Professional Documents

Culture Documents

Corporate Commercial Alert 13 February 2019

Corporate Commercial Alert 13 February 2019

Uploaded by

phumuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Commercial Alert 13 February 2019

Corporate Commercial Alert 13 February 2019

Uploaded by

phumuCopyright:

Available Formats

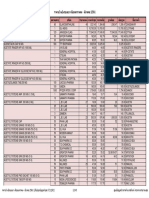

13 FEBRUARY 2019

CORPORATE

& COMMERCIAL

SHARED WISDOM FOR EMPLOYEE

IN THIS SHARE SCHEMES

ISSUE Most businesses would agree that their most important and most

valuable assets are the people that comprise the organisation.

In order to retain the best people and to align the interests of

employees, employers and shareholders, companies may wish to

incentivise key individuals to stay for the “long haul” or to reward

employees for the fruits of their hard work by implementing a

share incentive scheme.

FOR MORE INSIGHT INTO OUR

EXPERTISE AND SERVICES

CLICK HERE

1 | CORPORATE & COMMERCIAL ALERT 13 February 2019

SHARED WISDOM FOR EMPLOYEE

SHARE SCHEMES

Recent developments in South Africa relating

to the adoption of certain ‘say on pay’

measures create an impression that

South Africa’s regulation of the

determination of executive

remuneration is

stringent. Most businesses would agree that their most important and most valuable assets are

the people that comprise the organisation. In order to retain the best people and to

align the interests of employees, employers and shareholders, companies may wish

to incentivise key individuals to stay for the “long haul” or to reward employees for

the fruits of their hard work by implementing a share incentive scheme.

However, there are a few factors that Tax considerations

should be kept in mind in order to ensure

Put simply, scheme shares or units (Shares)

that the arrangement is effective and

issued to a Participant at a discount, or

achieves its stated purpose.

Depending on the Shares which vest over time or “lock in”

Keep it simple employees, will usually fall under s8C of

purpose of the scheme, the Income Tax Act, No 58 of 1962 (ITA)

In many instances, schemes are put in

if possible, employers place which are very complicated and

because the Shares are received by virtue

of the Participant’s employment. In terms

should try to structure difficult to administer.

of s8C of the ITA, such Shares will be seen

the scheme in such a When drafting the rules of the scheme, as “restricted equity instruments”.

way that it is the most employers should ask themselves

Ordinarily, gains on the disposal of

whether they are prepared to keep up to

tax effective for the date records and comply with the legal,

shares held as an investment would be

subject to capital gains tax. However, in

Participants. regulatory and formal requirements for a

terms of s8C of the ITA, when the Shares

share scheme.

become unrestricted and “vest” or the

Often, schemes use a trust-based structure Participant realises the Shares, any gains

where shares in the employer company will be deemed remuneration and taxed

(Company) are issued or sold to a trust and as income in the hands of the Participant

the trust issues units to the employees who at his or her marginal income tax rate. This

participate in the scheme (Participants). A is a risk that needs to be explained to the

trust must be administered separately to employee.

the company with its own bank account

Another tax consideration is that if the

and set of financials. Trustees need to

scheme shares are subject to s8C of the

authorise all decisions of the trust by

ITA, the Company will have an obligation

resolution.

to withhold employees’ tax (PAYE). The

In many smaller businesses and start-ups Company may need to apply to SARS for a

that do not have a dedicated company directive on how much PAYE to withhold.

secretary, this could result in a large

Depending on the purpose of the

administrative burden. Thus, if employers

scheme, if possible, employers should

who do not like too much paperwork

try to structure the scheme in such a way

should keep the scheme as simple as

that it is the most tax effective for the

possible.

Participants.

