Professional Documents

Culture Documents

INSTRUCTIONS: Answer ALL Questions Question One (20 Marks)

INSTRUCTIONS: Answer ALL Questions Question One (20 Marks)

Uploaded by

Frankincense WesleyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INSTRUCTIONS: Answer ALL Questions Question One (20 Marks)

INSTRUCTIONS: Answer ALL Questions Question One (20 Marks)

Uploaded by

Frankincense WesleyCopyright:

Available Formats

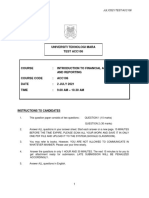

UNIVERSITY EXAMINATIONS: 2019/2020

EXAMINATION FOR THE BACHELOR OF SCIENCE DEGREES IN

INFORMATION TECHNOLOGY/ APPLIED COMPUTING

BIT 1309/ BAC 2206/ BISF 2206: FINANCIAL MANAGEMENT FOR IT

FULLTIME/ PART TIME/ DISTANCE LEARNING

ORDINARY EXAMINATIONS

DATE: AUGUST, 2020 TIME: 6 HOURS

INSTRUCTIONS: Answer ALL Questions

QUESTION ONE (20 MARKS)

The following trial balance has been extracted from the ledger of Mr. Peter, a sole trader.

Trial Balance as at 31 May 2020

Dr Cr

Kshs. Kshs.

Sales 138,078

Purchases 82,350

Carriage 5,144

Drawings 7,800

Rent, rates and insurance 6,622

Postage and stationery 3,001

Advertising 1,330

Salaries and wages 26,420

Bad debts 877

Allowance for doubtful debts 130

Accounts receivable 12,120

Accounts payable 6,471

Cash in hand 177

Cash at bank 1,002

Inventory as at 1 June 2019 11,927

Equipment at cost 58,000

Accumulated depreciation 19,000

Capital 53,091

216770 216,770

The following additional information as at 31 May 2020 is available:

(a) Rent is accrued by Kshs.210.

(b) Rates have been prepaid by Kshs.880.

(c) Kshs. 2,211 of carriage represents carriage inwards on purchases.

(d) Equipment is to be depreciated at 15% per annum using the straight line method.

(e) The allowance for doubtful debts to be increased by Kshs.40.

(f) Inventory at the close of business has been valued at Kshs.13,551.

Required:

Prepare: A statement of profit or loss for the year ending 31 May 2020 (12 Marks)

A statement of financial position as at that date. (8 Marks)

QUESTION TWO (20 MARKS)

Mary began professional practice as a system analyst on July 1. She plans to prepare a

monthly financial statement. During July, the owner completed these transactions.

July 1. Owner invested Kshs. 700,000 cash along with computer equipment that had a market

value of Kshs. 120,000.

July 2. Paid Kshs. 15,000 cash for the rent of office space for the month.

July 4. Purchased Kshs. 12,000 of additional equipment on credit from XYZ ltd.

July 8. Completed a work for a client and immediately collected Kshs. 32,000 cash.

July 10. Completed work for a client and sent a bill for Kshs. 27,000 to be paid within 30

days.

July 12. Purchased additional equipment for Kshs. 8,000 in cash.

July 15. Paid an assistant Kshs. 6,200 cash as wages for 15 days.

July 18. Collected Kshs. 15,000 on the amount owed by the client.

July 25. Paid Kshs. 12,000 cash to settle the liability on the equipment purchased.

July 28. Owner withdrew Kshs. 2,500 cash for personal use.

July 30. Completed work for another client who paid only Kshs. 40,000 for 50% of the

system design.

July 31. Paid salary of assistant Kshs. 11,000.

Required:

Prepare ledger accounts and trial balance for this business (20 Marks).

QUESTION THREE (10 MARKS)

Identify and explain 5 users of accounting information including their needs for such

information (10 Marks)

You might also like

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraNo ratings yet

- Final Accounts SumDocument2 pagesFinal Accounts SumRohit Aswani25% (4)

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- Paper 1 Financial AccountingDocument10 pagesPaper 1 Financial AccountingTuryamureeba JuliusNo ratings yet

- Final Exam QuestionDocument4 pagesFinal Exam QuestionHồng XuânNo ratings yet

- Problem and Chart of AccountsDocument2 pagesProblem and Chart of AccountsRey Joyce AbuelNo ratings yet

