Professional Documents

Culture Documents

Name The Different Methods of Payment Acceptable Internationally

Name The Different Methods of Payment Acceptable Internationally

Uploaded by

Conni Comaling0 ratings0% found this document useful (0 votes)

14 views3 pagesOriginal Title

Ass 3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views3 pagesName The Different Methods of Payment Acceptable Internationally

Name The Different Methods of Payment Acceptable Internationally

Uploaded by

Conni ComalingCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Conni Joy A.

Comaling October 15, 2021

Group 6 AC 4105

1. Name the different methods of payment acceptable internationally.

Cash in Advance

Documentary Credit or Letter of Credit

Documentary Collections

Open Account

Consignment and Trade Finance

2. Describe each method.

Cash in Advance – Goods are securely paid for by the buyer or importer first

before shipment and ownership is transferred.

Documentary credit or letter of credit – A promise by the bank to pay an exporter

if all the terms in contract are executed properly. One of the most secured

payment methods.

Documentary Collection – Exporter instructs bank to forward documents

regarding the sale to the importer’s bank with a request to present them to the

buyer as a request for payment indicating the conditions for it to be released to the

buyer. Importer may obtain possession of goods is he/she possesses the shipping

documents. This method can be done in two ways.

Open Account – Goods are shipped and delivered before payment is due usually

in 30, 60 or 90.

Consignment & Trade Finance – Consignment is when payment is sent only to

the exporter when the importer and distributer has sold the goods to the end

customer. Trade finance is when exporter requires an importer to prepay the

goods the goods shipped.

3. Give the procedure on how this payment can be made.

Cash in Advance

i. Importer purchases goods in an international market through online

or other platforms.

ii. Before the purchase pushes through, the market receives payment

from the importer in advance through wire transfers, credit cards,

escrow services or international cheque.

iii. The purchase then pushes through after payment then shipment is

prepared and ownership is transferred to the importer.

Documentary credit or letter of credit

i. The contract is negotiated and confirmed then importer applies for

documentary credit with their bank.

ii. The documentary credit is then set up by the issuing bank and the

exporter and exporter’s bank are then notified by the importer’s

bank.

iii. The goods are then shipped.

iv. Terms of sale as well as documents verifying the shipment are then

provided by the exporter to the exporter’s bank and the exporter’s

forwards the documents to the importer’s issuing bank.

v. The issuing bank then verifies the documents and issues payment to

the exporter’s bank.

vi. The importer then collects the goods.

Documentary collection

A. Document against payment

i. Contract is negotiated and confirmed then exporter ships goods.

ii. Exporter forwards documents to his/her bank confirming the

transaction.

iii. Exporter’s bank forwards documents to importer’s bank then

requests payment from the importer by presenting the documents.

iv. The importer then pays his/her bank then the payment is transferred

to the exporter’s bank.

v. The exporter’s bank pays the exporter.

B. Document against acceptance

i. Contract is negotiated and confirmed then exporter ships the goods.

ii. Exporter presents transaction documents to their bank.

iii. Exporter’s bank forwards documents to the importer’s bank.

iv. Importer’s bank requests payment by presenting the documents

banks.

v. The importer makes payment, receives the documents and collects

the goods.

vi. The importer’s bank pays the exporter’s bank and the exporter’s

bank pays the exporter.

Open Account

i. Importer makes an open account purchase from an exporter in the

international market.

ii. The goods along with the necessary documents are then shipped to

the importer who has agreed to pay the exporter’s invoice at a

specified date.

iii. The exporter has trust and confidence that the importer will accept

shipment and would pay at the agreed time and that the importing

country is commercially and politically secure.

Consignment & Trade Finance

A. Consignment

i. Exporter in the international market comes to an agreement with an

importer on terms and conditions of the transaction.

ii. The goods are then shipped along with the necessary documents to

the importer.

iii. Importer is responsible for the management and sale of the goods.

iv. Importer only obliged to fulfill payment when the goods are sold to

end customers.

B. Trade Finance

i. Importer’s bank will provide a letter of credit to the exporter to

provide payment and the presentation of necessary documents like

the bill of lading. Note that the bank is only responsible of the

documents.

ii. The exporter then receives the documents stating the specified date

and time on which he/she will be paid for the shipped goods.

iii. The exporter is then paid at a specified date and time.

4. Choose one mode of payment that is best for you and explain.

Cash in Advance is the best mode of payment for me especially in

international stores or even the local ones because it is less hassle on my

part than other modes of payment that could cost more because of other

fees as well as it might take longer than usual. It is also understandable

that sellers will require advance payment since the sale is in an

international platform. Through the use of a credit card, you can access

international stores and make purchases with just a tap of a finger.

