Professional Documents

Culture Documents

ELEC2 - Module 1 - Fundamentals Principles of Valuation

ELEC2 - Module 1 - Fundamentals Principles of Valuation

Uploaded by

Maricar Pineda0 ratings0% found this document useful (0 votes)

515 views32 pagesOriginal Title

ELEC2_Module 1_Fundamentals Principles of Valuation

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

515 views32 pagesELEC2 - Module 1 - Fundamentals Principles of Valuation

ELEC2 - Module 1 - Fundamentals Principles of Valuation

Uploaded by

Maricar PinedaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 32

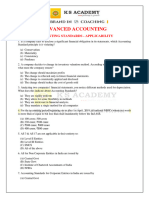

CHAPTER 1

FUNDAMENTALS

PRINCIPLES OF

VALUATION

This Photo by Unknown Author is licensed under CC BY-SA

Department of Accountancy – MGT7A-Financial Management

LEARNING OUTCOME

• Define Valuation.

• Identify the role of valuation in the business

world.

• Enumerate the Key principles in Valuation.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

LEARNING CONTENTS

• Fundamentals Principles of Valuation

• Interpreting different Concepts of Value

• Roles of Valuation in Business

• Valuation Process

• Key principles in Valuation

• Risks in Valuation

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

FUNDAMENTALS PRINCIPLES OF VALUATION

• Valuation is the estimation of an asset’s value based

on variables perceived to be related to future

investment returns, on comparison with similar assets

or, when relevant, on estimates of immediate

liquidation proceeds. (CFA)

• Includes the use of forecasts to come up with

reasonable estimate of value of an entity’s assets or its

equity.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

FUNDAMENTALS PRINCIPLES OF VALUATION

• Valuation techniques may differ across different

assets, but all follow similar fundamentals principles

that drive the core of these approaches.

• Valuation places great emphasis on the professional

judgment that are associated in the exercise.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

FUNDAMENTALS PRINCIPLES OF VALUATION

• Valuation mostly deals with projections about future

events, analysts should hone their ability to balance

and evaluate different assumptions used in each phase

of the valuation exercise, assess validity of available

empirical evidence and come up with rational choices

that align with the ultimate objective of the valuation

activity.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

INTERPRETING DIFFERENT CONCEPTS OF VALUATION

• In corporate setting, the fundamental equation of value is

grounded on that principle as popularized by Alfred Marshall:

• A company creates value if and only if the return on invested

capital exceed the cost of acquiring capital.

• Value in the point of view of the corporate shareholders, relates to

the difference between cash inflows generated by an investment

and the cost associated with the capital invested which captures

both time value of money and risk premium.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

INTERPRETING DIFFERENT CONCEPTS OF VALUATION

The value of a business can be basically linked to three major

factors:

• Current operations – how is the operating performance of the firm

in recent year?

• Future prospects – what is the long-term, strategic direction of the

company?

• Embedded risk – what are the business risks involved in running

the business?

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

OBJECTIVE OF THE VALUATION EXERCISE

Intrinsic Value – refers to the value of any asset based on the

assumption assuming there is a hypothetically complete

understanding of its investment characteristics. It is the

value that an investor considers, on the basis of an

evaluation or available facts, to be the “true” or “real” value

that will become the market value when other investors

reach the same conclusion.

Going Concern Value – the going concern assumption believes

that the entity will continue to do its business activities into

the foreseeable future.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

OBJECTIVE OF THE VALUATION EXERCISE

Liquidation Value – the net amount that would be realized if

the business is terminated and the assets are sold

piecemeal. It is particularly relevant for companies who are

experiencing severe financial distress.

Fair Market Value – the price, expressed in terms of cash

equivalents, at which property would change hands

between a hypothetical willing and able buyer and a

hypothetical willing and able seller, acting at arm’s length in

an open and unrestricted market, when neither is under

compulsion to buy or sell and when both have reasonable

knowledge of the relevant facts

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

ROLES OF VALUATION IN BUSINESS

Portfolio Management

• Fundamental Analysts – these are persons who are interested in

understanding and measuring the intrinsic value of a firm.

