Professional Documents

Culture Documents

Capital Budgeting Questions - UE - FM

Capital Budgeting Questions - UE - FM

Uploaded by

Vimoli Mehta0 ratings0% found this document useful (0 votes)

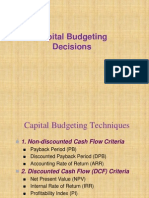

82 views3 pagesThis document contains 10 questions related to capital budgeting techniques including payback period, discounted payback period, net present value, internal rate of return, and profitability index. The questions provide cash flow information for various investment projects and ask the reader to calculate key metrics to evaluate the projects. Sample calculations are included to illustrate how to apply the techniques to make capital investment decisions.

Original Description:

Original Title

Capital Budgeting Questions_UE_FM

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains 10 questions related to capital budgeting techniques including payback period, discounted payback period, net present value, internal rate of return, and profitability index. The questions provide cash flow information for various investment projects and ask the reader to calculate key metrics to evaluate the projects. Sample calculations are included to illustrate how to apply the techniques to make capital investment decisions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

82 views3 pagesCapital Budgeting Questions - UE - FM

Capital Budgeting Questions - UE - FM

Uploaded by

Vimoli MehtaThis document contains 10 questions related to capital budgeting techniques including payback period, discounted payback period, net present value, internal rate of return, and profitability index. The questions provide cash flow information for various investment projects and ask the reader to calculate key metrics to evaluate the projects. Sample calculations are included to illustrate how to apply the techniques to make capital investment decisions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Capital Budgeting Numerical

Pay Back Period and Discounted Pay Back Period:

Q .1: Shivangi Crafts Ltd. is planning major investment to expand its current manufacturing

of cotton yarn with initial cash outlays of Rs. 330 lakhs. The finance department has

projected a following cash flows over the next 7 years considered to be life of the project.

Year 0 1 2 3 4 5 6 7

Cash Flow -330 90 120 380 420 310 240 60

(Rs. Lakh)

a) What is the payback period of the project?

b) What is the discounted payback period assuming that discount rate is 15%?

Q.2 (Practice):

A company is considering a new project for which Rs. 10,00,000 requires for an investment.

The forecasted cash flows for 5 years are mentioned below:

Year 1 2 3 4 5

Cash Flow 150 200 350 450 220

(Rs. in

000)

a) Calculated the payback period of the project?

b) Also calculate the discounted payback period if the discount rate is 10%.

Discounted PBP, PI and NPV of Single Project

Que 3: A firm considering a project which requires an initial investment of Rs. 10,00,000.

The expected cash inflows are given below:

Year 1 2 3 4 5 6

Cash Flow 1,50,000 2,00,000 3,00,000 4,50,000 5,00,000 4,00,000

(Rs.)

Calculated the discounted payback period, Net present value and Profitability Index.

Consider 12% discount factor.

Que 4 (Practice): After conducting a survey, X ltd decided to undertake a project for placing

a new product on the market. It was estimated that the project would cost of Rs. 20,00,000.

The company cut off rate is 14%.

The expected cash inflows are given below:

Year 1 2 3 4 5 6 7

Cash Flow 3,00,000 4,20,000 5,00,000 7,50,000 8,00,000 6,00,000 2,50,000

(Rs.)

Ascertain the discounted payback period, Net present value and Profitability Index.

Pay Back, Discounted Payback, NPV, PI and IRR:

Q. 5: Zebra Rolling Ltd. is considering a two mutually exclusive projects to produce iron

ingot with in initial investment of Rs. 15 crores. Opportunity cost of capital is 14%. The cash

flow (Rs. In crore) expected from the two projects is as follows:

Year 1 2 3 4 5 6 7

Project A 4 4 3 4 5 4 2

Cash flows (Cr. in Rs)

Project B 3 4 4 5 6 3 2

Cash flows (Cr. in Rs)

You are required to calculated the following:

a. Pay back period of each project.

b. Discounted pay back of each project.

c. Net Present Value of each project

d. Profitability Index of each project.

e. IRR of each project.

Que 6 (Practice):

A firm has two investment opportunities, each costing Rs. 30,00,000 and each having

estimated cash inflows as shown below:

Year Cash Inflows (in Rs.)

Project X Project Y

1 500000 500000

2 700000 650000

3 850000 850000

4 940000 1000000

5 1050000 1100000

6 900000 700000

Both the projects are mutually exclusive.

After giving due consideration to the risk criteria in each project, the management has

decided to evaluate the both the project at a 11% cost of capital.