5. In the future, what transaction do you want to use that method of payment?

I want to use Cash in Advance in the event that I will open my personal

business since it’s a security in my part that will assure me that I will

really receive payment for the goods that I ship to buyers. Also, I know

within myself that I am a legit seller thus, employing the cash in advance

as my payment method will be understandable among my buyers.

You might also like

- Stow Questions and AnswersDocument68 pagesStow Questions and AnswersRodney SeepersadNo ratings yet

- Methods of PaymentDocument4 pagesMethods of PaymentRashad Ahamed100% (1)

- Unit 4 - Payment in International Trade - To StsDocument21 pagesUnit 4 - Payment in International Trade - To StsK59 TRAN THI THU HANo ratings yet

- Unit 4 - Payment in International Trade - To StsDocument21 pagesUnit 4 - Payment in International Trade - To StsMinh Khuê NguyễnNo ratings yet

- Payment Terms: Dr. A.K. Sengupta Principal Advisor CED Former Dean, Indian Institute of Foreign TradeDocument14 pagesPayment Terms: Dr. A.K. Sengupta Principal Advisor CED Former Dean, Indian Institute of Foreign TradeimadNo ratings yet

- Risk Bearing Documents in International TradeDocument8 pagesRisk Bearing Documents in International TradeSukrut BoradeNo ratings yet

- Chapter 5Document41 pagesChapter 5ngonh.nguyenhuyNo ratings yet

- Methods of EximDocument23 pagesMethods of Eximvchoudhry2No ratings yet

- DIB 02 - 202 International Trade and Finance - 04Document19 pagesDIB 02 - 202 International Trade and Finance - 04farhadcse30No ratings yet

- L 10 External TradeDocument5 pagesL 10 External TradeDeveshi TewariNo ratings yet

- Export Import ProcessDocument26 pagesExport Import ProcessM HarikrishnanNo ratings yet

- MNGT412 Letter of Credit 141403Document67 pagesMNGT412 Letter of Credit 141403Sales LinkedpharmaNo ratings yet

- TA4 G4 Presentation - Chap 7 HandoutDocument1 pageTA4 G4 Presentation - Chap 7 HandoutK60 Hoàng Thiên TrangNo ratings yet

- Difference Between Export Bill Collection and Export Bill Discounting.Document3 pagesDifference Between Export Bill Collection and Export Bill Discounting.lavanyakotaNo ratings yet

- Chap 10Document32 pagesChap 10Sarjil alamNo ratings yet

- Cash Against Documents (CAD) : Group 4Document17 pagesCash Against Documents (CAD) : Group 4Bùi Huy CườngNo ratings yet

- Bài tập Unit 4Document8 pagesBài tập Unit 4Thu HàNo ratings yet

- Bài tập Unit 4Document8 pagesBài tập Unit 4Thắng Trần LêNo ratings yet

- Unit 4 - Exercises to sts tiếng anh chuyên ngành 3 FTUDocument6 pagesUnit 4 - Exercises to sts tiếng anh chuyên ngành 3 FTUvunguyenvankhanh171104No ratings yet

- Chaptre 4Document19 pagesChaptre 4Tariku AsmamawNo ratings yet

- Letter of Credit I UpdatedDocument24 pagesLetter of Credit I UpdatedaeeeNo ratings yet

- Bài Tập Unit 4Document7 pagesBài Tập Unit 4Nguyễn Lanh AnhNo ratings yet

- Cridit Managment: MBA Banking & Finance 3 TermDocument28 pagesCridit Managment: MBA Banking & Finance 3 Term✬ SHANZA MALIK ✬100% (2)

- International Trade and Trade Service OperationDocument19 pagesInternational Trade and Trade Service OperationEmebet Tesema100% (2)

- Chapter 11Document18 pagesChapter 11Thai Ngoc Minh (K17 DN)No ratings yet

- MethodsDocument18 pagesMethodsMamoona DarNo ratings yet

- CH 7Document16 pagesCH 7ismail adanNo ratings yet

- Trade Settlement MethodsDocument25 pagesTrade Settlement Methodspinku_thakkar0% (1)

- CHP 6Document26 pagesCHP 6appenincorpNo ratings yet

- Methods of PaymentDocument100 pagesMethods of Paymentlaponad628No ratings yet

- Methods of Settlement of PaymentDocument35 pagesMethods of Settlement of Paymentfamilyfriend070No ratings yet