Fundamentals refer to the characteristics of an entity related to its

financial strength, profitability or risk appetite.

• Activist Investors – activist investors tend to look for companies

with good growth prospects that have poor management. Activist

investors usually do “takeovers” – they use their equity holdings to

push old management out of the company and change the way

the company is being run.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

ROLES OF VALUATION IN BUSINESS

Portfolio Management

• Chartists – they rely on the concept that stock prices are

significantly influenced by how investors think and act and on

available trading KPIs such as price movements, trading volume,

short sales – when making their investment decisions.

• Information Traders – they react based on new information about

firms that are revealed to the stock market. The underlying belief

is that information traders are more adept in guessing or getting

new information about firms and they can make predict how the

market will react based on this.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

ROLES OF VALUATION IN BUSINESS

Portfolio Management

Activities can be performed through the use of valuation

techniques:

• Stock selection – Is a particular asset fairly priced, overpriced, or

underpriced in relation to its prevailing computed intrinsic value

and prices of comparable assets?

• Deducing market expectations – which estimates of a firm’s future

performance are in line with the prevailing market price of its

stocks? Are there assumptions about fundamentals that will justify

the prevailing price?

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

ROLES OF VALUATION IN BUSINESS

Analysis of Business Transactions/Deals

• Acquisition – an acquisition usually has two parties: the

buying firm that needs to determine the fair value of the

target company prior to offering a bid price and the selling

firm who gauge reasonableness of bid offers.

• Merger – transaction of two companies combined to form

a wholly new entity.

• Divestiture – sale of a major component or segment of a

business to another company.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

ROLES OF VALUATION IN BUSINESS

Analysis of Business Transactions/Deals

• Spin-off – separating a segment or component business

and transforming this into a separate legal entity whose

ownership will be transferred to shareholders.

• Leverage buyout – acquisition of another business by

using significant debt which uses the acquired business as

a collateral.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

ROLES OF VALUATION IN BUSINESS

Analysis of Business Transactions/Deals

Two important unique factors:

• Synergy – potential increase in firm value that can be

generated once two firms merge with each other.

• Control – change in people managing the organization

brought about by the acquisition.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

ROLES OF VALUATION IN BUSINESS

Corporate finance involves managing the firm’s structure, including

funding sources and strategies that the business should pursue to

maximize firm value.

Legal and Tax Purposes. Valuation is also important to businesses

because of tax and legal purposes.

Other Purposes

• Issuance of a fairness opinion for valuations provided by third

party.

• Basis for assessment of potential lending activities by financial

institutions.

• Shared-based payment/compensation.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

VALUATION PROCESS

• 5 steps in the valuation process

• Understanding the business – it includes performing industry and

competitive analysis and analysis of publicly available financial

information and corporate disclosures. An investor should be able to

encapsulate the industry structure. One of the most common tools used

in encapsulating industry is Porter’s Five Forces:

➢Industry Rivalry refers to the nature and intensity of rivalry between

market players in the industry.(market players, degree of differentiation,

switching costs, information and government restraints)

➢New Entrants refers to the barriers to entry to industry by new

entrants. (entry costs, speed adjustment, economies of scale,

reputation, switching costs, sunk costs and government restraints.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

VALUATION PROCESS

Porter’s Five Forces:

➢Substitutes and Complements – this refers to the relationships

between interrelated products and services in the industry. (prices of

substitute products/services, complement products/services and

government limitations.

➢Supplier Power – refers to how suppliers can negotiate better terms in

their favor. ( supplier concentration, prices of alternative inputs,

relationship-specific investments, supplier switching costs and

government regulations

➢Buyer Power –pertains to how customers can negotiate better terms in

their favor for products/services they purchase. (buyer concentration,

value of substitute products, customer switching costs and government

restraints.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

VALUATION PROCESS

Competitive position refers to how the products, services and the

company itself is set apart from other competing market players.

