Professional Documents

Culture Documents

Chapter 4 Sent To SV

Chapter 4 Sent To SV

Uploaded by

Hung DuyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4 Sent To SV

Chapter 4 Sent To SV

Uploaded by

Hung DuyCopyright:

Available Formats

FINANCIAL ACCOUNTING 1- CHAPTER 4

CHAPTER 4

NON-CURRENT ASSETS

Mai Anh Pham, ACCA, MSc Page 1

FINANCIAL ACCOUNTING 1- CHAPTER 4

1. Definition

IAS 16: PPE

Property, plant and equipment are tangible assets that:

– Are held by an entity for use in the production or supply of goods or services, for rental to others,

or for administrative purposes

– Are expected to be used during more than one period

Two criteria.

(a) It is probable that future economic benefits associated with the asset will flow to the entity.

(b) The cost of the asset to the entity can be measured reliably

PRACTICE

1 Which one of the following statements correctly defines non-current assets?

A Assets that are held for use in the production of goods or services and are expected to be used during

more than one accounting period

B Assets which are intended to be used by the business on a continuing basis, including both

tangible and intangible assets that do not meet the IASB definition of a current asset

C Non-monetary assets without physical substance that are controlled by the entity and from which

future benefits are expected to flow

D Assets in the form of materials or supplies to be consumed in the production process

2 Which one of the following assets may be classified as a non-current asset in the accounts of a

business?

A A tax refund due next year

B A motor vehicle held for resale

C A computer used in the office

D Cleaning products used to clean the office floors

Mai Anh Pham, ACCA, MSc Page 2

FINANCIAL ACCOUNTING 1- CHAPTER 4

2. Initial measurement

IAS 16 lists the components that make up the cost of an item of property, plant and equipment :

Purchase price, including any import duties paid, but excluding any trade discount and sales tax

paid

Initial estimate of the costs of dismantling and removing the item and restoring the site on which it

is located

Directly attributable costs of bringing the asset to working condition for its intended use, eg:

– The cost of site preparation, eg levelling the floor of the factory so the machine can be

installed

– Initial delivery and handling costs

– Installation and assembly costs

– Professional fees (lawyers, architects, engineers)

– Costs of testing whether the asset is working properly, after deducting the net proceeds from selling

samples produced when testing equipment

– Staff costs arising directly from the construction or acquisition of the asset

Entry:

Dr

Cr

Note :

The following costs will not be part of the cost of property, plant or equipment unless they can be

attributed directly to the asset's acquisition, or bringing it into its working condition.

Expenses of operations that are incidental to the construction or development of the item

Administration and other general overhead costs

Start-up and similar pre-production costs

Initial operating losses before the asset reaches planned performances

Staff training costs

Maintenance contracts purchased with the asset

All of these will be recognised as an expense rather than as part of the cost of the asset

PRACTICE

Mai Anh Pham, ACCA, MSc Page 3

FINANCIAL ACCOUNTING 1- CHAPTER 4

3. Subsequent Expenditure

Subsequent expenditure is added to the carrying amount of the asset

When: improves the condition of the asset beyond the previous performance:

(a)Modification of an item of plant to extend its useful life, including increased capacity

(b) Upgrade of machine parts to improve the quality of output

(c) Adoption of a new production process leading to large reductions in operating costs

Sau khi ghi tăng PPE, nếu psinh các chi phí liên quan thì:

- Cost P/L: bảo dưỡng, sửa chữa

Dr expense/Cr cash, A.P

- Cost ADDED to the PPE only if:

+tăng thời gian sử dụng hữu ích của PPE useful life

+nâng cấp, cải tiến về bản chất của PPE increased capacity/ improve the quality of output

+áp dụng được quy trình sản xuất mới tiết kiệm chi phí sản xuất reductions in operating

costs

DR PPE/ Cr cash, A.P

Mai Anh Pham, ACCA, MSc Page 4

FINANCIAL ACCOUNTING 1- CHAPTER 4

4. Depreciation

Concepts:

Depreciation is the allocation of the depreciable amount (giá trị phải khấu hao) of an asset over its

estimated useful life (thời gian sử dụng hữu ích ước tính).

Depreciation for the accounting period is charged to net profit or loss for the period either directly or

indirectly.

Machine acquire 1.1.2020.