2 | CORPORATE & COMMERCIAL ALERT 13 February 2019

SHARED WISDOM FOR EMPLOYEE

SHARE SCHEMES

CONTINUED

Even if the Participant Liquidity In these instances, careful planning

is required to ensure that vesting and

were to sell some The liquidity of the Shares could become

realisation are aligned with a liquidity

an issue in the event that the Participant

Shares to fund the is entitled to realise the value of his or her

event.

tax, in the context of scheme Shares. Similarly, if Participants are entitled

to realise the value of their Shares by

a private company, There are a number of ways that this

requiring the Company to buy back their

can be achieved, including allowing the

there may be no ready Participant to sell to a third party, paying

Shares or to redeem them for a cash

amount, the Company may also be placed

market for the Shares. the Participant the value of his or her

in a position where it does not have

Shares or the Company buying back the

available cash to fund the payment. In

Shares. It is also possible to delay vesting

such cases, the Company could consider

until there is a “liquidity event” such as a

settling the payment in tranches over time.

takeover or initial public offering.

Scheme rules should provide for flexibility

Realisation of Shares can have cash flow

so that employers have options available to

implications for both the Participant and

ease the burden on cash resources.

the Company. As set out above, upon

vesting the Participant may become liable Regulatory

to pay income tax. This would be the case

Under s97 of the Companies Act, No 71

even if the Shares vest in the Participant

of 2008 (Companies Act) a scheme will

and the Participant does not sell the Shares

qualify as an employee share incentive

or receives any proceeds. This could result

scheme if the scheme meets the

in a large tax bill that the Participant would

requirements set out in that section. A

have to fund without necessarily having

qualifying scheme will be exempt from

cash available.

certain obligations under the Companies

Even if the Participant were to sell some Act, including exemptions relating to

Shares to fund the tax, in the context of a financial assistance and public offerings.

private company, there may be no ready

market for the Shares.

CDH’s latest edition of

Doing Business in South Africa

CLICK HERE to download our 2018 thought leadership

3 | CORPORATE & COMMERCIAL ALERT 13 February 2019

SHARED WISDOM FOR EMPLOYEE

SHARE SCHEMES

CONTINUED

In the case of a Briefly, these rules apply to schemes If a Company extends loans to the

where the Company issues shares or Participants in order to acquire the Shares,

Company whose shares options to employees. To qualify, the rules the Company should seek advice as to

are listed on the JSE, of the scheme must be registered with whether the National Credit Act, No 35 of

the Companies and Intellectual Property 2005 is applicable to the arrangement.

the scheme will need to Commission (CIPC) and a compliance

Conclusion

comply with schedule officer must be appointed. The compliance

officer will have reporting obligations to Employee share schemes are an excellent

14 of the JSE Listings the CIPC. way to align the interests and vision of

Requirements and be In the case of a Company whose shares

employers and shareholders with that of

management and key personnel as well

approved by the JSE. are listed on the JSE, the scheme will need

as to reward employees by enabling them

to comply with schedule 14 of the JSE

to share in the growth of the company.

Listings Requirements and be approved

If the above considerations are borne in

by the JSE.

mind, employers should be able to find an

effective structure for the scheme.

FOR MORE INSIGHT INTO OUR Ben Strauss and Clara Hofmeyr

EXPERTISE AND SERVICES

CLICK HERE

EMEA FINANCIAL AND

Cliffe Dekker Hofmeyr Cliffe Dekker Hofmeyr Cliffe Dekker Hofmeyr 2012-2017 CORPORATE

BAND 2 Ranked Cliffe Dekker Hofmeyr TOP TIER FIRM

BAND 1 Energy & Natural Resources:

BAND 1

Corporate/M&A Capital Markets: Equity

Mining

TIER 1

Corporate/M&A

2019

4 | CORPORATE & COMMERCIAL ALERT 13 February 2019

OUR TEAM

For more information about our Corporate & Commercial practice and services, please contact:

Willem Jacobs Lilia Franca Giada Masina Verushca Pillay

National Practice Head Director Director Director

Director T +27 (0)11 562 1148 T +27 (0)11 562 1221 T +27 (0)11 562 1800

Corporate & Commercial M +27 (0)82 564 1407 M +27 (0)72 573 1909 M +27 (0)82 579 5678

T +27 (0)11 562 1555 E lilia.franca@cdhlegal.com E giada.masina@cdhlegal.com E verushca.pillay@cdhlegal.com