Generic Corporate Strategies to achieve Competitive Advantage

• Cost leadership – incurring the lowest cost among market players

with quality that is comparable to competitors allow the firm to be

price products around the industry average.

• Differentiation – offering differentiated or unique product or

service characteristics that customers are willing to pay for an

additional premium.

• Focus – identifying specific demographic segment or category

segment to focus on by using cost leadership strategy or

differentiation strategy.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

VALUATION PROCESS

Understanding company’s business model – business model

pertains to the method how the company makes money – what are

products or services they offer, how they deliver and provide these

to customers and their target customers.

The results of execution of aforementioned strategies will ultimately

be reflected in the company performance results contained in the

financial statements.

Analysis of historical financial reports typically use horizontal,

vertical and ratio analysis.

Typical sources of information about companies can be found in

government-mandated disclosures like audited financial statements.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

VALUATION PROCESS

In analyzing historical financial information, focus is afforded in

looking at quality of earnings.

Quality of earnings analysis pertain to the detailed review of

financial statements and accompanying notes to assess

sustainability of company performance and validate accuracy of

financial information versus economic reality.

During analysis, transactions that are nonrecurring such as financial

impact of litigation settlements, temporary tax reliefs or gains/losses

on sales of nonoperating assets might need to be adjusted to arrive

at the performance of the firm’s core business.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

VALUATION PROCESS

Quality of earnings analysis also compares net income against operating cash

flow to make sure reported earnings are actually realizable to cash and are not

padded through significant accrual entries. Typical observations that analysts

can derive from financial statements are listed below:

Line item Possible Observation Possible Interpretation

Revenues and gain Early recognition of revenues Accelerated revenue recognition

(e.g. bill-and-hold sales, sales improves income and can be

recognition prior to installation used to hide declining

and acceptance of customer performance

Inclusion of nonoperating Nonrecurring gains that do not

income or gains as part of relate to operating performance

operating income may hide declining

performance.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

VALUATION PROCESS

Line item Possible Observation Possible Interpretation

Expenses and Recognition of too high little Too little reserves may improve

losses reserves (e.g. restructuring, bad current year income but might affect

debts) future income (and vice versa)

Deferral of expenses such as May improve current income but will

customer acquisition or product reduce future income. May hide

development costs by declining performance.

capitalization.

Aggressive assumptions such as Aggressive estimates may imply that

long useful lives, lower asset there are steps taken to improve

impairment, high assumed current year income. Sudden

discount rate for pension liabilities changes in estimates may indicate

or high expected return on plan masking of potential problems in

assets. operating performance.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

VALUATION PROCESS

Line item Possible Observation Possible Interpretation

Balance sheet Off-balance sheet financing (those Assets/liabilities may not be fairly

items not reflected in the face of the reflected

balance sheet) like leasing or

securitizing receivables.

Operating cash Increase in bank overdraft as Potential artificial inflation in

flows operating cash flow operating cash flow.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

VALUATION PROCESS

• Forecasting financial performance – can be looked at two

perspectives: on a macro perspective viewing the economic

environment and industry where the firm operates in and micro

perspective focusing in the firm’s financial and operating

characteristics.

• Two Approaches of Forecast Financial Performance

➢Top down forecasting approach – international or national

macroeconomic projections with utmost consideration to industry

specific forecasts.

➢Bottom-up forecasting approach – forecast starts from the lower

levels of the firm and builds the forecast as it captures what will

happen to the company based on the inputs of its segments/units

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

VALUATION PROCESS

• Selecting the right valuation model – it depends on the context

of the valuation and the inherent characteristics of the company

being valued.

