Professional Documents

Culture Documents

AC78 Module 3 Investments in Debt Securities and Other Noncurrent Financial Assets

AC78 Module 3 Investments in Debt Securities and Other Noncurrent Financial Assets

Uploaded by

merryOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AC78 Module 3 Investments in Debt Securities and Other Noncurrent Financial Assets

AC78 Module 3 Investments in Debt Securities and Other Noncurrent Financial Assets

Uploaded by

merryCopyright:

Available Formats

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

LESSON 3

MODULE NO. 3: INVESTMENTS IN DEBT SECURITIES

AND OTHER NONCURRENT FINANCIAL ASSETS

1. Nature and Characteristics of Investments

2. Nature, Characteristics and Accounting Procedures for Investment

in Debt Securities/Bonds

3. Reclassification of Debt Instruments

4. Funds for Future Use such as Bond Sinking Fund, Cash Surrender

Value and Long-term Advances and Deposits

Overview

This module is prepared for the students to understand the nature of

investments in debt securities and other financial noncurrent assets.

This module introduces the nature of investments in general, discusses

investment in debt securities, its characteristics, types and classification,

initial recognition and measurement, subsequent measurement and

reclassification, derecognition and presentation in the financial statements.

This module also discusses the nature of other financial non-current

assets that must be recognized and presented in the financial statements.

This module will cover a brief discussion of the theory and standard

behind the topic, exercises and practice problem the cover the said topic.

INTERMEDIATE ACCOUNTING PART 1 1

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Study Guide

This module is designed for the students to understand provisions,

contingencies and other liabilities. This module includes:

1. Topic Discussions - to be read by the students to fully understand the

topic.

2. Assessment – to be accomplished by the students after the

discussion to test their skills and understanding to the subject matter.

3. Assignment – activity to be done by students to be submitted to the

instructor. This is to reinforce or advance the student’s learning. It is

relevant to the past, current, and future lessons.

To complete the requirements of this module, the students are required to:

1. Read and understand the topic discussion and the guided exercises

2. Accomplish the assessment.

3. Accomplish the assignment due on next meeting.

Learning Outcomes

At the end of the discussion, the students are expected to:

1. Identify and describe different types of debt securities, its classification

as a financial asset, its initial recognition and measurement,

subsequent measurement and reclassification, derecognition and

presentation in the financial statements.

2. Explain the nature and formulate entries on long-term funds, cash

surrender value and long-term advances and deposits.

INTERMEDIATE ACCOUNTING PART 1 2

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Topic Presentation

INTRODUCTION TO INVESTMENTS AND INVESTMENTS IN DEBT SECURITIES

Investments are assets held by an entity for the accretion of wealth, through

distribution such as interest, royalties, dividends and rentals, for capital

appreciation or for other benefits to the investing entity such as those obtained

through trading relationships.

Examples of investments include:

1. Investment in debt securities

2. Investment in equity securities

3. Funds for long-term use such as sinking funds, funds for future use, cash

surrender value of life insurance policies, etc.

Debt securities

A debt security pertains to a financial debt instrument which can be bought or sold

between two parties has basic terms defined, such as amount borrowed, interest

rate, maturity and renewal date.

Bonds

A bond is a formal unconditional promise, made under seal, to pay a specified sum of

money at a determinable future date and to make periodic interest payment at a

stated rate until the principal sum is paid.

Parties involved in the bond agreement:

1. Bond issuer (borrower)

2. Bondholder (investor/lender)

3. Underwriter/arranger (one who serves as a middleman for a fee from the borrower)

Bond Certificate

This is a certificate of indebtedness issued by the bond issuer which entitles the

bondholder to receive principal and interest payments. This serves as a proof of

ownership over the bonds by the investor.

Bond Indenture (deed of trust, bond resolution or bond contract)

This is the unconditional contract between the bond issuer and the bondholder that

specifies the terms of the bond. Terms may include the

a. interest date,

b. date when the interest will be paid,

c. maturity date/s and the provision for repayment,

d. establishment of funds to cover periodic payments of interest and principal

e. Provisions regarding security or collateral for bonds issued

f. Other terms and conditions of the bond issue that may be required by the

parties involved such as financial ratios and working capital requirements

INTERMEDIATE ACCOUNTING PART 1 3

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Types of Bonds

TYPE DESCRIPTION

With reference to maturity

Term bonds Bonds which mature on a single date

Serial bonds Bonds with a series of maturity date

With reference to attached security

Mortgage bonds Bonds secured by a mortgage on real properties

Collateral trust bonds Bonds secured by stocks and bonds of another

corporation

Guaranteed bonds Bonds guaranteed by another party’s promise to

pay in case the bond issuer fails to make

payments

Debenture bonds Bonds without any security or collateral

With reference to registration in the books of the bond issuer

Registered bonds Bonds in which the names of the bondholder are

registered in the books of the bond issuer

Coupon or bearer bonds Bonds in which the holder of the bond certificate

is the acknowledged bondholder. The bond

issuer does not maintain any record to monitor

persons who own the bonds.

Other types of bonds

Convertible bonds Bonds that entitle bondholder to convert the

bonds into shares of the issuing entity

Callable bonds Bonds which may be redeemed prior to maturity

Junk bonds High-risk, high-yield bonds issued by entities

that are heavily indebted

Zero-interest bonds Bonds whose principal and interest payments

are made at the end of the term of the bonds

Classification of Investment in Debt Securities

1. Financial asset at fair value through Profit or Loss (FVPL)

2. Financial assets at amortized cost (FAAC)

3. Financial asset at fair value through Other Comprehensive Income (FVOCI)

Initial Recognition

Under PFRS 9, financial assets are recognized when, and only when the entity

becomes party to the contractual provisions of the instrument.

Measurement

Under PFRS 9, financial assets, except for FVPL, are measured at fair value plus

transaction costs. The fair value of financial assets is determined using the following

order of priority:

1. Quotation price in an active market

2. Present value of the related cash flows (principal and interest) using an

effective interest rate.

Presentation in the Financial Statements

INTERMEDIATE ACCOUNTING PART 1 4

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

1. Financial assets at FVPL – current assets

2. Financial assets at FVOCI and FAAC – generally as noncurrent assets,

except when they are due within 12 months from the reporting date.

ADDITIONAL NOTES:

Bonds: Acquired in Between Interest Dates

Steps:

1. Compute for the present value of the bonds on the last interest date (or date of the

bonds).

2. To get the present value – date of acquisition, add the bond discount amortization

(or deduct premium amortization) from the last interest date until the date of

acquisition.

3. To get the purchase price, add the nominal interest from the last interest date until

the date of acquisition to the present value – date of acquisition.

Bonds with Interpolation

Financial asset at amortized cost is required to be subsequently measured at

amortized cost using the effective interest method. Since the transaction cost was

included in the initial carrying amount of the financial asset, computation of new

effective interest rate using interpolation is needed, unless the transaction cost

was already considered in determining the new effective rate of interest.

If the acquisition is at a premium, the new effective rate must be lower than the

original effective rate and nominal rate.

If the acquisition is at a discount, the new effective rate must be higher than the

original effective rate and nominal rate.

Serial Bonds

In amortizing for investment in debt securities that is serial bonds – or its payment of

principal has multiple maturities, the collection of principal must be considered in

computing for interest and carrying amount of bonds.

Acquisition of Investment in Bonds with Warrants

When an investment in debt securities is acquired together with warrants, the

company should use the relative fair value to allocate the acquisition cost.

A. Financial Asset at Fair Value Through Profit or Loss

INTERMEDIATE ACCOUNTING PART 1 5

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

This classification of financial assets includes instruments which are:

1. Held for trading

2. Irrevocably designed at FVPL

3. All other investments in debt securities that do not satisfy the requirements for

measurement at FAAC and FVOCI

Initial Measurement – FVPL

Investment in debt securities classified as FVPL is initially measured at fair value.

