Professional Documents

Culture Documents

ACCT6083003 MID RCQuestion

ACCT6083003 MID RCQuestion

Uploaded by

asdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT6083003 MID RCQuestion

ACCT6083003 MID RCQuestion

Uploaded by

asdCopyright:

Available Formats

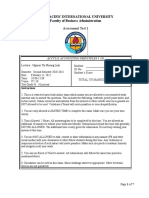

FM-BINUS-AA-FPU-78/V2R0

BINUS University

Academic Career: Class Program:

Undergraduate / Master / Doctoral *) International/Regular/Smart Program/Global Class*)

√ Mid Exam Final Exam Term : Odd/Even/Short *)

Short Term Exam Others Exam : _____________

√ Kemanggisan √ Alam Sutera √ Bekasi Academic Year :

Senayan Bandung Malang 2021 / 2022

Faculty / Dept. : Economics & Communication & School of Deadline Day / Date : Monday / 29 Nov 2021

Information Systems / Accounting & Time : 13:00:00

Finance ; Accounting & Information

Systems

Code - Course : ACCT6083020 / ACCT6083003 - Class : LA16, LA53, LA55,

Advanced Accounting LB53, LB55, LC53,

LD53, LE53, LF53, LG53

Lecturer : Team Exam Type : Online

) Strikethrough the unnecessary items

The penalty for CHEATING is DROP OUT!!!

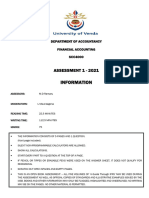

INFORMATION :

• LO 1: Explain the concept of business combination, concept of group reporting, and

insolvency

• LO 2: Prepare The Consolidated Financial Statement on the Date and After the

Acquisition

• LO 3: Prepare Consolidated Working Papers for Inter Company Sales of Inventory,

Property, Equipment, and Bond using Cost and Complete Equity Methods

1a. (10 marks) (LO1) Under the economic entity concept, the net assets of the subsidiary will

be recorded at their fair value that is implied by the price paid by the parent company in their

consolidated financial statements. What will the conceptual problems be if those valuation

approaches are implemented?

b. (5 marks) (LO1) Since its enactment, PSAK 22: Business Combinations must be applied to all

acquisitions. Explain how the treatment for goodwill should be based on PSAK 22.

c. (10 marks) (LO1) From a consolidated point of view, when should the profit be recognized

on intercompany sales of depreciable assets and non-depreciable assets?

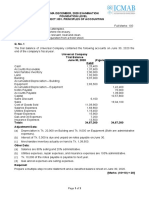

2.(34 marks) (LO2) On July 1, 2014, Pipe Corporation issued 23,000 shares of its own $2 par

value common stock for 40,000 shares of the outstanding stock of Sector Inc. in an

acquisition. Pipe common stock at July 1, 2014 was selling at $16 per share. Just before the

business combination, balance sheet information of the two corporations was as follows:

Pipe Sector Sector

Verified by,

[Silvia Dewiyanti] (D5893) and sent to Department/Program on OCT 31, 2021

Page 1 of 3

FM-BINUS-AA-FPU-78/V2R0

Book Book Fair

Value Value Value

Cash $25,000 $17,000 $17,000

Inventories 55,000 42,000 47,000

Other current assets 110,000 40,000 30,000

Land 100,000 45,000 35,000

Plant and equipment-net 660,000 220,000 280,000

$950,000 $364,000 $409,000

Liabilities $220,000 $70,000 $75,000

Capital stock, $2 par value 500,000 100,000

Additional paid-in capital 170,000 90,000

Retained earnings 60,000 104,000

$950,000 $364,000

Required:

1. Prepare the journal entry on Pipe Corporation's books to account for the investment in

Sector Inc. (6 marks)

2. Prepare a consolidated balance sheet for Pipe Corporation and Subsidiary immediately

after the business combination. (28 marks)

3. (13 marks) (LO3) Peter Corporation acquired an 80% interest in Stern Corporation several

years ago when the book values and fair values of Stern's assets and liabilities were equal. At

the time of acquisition, the cost of the 80% interest was equal to 80% of the book value of

Stern's net assets. Separate company income statements for Peter and Stern for the year

ended December 31, 2014 are summarized as follows:

Peter Stern

Sales Revenue $1,000,000 $600,000

Investment income from Stern 85,000

Cost of Goods Sold (600,000) (300,000)

Expenses (200,000) (200,000)

Net Income $285,000 $100,000

During 2013, Peter sold merchandise that cost $120,000 to Stern for $180,000. Half of this

merchandise remained in Stern's inventory at December 31, 2013. During 2014, Peter sold

merchandise that cost $150,000 to Stern for $225,000. One-third of this merchandise

remained in Stern's December 31, 2014 inventory.