- FS Withadj QuesDocument7 pagesFS Withadj QuesHimank SaklechaNo ratings yet

- Review Questions Ias 1 & Ias 7Document7 pagesReview Questions Ias 1 & Ias 7hajiraj504No ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- Final Accounts Problem No.01Document1 pageFinal Accounts Problem No.01Rajendra KasettyNo ratings yet

- Final Account ProblemDocument22 pagesFinal Account ProblemAbhijeet Anand100% (1)

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- BK Holiday Package Form 4Document4 pagesBK Holiday Package Form 4TabithaNo ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- Test 1 (QP)Document2 pagesTest 1 (QP)Bushra AsgharNo ratings yet

- Igcse - Final AccountsDocument4 pagesIgcse - Final AccountsMUSTHARI KHANNo ratings yet

- Partnership 1Document7 pagesPartnership 1asamoahfredrica5No ratings yet

- 1819 IB124 Summer Exam PaperDocument6 pages1819 IB124 Summer Exam PaperHarry TaylorNo ratings yet

- BUS10250 Financial Accounting Semester B 2019/2020 Written Assignment 1Document2 pagesBUS10250 Financial Accounting Semester B 2019/2020 Written Assignment 1Y KNo ratings yet

- SPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesDocument8 pagesSPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesOladapo Oluwakayode AbiodunNo ratings yet

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet

- SA1 - Grade AS CAIE Accounting Paper 2Document7 pagesSA1 - Grade AS CAIE Accounting Paper 221ke23b15089No ratings yet

- Lecture 6 - Practice Questions-1Document4 pagesLecture 6 - Practice Questions-1donkhalif13No ratings yet

- Easy Round: Suggested Answer: ADocument35 pagesEasy Round: Suggested Answer: ALovely Dela Cruz GanoanNo ratings yet

- A222 SELF STUDY TOPIC 2 - QueDocument2 pagesA222 SELF STUDY TOPIC 2 - QueAdelene NengNo ratings yet

- (Module 3) ProblemsDocument17 pages(Module 3) ProblemsArriane Dela CruzNo ratings yet

- ACC101 - Accounting CycleDocument3 pagesACC101 - Accounting CycleJade PielNo ratings yet

- Ingenuity International School and College Baridhara, Gulshan, Dhaka. MCT-4 Sub: Accounting Class-Std - VIIIDocument2 pagesIngenuity International School and College Baridhara, Gulshan, Dhaka. MCT-4 Sub: Accounting Class-Std - VIIINayna Sharmin100% (1)

- Final BASIC AcctgDocument3 pagesFinal BASIC AcctgFiona Concepcion100% (1)

- Accounts Test (Class Xi) (Set - 1) : Particular Rs. RsDocument2 pagesAccounts Test (Class Xi) (Set - 1) : Particular Rs. RsDiya KumariNo ratings yet

- Model-Financial Accounting - Set1 - CZ21ADocument4 pagesModel-Financial Accounting - Set1 - CZ21AJuli SunNo ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- Additional Class Tutorial Basic Sopl SofpDocument2 pagesAdditional Class Tutorial Basic Sopl Sofpazra balqisNo ratings yet

- Psaf Revision Day 3 May 2023Document8 pagesPsaf Revision Day 3 May 2023Esther AkpanNo ratings yet

- Last Term RevisionDocument2 pagesLast Term RevisionNgoc Huỳnh HyNo ratings yet

- FAR Adjusting Entries ExcerciseDocument3 pagesFAR Adjusting Entries ExcerciseSheena LeysonNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Company Financial StatementsDocument6 pagesCompany Financial StatementsHasnain MahmoodNo ratings yet

- LQ - Cash and ReceivablesDocument1 pageLQ - Cash and ReceivablesWawex DavisNo ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- 05 Completing The Accounting Cycle PROBLEMSDocument5 pages05 Completing The Accounting Cycle PROBLEMSbetlogNo ratings yet

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- Tutorial Chapter 5Document8 pagesTutorial Chapter 5Aisyah SafiNo ratings yet

- How Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Document8 pagesHow Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Raenessa FranciscoNo ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- ACCT 110 Foundations of Accounting I - Kabarak UniversityDocument8 pagesACCT 110 Foundations of Accounting I - Kabarak UniversityewayuaNo ratings yet

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- 01.correction of Errors - 245038322 PDFDocument4 pages01.correction of Errors - 245038322 PDFMaan CabolesNo ratings yet