- Export/Import Procedures: Md. Sarwar Hossain Deputy General Manager Bangladesh BankDocument12 pagesExport/Import Procedures: Md. Sarwar Hossain Deputy General Manager Bangladesh BankAlam (MDO)No ratings yet

- Modes of Payment WorkshopDocument2 pagesModes of Payment WorkshopDianaTamayoNo ratings yet

- Trade Payment MethodsDocument12 pagesTrade Payment MethodsDhruveet RaiyaniNo ratings yet

- External Trade: Team ADocument11 pagesExternal Trade: Team AKhan ShahRukhNo ratings yet

- Documentationprocessininternationalshipping 170708143239 PDFDocument15 pagesDocumentationprocessininternationalshipping 170708143239 PDFSunil SainiNo ratings yet

- International BankingDocument46 pagesInternational BankingSandesh Bhat100% (1)

- Foreign Exchange NoteDocument37 pagesForeign Exchange NoteAtia IbnatNo ratings yet

- Payment Method in International TradeDocument9 pagesPayment Method in International TradeLIZMARIA SEBYNo ratings yet

- 12 Letter of CreditDocument16 pages12 Letter of Creditحسيب مرتضي96% (25)

- Letter of CreditDocument7 pagesLetter of CreditprasadbpotdarNo ratings yet

- FCIB Webinar Series: Documentary CollectionsDocument22 pagesFCIB Webinar Series: Documentary CollectionsYanLi YangNo ratings yet

- Payment TermDocument29 pagesPayment Termthanhtruong.31211023016No ratings yet

- U4 Financing International TradeDocument49 pagesU4 Financing International TradeQP0084 Pham Duc VietNo ratings yet

- Hansa A4 Dokmaksed Eng UUS PDFDocument51 pagesHansa A4 Dokmaksed Eng UUS PDFmackjblNo ratings yet

- Banking Project NewDocument77 pagesBanking Project NewMohit PaleshaNo ratings yet

- Chapter 4-1Document18 pagesChapter 4-1syahiir syauqiiNo ratings yet

- Introduction To Foreign Exchange and Trade Finance: Mahesh Sabharwal Punjab & Sind BankDocument35 pagesIntroduction To Foreign Exchange and Trade Finance: Mahesh Sabharwal Punjab & Sind BankMahesh SabharwalNo ratings yet

- Letter of CreditDocument16 pagesLetter of CreditDaniyal100% (2)

- Harshit TiwariDocument6 pagesHarshit TiwariGaurav Singh NegiNo ratings yet

- DP ProcessDocument3 pagesDP ProcessKiều Ngọc DungNo ratings yet

- Parties Involved in A Letter of CreditDocument3 pagesParties Involved in A Letter of CreditGhulam AbbasNo ratings yet

- FinancingDocument30 pagesFinancingAsiyah KhiruddinNo ratings yet

- Pre-Shipment and Post-Shipment Finance: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign TradeDocument7 pagesPre-Shipment and Post-Shipment Finance: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign TradeimadNo ratings yet

- International Trade FinanceDocument12 pagesInternational Trade FinanceHarshit GoyalNo ratings yet

- Payment MethodDocument36 pagesPayment MethodNazneen SabinaNo ratings yet

- Unit 4 Notes Global Business ManagementDocument56 pagesUnit 4 Notes Global Business ManagementGracyNo ratings yet

- Letters of Credit and Documentary Collections: An Export and Import GuideFrom EverandLetters of Credit and Documentary Collections: An Export and Import GuideRating: 1 out of 5 stars1/5 (1)

- Summary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeFrom EverandSummary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeNo ratings yet

- Reverse Mortgage: Leverage Home Equity, the Appraised Value, and Asset-Backed SecuritiesFrom EverandReverse Mortgage: Leverage Home Equity, the Appraised Value, and Asset-Backed SecuritiesNo ratings yet

- Budgeting 101: Getting The Best Budget Planner: How To Budget and Save Money To Transform Your FinancesDocument18 pagesBudgeting 101: Getting The Best Budget Planner: How To Budget and Save Money To Transform Your FinancesConni ComalingNo ratings yet

- Virtual Assistant For Coaches: How To Make Money From Home As A Virtual AssistantDocument7 pagesVirtual Assistant For Coaches: How To Make Money From Home As A Virtual AssistantConni ComalingNo ratings yet

- Case Study SM SupermarketsDocument2 pagesCase Study SM SupermarketsConni ComalingNo ratings yet

- Rizal and Popular NationalismDocument8 pagesRizal and Popular NationalismConni ComalingNo ratings yet