Transaction cost is expensed outright.

Subsequent measurement – FVPL

Investment in debt securities classified as FVPL is subsequently measured at fair

value, with changes in fair value included in profit or loss. The formula is as follows:

Fair value (current reporting date) xxx

Less carrying value (FV, previous reporting date) xxx

Unrealized gain (loss) – P&L xxx

The journal entry to record the unrealized gain or loss on fair value changes is:

Unrealized gain Investments in debt securities – FVPL xxx

Unrealized gain – P/L xxx

Unrealized loss Unrealized loss – P/L xxx

Investments in debt securities – FVPL xxx

Derecognition – FVPL

Realized gain or losses on derecognition of financial asset at FVPL is recognized in

profit or loss. The gain/loss is computed as follows:

Consideration received xxx

Less: Interest income of investment sold* (xxx)

Transaction cost (xxx)

Net selling price xxx

Less carrying value (FV of previous reporting date) (xxx)

Realized gain (loss) – P&L xxx

Note: The interest income of investment sold is deducted from the

consideration received if the entity sold the investment in between interest

dates.

The journal entry to record the derecognition of the investment is:

Cash xxx

Loss on sale (if any) xxx

Investment in debt securities – FVPL xxx

Gain on sale (if any) xxx

Interest income or receivable (if any) xxx

B. Financial Asset at Amortized Cost

INTERMEDIATE ACCOUNTING PART 1 6

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Investment in debt securities are classified at financial asset at amortized cost when

both of the following conditions are met:

1. The business model is to hold the financial assets in order to collect

contractual cash flows on specified date and

2. The contractual cash flows are solely payments of principal and interest on

the principal amount outstanding

Initial Measurement – FAAC

Investment in debt securities classified as FAAC is subsequently measured at fair

value plus transaction costs.

Bonds maybe acquired thru the following scheme:

Characteristics

Scheme Proceeds (P) vs. Effective Rate (E) vs. Maturity

Face Amount (FA) Nominal Rate (N) Value

At face amount P = FA E=N FA

At a premium P > FA E<N FA

At a discount P < FA E>N FA

Subsequent Measurement – FAAC

Subsequent to initial recognition, investment in bonds classified as financial asset at

amortized cost is measured at amortized cost using effective interest method.

Unrealized gain or loss due to change in fair value is ignored.

Interest Collection

Interest received is computed by multiplying the face value of the bonds and the

nominal rate. The journal entry to record the interest collection and/or accrual is:

Cash/Interest Receivable xxx

Interest Income xxx

Amortization of Premium or Discount

The premium or discount for FAAC is amortized at the end of each reporting period.

The journal entry to record the premium/discount amortization is:

Amortization of Investments in debt securities – FAAC xxx

bond discount Interest income xxx

Amortization of Interest income xxx

bond premium Investments in debt securities – FAAC xxx

Interest Income

Amortization of premium will decrease interest income based on nominal rate while

amortization of discount will increase interest income, thus the interest income during

the period will include the interest received or accrued and the amortization of the

premium or the discount.

Alternatively, interest income may be computed by using the following formula:

Interest income = Present value, beginning of the period x Effective interest

rate

INTERMEDIATE ACCOUNTING PART 1 7

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Derecognition – FAAC

Realized gain or losses on derecognition of financial asset at amortized cost is

recognized in profit or loss. The gain/loss is computed as follows:

Consideration received xxx

Less: Interest income of investment sold* (xxx)

Transaction cost (xxx)

Net selling price xxx

Less amortized cost at the date of derecognition xxx

Realized gain (loss) – P&L xxx

Note: The interest income of investment sold is deducted from the

consideration received if the entity sold the investment in between interest

dates.

The journal entry to record the derecognition of the investment is:

Cash xxx

Loss on sale (if any) xxx

Investment in debt securities – FAAC xxx

Gain on sale (if any) xxx

Interest income or receivable (if any) xxx

Cash (transaction cost) xxx

C. Financial asset at Fair Value through Other Comprehensive Income

Investment in debt securities are classified at financial asset through OCI when both

of the following conditions are met:

1. The business model is achieved both by collecting contractual cash flows and

by selling the financial assets and

2. The contractual cash flows are solely payments of principal and interest on

the principal amount outstanding

Initial Measurement – FVOCI

Investment in debt securities classified as FVOCI is subsequently measured at fair

value plus transaction costs.

Subsequent Measurement – FVOCI

Subsequent to initial recognition, investment in bonds classified as financial asset at

OCI is measured at fair value. However, the amortized cost of the investment will still

be computed using effective interest method. The difference between the fair value

and the amortized cost is the cumulative amount presented in equity.

Journal entries to record amortization of premium or discount and computation of

interest income are actually the same under FAAC and FVOCI. The only difference is

the recognition of changes in fair value under FVOCI.

INTERMEDIATE ACCOUNTING PART 1 8

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Computation of Unrealized Gain or Loss

The following formula should be used to compute unrealized gain or loss in equity:

Fair value – year end xxx

Less: amortized cost – year end xxx

Unrealized gain (loss) in equity – cumulative balance xxx

Less: Unrealized gain (loss) in equity – cumulative balance last year xxx

Unrealized gain (loss) – OCI xxx

The journal entry to record the unrealized gain or loss is:

Unrealized gain Investments in debt securities – FVOCI xxx

Unrealized gain – OCI xxx

Unrealized loss Unrealized loss – OCI xxx

Investments in debt securities – OCI xxx

Interest Income

Interest income under FAAC and FVOCI may be computed in the same way by using

the following formula:

Interest income = Present value, beginning of the period x Effective interest

rate

Derecognition – FAAC

Realized gain or loss on derecognition of financial asset at FVOCI should be

recognized in the profit or loss. However, cumulative gains or losses previously

recognized in OCI are reclassified to profit or loss as provided under PFRS 9. The

formula is as follows:

Consideration received xxx

Less: Interest income of investment sold* (xxx)

Transaction cost (xxx)

Net selling price xxx

Add: Unrealized gain – OCI in equity xxx

Less: Unrealized loss – OCI in equity xxx

Less carrying amount at the date of derecognition xxx

Realized gain (loss) – P&L xxx

OR

Consideration received xxx

Less: Interest income of investment sold* (xxx)

Transaction cost (xxx)

Net selling price xxx

Less amortized cost at the date of derecognition xxx

Realized gain (loss) – P&L xxx

Note: The interest income of investment sold is deducted from the

consideration received if the entity sold the investment in between interest

dates.

INTERMEDIATE ACCOUNTING PART 1 9

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

The journal entry to record the derecognition of the investment is:

Cash xxx

Unrealized gain – OCI (if any) xxx

Loss on sale – P/L(if any) xxx

Investment in debt securities – FVOCI xxx

Unrealized loss – OCI (if any) xxx

Gain on sale – P/L(if any) xxx

Interest income or receivable (if any) xxx

Cash (transaction cost) xxx

D. Reclassification of Debt Instruments

Reclassification is allowed only when there is a change in business model for

managing its financial assets and applicable only to debt securities.

Examples of change in business model:

1. An entity has a portfolio of commercial loans that it holds to sell in the short

term. The entity acquires a company that manages commercial loans and has

a business model that holds the loans in order to collect the contractual cash

flows. The portfolio of commercial loans is no longer for sale, and the portfolio

is now managed together with the acquired commercial loans and all are held

to collect the contractual cash flows. (FVPL to FAAC)

2. A financial services firm decides to shut down its retail mortgage business.

That business no longer accepts new business and the financial services firm

is actively marketing its mortgage loan portfolio for sale. (FAAC to FVPL)

A reclassification is prohibited under the following circumstances:

1. Change in management intention

2. Temporary disappearance of a particular market

3. Transfer of assets between existing models

Any reclassification shall be treated prospectively from the date of reclassification.