M +27 (0)83 326 8971

E willem.jacobs@cdhlegal.com John Gillmer Nkcubeko Mbambisa David Pinnock

Director Director Director

David Thompson T +27 (0)21 405 6004 T +27 (0)21 481 6352 T +27 (0)11 562 1400

Regional Practice Head M +27 (0)82 330 4902 M +27 (0)82 058 4268 M +27 (0)83 675 2110

Director E john.gillmer@cdhlegal.com E nkcubeko.mbambisa@cdhlegal.com E david.pinnock@cdhlegal.com

Corporate & Commercial

T +27 (0)21 481 6335 Sandra Gore Nonhla Mchunu Allan Reid

M +27 (0)82 882 5655 Director Director Director

E david.thompson@cdhlegal.com T +27 (0)11 562 1433 T +27 (0)11 562 1228 T +27 (0)11 562 1222

M +27 (0)71 678 9990 M +27 (0)82 314 4297 M +27 (0)82 854 9687

Mmatiki Aphiri E sandra.gore@cdhlegal.com E nonhla.mchunu@cdhlegal.com E allan.reid@cdhlegal.com

Director

T +27 (0)11 562 1087 Johan Green Ayanda Mhlongo Ludwig Smith

M +27 (0)83 497 3718 Director Director Director

E mmatiki.aphiri@cdhlegal.com T +27 (0)21 405 6200 T +27 (0)21 481 6436 T +27 (0)11 562 1500

M +27 (0)73 304 6663 M +27 (0)82 787 9543 M +27 (0)79 877 2891

Roelof Bonnet E johan.green@cdhlegal.com E ayanda.mhlongo@cdhlegal.com E ludwig.smith@cdhlegal.com

Director

T +27 (0)11 562 1226 Allan Hannie William Midgley Ben Strauss

M +27 (0)83 325 2185 Director Director Director

E roelof.bonnet@cdhlegal.com T +27 (0)21 405 6010 T +27 (0)11 562 1390 T +27 (0)21 405 6063

M +27 (0)82 373 2895 M +27 (0)82 904 1772 M +27 (0)72 190 9071

Tessa Brewis E allan.hannie@cdhlegal.com E william.midgley@cdhlegal.com E ben.strauss@cdhlegal.com

Director

T +27 (0)21 481 6324 Peter Hesseling Tessmerica Moodley Tamarin Tosen

M +27 (0)83 717 9360 Director Director Director

E tessa.brewis@cdhlegal.com T +27 (0)21 405 6009 T +27 (0)21 481 6397 T +27 (0)11 562 1310

M +27 (0)82 883 3131 M +27 (0)73 401 2488 M +27 (0)72 026 3806

Etta Chang E peter.hesseling@cdhlegal.com E tessmerica.moodley@cdhlegal.com E tamarin.tosen@cdhlegal.com

Director

T +27 (0)11 562 1432 Quintin Honey Anita Moolman Roxanna Valayathum

M +27 (0)72 879 1281 Director Director Director

E etta.chang@cdhlegal.com T +27 (0)11 562 1166 T +27 (0)11 562 1376 T +27 (0)11 562 1122

M +27 (0)83 652 0151 M +27 (0)72 252 1079 M +27 (0)72 464 0515

Clem Daniel E quintin.honey@cdhlegal.com E anita.moolman@cdhlegal.com E roxanna.valayathum@cdhlegal.com

Director

T +27 (0)11 562 1073 Roelf Horn Jo Neser Deepa Vallabh

M +27 (0)82 418 5924 Director Director Head: Cross-border M&A,

E clem.daniel@cdhlegal.com T +27 (0)21 405 6036 T +27 (0)21 481 6329 Africa and Asia

M +27 (0)82 458 3293 M +27 (0)82 577 3199 Director

Jenni Darling E roelf.horn@cdhlegal.com E jo.neser@cdhlegal.com T +27 (0)11 562 1188