Cost: NGia: 1.000

estimated useful life: 5years/ yrs

31.12.2020 Cost of machine: 1.000, Acc Depn: 180 gia tri con lai: carrying amount: 1000-180 =820

31.12.2021 Cost of machine: 1.000, Acc Depn: 180 + 180 = 360 C.A = 1000 – 360 = 640

31.12.2022 Cost of machine: 1.000, Acc Depn: 180 + 180+180 = 540 C.A = 1000 – 540 = 460

31.12.2023 Cost of machine: 1.000, Acc Depn: 180 + 180+180 +180 = 720 C.A = 1000 – 720 = 280

31.12.2024 Cost of machine: 1.000, Acc Depn: 180 + 180+180 +180 +180 = 900 C.A = 100

(estimate scrap value)

1.1.2025, scrap value, residual value, proceed value: estimate: 100

depreciable amount = 1 000 - 100 = 900 in 5yrs

Dr depreciation expense: 180

Cr accumulate depreciation: 180

Method of depreciation:

1.Straight line method(khau hao theo pp duong thang)

Depreciation exp = depreciable amount : expected useful life

depreciable amount = cost – estimated scrap value (NG – gia tri thanh ly uoc tinh)

expected useful life la thoi gian su dung huu ich( 5nam) hoac tong so san pham uoc tinh san xuat

duoc (1trieu san pham)

900 : 5 = 180

2. Reducing balance (khau hao theo so du giam dan)

Depn exp = opening balance of PPE x %

1.1.2020 Cost of machine: 1.000, Reducing balance: 30%

31.12.2020 Cost of machine: 1.000, Depn exp = 1000 x 30% =300 Acc Depn: 300 gia tri con lai:

carrying amount: 1000-300 =700

31.12.2021 Cost of machine: 1.000, Depn exp = 700 x 30% =210 Acc Depn: 300 + 210 = 510 gia

tri con lai: carrying amount: 1000-510 =490

31.12.2022 Cost of machine: 1.000, Depn exp = 490 x 30% =167 Acc Depn: 300 + 210 +147= 657

gia tri con lai: carrying amount: 1000-657 =343

Mai Anh Pham, ACCA, MSc Page 5

FINANCIAL ACCOUNTING 1- CHAPTER 4

? giá trị của machine ngày càng giảm

??có đc lợi ích từ machine for 5yrs chi phi lquan may ghi nhan ntn

Matching concepts

allocate: depreciable amount in 5years depreciation: khau hao tscd

Depreciable assets are assets which:

– Are expected to be used during more than one accounting period

– Have a limited useful life

– Are held by an enterprise for use in the production or supply of goods and service, for rental to

others, or for administrative purposes

Depreciable amount of a depreciable asset is the historical cost or other amount substituted for

historical cost in the financial statements, less the estimated residual value

Useful life is either:

The period over which a depreciable asset is expected to be used by the enterprise; or

The number of production or similar units expected to be obtained from the asset by the

enterprise

The residual value is the net amount which the entity expects to obtain for an asset at the end of its

useful life after deducting the expected costs of disposal

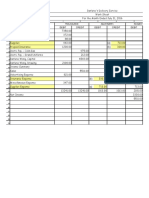

Ledger Entry:

DEBIT Depreciation expense (statement of profit or loss) : the depreciation charge for the period.

CREDIT Accumulated depreciation account (statement of financial position) the depreciation

charge for the period.

Trial Balance:

Depreciation Methods

a.straght line method

For examAple, if a non-current asset costing $40,000 has an expected life of 4 years and an

estimated residual value of nil, it might be depreciated by $10,000 per annum

Mai Anh Pham, ACCA, MSc Page 6

FINANCIAL ACCOUNTING 1- CHAPTER 4

Note:

Assets acquired part-way through an accounting period

A business which has an accounting year that runs from 1 January to 31 December purchases a new

non-current asset on 1 April 20X1, at a cost of $24,000. The expected life of the asset is 4 years, and its

residual value is nil. What should the depreciation charge for 20X1 be?

Solution

b.Reducing balance

reducing balance method of depreciation calculates the annual depreciation charge as a fixed

percentage of the carrying amount of the asset, as at the end of the previous accounting period

EXAMPLE:

a business purchases a non-current asset at a cost of $10,000. Its estimated residual value is $2,160,

40% of reducing amount of assets:

c.Change in method of depreciation

Mai Anh Pham, ACCA, MSc Page 7

FINANCIAL ACCOUNTING 1- CHAPTER 4

the chosen method of depreciation should be applied

consistently from year to year. However, IAS 16 requires that the depreciation method should be

reviewed periodically.