Required:

Prepare a consolidated income statement for Peter Corporation and Subsidiary for 2014.

Verified by,

[Silvia Dewiyanti] (D5893) and sent to Department/Program on OCT 31, 2021

Page 2 of 3

FM-BINUS-AA-FPU-78/V2R0

4. (16 points) (LO3) Paka Corporation owns an 80% interest in Sandra Company. Paka acquired

Sandra's bonds on January 2, 2014. The following information is from the adjusted trial

balances at December 31, 2014, at which time the bonds have three years to maturity. The

bonds have interest payment dates of January 1 and July 1. Straight-line amortization is used

by both companies.

Paka Sandra

Investment in Sandra Bonds, $100,000 par 98,500

7% Bonds payable, $200,000 200,000

Bond premium 6,000

Interest expense 12,000

Interest receivable 7,000

Interest income 7,500

Interest payable 7,000

Required:

Prepare the necessary consolidation working paper entries on December 31, 2014 with

respect to the intercompany bonds.

5. (12 marks) (LO1) In 1 January 2016, PT ABC paid Rp 2 million for 30% shares of PT Willow.

Accumulated loss of PT Willow for 3 years ended 31 Dec 2018 is Rp 10 million.

Based on PSAK 15, Explain how these transactions will be recorded in the book of PT ABC.

GOOD LUCK

- It’s always seem impossible until its done - Nelson Mandela

Verified by,

[Silvia Dewiyanti] (D5893) and sent to Department/Program on OCT 31, 2021

Page 3 of 3

You might also like

- Activities and AssessmentDocument38 pagesActivities and AssessmentOrlean Mae Casiño Lacaba100% (7)

- ReSA B46 AFAR Final PB Exam Questions Answers SolutionsDocument24 pagesReSA B46 AFAR Final PB Exam Questions Answers SolutionsJohair BilaoNo ratings yet

- Prof. Francis O. Mateos, CPA: Bappaud - Applied AuditingDocument5 pagesProf. Francis O. Mateos, CPA: Bappaud - Applied AuditingElisha Batalla80% (5)

- Investment Quizzers Investment QuizzersDocument16 pagesInvestment Quizzers Investment QuizzersAnna Taylor0% (1)

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document5 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )johanes ongoNo ratings yet

- ACCT6003 Assessment 2 T1 2020 Brief PDFDocument7 pagesACCT6003 Assessment 2 T1 2020 Brief PDFbhavikaNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Commerce)Document5 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Commerce)Abdullah ShahNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document3 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )annisaNo ratings yet

- 2020-12 ICMAB FL 001 PAC Year Question December 2020Document3 pages2020-12 ICMAB FL 001 PAC Year Question December 2020Mohammad ShahidNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document3 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Anita RatnawatiNo ratings yet

- Ca Zambia June 2021 QaDocument415 pagesCa Zambia June 2021 QaESGNo ratings yet

- Accounts and Statistics 2Document41 pagesAccounts and Statistics 2BrightonNo ratings yet

- Assessment Test 1 - Without KeyDocument7 pagesAssessment Test 1 - Without KeyNicolas ErnestoNo ratings yet

- Baking HistoryDocument28 pagesBaking HistoryBryan Kyle ReyesNo ratings yet

- Accounting 1 Funal F 20Document3 pagesAccounting 1 Funal F 20Pak KhNo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- Final Exam July 2021 QQDocument8 pagesFinal Exam July 2021 QQLampard AimanNo ratings yet

- Intermediate Accounting ExamDocument6 pagesIntermediate Accounting ExamPISONANTA KRISETIANo ratings yet

- Assign 1& 2Document8 pagesAssign 1& 2AreebaNo ratings yet

- Afinassign1 PDFDocument6 pagesAfinassign1 PDFJoseph Mwezi MunukayumbwaNo ratings yet

- Resource Booklet Jun 2021Document8 pagesResource Booklet Jun 2021ElenaNo ratings yet

- MC 4 Inventories QUESTIONDocument4 pagesMC 4 Inventories QUESTIONNaaNo ratings yet