- MP202324725 1Document2 pagesMP202324725 1betelehem hailuNo ratings yet

- Brand Mantras Rationale Criteria and ExamplesDocument11 pagesBrand Mantras Rationale Criteria and ExamplesBrownbrothaMNo ratings yet

- MBA 509-1 HRM Lecture 3 IUB FinalDocument15 pagesMBA 509-1 HRM Lecture 3 IUB FinalMd. Muhinur Islam AdnanNo ratings yet

- Machine Learning in Production Planning and Control A Review of Empirical LiteratureDocument6 pagesMachine Learning in Production Planning and Control A Review of Empirical LiteratureRicardo KatoNo ratings yet

- TPMDocument64 pagesTPMShubham Saraf100% (1)

- Principles of Risk Management and Insurance 12th Edition Rejda Test BankDocument25 pagesPrinciples of Risk Management and Insurance 12th Edition Rejda Test BankRobertBlankenshipbrwez100% (36)

- K 1351010 Abstract enDocument1 pageK 1351010 Abstract enNovi NoviNo ratings yet

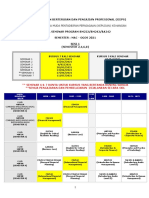

- Program Ijazah Sarjana Muda Pentadbiran Perniagaan (Kepujian) KewanganDocument7 pagesProgram Ijazah Sarjana Muda Pentadbiran Perniagaan (Kepujian) Kewangannur fatinNo ratings yet

- Pur-Man-0001 Rev 20.0)Document24 pagesPur-Man-0001 Rev 20.0)ALEX MURPHYNo ratings yet

- 3a Lab Commodity MGT PDFDocument53 pages3a Lab Commodity MGT PDFsisay SolomonNo ratings yet

- List of Documents For Plates & TubularsDocument6 pagesList of Documents For Plates & Tubularssudeep dsouzaNo ratings yet

- Market Analysis AssignmentDocument2 pagesMarket Analysis AssignmentnaveenabiNo ratings yet

- Carey & Simnett (2006)Document25 pagesCarey & Simnett (2006)ashkanfashamiNo ratings yet

- Product Outline 1Document5 pagesProduct Outline 1MasterPotatoNo ratings yet

- Kano S Theory of Attractive Quality and PackagingDocument33 pagesKano S Theory of Attractive Quality and PackagingAvyno AvynoNo ratings yet

- Case-Study-Cebu-Pac DoneDocument4 pagesCase-Study-Cebu-Pac DonemarkNo ratings yet

- Peter EnglandDocument22 pagesPeter EnglandRitesh Umraniya100% (1)

- Recognising Forced Labour Risks in Global Supply Chains, With Data From 100,000 AuditsDocument26 pagesRecognising Forced Labour Risks in Global Supply Chains, With Data From 100,000 AuditsComunicarSe-ArchivoNo ratings yet

- Tea M 12: Evaluating Salesperson PerformanceDocument33 pagesTea M 12: Evaluating Salesperson PerformanceHoàng CườngNo ratings yet

- Bloomberg Global MA Financial Rankings 1H 2018 PreliminaryDocument17 pagesBloomberg Global MA Financial Rankings 1H 2018 PreliminaryPierreNo ratings yet

- AUD339 - OBE Lesson Plan 1Document11 pagesAUD339 - OBE Lesson Plan 1MUHAMMAD AMIR HAMZAH NURZAFILNo ratings yet

- Group-2 Golden Circle MM&MGW Presentation Term-VDocument6 pagesGroup-2 Golden Circle MM&MGW Presentation Term-VFIN GYAANNo ratings yet

- A Shared Service Centre (SSC) For Consolidation and Outsourcing of Smes Internal Business Process in MalaysiaDocument5 pagesA Shared Service Centre (SSC) For Consolidation and Outsourcing of Smes Internal Business Process in MalaysiaMahendra JayaKumarNo ratings yet

- Operations-Production PlanDocument3 pagesOperations-Production PlanKofiya WillieNo ratings yet

- Revision of TPM Excellence AwardsDocument23 pagesRevision of TPM Excellence AwardsSharad JaiswalNo ratings yet

- Shoaib Tariq Operation Manager: MCB Bank LTDDocument1 pageShoaib Tariq Operation Manager: MCB Bank LTDShoaib TariqNo ratings yet

- Yes Bank - Case Study.Document5 pagesYes Bank - Case Study.Harsh Raj GuptaNo ratings yet

- RICO ASR IQA CertificatesDocument40 pagesRICO ASR IQA CertificatesSharad JainNo ratings yet

- Chapter 6assignmentDocument6 pagesChapter 6assignmentUnni KuttanNo ratings yet