Professional Documents

Culture Documents

Adobe Scan 02-Jul-2021

Adobe Scan 02-Jul-2021

Uploaded by

The Unknown vloggerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adobe Scan 02-Jul-2021

Adobe Scan 02-Jul-2021

Uploaded by

The Unknown vloggerCopyright:

Available Formats

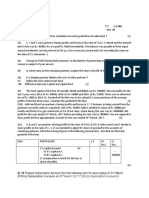

2.

84 Double

Entryy Book

Boo Keeping-CBSEXW

Profit and Loss

afvopm ak m

3.

Vinod and Appropriation

propriation Account

Mohan are partners. Vinod's Capital is 1,00,000 and Mohan'sCapital is 7 60,000.

han are

capitai is payable

Prepare Profit and @ p.a. Vinod is to get salaryof 3,000 per month. Net Prof ofit for the

year i nterest on

14. X,Y

and Z

nd Loss Apropriation

I

are arthers

par

Account [Ans.: of Share Profit: Vinod-

17,200;

Mohan

in a firm sharing profits in the ratio of 2:2:1. Fxed capitals of the na

80,17000200

i s to be 5,00,000 and Z 2,50,000 respectively. The Partnersnip Deed provides that were

be alloweda salary of 2,000 per month. Profit ofthat inte test on

allowed @ 10% p.a. Zis to

ended 31st March,

Prepare Profit and 2021 after debiting Z's the firm

15. Loss

salary was 4,00,0 for the

Xand Y

are partner Appropriation Account. Ans.: Divisible Profit--2,75,000u

Interest on capital profts in the ratio of 3:2 with

capitals of 7 8,00,000 and R 6,00,00 00

beenon capital is agreed agreed @ 5% p.a. Y is to be 000 respectively.

Y's withdrawn. Profit for the allowed an annual salary

of t 60,000 which n

A

salary was 2,40,000.

ear

year ended 31st March, 2021 before

interest on capital has not

provision but: after chargind

of 5% of

the netprofit is

repare Profit and pr to be made in

respect of commission to

Loss Appro the

propriation Account showing the Manager.

allocation of profits.

[Ans.: Provision for

16. Atul

and

Manager's Commission- 15,000

Mithun (i.e., 5% of

Balances as on 1st partners sharing profits in the ratio of 3: Share of Profit: X-R 93,000; Y-3,00,000

are

Capital Accounts April, 2020 were as follows:

2. 62,003

(Fixed):

Loan

Acounts: Atul- Atul-R 5,00,000 and

It was Mithun-6,00,000.

agreed to allow and3,00,000 (Cr.) and Mithun-F 2,00,000

@10% p.a. Interest charge interest @ 8% (Dr.)

p.a.

Profit before

on

Drawings was Partnership Deed provided to

giving effect to above wascharged 5,000 each. allow interest on

Prepare Profit and Loss R

2,28,000 for the year capital

Appropriation Account. ended 31st

March, 2021.

17. Reema and Seema are [Ans.:

Share of

and Seema will partners sharing Profit: Atul- 72,000;

get monthly profits equally. and Mithun-

lnterest on Drawings will salary of 15,000 The Partnership 48,000

be each, Interest Deed provides

the year were

60,000 each. charged@

charged @ 10%

109% p.a.

p.a. Their on that both Reema

The firm incurred

Their

capitals wereCapital will be allowed@5% @5% p.a.

net loss of 7

1,00,0 5,00,000

5,00,000 each pa. anand

Prepare Profit and Loss 0,000 during the and draw

and drawings

awings during

durny

Appropriation Account for year ended 31st

the year March, 2021.

18. Bhanu and Ans.: LossR 94,000; ended 31st

Partap are partners

sharing Reema' s March, 2021.

8,00,000 0 and 10,00,000 profits equally.

profits equally. Thei Share- 47,000;

respecti respectively.