Furthermore, the appropriate reclassification date is the first day of the reporting

period following the change in business model that results in an entity classifying

financial assets.

The following illustration will provide the guide for reclassifications of debt

instruments:

Original New category Accounting Impact

category

Fair value is measured at reclassification date.

Amortized Difference from carrying amount should be

cost FVPL recognized in profit or loss.

Fair value at the reclassification date becomes its

FVPL Amortized new gross carrying amount.

Cost

INTERMEDIATE ACCOUNTING PART 1 10

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

A new effective interest rate must be determined

based on the new carrying amount.

Fair value is measured at reclassification date.

Amortized FVOCI Difference from amortized cost should be recognized

cost in OCI.

The original effective interest rate is not adjusted.

Fair value at the reclassification date becomes its

new amortized cost carrying amount.

FVOCI Amortized Cumulative gain or loss in OCI is adjusted against

cost the fair value of the financial asset at

reclassification date.

The original effective interest rate is not adjusted.

Fair value at reclassification date becomes its new

FVPL FVOCI carrying amount.

A new effective interest rate must be determined

based on the new carrying amount.

Fair value at reclassification date becomes carrying

amount.

FVOCI FVPL

Cumulative gain or loss on OCI is reclassified to

profit or loss at reclassification date

E. Impairment Loss on Debt Instruments

The PFRS 9 impairment model for debt securities measures and accounts

impairments in these stages:

Stage 1 – Applied at initial recognition and subsequent measurement when

there is no significant increase in credit risk

a. As soon as a financial instrument is originated or purchased, 12-month expected

credit losses are recognized in profit or loss and a loss allowance is established.

b. Entities continue to recognize 12 month expected losses that are updated at each

reporting date

c. Effective interest is based on the gross carrying amount rather than the carrying

amount net of allowance for impairment.

Stage 2 – Applied at subsequent measurement when there is a significant

increase in credit risk.

a. If the credit risk increases significantly and the resulting credit quality is not

considered to be low credit risk, full lifetime expected credit losses are

recognized.

b. Lifetime expected credit losses are only recognized if the credit risk increases

significantly from when the entity originates or purchases the financial instrument.

INTERMEDIATE ACCOUNTING PART 1 11

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Impairment Flow Chart Guide (PFRS 9)

Measurement of Expected Credit Losses

1. Credit loss is the difference between all contractual cash flows that are due

to an entity in accordance with the contract and all the cash flows that the

entity expects to receive, discounted at the original effective interest rate.

2. Credit risk is the risk that one party to a financial instrument will cause a

financial loss for the other party by failing to discharge the obligation.

3. Cash shortfall is the difference between contractual cash flow and cash flow

that the entity expects to receive.

In measuring ECL, an entity shall measure ECL of a financial instrument in a way

that reflects:

a. An unbiased and probability-weighted amount that is determined by

evaluating a range of possible outcomes

b. The time value of money

c. Reasonable and supportable information that is available without undue cost

or effort.

Impairment Loss and Gain on Reversal of Impairment

The amount of loss is computed as follows:

Carrying amount xxx

Less: Present value of estimated future cash flows

discounted at original interest rate at initial recognition xxx

Impairment loss (gain) xxx

INTERMEDIATE ACCOUNTING PART 1 12

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

OTHER NONCURRENT FINANCIAL ASSETS

Funds for Future Use

Funds are in the form of cash and highly liquid financial instruments, which the entity

holds for specific purposes. Funds may be grouped into:

Fund for Current Operations Funds for Specific Purposes in the

Future that is Non-current

Petty cash fund Plant expansion fund

Change fund Bond sinking fund

Payroll fund Employment retirement fund

Dividend fund Preference share redemption fund

Interest fund Others

Others

For funds that are used in current operations, these are generally classified under cash

and cash equivalents, while noncurrent funds are classified as noncurrent investments.

BOND SINKING FUND

This is a fund set aside for the payment of bonds payable at the maturity date. These

arises because there may be a provision in the bond indenture that the issuing

corporation must set aside a specific amount for the payment of bonds.

CASH SURRENDER VALUE

The entity may enter into a life insurance policy to its officers and name itself as the

beneficiary. The accounting for life insurance premiums will depend on whether the

beneficiary is the entity itself or the officer insured.

When the entity is the designated beneficiary of an insurance policy on the life of an

officer, any premiums paid on the life insurance are recorded as life insurance expense.

The cash surrender value on such policy also accrues to the entity and should be

reported as an asset of the entity.

Cash surrender value is the amount which the insurance firm will pay upon the

surrender and cancellation of the life insurance policy. The cash surrender value is

classified as a noncurrent investment.

LONG-TERM ADVANCES AND DEPOSITS

Long-term advances and deposits such as security deposits, advances on rentals, etc.

fall under the category, loans and receivables which are measured in the statement

position at amortized cost using effective interest method. Thus, at initial recognition,

these are measured at present values based on effective interest rate. Subsequently,

interest income is recognized using the effective rate until the deposits and advances

are used up.

INTERMEDIATE ACCOUNTING PART 1 13

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Guided Exercises / Learning Activities

PRACTICE PROBLEMS:

1. INVESTMENT IN DEBT SECURITIES – FVPL

On January 1, 2020, BREWMASTER, Inc. purchased ₱ 1,000,000 bonds at 98.

The bonds mature on January 1, 2024 and pay 12% annual interest beginning

January 1, 2019. Commission paid on the acquisition of amounted to ₱ 50,000.

The objective of Aurora’s business model is to sell the bonds in the near term to

take advantage of fluctuations in the fair values for short-term profit taking.

On December 31, 2020, the bonds are quoted at 102.

On January 2, 2021, the bonds were sold at 105.

Required:

1. Prepare journal entry for the acquisition.

2. Compute for the unrealized gain or loss on December 31, 2020 and prepare

the journal entries for the unrealized gain and the interest income.

3. Compute for the realized gain or loss on January 2, 2021 and prepare the

journal entry.

ANSWERS:

1. Jan. 1, 2020 Investment in debt securities – FVPL 980,000

Commission expense 50,000

Cash 1,030,000

2. Unrealized G/L on Profit or Loss

Fair value, 12/31/2020 (1.02 x ₱ 1M) 1,020,000

Less carrying value (0.98 x 1M) 980,000

Unrealized gain – P&L 40,000

Dec. 31, 2020 Investment in debt securities – FVPL 40,000

Unrealized gain – P&L 40,000

Cash 120,000

Interest income (₱ 1M x 12%) 120,000

3. Consideration received/net selling price (1M x 1.05) 1,050,000

Less carrying value, 12/31/2020 1,020,000

Realized gain (loss) – P&L 30,000

Jan. 2, 2021 Cash 1,050,000

Investment in debt securities – FVPL 1,020,000

Gain on sale of investment in

debt securities - FVPL 30,000

INTERMEDIATE ACCOUNTING PART 1 14

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Recognition Between Interest Dates

Refer to the same problem but assuming the bonds were acquired on May 1,

2020 plus accrued interest. The interests are payable every March 1 and

September 1.

Required:

1. Prepare journal entry for the acquisition.

2. Compute for the unrealized gain or loss on December 31, 2020 and prepare

the journal entries for the unrealized gain and the interest income.

3. Compute for the realized gain or loss on January 2, 2021 and prepare the

journal entry.

