Professional Documents

Culture Documents

Top 200 Fund: Fund Assure, Investment Report, October 2021 ULIF 027 12/01/09 ITT 110

Top 200 Fund: Fund Assure, Investment Report, October 2021 ULIF 027 12/01/09 ITT 110

Uploaded by

Kumar0 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

Tata Top 200 Fund

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

9 views1 pageTop 200 Fund: Fund Assure, Investment Report, October 2021 ULIF 027 12/01/09 ITT 110

Top 200 Fund: Fund Assure, Investment Report, October 2021 ULIF 027 12/01/09 ITT 110

Uploaded by

KumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

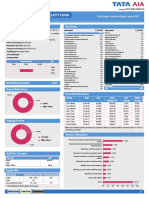

TOP 200 FUND Fund Assure, Investment Report, October 2021

ULIF 027 12/01/09 ITT 110

Fund Details Portfolio

Investment Objective: The Top 200 fund will invest primarily in select stocks and Instrument % Of NAV Instrument % Of NAV

equity linked instruments which are a part of BSE 200 Index with a focus on Equity 90.93 Ashok Leyland Ltd. 2.15

ICICI Bank Ltd. 6.32 Bharti Airtel Ltd. 2.08

generating long term capital appreciation. The fund will not replicate the index but

HDFC Bank Ltd 5.88 Gujarat Gas Ltd. 1.98

aim to attain performance better than the performance of the Index. As a defensive Reliance Industries Ltd. 4.47 Whirlpool of India Ltd 1.95

Infosys Ltd. 4.28 Supreme Industries Ltd 1.89

strategy arising out of market conditions, the scheme may also invest in debt and

Mahindra and Mahindra Ltd. 3.30 KPIT Engineering Ltd 1.88

money market instruments. APL Apollo Tubes Ltd. 3.07 Polycab India Ltd. 1.83

NAV as on 29 October, 21: `93.6146 SBI-ETF Nifty Bank 2.90 Tata Chemicals Ltd. 1.83

United Spirits Ltd 2.88 GAIL (India) Ltd. 1.82

Benchmark: S&P BSE 200 - 100% Radico Khaitan Ltd. 2.65 Navin Fluorine International Ltd 1.80

Corpus as on 29 October, 21: `493.14 Crs. SBI Cards & Payment Services Ltd 2.61 Bosch Ltd. 1.65

Fund Manager: Mr. Nitin Bansal Piramal Enterprises Ltd 2.47 Other Equity 20.29

The Federal Bank Ltd 2.27 MMI & Others 9.07

Co-Fund Manager: - Axis Bank Ltd. 2.26 Total 100.00

Investment Style Suven Pharmaceuticals Ltd 2.22

KEI Industries Ltd 2.18

Investment Style Size

Value Blend Growth

Large Fund Performance

Mid Period Date NAV S&P BSE 200 NAV INDEX

Small Change Change

Last 1 Month 30-Sep-21 93.6163 7617.01 0.00% 0.29%

Last 3 Months 30-Jul-21 88.8840 6878.74 5.32% 11.05%

Last 6 Months 30-Apr-21 77.6387 6298.84 20.58% 21.27%

Modified Duration 0.01 Last 1 Year 30-Oct-20 55.6641 4910.04 68.18% 55.58%

Last 2 Years 31-Oct-19 49.4182 4983.57 37.63% 23.81%

Asset Allocation Last 3 Years 31-Oct-18 42.0414 4440.16 30.58% 19.82%

Last 4 Years 31-Oct-17 42.5210 4541.26 21.81% 13.88%

Last 5 Years 28-Oct-16 36.0822 3754.45 21.01% 15.26%

90.93% Since Inception 12-Jan-09 10.0000 1091.37 19.09% 16.41%

9.07%

Note: The investment income and prices may go down as well as up.“Since Inception” and returns above “1 Year” are

calculated as per CAGR.