- BACC 416 Assignment 1 - QuestionsDocument6 pagesBACC 416 Assignment 1 - QuestionsnedaNo ratings yet

- ACC601 Xero Assignment S1 2020 v1 PDFDocument9 pagesACC601 Xero Assignment S1 2020 v1 PDFbhavikaNo ratings yet

- December 2021 CA Zambia QaDocument403 pagesDecember 2021 CA Zambia QaChisanga Chiluba100% (1)

- Check - Chapter 10 - She Part 1Document4 pagesCheck - Chapter 10 - She Part 1ARNEL CALUBAGNo ratings yet

- 2023spring Intro Assign4solDocument5 pages2023spring Intro Assign4solHamayun KhanNo ratings yet

- Nov 2022 Pathfinder SkillsDocument173 pagesNov 2022 Pathfinder SkillsEniola OlakunleNo ratings yet

- SCC 4000 Assessment 1 - 2021 Information 1LMDocument5 pagesSCC 4000 Assessment 1 - 2021 Information 1LMOdzulaho DemanaNo ratings yet

- Tutorial Questions Budgeting 2021Document10 pagesTutorial Questions Budgeting 2021nestory007No ratings yet

- FIA132 - Supplementary and Special Assessment NOVEMBER 2022Document8 pagesFIA132 - Supplementary and Special Assessment NOVEMBER 2022kaityNo ratings yet

- Acctg 41 DepartmentalDocument12 pagesAcctg 41 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- Uts 2021 2Document7 pagesUts 2021 2Wahyudi SyaputraNo ratings yet

- f2 Financial Accounting August 2015Document18 pagesf2 Financial Accounting August 2015Saddam HusseinNo ratings yet

- Allam Iqbal Open University, Islamabad: WarningDocument4 pagesAllam Iqbal Open University, Islamabad: WarningNoo UllahNo ratings yet

- Foreign Currency Transaction and TranslationDocument4 pagesForeign Currency Transaction and TranslationKrizia Mae Flores100% (1)

- Cta 2&Ft Applied Financial Accounting Reporting 2022 Test 1 - Scenario - TDDocument9 pagesCta 2&Ft Applied Financial Accounting Reporting 2022 Test 1 - Scenario - TDTakudzwa MashiriNo ratings yet

- Audit of Liabilities QuizDocument13 pagesAudit of Liabilities QuizAldrin DagamiNo ratings yet

- Bcom Y3 Acc3 12 August 2021 s1Document4 pagesBcom Y3 Acc3 12 August 2021 s1Ntokozo Siphiwo Collin DlaminiNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document5 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Martha Wulan TumangkengNo ratings yet

- Uj 38055+SOURCE1+SOURCE1.1Document11 pagesUj 38055+SOURCE1+SOURCE1.1khumalolusanda3No ratings yet

- Case Study InformationDocument3 pagesCase Study InformationNafilah RahmaNo ratings yet

- Professional MARCH... JULY 2020 #IfrsiseasyDocument172 pagesProfessional MARCH... JULY 2020 #IfrsiseasyJason Baba KwagheNo ratings yet

- June2023 - Dec 2020 FinanceDocument105 pagesJune2023 - Dec 2020 FinancebinuNo ratings yet

- Suggested CAP II Group II June 2023Document61 pagesSuggested CAP II Group II June 2023pratyushmudbhari340No ratings yet

- 2020-21 - HYE - QP - Accountancy - SET A - XII - PDFDocument3 pages2020-21 - HYE - QP - Accountancy - SET A - XII - PDFLakshay SethNo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- SHE2Document11 pagesSHE2sabit.michelle0903No ratings yet

- Mojks Uas 2010 GasalDocument13 pagesMojks Uas 2010 GasalHayyin Nur AdisaNo ratings yet

- Jan Cge201 Student Version 2021-2Document7 pagesJan Cge201 Student Version 2021-2ScribdTranslationsNo ratings yet

- Universitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Document3 pagesUniversitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Yoga SiahaanNo ratings yet

- 7001 Assignment #1Document6 pages7001 Assignment #1南玖No ratings yet

- Activity - Chapter 6 - Statement of Cash FlowsDocument4 pagesActivity - Chapter 6 - Statement of Cash FlowsKaren RiraoNo ratings yet

- Acct 4010 Ch2-Handout-QDocument4 pagesAcct 4010 Ch2-Handout-Qlokyee801mikiNo ratings yet

