6 pagesSellers 24102004moneyjungleNo ratings yet

- A Walk On The (Asian) Wild Side: James Chanos Kynikos AssociatesDocument24 pagesA Walk On The (Asian) Wild Side: James Chanos Kynikos AssociatessubflacherNo ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comNo ratings yet

- Graham Doddsville - Issue 30 - Spring 2017 - V3Document44 pagesGraham Doddsville - Issue 30 - Spring 2017 - V3marketfolly.com100% (2)

- Graham & Doddsville Issue: Fall 2019Document48 pagesGraham & Doddsville Issue: Fall 2019marketfolly.comNo ratings yet

- The Optimist - Bill Ackman - Portfolio - 05-2009Document10 pagesThe Optimist - Bill Ackman - Portfolio - 05-2009KuJungNo ratings yet

- John Deere Investment AnalysisDocument6 pagesJohn Deere Investment Analysisgl101No ratings yet

- Phil Carret - American MaizeDocument1 pagePhil Carret - American Maizebomby0No ratings yet

- Aquamarine Fund February 2012 LetterDocument7 pagesAquamarine Fund February 2012 LetterBrajesh MishraNo ratings yet

- Value Investing (Greenwald) SP2018Document5 pagesValue Investing (Greenwald) SP2018YOG RAJANINo ratings yet

- Moi201102 Super Investors PRINTDocument170 pagesMoi201102 Super Investors PRINTbrl_oakcliffNo ratings yet

- Aquamarine - 2013Document84 pagesAquamarine - 2013sb86No ratings yet

- Seth Klarman IIMagazine 2008Document2 pagesSeth Klarman IIMagazine 2008BolsheviceNo ratings yet

- DanLoeb BloombergDocument9 pagesDanLoeb BloombergbillcaneNo ratings yet

- Graham & Doddsville Winter Issue 2018Document33 pagesGraham & Doddsville Winter Issue 2018marketfolly.comNo ratings yet

- Seth Klarman's Baupost Fund Semi-Annual Report 19991Document24 pagesSeth Klarman's Baupost Fund Semi-Annual Report 19991nabsNo ratings yet

- ValueInvestorInsight-Issue 364 PDFDocument21 pagesValueInvestorInsight-Issue 364 PDFInnerScorecardNo ratings yet

- OBN 9 - Bank of Utica - Issue 22Document3 pagesOBN 9 - Bank of Utica - Issue 22Nate Tobik100% (2)

- Value Investor Insight - May 31, 2013Document10 pagesValue Investor Insight - May 31, 2013vishubabyNo ratings yet

- Bruce Greenwald Briefing BookDocument24 pagesBruce Greenwald Briefing BookguruekNo ratings yet

- Druckenmiller August 2010 Letter To InvestorsDocument1 pageDruckenmiller August 2010 Letter To InvestorsDealBook100% (1)

- Bill Ackman Ira Sohn Freddie Mac and Fannie Mae PresentationDocument111 pagesBill Ackman Ira Sohn Freddie Mac and Fannie Mae PresentationCanadianValueNo ratings yet

- 2016 04 29 - Mdca - FinalDocument40 pages2016 04 29 - Mdca - FinalgothamcityresearchNo ratings yet

- Graham & Doddsville - Issue 34 - v22Document33 pagesGraham & Doddsville - Issue 34 - v22marketfolly.com100% (1)

- Mohnish Pabrai Chicago Meeting 2009 NotesDocument3 pagesMohnish Pabrai Chicago Meeting 2009 NotesalexprywesNo ratings yet

- Jan Issue Vii TrialDocument21 pagesJan Issue Vii TrialDavid TawilNo ratings yet

- Krainosv 2Document20 pagesKrainosv 2Gabriel AntonieNo ratings yet

- Li Lu WSJ TranscriptDocument2 pagesLi Lu WSJ TranscriptJames HuaNo ratings yet

- 3 Steps to Investment Success: How to Obtain the Returns, While Controlling RiskFrom Everand3 Steps to Investment Success: How to Obtain the Returns, While Controlling RiskNo ratings yet

- AFBA - Merger Agreement and Fairness Opinion - March 2022Document114 pagesAFBA - Merger Agreement and Fairness Opinion - March 2022Nate Tobik100% (1)

- Hanover Fiscal Q2 2022Document7 pagesHanover Fiscal Q2 2022Nate TobikNo ratings yet

- LICOA Investment Schedule 12 31 2021Document32 pagesLICOA Investment Schedule 12 31 2021Nate TobikNo ratings yet

- Rockford Corporation - Notice of Special MeetingDocument28 pagesRockford Corporation - Notice of Special MeetingNate TobikNo ratings yet

- LICOA Annual Statement 12 31 2021Document61 pagesLICOA Annual Statement 12 31 2021Nate TobikNo ratings yet

- Berkshire's Performance vs. The S&P 500Document11 pagesBerkshire's Performance vs. The S&P 500Joseph AdinolfiNo ratings yet

- Bank of Utica (BKUTK) - Annual Report - FY 2021Document35 pagesBank of Utica (BKUTK) - Annual Report - FY 2021Nate TobikNo ratings yet

- Rofo 2018 ArDocument18 pagesRofo 2018 ArNate TobikNo ratings yet

- SHLTR 490641Document1 pageSHLTR 490641Nate TobikNo ratings yet

- Bank of Utica (BKUTK) - Shareholder Letter - 02 01 2022Document5 pagesBank of Utica (BKUTK) - Shareholder Letter - 02 01 2022Nate TobikNo ratings yet

- OBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Document2 pagesOBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Nate TobikNo ratings yet

- LICOA Quarterly Statement Q3 2021Document36 pagesLICOA Quarterly Statement Q3 2021Nate TobikNo ratings yet