• Preparing valuation model based on forecasts – there are two

aspects to be considered:

➢Sensitivity analysis – common methodology in valuation exercises

wherein multiple other analyses are done to understand how

changes in an input or variable will affect the outcome.

➢Situational adjustments – firm specific issues that affects firm

value that should be adjusted by analysts since these are events

that are not quantified if analysts only look at core business

operations.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

VALUATION PROCESS

• Applying valuation conclusions and providing

recommendations

Once the value is calculated based on all assumptions

considered, the analysts and investors use the results to

provide recommendations or make decisions thar suits

their investment objectives

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

KEY PRINCIPLES IN VALUATION

• The value of a business is defined only at a specific point in time.

Business value tend to change every day as transactions happens.

• Value varies based on the ability of business to generate future

cash flows.

General concepts for most valuation techniques put emphasis

future cash flows except for some circumstances where value can

be better derived from asset liquidation

• Market dictates the appropriate rate of return for investors.

Market forces are constantly changing, and they normally provide

guidance of what rate of return should investors expect from

different investment vehicles in the market.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

KEY PRINCIPLES IN VALUATION

• Firm value can be impacted by underlying net tangible assets.

Business valuation principles look at the relationship between

operational value of an entity and net tangible of its assets.

• Value is influenced by transferability of future cash flows.

Transferability of future cash flows is also important especially to

potential acquirers

• Value is impacted by liquidity.

This principle is mainly dictated by the theory of demand and

supply.

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

RISKS IN VALUATION

Uncertainty refers to the possible range of values where the real

firm lies. When performing any valuation method, analysts will

never be sure if they have accounted and included all potential risks

that may affect price of assets.

Aspects that contributes uncertainty

• Future estimates

• Use of judgment

• Business performance

• Innovations and entry of new businesses

Department of Accountancy – ELEC2 –Valuation Concepts and Methods

Source: Valuation Concepts and Methodologies

By: Marvin V. Lascano, Herbert C. Baron and Andrew Timothy L. Cachero

THANK YOU

STAY SAFE

This Photo by Unknown Author is licensed under CC BY-SA

Department of Accountancy – ELEC2

You might also like

- Chapter 1 - Approaches To Operational AuditingDocument7 pagesChapter 1 - Approaches To Operational AuditingMendoza, Kristine Joyce M.100% (1)

- APPLIED AUDITING 2018 Edition Updates and Editorial Corrections PDFDocument4 pagesAPPLIED AUDITING 2018 Edition Updates and Editorial Corrections PDFMelvin Jan Sujede100% (1)

- ACC 213 Strategic Cost Management Rev. 0 1st Sem SY 2019-2020Document9 pagesACC 213 Strategic Cost Management Rev. 0 1st Sem SY 2019-2020Rogel DolinoNo ratings yet

- Chapter 25 - Substantive Test of LiabilitiesDocument10 pagesChapter 25 - Substantive Test of LiabilitiesQuijano GpokskieNo ratings yet

- Specialized Industries GalvezDocument1 pageSpecialized Industries GalvezChristian GalvezNo ratings yet

- Valuation Concepts and Methods Introduction To ValuationDocument18 pagesValuation Concepts and Methods Introduction To ValuationPatricia Nicole BarriosNo ratings yet

- Valuation Concepts and Methods Sample ProblemsDocument2 pagesValuation Concepts and Methods Sample Problemswednesday addams100% (1)

- Chapter 5Document40 pagesChapter 5Celine ClaudioNo ratings yet

- Quiz 1Document2 pagesQuiz 1Princess Frean VillegasNo ratings yet

- System of Quality Control (Final) PDFDocument7 pagesSystem of Quality Control (Final) PDFMica R.No ratings yet

- OBE Auditing SYLLABUS JRiveraDocument6 pagesOBE Auditing SYLLABUS JRiveraK-Cube MorongNo ratings yet

- Module 2 Phases in Operational AuditingDocument11 pagesModule 2 Phases in Operational AuditingJeryco Quijano BrionesNo ratings yet