Ascertain the following:

a. What is the Pay back period of each project?

b. Calculate the discounted pay back of each project.

c. Compare the Net Present Value of each project

d. Profitability Index of each project.

e. IRR of each project.

IRR (One Project)

Que 7:

A company has an investment opportunity costing of Rs. 4,00,000 with the following

expected net cash inflows:

Year 1 2 3 4 5 6 7 8 9 10

CIFs 70,000 70,000 70,000 70,000 70,000 80,000 1,00,000 1,50,000 1,00,000 40,0000

(Rs.)

Determine the IRR, if discount rate is 10%

Que 8 (Practice):

A company is considering an investment proposal of 10,00,000 to install new milling

controls. The estimated cash flows from the proposed investment proposal is as follows:

Year 1 2 3 4 5 6 7

1,50,000 2,50,000 3,20,000 3,00,000 2,80,000 2,20,000 1,40,000

CIFs

(Rs.)

Calculate IRR, when the cost of capital is 11%.

NPV and Profitability Index

Que 9: The initial cash outlay of a project is Rs. 5,00,000 and it generates cash inflows of Rs.

1,00,000; Rs. 2,00,000; Rs. 3,00,000 and Rs 1,00,000. Assume 10% discount rate of discount.

Find Net present value and Profitability Index.

Que 10 (Practice): Following details of a project are given by a firm:

Initial Investment: Rs. 15,00,000

Year 1 2 3 4 5 6 7

1,70,000 2,90,000 3,70,000 4,40,000 5,00,000 3,80,000 2,40,000

CIFs

(Rs.)

The cost of capital or discount rate is 11%. Find out the NPV and profitability Index and

suggest whether the project should be accepted or rejected.

You might also like

- Franklin Lumber Capital Budgeting Procedures - Group 3Document28 pagesFranklin Lumber Capital Budgeting Procedures - Group 3Febriyani TampubolonNo ratings yet

- New Heritage Doll Company Capital BudgetDocument27 pagesNew Heritage Doll Company Capital BudgetCarlos100% (1)

- Capital Budgeting: Payback PeriodDocument4 pagesCapital Budgeting: Payback PeriodPooja SunkiNo ratings yet

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- 4.unit-4 Capital BudgetingDocument51 pages4.unit-4 Capital BudgetingGaganGabriel100% (1)

- CF - PWS - 5Document3 pagesCF - PWS - 5cyclo tronNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda50% (2)

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- UNIT-II-Problems On Capital BudgetingDocument2 pagesUNIT-II-Problems On Capital BudgetingGlyding FlyerNo ratings yet

- Ques On Capital BudgetingDocument5 pagesQues On Capital BudgetingMonika KauraNo ratings yet

- QuesDocument5 pagesQuesMonika KauraNo ratings yet

- Assignment Problems On Cap BudDocument3 pagesAssignment Problems On Cap BudSunil TripathiNo ratings yet

- HCPM Tutorial 6 Project Finance and AppraisalDocument3 pagesHCPM Tutorial 6 Project Finance and AppraisalAjay MeenaNo ratings yet

- Sample Problems-Capital Budgeting-Part 1: Expected Net Cash Flows Year Project L Project SDocument7 pagesSample Problems-Capital Budgeting-Part 1: Expected Net Cash Flows Year Project L Project SYasir ShaikhNo ratings yet

- Docslide - Us Assignment 2 55844503ab61cDocument4 pagesDocslide - Us Assignment 2 55844503ab61cAhmedNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- ACF ProblemsDocument11 pagesACF Problemsnithinnick66No ratings yet

- VND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Document4 pagesVND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Rohit Singh RajputNo ratings yet

- Project Financial Appraisal - NumericalsDocument5 pagesProject Financial Appraisal - NumericalsAbhishek KarekarNo ratings yet

- Problems of Capital BudgetingDocument4 pagesProblems of Capital Budgetingm agarwalNo ratings yet

- Module 3 - Capital Budgeting - 3A - Questions 2022-23Document10 pagesModule 3 - Capital Budgeting - 3A - Questions 2022-23Manya GargNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- 06 Investment DecisionsDocument23 pages06 Investment Decisionsnsm2zmvnbbNo ratings yet

- Discounted Cash Flow - 082755Document3 pagesDiscounted Cash Flow - 082755EuniceNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Tutorial Week 11 QuestionsDocument2 pagesTutorial Week 11 QuestionsLogan zhengNo ratings yet