ANSWERS:

1. Jan. 1, 2020 Investment in debt securities – FVPL 980,000

Interest receivable (1M x 12% x 2/12) 20,000

Commission expense 50,000

Cash 1,050,000

2. Unrealized G/L on Profit or Loss

Fair value, 12/31/2020 (1.02 x ₱ 1M) 1,020,000

Less carrying value (0.98 x 1M) 980,000

Unrealized gain – P&L 40,000

Sept. 1, 2020 Cash (1M x 12% x 6/12) 60,000

Interest receivable 20,000

Interest income 40,000

Dec. 31, 2020 Investment in debt securities – FVPL 40,000

Unrealized gain – P&L 40,000

Interest receivable (1M x 12% x 4/12) 40,000

Interest income 40,000

3. Consideration received/net selling price (1M x 1.05) 1,050,000

Interest income of investment sold ( 40,000)

Net selling price 1,010,000

Less carrying value, 12/31/2020 1,020,000

Realized gain (loss) – P&L (10,000)

Jan. 2, 2021 Cash 1,050,000

Loss on sale of investment in

debt securities - FVPL 10,000

Investment in debt securities – FVPL 1,020,000

Interest receivable 40,000

INTERMEDIATE ACCOUNTING PART 1 15

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

2. INVESTMENT IN DEBT SECURITIES – FAAC

On January 1, 2020, INVOKER, Inc. purchased 5-year bonds with face value of ₱

4,000,000 and stated interest of 10% per year payable semiannually June 30 and

December 31. The bonds were acquired to yield 8%.

On February 28, 2021, the bonds were sold at 105, including accrued interest.

Required:

1. Compute the initial measurement of the bonds on acquisition.

2. Compute for the interest income for 2020 and carrying amount, current

portion and the noncurrent portion of the investment on December 31, 2020

3. Compute for the carrying amount of the investment on February 28, 2021

prior to sale and compute for the gain or loss on sale of investment upon

derecognition on Feb 28, 2021.

4. Prepare the necessary journal entries from acquisition to derecognition.

ANSWERS:

1. INITIAL RECOGNITION

PV of 1 (₱ 4 M x 0.6756) 2,702,400

PVOA (₱ 4 M x 5% x 8.1109) 1,622,180

Initial PV of bonds 4,324,580

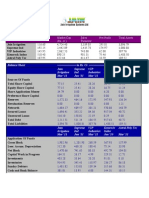

2. SUBSEQUENT RECOGNITION

Amortization table

Date Interest Interest Premium Present

Collection Income Amortization Value

(5%) (4%)

1/1/2020 4,324,580

6/30/2020 200,000 172,983 27,017 4,297,563

12/31/2020 200,000 171,903 28,097 4,269,466

6/30/2021 200,000 170,779 29,221 4,240,245

a. Interest income for 2020 (172,983+171,903) 344,886

b. Carrying amount of investment, 12/31/2020 4,269,466

c. Current portion of investment, 12/31/2020 ZERO

d. Noncurrent portion of investment, 12/31/2020 4,269,466

3. DERECOGNITION

Carrying amount, 12/31/2020 4,269,466

Less: premium amortization (29,221 x 2/6) (9,740)

Carrying amount, 2/28/2021 4,259,726

Total consideration (₱ 4 M x 1.05) 4,200,000

Less: accrued interest (₱ 4 M x 10% x 2/12) 66,667

Net selling price 4,133,333

Less: carrying amount, 2/28/2021 4,259,726

Loss on derecognition – P/L 126,393

INTERMEDIATE ACCOUNTING PART 1 16

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

4. Journal entries from 1/1/2020 to 2/28/2021

1/1/2020 Investments in debt securities – FAAC 4,324,580

Cash 4,324,580

6/30/2020 Cash 200,000

Interest income 172,983

Investments in debt securities – FAAC 27,017

12/31/2020 Cash 200,000

Interest income 171,903

Investments in debt securities – FAAC 28,097

2/28/2021 Cash 66,667

Interest income (170,779 x 2/6) 56,927

Investments in debt securities – FAAC 9,740

Cash 4,133,333

Loss on sale of investments in

debt securities – FAAC 126,393

Investments in debt securities – FAAC 4,259,726

3. INVESTMENT IN DEBT SECURITIES – FVOCI

On January 1, 2020, KUNKKA, Inc. purchased 5-year bonds with face value of ₱

6,000,000 and stated interest of 10% per year payable annually every December

31. The bonds were acquired for 105. Commission paid for the acquisition

amounted to ₱ 179,125. After considering the transaction cost, the effective rate

of the bond on initial recognition is computed at 8%. The objective of KUNKKA’s

business model is to collect the contractual cash flows and sell financial asset.

The fair value of the investment for the next five years is as follows:

2020 – 110 2021 – 108 2022 – 103 2023 - 101 2024 - 105

On December 31, 2024, the bonds were sold at 102, and the company incurred

transaction costs amounting to ₱ 100,000.

Required:

1. Compute the initial measurement of the bonds on acquisition.

2. Compute for the interest income for 2020 and the carrying amount on

December 31, 2020

3. Compute for the unrealized gain or loss to be recognized in the statement of

financial position and unrealized gain or loss to be recognized in the other

comprehensive income for 2021

4. Compute for the carrying amount of the investment on December 31, 2024

prior to sale and compute for the gain or loss on sale of investment upon

derecognition on December 31, 2024.

5. Prepare the necessary journal entries from acquisition to derecognition.

INTERMEDIATE ACCOUNTING PART 1 17

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

ANSWERS:

1. INITIAL RECOGNITION

Fair value (₱ 6 M x 1.05) 6,300,000

Add: Transaction costs 179,125

Initial PV of bonds 6,479,125

2. SUBSEQUENT RECOGNITION

Amortization table and Determination of Unrealized G/L to Equity and OCI

Date Interest Interest Premium Present Fair UG(UL) – UG(UL) – OCI

Collection Income Amorti- Value Value Equity

(10%) (8%) zation

(b) (a) (c = a – b) (d = cCY – cPY)

1/1/2020 6,479,125

12/31/2020 600,000 518,330 81,670 6,397,455 6,600,00 202,545 202,545

0

12/31/2021 600,000 511,796 88,204 6,309,251 6,480,00 170,749 (31,796)

0

12/31/2022 600,000 504,740 95,260 6,213,992 6,280,00 (33,992) (204,741)

0

12/31/2023 600,000 497,119 102,881 6,111,111 6,060,00 (51,111) (17,119)

0

12/31/2024 600,000 488,889 111,111 6,000,000 6,300,00 300,000 351,111

0

a. Interest income for 2020 518,330

b. Carrying amount, 12/31/2020 6,600,000

3. Unrealized gain/loss – Equity, 12/20/2021 170,749

Unrealized gain loss – OCI, 12/20/2021 (31,796)

4. DERECOGNITION

Consideration received (₱ 6 M x 1.02) 6,120,000

Less: Transaction cost 100,000

Net selling price 6,020,000

Add: Unrealized gain – OCI in equity 300,000

Less carrying amount at the date of derecognition (6,300,000)

Realized gain (loss) – P&L 20,000

OR

Consideration received (₱ 6 M x 1.02) 6,120,000

Less: Transaction cost 100,000

Net selling price 6,020,000

Less amortized cost at the date of derecognition 6,000,000

Realized gain (loss) – P&L 20,000

INTERMEDIATE ACCOUNTING PART 1 18

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

5. Journal entries from 1/1/2020 to 2/28/2021

1/1/2020 Investments in debt securities – FVOCI 6,479,125

Cash 6,479,125

12/31/2020 Cash 600,000

Interest income 518,330

Investments in debt securities – FVOCI 81,670

Investments in debt securities – FVOCI 202,545

Unrealized gain – OCI 202,545

12/31/2021 Cash 600,000

Interest income 511,796

Investments in debt securities – FVOCI 88,204

Unrealized gain – OCI 31,796

Investments in debt securities – FVOCI 31,796

12/31/2022 Cash 600,000

Interest income 504,740

Investments in debt securities – FVOCI 95,260

Unrealized gain – OCI 170,749

Unrealized loss – OCI 33,932

Investments in debt securities – FVOCI 204,741

12/31/2023 Cash 600,000

Interest income 497,119

Investments in debt securities – FVOCI 102,881

Unrealized loss – OCI 17,119

Investments in debt securities – FVOCI 17,119

12/31/2023 Cash 600,000

Interest income 488,889

Investments in debt securities – FVOCI 111,111

Investments in debt securities – FVOCI 351,111

Unrealized loss – OCI 51,111

Unrealized gain – OCI 300,000

Cash 6,020,000

Unrealized gain – OCI 300,000

Investments in debt securities – FVOCI 6,300,000

Gain on sale of investments in

debt securities – P/L 20,000

INTERMEDIATE ACCOUNTING PART 1 19

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

4. RECLASSIFICATION OF DEBT INSTRUMENTS

Required: Prepare all the necessary journal entries on the following independent

situations:

1. On January 1, 2020, WINDRANGER, Inc. purchased 5 year, 10% bonds with

a face amount of ₱5,000,000. WINDRANGER acquired the bonds at 120. The

business model of the entity is to sell the financial assets in short term in

order to realize fair value changes.