- Completing The Audit CycleDocument74 pagesCompleting The Audit CycleIryne Kim PalatanNo ratings yet

- Opertions Auditing - SyllabusDocument4 pagesOpertions Auditing - SyllabusMARIA THERESA ABRIONo ratings yet

- Auditing in CIS Environment Review of Auditing ConceptsDocument8 pagesAuditing in CIS Environment Review of Auditing ConceptsSani BautisTaNo ratings yet

- SYLLAB - 00accounting Information SystemDocument6 pagesSYLLAB - 00accounting Information SystemEfren100% (1)

- SEC Code of Corporate GovernanceDocument27 pagesSEC Code of Corporate GovernancePipz G. CastroNo ratings yet

- ACCT202 Accounting For Business CombinationsDocument8 pagesACCT202 Accounting For Business CombinationsMiles SantosNo ratings yet

- I. General Provisions Basic Standards and PoliciesDocument19 pagesI. General Provisions Basic Standards and Policiesedelmay CariateNo ratings yet

- Course Syllabus: Christine Joy D. Carmona Rizalina B. Ong 2019-2020/1 Term OVPAA-034-02Document4 pagesCourse Syllabus: Christine Joy D. Carmona Rizalina B. Ong 2019-2020/1 Term OVPAA-034-02Christine CarmonaNo ratings yet

- With Diclosure On Transition To The Pfrs For Ses, See Below Example in No.18Document2 pagesWith Diclosure On Transition To The Pfrs For Ses, See Below Example in No.18Allyssa Camille Arcangel100% (2)

- Chapter 1 Professional Practice of AccountancyDocument44 pagesChapter 1 Professional Practice of AccountancyVanjo MuñozNo ratings yet

- Toaz - Info WFWFW PRDocument37 pagesToaz - Info WFWFW PRLiaNo ratings yet

- Mod 1 Valuation and ConceptswDocument2 pagesMod 1 Valuation and Conceptswvenice cambryNo ratings yet

- Gonzaga - Sec1 - Exercises On Internal Control FrameworkDocument2 pagesGonzaga - Sec1 - Exercises On Internal Control FrameworkSteph GonzagaNo ratings yet

- Fundamentals of Assurance ServicesDocument22 pagesFundamentals of Assurance ServicesMargie Abad Santos100% (1)

- Mod 2 Answers - Valuation and ConceptsDocument2 pagesMod 2 Answers - Valuation and Conceptsvenice cambryNo ratings yet

- ValuationDocument3 pagesValuationBryan IbarrientosNo ratings yet

- At - (14) Internal ControlDocument13 pagesAt - (14) Internal ControlLorena Joy Aggabao100% (2)

- Share-Based PaymentsDocument10 pagesShare-Based PaymentsNoella Marie BaronNo ratings yet

- Elements of Strategic AuditDocument2 pagesElements of Strategic AuditMae ann LomugdaNo ratings yet

- MA Cabrera 2010 - SolManDocument4 pagesMA Cabrera 2010 - SolManCarla Francisco Domingo40% (5)

- Introduction To Management AccountingDocument3 pagesIntroduction To Management AccountingEi HmmmNo ratings yet

- FM QuizDocument3 pagesFM QuizSheila Mae AramanNo ratings yet

- Financial Statement Assertions... Auditing Ass. (Nikita, Pooja, Shivani)Document9 pagesFinancial Statement Assertions... Auditing Ass. (Nikita, Pooja, Shivani)Brahamdeep KaurNo ratings yet

- Audit in CIS SyllabusDocument14 pagesAudit in CIS Syllabuscarl fuerzas100% (1)

- AFAR-05: PFRS 15 - Revenue From Contracts With Customers: Construction AccountingDocument10 pagesAFAR-05: PFRS 15 - Revenue From Contracts With Customers: Construction AccountingManuNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document15 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo GironellaNo ratings yet