Interest on Capital is a drawings Their ed

Their drawine fixed capitals Seema's Share-

be charged @ 15% p.a. Profit charge and is to be during capitals as

the year as on

on 1st April, 2020

were

tor the

F 1,20,000. year ended 31st allowed@ were

March 2021 10% p.a. and 50,000 00 and R 1,00,00

Prepare Profit and Loss Appropriation before givinginterest on dra

interest on drawings isto

Account. effecttot the abovevwas

Ans.: Loss48,750;Dr.

Bhanu's Current A

and Parta

You might also like

- Subhash Dey BST 12Document46 pagesSubhash Dey BST 12The Unknown vlogger100% (2)

- L1 Financial ReportingDocument273 pagesL1 Financial ReportingChamiNo ratings yet

- Sales Promotion Strategy of The Coca ColaDocument81 pagesSales Promotion Strategy of The Coca Colalokesh_045100% (1)

- Forecasting Metabical - Farid Ardika DasumDocument7 pagesForecasting Metabical - Farid Ardika DasumrizqighaniNo ratings yet

- 2016 MPesaDocument2 pages2016 MPesaSyahrial Maulana50% (2)

- Introduction To Project Risk ManagementDocument19 pagesIntroduction To Project Risk ManagementJignesh0% (1)

- Armstrong's Handbook of Management and Leadership For HR - 4thDocument472 pagesArmstrong's Handbook of Management and Leadership For HR - 4thMichael Phan100% (2)

- Adobe Scan 22 Mar 2023Document3 pagesAdobe Scan 22 Mar 2023Justin D'souzaNo ratings yet

- TB Meningitis Fact Sheet Dec 2017Document13 pagesTB Meningitis Fact Sheet Dec 2017Brix ArriolaNo ratings yet

- Fundamentals QuestionsDocument23 pagesFundamentals Questionsdhanvi1259No ratings yet

- Fundamental Important QuestionsDocument10 pagesFundamental Important Questionsaryanmadnani50No ratings yet

- 12 Accountancy Lyp 2015 Foreign Set1Document42 pages12 Accountancy Lyp 2015 Foreign Set1Ashish GangwalNo ratings yet

- Accountancy: Amount (?)Document4 pagesAccountancy: Amount (?)Thulsi JayadevNo ratings yet

- CBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot QuestionsDocument6 pagesCBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot Questionsdakshrwt06No ratings yet

- Retirement WSDocument2 pagesRetirement WSarhamenterprises5401No ratings yet

- 12 Acc Accoun Partner Firm Fundamentals Im6 PDFDocument12 pages12 Acc Accoun Partner Firm Fundamentals Im6 PDFDID You KNOWNo ratings yet

- SQ AcoountaciiDocument75 pagesSQ AcoountaciiAditya bansal100% (1)

- Set 1 Test No.1 Answer KeyDocument4 pagesSet 1 Test No.1 Answer KeyJOHAN JOJONo ratings yet

- Fundamental Day 3 HW ISCDocument6 pagesFundamental Day 3 HW ISCROHIT PAREEKNo ratings yet

- Xii Acct WDocument11 pagesXii Acct WFree Fire KingNo ratings yet

- Accountancy FinalDocument13 pagesAccountancy FinalVikram KaushalNo ratings yet

- RERETESTDocument4 pagesRERETESTshveta0% (1)

- Accountancy Revision Test 1Document3 pagesAccountancy Revision Test 1KHUSHI ARORA SOSHNo ratings yet

- 12th Partnership Revision SolutionDocument42 pages12th Partnership Revision Solutiongarima312006No ratings yet

- Fundamentals PDFDocument103 pagesFundamentals PDFDhairya JainNo ratings yet

- Chapter 1 Partnership Account 1Document21 pagesChapter 1 Partnership Account 1Akmal MalikNo ratings yet

- Partnership OperationsDocument2 pagesPartnership OperationsKristel SumabatNo ratings yet

- Piecemeal Distribution of CashDocument6 pagesPiecemeal Distribution of Cashtryok070707No ratings yet

- Past Adjustment QuestionsDocument7 pagesPast Adjustment Questionskvjlano2No ratings yet