If there has been a significant change in the expected pattern of economic benefits from those

assets, the method should be changed to suit this new pattern. When such a change in depreciation

method takes place, the remaining carrying amount is depreciated under the new method, ie only

current and future periods are affected; the change is not retrospective.

EXAMPLE

Jakob Co purchased an asset for $100,000 on 1.1.X1. It had an estimated useful life of 5 years and

it was depreciated using the reducing balance method at a rate of 40%. On 1.1.X3 it was decided to

change the method to straight line

d.Change in Expected useful life or Residual value of an asset

A business purchased a non-current asset costing $12,000 with an estimated life of four years and

no residual value. If it used the straight line method of depreciation,

Year 1: Depn: 25% of $12,000 = $3,000

Year 2: Depn: 25% of $12,000 = $3,000

If the remaining life of the asset is now revised to five more years, the remaining amount to be

depreciated (here $6,000) should be spread over the remaining life, giving an annual depreciation

charge for the final five years of

PRACTICE

Mai Anh Pham, ACCA, MSc Page 8

FINANCIAL ACCOUNTING 1- CHAPTER 4

6. Disposal thanh ly, nhuong ban PPE

Capital gain (profit on disposal)

Capital loss (loss on disposal)

A business purchased a machine on 1 July 20X1 at a cost of $35,000. The machine had an

estimated residual value of $3,000 and a life of 8 years. The machine was sold for $18,600 on 31

December 20X4, the last day of the accounting year of the business. To make the sale, the business had

to incur dismantling costs and costs of transporting the machine to the buyer's premises. These

amounted to $1,200

35 000 – 3000 = 32 000 in 8yrs 4 000

The ledger accounting entries for disposal asPPE

(i)

DEBIT Disposal of non-current asset account: 35 000

CREDIT Non-current asset account : cost of PPE: 35 000

(ii) trong ky da ghi nhan

Dr depreciation expense: 14 000 P/L

Cr accumulate depreciation: 14 000

Khi thanh ly

DEBIT Accumulated depreciation account: 14 000

CREDIT Disposal of non-current asset account 14 000

with the accumulated depreciation on the asset as at the date of sale.

(iii)

DEBIT Receivable account or cash book: 17 400

CREDIT Disposal of non-current asset account: 17 400

Mai Anh Pham, ACCA, MSc Page 9

FINANCIAL ACCOUNTING 1- CHAPTER 4

3. REVALUATION OF NON CURRENT ASSET

Initial recognition: at Cost (nguyen gia tai san co dinh)

Subsequent measurement (Sau ghi nhan ban dau

Method 1: Cost basis (Phuong phap gia goc)

SOFP (UNDER COST METHOD)

Carrying amount = cost – acc.depn

SOCI:

Computer equipment for office

Dr Depn Exp SOCI ( Administration exp giam Profit)

Cr Acc Depn SOFP

Method 2: the revaluation of non-current assets/ fair value: Phuong phap gia tri hop ly/ Phuong

phap danh gia lai/ revalue

When Ira Vann commenced trading as a car hire dealer on 1 January 20X1, he purchased business

premises at a cost of $50,000.

For the purpose of accounting for depreciation, he decided the following.

(a) The land part of the business premises was worth $20,000; this would not be depreciated.

(b) The building part of the business premises was worth the remaining $30,000. This would be

depreciated by the straight line method to a nil residual value over 30 years.--> depn exp = 1,000$

After 5 years of trading, on 1 January 20X6 Ira decides that his business premises are now worth

$150,000, divided into:

Mai Anh Pham, ACCA, MSc Page 10

FINANCIAL ACCOUNTING 1- CHAPTER 4

He estimates that the building still has a further 25 years' useful life remaining.

Before the revaluation, the annual depreciation charge is $1,000 (P/L) per annum on the building.

This charge is made in each of the first five years of the asset's life.