- The Budget Process - Quiz 1Document14 pagesThe Budget Process - Quiz 1Elvira AriolaNo ratings yet

- Fundamentals of Assurance ServicesDocument32 pagesFundamentals of Assurance ServicesDavid alfonsoNo ratings yet

- Govac Chap 6Document5 pagesGovac Chap 6Yami HeatherNo ratings yet

- Chapter 1 The Role and Environment of Managerial FinanceDocument27 pagesChapter 1 The Role and Environment of Managerial FinanceSteph BorinagaNo ratings yet

- Unit VIII Completing The AuditDocument16 pagesUnit VIII Completing The AuditMark GerwinNo ratings yet

- (PWC) Up Jpia Asset Audit Case Xyz Retail CompanyDocument7 pages(PWC) Up Jpia Asset Audit Case Xyz Retail CompanyJoyce BelenNo ratings yet

- Syllabus ACCO 20073 Cost Accounting and ControlDocument7 pagesSyllabus ACCO 20073 Cost Accounting and ControlCaia VelazquezNo ratings yet

- JAMES A. HALL - Accounting Information System Chapter 13Document45 pagesJAMES A. HALL - Accounting Information System Chapter 13Joe VaTaNo ratings yet

- Operational Auditing DefinitionDocument51 pagesOperational Auditing DefinitionJoyce Anne GarduqueNo ratings yet

- HBO MODULE1.s2020 PDFDocument4 pagesHBO MODULE1.s2020 PDFMaxVids EntertainmentNo ratings yet

- Financial ManagementDocument24 pagesFinancial ManagementMaan CabolesNo ratings yet

- ACCO 20053 - Intermediate Accounting 1Document5 pagesACCO 20053 - Intermediate Accounting 1Darryl LabradorNo ratings yet

- Overview of Legal Liability of CpaDocument15 pagesOverview of Legal Liability of CpaPankaj KhannaNo ratings yet

- Exam Notes AUI3703Document20 pagesExam Notes AUI3703Obert MarongedzaNo ratings yet

- ELEC2 - Module 3 - Liquidation Value MethodDocument31 pagesELEC2 - Module 3 - Liquidation Value MethodMaricar PinedaNo ratings yet

- ELEC2 - Module 2 - Asset Based ValuationDocument27 pagesELEC2 - Module 2 - Asset Based ValuationMaricar Pineda100% (1)

- ELEC2 - Module 6 - Market Approach ValuationDocument41 pagesELEC2 - Module 6 - Market Approach ValuationArsenio N. RojoNo ratings yet

- ELEC2 - Module 4 - Income Based ValuationDocument30 pagesELEC2 - Module 4 - Income Based ValuationMaricar Pineda100% (2)

- VALUATIONDocument4 pagesVALUATIONBHEJAY ORTIZNo ratings yet

- ELEC2 - Module 7 - Other Concepts and Valuation TechniquesDocument87 pagesELEC2 - Module 7 - Other Concepts and Valuation TechniquesMaricar PinedaNo ratings yet

- Lesson 1 - Overview of Valuation Concepts and MethodsDocument5 pagesLesson 1 - Overview of Valuation Concepts and MethodsF l o w e rNo ratings yet

- Chapter1 - Fundamental Principles of ValuationDocument21 pagesChapter1 - Fundamental Principles of ValuationだみNo ratings yet

- Module 2 The Accounting Information SystemsDocument49 pagesModule 2 The Accounting Information SystemsMaricar PinedaNo ratings yet

- Module 3 Transactions Processing CyclesDocument25 pagesModule 3 Transactions Processing CyclesMaricar PinedaNo ratings yet

- AC20 MIDTERM EXAMINATION FY21 22 - DGCupdDocument10 pagesAC20 MIDTERM EXAMINATION FY21 22 - DGCupdMaricar PinedaNo ratings yet