On December 31, 2020, the entity changed its business model to hold assets

in order to collect contractual cash flows. The fair value of bonds on date of

reclassification is ₱5,331,050.

ANSWER:

Jan 1, 2020 Investment in bonds – FVPL 6,000,000

Cash 6,000,000

Dec 31, 2020 Unrealized loss – P/L 668,950

Investment in bonds – FVPL 668,950

Cash 500,000

Interest income 500,000

Jan 1, 2021 Investment in bonds – FAAC 5,331,050

Investment in bonds – FVPL 5,331,050

New effective rate: 8%

2. On January 1, 2020, DROW RANGER, Inc. purchased 4 year, 10% bonds

with a face amount of ₱5,000,000. Interest is payable annually on December

31. The business model of the entity is to hold financial assets in order to

collect contractual cash flows. The effective rate is 8%.

On December 31, 2020, the entity changed its business model to sell the

financial assets in short term in order to realize fair value changes. The fair

value of bonds on date of reclassification is ₱5,500,000.

ANSWER:

Jan 1, 2020 Investment in bonds – FAAC 5,331,050

Cash (0.7350 x 5M) + (3.3121 x 10% x 5M) 5,331,050

Dec 31, 2020 Cash 500,000

Interest income (5,331,050 x 8%) 426,284

Investment in bonds – FAAC 73,516

Jan 1, 2021 Investment in bonds – FVPL 5,500,000

Investment in bonds – FAAC 5,257,534

Gain on reclassification – P/L 242,466

INTERMEDIATE ACCOUNTING PART 1 20

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

3. On January 1, 2020, SNIPER, Inc. purchased 4 year, 10% bonds with a face

amount of ₱5,000,000. Interest is payable annually on December 31. The

business model of the entity is to hold financial assets in order to collect

contractual cash flows. The effective rate is 8%.

On December 31, 2020, the entity changed its business model to sell the

financial assets in short term in order to realize fair value changes and collect

contractual cash flows. The fair value of bonds on date of reclassification is

₱5,500,000.

ANSWER:

Jan 1, 2020 Investment in bonds – FAAC 5,331,050

Cash (0.7350 x 5M) + (3.3121 x 10% x 5M) 5,331,050

Dec 31, 2020 Cash 500,000

Interest income (5,331,050 x 8%) 426,284

Investment in bonds – FAAC 73,516

Jan 1, 2021 Investment in bonds – FVOCI 5,500,000

Investment in bonds – FAAC 5,257,534

Gain on reclassification – OCI 242,466

4. On January 1, 2020, BEASTMASTER, Inc. purchased 4 year, 10% bonds

with a face amount of ₱5,000,000. BEASTMASTER acquired the bonds at

5,331,050 including transaction costs. The business model of the entity is to

hold financial assets in order to collect contractual cash flows. The effective

rate is 8%.

On December 31, 2020, the fair value of the bonds is 110. The entity changed

its business model to sell the financial assets in short term in order to realize

fair value changes and collect contractual cash flows. The fair value of bonds

on date of reclassification is ₱5,500,000.

ANSWER:

Jan 1, 2020 Investment in bonds – FVOCI 5,331,050

Cash 5,331,050

Dec 31, 2020 Cash 500,000

Interest income (5,331,050 x 8%) 426,284

Investment in bonds – FVOCI 73,516

Investment in bonds – FVOCI 242,466

Unrealized gain – FVOCI 242,466

Date Interest Interest Premium Present Fair UG(UL) – UG(UL) – OCI

Collection Income Amorti- Value Value Equity

(10%) (8%) zation

(b) (a) (c = a – b) (d = cCY – cPY)

1/1/2020 5,331,050

12/31/2020 500,000 426,284 73,516 5,257,534 5,500,00 242,466 242,466

0

INTERMEDIATE ACCOUNTING PART 1 21

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Jan 1, 2021 Investment in bonds – FAAC 5,500,000

Investment in bonds – FVOCI 5,500,000

Unrealized gain – OCI 242,466

Investments in bonds - FAAC 242,466

5. On January 1, 2020, CRYSTAL MAIDEN, Inc. purchased 5 year, 10% bonds

with a face amount of ₱5,000,000. CRYSTAL MAIDEN acquired the bonds at

120. The business model of the entity is to sell the financial assets in short

term in order to realize fair value changes.

On December 31, 2020, the entity changed its business model to hold assets

in order to collect contractual cash flows and sell the financial assets. The fair

value of bonds on date of reclassification is ₱5,331,050.

ANSWER:

Jan 1, 2020 Investment in bonds – FVPL 6,000,000

Cash 6,000,000

Dec 31, 2020 Unrealized loss – P/L 668,950

Investment in bonds – FVPL 668,950

Cash 500,000

Interest income 500,000

Jan 1, 2021 Investment in bonds – FVOCI 5,331,050

Investment in bonds – FVPL 5,331,050

New effective rate: 8%

6. On January 1, 2020, NECROPHOS, Inc. purchased 4 year, 10% bonds with a

face amount of ₱5,000,000. NECROPHOS acquired the bonds at 5,331,050

including transaction costs. The business model of the entity is to hold

financial assets in order to collect contractual cash flows. The effective rate is

8%.

On December 31, 2020, the entity changed its business model to sell the

financial assets in short term in order to realize fair value changes. The fair

value of bonds on date of reclassification is ₱5,600,000.

ANSWER:

Jan 1, 2020 Investment in bonds – FVOCI 5,331,050

Cash 5,331,050

Dec 31, 2020 Cash 500,000

Interest income (5,331,050 x 8%) 426,284

Investment in bonds – FVOCI 73,516

Investment in bonds – FVOCI 242,466

Unrealized gain – FVOCI 242,466

Date Interest Interest Premium Present Fair UG(UL) – UG(UL) – OCI

Collection Income Amorti- Value Value Equity

(10%) (8%) zation

(b) (a) (c = a – b) (d = cCY – cPY)

1/1/2020 5,331,050

12/31/2020 500,000 426,284 73,516 5,257,534 5,500,00 242,466 242,466

INTERMEDIATE ACCOUNTING PART 1 22

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Jan 1, 2021 Investment in bonds – FVPL 5,600,000

Investment in bonds – FVOCI 5,500,000

Gain on reclassification – P/L 100,000

Unrealized gain – OCI 242,466

Unrealized gain – P/L 242,466

5. IMPAIRMENT OF DEBT SECURITIES

On January 1, 2019, RIKIMARU Company purchased 5-year bonds with face amount

of ₱ 2,000,000 and stated interest of 12% payable every December 31. The bonds

were acquired at ₱ 2,126,776 to yield rate of 10%.

On December 31, 2020, after receiving the interest, the issuer of bonds is in financial

difficulty due to the COVID-19 pandemic. RIKIMARU assessed that investment’s

credit risk and it is probable that an impairment loss should be recognized.