Equity

MMI & Others

Asset Mix

Instrument Asset Mix as per F&U Actual Asset Mix

Equity 60% - 100% 91%

Money Market & Others * 0% - 40% 9%

* Money Market & Others includes current assets

AUM (in Crores) Sector Allocation

Instrument Hybrid Fund AUM

Financial service activities, except insurance and

Equity 448.40 25.57%

pension funding

Debt - Manufacture of chemicals and chemical products 6.41%

MMI & Others 44.74

Computer programming, consultancy and related

6.16%

activities

Manufacture of electrical equipment 5.97%

Manufacture of motor vehicles, trailers and semi-trailers 5.34%

Manufacture of pharmaceuticals,medicinal chemical and

4.69%

botanical products

Manufacture of coke and refined petroleum products 4.47%

Land transport and transport via pipelines 3.80%

Manufacture of machinery and equipment n.e.c. 3.30%

Manufacture of rubber and plastics products 3.15%

Others 31.14%

0% 5% 10% 15% 20% 25% 30% 35%

Equity Fund Debt Fund Hybrid Fund 11

You might also like

- ProfitDocument320 pagesProfitSumit Kumar100% (1)

- Company Profile Sample PDFDocument30 pagesCompany Profile Sample PDFFrancis VicencioNo ratings yet

- Top 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110Document1 pageTop 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110editor's cornerNo ratings yet

- Multi Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110Document1 pageMulti Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110editor's cornerNo ratings yet

- Tata Multi Cap FundDocument1 pageTata Multi Cap FundJeremiah SolomonNo ratings yet

- Tata Multi Cap FundDocument1 pageTata Multi Cap FundHarsh SrivastavaNo ratings yet

- Tata India Consumption FundDocument1 pageTata India Consumption FundJeremiah SolomonNo ratings yet

- Tata Emerging Opportunities FundDocument1 pageTata Emerging Opportunities FundJeremiah SolomonNo ratings yet

- Tata Super Select Equity FundDocument1 pageTata Super Select Equity FundsanoobkarimNo ratings yet

- UTIFLEXICAPFUNDDocument2 pagesUTIFLEXICAPFUNDmeghaNo ratings yet

- Sbi Life Balanced Fund PerformanceDocument1 pageSbi Life Balanced Fund PerformanceVishal Vijay SoniNo ratings yet

- Whole Life Mid Cap Equity Fund: ULIF 009 04/01/07 WLE 110 Fund Assure, Investment Report, January 2021Document1 pageWhole Life Mid Cap Equity Fund: ULIF 009 04/01/07 WLE 110 Fund Assure, Investment Report, January 2021Abhishek BadalNo ratings yet

- Tata Super Select Equity FundDocument1 pageTata Super Select Equity FundAbdulazeezNo ratings yet

- Tata Whole Life Mid Cap Equity FundDocument1 pageTata Whole Life Mid Cap Equity FundK Dviya VennelaNo ratings yet

- SBI Multi Asset Allocation Fund FactsheetDocument1 pageSBI Multi Asset Allocation Fund FactsheetamanNo ratings yet

- Sbi Life Top 300 Fund PerformanceDocument1 pageSbi Life Top 300 Fund PerformanceVishal Vijay SoniNo ratings yet

- Equity Elite OpportunitiesDocument1 pageEquity Elite OpportunitiesdibuayroorNo ratings yet

- Canara Robeco Emerging Equities PDFDocument1 pageCanara Robeco Emerging Equities PDFJasmeet Singh NagpalNo ratings yet

- Utivalueopportunitiesfund 193Document2 pagesUtivalueopportunitiesfund 193201 TVNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- Utimidcapfund 16020220823 053119Document2 pagesUtimidcapfund 16020220823 053119meghaNo ratings yet

- Uti Children'S Career Fund - Investment Plan: JANUARY 2023Document3 pagesUti Children'S Career Fund - Investment Plan: JANUARY 2023rout.sonali20No ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- Sbi Life Bond Optimiser Fund PerformanceDocument1 pageSbi Life Bond Optimiser Fund PerformanceVishal Vijay SoniNo ratings yet

- Kotak Equity OpportunitiesDocument8 pagesKotak Equity OpportunitiesKiran VidhaniNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- Tata Mid Cap Growth Fund December 2019Document2 pagesTata Mid Cap Growth Fund December 2019ChromoNo ratings yet

- Tata Quant PortfolioDocument1 pageTata Quant PortfolioDeepanshu SatijaNo ratings yet

- SBI Small Cap PDFDocument1 pageSBI Small Cap PDFJasmeet Singh NagpalNo ratings yet