- Module 1 Quick Review of The Need To Study Information TechnologyDocument15 pagesModule 1 Quick Review of The Need To Study Information TechnologyMaricar PinedaNo ratings yet

- Module 4 Application of The Principles of Systems Analysis DesignDocument48 pagesModule 4 Application of The Principles of Systems Analysis DesignMaricar PinedaNo ratings yet

- ELEC2 - Module 7 - Other Concepts and Valuation TechniquesDocument87 pagesELEC2 - Module 7 - Other Concepts and Valuation TechniquesMaricar PinedaNo ratings yet

- Cdi Pre Board Answer KeyDocument6 pagesCdi Pre Board Answer KeyMaricar Pineda100% (1)

- Ac19 Module 4 - DGCDocument19 pagesAc19 Module 4 - DGCMaricar PinedaNo ratings yet

- Ac20 Quiz 3 - DGCDocument10 pagesAc20 Quiz 3 - DGCMaricar PinedaNo ratings yet

- AIS Module 8 - 11Document30 pagesAIS Module 8 - 11Maricar PinedaNo ratings yet

- ELEC2 - Module 3 - Liquidation Value MethodDocument31 pagesELEC2 - Module 3 - Liquidation Value MethodMaricar PinedaNo ratings yet

- 1700 Itr SampleDocument2 pages1700 Itr SampleMaricar PinedaNo ratings yet

- AC19 MODULE 5 - UpdatedDocument14 pagesAC19 MODULE 5 - UpdatedMaricar PinedaNo ratings yet

- Criminalistics Pre Board Answer KeyDocument6 pagesCriminalistics Pre Board Answer KeyMaricar Pineda100% (5)

- Case Study 3 - Volume Telemarketing CompanyDocument2 pagesCase Study 3 - Volume Telemarketing CompanyMaricar PinedaNo ratings yet

- ELEC2 - Module 4 - Income Based ValuationDocument30 pagesELEC2 - Module 4 - Income Based ValuationMaricar Pineda100% (2)

- Ac19 Module 1 - DGCDocument10 pagesAc19 Module 1 - DGCMaricar PinedaNo ratings yet

- AIS Module 7Document98 pagesAIS Module 7Maricar PinedaNo ratings yet

- ELEC2 - Module 2 - Asset Based ValuationDocument27 pagesELEC2 - Module 2 - Asset Based ValuationMaricar Pineda100% (1)

- Case Study 2 Carlson Department StoreDocument2 pagesCase Study 2 Carlson Department StoreMaricar PinedaNo ratings yet

- Ac20 Quiz 4 - DGCDocument8 pagesAc20 Quiz 4 - DGCMaricar PinedaNo ratings yet

- Pineda, Maricar R. CBET-01-502A: Internal FactorsDocument5 pagesPineda, Maricar R. CBET-01-502A: Internal FactorsMaricar PinedaNo ratings yet

- Quiz 2 Receivables - Solution GuideDocument8 pagesQuiz 2 Receivables - Solution GuideMaricar PinedaNo ratings yet

- Auditing Theory SkeletonDocument6 pagesAuditing Theory SkeletonMaricar PinedaNo ratings yet

- Case Study 4 - Kennedy GraphicsDocument2 pagesCase Study 4 - Kennedy GraphicsMaricar PinedaNo ratings yet

- Ac20 Exercise 1 Solution - DGCDocument6 pagesAc20 Exercise 1 Solution - DGCMaricar PinedaNo ratings yet

- Alex M. Versola: Personal InformationDocument3 pagesAlex M. Versola: Personal InformationMaricar PinedaNo ratings yet

- End of Chapter 2 ExerciesDocument11 pagesEnd of Chapter 2 ExerciesMaricar PinedaNo ratings yet

- Ac20 Quiz 1 - DGCDocument10 pagesAc20 Quiz 1 - DGCMaricar PinedaNo ratings yet

- Sabaw Ulam Gulay Isda OthersDocument1 pageSabaw Ulam Gulay Isda OthersMaricar PinedaNo ratings yet