RIKIMARU assessed also that only the principal amount will be received on the

maturity date. The prevailing interest on this date is 11%.

On December 31, 2021, the financial condition of the borrower has improved, and it

can pay its unpaid obligation including principal and interest at maturity. The

prevailing rate of interest on this date is 12%.

Required: Compute for the following under PFRS 9:

a. Impairment loss on December 31, 2020

b. Carrying amount on December 31, 2020

c. Interest income on 2021

d. Gain on reversal of impairment in 2021.

e. Carrying amount on December 31, 2021

f. Interest income in 2022.

ANSWERS:

ORIGINAL AMORTIZATION TABLE

Date Interest Interest Premium Present

Collection Income Amortization Value

(12%) (10%)

1/1/2019 2,126,776

12/31/2019 240,000 212,678 27,322 2,099,454

12/31/2020 240,000 209,945 30,055 2,069,399

12/31/2021 240,000 206,940 33,060 2,036,339

12/31/2022 240,000 203,634 36,366 2,000,000

a. Carrying amount, 12/31/2020 2,069,399

Less: PV of expected cash flows using original

rate (₱2M x .8264) 1,652,800

Impairment loss 416,599

INTERMEDIATE ACCOUNTING PART 1 23

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

b. Carrying amount, 12/31/2020 = PV of

expected cash flows 1,652,800

c. REVISED AMORTIZATION TABLE

Date Interest Income (10%) Present Value

12/31/2020 1,652,800

12/31/2021 165,280 1,818,080

12/31/2022 181,808 2,000,000

Interest income for 2021 165,280

d. Principal 2,000,000

Add: accrued interest (₱2M x 12% x 2 years unpaid interest) 480,000

Total 2,480,000

Multiply by: PV of 1 using OEIR 0.9091

Total PV of future cash inflows 2,254,568

Less: amortized cost, 12/31/2021 1,818,080

Gain on reversal of impairment 436,488

e. Carrying amount, 12/31/2021 = PV of

expected cash flows 2,254,568

f. Interest income for 2022 203,634

Use again the original amortization table.

Date Interest Interest Premium Present

Collection Income Amortization Value

(12%) (10%)

1/1/2019 2,126,776

12/31/2019 240,000 212,678 27,322 2,099,454

12/31/2020 240,000 209,945 30,055 2,069,399

12/31/2021 240,000 206,940 33,060 2,036,339

12/31/2022 240,000 203,634 36,366 2,000,000

Let us illustrate the journal entries starting from the impairment loss up to

2022:

12/31/2020 Impairment loss 416,599

Allowance for impairment loss 416,599

12/31/2021 Investment in debt securities 165,280

Interest income 165,280

Allowance for impairment loss 436,488

Gain on reversal of impairment 436,488

12/31/2022 Cash 240,000

Investment in debt securities 36,366

Interest income 203,634

Cash 2,000,000

Investment in bonds 2,000,000

INTERMEDIATE ACCOUNTING PART 1 24

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

6. FUNDS FOR FUTURE USE

BOND SINKING FUND

On January 1, 2020, SNAPFIRE COMPANY issued ₱1M bonds that will mature on

December 31, 2022.

According to the agreement, the entity is required to maintain a separate bank

account and make a periodic deposit every December 31 that will accumulate at

least ₱1M at December 31, 2022. The market rate being paid by bank on the

deposits is 10% yield net of tax.

Required: Compute the carrying amount of the fund until December 31, 2022 and

prepare journal entries.

1. Compute for the required annual deposit by dividing the required ending

balance of the sinking fund by future value of ordinary annuity.

Required balance of the sinking fund at bond maturity 1,000,000

Divide by future value at OA 3.31

Required annual deposit 302,115

2. Compute for the carrying amount of bond sinking fund until 2024.

TABLE FOR ACCUMULATION OF FUND BALANCE

Date Deposit Interest Income Premium

(10%) Amortization

12/31/2020 302,115 - 302,115

12/31/2021 302,115 30,212 634,442

12/31/2022 302,115 63,444 1,000,000

3. Journal Entries related to Bond Sinking Fund

12/31/2020 Bond sinking fund 302,115

Cash 302,115

12/31/2021 Bond sinking fund 332,327

Interest income 30,212

Cash 302,115

12/31/2022 Bond sinking fund 365,559

Interest income 63,444

Cash 302,115

CASH SURRENDER VALUE

PUDGE COMPANY insured the life of its president, Ms. Lina, for ₱ 5,000,000 the

entity being the beneficiary of an ordinary life policy. The annual premium is ₱

INTERMEDIATE ACCOUNTING PART 1 25

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

50,000. The policy is dated January 1, 2020 and carried the following cash surrender

value.

End of policy year Cash surrender value

2020 0

2021 0

2022 100,000

2023 250,000

2024 300,000

Ms. Lina died on July 1, 2024 and the policy was collected on August 1, 2024.

Required: Prepare journal entries for the transactions occurred above.

ANSWERS:

1/1/2020 Life insurance expense 50,000

Cash 50,000

1/1/2021 Life insurance expense 50,000

Cash 50,000

1/1/2022 Life insurance expense 50,000

Cash 50,000

12/31/2022 Cash surrender value 100,000

Life insurance expense (1/3) 33,333

Retained earnings 66,667

1/1/2023 Life insurance expense 50,000

Cash 50,000

12/31/2023 Cash surrender value (250,000 – 100,000) 150,000

Life insurance expense 150,000

1/1/2024 Life insurance expense 50,000

Cash 50,000

7/1/2024 Cash surrender value 25,000

Life insurance expense 25,000

[(300,000 – 250,000) x 6/12]

8/1/2024 Cash 5,000,000

Cash surrender value 275,000

Life insurance expense (50,000 x 6/12) 25,000

Gain on life insurance settlement (BF) 4,700,000

INTERMEDIATE ACCOUNTING PART 1 26

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Assessment

Provide the requirement for the following

problems. Provide the solutions as necessary. For problems that require the

determination of present value factors, round off your answer to four decimal

1. On January 1, 2020, VIPER COMPANY purchased 12% bonds with face

amount of ₱ 5,000,000 for ₱ 5,380,000 and it has an effective yield of 10%.

Interest are payable annually on December 31 of each year. The bonds are

quoted at 120 on December 31, 2020 and 115 on December 31, 2021. The

business model of VIPER is to trade or sell the financial assets.

Required: Prepare all journal entries for 2020 and 2021 applicable to this

transaction.

2. On January 1, 2021, RUBICK COMPANY acquired 5-year, 15%, ₱ 8,000,000

H-bonds. The investments were acquired at a price to yield 14%. Interest are

payable annually on December 31. RUBICK’s business model is to hold the

financial assets in order to collect contractual cash flows.

a. Determine the initial measurement of H-bonds on January 1, 2021.

b. Prepare a schedule of amortization using the effective interest method.

Use the following columns:

Date Interest Interest Amortization Present

Collection Income Value

c. Prepare all journal entries for 2021 and 2022 applicable to this

transaction.

3. On January 1, 2022, HUSKAR COMPANY purchased bonds with a face

amount of ₱ 5,000,000 at a cost of ₱ 5,200,000. The stated interest is 10%

payable annually every December 31. The bonds mature in December 31,

2025. business model is to hold the financial assets in order to collect

contractual cash flows.

a. Compute for the interest income for the current year.

b. Prepare journal entries for the current year.

4. Refer to Problem #3. Assuming on December 2022, HUSKAR changed its

business model from holding the financial assets in order to collect

contractual cash flows to realizing gains. The fair value of the bonds on the

reclassification date is 105.

Required: When will HUSKAR recognize the reclassification gain or loss and

compute the amount of reclassification gain or loss. Prepare the journal entry

to record the reclassification of bonds.