- BOP One Pager Jan 2019Document1 pageBOP One Pager Jan 2019Ashwin HasyagarNo ratings yet

- Utiniftyindexfund 12820200210 213216Document2 pagesUtiniftyindexfund 12820200210 213216VarathavasuNo ratings yet

- Equity FundDocument1 pageEquity Fundnitin choudharyNo ratings yet

- 4614 A Fact SheetDocument1 page4614 A Fact SheetAatish TNo ratings yet

- Midcap FundDocument1 pageMidcap FundAman KumarNo ratings yet

- Sbi Nifty Index Fund Factsheet (December-2020!13!11) PDFDocument1 pageSbi Nifty Index Fund Factsheet (December-2020!13!11) PDFSubscriptionNo ratings yet

- Sbi Focused Equity Fund Factsheet (May-2019!25!1)Document1 pageSbi Focused Equity Fund Factsheet (May-2019!25!1)Chandrasekar Attayampatty TamilarasanNo ratings yet

- 578380618monthly Communique May, 2022Document12 pages578380618monthly Communique May, 2022Dhairya BuchNo ratings yet

- 8ccff Pms Communique August 22Document13 pages8ccff Pms Communique August 22pradeep kumarNo ratings yet

- 590784414monthly Communique March, 2022Document12 pages590784414monthly Communique March, 2022Dhairya BuchNo ratings yet

- SBI Bluechip Fund - One PagerDocument1 pageSBI Bluechip Fund - One PagerjoycoolNo ratings yet

- Factsheet Mirae Asset Mid Cap Fund Reg (G) 61541Document2 pagesFactsheet Mirae Asset Mid Cap Fund Reg (G) 61541ksenpriNo ratings yet

- LIC Flexi Smart Growth FundDocument1 pageLIC Flexi Smart Growth FundbamneekhilNo ratings yet

- Axis Growth Opportunities FundDocument1 pageAxis Growth Opportunities FundManoj JainNo ratings yet

- Sbi Life Midcap Fund PerformanceDocument1 pageSbi Life Midcap Fund PerformanceVishal Vijay SoniNo ratings yet

- 360 ONE Equity Opportunity Fund - Apr24Document2 pages360 ONE Equity Opportunity Fund - Apr24speedenquiryNo ratings yet

- DSP Dec 2021Document97 pagesDSP Dec 2021RUDRAKSH KARNIKNo ratings yet

- Bajaj_EquityGrowth_fund_llDocument1 pageBajaj_EquityGrowth_fund_llcactusf1111No ratings yet

- BLACKSTONEDocument32 pagesBLACKSTONESeoNaYoungNo ratings yet

- Rawat Bhaskar SinghDocument13 pagesRawat Bhaskar SinghBhaskar RawatNo ratings yet

- Mid Cap Growth FundDocument1 pageMid Cap Growth FundChromoNo ratings yet

- LST ProtfolioDocument14 pagesLST ProtfolioPranjay ChauhanNo ratings yet

- Kotak Small Cap Fund - 20220201190020276Document1 pageKotak Small Cap Fund - 20220201190020276Kunal SinhaNo ratings yet

- Stocks - Stocks From This Sector Have Rallied 2,100% Expect Good Times To Roll - The Economic TimesDocument4 pagesStocks - Stocks From This Sector Have Rallied 2,100% Expect Good Times To Roll - The Economic Timeserkant007No ratings yet

- Value Product Note October-20Document2 pagesValue Product Note October-20Swades DNo ratings yet

- Daily Notes: Friday, 03 May 2024Document4 pagesDaily Notes: Friday, 03 May 2024philnabank1217No ratings yet

- Sbi Mutual FundDocument1 pageSbi Mutual Fundramana purushothamNo ratings yet

- SBI Focused Equity Fund (1) 09162022Document4 pagesSBI Focused Equity Fund (1) 09162022chandana kumarNo ratings yet

- Sbi Life Pure Fund PerformanceDocument1 pageSbi Life Pure Fund PerformanceVishal Vijay SoniNo ratings yet

- UlipDocument1 pageUlipsanu091No ratings yet

- Small Cap Fun7Document1 pageSmall Cap Fun7kumarsaurabhprincyNo ratings yet

- Midcap FundDocument1 pageMidcap Fundnitin choudharyNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Impact of Merger and Acquisition On Performance of Indian Overseas Bank: An AnalysisDocument11 pagesImpact of Merger and Acquisition On Performance of Indian Overseas Bank: An AnalysisPavithra GowthamNo ratings yet