Director M +27 (0)82 571 0707

T +27 (0)11 562 1878 Yaniv Kleitman Francis Newham E deepa.vallabh@cdhlegal.com

M +27 (0)82 826 9055 Director Director

E jenni.darling@cdhlegal.com T +27 (0)11 562 1219 T +27 (0)21 481 6326 Roux van der Merwe

M +27 (0)72 279 1260 M +27 (0)82 458 7728 Director

André de Lange E yaniv.kleitman@cdhlegal.com E francis.newham@cdhlegal.com T +27 (0)11 562 1199

Director M +27 (0)82 559 6406

T +27 (0)21 405 6165 Justine Krige Gasant Orrie E roux.vandermerwe@cdhlegal.com

M +27 (0)82 781 5858 Director Cape Managing Partner

E andre.delange@cdhlegal.com T +27 (0)21 481 6379 Director Charl Williams

M +27 (0)82 479 8552 T +27 (0)21 405 6044 Director

Werner de Waal E justine.krige@cdhlegal.com M +27 (0)83 282 4550 T +27 (0)21 405 6037

Director E gasant.orrie@cdhlegal.com M +27 (0)82 829 4175

T +27 (0)21 481 6435 Johan Latsky E charl.williams@cdhlegal.com

M +27 (0)82 466 4443 Executive Consultant

E werner.dewaal@cdhlegal.com T +27 (0)11 562 1149

M +27 (0)82 554 1003

E johan.latsky@cdhlegal.com

BBBEE STATUS: LEVEL TWO CONTRIBUTOR

This information is published for general information purposes and is not intended to constitute legal advice. Specialist legal advice should always be sought

in relation to any particular situation. Cliffe Dekker Hofmeyr will accept no responsibility for any actions taken or not taken on the basis of this publication.

JOHANNESBURG

1 Protea Place, Sandton, Johannesburg, 2196. Private Bag X40, Benmore, 2010, South Africa. Dx 154 Randburg and Dx 42 Johannesburg.

T +27 (0)11 562 1000 F +27 (0)11 562 1111 E jhb@cdhlegal.com

CAPE TOWN

11 Buitengracht Street, Cape Town, 8001. PO Box 695, Cape Town, 8000, South Africa. Dx 5 Cape Town.

T +27 (0)21 481 6300 F +27 (0)21 481 6388 E ctn@cdhlegal.com

©2019 7609/FEB

CORPORATE & COMMERCIAL | cliffedekkerhofmeyr.com

You might also like

- Inside Out - Driven by Emotions (Disney Chapter Book (Ebook) ) - NodrmDocument100 pagesInside Out - Driven by Emotions (Disney Chapter Book (Ebook) ) - NodrmLetsNotKidOurselves100% (2)

- Mergers and Acquisitions SolutionsDocument56 pagesMergers and Acquisitions Solutionstseboblessing7No ratings yet

- Joint Venture Vs SPVDocument3 pagesJoint Venture Vs SPVanimes prusty89% (9)

- 'BOOTS Pension Fund Management TO CHECKDocument2 pages'BOOTS Pension Fund Management TO CHECKMatsatka VitaNo ratings yet

- ISO 22301: 2019 - An introduction to a business continuity management system (BCMS)From EverandISO 22301: 2019 - An introduction to a business continuity management system (BCMS)Rating: 4 out of 5 stars4/5 (1)

- Human HeartDocument10 pagesHuman HeartEzlivia Pineda100% (1)

- ราคาอ้างอิงของยา เดือนมกราคม-มีนาคม 2561Document143 pagesราคาอ้างอิงของยา เดือนมกราคม-มีนาคม 2561Tommy PanyaratNo ratings yet

- Unit Company: 18 Audit-HiDocument7 pagesUnit Company: 18 Audit-HiRishabh GuptaNo ratings yet

- PARTNERTSHIPDocument2 pagesPARTNERTSHIPMafel Udarve JumuadNo ratings yet

- Taxation of Partnerships and LlpsDocument5 pagesTaxation of Partnerships and LlpskalinovskayaNo ratings yet