- Accountancy TestDocument2 pagesAccountancy Testdixa mathpalNo ratings yet

- HHW Accounts Class 12-2Document6 pagesHHW Accounts Class 12-2Pari AggarwalNo ratings yet

- Retirement Hots and Application Based QuestionsDocument5 pagesRetirement Hots and Application Based Questionspriya longaniNo ratings yet

- Accountancy Unit Test 2 - WorksheetDocument12 pagesAccountancy Unit Test 2 - WorksheetFawaz YoosefNo ratings yet

- Cbse Questions Change in PSRDocument4 pagesCbse Questions Change in PSRDeepanshu kaushikNo ratings yet

- CBSE Class 12 Reconstitution of PartnershipDocument7 pagesCBSE Class 12 Reconstitution of Partnershipajay yadavNo ratings yet

- Lesson 1 To 5-1Document3 pagesLesson 1 To 5-1Aayush PatelNo ratings yet

- CTF Edited Solved Paper 1Document2 pagesCTF Edited Solved Paper 1Umesh JaiswalNo ratings yet

- Int On Drawings 2Document10 pagesInt On Drawings 2JanaNo ratings yet

- Account Ch-1 Partnership Firm - FundamentalsDocument19 pagesAccount Ch-1 Partnership Firm - Fundamentalsapsonline8585No ratings yet

- Sample Paper 2 G 12 - Accountancy - SUMMER BREAKDocument9 pagesSample Paper 2 G 12 - Accountancy - SUMMER BREAKpriya longaniNo ratings yet

- C. Retirement & Death Assingment UpdateDocument7 pagesC. Retirement & Death Assingment UpdateNishtha GargNo ratings yet

- CH 1 Accounting of Partnership Basic ConceptDocument15 pagesCH 1 Accounting of Partnership Basic Concepthk6206131516No ratings yet

- 12th AccountsDocument6 pages12th AccountsHarjinder SinghNo ratings yet

- Xyhhj 3 of 1 Aud 1 W EKXw QLDocument11 pagesXyhhj 3 of 1 Aud 1 W EKXw QLhk6206131516No ratings yet

- 12 Accountancy 2023-24Document37 pages12 Accountancy 2023-24chiragdahiya0602No ratings yet

- Premium Mock 03Document13 pagesPremium Mock 03Rahul MajumdarNo ratings yet

- Foundation Practice SumsDocument9 pagesFoundation Practice SumsBRISTI SAHANo ratings yet

- Partnership FundamentalsDocument15 pagesPartnership Fundamentalsrockstargautham2No ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- Accounts WorksheetDocument3 pagesAccounts Worksheetneeraj sharmaNo ratings yet

- ACCT 423 Cheat Sheet 1.0Document2 pagesACCT 423 Cheat Sheet 1.0HelloWorldNowNo ratings yet

- Assessement Test 6 - Change of PSR - Docx - 1661182024584Document2 pagesAssessement Test 6 - Change of PSR - Docx - 1661182024584Shreya PushkarnaNo ratings yet

- Accountancy Test 5Document2 pagesAccountancy Test 5dixa mathpalNo ratings yet

- PartnershipDocument10 pagesPartnershipOm JainNo ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- Adobe Scan 06 Sep 2022Document10 pagesAdobe Scan 06 Sep 2022kumardeepak5242No ratings yet

- Past Adjustments QuestionsDocument6 pagesPast Adjustments QuestionsTanisha JainNo ratings yet

- 07 Sample PaperDocument42 pages07 Sample Papergaming loverNo ratings yet

- Computation of Total IncomeDocument2 pagesComputation of Total Income2154 taibakhatunNo ratings yet

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU N0% (1)

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- QR Code (Partnership)Document10 pagesQR Code (Partnership)saumya sainiNo ratings yet

- Assessement Test - Retirment of A PartnerDocument2 pagesAssessement Test - Retirment of A PartnerShreya PushkarnaNo ratings yet

- 08 Sample PaperDocument38 pages08 Sample Papergaming loverNo ratings yet

- Exam Handbook: EconomicsDocument50 pagesExam Handbook: EconomicsThe Unknown vlogger100% (1)