The carrying amount of the asset will decline by $1,000 per annum, to:

(i) $49,000 as at 31.12.X1 SOFP

(ii) $48,000 as at 31.12.X2

(iii) $47,000 as at 31.12.X3

(iv) $46,000 as at 31.12.X4

(v) $45,000 as at 31.12.X5 ( 20,000 LAND/ 25,000 BUILDING) Cost method

150,000 ( 75,000 LAND/ 75,000 BUILDING) FAIR VALUE/ GTRI HOP LY

Mai Anh Pham, ACCA, MSc Page 11

FINANCIAL ACCOUNTING 1- CHAPTER 4

(b) When the revaluation takes place, the amount of the revaluation is:

The asset will be revalued by $105,000 to $150,000 REVALUATION SURPLUS (THANG DU DO

DANH GIA LAI) >< REVALUATION LOSS/ DEFICIT

1.1.20X6,

BUILDING CA: 25,000 75,000

LAND CA: 20.000 75,000

DR BUILDING: 50,000 FROM 1.1.20X6 : 75,000: 25 = 3,000 /yr

CR REVALUATION SUPLUS : 50,000

DR LAND: 55,000 NO DEPN

CR REVALUATION SUPLUS: 55.000

TOTAL REVALUAITON SURPLUS: 105.000

31.12.20X6,

CA: LAND = 75,000

CA: BUILDING : 75,000 – ACC DEPN = 72,000 NBV

31.12.20X6, FAIR VALUE OF

LAND: 70,000 SOFP

BUILDING: 60,000 SOFP

DR REVALUATION SURPLUS: 17,000

CR LAND: 5,000

CR BUILDING: 12,000

1.1.X7 31.12 X7 : 60.000 : 24 =

31.12.X7 , CA OF LAND, BUILDING

SOFP : FAIR VALUE OF LAND, BUILDING

DIFF REVALUATION SURPLUS ( FV > CA) DR PPE/ CR REVALUATION SURPLUS

REVALUATION LOSS (FV < CA)

DR revaluation surplus (neu con)

Or DR revluation loss (exp) PL

Mai Anh Pham, ACCA, MSc Page 12

FINANCIAL ACCOUNTING 1- CHAPTER 4

PRACTICE

1.A company bought a property four years ago on 1 January for $ 170,000. Since then property prices have

risen substantially and the property has been revalued at $210,000.

The property was estimated as having a useful life of 20 years when it was purchased.

What is the balance on the revaluation surplus reported in the statement of financial position?

2. What are the correct ledger entries to record an acquisition of a non-current asset on credit?

Mai Anh Pham, ACCA, MSc Page 13

FINANCIAL ACCOUNTING 1- CHAPTER 4

7. The asset register

Data kept in an asset register about each non-current asset usually include the following.

The internal reference number (for physical identification purposes)

Manufacturer's serial number (for maintenance purposes)

Description of asset

Location of asset

Department which 'owns' asset

Purchase date (for calculation of depreciation)

Cost

Depreciation method and estimated useful life (for calculation of depreciation)

Carrying amount

Internal Control:

Assets at cost (from the non-current asset cost ledger account) X

Accumulated depreciation (from the ledger account) (X)

Total of carrying amounts listed in the asset register X

Any difference should be investigated and corrected, for instance because:

Assets have been stolen, damaged or scrapped (for nil proceeds)

Assets are obsolete

There are new assets, not yet recorded in the register

There have been enhancements not yet recorded in the register

There are errors in the register

Mai Anh Pham, ACCA, MSc Page 14

FINANCIAL ACCOUNTING 1- CHAPTER 4

8. Intangible non-current assets

Definitions are given by IAS 38.

An intangible asset is an identifiable non-monetary asset without physical substance. The asset must

be:

– Controlled by the entity as a result of events in the past

– Something from which the entity expects future economic benefits to flow

Research is original and planned investigation undertaken with the prospect of gaining new

scientific or technical knowledge and understanding.

– Activities aimed at obtaining new knowledge

– The search for applications of research findings or other knowledge

– The search for product or process alternatives

– The formulation and design of possible new or improved product or process alternatives

Development is the application of research findings or other knowledge to a plan or design for the

production of new or substantially improved materials, devices, products, processes, systems or

services prior to the commencement of commercial production or use

– The design, construction and testing of pre-production prototypes and models

– The design of tools, jigs, moulds and dies involving new technology

– The design, construction and operation of a pilot plant that is not of a scale economically

feasible for commercial production

– The design, construction and testing of a chosen alternative for new/improved materials

Amortisation is the systematic allocation of the depreciable amount of an intangible asset over its

useful life. Amortisation period and amortisation method should be reviewed at each financial year

end.

Depreciable amount is the cost of an asset, or other amount substituted for cost, less its

residual value.