- Stice 18e Ch14 SOL FinalDocument54 pagesStice 18e Ch14 SOL FinalAndre SitepuNo ratings yet

- TIA Tax Effective Restructuring For SMEsDocument9 pagesTIA Tax Effective Restructuring For SMEsShamir GuptaNo ratings yet

- Detailed Explanation of Growth-SharesDocument2 pagesDetailed Explanation of Growth-Shareskashif1905No ratings yet

- Notes Forming Part of Financial StatementsDocument58 pagesNotes Forming Part of Financial StatementsAndrew StarkNo ratings yet

- Tax Implications Amalgamation DemergerDocument51 pagesTax Implications Amalgamation DemergerRitika JhajhariaNo ratings yet

- Cda Irr 2016Document1 pageCda Irr 2016Nadine BaligodNo ratings yet

- Equity and RoyaltyDocument6 pagesEquity and Royaltycryptiz.epNo ratings yet

- Spectrans M1 M2Document7 pagesSpectrans M1 M2Patricia CruzNo ratings yet

- Board's Report Under The Companies Act, 2013 - An Ambitious Step Towards Better Corporate Governance - by Payel JainDocument5 pagesBoard's Report Under The Companies Act, 2013 - An Ambitious Step Towards Better Corporate Governance - by Payel JainPayel JainNo ratings yet

- AFM Dividend Policy Swetha Ma'AmDocument5 pagesAFM Dividend Policy Swetha Ma'AmNavya KNo ratings yet

- Accounting Principles and Business Transactions Cheat Sheet: by ViaDocument1 pageAccounting Principles and Business Transactions Cheat Sheet: by ViaAlison JcNo ratings yet

- Chapter 10, Modern Advanced Accounting-Review Q & ExrDocument26 pagesChapter 10, Modern Advanced Accounting-Review Q & Exrrlg4814100% (2)

- Annexure A' To The Board's Report: External FactorsDocument16 pagesAnnexure A' To The Board's Report: External FactorsAmanVatsNo ratings yet

- Blue and White Project Proposal - PresentationDocument18 pagesBlue and White Project Proposal - PresentationMohamed RadwanNo ratings yet

- Prefinal Acfar Chapter 13Document10 pagesPrefinal Acfar Chapter 13Jessica Valerie AlvarezNo ratings yet

- Blue and White Project Proposal - PresentationDocument18 pagesBlue and White Project Proposal - PresentationMohamed RadwanNo ratings yet

- Reforming Provisions That Impact The of Cama 2020Document15 pagesReforming Provisions That Impact The of Cama 2020papiloNo ratings yet

- 76345cajournal Oct2023 19Document6 pages76345cajournal Oct2023 19S M SHEKARNo ratings yet

- Takeover GuideDocument25 pagesTakeover GuideJeremy FongNo ratings yet

- MODULE 5 Management AspectDocument18 pagesMODULE 5 Management AspectSean William CareyNo ratings yet

- The Organizational Plan: Hisrich Peters ShepherdDocument23 pagesThe Organizational Plan: Hisrich Peters Shepherdbakhtawar soniaNo ratings yet

- Articul.o Forma AmericanaDocument5 pagesArticul.o Forma AmericanacajosopaNo ratings yet

- Accounting Principles and Business Transactions Cheat Sheet: by ViaDocument1 pageAccounting Principles and Business Transactions Cheat Sheet: by Viaheehan6No ratings yet

- Corporate Finance Cheat Sheet 1719730911Document7 pagesCorporate Finance Cheat Sheet 1719730911Guigui Franck SibliNo ratings yet

- CII Ethics MeeDocument26 pagesCII Ethics MeeDivyangi SinghNo ratings yet

- Solution Manual For South Western Federal Taxation 2020 Corporations Partnerships Estates and Trusts 43rd Edition William A RaabeDocument19 pagesSolution Manual For South Western Federal Taxation 2020 Corporations Partnerships Estates and Trusts 43rd Edition William A RaabeCourtneyCollinsntwex100% (43)

