Professional Documents

Culture Documents

Three Jays Corporation Case Data Analysis: Comparison of Old and New Eoq (With Updated Costs)

Three Jays Corporation Case Data Analysis: Comparison of Old and New Eoq (With Updated Costs)

Uploaded by

Afaq ZaimOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Three Jays Corporation Case Data Analysis: Comparison of Old and New Eoq (With Updated Costs)

Three Jays Corporation Case Data Analysis: Comparison of Old and New Eoq (With Updated Costs)

Uploaded by

Afaq ZaimCopyright:

Available Formats

THREE JAYS

CORPORATION

CASE DATA ANALYSIS

Group Number: Team 8

Group Name: Afaq Zaim

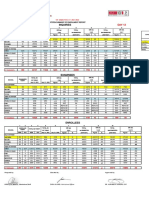

COMPARISON OF OLD AND NEW EOQ (WITH UPDATED COSTS)

T EOQ USING EXISTING METHOD (USING 2010 SALES DATA AND DATA GIVEN IN

EXHIBIT 2)

PRODUCT (12 OZ) 3JS MARRAN KERRY DOM AAA

SALES/WK 57.56 44.9 28.69 17.04 12.02

S=SETUP COST 63.7 63.7 63.7 63.7 63.7

D=ANNUAL DEMAND (CASES) 2993 2335 1492 886 625

I=CARRYING COST 2.5506 2.7468 2.4174 2.6109 1.647

C=FULL COST/CASE 0.00946876 0.0130706 0.018002681 0.032742664 0.042112

EOQ (OLD) 387 329 280 208 220

ROP (3 WEEKS) 173 135 86 51 36

T EOQ USING EXISTING METHOD (USING 2012 SALES DATA AND DATA GIVEN IN

EXHIBIT 2)

PRODUCT (12 OZ) 3JS MARRAN KERRY DOM AAA

SALES/WK 74.4 57.81 37.88 23.29 16

S=SETUP COST 63.7 63.7 63.7 63.7 63.7

D=ANNUAL DEMAND (CASES) 3869 3006 1970 1211 832

I=CARRYING COST 2.55 2.75 2.42 2.61 1.65

C=FULL COST/CASE 0.00732 0.01015 0.010465 0.02396 0.03163

EOQ (OLD) 440 373 322 243 253

ROP (3 WEEKS) 223 173 114 70 48

% INCREASE IN SALES 29.26% 28.75% 32.03% 36.68% 33.11%

% INCREASE IN EOQ 13.71% 13.40% 14.85% 16.93% 15.27%

T EOQ USING RECOMMENDED COSTS AND 2012 SALES DATA

PRODUCT (12 OZ) 3JS MARRAN KERRY DOM AAA

SALES/WK 74.4 57.81 37.88 23.29 16

S=SETUP COST 37.5 37.5 37.5 37.5 37.5

D=ANNUAL DEMAND (CASES) 3869 3006 1970 1211 832

I=CARRYING COST 0.23 0.23 0.23 0.23 0.23

C=FULL COST/CASE 25.79 27.97 24.31 24.46 23.77

EOQ (OLD) 221 187 163 127 107

ROP (3 WEEKS) 223 173 114 70 48

% INCREASE IN SALES 29% 29% 32% 37% 33%

% INCREASE IN EOQ -43% -43% -42% -39% -51%

ROP (4 WEEKS) 298 231 152 93 64

WHAT IS THE IMPACT OF SETUP COSTS AND CARRYING COSTS ON EOQ? MENTION IN 1 LINE

The change in setup cost and carrying cost has led to a decrease in EOQ of the company

You might also like

- Case Study Report 1: Three Jays Corporation: The 2012 Annual Demand Is Given AsDocument12 pagesCase Study Report 1: Three Jays Corporation: The 2012 Annual Demand Is Given AsSakshi Sharda100% (5)

- Three Jays Corporation: BY AMIT TAYDE-20192202 Animesh Mahapatra - 2019129 SUBHAMPAUL - 20192254 PRATIK BHOSALE - 20191072Document13 pagesThree Jays Corporation: BY AMIT TAYDE-20192202 Animesh Mahapatra - 2019129 SUBHAMPAUL - 20192254 PRATIK BHOSALE - 20191072subham paulNo ratings yet

- Daily Production Report Format and ExampleDocument1 pageDaily Production Report Format and ExampleJCS0% (2)

- ACSR Conductor Data SheetsDocument4 pagesACSR Conductor Data SheetsPrasad Yeluripati100% (2)

- Internship Report On ISPDocument60 pagesInternship Report On ISPsuprithsai50% (2)