- Accountancy All FormulaDocument23 pagesAccountancy All FormulaThe Unknown vlogger100% (1)

- English Core Code No. 301 Class XI (2021-22) Term Wise SyllabusDocument2 pagesEnglish Core Code No. 301 Class XI (2021-22) Term Wise SyllabusThe Unknown vloggerNo ratings yet

- Vdocuments - MX - Fria Flow Chart Final 1 PDFDocument44 pagesVdocuments - MX - Fria Flow Chart Final 1 PDFM Grazielle EgeniasNo ratings yet

- Advanced Vlookup ExamplesDocument9 pagesAdvanced Vlookup ExamplesHalari MukeshNo ratings yet

- RMO 47-2020 - Consolidated VAT RefundDocument36 pagesRMO 47-2020 - Consolidated VAT Refunduno_01No ratings yet

- Solution of Sarvodaya Samiti Case StudyDocument29 pagesSolution of Sarvodaya Samiti Case StudyAparna SinghNo ratings yet

- Bsi Standards Books Catalogue Uk enDocument40 pagesBsi Standards Books Catalogue Uk enAnsarMahmoodNo ratings yet

- Modern Floorplans An Average Modern Shopping MallDocument62 pagesModern Floorplans An Average Modern Shopping MallJackNo ratings yet

- Section 24 - Facebook AdsDocument5 pagesSection 24 - Facebook Adsshihab aliNo ratings yet

- Double Entry Part 2Document44 pagesDouble Entry Part 2Jahanzaib ButtNo ratings yet

- PAEP MLN OPS 0015 Handover ProcedureDocument9 pagesPAEP MLN OPS 0015 Handover ProcedureAbdelaaliNo ratings yet

- Cadbury Financial StatementsDocument4 pagesCadbury Financial Statementsapi-505775092No ratings yet

- CEO Executive Director in Reno NV Resume Phillip NowakDocument4 pagesCEO Executive Director in Reno NV Resume Phillip NowakPhillipNowakNo ratings yet

- Mẫu kế hoạch truyền thôngDocument5 pagesMẫu kế hoạch truyền thôngHoanganh SetupNo ratings yet

- Sema BalageruDocument91 pagesSema Balagerusemahegn amareNo ratings yet

- Basic Cost Terms and ConceptsDocument8 pagesBasic Cost Terms and Conceptstegegn mogessieNo ratings yet

- Quality ManagementDocument7 pagesQuality ManagementMidhun K ChandraboseNo ratings yet

- MAS8Document43 pagesMAS8Villena Divina VictoriaNo ratings yet

- 2003 - Schnatterly - CEO Compenesation - Increasing Firm Value Through Detection and Prevention of White CollarDocument28 pages2003 - Schnatterly - CEO Compenesation - Increasing Firm Value Through Detection and Prevention of White Collarahmed sharkasNo ratings yet

- MOA With ARBOs, CLAAPDocument24 pagesMOA With ARBOs, CLAAPMaita GuanzonNo ratings yet

- CT-2 SM 2021Document5 pagesCT-2 SM 2021Incredible video'sNo ratings yet

- Chapter 3 IMDocument23 pagesChapter 3 IMchromeNo ratings yet

- Robin Kuckyr Selling Your Accounting Practice NewsletterDocument16 pagesRobin Kuckyr Selling Your Accounting Practice NewsletterWard WichtNo ratings yet

- Sample Policy From Jabil Foreign Corrupt Policies ActDocument6 pagesSample Policy From Jabil Foreign Corrupt Policies Acttaj133No ratings yet

- ISO 13485 2016 Documentation Manual Clause Wise RequirementsDocument15 pagesISO 13485 2016 Documentation Manual Clause Wise Requirementsqmicertification100% (1)

- Company Background of NandoDocument4 pagesCompany Background of NandoHaliyana HamidNo ratings yet

- Citi BankDocument10 pagesCiti BankJyoti ChaudharyNo ratings yet