- 0402 SharebasedDocument4 pages0402 Sharebased5gny4dfrqzNo ratings yet

- M Ule 21 P Ofessional Responsib T ES: OD R ILI IDocument2 pagesM Ule 21 P Ofessional Responsib T ES: OD R ILI IZeyad El-sayedNo ratings yet

- Capital of A CompanyDocument7 pagesCapital of A CompanyPaki PinguNo ratings yet

- HarvestingDocument3 pagesHarvestingOckouri BarnesNo ratings yet

- Week 6 - Parties in TakafulDocument28 pagesWeek 6 - Parties in TakafullegallymoonNo ratings yet

- Accounting & FinanceDocument57 pagesAccounting & Financemani_selvaNo ratings yet

- Work Within The Law - Memo by JuventDocument4 pagesWork Within The Law - Memo by JuventJuvent .HNo ratings yet

- Fabm L2Document3 pagesFabm L2Mar InaNo ratings yet

- Fund Structuring Beyond Just TheoriesDocument16 pagesFund Structuring Beyond Just TheoriesalagendraNo ratings yet

- IndAS 103 AmalgamationDocument98 pagesIndAS 103 AmalgamationadityaNo ratings yet

- Financial MGMT - Fin 1aDocument8 pagesFinancial MGMT - Fin 1arossNo ratings yet

- Business Combination and Corporate Restructuring: After Studying This Chapter, You Would Be Able ToDocument98 pagesBusiness Combination and Corporate Restructuring: After Studying This Chapter, You Would Be Able ToYUUSDHNo ratings yet

- Remote Governance and Controls: The New Reality Publication SeriesDocument20 pagesRemote Governance and Controls: The New Reality Publication Serieskovi mNo ratings yet

- Deloitte Uk Pension Scheme Valuations Corp GuideDocument40 pagesDeloitte Uk Pension Scheme Valuations Corp GuideharihfamNo ratings yet

- Tax Loan-V2Document3 pagesTax Loan-V2aaravsharma23No ratings yet

- Tax Advantages & Disadvantages: of Multiple Entity StructuresDocument4 pagesTax Advantages & Disadvantages: of Multiple Entity StructuresDemewez AsfawNo ratings yet

- Allowable DeductionsDocument16 pagesAllowable DeductionsChyna Bee SasingNo ratings yet

- Liquidnet MiFID II Research - UnbundlingDocument16 pagesLiquidnet MiFID II Research - UnbundlingtabbforumNo ratings yet

- Summary of Factors Influencing Dividend Policy: 15-5A ConstraintsDocument2 pagesSummary of Factors Influencing Dividend Policy: 15-5A ConstraintsHo Thi Huynh Giao B1901835No ratings yet

- I. Why Is It Important To Disclose Related Party TransactionsDocument12 pagesI. Why Is It Important To Disclose Related Party TransactionsLe YenNo ratings yet

- PWC Tax Alert Compensation For Loss of Employment Sep 2017 1Document1 pagePWC Tax Alert Compensation For Loss of Employment Sep 2017 1BadmusGbolahanAceNo ratings yet

- ILPA Private Equity PrinciplesDocument16 pagesILPA Private Equity PrinciplesDan PrimackNo ratings yet

- Financial Management: Business FinanceDocument7 pagesFinancial Management: Business Financeazileinra OhNo ratings yet

- FM FinalsDocument8 pagesFM FinalsShane VelascoNo ratings yet

- Aadi Jain - Accounts Sem 2Document12 pagesAadi Jain - Accounts Sem 222010126148No ratings yet

- NZ Employee Share Schemes Brochure Feb 2016Document12 pagesNZ Employee Share Schemes Brochure Feb 2016Ellamie EclipseNo ratings yet

- Group Assignment 2Document2 pagesGroup Assignment 2zinilNo ratings yet

- Bicycle Owner's Manual: ImportantDocument55 pagesBicycle Owner's Manual: ImportantAnderson HenriqueNo ratings yet