Useful life is:

(a) The period over which an asset is expected to be available for use by an entity; or

(b) The number of production or similar units expected to be obtained from the asset by an

entity

Mai Anh Pham, ACCA, MSc Page 15

You might also like

- 17 Property Plant and Equipment PART 1 PDFDocument25 pages17 Property Plant and Equipment PART 1 PDFJay Aubrey PinedaNo ratings yet

- BCG Reigniting Radical Growth June 2019 Tcm9 222638Document33 pagesBCG Reigniting Radical Growth June 2019 Tcm9 222638sdadaaNo ratings yet

- Ias 16Document3 pagesIas 16CandyNo ratings yet

- Final Examination Cost Accounting 2019 FinalDocument6 pagesFinal Examination Cost Accounting 2019 FinalElias DeusNo ratings yet

- 10a IAS 16Document30 pages10a IAS 16Ian chisema100% (1)

- 17.11.2020 IAS 16 Property, Plant and EquipmentDocument12 pages17.11.2020 IAS 16 Property, Plant and EquipmentLolita IsakhanyanNo ratings yet

- III. Accounting Treatment For Non-Current AssetsDocument6 pagesIII. Accounting Treatment For Non-Current AssetsCezar CalinNo ratings yet

- 001.property Plant and EquipmentDocument23 pages001.property Plant and EquipmentShane PajaberaNo ratings yet

- Ias 16 PpeDocument168 pagesIas 16 PpeValeria PetrovNo ratings yet

- First Term Exam (Sba) : RequiredDocument23 pagesFirst Term Exam (Sba) : RequiredblueberryNo ratings yet

- Module 4 (Topic 4) - MachineryDocument8 pagesModule 4 (Topic 4) - MachineryAnn BergonioNo ratings yet

- Financial Accounting - Fixed AssetsDocument5 pagesFinancial Accounting - Fixed Assetsearlalegre48No ratings yet

- Far410 Chapter 5 Ppe NoteDocument19 pagesFar410 Chapter 5 Ppe NoteAQILAH NORDINNo ratings yet

- Ias 16 & Ias 40Document47 pagesIas 16 & Ias 40Etiel Films / ኢትኤል ፊልሞች100% (1)

- Lecture One Management Information& Cost Accounti: Financial Accounting - Legal RequirementDocument8 pagesLecture One Management Information& Cost Accounti: Financial Accounting - Legal RequirementVi TranNo ratings yet

- PAS 16 - Property Plant and EquipmentDocument23 pagesPAS 16 - Property Plant and Equipmentロザリーロザレス ロザリー・マキルNo ratings yet

- Quizzer For QE 3BSA Management ServicesDocument15 pagesQuizzer For QE 3BSA Management ServicesSara ChanNo ratings yet

- IAS16 Notes Property-Plant-And-Equipment - 23 Feb 2024Document23 pagesIAS16 Notes Property-Plant-And-Equipment - 23 Feb 2024Katlego BafanaNo ratings yet

- Ias 16Document44 pagesIas 16Faraz Ahmed QuddusiNo ratings yet

- Accounting Ch. 9Document244 pagesAccounting Ch. 9a.j.h.149162536496481100No ratings yet

- Part D-8 Tangible Non Current Assests (ch06)Document68 pagesPart D-8 Tangible Non Current Assests (ch06)hyangNo ratings yet

- More ConceptsDocument47 pagesMore ConceptsGurkirat Singh100% (1)

- Cost AccountingDocument14 pagesCost Accountingkiros100% (1)

- Paper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsDocument22 pagesPaper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsSneha VermaNo ratings yet

- Property, Plant and Equipment: Discontinued Operations)Document8 pagesProperty, Plant and Equipment: Discontinued Operations)Justine VeralloNo ratings yet

- Financial JustificationDocument5 pagesFinancial JustificationDilippndtNo ratings yet

- Ias - 16 - PpeDocument25 pagesIas - 16 - PpeRMG Career Society BDNo ratings yet

- FA Materials - Chapter 8Document18 pagesFA Materials - Chapter 8Nazrin HasanzadehNo ratings yet

- LKAS 16 - TheoryDocument27 pagesLKAS 16 - Theoryshafeeibrahim75No ratings yet

- 2.1. Property Plant and Equipment IAS 16Document7 pages2.1. Property Plant and Equipment IAS 16Priya Satheesh100% (1)