- Coin Sorter NewDocument14 pagesCoin Sorter Newvishnu100% (1)

- DHROL BOQ (Abstract)Document1 pageDHROL BOQ (Abstract)O Vijay ChandNo ratings yet

- 2.0 MR01 - Jan 2015 Total Project Cost - Overall Summary WO Fee FOREX Below TotalDocument1 page2.0 MR01 - Jan 2015 Total Project Cost - Overall Summary WO Fee FOREX Below TotalWilmer Lapa QuispeNo ratings yet

- 18 Col Ten-4 - 2024-MARDocument4 pages18 Col Ten-4 - 2024-MARjarar60723No ratings yet

- Est 230715 132158Document4 pagesEst 230715 132158Sambhav SinghalNo ratings yet

- ENGIE FY 2022 Databook ExcelDocument73 pagesENGIE FY 2022 Databook ExcelshyamagniNo ratings yet

- EnergyAuditReport-May 2024Document1 pageEnergyAuditReport-May 2024Biradarmanjula BiradarNo ratings yet

- Summar Ry of Profit & Loss Stateme Ent 1991 20 013 in US$,000 0Document2 pagesSummar Ry of Profit & Loss Stateme Ent 1991 20 013 in US$,000 0djokouwmNo ratings yet

- Planning Decision Support ModelDocument2,505 pagesPlanning Decision Support ModelwahajNo ratings yet

- Test Kuat Tekan 350Document3 pagesTest Kuat Tekan 350erik tiblolaNo ratings yet

- Daily 02-07-2023Document2 pagesDaily 02-07-2023Andi RiyantoNo ratings yet

- AZ and Eazy JetDocument3 pagesAZ and Eazy JetAleem ShahidNo ratings yet

- System Wide 1st SemDocument3 pagesSystem Wide 1st SemPerpetual DALTA OfficialNo ratings yet

- Daily Report 04 February 2011Document5 pagesDaily Report 04 February 2011abhijit_athalyeNo ratings yet

- Progress Claim Form - Example: Mr. Bob SmithDocument1 pageProgress Claim Form - Example: Mr. Bob SmithMandalinaQitryNo ratings yet

- Progress Claim Form - Example: Mr. Bob SmithDocument1 pageProgress Claim Form - Example: Mr. Bob SmithMandalinaQitryNo ratings yet

- Progress Claim Form - Example: Mr. Bob SmithDocument1 pageProgress Claim Form - Example: Mr. Bob SmithdtsecuritysolutionNo ratings yet

- Daily Report Apr MayDocument223 pagesDaily Report Apr Maysandip maneNo ratings yet

- JGPKJG (KLDocument11 pagesJGPKJG (KLjdgregorioNo ratings yet

- FM II Assignment 3Document12 pagesFM II Assignment 3TestNo ratings yet

- BrokeragesDocument24 pagesBrokeragesCariza BitongNo ratings yet

- Konversi Mutu Beton ADHIMIX 97Document21 pagesKonversi Mutu Beton ADHIMIX 97mudifNo ratings yet

- Plan de Trabajos: Cash FlowDocument3 pagesPlan de Trabajos: Cash FlowAriel IsaackNo ratings yet

- Informacion Cuantitativa: Grado de Exposición No Expuesto No ExpuestoDocument6 pagesInformacion Cuantitativa: Grado de Exposición No Expuesto No ExpuestoLina ZolNo ratings yet

- Compare MEP All RankingDocument6 pagesCompare MEP All RankingJimmy WalkerNo ratings yet

- ColumnDocument1 pageColumnKapukets GreyNo ratings yet

- Wholesales - Retail Sales - Production - Export Import by Category Jan-Aug 2020Document2 pagesWholesales - Retail Sales - Production - Export Import by Category Jan-Aug 2020Dwi PranomoNo ratings yet

- Overall FinalDocument5 pagesOverall FinalVijayNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document2 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Engie Fy 2022 Databook PDFDocument90 pagesEngie Fy 2022 Databook PDFshyamagniNo ratings yet

- Serasa Experian Credit RatingDocument8 pagesSerasa Experian Credit Ratingsrmfilho123No ratings yet

- WMP - 1324Document14 pagesWMP - 1324benny nggoNo ratings yet

- CTC R2Document6 pagesCTC R2patnamsuseelNo ratings yet

- Update Stock 14 Mei 22-1Document21 pagesUpdate Stock 14 Mei 22-1Naffa NapolNo ratings yet

- 1a Measures of Central TendencyDocument30 pages1a Measures of Central TendencyVipulkumar Govindbhai UlvaNo ratings yet