- Capital Budgeting Illustrative NumericalsDocument6 pagesCapital Budgeting Illustrative NumericalsPriyanka Dargad100% (1)

- Capital Budgeting Problems 1Document5 pagesCapital Budgeting Problems 1Juber AhamadNo ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Assignment - 1 (Capital Budgeting)Document3 pagesAssignment - 1 (Capital Budgeting)AnusreeNo ratings yet

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentRITU NANDAL 144No ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Practice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Document3 pagesPractice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Sumit Kumar SahooNo ratings yet

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- Question Paper Code:: Reg. No.Document26 pagesQuestion Paper Code:: Reg. No.Khanal NilambarNo ratings yet

- Business Finance II: Exercise 1Document7 pagesBusiness Finance II: Exercise 1faisalNo ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- Practice CorpDocument2 pagesPractice CorpShafiquer RahmanNo ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- Project Appraisal FinanceDocument20 pagesProject Appraisal Financecpsandeepgowda6828No ratings yet

- FM Practical QuestionsDocument6 pagesFM Practical QuestionsLakshayNo ratings yet

- Questions - Investment AppraisalDocument2 pagesQuestions - Investment Appraisalpercy mapetere100% (1)

- NPV PDFDocument2 pagesNPV PDFMOHD AnasNo ratings yet

- Use of Statistical Tables PermittedDocument2 pagesUse of Statistical Tables PermittedPAVAN KUMARNo ratings yet

- Capital Investment Appraisal MethodsDocument13 pagesCapital Investment Appraisal MethodsBwami Vieira PatrickNo ratings yet

- Financial Management (MBOF 912 D) 1Document5 pagesFinancial Management (MBOF 912 D) 1Siva KumarNo ratings yet

- Project Appraisal 1Document23 pagesProject Appraisal 1Fareha RiazNo ratings yet

- Project Appraisal-1 PDFDocument23 pagesProject Appraisal-1 PDFFareha RiazNo ratings yet

- Sem4 qp2Document2 pagesSem4 qp2iyerchandraNo ratings yet

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004No ratings yet

- Capital Budgeting ProblemsDocument2 pagesCapital Budgeting Problemsvijayadarshini vNo ratings yet

- Innovative Infrastructure Financing through Value Capture in IndonesiaFrom EverandInnovative Infrastructure Financing through Value Capture in IndonesiaRating: 5 out of 5 stars5/5 (1)

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Virtual MemoryDocument57 pagesVirtual MemoryVimoli MehtaNo ratings yet

- Ch-1: Financial Management UEIM007: Prepared by Dr. Vishal Goel 9924046460Document48 pagesCh-1: Financial Management UEIM007: Prepared by Dr. Vishal Goel 9924046460Vimoli MehtaNo ratings yet

- Instructions and AddressingDocument52 pagesInstructions and AddressingVimoli MehtaNo ratings yet

- Multipliers and DividersDocument25 pagesMultipliers and DividersVimoli MehtaNo ratings yet

- Memory: Prof. Dhaval ShahDocument45 pagesMemory: Prof. Dhaval ShahVimoli MehtaNo ratings yet

- MIPS SC ExtendedDocument39 pagesMIPS SC ExtendedVimoli MehtaNo ratings yet

- MIPS MC ExtendedDocument20 pagesMIPS MC ExtendedVimoli MehtaNo ratings yet

- Early Prediction of Employee Attrition Using Data Mining TechniquesDocument6 pagesEarly Prediction of Employee Attrition Using Data Mining TechniquesVimoli MehtaNo ratings yet

- Predicting Employee Attrition Along With Identifying High Risk Employees Using Big Data and Machine LearningDocument8 pagesPredicting Employee Attrition Along With Identifying High Risk Employees Using Big Data and Machine LearningVimoli MehtaNo ratings yet

- Employee Attrition Using Machine Learning and Depression AnalysisDocument6 pagesEmployee Attrition Using Machine Learning and Depression AnalysisVimoli MehtaNo ratings yet

- DSP Quiz-3 SolutionDocument3 pagesDSP Quiz-3 SolutionVimoli MehtaNo ratings yet

- DSP Quiz-4 SolutionDocument2 pagesDSP Quiz-4 SolutionVimoli MehtaNo ratings yet

- Optical ComponentsDocument81 pagesOptical ComponentsVimoli MehtaNo ratings yet

- 2EC502 DSP Quiz 2 SolutionDocument2 pages2EC502 DSP Quiz 2 SolutionVimoli MehtaNo ratings yet