- Property Plant and Equipment, GovernmentDocument17 pagesProperty Plant and Equipment, GovernmentJomerNo ratings yet

- Financial Accounting - Information For Decisions - Session 5 - Chapter 7 PPT gFWXdxUqrsDocument55 pagesFinancial Accounting - Information For Decisions - Session 5 - Chapter 7 PPT gFWXdxUqrsmukul3087_305865623No ratings yet

- Ia1 - Final ExaminationDocument7 pagesIa1 - Final ExaminationLorence IbañezNo ratings yet

- Cost CH 3Document20 pagesCost CH 3Yonas AyeleNo ratings yet

- 02-08-2022 CRC-ACE - AFAR - Week 05 - Factory OverheadDocument14 pages02-08-2022 CRC-ACE - AFAR - Week 05 - Factory Overheadjohn francisNo ratings yet

- Property, Plant and Equipment - DepreciationDocument34 pagesProperty, Plant and Equipment - DepreciationSharmaineMiranda50% (2)

- Faculty Name - Sandeep Bhatiya: Financial Accounting FundamentalDocument34 pagesFaculty Name - Sandeep Bhatiya: Financial Accounting FundamentalNamrata PrasadNo ratings yet

- Ias 16 PropertyDocument11 pagesIas 16 PropertyFolarin EmmanuelNo ratings yet

- 1.2 Far1 Vol II Autumn 2022Document417 pages1.2 Far1 Vol II Autumn 2022rana m harisNo ratings yet

- Toa Mas p1 p2 2Document9 pagesToa Mas p1 p2 2alyssagdNo ratings yet

- Learning Outcomes: After Studying This Chapter, Students Should Be Able ToDocument12 pagesLearning Outcomes: After Studying This Chapter, Students Should Be Able ToNUR SYAZANI MUHAMMADNo ratings yet

- Property Plant and Equipment Adacp Outline Chapter 10Document9 pagesProperty Plant and Equipment Adacp Outline Chapter 10raderpinaNo ratings yet

- Solution DEc-19 CMADocument20 pagesSolution DEc-19 CMAvertikaNo ratings yet

- Exercise 6-1 (Classification of Cost Drivers)Document18 pagesExercise 6-1 (Classification of Cost Drivers)Barrylou ManayanNo ratings yet

- Property, Plant and EquipmentDocument45 pagesProperty, Plant and EquipmentRiyah ParasNo ratings yet

- Cost U4Document29 pagesCost U4firaolmosisabonkeNo ratings yet

- Job Costing and Balance Scorecard NotesDocument4 pagesJob Costing and Balance Scorecard NotesArun HariharanNo ratings yet

- Theory of Accounting - SUMMARY of PPEDocument15 pagesTheory of Accounting - SUMMARY of PPESteven Chou100% (2)

- Property, Plant and Equipment (IAS 16)Document4 pagesProperty, Plant and Equipment (IAS 16)Yunus AlamgeerNo ratings yet

- Cost AllocationDocument52 pagesCost Allocationalafitoso MedinaNo ratings yet

- CF07 - Property Plant and Equipment Acquisition, Classification and DepreciationDocument9 pagesCF07 - Property Plant and Equipment Acquisition, Classification and DepreciationABMAYALADANO ,ErvinNo ratings yet

- Ppe 2016Document40 pagesPpe 2016Benny Wee0% (1)

- ACC 1100 Days 14&15 Long-Lived Assets PDFDocument25 pagesACC 1100 Days 14&15 Long-Lived Assets PDFYevhenii VdovenkoNo ratings yet

- Paper 5 Cost Management AccountingDocument685 pagesPaper 5 Cost Management AccountingAlson PrasaiNo ratings yet

- Intermediate Group II Test Papers (Revised July 2009)Document55 pagesIntermediate Group II Test Papers (Revised July 2009)Sumit AroraNo ratings yet

- Chapter - 01 - Overview - of - Management - Accounting - Doc - Filename UTF-8''Chapter 01 Overview of Management AccountingDocument3 pagesChapter - 01 - Overview - of - Management - Accounting - Doc - Filename UTF-8''Chapter 01 Overview of Management AccountingNasrinTonni AhmedNo ratings yet

- 2nd Evaluation Exam Management Services - January 11, 2017 (G.Sanchez)Document16 pages2nd Evaluation Exam Management Services - January 11, 2017 (G.Sanchez)Beverlene BatiNo ratings yet