INTERMEDIATE ACCOUNTING PART 1 27

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

5. On January 1, 2020, KUNKKA, Inc. acquired 10%, 3-year bonds with face

value of ₱ 2,000,000. Interest is payable semiannually every June 30 and

December 31. The bonds were acquired for 104. Commission paid for the

acquisition amounted to ₱ 54,670. After considering the transaction cost, the

effective rate of the bond on initial recognition is computed at 8%. The

objective of KUNKKA’s business model is to collect the contractual cash flows

and sell financial asset.

The fair value of the investment for the next periods are the following:

6/30/2020 105 6/30/2021 102 6/30/2022 108

12/31/2020 101 12/31/2021 112 12/31/2022 120

On January 1, 2021, the bonds were sold at 107, and the company incurred

transaction costs amounting to ₱ 20,000.

Required:

a. Compute the initial measurement of the bonds on acquisition.

b. Compute for the interest income for 2020 and the carrying amount on

December 31, 2020.

c. Compute for the unrealized gain or loss to be recognized in the

statement of financial position and unrealized gain or loss to be

recognized in the other comprehensive income for 2020.

d. Compute for the amount of realized gain or loss to be recognized in the

profit or loss section.

e. Prepare journal entries for the current year.

6. On January 1, 2020, MIRANA COMPANY issued Php 15M bonds that is due

on December 31, 2029. The bond indenture stated that the entity must

establish a bond sinking fund in relation to the borrowing agreement. The

entity set up a bank account for deposits on bond sinking fund. It was decided

that deposits will be made every June 30 and December 31 starting June 30,

2019. The company expects to an average interest of 8% net of tax on this

investment.

a. How much MIRANA will deposit every payment period to accumulate the

target the Php 15 M at December 31, 2029.

b. Prepare journal entries for the current year in relation to the bond sinking

fund.

INTERMEDIATE ACCOUNTING PART 1 28

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

INTERMEDIATE ACCOUNTING PART 1 29

You might also like

- Additional Case-Lets For Practice-April 17-RaoDocument13 pagesAdditional Case-Lets For Practice-April 17-RaoSankalp BhagatNo ratings yet

- Securitization of Assets File 2Document24 pagesSecuritization of Assets File 2khush preet100% (1)

- Investment Law InterimDocument16 pagesInvestment Law InterimabcNo ratings yet

- Capstone Project ReportDocument12 pagesCapstone Project ReportManisha VermaNo ratings yet

- Classroom Discussion 2 - 04172021Document3 pagesClassroom Discussion 2 - 04172021LLYOD FRANCIS LAYLAY50% (2)

- Non-Agency Mbs PrimerDocument50 pagesNon-Agency Mbs Primerab3rd100% (1)

- Premier University: Assignment 1 & 2Document22 pagesPremier University: Assignment 1 & 2Ringkel BaruaNo ratings yet

- Assignment 1Document10 pagesAssignment 1Ringkel BaruaNo ratings yet

- Bond and EquityDocument13 pagesBond and EquityDarkknightNo ratings yet

- Mfs Unit 2 FinalDocument12 pagesMfs Unit 2 FinalRama SardesaiNo ratings yet

- Business Finance-Lm3Document10 pagesBusiness Finance-Lm3Nathan Kurt LeeNo ratings yet

- Module 5 - Credit Instruments and Its Negotiation PDFDocument13 pagesModule 5 - Credit Instruments and Its Negotiation PDFRodel Novesteras ClausNo ratings yet

- Chapter Two: Non - Current LiabilitiesDocument10 pagesChapter Two: Non - Current LiabilitiesJuan KermaNo ratings yet

- Fin Eco 9 PDFDocument8 pagesFin Eco 9 PDFRajesh GargNo ratings yet

- Lesson 8 Bonds and Stock For Students 3Document8 pagesLesson 8 Bonds and Stock For Students 3dorothyannvillamoraaNo ratings yet

- Financial Services - Unit 1Document72 pagesFinancial Services - Unit 1Darshini Thummar-ppmNo ratings yet

- Investment LawDocument18 pagesInvestment LawDevvrat garhwalNo ratings yet

- CM Chapter 3 - CarlomanDocument21 pagesCM Chapter 3 - CarlomanJonavel Torres MacionNo ratings yet

- Debt Securities Market ObjectivesDocument4 pagesDebt Securities Market ObjectivesFaith Barredo InfanteNo ratings yet

- 2.2.1 Valuation of BondsDocument12 pages2.2.1 Valuation of Bondssumit kumarNo ratings yet

- Chapter 9: Credit Instruments ObjectivesDocument43 pagesChapter 9: Credit Instruments ObjectiveskatlicNo ratings yet

- Securitisation of Financial AssetsDocument27 pagesSecuritisation of Financial Assetsvahid100% (3)

- Non Non Non Non - Current Liabilities Current Liabilities Current Liabilities Current LiabilitiesDocument93 pagesNon Non Non Non - Current Liabilities Current Liabilities Current Liabilities Current LiabilitiesBantamkak FikaduNo ratings yet

- Chapter 4 - Financial InstrumentsDocument17 pagesChapter 4 - Financial InstrumentsMerge MergeNo ratings yet

- June 27, 2017 - FINANCIAL MARKETSDocument26 pagesJune 27, 2017 - FINANCIAL MARKETSLaila Mae PiloneoNo ratings yet

- Non-Current LiabilitiesDocument74 pagesNon-Current LiabilitiesHawi BerhanuNo ratings yet

- Financial Management Long Term Securities and ValuationDocument24 pagesFinancial Management Long Term Securities and ValuationAiza JuttNo ratings yet

- Content PDFDocument18 pagesContent PDFSecurity Bank Personal LoansNo ratings yet

- Bank LendingDocument77 pagesBank Lendinghaarrisali7No ratings yet

- Brief Introduction To Share and Bonds & Their TypesDocument21 pagesBrief Introduction To Share and Bonds & Their TypesFocus CoachingNo ratings yet

- SecuritizationDocument4 pagesSecuritizationshweta jaiswalNo ratings yet

- SecuritisationDocument32 pagesSecuritisationAmit SinghNo ratings yet

- Chapter One Introduction To InvestmentDocument10 pagesChapter One Introduction To InvestmentMIKIYAS BERHENo ratings yet

- BST 1 - Variable Life Insurance v1.0Document42 pagesBST 1 - Variable Life Insurance v1.0Donna Mae Palabay MalasigNo ratings yet

- Bonds - DISHA AGARWAL-01 - BNFDocument17 pagesBonds - DISHA AGARWAL-01 - BNFdisha agarwalNo ratings yet

- What Are The Recognition Criteria For Bonds Payable?Document1 pageWhat Are The Recognition Criteria For Bonds Payable?hae1234No ratings yet

- Features of A Bond IssueDocument8 pagesFeatures of A Bond IssueAnsherina LaviñaNo ratings yet

- Chapter 5 Non-Current Liabilities-Kieso IfrsDocument67 pagesChapter 5 Non-Current Liabilities-Kieso IfrsAklil TeganewNo ratings yet

- Securities Regulation CodeDocument118 pagesSecurities Regulation CodedasdsadsadasdasdNo ratings yet

- Capital-markets-Midterm With ExplanationDocument9 pagesCapital-markets-Midterm With ExplanationfroelanangusatiNo ratings yet

- Long-Term Financial Liabilities: Chapter Topics Cross Referenced With CicaDocument10 pagesLong-Term Financial Liabilities: Chapter Topics Cross Referenced With CicaghostbooNo ratings yet

- Philippine Bond MarketDocument30 pagesPhilippine Bond MarketMARY JUSTINE PAQUIBOTNo ratings yet

- Financial Instruments and SecuritiesDocument8 pagesFinancial Instruments and SecuritiesDonita MantuanoNo ratings yet

- SecuritizationDocument35 pagesSecuritizationvineet ranjan100% (1)