- The Tinplate Company of India Limited: Outcome of Board MeetingDocument5 pagesThe Tinplate Company of India Limited: Outcome of Board MeetingAmrut BhattNo ratings yet

- Tahun Tingkat Penjualan Biaya Produksi Biaya DistribusiDocument4 pagesTahun Tingkat Penjualan Biaya Produksi Biaya DistribusiFira LoraNo ratings yet

- Fira Lora Gita - 20101155310510Document4 pagesFira Lora Gita - 20101155310510Fira LoraNo ratings yet

- DOP - OrgDocument12 pagesDOP - OrgAHMED HASSAN RAZANo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- DAP & PAP Project Cost EstimateDocument8 pagesDAP & PAP Project Cost EstimateSantosh JayasavalNo ratings yet

- Load Vs Settlement-12.xlsx - GroupDocument4 pagesLoad Vs Settlement-12.xlsx - GroupNeelakantamNo ratings yet

- Project SummaryDocument2 pagesProject SummaryEr. Kishor NishadNo ratings yet

- Annual Project Report 2013-2014-2Document140 pagesAnnual Project Report 2013-2014-2umangcomputersNo ratings yet

- TN1021 PDFDocument2 pagesTN1021 PDFvinay rodeNo ratings yet

- QT Company AssignmentDocument21 pagesQT Company AssignmentAISHWARYA MADDAMSETTYNo ratings yet

- تقاريرDocument10 pagesتقاريرAhmed AhmedNo ratings yet

- OTB Vs Budget GIK September2022Document1 pageOTB Vs Budget GIK September2022ErawanNo ratings yet

- Mix Desian DBM Gr-IIDocument126 pagesMix Desian DBM Gr-IISatish JaysiNo ratings yet

- Competition Leaderboard TFTDocument1 pageCompetition Leaderboard TFTSamy Ï Kabwe NundaNo ratings yet

- XM 2007 Maintenance Fee BudgetDocument3 pagesXM 2007 Maintenance Fee BudgetHoward VanMeterNo ratings yet

- Glazetech Glass & Aluminum Installation Total Running Labor Cost As of January - October 2016Document36 pagesGlazetech Glass & Aluminum Installation Total Running Labor Cost As of January - October 2016Aldrin MacaraegNo ratings yet

- 5 Months: Construction and Renovation Works To A Double Storey Link Bungalow at Kelana Jaya, SelangorDocument3 pages5 Months: Construction and Renovation Works To A Double Storey Link Bungalow at Kelana Jaya, SelangorAzhar AhmadNo ratings yet

- Jinhun Bs 2018Document2 pagesJinhun Bs 2018jinhunmachineryNo ratings yet

- FY2019-20 q3 RESULTDocument4 pagesFY2019-20 q3 RESULTgauravkrastogiNo ratings yet

- DCW - Quarterly Result - December 31, 2010Document2 pagesDCW - Quarterly Result - December 31, 2010kayalonthewebNo ratings yet

- Screenshot 2021-01-28 at 3.41.56 PMDocument1 pageScreenshot 2021-01-28 at 3.41.56 PMAfaq ZaimNo ratings yet

- Ford Ka (A) - Data SetDocument37 pagesFord Ka (A) - Data SetAfaq ZaimNo ratings yet

- Empirical Analysis of Ride Sharing Applications in KarachiDocument10 pagesEmpirical Analysis of Ride Sharing Applications in KarachiAfaq ZaimNo ratings yet

- Srilankan Company-FinalDocument18 pagesSrilankan Company-FinalAfaq ZaimNo ratings yet

- Economics 305: Intermediate Microeconomics (Winter 2013)Document9 pagesEconomics 305: Intermediate Microeconomics (Winter 2013)Afaq ZaimNo ratings yet

- Business Policy Chapter 1-3 SlidesDocument77 pagesBusiness Policy Chapter 1-3 SlidesAfaq Zaim0% (1)

- You Must Write Your Answers On An Assignment Sheet and Scan It Before As One Document Before Uploading On The LMS. Typed Assignments Will Not Be AcceptedDocument1 pageYou Must Write Your Answers On An Assignment Sheet and Scan It Before As One Document Before Uploading On The LMS. Typed Assignments Will Not Be AcceptedAfaq ZaimNo ratings yet

- Clark York MR RiftsandShiftsDocument13 pagesClark York MR RiftsandShiftsAfaq ZaimNo ratings yet

- Business Communication Today: Global EditionDocument7 pagesBusiness Communication Today: Global EditionAfaq ZaimNo ratings yet

- Hilton Book Chap 1 SolutionsDocument16 pagesHilton Book Chap 1 SolutionsAfaq ZaimNo ratings yet