- OBN - UNIF - Issue 33 (January 2021)Document1 pageOBN - UNIF - Issue 33 (January 2021)Nate TobikNo ratings yet

- 2020 Friendly Hills BankDocument34 pages2020 Friendly Hills BankNate TobikNo ratings yet

- 2019 Friendly Hills BankDocument36 pages2019 Friendly Hills BankNate TobikNo ratings yet

- OBN - BKUTK - Issue 32 (November 2020)Document1 pageOBN - BKUTK - Issue 32 (November 2020)Nate TobikNo ratings yet

- Catahoula ExcerptDocument6 pagesCatahoula ExcerptNate TobikNo ratings yet

- Friendly Hills BANK Story ...Document4 pagesFriendly Hills BANK Story ...Nate TobikNo ratings yet

- LICOA 2020 Annual ReportDocument8 pagesLICOA 2020 Annual ReportNate TobikNo ratings yet

- Bank of Utica 2020 Annual ReportDocument35 pagesBank of Utica 2020 Annual ReportNate TobikNo ratings yet

- Hanover Foods 3rd Fiscal QuarterDocument5 pagesHanover Foods 3rd Fiscal QuarterNate TobikNo ratings yet

- Licoa - Plaintiffs' Third Amended Consolidated ComplaintDocument55 pagesLicoa - Plaintiffs' Third Amended Consolidated ComplaintNate TobikNo ratings yet

- LICOA Third Complaint ExhibitsDocument359 pagesLICOA Third Complaint ExhibitsNate TobikNo ratings yet

- Function and Importance of Capital MarketDocument1 pageFunction and Importance of Capital MarketKhurram KhanNo ratings yet

- FIMM BookletDocument12 pagesFIMM BookletGoh Koon LoongNo ratings yet

- Corporate Finances Problems Solutions Ch.18Document9 pagesCorporate Finances Problems Solutions Ch.18Egzona FidaNo ratings yet

- Assessing HR Programmes:: UNIT-06 Creating HR ScorecardDocument9 pagesAssessing HR Programmes:: UNIT-06 Creating HR ScorecardAppu SpecialNo ratings yet

- FinanceDocument3 pagesFinanceAbrarNo ratings yet

- Letter of Intend JVDocument7 pagesLetter of Intend JVRedefine SpacesNo ratings yet

- Ccil Study MaterialDocument47 pagesCcil Study Materialtanvi kansaraNo ratings yet

- Cases: Case 1 Case 2 Case 3 Case 4 Case 16Document12 pagesCases: Case 1 Case 2 Case 3 Case 4 Case 16Shah-Baz HassanNo ratings yet

- ACTBFAR Work Text - Chapter 12 - 2T1920 - FormattedDocument18 pagesACTBFAR Work Text - Chapter 12 - 2T1920 - FormattednuggsNo ratings yet

- Project On Comparison Between Stock BrokersDocument15 pagesProject On Comparison Between Stock BrokersankitsawhneyNo ratings yet

- Investors' Chronicle 8 - 14 March 2024Document73 pagesInvestors' Chronicle 8 - 14 March 2024HARMAN KAUR BABBARNo ratings yet

- Copy KCP Prelim Exam 09122021Document11 pagesCopy KCP Prelim Exam 09122021Cezanne Pi-ay EckmanNo ratings yet

- Balancing Cash HoldingsDocument59 pagesBalancing Cash Holdingsabel becheni100% (4)

- Esmeralda Springs SurpriseDocument8 pagesEsmeralda Springs Surpriseflorinmen1No ratings yet

- 01 - Global Finantial MarketsDocument16 pages01 - Global Finantial MarketsManjuNo ratings yet

- Abdul Samad (01-112182-043)Document5 pagesAbdul Samad (01-112182-043)ABDUL SAMADNo ratings yet

- Foreign Investments Reviewer PDFDocument13 pagesForeign Investments Reviewer PDFJan Aldrin AfosNo ratings yet

- BITONG v. CADocument2 pagesBITONG v. CAVon Lee De Luna0% (2)

- A Study On Indian Stock Market: Nse and Bse"Document88 pagesA Study On Indian Stock Market: Nse and Bse"Ankita SolankiNo ratings yet

- M&ADocument166 pagesM&AVishakha PawarNo ratings yet

- NISM Series VB Mutual Fund Foundation Dec 2017 PDFDocument141 pagesNISM Series VB Mutual Fund Foundation Dec 2017 PDFPurvaNo ratings yet

- Financing of Textile Industry in PakistanDocument7 pagesFinancing of Textile Industry in PakistanAmna KhanNo ratings yet

- Order in The Matter of M/s Century Finvest Private Ltd.Document35 pagesOrder in The Matter of M/s Century Finvest Private Ltd.Shyam SunderNo ratings yet

- Economics: Regulatory Arbitrage Regulation Used To Exploit Differences in EconomicDocument28 pagesEconomics: Regulatory Arbitrage Regulation Used To Exploit Differences in EconomicAniket JainNo ratings yet

- Investment LawDocument11 pagesInvestment LawHarmanSinghNo ratings yet

- Financial Management: Question No. 1Document17 pagesFinancial Management: Question No. 1Usuf JabedNo ratings yet

- Lecture Notes Dealings in PropertyDocument9 pagesLecture Notes Dealings in PropertyweewoouwuNo ratings yet

- FAR Last Minute by HerculesDocument10 pagesFAR Last Minute by Herculesjanjan3256No ratings yet

- De000a0d6554 Ja 2018 Eq e 00 PDFDocument186 pagesDe000a0d6554 Ja 2018 Eq e 00 PDFcristian montanaresNo ratings yet

- Daiwa India - Auto Sector - InitiationDocument89 pagesDaiwa India - Auto Sector - InitiationHardiksureshshahNo ratings yet