- INTACT2 - Handout No. 4Document10 pagesINTACT2 - Handout No. 4Charlyn Jewel OlaesNo ratings yet

- Investment and Risk Management Chapter 1 Concepts in ReviewDocument8 pagesInvestment and Risk Management Chapter 1 Concepts in ReviewAnn Connie PerezNo ratings yet

- Loans and AdvancesDocument6 pagesLoans and AdvancesAnusuya Chela100% (1)

- IM - Unit-3Document25 pagesIM - Unit-3Maddi NikhithaNo ratings yet

- Bfinel4x C1Document2 pagesBfinel4x C1patrickclarin1515No ratings yet

- Financial Assets at Fair Value Through Profit or LossDocument13 pagesFinancial Assets at Fair Value Through Profit or LossALEJANDRE, Chris Shaira M.No ratings yet

- Chapter 13 - Financial Asset at Fair ValueDocument10 pagesChapter 13 - Financial Asset at Fair ValueMark LopezNo ratings yet

- Reportko 140722051523 Phpapp02Document20 pagesReportko 140722051523 Phpapp02rhonaclancyNo ratings yet

- Financial Management - Bond ValuationDocument17 pagesFinancial Management - Bond ValuationNoelia Mc DonaldNo ratings yet

- Chapter 11 - Financial Asset at Fair ValueDocument10 pagesChapter 11 - Financial Asset at Fair Valuesungdeok.sun22No ratings yet

- WEEK 13 - Treasury ManagementDocument11 pagesWEEK 13 - Treasury ManagementJerwin LomibaoNo ratings yet

- New Financial InstrumentsDocument9 pagesNew Financial Instrumentsmanisha guptaNo ratings yet

- Name: Chenee Yvette Torbeles Chapter 4. Key Players in The Financial SystemDocument2 pagesName: Chenee Yvette Torbeles Chapter 4. Key Players in The Financial SystemTorbeles ChenNo ratings yet

- Symbiosis International (Deemed University) : (Established Under Section 3 of The UGC Act 1956)Document17 pagesSymbiosis International (Deemed University) : (Established Under Section 3 of The UGC Act 1956)Avirath PareekNo ratings yet

- Assignment 1Document4 pagesAssignment 1Sanjida Ashrafi AnanyaNo ratings yet

- Money Markets and Capital MarketsDocument4 pagesMoney Markets and Capital MarketsEmmanuelle RojasNo ratings yet

- Bank Accounts and Credit Securities: Lesson 2: FM 42 Investment and Portfolio ManagementDocument25 pagesBank Accounts and Credit Securities: Lesson 2: FM 42 Investment and Portfolio ManagementSarah Jane OrillosaNo ratings yet

- AssaignmentDocument11 pagesAssaignmentMaruf HasanNo ratings yet

- Module in Financial Management - 06Document11 pagesModule in Financial Management - 06Karla Mae GammadNo ratings yet

- PIE Application Tricks: Provided by AcadsocDocument21 pagesPIE Application Tricks: Provided by AcadsocmerryNo ratings yet

- Teacher Book For: Rainbow Bridge (H5) Trial LessonsDocument14 pagesTeacher Book For: Rainbow Bridge (H5) Trial LessonsmerryNo ratings yet

- Internationally Accredited English For Young Learners CEFR Cert.Document29 pagesInternationally Accredited English For Young Learners CEFR Cert.merryNo ratings yet

- Chapter 6 Manufacturing Overhead Accounting Overapplied UnderappliedDocument39 pagesChapter 6 Manufacturing Overhead Accounting Overapplied UnderappliedmerryNo ratings yet

- Partnership Session 9 Limited PDocument5 pagesPartnership Session 9 Limited PmerryNo ratings yet

- GE ELEC2 Silabus Rev. Sept 2021Document8 pagesGE ELEC2 Silabus Rev. Sept 2021merryNo ratings yet

- This Study Resource Was: AnswerDocument2 pagesThis Study Resource Was: AnswermerryNo ratings yet

- Banking Management Chapter 01Document8 pagesBanking Management Chapter 01AsitSinghNo ratings yet

- NGAS LectureDocument56 pagesNGAS LectureVenianNo ratings yet

- Risk Management in Islamic Banks A Case Study of The Faisal Islamic Bank of EgyptDocument9 pagesRisk Management in Islamic Banks A Case Study of The Faisal Islamic Bank of EgyptOsamaIbrahimNo ratings yet

- Chapter - 1: 1.1 Introduction To Asian Paints LTDDocument97 pagesChapter - 1: 1.1 Introduction To Asian Paints LTDSingh ManpreetNo ratings yet

- Bank Stress Testing and Comprehensive Capital Assessment and Review (CCAR)Document34 pagesBank Stress Testing and Comprehensive Capital Assessment and Review (CCAR)Xiaohu ZhangNo ratings yet

- ArcelorMittal - Fact Book 2011Document110 pagesArcelorMittal - Fact Book 2011Ayam Zeboss100% (1)

- Chapter 27 Cash and Liquidity ManagementDocument20 pagesChapter 27 Cash and Liquidity ManagementPratik GanatraNo ratings yet

- Risk Diversification Benefits of Multiple-Stock Portfolios: Holding Between One and One Hundred StocksDocument8 pagesRisk Diversification Benefits of Multiple-Stock Portfolios: Holding Between One and One Hundred StocksDonny FirmansyahNo ratings yet

- Business Strategy ModuleDocument7 pagesBusiness Strategy ModulesafdsfdjlkjjNo ratings yet

- Worksheets 2022 FarDocument7 pagesWorksheets 2022 FarMariñas, Romalyn D.No ratings yet

- Books of Account and Companies Act, 2013Document16 pagesBooks of Account and Companies Act, 2013Jayshree ChoudharyNo ratings yet

- Irr AmlaDocument204 pagesIrr AmlaTon DrioNo ratings yet

- AIG Annual Report 2007Document276 pagesAIG Annual Report 2007highfinance100% (4)

- Company - Jain Irrigation System LTDDocument31 pagesCompany - Jain Irrigation System LTDNoor_DawoodaniNo ratings yet

- Beginners Guide To VCDocument19 pagesBeginners Guide To VCAnthonyDiMinnoNo ratings yet

- Akre Focus Fund Commentary First Quarter 2021Document2 pagesAkre Focus Fund Commentary First Quarter 2021Pranab PattanaikNo ratings yet

- Economic Highlights - Proposals by Pemandu To Cut Subsidies - 31/5/2010Document3 pagesEconomic Highlights - Proposals by Pemandu To Cut Subsidies - 31/5/2010Rhb InvestNo ratings yet

- Presidential Decree No. 1146Document15 pagesPresidential Decree No. 1146SocNo ratings yet

- Framework For Business AnalysisDocument10 pagesFramework For Business AnalysismkhanmajlisNo ratings yet

- Okoth Benard Odhiambo G34/30691/2015 Devolution Discuss The Various Sources of County FinancesDocument10 pagesOkoth Benard Odhiambo G34/30691/2015 Devolution Discuss The Various Sources of County FinancesBenard Odhiambo OkothNo ratings yet

- ACC205 Week1 AssignmentDocument17 pagesACC205 Week1 Assignmentmagickbear70No ratings yet

- HSBC Project-1Document62 pagesHSBC Project-1Arpit MishraNo ratings yet

- Cpale Cpa Exam Far 1 PDFDocument6 pagesCpale Cpa Exam Far 1 PDFJohn Rashid HebainaNo ratings yet

- ABM NumericalsDocument38 pagesABM NumericalsBasavaraj GadadavarNo ratings yet

- FM - Chapter 32Document5 pagesFM - Chapter 32Amit SukhaniNo ratings yet

- Diversification of RisksDocument14 pagesDiversification of RisksManisha MehtaNo ratings yet