- Traffic GroomingDocument26 pagesTraffic GroomingVimoli MehtaNo ratings yet

- Routing and Wavelength Assignment Algorithms: Dr. D. K. KothariDocument17 pagesRouting and Wavelength Assignment Algorithms: Dr. D. K. KothariVimoli MehtaNo ratings yet

- 1.1 LECTURE Intoduction To ES 702Document17 pages1.1 LECTURE Intoduction To ES 702Vimoli MehtaNo ratings yet

- Optical AmplifiersDocument21 pagesOptical AmplifiersVimoli MehtaNo ratings yet

- Optical Switching EditedDocument82 pagesOptical Switching EditedVimoli MehtaNo ratings yet

- Optical Access NetworkDocument86 pagesOptical Access NetworkVimoli MehtaNo ratings yet

- 1.2 LECTURE Intoduction To ES (ES Component) EC702 ESDocument40 pages1.2 LECTURE Intoduction To ES (ES Component) EC702 ESVimoli MehtaNo ratings yet

- Fundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DDocument56 pagesFundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DNguyen Thi Mai Lan100% (1)

- Net Present Value Research PaperDocument6 pagesNet Present Value Research Paperefdrkqkq100% (1)

- Chapter 9Document35 pagesChapter 9MorerpNo ratings yet

- Chapter 14Document43 pagesChapter 14Maryane AngelaNo ratings yet

- Chapter 11 Financial Preparation For Entrepreneurial VenturesDocument27 pagesChapter 11 Financial Preparation For Entrepreneurial VenturesBlue StoneNo ratings yet

- BRM ProjectDocument23 pagesBRM ProjectimaalNo ratings yet

- SyllabusDocument4 pagesSyllabusKamlesh PatelNo ratings yet

- 2015 BCom Hons 2015 SemSysSyllabus 030615Document38 pages2015 BCom Hons 2015 SemSysSyllabus 030615kalpesh deora100% (2)

- Financial Management Ashish Kumar Sana Full ChapterDocument67 pagesFinancial Management Ashish Kumar Sana Full Chaptercarrie.owen807100% (18)

- ACC501 Solved Current Papers McqsDocument36 pagesACC501 Solved Current Papers Mcqssania.mahar100% (2)

- Basic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingDocument107 pagesBasic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingKang JoonNo ratings yet

- Full Download Book Fundamentals of Corporate Finance 5Th Global Edition PDFDocument41 pagesFull Download Book Fundamentals of Corporate Finance 5Th Global Edition PDFshirley.sur179100% (33)

- CapbudprobsolDocument8 pagesCapbudprobsolAlicia May Castro LapuzNo ratings yet

- FIN 5001 - Course OutlineDocument6 pagesFIN 5001 - Course OutlineJoe Thampi KuruppumadhomNo ratings yet

- Capital BudgetingDocument26 pagesCapital Budgetingkkv_phani_varma5396No ratings yet

- Manacc Online QuizDocument3 pagesManacc Online QuizJoshuaTagayunaNo ratings yet

- Book 1Document10 pagesBook 1AbRam KNo ratings yet

- NVP, Arr, MNPVDocument64 pagesNVP, Arr, MNPVSaad Bin AslamNo ratings yet

- Managerial Accounting Jiambalvo 5th Edition Solutions ManualDocument23 pagesManagerial Accounting Jiambalvo 5th Edition Solutions ManualTammyTylercwjd100% (49)

- Stat 2032Document8 pagesStat 2032Karthik GurusamyNo ratings yet

- 6Document459 pages6sunildubey02100% (1)

- Mba 711 Financial ManagementDocument5 pagesMba 711 Financial ManagementAli MohammedNo ratings yet

- CH.1 Managerial Economics For NMDocument10 pagesCH.1 Managerial Economics For NMDannyelle SorredaNo ratings yet

- Ma2 Project Screening Projec Ranking and Capital RationingDocument11 pagesMa2 Project Screening Projec Ranking and Capital RationingMangoStarr Aibelle Vegas100% (1)

- Module 6 AND 7 AnswerDocument30 pagesModule 6 AND 7 AnswerSophia DayaoNo ratings yet

- ACCT 2200 - Chapter 11 P2 - With SolutionsDocument26 pagesACCT 2200 - Chapter 11 P2 - With Solutionsafsdasdf3qf4341f4asDNo ratings yet

- MCQ - 2022Document58 pagesMCQ - 2022Master Mind100% (1)

- Study On Financial ManagementDocument12 pagesStudy On Financial ManagementOyewande ToyinNo ratings yet