- Case Study 2 IkeaDocument4 pagesCase Study 2 IkeaAfaq ZaimNo ratings yet

- Assignment 2 & 3Document4 pagesAssignment 2 & 3Afaq ZaimNo ratings yet

- You Must Write Your Answers On An Assignment Sheet and Scan It Before As One Document Before Uploading On The LMS. Typed Assignments Will Not Be AcceptedDocument1 pageYou Must Write Your Answers On An Assignment Sheet and Scan It Before As One Document Before Uploading On The LMS. Typed Assignments Will Not Be AcceptedAfaq ZaimNo ratings yet

- 84 164046 5994Document3 pages84 164046 5994Afaq ZaimNo ratings yet

- Casio Pathfinder PAG240T 7CR Triple Sensor Men's Watch Module Qw3246Document10 pagesCasio Pathfinder PAG240T 7CR Triple Sensor Men's Watch Module Qw3246Suneo DeltaNo ratings yet

- 01 Become A PostgreSQL DBA Understanding The ArchitectureDocument10 pages01 Become A PostgreSQL DBA Understanding The ArchitectureStephen EfangeNo ratings yet

- Smooth Lower ThirdDocument2 pagesSmooth Lower ThirdAmaliahAisyahRakhmiNo ratings yet

- Abhw 4BDocument18 pagesAbhw 4Bablancheth01No ratings yet

- 90th Percentile Response Time Loadrunner Analysis ReportDocument1 page90th Percentile Response Time Loadrunner Analysis ReportGouse SmdNo ratings yet

- PTC University Creo Curriculum enDocument3 pagesPTC University Creo Curriculum enUsman SarwarNo ratings yet

- Department of Labor: Fpo ContactsDocument5 pagesDepartment of Labor: Fpo ContactsUSA_DepartmentOfLaborNo ratings yet

- Movie Recommendations Based On Emotions Using Web ScrapingDocument7 pagesMovie Recommendations Based On Emotions Using Web ScrapingIJRASETPublicationsNo ratings yet

- Accenture Cover Letter AddressDocument6 pagesAccenture Cover Letter Addressafdnaaxuc100% (1)

- Hair Tutorial in LightwaveDocument15 pagesHair Tutorial in LightwaveElinho GalvãoNo ratings yet

- Unit 1 - The Crime Scene Cheat Sheet: by ViaDocument2 pagesUnit 1 - The Crime Scene Cheat Sheet: by ViaYadirf LiramyviNo ratings yet

- Pornirea MS Cu Magnet PermanentDocument6 pagesPornirea MS Cu Magnet PermanentMeterna AdrianNo ratings yet

- AnsweDocument100 pagesAnsweDharun SingaravadiveluNo ratings yet

- EfreDocument4 pagesEfrealireza doostdariNo ratings yet

- Current Threats For Internal Security of IndiaDocument2 pagesCurrent Threats For Internal Security of IndiaGrave diggerNo ratings yet

- Numerical SolutionDocument2 pagesNumerical SolutionAicelleNo ratings yet

- Impact of Social MediaDocument55 pagesImpact of Social Mediashljins smNo ratings yet

- ISM WM200 Partner Manual PT BRDocument32 pagesISM WM200 Partner Manual PT BREduardo Villas BoasNo ratings yet

- 2D Rotary EncodersDocument88 pages2D Rotary Encodersddsf2012No ratings yet

- Oracle Erp Cloud Implementation Leading Practices WPDocument35 pagesOracle Erp Cloud Implementation Leading Practices WPMiguel Felicio100% (1)

- Ebook Design For Thermal Key Requirements Qualcomm Technologies Inc Online PDF All ChapterDocument49 pagesEbook Design For Thermal Key Requirements Qualcomm Technologies Inc Online PDF All Chaptercynthia.guerrant485100% (8)

- Practical-2: 2IT702: Artificial Intelligence Practical-2Document5 pagesPractical-2: 2IT702: Artificial Intelligence Practical-2DEVANSHI PAREJIYANo ratings yet

- Mengapakah Penting Untuk Mempertimbangkan Isu-Isu Etika Dalam Dunia Siber?Document4 pagesMengapakah Penting Untuk Mempertimbangkan Isu-Isu Etika Dalam Dunia Siber?Faidz FuadNo ratings yet

- Analog Lab Manual enDocument69 pagesAnalog Lab Manual enamcb.021No ratings yet

- GDPR TrainingDocument60 pagesGDPR TrainingMiruna Mihailescu83% (6)

- Windows Defender GuideDocument3 pagesWindows Defender Guideioana tarnaNo ratings yet

- NIH Public AccessDocument14 pagesNIH Public AccesstuNo ratings yet