- 50 Procurement Formulas!Document9 pages50 Procurement Formulas!ebnugroho123No ratings yet

- Problem 1 Write The Letter As Well As The Entire AnswersDocument4 pagesProblem 1 Write The Letter As Well As The Entire Answerslirva cantonaNo ratings yet

- Dabur India: Previous YearsDocument6 pagesDabur India: Previous Yearsyash mehtaNo ratings yet

- Ca Inter Advanced Accounting MCQDocument210 pagesCa Inter Advanced Accounting MCQVikramNo ratings yet

- 6.1 Non-Current Asset Held For Sale and Discontinued OperationDocument9 pages6.1 Non-Current Asset Held For Sale and Discontinued OperationMica R.100% (3)

- Annex GDocument3 pagesAnnex GREGIONAL DIRECTOR SOUTHERN TAGALOGNo ratings yet

- Chapter 4 - Cost Accumulation, Tracing and Allocation by EdmondsDocument47 pagesChapter 4 - Cost Accumulation, Tracing and Allocation by EdmondsShaeen Sarwar100% (1)

- Financial Statements ConceptsDocument6 pagesFinancial Statements ConceptsAlberto NicholsNo ratings yet

- 3004 Home Office and BranchesDocument6 pages3004 Home Office and BranchesTatianaNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument24 pagesCambridge International General Certificate of Secondary EducationbensonNo ratings yet

- Financial Accounting and Reporting: Page 1 of 4Document4 pagesFinancial Accounting and Reporting: Page 1 of 4ebshuvoNo ratings yet

- Chapter 1Document17 pagesChapter 1Kanbiro OrkaidoNo ratings yet

- Accountancy Notes PDF Class 11 Chapter 7Document4 pagesAccountancy Notes PDF Class 11 Chapter 7UwuuuuNo ratings yet

- Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +Document2 pagesFormat For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +shidupk5 pkNo ratings yet

- NCA SummaryDocument5 pagesNCA Summary465jgbgcvfNo ratings yet

- Cash Flow - Wikipedia, The Free EncyclopediaDocument4 pagesCash Flow - Wikipedia, The Free EncyclopediaSachinsuhaNo ratings yet

- Cost Two IIDocument65 pagesCost Two IIAbdi Mucee TubeNo ratings yet

- Meaning and Classification of CostDocument13 pagesMeaning and Classification of Costpooja456No ratings yet

- Answer All 30 QuestionsDocument10 pagesAnswer All 30 QuestionsNur Syazmira HarunNo ratings yet

- Accounting Slides Income StatmentDocument20 pagesAccounting Slides Income StatmentEdouard Rivet-BonjeanNo ratings yet

- Complex GroupDocument5 pagesComplex Grouptαtmαn dє grєαtNo ratings yet

- Multiple Choice: Property of STIDocument2 pagesMultiple Choice: Property of STIJanineD.MeranioNo ratings yet

- Problem Sheet Agr323Document8 pagesProblem Sheet Agr323ammarsalleh20No ratings yet

- Quiz 1 Cost AccountingDocument3 pagesQuiz 1 Cost AccountingKryss Clyde TabliganNo ratings yet

- Commission On Audit: Dr. Josephine B. SabandoDocument3 pagesCommission On Audit: Dr. Josephine B. SabandoNikolai Avery NorthNo ratings yet

- User Manual of Microfin360Document43 pagesUser Manual of Microfin360Song Of Religion100% (1)

- Ind AS36 1Document2 pagesInd AS36 1Nishant NagpurkarNo ratings yet

- Revision ch3 1thDocument18 pagesRevision ch3 1thYousefNo ratings yet

- AFM-Assignment-2021: Trial Balance As On 31 March 2015Document1 pageAFM-Assignment-2021: Trial Balance As On 31 March 2015SILLA SAIKUMARNo ratings yet