- ACC2002 Practice 1Document9 pagesACC2002 Practice 1Đan LêNo ratings yet

- Pengantar AkuntansiDocument2 pagesPengantar AkuntansiYohana NataliaNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Audit Pre TestDocument13 pagesAudit Pre Testpwcpresident.nfjpia2324No ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- HCM TRG UkDocument4 pagesHCM TRG UkAditya DeshpandeNo ratings yet

- Fundamentals of Accounting IiDocument39 pagesFundamentals of Accounting IiMintayto TebekaNo ratings yet

- Chap 2 National Income AccountingDocument57 pagesChap 2 National Income AccountingDashania GregoryNo ratings yet

- Bir Ruling Da 427 06Document5 pagesBir Ruling Da 427 06JM Dela PazNo ratings yet

- LK Kosong PT JayatamaDocument23 pagesLK Kosong PT JayatamaREZA ADITYA PRATAMANo ratings yet

- Long Term Capital GainDocument18 pagesLong Term Capital GainSTNo ratings yet

- FA Dec 2022Document8 pagesFA Dec 2022Shawn LiewNo ratings yet

- CHAPTER 4 Worksheet and Financial StatementsDocument6 pagesCHAPTER 4 Worksheet and Financial StatementsJeva, Marrian Jane NoolNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsRositaNo ratings yet

- Corporate Tax Planning and ManagemantDocument11 pagesCorporate Tax Planning and ManagemantVijay KumarNo ratings yet

- Chapter 6 Financial Reporting and Management Reporting System 10.2021Document15 pagesChapter 6 Financial Reporting and Management Reporting System 10.2021AMNo ratings yet

- Income Tax - Income Tax Guide 2023, Latest NewsDocument34 pagesIncome Tax - Income Tax Guide 2023, Latest NewsnandiniNo ratings yet

- 10 Column Worksheet FormDocument1 page10 Column Worksheet Formcatherinemariposa001No ratings yet

- Majid 12 3762 1 Accounting Principles and ConceptsDocument5 pagesMajid 12 3762 1 Accounting Principles and ConceptsHasnain BhuttoNo ratings yet

- Presentation of Financial Statements (IAS 1)Document30 pagesPresentation of Financial Statements (IAS 1)Ashura ShaibNo ratings yet

- Maxis - Tax Advisory On PEDocument12 pagesMaxis - Tax Advisory On PEAdamNo ratings yet

- Vicariato of Sto. Nino de Tondo: Cash and Cash Equivalent P Trade and Other Receivables, Net PDocument5 pagesVicariato of Sto. Nino de Tondo: Cash and Cash Equivalent P Trade and Other Receivables, Net PEdgardo Pajo CulturaNo ratings yet

- Dividend Yeild RatioDocument20 pagesDividend Yeild RatioTristan ManalotoNo ratings yet

- Case Study 22 - Question - PDFDocument3 pagesCase Study 22 - Question - PDFDivya MalooNo ratings yet

- Cost of Capital (Updated)Document21 pagesCost of Capital (Updated)Asmaa AlsabaaNo ratings yet

- 2021 Pre-Week - HO 5 - Taxation LawDocument18 pages2021 Pre-Week - HO 5 - Taxation LawJc AraojoNo ratings yet

- Taxation System: A Comparison Between Thailand and PhilippinesDocument2 pagesTaxation System: A Comparison Between Thailand and PhilippinesBeberlie LapingNo ratings yet

- Depreciation CasesDocument26 pagesDepreciation CasesHADTUGINo ratings yet

- Taxation of Partnerships and Partners Learning ObjectivesDocument8 pagesTaxation of Partnerships and Partners Learning ObjectivesClaire BarbaNo ratings yet

- Develop and Understand TaxationDocument26 pagesDevelop and Understand TaxationNigussie BerhanuNo ratings yet

- ACC Final Exam S1 2022Document9 pagesACC Final Exam S1 2022Vikash PatelNo ratings yet

- Xyz CT 2020Document2 pagesXyz CT 2020zhart1921No ratings yet

- Chapter 5: Accounting For Merchandising Operations: Question 1 A, B & CDocument3 pagesChapter 5: Accounting For Merchandising Operations: Question 1 A, B & CTyra CoyNo ratings yet

- Macroeconomics Study GuideDocument13 pagesMacroeconomics Study GuideChanelleNo ratings yet