- Entrepreneurship v1.0Document16 pagesEntrepreneurship v1.0Gde Arvindo AnandiraNo ratings yet

- SBI Life InsuranceDocument41 pagesSBI Life InsuranceSandeep Mauriya0% (1)

- Global Financial Crisis (Edited)Document7 pagesGlobal Financial Crisis (Edited)AngelicaP.Ordonia100% (1)

- Question Bank For The Final ExamDocument2 pagesQuestion Bank For The Final ExamRaktim100% (2)

- 3.2.b-Technological ChangeDocument23 pages3.2.b-Technological Changejjamppong09No ratings yet

- Annual Report 2017 18 PDFDocument212 pagesAnnual Report 2017 18 PDFWarjriNo ratings yet

- Acctg3-7 Debt SecuritiesDocument2 pagesAcctg3-7 Debt Securitiesflammy07No ratings yet

- Lesson 2: Relationship of Financial Objectives To Organizational Strategy and Objectives Learning ObjectivesDocument5 pagesLesson 2: Relationship of Financial Objectives To Organizational Strategy and Objectives Learning ObjectivesAngelyn MortelNo ratings yet

- Securities Analysis & Portfolio ManagementDocument52 pagesSecurities Analysis & Portfolio ManagementruchisinghnovNo ratings yet

- Unit 9: Management Accounting: Costing and BudgetingDocument18 pagesUnit 9: Management Accounting: Costing and Budgetingnhungnnguyen1480% (1)

- Balck MarketDocument5 pagesBalck Marketapi-305355238No ratings yet

- CHINA'S SOCIAL CREDIT SYSTEM A Big-Data Enabled Approach To Market Regulation With Broad Implications For Doing Business in ChinaDocument13 pagesCHINA'S SOCIAL CREDIT SYSTEM A Big-Data Enabled Approach To Market Regulation With Broad Implications For Doing Business in ChinaVucjipastir77No ratings yet

- 9706 w05 QP 4Document8 pages9706 w05 QP 4Jean EmanuelNo ratings yet

- Value Beat 121013Document3 pagesValue Beat 121013zarr pacificadorNo ratings yet

- Investor Day Presentation 2015 PDFDocument152 pagesInvestor Day Presentation 2015 PDFexpairtiseNo ratings yet

- Assignment 3B: Financial Report and Analysis: Course: Accounting in Organisation and SocietyDocument22 pagesAssignment 3B: Financial Report and Analysis: Course: Accounting in Organisation and SocietyAn NguyenthenamNo ratings yet

- Reasoning Skills Success in 20 Minutes A Day by LearningExpress Editors PDFDocument174 pagesReasoning Skills Success in 20 Minutes A Day by LearningExpress Editors PDFTshepo Sharky Sebe100% (1)

- Deriving The Gold Lease RateDocument1 pageDeriving The Gold Lease Ratejpkoning50% (2)

- 8001 General Paper: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersDocument11 pages8001 General Paper: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of Teachersval22788No ratings yet

- Soleadea Mock Exam 1 Level I CFADocument33 pagesSoleadea Mock Exam 1 Level I CFAAshutosh Singh100% (3)

- Risk MGT SheetsDocument128 pagesRisk MGT SheetsMunawar AliNo ratings yet

- Poverty and Patterns of GrowthDocument24 pagesPoverty and Patterns of GrowthAsian Development BankNo ratings yet

- FM2 Cheat Sheet From CREsDocument4 pagesFM2 Cheat Sheet From CREstrijtkaNo ratings yet

- Tutorial W3Document28 pagesTutorial W3Мереке ӘбдіәшімNo ratings yet

- Balance Sheet or Statement of Financial PositionDocument52 pagesBalance Sheet or Statement of Financial PositionkarishmaNo ratings yet

- Week 9 Tutorial Questions Chp#6-With AnswersDocument5 pagesWeek 9 Tutorial Questions Chp#6-With AnswersBowen ChenNo ratings yet

- Signature of TestatorDocument2 pagesSignature of TestatorChaya NgNo ratings yet