- Cost Accounting ExamDocument5 pagesCost Accounting ExamPrecy Lyn UntalNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Beneish M ScoreDocument3 pagesBeneish M ScoreLarasati LalatNo ratings yet

- Dare To Make Robotics Startup: Evans Winanda Wirga, ST, MMSI Instagram: @evanswinanda Facebook: @evans - WinandawirgaDocument45 pagesDare To Make Robotics Startup: Evans Winanda Wirga, ST, MMSI Instagram: @evanswinanda Facebook: @evans - WinandawirgaKong ArthurNo ratings yet

- Organic Trade Association RFPDocument28 pagesOrganic Trade Association RFPEbony ShambergerNo ratings yet

- Chapter 23 Hedging With Financial DerivativesDocument15 pagesChapter 23 Hedging With Financial DerivativesGiang Dandelion100% (1)

- Latsol Pas Ipa XiiDocument16 pagesLatsol Pas Ipa XiiWanda DestaliaNo ratings yet

- Insurance Digests 1Document128 pagesInsurance Digests 1Cyril Rufino Casabar PelayoNo ratings yet

- JOHANSSON - ChapDocument29 pagesJOHANSSON - Chaplow profileNo ratings yet

- Chapter 8 WorkingPapers 315F0EBDBB892Document16 pagesChapter 8 WorkingPapers 315F0EBDBB892Lalee ThomasNo ratings yet

- Homework 2 - Lakshmi Mittal and The Growth of Mittal Steel - EditedDocument10 pagesHomework 2 - Lakshmi Mittal and The Growth of Mittal Steel - Editedjjc60631100% (1)

- Commissioner Sharon Barnes Sutton and Judy Brownlee Ethics Complaint and AmendmentDocument33 pagesCommissioner Sharon Barnes Sutton and Judy Brownlee Ethics Complaint and AmendmentViola Davis100% (1)

- Marketing Presentation On Haldiram Case StudyDocument9 pagesMarketing Presentation On Haldiram Case StudysundarsmmNo ratings yet

- 01-Lecture 1Document29 pages01-Lecture 1umerNo ratings yet

- Jetblue Ipo Case: What Are The Advantages and Disadvantages of Going Public?Document2 pagesJetblue Ipo Case: What Are The Advantages and Disadvantages of Going Public?HouDaAakNo ratings yet

- CR Bank ListDocument1 pageCR Bank ListHonest ReviewsNo ratings yet

- Checking SummaryDocument4 pagesChecking SummaryIrnes BainNo ratings yet

- Corporate Social Responsibility: MGMT 621 Contemporary Ethical Issues in Management Jeffery D. SmithDocument14 pagesCorporate Social Responsibility: MGMT 621 Contemporary Ethical Issues in Management Jeffery D. SmithSagarika SadiNo ratings yet

- Sun Sand Ceiling FDocument13 pagesSun Sand Ceiling FAngela Teberga de PaulaNo ratings yet

- Unit IIDocument24 pagesUnit IISaurav KakkarNo ratings yet

- East Punjab Utilization of Lands Act, 1949 PDFDocument11 pagesEast Punjab Utilization of Lands Act, 1949 PDFLatest Laws TeamNo ratings yet

- Direct Custody and ClearingDocument2 pagesDirect Custody and Clearingapi-313045815No ratings yet

- Vibhor Kumar CVDocument2 pagesVibhor Kumar CVVibhorkmrNo ratings yet

- Stanley Partners Fund PDFDocument24 pagesStanley Partners Fund PDFtkgoon6349No ratings yet

- Addis Atinafu Mangemet ArticleDocument40 pagesAddis Atinafu Mangemet ArticleAlazer Tesfaye Ersasu TesfayeNo ratings yet

- WC Claim FormDocument3 pagesWC Claim FormSakthivel MechNo ratings yet

- Limitations of The MFRS 119Document2 pagesLimitations of The MFRS 119HidayahFauzi100% (1)

- Sri Lanka Budget Speech 2014Document46 pagesSri Lanka Budget Speech 2014Ada DeranaNo ratings yet

- WRD FinMan 14e - SM 05Document82 pagesWRD FinMan 14e - SM 05CyyyNo ratings yet

- Disadvantage of CapitalismDocument2 pagesDisadvantage of CapitalismRonnel Angelo TrevinioNo ratings yet