- Week 9Document10 pagesWeek 9shella mar barcialNo ratings yet

- Consumers, Producers, and The Efficiency of MarketsDocument43 pagesConsumers, Producers, and The Efficiency of MarketsRoland EmersonNo ratings yet

- Transformer T1Document1 pageTransformer T1Vikash TiwariNo ratings yet

- Astronomy - 12 - 15 - 18 - 5 - 6 KeyDocument11 pagesAstronomy - 12 - 15 - 18 - 5 - 6 Keykalidindi_kc_krishnaNo ratings yet

- Fuschi Et Al 2022 Microplastics in The Great Lakes Environmental Health and Socioeconomic Implications and FutureDocument18 pagesFuschi Et Al 2022 Microplastics in The Great Lakes Environmental Health and Socioeconomic Implications and FuturecriscazanNo ratings yet

- Asimakopulos, A. (1975) - A Kaleckian Theory of Income Distribution. Canadian Journal of Economics, 313-333.Document22 pagesAsimakopulos, A. (1975) - A Kaleckian Theory of Income Distribution. Canadian Journal of Economics, 313-333.lcr89No ratings yet

- Graph Writing Vocabulary IndexDocument37 pagesGraph Writing Vocabulary IndexKamal deep singh SinghNo ratings yet

- Switching Theory and Logic DesignDocument2 pagesSwitching Theory and Logic DesignManjunath BadigerNo ratings yet

- The Impact of Food Branding On Children's Eating Behaviour and ObesityDocument8 pagesThe Impact of Food Branding On Children's Eating Behaviour and ObesityAlessandraBattagliaNo ratings yet

- Spoken English PPT 1Document147 pagesSpoken English PPT 1Sindhu Manja100% (3)

- Introduction To Naming and Drawing of Carboxylic Acids and EsterDocument38 pagesIntroduction To Naming and Drawing of Carboxylic Acids and Esterkartika.pranotoNo ratings yet

- Bermundo Task 3 Iii-20Document2 pagesBermundo Task 3 Iii-20Jakeson Ranit BermundoNo ratings yet

- TLNB SeriesRules 7.35Document24 pagesTLNB SeriesRules 7.35Pan WojtekNo ratings yet

- Spitfire v2 Semff Combat Plane FullDocument1 pageSpitfire v2 Semff Combat Plane FullFilipe GonçalvesNo ratings yet

- INTED2015TOCDocument55 pagesINTED2015TOCIvan VillanevaNo ratings yet

- CC Pinwheel BWDocument1 pageCC Pinwheel BWTariq ZuhlufNo ratings yet

- Assingment 1 Mobile RobotDocument12 pagesAssingment 1 Mobile Robotiqbal105No ratings yet

- 55 Selection of Appropriate Internal Process Challenge Devices PCDsDocument4 pages55 Selection of Appropriate Internal Process Challenge Devices PCDsRakeshNo ratings yet

- Chapter 3 Practice Problems Review and Assessment Solution 2 Use The V T Graph of The Toy Train in Figure 9 To Answer These QuestionsDocument52 pagesChapter 3 Practice Problems Review and Assessment Solution 2 Use The V T Graph of The Toy Train in Figure 9 To Answer These QuestionsAref DahabrahNo ratings yet

- CR 48JACPAdrenalmediastinalcystDocument4 pagesCR 48JACPAdrenalmediastinalcystKartik DuttaNo ratings yet

- Quick Installation GuideDocument2 pagesQuick Installation GuidePaulo R. Lemos MessiasNo ratings yet

- Executing / Implementing Agency: Financial Management Assessment Questionnaire Topic ResponseDocument6 pagesExecuting / Implementing Agency: Financial Management Assessment Questionnaire Topic ResponseBelle CartagenaNo ratings yet

- File ListDocument5 pagesFile ListanetaNo ratings yet

- Burner Manual - 60 FTDocument18 pagesBurner Manual - 60 FTsambhajiNo ratings yet

- 03-737-800 Ramp & Transit Electrical PowerDocument92 pages03-737-800 Ramp & Transit Electrical PowerNicolas Sal100% (2)