- MHM 507 Midterm Exam OCTOBER 16, 2021: Answer The FollowingDocument3 pagesMHM 507 Midterm Exam OCTOBER 16, 2021: Answer The FollowingRenj CruzNo ratings yet

- Studi Kelayakan Bisnis TugasDocument2 pagesStudi Kelayakan Bisnis TugasLena Rahma MustikaNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- QuestionsDocument8 pagesQuestionsHislord BrakohNo ratings yet

- Frankwood 361-361Document1 pageFrankwood 361-361saiimbutt525No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Engineering Economics: Rizal Technological UniversityDocument6 pagesEngineering Economics: Rizal Technological UniversityJoshuaNo ratings yet

- An Electric Components ManufacturerDocument3 pagesAn Electric Components Manufactureraudrey gadayNo ratings yet

- ch08 SolDocument18 pagesch08 SolJohn Nigz Payee50% (2)

- Test Bank For Corporate Finance Core Principles and Applications 5th Edition by RossDocument24 pagesTest Bank For Corporate Finance Core Principles and Applications 5th Edition by RossDebraWrighterbis100% (49)

- Financial Ratio AnalysisDocument19 pagesFinancial Ratio Analysisssophal100% (2)

- Financial Statements Balance Sheets Cash Flow StatementsDocument7 pagesFinancial Statements Balance Sheets Cash Flow StatementsMahima BharathiNo ratings yet

- Depreciation MethodsDocument13 pagesDepreciation MethodsOl Qab KeNo ratings yet

- Welcome: Selestian AugustinoDocument24 pagesWelcome: Selestian AugustinoDane Chybo TzNo ratings yet

- Def 3Document48 pagesDef 3Alberto Miguel YuNo ratings yet

- 20 QuestionsDocument6 pages20 QuestionsELLENNo ratings yet

- Chapter 8 Stock ValuationDocument35 pagesChapter 8 Stock ValuationHamza KhalidNo ratings yet

- TRDocument15 pagesTRBhaskar BhaskiNo ratings yet

- Industry Profile of MilmaDocument23 pagesIndustry Profile of MilmaDavid Le71% (14)

- Advanced Accounting Part II Quiz 13 Intercompany Profits Long QuizDocument14 pagesAdvanced Accounting Part II Quiz 13 Intercompany Profits Long QuizRarajNo ratings yet

- Finman FinalsDocument4 pagesFinman FinalsDianarose RioNo ratings yet

- Accounting Cycle 6Document49 pagesAccounting Cycle 6buuh abdi100% (1)

- Incremental QuestionsDocument5 pagesIncremental QuestionsANo ratings yet

- Quiz 5 InventoryDocument4 pagesQuiz 5 InventoryCindy CrausNo ratings yet

- Finance Interview QuestionsDocument75 pagesFinance Interview QuestionsJITHIN PADINCHARE RAMATH KANDIYILNo ratings yet

- Solutions Exercises Financial AccountingDocument11 pagesSolutions Exercises Financial Accountingddd huangNo ratings yet

- Short Term Decision Making: Vincent Joseph D. Disu, CPPS, MbaDocument22 pagesShort Term Decision Making: Vincent Joseph D. Disu, CPPS, MbaMaria Maganda MalditaNo ratings yet

- ITC Financial Result Q4 FY2023 SfsDocument6 pagesITC Financial Result Q4 FY2023 Sfsaanchal prasadNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Market Problems and FormulasDocument3 pagesFinancial Market Problems and FormulasNufayl KatoNo ratings yet

- Consolidated Statement of Stockholders'EquityDocument1 pageConsolidated Statement of Stockholders'EquityMs. AngNo ratings yet

- Economic Order Quantity - Examples - Formula - QuestionsDocument29 pagesEconomic Order Quantity - Examples - Formula - Questionssalahadin assefaNo ratings yet

- TCS Financial ModelDocument47 pagesTCS Financial ModelAnshul NemaNo ratings yet

- EDUSE161121-Practical Accounting in The GST REgime For Acctg Staff-AnisDocument4 pagesEDUSE161121-Practical Accounting in The GST REgime For Acctg Staff-AnisMahwiah JupriNo ratings yet

- ENMG602 Week6 HW3Document4 pagesENMG602 Week6 HW3Issam TamerNo ratings yet

- Average Method and Fifo Method Copr TemplateDocument2 pagesAverage Method and Fifo Method Copr TemplateRosete San Agustin GalvezNo ratings yet